Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ARTICLES & REPORTS

Oct 10, 2022

Webinar Rewind: How can banks reduce regulatory risk capital in volatile markets?

by Stuart Nield, Ph.D. and Allan Cowan, Ph.D

Regulatory capital is an ongoing challenge for most banks, from Tier 1 to regional institutions. Each bank faces its own challenges, but there is no denying that current market conditions including high inflation, increasing interest rates, falling equity, and widening credit spreads, have brought renewed concern among market players.

In a recent webinar, we reviewed which part of the capital framework is most impacted and why, as well as the strategies banks are using to maximize capital efficiency. Here's a snapshot of what was discussed in the webinar.

What are the different elements of capital that should be considered when reviewing regulatory risk?

Stuart Nield, Ph.D.

We continually look at the measures which influence the capital of investment banks and measure the ones that are responsive to market volatility. Specifically, we're looking at counterparty credit risks, market risks, and credit value adjustment (CVA) risks.

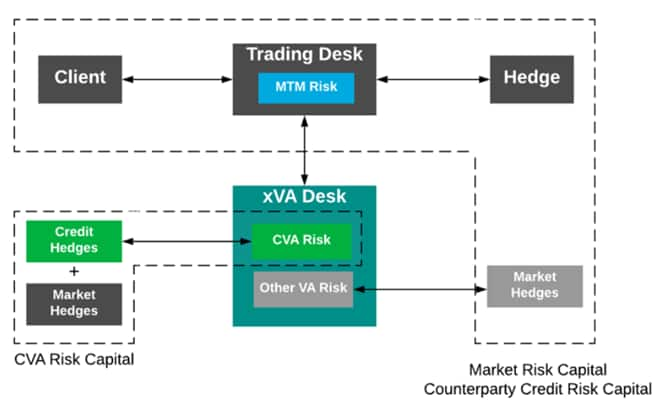

If we look at the schematic of a typical investment bank setup (Figure 1), at the top are the trading desks, which are doing business with customers and then hedging the mark-to-market risk of those derivative transactions with other dealers or central counterparties through hedges. And it's generally that activity that is covered by the market risk capital framework and the counterparty credit risk capital framework.

Figure 1 - Generic Investment Bank Organization. Source.

S&P Global Market Intelligence. For illustrative purposes

only.

One of the key aspects that needs to be considered is where banks place these hedges under different capital frameworks.

Under current capital frameworks, the credit hedges are included in the CVA risk capital framework. But all market risk hedges are currently in the market risk capital framework. That's changing under the revisions to the CVA risk capital framework that are due to come into effect in January 2023, which introduces two new types of risk models: the Basic Approach (BA-CVA), and the Standardized Approach (SA-CVA) which is based on CVA sensitivities. Under SA-CVA, market risk hedges of CVA risk will be included in the CVA risk capital framework.

What aspects of the capital structure are impacted by market volatility?

Allan Cowan, Ph.D.

Counterparty credit risk capital has been stable for some EU banks over the last couple of years. Compared to market risk capital, it's been relatively unresponsive to the shocks of COVID-19. This is motivated by the design of the counterparty credit risk framework, where the risk-weight used in these calculations is dependent on the historical probability of default, which will not react quickly to market volatility. There are other downgrades that you might do in your internal ratings-based (IRB) approach to capital requirements for credit risk. And in the EU, all the banks except for one are internal model method (IMM)-approved banks.

So, the exposure at default is motivated by the simulation of the exposures. But these simulations are, again, calibrated to historical-looking volatilities, which will not react quickly to current market changes as those parametric values will only change gradually. Furthermore, their volumes may only be updated quarterly or even semi-annually.

At this stage, we're not seeing a lot of impact on the counterparty credit risk capital. But there are still a few things to remember when assessing counterparty credit risk. Currently, it's likely that the probability of default will be increasing for Russian-based counterparties or Ukraine-based counterparties. So that risk-weight could change as we go forward to future quarters.

And lastly, a poorly diversified portfolio is, of course, always a concern. With rates that our portfolios haven't seen for a long time, along with inflation, the replacement cost term may increase.

What options do banks have? And what do we see banks doing to minimize the impact of market volatility on capital requirements?

Stuart Nield, Ph.D.

We begin by looking at the different risk frameworks and some of the steps you could take to mitigate the capital size and volatility for the regulation in force today as well as in the future. One of the strategies we see banks adopting is to try to have as much of their trading book under the internal models approach (IMA) rather than split between IMA and SA. That way, they get the most benefit from diversification across the positions in their trading book.

But when we move to the future FRTB capital requirements, banks are looking at different strategies to minimize their capital. Banks often hedge on a risk factor correlated to the risk exposure factor. Typically, the more risk factors banks have that can be modeled, the lower the capital charge. So, seeking out data pools and providers is an excellent avenue to explore here.

One final way that banks could minimize capital under FRTB is by optimizing which of their trading desks are put on SA versus IMA. So you see a diversification benefit across risk factors, and there isn't diversification between the two approaches. This means there's an efficient frontier.

Moving on to counterparty credit risk. Under the standardized approach for counterparty credit risk (SA-CCR), which is now in force, it's quite punitive for directional portfolios, even more so than the previous current exposure method (CEM). If banks can make their portfolios more balanced, they can make capital savings. And then, for the standardized approach in the internal model method, improving the strength of credit support annex (CSA) agreements and improving the quality of the collateral that minimizes the gap risk of collateral over the margin risks are ways to reduce capital requirements.

How do we see our customers future-proofing their books?

Allan Cowan, Ph.D.

One of the critical elements we've mentioned is having diversified portfolios and understanding the impact of your trade. We see banks moving towards analyzing their capital at deal time. This allows an understanding of the incremental change in the capital due to the deal. It also enables traders to more aggressively go after trades that are capital-reducing, or to bypass trades that are not beneficial from a capital standpoint.

So if you were to do a new deal considering SA- CCR, for example, the replacement costs, you get full netting benefit. However, in the potential future exposure (PFE) term, there are regulatory prescribed buckets, and correlations between those buckets dictate the extent to which you can get diversification benefits.

For SA-CVA, the capital is calculated using the sensitivities-based approach. So you must have the sensitivities of your portfolio recalculated with the impact of the new trade. If you can calculate that at the deal time, you can start quantitatively understanding what the benefit of your new trade is.

The other element, of course, is the total lifetime cost of the capital or the return on capital. And this is measured through the capital valuation adjustment (KVA) calculation. This allows you to understand not just the change in your current capital, but what the capital requirements associated with holding that trade to maturity would be. So this calculation requires you to predict the future capital requirements at every time step and exposure date within your simulation. This requires you to understand future exposure in the portfolio with the new trade, future variation, or initial margin requirements.

Learn more about our Financial Risk Analytics solutions for XVA, Counterparty Credit Risk and FRTB.

About the authors:

Stuart Nield, Ph.D., Global Head of Product, Financial Risk Analytics, S&P Global Market Intelligence

Stuart Nield is the Global Head of Product, Financial Risk Analytics at S&P Global Market Intelligence. He has worked on many aspects of risk in his career and has held senior positions in risk management, quantitative analytics and system development. Over a 15-year career, Dr. Nield has worked for Barclays Capital, UBS Investment Bank and Detica (a data analytics consulting firm). He has a passion for developing risk software that solves business problems in a simple and elegant way.

Allan Cowan, Ph.D., Global Head of Data Analytics, Financial Risk Analytics, S&P Global Market Intelligence

Allan Cowan is global head of financial engineering for Financial Risk Analytics at S&P Global Market Intelligence. He is responsible for the R&D initiatives for the Financial Risk Analytics team. He oversees the research and development of the quantitative libraries and methodology used in the groups counterparty credit risk and xVA solutions. With over 13 years of experience, he is an expert in the field of derivatives valuations, regulatory risk and xVA management.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-reduce-regulatory-risk-capital-volatile-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-reduce-regulatory-risk-capital-volatile-markets.html&text=Webinar+Rewind%3a+How+can+banks+reduce+regulatory+risk+capital+in+volatile+markets%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-reduce-regulatory-risk-capital-volatile-markets.html","enabled":true},{"name":"email","url":"?subject=Webinar Rewind: How can banks reduce regulatory risk capital in volatile markets? | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-reduce-regulatory-risk-capital-volatile-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Webinar+Rewind%3a+How+can+banks+reduce+regulatory+risk+capital+in+volatile+markets%3f+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-reduce-regulatory-risk-capital-volatile-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}