Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 25, 2023

APAC tourism surges in first half of 2023

There have been significant headwinds to Asia-Pacific (APAC) merchandise exports during the first half of 2023 due to weak growth in key export markets. However, the strong rebound in international tourism inflows evident in the first half of 2023 signals that the rebound in the tourism economy in 2023 will help to mitigate the negative impact of weak merchandise exports for a number of APAC economies.

Continued recovery in international tourism is expected in the Asia-Pacific region in 2024, as tourism flows continue to recover towards pre-pandemic highs. Over the medium-term, international tourism flows to the APAC region are expected to show strong growth, helped by rapidly rising household incomes in large Asian economies, notably mainland China, India and Indonesia.

Global rebound in tourism and recreation

Prior to the COVID-19 pandemic, the world tourism industry was estimated to account for around 10% of global GDP after including indirect output and employment effects. Gradual recovery in the world tourism industry has been underway during 2021 and 2022, although international borders in much of the APAC region remained largely closed for international tourism travel during 2021 and early 2022. However, with the progressive reopening of international borders during 2022, international tourism in the APAC region has shown a significant rebound during the first half of 2023.

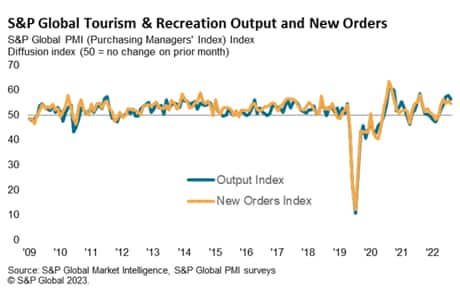

At a global level, the S&P Global Sector PMI for Tourism and Recreation has shown significant expansionary momentum in recent months, as international tourism has continued to recover globally.

In the APAC region, international tourism flows have continued to recover during the first half of 2023. The pace at which APAC economies reopened their borders has varied significantly, although most had reopened for international tourist travel by late 2022. This has resulted in a significant upturn in international tourism travel during the first half of 2023, helped by the reopening of mainland China's international borders for tourist travel.

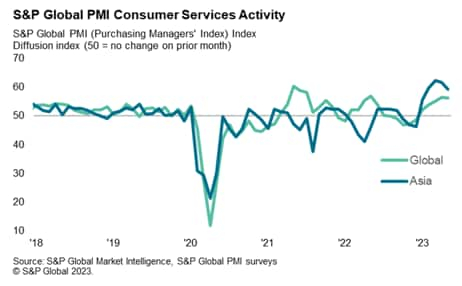

With tourism having accounted for a significant share of GDP in many APAC countries prior to the pandemic, the recovery in tourism is contributing to strong growth in consumer services expenditure in the APAC region.

Recovery of ASEAN's tourism sector

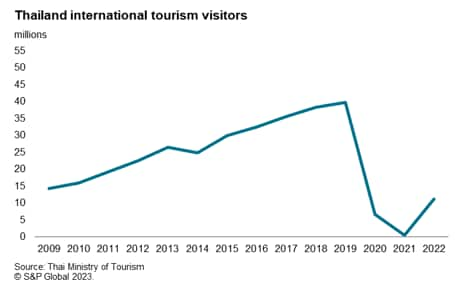

Thailand: Due to the important contribution of international tourism to Thailand's GDP, a key factor that constrained the rate of recovery of the Thai economy in 2022 was the slow pace of reopening of international tourism, although this gathered momentum in the second half of 2022.

International tourism was a key part of Thailand's GDP prior to the COVID-19 pandemic, contributing an estimated 11.5% of GDP in 2019. However, foreign tourism visits collapsed after April 2020 as many international borders worldwide were closed, including Thailand's own restrictions on foreign visitors.

As COVID-19 border restrictions were gradually relaxed in Thailand and also in many of Thailand's largest tourism source countries during 2022, international tourism showed a significant improvement during the second half of the year. The number of international tourist arrivals reached 11.15 million in 2022, compared with just 430,000 in 2021. However, the total number of visits was still far below the 2019 peak of 39.8 million, indicating considerable scope for further rapid growth in the tourism sector during 2023.

International tourism arrivals in the first quarter of 2023 surged to 6.5 million visitors, which was more than half the total number of international tourists visits in 2022. Total tourism receipts in the first quarter for both domestic and international tourism spending was estimated at 499 billion baht, up by 127% year-on-year (y/y). The Tourism Authority of Thailand has increased its estimated target for international tourism visits in 2023 to 25 million, which is more than double the total number of international tourism arrivals in 2022.

Malaysia: In Malaysia, international tourism is expected to strengthen during 2023, as tourist arrivals from major tourism markets in ASEAN, Middle East and Europe continue to recover, while Chinese tourist arrivals gradually improve. Tourism Malaysia is targeting 16.1 million international visitor arrivals for 2023, a 60% increase compared with the estimated 10.1 million international visitor arrivals in 2022. This compares with the pre-pandemic level of 26.1 million international visitor arrivals in 2019. In 2019, total domestic and international tourism was estimated to have accounted for around 16% of gross value added in Malaysia's total GDP.

Malaysia's international commercial aviation passenger traffic grew by around 81% quarter-on-quarter (q/q) and was up by 246% y/y in the first quarter of 2023.

Philippines: Easing of pandemic-related travel restrictions during 2022 has allowed a gradual reopening of domestic and international tourism travel. This will provide an important boost to the economy in 2023. Total international visitor arrivals reached a total of 2 million visits between 1st January and 12th May 2023. Total international visitor arrivals in 2022 reached 2.65 million for the full calendar year, generating estimated tourism revenue of Peso 210 billion.

Prior to the pandemic, in 2019, gross direct tourism value added as a share of GDP was estimated at 12.7% of GDP, including both international and domestic tourism spending. International tourism spending was estimated at PHP 549 billion, while domestic tourism spending was estimated at PHP 3.1 trillion. Due to the importance of domestic tourism in the overall contribution of tourism to GDP, the recovery of domestic tourism could be a significant growth driver in 2023.

Singapore: Total international visitor arrivals reached 4 million in the first four months of 2023, showing a strong upturn compared with 2022, when total international visitor arrivals was estimated at 6.3 million for the full calendar year. Based on this pace of monthly tourism arrivals, total international tourism visits for 2023 are projected at around 12 million, which would represent a significant recovery towards pre-pandemic tourism levels. Total international visitor arrivals reached 19.1 million in 2019, with tourism revenue estimated at SGD 27.7 billion. The Singapore Tourism Board expects that international tourism will return to pre-pandemic levels by 2024.

Australia tourism inflows rebound

Total international short-term visitor arrivals during the first four months of 2023 reached 2.2 million visitors, up sharply from 556,000 short-term visitors in the first four months of 2022, when international border restrictions related to the COVID-19 pandemic still significantly limited international travel. In 2019, prior to the onset of the pandemic, total international tourism visits to Australia had reached 9.4 million visits for the full calendar year. In 2018-19, both domestic and international tourism, combined together, contributed AUD 61 billion to Australian GDP and provided employment for 666,000 workers, equivalent to 5.2% of Australia's total workforce. In Australia, three-quarters of tourism consumption is attributable to domestic tourism, which has already recovered to pre-pandemic levels. The level of visitor arrivals for the first four months of 2023 also indicates a considerable recovery of international tourism, with visitor arrivals likely to reach pre-pandemic levels by 2024.

Japan

In Japan, the domestic tourism sector was estimated to account for around 80% of total tourism spending in 2019. The high share of domestic tourism helped to substantially limit the vulnerability of the Japanese tourism industry to the slump in international tourism during the COVID-19 pandemic, although domestic tourism was also impacted by the succession of COVID-19 waves that hit Japan during 2020-2022. Annual domestic tourist spending rose by 90% in 2022 to a level of JPY 17.2 trillion.

With the reopening of Japan's international borders for international tourism since October 2022, tourism visits have risen sharply. According to the Japanese National Tourism Organization, total foreign visitor arrivals to Japan in the first four months of 2023 reached 6.7 million, compared with total foreign visitor arrivals of 3.8 million in the whole of calendar year 2022.

Hong Kong SAR

The Hong Kong Special Administrative Region (SAR) of the People's Republic of China has seen a strong rebound in tourism arrivals following the reopening of mainland China for tourism travel. Total tourism arrivals in Hong Kong SAR reached 7.3 million during the January to April period of 2023, compared with only 16,182 arrivals during the same period of 2022 when significant COVID-19 border controls remained in place in Hong Kong SAR as well as mainland China. Out of the 7.3 million visitor arrivals in the first four months of 2023, 5.7 million were from mainland China. The upturn in tourism is expected to be an important growth driver for the Hong Kong SAR economy in 2023, with the recovery in tourism expected to continue in 2024.

Medium-term outlook for APAC tourism

The outlook for the APAC tourism industry is for significant recovery during 2023, with international tourism visits expected to reach pre-pandemic levels in many APAC economies by 2024.

Beyond the near-term recovery of the APAC tourism industry to similar levels of activity as prior to the pandemic, the medium-term outlook is for a return to rapid growth in both domestic and international tourism visits. This will be driven by continued rapidly rising household incomes across the large emerging markets of the APAC region, notably in the most populous nations of mainland China, India, Indonesia, Philippines and Vietnam.

This is expected to drive rapid growth across the APAC tourism sector, boosting output and employment growth in the tourism sector. The transportation sector will also benefit from the upturn in tourism travel, notably the APAC commercial aviation industry.

Consequently, after severe economic disruption and deep recessionary conditions in large segments of the APAC tourism industry during 2020-2022, the sector is poised for a strong resurgence over the medium-term outlook.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, S&P Global nc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-tourism-surges-in-first-half-of-2023-jun23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-tourism-surges-in-first-half-of-2023-jun23.html&text=APAC+tourism+surges+in+first+half+of+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-tourism-surges-in-first-half-of-2023-jun23.html","enabled":true},{"name":"email","url":"?subject=APAC tourism surges in first half of 2023 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-tourism-surges-in-first-half-of-2023-jun23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=APAC+tourism+surges+in+first+half+of+2023+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fapac-tourism-surges-in-first-half-of-2023-jun23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}