Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 05, 2018

Caixin PMI surveys point to steady economic growth despite export decline

- Caixin Composite PMI Output Index at 52.3 in May, unchanged from April

- Export sales fall again, partly weighed on by stronger CNY

- Surveys point to resilient domestic demand

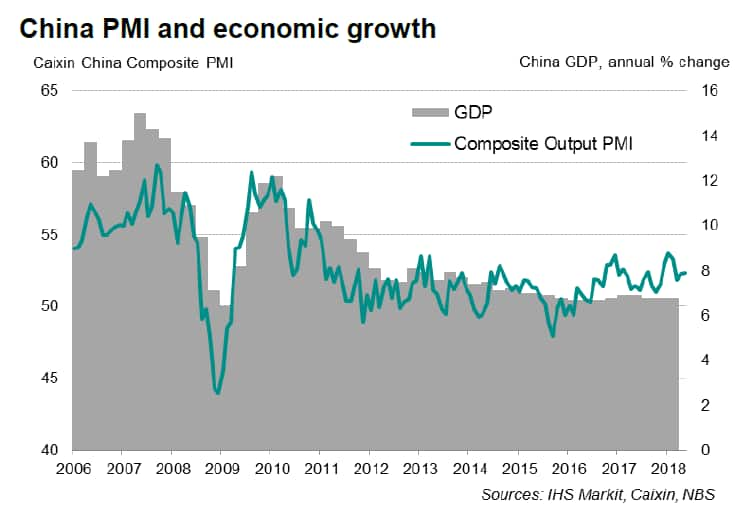

China's economy maintained a steady momentum midway through the second quarter, according to the latest Caixin PMI surveys. The upturn appeared increasingly driven by domestic demand, indicating further progress of the government's planned shift towards more consumption-based economic growth.

Resilient growth

The Caixin China Composite PMI™ Output Index came in at 52.3 in May, unchanged from April, signalling another modest increase in Chinese business activity. At 52.7, the average PMI reading so far this year is up from 51.9 in 2017, and represents the strongest start to a year since 2011.

Other survey sub-indicators point to stable growth in coming months. New business inflows grew at a rate that was similar to those seen in recent months, while business confidence remained positive. Backlogs of work continued to accumulate, albeit at a slower pace.

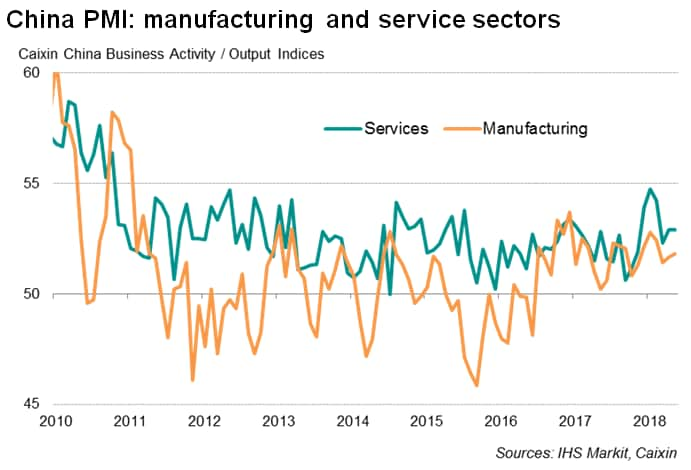

By sector, services activity continued to expand at a faster rate than manufacturing output. With export sales remaining in decline across the manufacturing sector, the survey data suggest domestic demand has increasingly become the main growth driver.

Domestic-led upturn

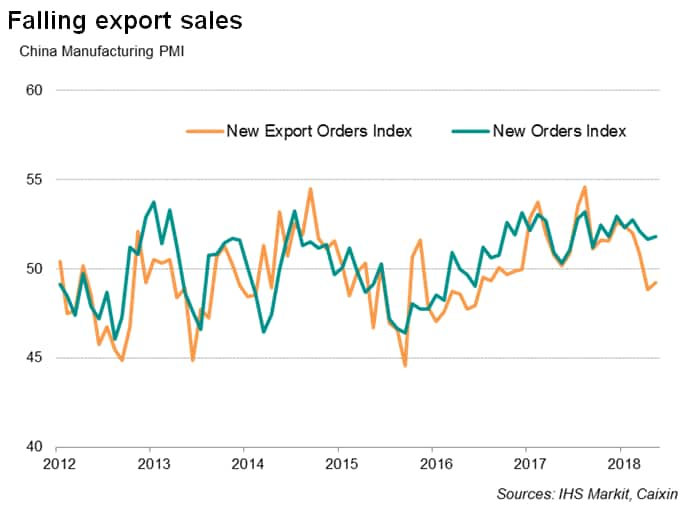

A recent easing of global trade growth has coincided with a downturn in Chinese exports. May data indicated a second monthly fall in new export orders. There were also signs that a stronger yuan has started to reduce export competitiveness. Despite a recent depreciation, the yuan is still up 2.1% against the US dollar so far this year. There were very few mentions of rising sino-US trade tensions in the survey's anecdotal evidence, suggesting Chinese manufacturers were not overly concerned about tit-for-tat trade measures. Future expectations of growth even ticked higher in the manufacturing sector, albeit remaining below highs seen at the start of the year.

Softer external sales were offset by rising local demand, reflecting a strengthening domestic market. Data broken down by types of manufactured goods revealed that output growth of consumer products continued to outpace that of intermediate and investment goods.

Another key gauge of domestic demand is the service sector's performance. Service sector business activity saw a higher rate of expansion in May than the annual averages in the past five years. As such, recent survey data highlight the resilience of the domestic market, which indicated progress in efforts to transition the economy from high-speed to high-quality growth.

Steady growth momentum will permit - even encourage - the Chinese government to continue pursuing its reform agenda, such as boosting consumption, reining in excess credit growth, and market liberalisation.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-point-to-steady-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-point-to-steady-growth.html&text=Caixin+PMI+surveys+point+to+steady+economic+growth+despite+export+decline+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-point-to-steady-growth.html","enabled":true},{"name":"email","url":"?subject=Caixin PMI surveys point to steady economic growth despite export decline | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-point-to-steady-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Caixin+PMI+surveys+point+to+steady+economic+growth+despite+export+decline+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-point-to-steady-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}