Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 01, 2019

Caixin PMI signals solid start to fourth quarter as factory upturn gains momentum

- Caixin China Manufacturing PMI reaches highest in over two-and-a-half years

- Growth of both output and order books accelerates

- Survey data shows upturn broadening out across the manufacturing sector

- Business confidence rises to six-month high

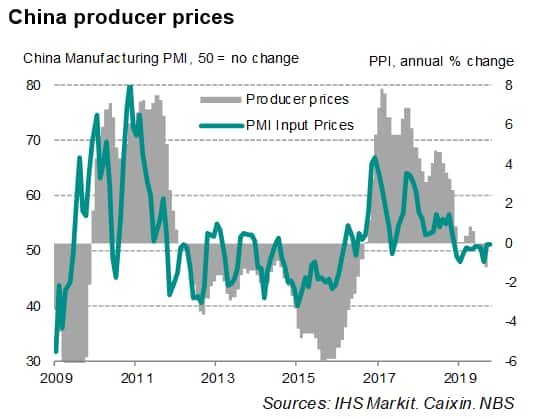

The latest Caixin PMI painted a picture of a sustained improvement in manufacturing conditions across China during October. Goods producers reported improved demand due to stimulus measures as well as rising hopes that trade tensions are starting to ease. The survey also brought signs that the latest output expansion has become more broad-based, suggesting that the improvement has more to run in the coming months.

Solid start to fourth quarter

After adjusting for seasonal influences, the headline Caixin China General Manufacturing PMI reached 51.7 in October, up from 51.4 in September, to signal the strongest improvement in the health of the sector since early 2017.

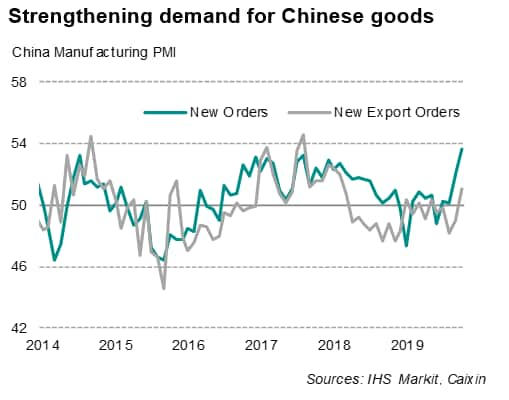

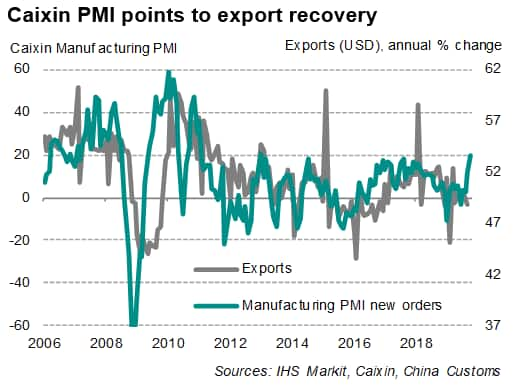

Driving the headline index was a quicker expansion in output that was the sharpest since December 2016, fueled in turn by a concurrent strengthening of demand, both at home and across export markets. New orders rose at the fastest rate for over six-and-a-half years, supported by a return to growth of export sales. Foreign demand for Chinese goods increased at the quickest pace since February 2018 during October. However, firms also perceived that sales had gained momentum and the business environment had improved on the back of policy support.

In line with stronger sales growth was a further (and faster) rise in backlogs of work, the quickest for over one-and-a-half years. However, despite the further development of capacity pressures, factories reported another fall in employment. October survey data showed an increased rate of job shedding, with workers being lost at the fastest rate for just over a year. However, job losses primarily reflected voluntary leavers.

The PMI has now risen for four consecutive months, and the improved manufacturing performance has fed through to business sentiment. While still subdued by historical standards, optimism rose to a six-month high in October, as measured by the Future Output Index.

Greater confidence was also reflected in firms' willingness to continue raising purchasing activity and accumulating input stocks in October.

Broadening upturn

Digging into the details of the survey revealed that manufacturing conditions are strengthening across the spectrum of manufacturing firms by size. While large manufacturers continued to lead the improvement, medium- and small-sized firms were also seeing stronger growth. Looking at the types of manufactured goods, producers of consumer goods and investment products were reporting faster rates of growth compared to those manufacturing intermediate goods.

Bernard Aw, Principal Economist, IHS

Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-signals-solid-start-to-fourth-quarter-as-factory-upturn-gains-momentum-nov19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-signals-solid-start-to-fourth-quarter-as-factory-upturn-gains-momentum-nov19.html&text=Caixin+PMI+signals+solid+start+to+fourth+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-signals-solid-start-to-fourth-quarter-as-factory-upturn-gains-momentum-nov19.html","enabled":true},{"name":"email","url":"?subject=Caixin PMI signals solid start to fourth quarter | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-signals-solid-start-to-fourth-quarter-as-factory-upturn-gains-momentum-nov19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Caixin+PMI+signals+solid+start+to+fourth+quarter+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcaixin-pmi-signals-solid-start-to-fourth-quarter-as-factory-upturn-gains-momentum-nov19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}