Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Oct 14, 2021

APAC REITs Outlook

The REITs sector, well-known for its stable income and solid dividend yield was not spared from Covid-19's economic fallout. As the world's vaccination rate continues to improve and economies gradually transition back to full reopening, we see some positive signs for Global REITs over the coming years. Mohammad Hassan, Head of Dividend Forecasting for APAC sits down with our analyst and co-author of the REITs Outlook, Ralph Chen to find out more about the trends we are witnessing and the prospects for dividend growth for this sector going forward. To access the video, please click here

Key implications

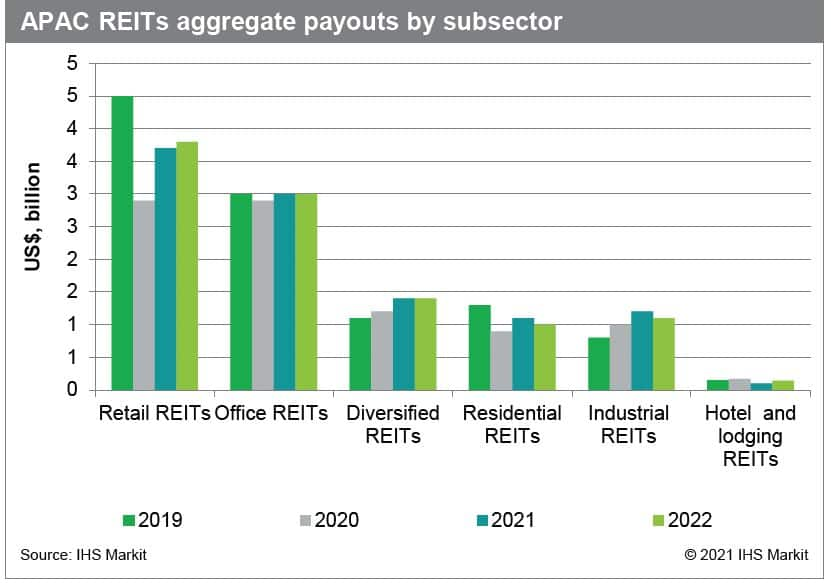

• From the perspective of aggregate distributions, the Asia Pacific real estate investment trusts (REITs) sector is expected to grow at around 15% for fiscal year (FY) 2021 to US$10.4 billion and remain stable in 2022.

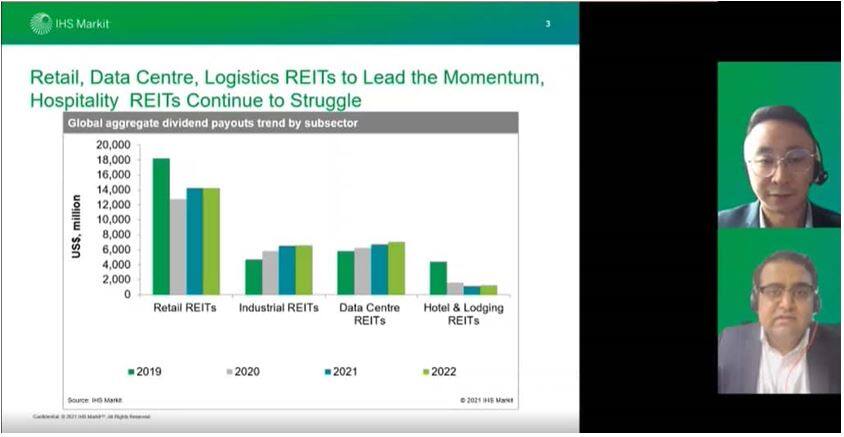

• Retail REITs are expected to lead the momentum, with the steepest growth in the aggregate amount of dividends, attributable to the removal of mobility restrictions in Asia Pacific countries and the return of footfalls to malls.

• Being resilient during the pandemic, industrial REITs are expected to continue the growing trend in short term, with data center and logistics REITs benefiting from the new trend brought about by the pandemic.

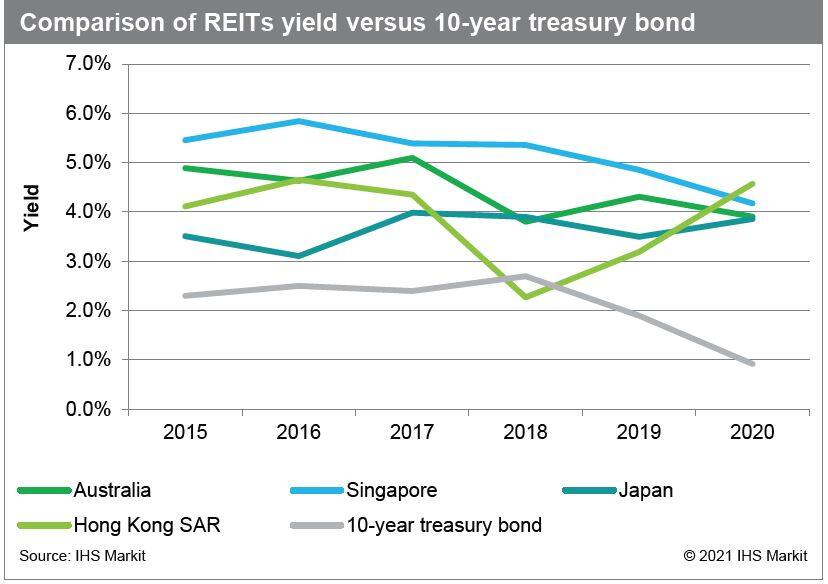

• REITs from Australia and Singapore are expected to offer

higher yields in 2022 as compared with Hong Kong SAR and Japan, as

the REITs from these two markets dominate the top-10 dividend yield

REITs list in 2022.

For more information, please contact dividendsapac@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-reits-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-reits-outlook.html&text=APAC+REITs+Outlook++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-reits-outlook.html","enabled":true},{"name":"email","url":"?subject=APAC REITs Outlook | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-reits-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=APAC+REITs+Outlook++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-reits-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}