Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 04, 2023

Banking risk monthly outlook: August 2023

Our banking risk experts provide insight into events impacting the financial sector in emerging markets in August.

- Savings growth is unlikely to slow substantially due to lack of alternative avenue for deposits in Mainland China

- Thailand's new prime minister will likely introduce loan support for farmers, with a limited impact on the banking sector

- Q2 data releases to reveal the extent of credit tightening and asset quality deterioration in CEB

- Potential approval of Ecuador's new bankruptcy law, likely improving corporate asset quality of banks

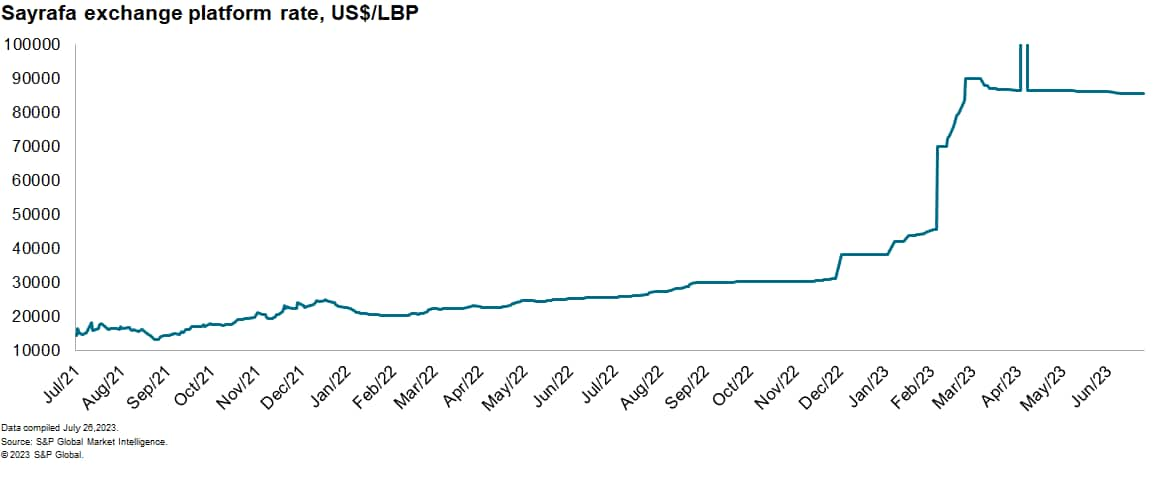

- The end of the Banque Du Liban (BDL) governor's 30-year term indicates bigger uncertainty and urgency for the Lebanese banking system

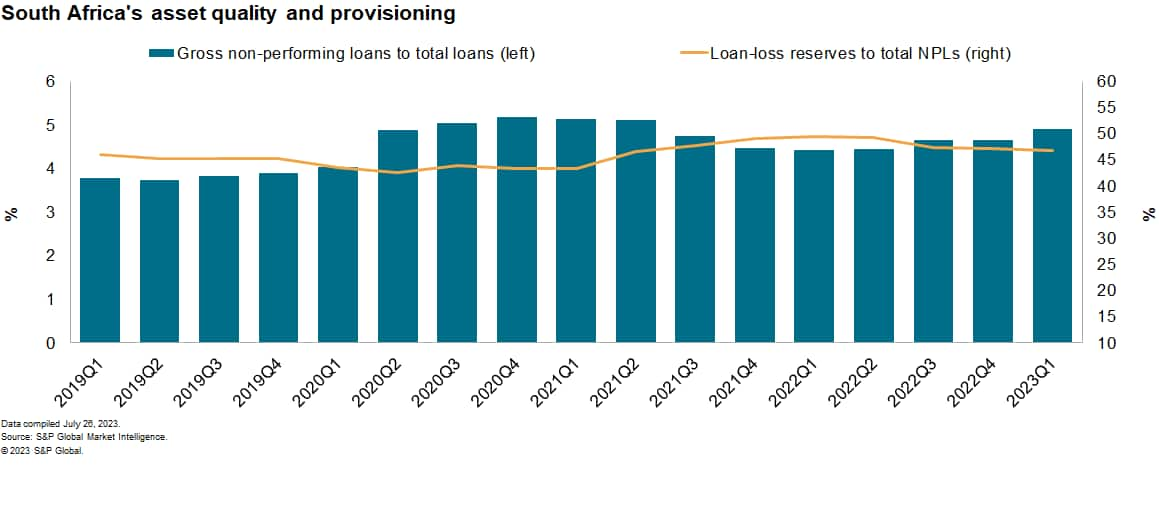

- South African banks are expected to release Q2 data, likely to reveal pressures on credit risk and asset quality

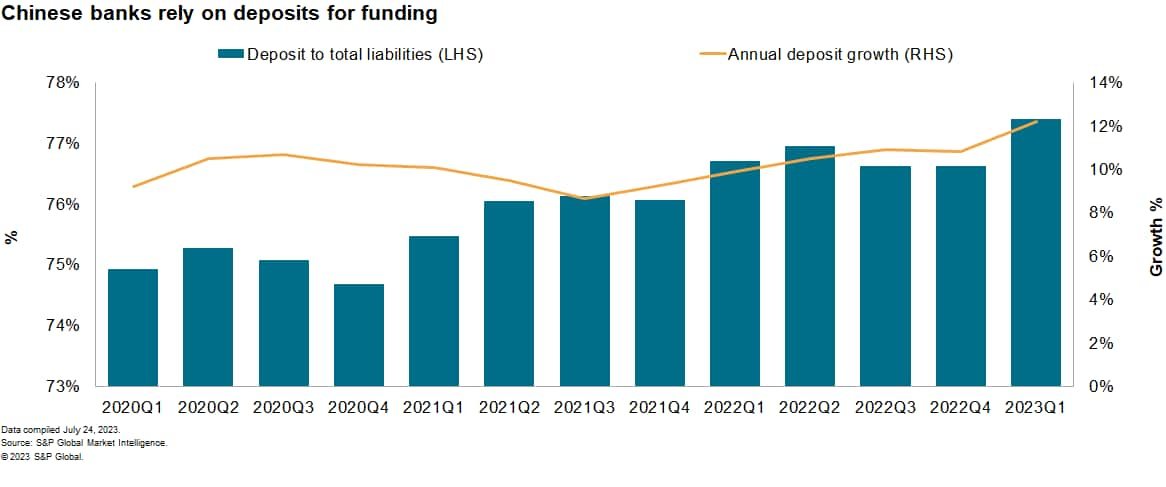

Removing higher return investment products will likely maintain deposits in Mainland Chinese banks.

Mainland China's banks rely heavily on deposits as a source of funding. The Chinese authorities have recently asked financial entities to stop offering investment products paying a return of more than 3%. Such a move is expected to support deposits in the banking sector as savers are looking for alternative avenues for their deposits following a fall in interest rates offered for savings. This also likely spells the higher likelihood of further interest rate cuts in the third quarter of 2023.

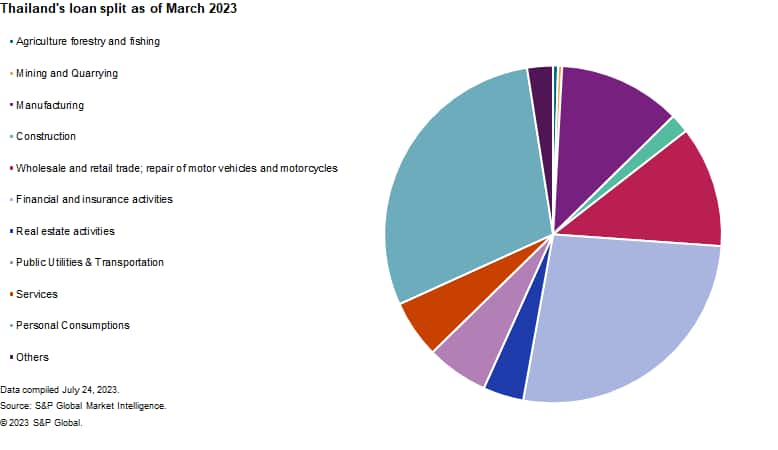

Farm loan relief likely in Thailand.

Although the decision of Thailand's new prime minister (PM) is pending, the process of relieving farm loans is likely to conclude by the end of July. The new PM will introduce some form of loan support for farmers, potentially ranging from a moratorium to complete debt forgiveness. Either way, considering that agriculture and fishing loans only accounted for 0.5% of total loans outstanding in Thailand in the first quarter of 2023, the impact on the banking sector is minimal.

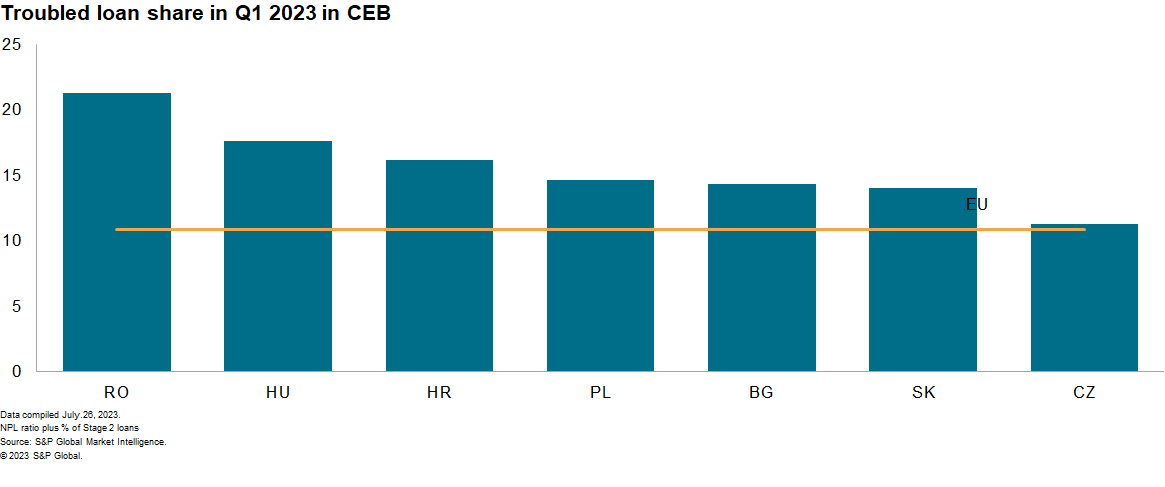

Q2 data releases to reveal extent of credit tightening and asset quality deterioration in CEB.

Second quarter data is to be released for many European banking sectors in August and we expect to see a continued slowdown in headline credit growth rates and an increase in non-performing loan (NPL) ratios in sectors such as Romania and Croatia. European bank lending surveys for the first quarter indicate further tightening in lending standards with expectations for this tightening and reduced demand to persist in Q2. The mix of lower credit growth and asset quality deterioration is likely to drive up NPL ratios in 2023, although ample capital buffers limit risks to financial stability.

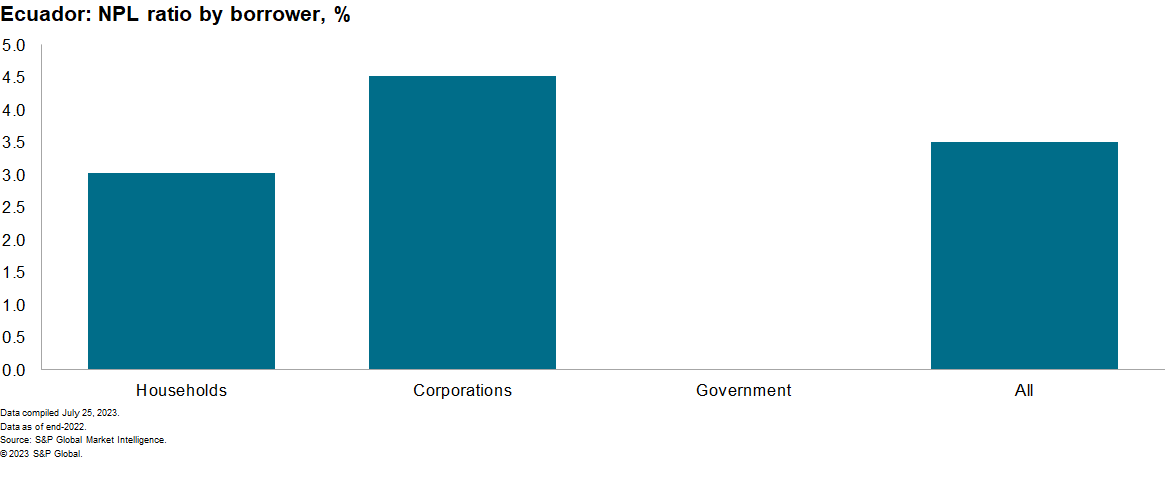

Potential approval of Ecuador's new bankruptcy law, likely improving corporate asset quality of banks.

Ecuador's President Guillermo Lasso issued a decree in mid-July potentially establishing a law for corporate restructuring that would allow companies in liquidity stress — but with strong solvency fundamentals — to restructure themselves before declaring bankruptcy. The decree must still be ratified by the Constitutional Court to become law — and there have been hearings surrounding its approval — but it has the potential to improve the banking sector's weakened corporate portfolio, whose NPL ratio stood at 4.5% as of end-2022 below the headline ratio at 3.8%.

The end of Banque Du Liban (BDL)'s governor's 30-year term indicates greater uncertainty and urgency for the Lebanese banking system.

Following the end of Riad Toufic Salameh's tenure on July 31, new policy initiatives including the discontinuation of the Sayrafa exchange platform and the floating of the exchange rate are possible in August and September. The Sayrafa exchange platform has been supplying banks with FX under a regulated rate set by the BDL, which has further depleted foreign reserves. Although suspending Sayrafa and allowing the Lebanese pound to float have been discussed by officials, actual implementation will depend in large part on successful appointment of a new BDL governor and continued terms of the four current vice governors who have expressed support for these initiatives.

South African banks are expected to release second-quarter data, likely to reveal pressures on credit risk and asset quality.

Three of the five big banks that hold about 90% of the banking sector's total assets in South Africa (Standard Bank, which is the largest in the country and continent, Absa Bank, and Nedbank) are likely to release financial results for the second quarter of 2023 before the end of August. Asset-quality indicators are expected to reflect a moderate materialization of credit risks, given significant increases in the policy interest rate (between January 2022 and May 2023, the South African Reserve Bank raised its benchmark interest rates by a cumulative 475 basis points). The rising interest rate environment is particularly challenging for South African borrowers considering high household indebtedness. S&P Global Market Intelligence projects loan growth to slow down owing to banks' risk aversion towards lending to the private sector given increased credit risks.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-august-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-august-2023.html&text=Banking+risk+monthly+outlook%3a+August+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-august-2023.html","enabled":true},{"name":"email","url":"?subject=Banking risk monthly outlook: August 2023 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-august-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+risk+monthly+outlook%3a+August+2023+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-august-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}