Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 06, 2020

Atlantic Capesize freight rates spiked again with a limited number of ballasters to the west

At the start of October, Capesize (180,000 dwt) timecharter rates increased to about USD30,000/day from USD15,000/day from just two weeks ago. The increase has almost doubled within half a month, according to the Baltic Exchange.

Strong Atlantic mineral chartering demand helped to support the Atlantic rates again, for example the Baltic C8 (Capesize Atlantic Round Voyage rates, USD/day) spiked almost by 300% to USD36,400/day (1/Oct) from USD12,725/day (17/Sep), whereas C9 (Capesize iron ore shipments from Canada to Asia, USD/day) routes jumped to above USD50,000/day from about USD30,000/day two weeks ago.

Now, Pacific and Atlantic round voyage earnings spread has increased to 50%, equivalent to more than USD10,000/Day. Therefore, if Australian miners tried to secure tonnage for their October shipments in the Pacific, they may need to pay up almost twice more than their September rates in the Pacific to match the Atlantic rates.

From a demand perspective, IHS Markit notes good demand recovery. Iron ore demand flow from Brazil - as well as Ukraine and Canada - has nearly reached a similar level to shipments in July (when the C5TC spiked above USD30,000/day). Moreover, Guinean bauxite is likely to recover in the fourth quarter from the disruption of the third quarter due to the seasonal weather issue. Demand for Indian coal is also recovering although China is still under tight import control.

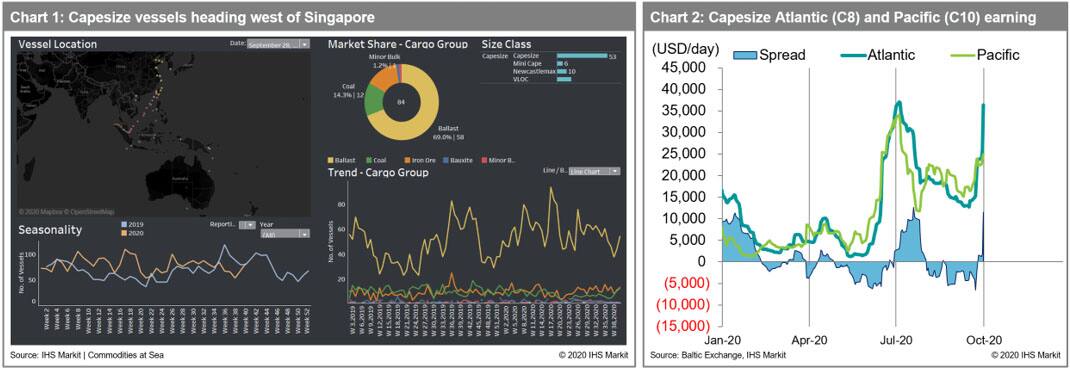

From the supply side, we observed limited ballasters to the Atlantic Basin owing to weaker Atlantic rates than Pacific figures over the past two months (see the spread in chart 2). This tightness would support Atlantic rates in the near future. However, we also observed increased tonnage heading to the Indian Ocean. According to IHS Markit's high-frequency cargo and fleet analytics tool Commodities at Sea, the number of Capesize vessels heading to west of Singapore has increased to 80 vessels (including 15 very large ore carriers [VLOCs]) in week 40 from the average 65 in September. (see the trend - cargo group in chart 1)

Interestingly, this time increased coal cargo shipments to India has provided faster Capesize tonnage in the west of Singapore. Therefore, once those vessels heading to Indian waters becomes available tonnage for the Atlantic market, it is expected to face adjustments in the freight market - similar to what we have seen in July 2020 and in September 2019.

The IHS Markit Freight Rate Forecast models have predicted higher earning for Capesize in October compared with September. This is mainly driven by higher demand indicators, which includes stable Chinese PMI index and stronger iron ore and bauxite cargo flows, as well as supply indicators, including the number of Indian Ocean ballasters.

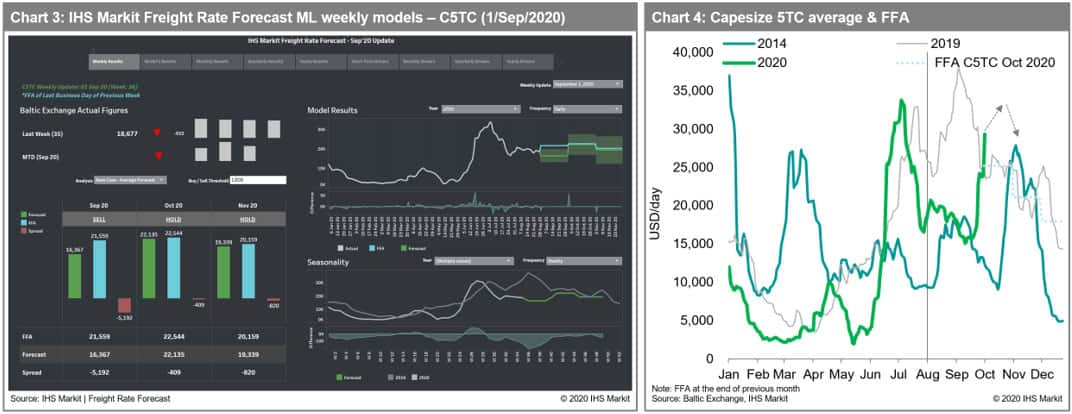

Our weekly Capesize 5TCs forecast models have also consistently predicted higher freight in October compared to September whereas FFA assessments showed similar rates between September and October 2020. As of 1 September 2020, a month ago, our C5TC prediction showed October 2020 average settlements forecast to be USD 6,000/day higher than the September average. (see the green bars in chart 3).

However, we still remain cautious towards the end of the fourth quarter of 2020. IHS Markit models predict October will be the peak of the fourth quarter.

From a technical perspective, if the freight trend followed historical movements, C5TC would face the resistance from the 2020 peak (USD34,000/day) or 2019 peak (USD38,000/day), and then it could drop again with profit taking movement from FFA players as well as shipowners and operators.

From a fundamental perspective, iron ore and coal demands are forecast to be under pressure because of import controls and environment regulations. Many countries have started announcing their winter regulation on coal consumption and on steel and metal smelters to tackle air pollution. Furthermore, we note there is a very high spread between Capesize and Panamax. Many Capesize coal are switching to Panamax shipments and the recent, declining congestion trend in China would increase overall supply, specifically in the Pacific.

Moreover, IHS Markit economists do not foresee the recent momentum in commodity markets to last. Once inventory restocking is complete, growth may fade, thus exposing some markets to a price correction. With the US presidency election coming, this uncertainty could increase the risk of commodity prices correcting in the near future, if our view of the fundamentals is correct.

In conclusion, IHS Markit maintains the view that there is still upside potential in the short-term, while downside risk remains towards the end of 2020.

For more insight subscribe to our complimentary quarterly commodity analytics newsletter

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fatlantic-capesize-freight-rates-spiked-again.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fatlantic-capesize-freight-rates-spiked-again.html&text=Atlantic+Capesize+freight+rates+spiked+again+with+a+limited+number+of+ballasters+to+the+west+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fatlantic-capesize-freight-rates-spiked-again.html","enabled":true},{"name":"email","url":"?subject=Atlantic Capesize freight rates spiked again with a limited number of ballasters to the west | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fatlantic-capesize-freight-rates-spiked-again.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Atlantic+Capesize+freight+rates+spiked+again+with+a+limited+number+of+ballasters+to+the+west+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fatlantic-capesize-freight-rates-spiked-again.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}