Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 21, 2020

Brexit and the UK economic impact

The UK parliament has ratified the renegotiated Withdrawal Agreement, which allowed the United Kingdom to leave the European Union on 31 January 2020. It was hoped that this would help push the risk of a disorderly Brexit into the long grass and could be a first step towards restoring business confidence and repairing the investment malaise. However, new Brexit uncertainties are sounding on the risk radar, namely whether the 11-month transition period is sufficient to deliver an agreement on the future UK-EU relationship, and whether it is the right deal for UK firms. With both sides distracted by the COVID-19 virus crisis, talks to determine the future UK-EU relationship have failed to make any significant progress.

Key points

- The Conservative government, with an 86-seat majority following the December 2019 general election, has obtained parliamentary ratification of both its renegotiated Withdrawal Agreement and Political Declaration. This step allowed the United Kingdom to leave the European Union on 31 January 2020.

- The transition period is under way, with the UK temporarily remaining part of the EU trading bloc from the point of its departure to 31 December 2020. The UK will need to abide by EU rules and pay into the EU budget but will lose its voting rights during this period.

- The current negotiations are to determine the future EU-UK trade relationship after the transition period ends. The whole of the UK will leave the EU Customs Union and Single Market at the end of December 2020.

- The coronavirus disease 2019 (COVID-19) virus has disrupted the EU-UK trade negotiations, which were already challenging given the short timeframe.

- The IHS Markit baseline scenario assumes that, in the possible absence of a fully-fledged treaty, both the UK and the EU will strive to avoid a disorderly Brexit from January 2021. They are likely to seek mutually acceptable temporary emergency measures to facilitate further negotiations and avoid disruptions to the highly integrated supply chains and use of services, with both the EU and UK economies scarred by the COVID-19 crisis.

- There are significant Brexit risks associated with EU-UK trade talks. Should failed trade talks result in the UK reverting to World Trade Organization (WTO) terms to trade with the EU from 1 January 2021, the UK's economy is likely to face a new recession in the first half of next year.

Even without considering the implications of a "no EU-UK trade deal" outcome, the UK economy is experiencing an unprecedented downturn in 2020.

- UK GDP shrank by a cumulative 22.1% in first half 2020, one of the worst-affected economies.

- Even before the COVID-19 virus-related lockdown, the stretched and still uncertain Brexit process had taken its toll on the UK's industrial sector, damaging investment activity since 2018.

- Without a trade deal, UK firms will face new tariffs when trading with the EU, threats to their supply chains, and increases in the cost of their products and services at the worst possible moment for the UK economy.

- Poorer labor market conditions have ensued, namely a falling number of workers on the payroll, people working fewer hours and earning less, and rising unemployment benefit claims.

- The fiscal landscape has deteriorated markedly, suggesting less policy flexibility to mitigate the economic shock of failed EU-UK trade negotiations.

The scenario results of failed EU-UK trade talks

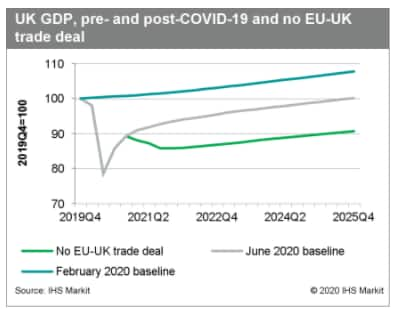

Failed EU-UK trade negotiations could spark a new UK recession during 2021, with the economy scarred by the COVID-19 shock.

- UK GDP would contract 1.4% in 2021 and 0.4% in 2022 before growth returns in 2023.

- This forecast is a marked step down from our June baseline assessment, which estimates UK GDP expanding 4.9% in 2021 and 2.7% in 2022.

- A large GDP hit in a "no trade deal" scenario reflects deep pressures on the economy in 2021.

- A "no trade deal" outcome would lower UK GDP 9.4% by 2025 when compared with the June baseline.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-and-the-uk-economic-impact.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-and-the-uk-economic-impact.html&text=Brexit+and+the+UK+economic+impact+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-and-the-uk-economic-impact.html","enabled":true},{"name":"email","url":"?subject=Brexit and the UK economic impact | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-and-the-uk-economic-impact.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit+and+the+UK+economic+impact+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbrexit-and-the-uk-economic-impact.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}