Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 12, 2024

ASEAN economic outlook in 2024

The near-term economic outlook for the ASEAN region in 2024 remains positive, supported by the continued expansion of domestic demand in a number of large Southeast Asian economies. Foreign direct investment inflows are also expected to remain strong, as multinationals continue to diversify their manufacturing supply chains towards Southeast Asian industrialized nations.

The ASEAN tourism industry, which is an important part of the economy for a significant number of nations in the region, is expected to continue to recover during 2024, as international tourism flows continue to normalize towards pre-pandemic levels in many Southeast Asian countries.

Over the next decade, the ASEAN region is therefore expected to continue to be one of the fastest-growing regions of the global economy and an increasingly important growth engine for the Asia-Pacific (APAC).

ASEAN outlook remains robust

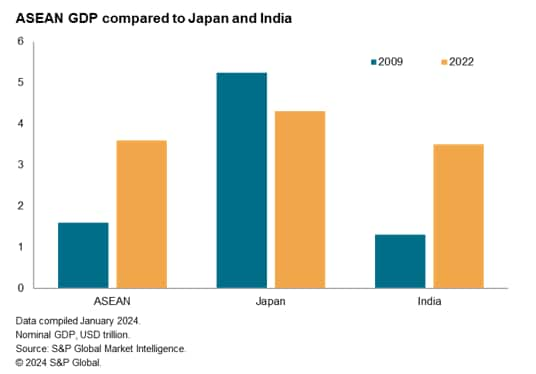

The total nominal GDP of the ten ASEAN nations measured in US dollar terms amounted to USD 3.6 trillion in 2022, more than doubling compared with total GDP of USD 1.6 trillion in 2009. The total size of the ASEAN economy was slightly larger than India in 2022, which had an estimated GDP of USD 3.5 trillion in that year.

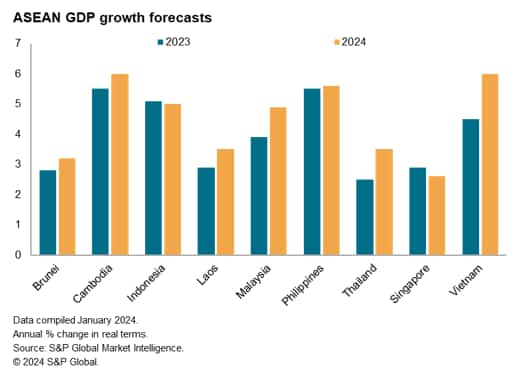

The near-term outlook is for continued strong growth in the ASEAN region in 2024, helped by resilient domestic demand and some improvement in exports of goods and services. A gradual upturn in merchandise exports is expected during 2024, after a significant downturn in exports of goods in many Asian industrial nations during 2023 due to weakness in key consumer markets in Western Europe and mainland China.

A number of ASEAN central banks are also expected to commence easing monetary policy during 2024, which will help to provide some stimulus for economic growth.

Indonesia

Indonesia's GDP growth rate in 2023 is estimated at around 5%, with a similar pace of economic growth forecast for 2024. Private consumption is a key driver of economic growth, accounting for around 53% of total GDP and growing at a pace of 5.1% year over year (y/y) in the third quarter of 2023. The outlook for 2024 is for continued robust growth in private consumption and fixed investment. During 2023, foreign direct investment inflows remained strong, buoyed by large investment inflows into base metals sector, notably new nickel smelter projects, as well as into downstream projects for manufacturing of electric vehicle batteries for which nickel is an important input.

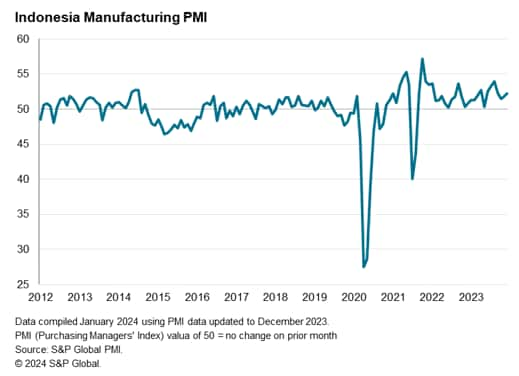

The S&P Global Indonesia Manufacturing Purchasing Manager's Index (PMI) rose to 52.2 in December, up from 51.7 in November, to signal that manufacturing sector conditions continued to improve and at the fastest rate since September. This extended the current period of manufacturing sector expansion to 28 months.

Vietnam

Vietnam's GDP growth rate in 2023 was estimated at 5.1%, with economic growth momentum having been impacted by weak demand in key export markets, including the US, EU and mainland China. However, the pace of economic growth improved in the fourth quarter of 2023, rising to 6.7% y/y compared with 5.5% y/y in the third quarter. This was helped by a gradual recovery in exports, which rose by 6.7% y/y in November.

The S&P Global Vietnam Manufacturing PMI posted 48.9 in December, improving from 47.3 in November, although remaining slightly below the 50.0 no-change mark and signalling a fourth consecutive monthly decline in business conditions in the sector. In December, new export orders neared stabilization after having shown considerable weakness earlier during 2023.

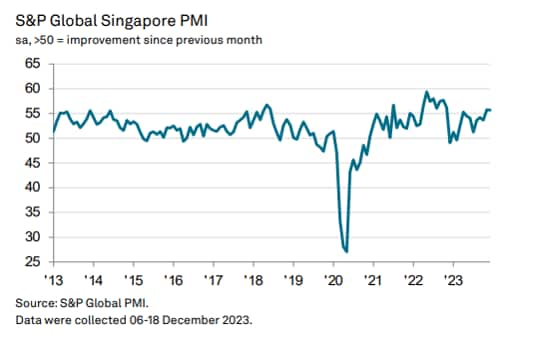

Singapore

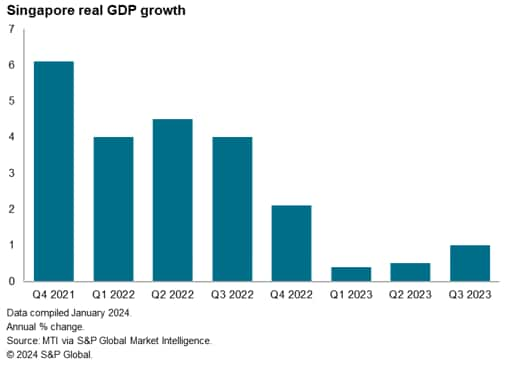

Singapore's GDP growth rate improved to a pace of 2.8% y/y in the fourth quarter of 2023 according to the advance estimate of GDP from the Ministry of Trade and Industry (MTI). This compared with GDP growth of 1.0% y/y in the third quarter of 2023. For calendar 2023, GDP growth was 1.2%, significantly slower than the growth rate of 3.6% recorded in 2022, when the economy rebounded strongly after the COVID-19 pandemic.

The S&P Global Singapore PMI posted 55.7 in December, edging lower from 55.8 in November. The latest reading signalled a tenth consecutive monthly expansion of Singapore's private sector economy and signalled continued strong business conditions. New orders continued to rise at the end of 2023, growing at the fastest pace in seven months on the back of better underlying demand conditions.

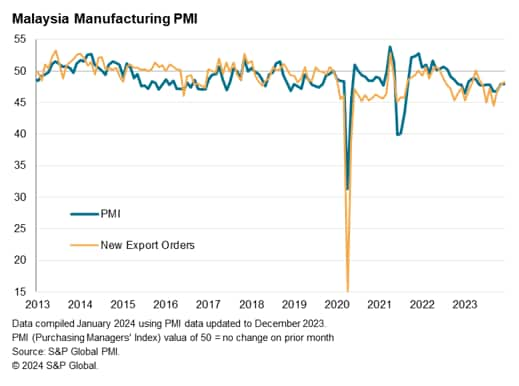

Malaysia

Malaysia's economy showed resilient economic expansion in 2023 at an estimated rate of around 4%, albeit the pace of growth moderated after the buoyant 8.7% GDP growth rate recorded in 2022.

Malaysian GDP growth improved to a pace of 3.3% y/y in the third quarter of 2023, compared with growth of 2.9% y/y in the second quarter of 2023. When measured on a quarter-on-quarter (q/q) basis, the pace of growth strengthened to 2.6% q/q, compared with 1.5% q/q in the second quarter of 2023 and just 0.9% q/q in the first quarter of 2023.

The S&P Global Malaysia Manufacturing PMI was unchanged at 47.9 in December, indicating that business conditions remained challenging for manufacturing firms. Demand conditions in international markets remained contractionary, with new export orders falling for the eighth month in a row, but at the softest rate since May.

Philippines

Philippines economic growth remained strong in 2023, with GDP growth improving to a pace of 5.9% y/y in the third quarter of 2023, compared with GDP growth of 4.3% y/y in the second quarter of 2023. The outlook for 2024 is for continued rapid economic growth, helped by expected gradual easing of monetary policy during 2024.

The S&P Global Philippines Manufacturing PMI was at 51.5 in December 2023, continuing to indicate expansionary conditions in the manufacturing sector, albeit moderating from November's nine-month high of 52.7.

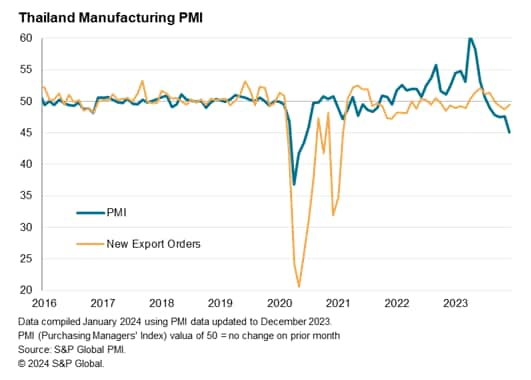

Thailand

In Thailand the manufacturing PMI fell to 45.1 in December, down from 47.6 in November. This signalled a fifth successive monthly contraction in manufacturing sector conditions and at the sharpest pace since June 2020.

Thailand's total GDP also showed weakness in the third quarter of 2023, slowing to a pace of 1.5% growth y/y, following moderate growth of 1.8% y/y in the second quarter. Monetary policy tightening by the Bank of Thailand has acted as a drag on economic growth, with eight rate hikes having been implemented since August 2022, which has raised the policy rate by a cumulative 200 basis points.

Due to the important contribution of international tourism to Thailand's GDP, a key factor that constrained the rate of recovery of the Thai economy in 2022 was the slow pace of reopening of international tourism, although this gathered momentum in the second half of 2022 and during 2023. Total international tourism arrivals in 2023 reached 28 million, compared with 11.5 million in 2023. Further recovery in the tourism sector is expected during 2024, helped by the decision of the Thai government to allow visa-free entry for tourists from mainland China and India.

ASEAN medium term economic outlook

The medium-term growth outlook for the ASEAN region remains very positive, underpinned by sustained expansion in private consumption in some of the largest consumer markets in Southeast Asia, including Indonesia, Philippines, Vietnam and Malaysia. Strong government investment in infrastructure is also expected to boost the overall pace of growth in domestic demand. Southeast Asia is also expected to become an increasingly important destination for foreign direct investment inflows, as multinationals diversify their supply chains to benefit from a growing number of competitive advantages in the ASEAN region.

The favourable ASEAN outlook for foreign direct investment inflows is supported by a number of key factors.

- Continued strong expansion in domestic consumer markets in large APAC economies, notably mainland China and India, will be an important factor supporting further growth in demand for ASEAN's raw materials, intermediate goods and final manufactured products. Sustained firm economic growth is driving rapid growth in per capita GDP in many of Asia's largest emerging markets, which will help to boost demand for a wide range of ASEAN exports. Intra-ASEAN trade is also expected to show sustained rapid growth, buoyed by rapid growth in large and fast-growing Southeast Asian nations, notably Indonesia, Philippines, Malaysia and Vietnam.

- Electronics production is an important part of the manufacturing export sector for many ASEAN economies, including Malaysia, Singapore, Philippines, Thailand and Vietnam. Furthermore, the electronics supply chain is highly integrated across different economies in East Asia. The medium-term outlook for Asian electronics manufacturing is supported by many key growth drivers. This includes continued 5G rollout over the next five years, which will continue to support demand for 5G mobile phones, as well as demand growth for electronics products that integrate artificial intelligence capabilities. Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics.

- The ASEAN auto manufacturing industry will benefit from the global transition to electric vehicles (EV), which is driving demand for EVs. In early 2023, Hyundai started assembly of Ioniq 5 EVs at its new Hyundai Motor Group Innovation Center in Singapore. Indonesia is already a key Asian automotive manufacturing hub and has also benefited from strong foreign direct investment flows from multinationals to build new nickel smelters and electric vehicle battery plants. In Thailand, the Board of Investment has approved investments by 16 electric battery vehicle manufacturers amounting to a total of around Baht 40 billion.

- With international tourism travel recovering strongly following the COVID-19 pandemic, the tourism industry is expected to be another important growth driver for ASEAN exports over the medium-term. Overall international tourism flows are expected to show strong growth as per capita household incomes in large Asian consumer markets continue to grow rapidly, driving international tourism travel to ASEAN tourism destinations. This will help a number of ASEAN economies where tourism contributes a significant share of total GDP, including Thailand, Malaysia, Philippines and Singapore.

- The rapid growth of ASEAN exports is also expected to be strengthened by the APAC regional trade liberalization architecture. This includes the large Regional Comprehensive Economic Partnership (RCEP) in which all ten ASEAN nations are members, as well as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) multilateral trade agreement which has a number of ASEAN members. The ASEAN region also benefits from the ASEAN Free Trade Area (AFTA) as well as a growing network of major free trade agreements (FTAs) involving APAC economies.

The ASEAN region is hence expected to remain one of the fastest growing regions of the world economy over the decade ahead. Indonesia, which is already ASEAN's largest economy, will become one of the world's leading emerging markets over the next decade, with the size of its GDP forecast to rise from USD 1.3 trillion in 2022 to USD 4.1 trillion by 2035. Vietnam and Philippines are also expected to join the ranks of the world's largest emerging markets by 2035. Meanwhile Malaysia is set to become one of the advanced economies of the APAC region as measured by per capita GDP, with its per capita GDP projected to reach around USD 26,000 by 2035.

Consequently ASEAN, together with mainland China and India, will be one of the three main growth engines for the APAC economy over the next decade.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-economic-outlook-in-2024-jan24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-economic-outlook-in-2024-jan24.html&text=ASEAN+economic+outlook+in+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-economic-outlook-in-2024-jan24.html","enabled":true},{"name":"email","url":"?subject=ASEAN economic outlook in 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-economic-outlook-in-2024-jan24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ASEAN+economic+outlook+in+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasean-economic-outlook-in-2024-jan24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}