Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 18, 2024

Basic Materials jumps up growth rankings, but firms continue to cut employment

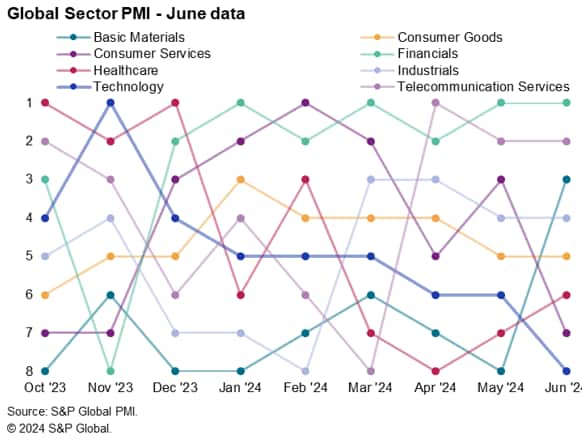

S&P Global PMI sector data signalled a further strong performance from the Financials sector in June, as the segment remained the top performer at the global level. Nonetheless, there were changes seen elsewhere. Basic Materials - a sector long in the doldrums - shot up to the third-best performing sector midway through 2024. Replacing Basic Materials at the bottom of the growth rankings table was Technology amid slower expansions in both Technology Equipment and Software & Services.

Despite expansions recorded in all 21 monitored sectors, June data indicated lingering weak demand in some areas, with almost half of monitored segments continuing to lower workforce numbers. Despite greater output and sustained increases in new orders, Financials and Consumer Goods were the only broad sectors* to see a drop in employment.

Basic Materials register solid growth, driven by an upturn in the Chemicals sector

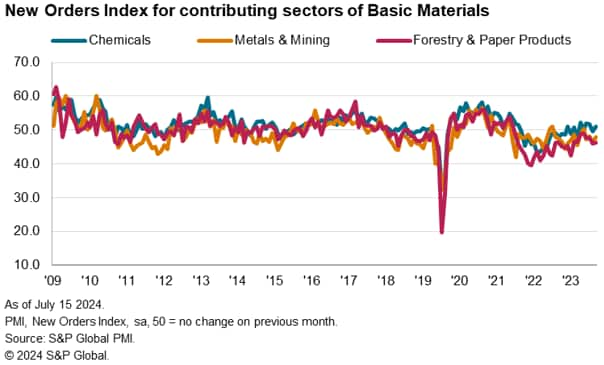

At the global level, the Basic Materials category registered a sharper expansion in production during June, with the pace of growth accelerating to the fastest since February 2022. The latest rise in output contrasted notably with May data, when the Basic Materials category was the weakest-performing of the eight broad sectors monitored by the survey. The jump to third place in the rankings table was supported by upturns in each of the constituent sub-sectors, including Chemicals, Metals & Mining, and Forestry & Paper Products.

That said, of the sectors, Chemicals was alone in seeing an uptick in client demand midway through 2024. Although declines in new orders at Metals & Mining and Forestry & Paper Products firms eased, they were solid overall amid challenges spurring new sales and steep drops in new export orders.

Meanwhile, June data saw the fastest rise in employment in the Chemicals sector since September 2022 despite business confidence slipping to the lowest since October last year. Nonetheless, this contrasted with the trend among Resources companies, which includes Metals & Mining and Forestry & Paper Products, where modest job cuts were made.

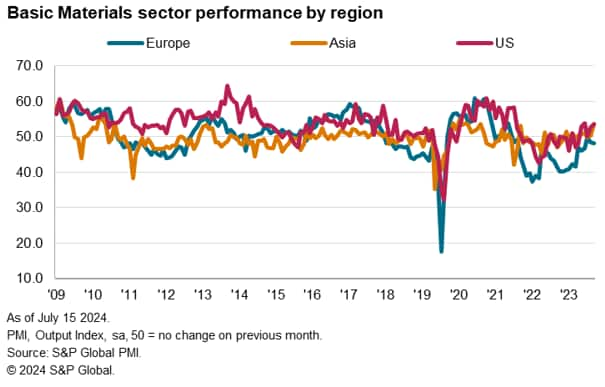

At the regional level, the improvement in the performance of the wider Basic Materials category stemmed from faster expansions in Asia and the US. In contrast, a decline continued to be recorded in Europe, with all three contributing sectors posting contractions in output.

Financials strongest overall performer, but job cuts persist

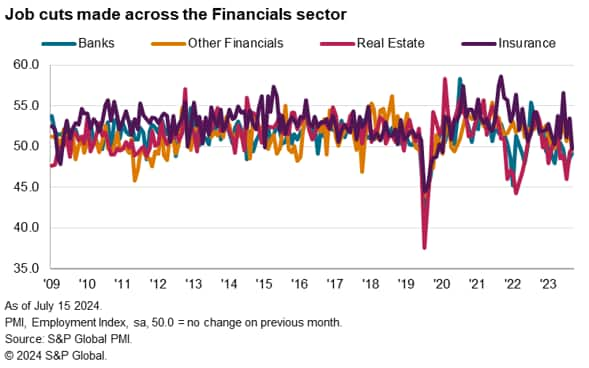

The Financials sector continued to dominate the growth rankings table at the global level during June, as the four contributing sectors (Other Financials, Banks, Insurance, and Real Estate) were the top-performing segments for the first time on record.

At the regional level, the broader Financials category signalled stronger activity growth in the US, while Banks and Other Financials continued to record the sharpest expansions of the 21 monitored sectors in Europe. Meanwhile, the pace of increase in output for Banks, Insurance, and Real Estate slowed in Asia.

Underlying PMI data at the global level indicated that Financials firms were not immune to challenges faced by others, despite faster upturns in business activity and new orders during June.

Although Insurance saw the quickest rise in selling prices of the monitored sectors again, Banks and Real Estate registered renewed cuts to their output charges. At the same time, all four contributing sectors to the Financials category lowered their workforce numbers despite softening input price pressures. Moreover, Banks and Real Estate reduced employment for the fourth and fifth month running, albeit at slower rates in June.

Subdued export demand weighs on total new orders

Of the 21 sectors monitored by global sector PMI data, only three saw a contraction in new orders during June (Forestry & Paper Products, Metals & Mining, and Construction Materials). However, 11 other sectors saw the pace of growth in new business slow as external demand conditions weighed on the expansion in total sales. Moreover, 11 segments across both manufacturing and services recorded a drop in new export orders midway through the year as firms highlighted subdued interest from foreign customers.

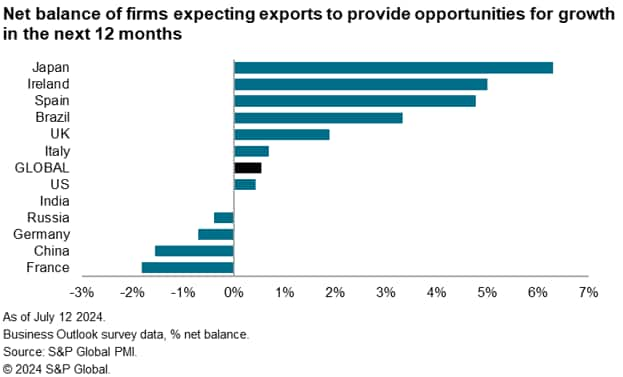

Anecdotal evidence from the recently released Business Outlook surveys conducted by S&P Global highlighted that competition, geopolitical tensions, and weak purchasing power among foreign customers were threats to the outlook for business activity over the coming year, as firms seek to remain attractive and drive new sales on the global market.

Those expecting exports to further weigh on overall business activity included large exporting economies Germany and China. Meanwhile, manufacturing and services companies in the US were only slightly confident of seeing gains in output from export demand over the coming year. Firms in Japan, however, were the most optimistic of benefits to business activity from export demand of the economies monitored by the S&P Global Business Outlook surveys.

Sian Jones, Principal Economist, S&P Global Market Intelligence

Tel: +44 1491 461 017

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasic-materials-jumps-up-growth-rankings-but-firms-continue-to-cut-employment-Jul24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasic-materials-jumps-up-growth-rankings-but-firms-continue-to-cut-employment-Jul24.html&text=Basic+Materials+jumps+up+growth+rankings%2c+but+firms+continue+to+cut+employment+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasic-materials-jumps-up-growth-rankings-but-firms-continue-to-cut-employment-Jul24.html","enabled":true},{"name":"email","url":"?subject=Basic Materials jumps up growth rankings, but firms continue to cut employment | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasic-materials-jumps-up-growth-rankings-but-firms-continue-to-cut-employment-Jul24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Basic+Materials+jumps+up+growth+rankings%2c+but+firms+continue+to+cut+employment+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasic-materials-jumps-up-growth-rankings-but-firms-continue-to-cut-employment-Jul24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}