Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 27, 2022

Bond-linked equity signals

Research Signals - September 2022

The bond market has long been considered a leading indicator of future economic conditions, yet the relationship between corporate bonds and the underlying company stock price is a less researched topic. However, this connection has become more acute in the current environment characterized by inflation running above central bank objectives and hawkish messaging in several key regions. Using data provided by the IHS Markit Corporate and Sovereign Bond Pricing team, now a part of S&P Global, Research Signals tests the use of corporate bond pricing data as a predictor of future stock returns. Using this rich dataset, we introduce 19 base factors (and seven variants to extend coverage) using bond return and curve data to predict equity price movement.

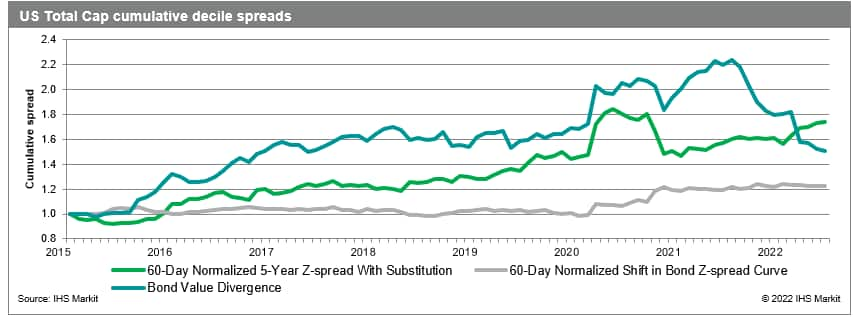

- Robust average monthly performance between buy- versus sell-rated stocks was found for factors such as 60-Day Normalized 5-Year Z-spread With Substitution (0.68%) in the US Total Cap universe, Twist in Bond Z-Spread Curve (0.69%) in Emerging Markets and Bond Value Divergence in Developed Europe (0.69%) and Developed Pacific (0.33%)

- Rank correlations between three main bond pricing factors and various thematic signals from the Research Signals factor library suggests low commonality in general, confirming the uniqueness of the signals which is a beneficial feature in many quantitative and fundamental settings

- We provide a use case of bond pricing factors as an overlay with our proven Value Momentum Analyst Model, demonstrating additional monthly alpha in the US Total Cap (25 bps), Developed Europe (2 bps), Developed Pacific (8 bps) and Emerging Markets (3 bps) universes, with negligible impact on turnover

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbond-linked-equity-signals.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbond-linked-equity-signals.html&text=Bond-linked+equity+signals+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbond-linked-equity-signals.html","enabled":true},{"name":"email","url":"?subject=Bond-linked equity signals | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbond-linked-equity-signals.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bond-linked+equity+signals+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbond-linked-equity-signals.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}