Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 21, 2023

Banking stresses amplify economic risks

Global economic growth is slowing in 2023 as financial conditions tighten and excesses of the early stages of the pandemic unwind.

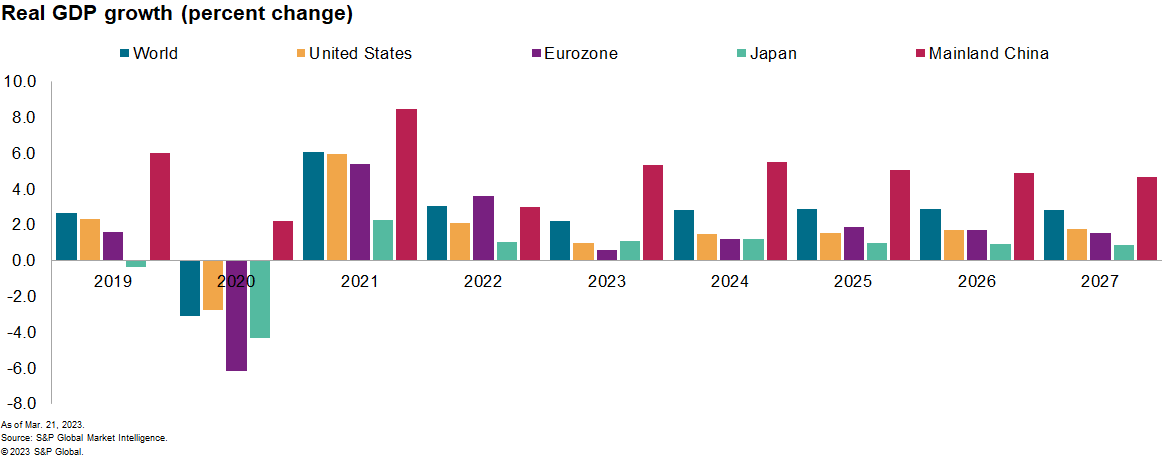

The S&P Global Market Intelligence forecast calls for world real GDP growth to slow from 6.0% in 2021 and 3.0% in 2022 to 2.2% in 2023 before picking up to 2.8% in 2024 and 2.9% in 2025. The slowdown in 2023 is centered in Europe and the Americas—regions that are fighting high inflation. The reopening of mainland China's economy following the end of zero-COVID policies will lift its growth from 3.0% in 2022 to 5.3% in 2023, providing some offsetting support to the world economy.

Turbulence in the banking sector poses downside risks to the forecast, especially in the United States and Western Europe.

While the failure of Silicon Valley Bank (SVB) and the forced sale of Credit Suisse were unique situations in many ways, the problems of bank portfolio losses on long-term bond holdings, deposit flight, and contagion risk are concerning. Coordinated liquidity measures by the US Federal Reserve (Fed); the European Central Bank (ECB); and the central banks of the United Kingdom, Japan, Canada, and Switzerland will help to stabilize financial markets, but some aftershocks are possible. Bank capital positions have improved since the 2008 crisis, although some banks are under pressure from potential trading losses, while the ability to raise new equity is curtailed by falling stock prices.

Even as the banking crisis is contained, financial conditions will tighten with adverse macroeconomic consequences.

Although reference yields on government bonds have decreased since the failure of SVB, risk premia have widened, raising financing costs and discouraging investment. The problems of SVB and First Republic Bank could also temporarily disrupt lending to technology firms and venture-backed startups. Deposit withdrawals and declining equity valuations will put banks in a defensive posture—holding more liquid assets, reducing lending, and tightening credit terms. Consumers and small businesses that depend on bank loans to finance their purchases will be adversely affected. Meanwhile, the flight to quality has widened credit spreads on high-yield and lower rated emerging market debt, limiting central banks' capacity to lower interest rates as inflation moderates and increasing debt default risk in parts of Sub-Saharan Africa.

Central banks will continue to battle inflation.

The experiences of the 1980s suggest that central banks should not relent in the fight against inflation. Thus, in the face of record core consumer price inflation, the European Central Bank (ECB) delivered a 50-basis-point increase in policy rates on March 16, taking its refinancing rate to 3.50%. The ECB kept its options open for future meetings, noting that the elevated level of uncertainty reinforces the importance of a data-dependent approach. The Fed is expected to raise the federal funds rate by 25 basis points on March 23, demonstrating that it can simultaneously pursue the two goals of financial stability and 2% inflation. Yet, in an unsettled banking environment fewer policy rate increases may be needed to achieve the same degree of financial market tightening.

Inflation pressures will gradually subside as commodity prices retreat.

Industrial and agricultural commodity prices are expected to decline over the remainder of 2023 in response to tightening financial markets, cooling demand, and improving supply chain conditions. Wage pressures will diminish as unemployment rates edge upward, bringing a deceleration in services prices. Global consumer price inflation is projected to ease from 7.6% in 2022 to 5.6% in 2023 and 3.4% in 2024.

Banking stresses create new headwinds for the US economy.

After 2.7% annualized growth in the fourth quarter of 2022, the US economy has decelerated but not tipped into recession in early 2023. Our latest tracking estimate calls for 0.6% real GDP growth in the first quarter as a solid gain in consumer spending is being offset by declines in residential construction, business equipment investment, and inventory accumulation. A slight economic contraction is expected in the second quarter, when a downturn in consumer spending on goods will be offset by a countercyclical rebound in vehicle production. Growth in subsequent quarters will be restrained, leading to an upward creep in the US unemployment rate to 4.5% at mid-decade. Annual real GDP growth is projected to slow from 2.1% in 2022 to 1.0% in 2023, followed by subpotential growth of 1.5% in each of 2024 and 2025. Our US forecast was released on March 6, prior to the failure of SVB.

Persistent inflation pressures and financial tightening stall eurozone growth.

High inflation continues to undermine household purchasing power and economic growth across Western Europe. Eurozone headline consumer price inflation eased marginally to 8.5% year on year (y/y) in February, but core inflation climbed to a record 5.6%. Rising interest rates, tightening credit, and housing market corrections will impede near-term growth. As inflation subsides, our forecast envisions a gradual pickup in real GDP growth from 0.6% in 2023 to 1.2% in 2024 and 1.8% in 2025. However, several risks could pull the eurozone into recession, including an escalation of financial-sector stresses, sticky core inflation rates leading to extended central bank tightening, an intensification of the conflict in Ukraine, widespread declines in house prices, and spillovers from economic weakness outside the region.

Mainland China's economic growth is reviving after the end of containment policies.

Following year-on-year declines in December, service sector output rose 5.5% y/y in the first two months of 2023 while retail sales increased 3.5%. Industrial production growth slowly picked up to 2.4% y/y, restrained by a continuing decline in goods exports. The government's policy shift to ease credit conditions for property developers has stabilized home prices and sparked an upturn in housing construction completions from a depressed level. After just 3.0% growth in 2022, real GDP should increase 5.3% in 2023 and 5.5% in 2024 before resuming a long-term deceleration.

Bottom line

Our mid-March macroeconomic forecasts were mostly completed before the significant stresses in the banking sector emerged. Actions by central banks and regulators to provide liquidity and broaden deposit insurance will likely avert a major financial crisis, but the flight to safety and tightening financial market conditions will further restrain global economic growth and add to recession risks in the United States and Europe.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-stresses-amplify-economic-risks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-stresses-amplify-economic-risks.html&text=Banking+stresses+amplify+economic+risks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-stresses-amplify-economic-risks.html","enabled":true},{"name":"email","url":"?subject=Banking stresses amplify economic risks | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-stresses-amplify-economic-risks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+stresses+amplify+economic+risks+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-stresses-amplify-economic-risks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}