Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 05, 2022

Business activity revives across manufacturing and services in June, but demand headwinds persist amid ongoing COVID-19 restrictions

PMI survey data for mainland China signaled a strong rebound in economic activity across both manufacturing and services in June as pandemic-related restrictions were eased. New business inflows also rose, albeit to a less marked extent, with demand reportedly again restrained by COVID-19 restrictions which, although loosened, remain tighter than in other major economies. Price pressures meanwhile also remained subdued, often linked to sluggish demand growth associated with the ongoing health measures designed to fight the pandemic as China persists with is 'zero-covid' policy.

Broad-based growth resumes in June

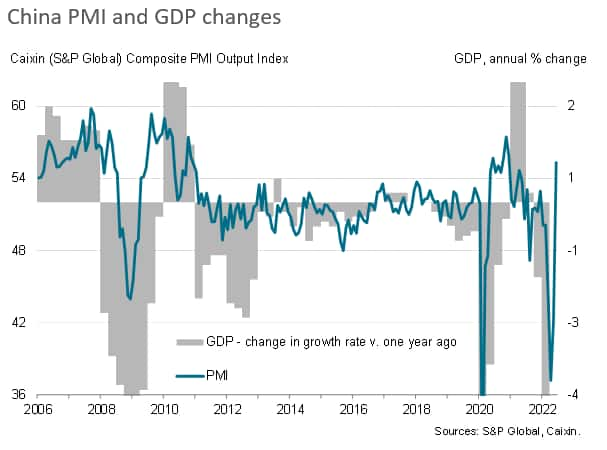

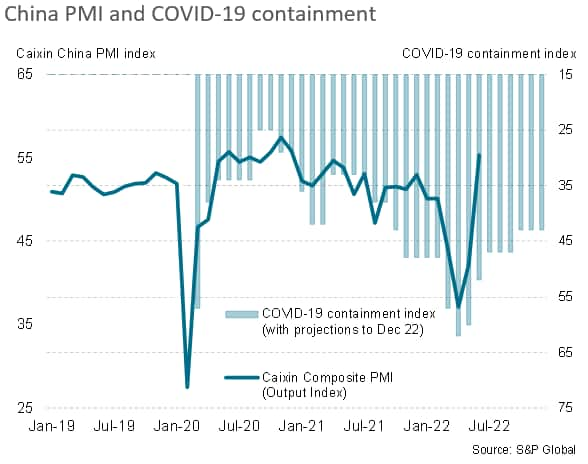

Business activity surged higher across mainland China in June, according to Caixin PMI survey data compiled by S&P Global. The survey's output index covering both manufacturing and services jumped over 13 points - a gain only exceeded over the past 22 years of survey history by that seen in March 2020. The latest reading therefore signals a strong return to growth after three consecutive monthly steep declines. Barring the early months of recovery from the initial pandemic lockdowns, the latest gain was the largest recorded for over a decade.

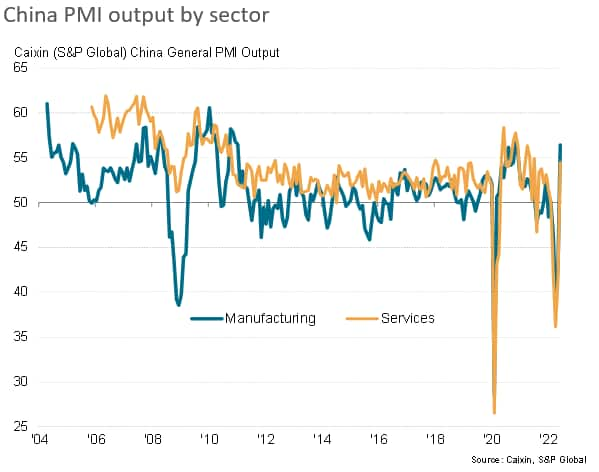

Business activity rebounded in both manufacturing and services in June as COVID-19 containment measures were partially relaxed. While manufacturers reported the steeper rate of expansion, enjoying the second-largest increase in production since the start of 2011, service providers also reported a marked improvement, with output growing at the strongest rate since July 2021.

Demand shows less impressive rebound

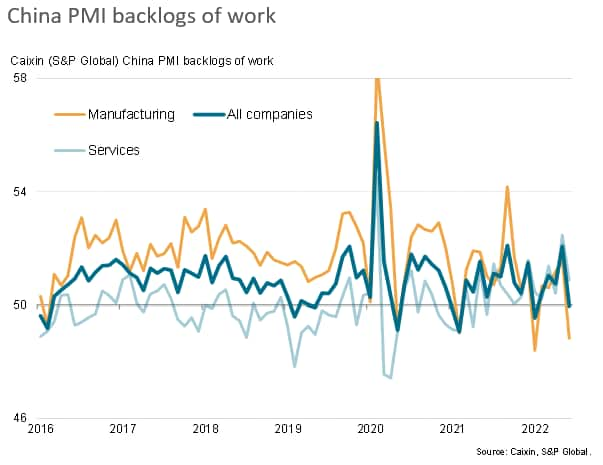

The improvements in output were principally a reflection of greater activity being facilitated by looser COVID-19 restrictions. Firms were often able to reduce their backlogs of work, which had accumulated due to the pandemic-related restrictions imposed to fight the Omicron variant. These backlogs fell notably in manufacturing and rose only very modestly in services as a result.

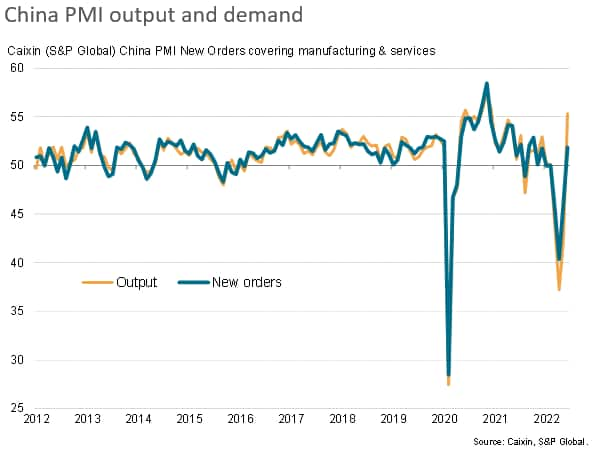

Although the easing of COVID-19 containment measures also helped drive a return to growth of new business for the first time since December, the rebound in orders was notably less marked than the recovery of activity. This divergence hints that activity growth could weaken again in July absent a further upturn in demand growth, especially given the pull-back in indicators of backlogs of orders.

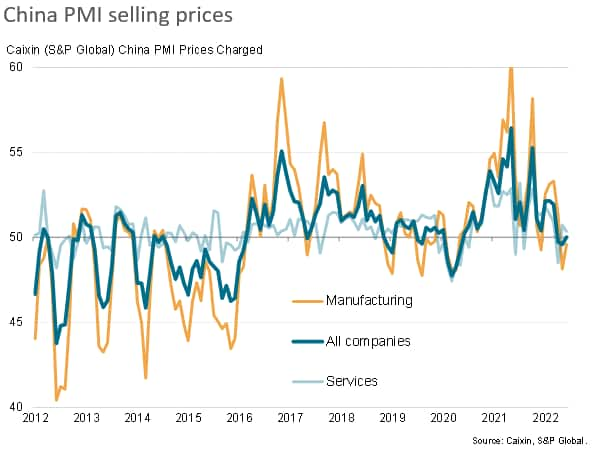

Prices merely stabilise

Average prices charged for goods and services were meanwhile steady in June, contrasting with marginal declines seen over the prior two months. Despite the rebound from the Omicron-related containment measures, manufacturing prices fell for a second successive month in June and rates charged for services rose only marginally, the rate of inflation in fact cooling slightly from May.

Outlook

The relatively subdued rebound in demand in June and the accompanying modest upward pressure on prices (and, in the case of manufacturing, falling prices) to a large extent reflect the persistence of COVID-19 containment measures. Despite some of the restrictions being eased in May and June, the overall degree of containment remains high according to S&P Global's calculations (see chart). What's more, given the government's zero-covid policy, restrictions also look set to remain problematic for demand growth at least until the end of the year.

Link to press releases

Caixin China General Services PMI

Caixin China General Manufacturing PMI

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbusiness-activity-revives-across-manufacturing-and-services-in-june-june22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbusiness-activity-revives-across-manufacturing-and-services-in-june-june22.html&text=Business+activity+revives+across+manufacturing+and+services+in+June%2c+but+demand+headwinds+persist+amid+ongoing+COVID-19+restrictions+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbusiness-activity-revives-across-manufacturing-and-services-in-june-june22.html","enabled":true},{"name":"email","url":"?subject=Business activity revives across manufacturing and services in June, but demand headwinds persist amid ongoing COVID-19 restrictions | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbusiness-activity-revives-across-manufacturing-and-services-in-june-june22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Business+activity+revives+across+manufacturing+and+services+in+June%2c+but+demand+headwinds+persist+amid+ongoing+COVID-19+restrictions+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbusiness-activity-revives-across-manufacturing-and-services-in-june-june22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}