Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 04, 2021

Banking risk monthly outlook: March 2021

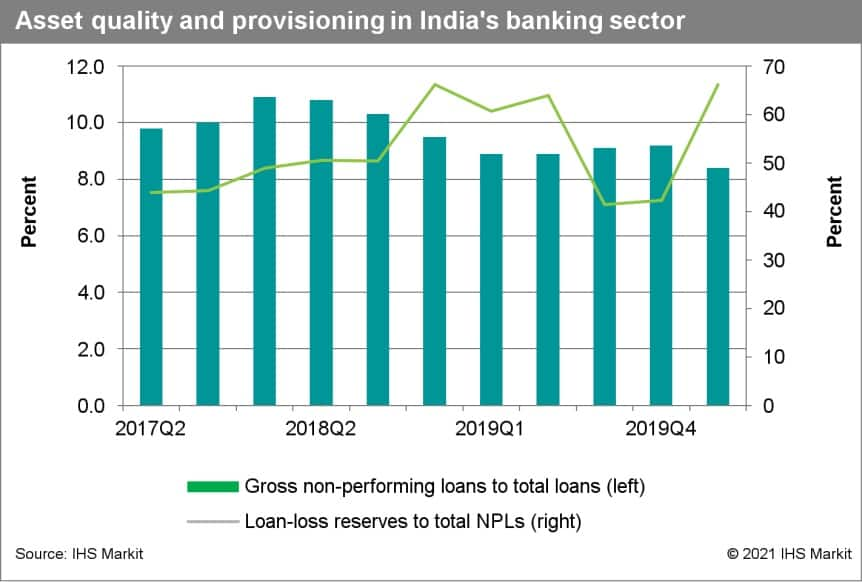

- Introduction of asset-quality review alongside the establishment of the "bad bank" in India

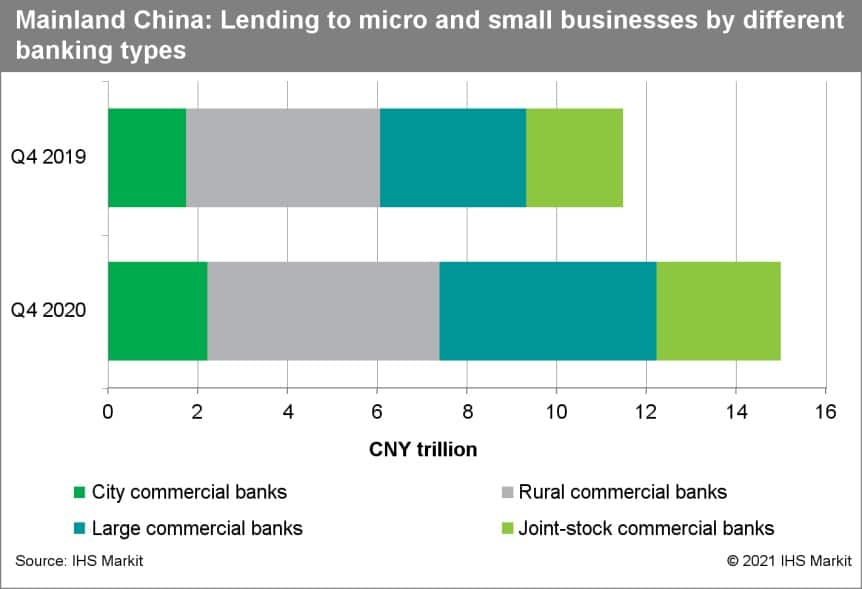

- Mainland China continuing to set lending targets for micro, small, and medium-sized enterprise (MSME) loans at large banks

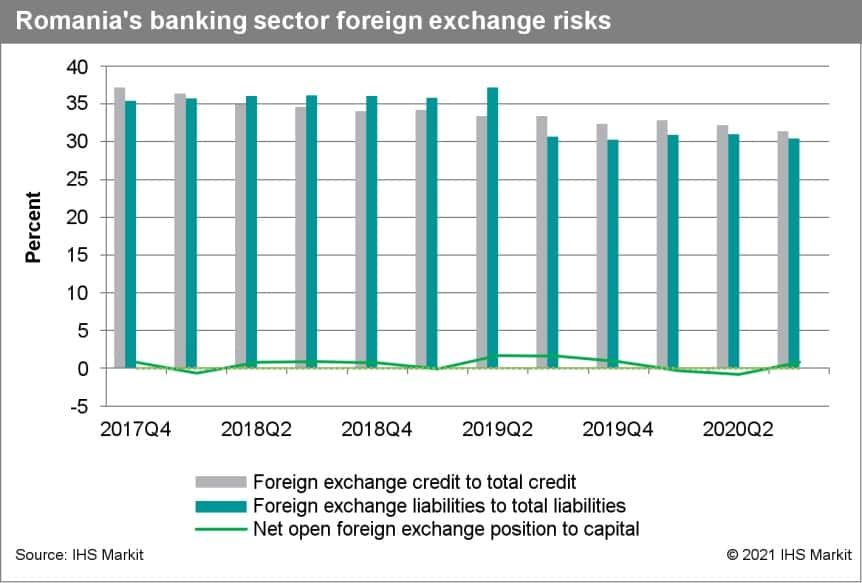

- Romanian banking sector's shrinking foreign currency balance sheet exposure

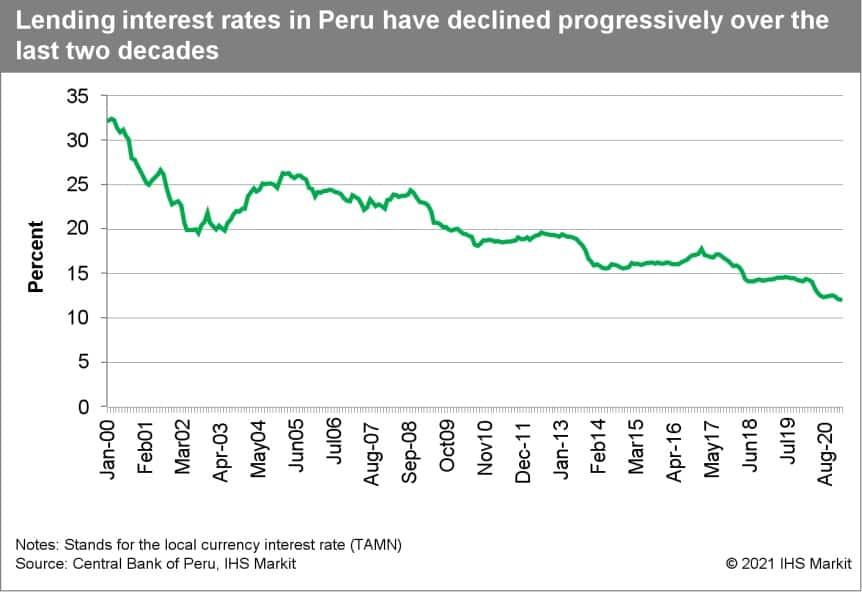

- Executive branch of the Peruvian government challenging law setting interest-rate caps

- Lebanon's central bank providing large banks more time to meet an end-February capital-raising deadline if needed, and small bank closures

- Extension of COVID-19 virus-related forbearance measures across Sub-Saharan Africa

Introduction of asset-quality review in association with the introduction of the "bad bank" in India.

The Indian authorities last conducted an asset-quality review in 2015/16, and the impact can still be felt to this day. The introduction of a "bad bank" will likely include asking banks to properly recognise their "bad loan" problems in the first place, and authorities could potentially start a second asset-quality review to find out the extent of the problem and clear bad loans once and for all, especially after numerous COVID-19 policies affecting loan classification.

Continued MSME lending target for large banks in China (mainland).

Mainland Chinese authorities are enhancing oversight of online lending platforms, which is expected to limit smaller banks' MSME lending ability by limiting their activities to their home region. To maintain the positive growth and rebalancing to lend to MSMEs, the authorities are likely to continue setting an MSME lending growth target for larger banks in 2021.

Romanian banking sector's shrinking foreign currency balance sheet exposure.

As Romania moves towards joining the eurozone, the National Bank of Romania has sought to encourage banks to increase their borrowing and lending denominated in euros by cutting the minimum reserve requirement ratio on foreign currency-denominated liabilities for credit institutions twice since February 2020. Despite this, the sector's foreign currency exposure has continued to decline, with foreign currency liabilities as a proportion of total liabilities remaining largely unchanged in the third quarter of 2020 versus end-2019. It is likely that this exposure will continue to fall on both sides of the balance sheet, prompting authorities to intervene by taking additional action by, for example, loosening reserve requirements further.

Executive branch of the Peruvian government challenging law setting interest-rate caps.

At the end of 2020, the Peruvian congress approved a law setting interest-rate caps. However, the central government, the central bank, and several actors of the private sector objected to the law on the grounds that it was unconstitutional and claimed that it would be "harmful for the stability of the financial system and the protection of savings". The executive did not sanction the bill and returned it to Congress. There was a rapid review by the relevant committee of the legislative power that dismissed the objections of the government, reinitiating a process for the bill to be published without the need for the executive's approval. Given the friction produced by this law proposal, we expect further news related to the objections against this bill.

Structural changes in the Lebanese banking sector.

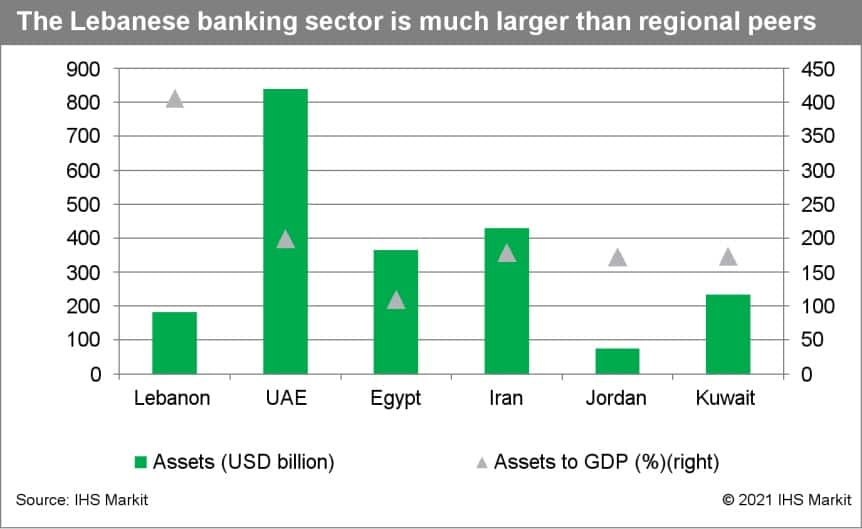

As reported previously, it is unlikely that the majority of banks in Lebanon will be able to meet the central bank's end-February capital-raising deadline. However, given that the Banque du Liban (BDL) has not announced a delay in the deadline at this stage, IHS Markit expects it will be partially implemented. This is likely to include the BDL providing additional time for large banks that have taken steps to meet the deadline to raise additional capital and the central bank takeover of smaller banks or the formation of a "bad bank". With assets representing 317% of GDP in September 2020 and 47 banks offering commercial, Islamic, or both banking services as of end-2018 (last reported), there are many small players in operation in the banking sector, and significant room for consolidation.

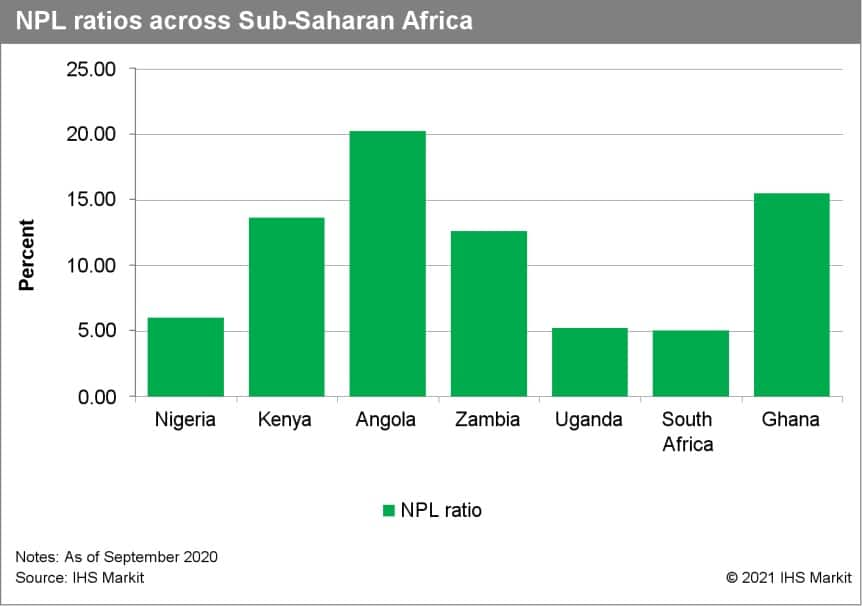

Extension of COVID-19 virus-related forbearance measures across Sub-Saharan Africa.

The extension of existing forbearance measures will be critical to prevent a significant spike in NPLs given the substantial set of measures coming to an end, particularly in economies such as Ghana, Kenya, and Nigeria that have reported significant amounts of restructured loans. In the case of Ghana and Kenya, NPLs were already at elevated levels at the onset of the pandemic because of an overhang of credit risk. Ghana's central bank has indicated it is in discussions to extend forbearance measures that expired in December 2020.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-march-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-march-2021.html&text=Banking+risk+monthly+outlook%3a+March+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-march-2021.html","enabled":true},{"name":"email","url":"?subject=Banking risk monthly outlook: March 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-march-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+risk+monthly+outlook%3a+March+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-march-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}