Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 11, 2021

Capesize regional SD balance signaled a strong rebound of freight rates in the coming weeks

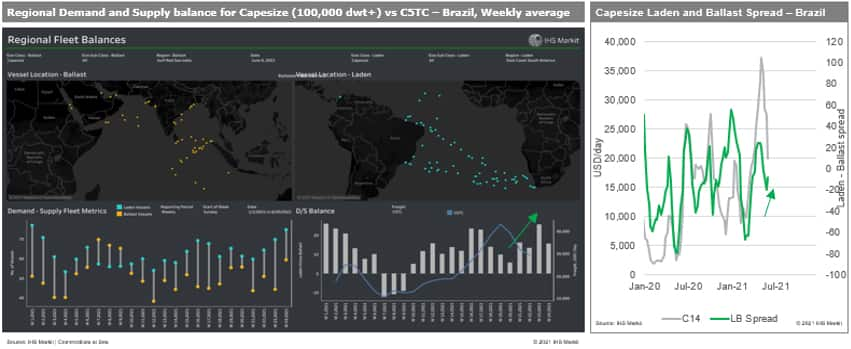

Chart 1: High-frequency indicators for C5TCs — Laden and ballast spread in Brazilian routes — started to rebound and indicated freight rates will increase in the coming weeks with the recovery of laden shipments against limited ballasters

Source: IHS Markit Commodities at Sea

Over the past few weeks, the C5TC spot rates had continued to decline and fell below $20,000/day in the week starting 7 June from more than $40,000/day a month ago with several operational issues from Atlantic mineral exporters, the falling steel-related commodity prices, and negative sentiments with news of attempts by the mainland Chinese governments to limit the rising commodity prices.

However, as we discussed in the Freight Rate Forecast Service Research note, the bigger size sector has clear upside potential in the coming months based on fundamental assessment. In the June 2021 update (released 3 June 2021), Capesize monthly statistical models forecast C5TC spot rates to increase more than 50% ($10,000/day) higher than the current spot rates ($20,000/day as of writing) in the coming months based on demand and supply fundamental assessments.

Moreover, since freight rates have been more affected by sentiments and commodity prices in recent period, once commodity prices stop declining, there will be likely recovery in the dry bulk freight rates. Specifically, as long as iron ore prices remain high, there is possibility of another short-term spike in Capesize freight market; even though 62% Fe iron ore prices have declined, high-quality 65% Fe iron ore prices, mostly from Brazil, have maintained its value with strong demand from mainland China, trying to reduce emissions with high quality ore and limited capacity. Therefore, we believe that high quality iron ore exports from Brazil and its Capesize shipments are expected to increase in the third quarter this year.

Our weekly forecast models supported our view that although Capesize freight rates have declined over the past few weeks with the correction in commodity prices, models still signaled a strong rebound in the coming months (see Appendix 1). Interestingly, one of the high-case models indicated July 2021 C5TC spot rates could go up to $60,000/day and we will not be surprised to see those upside scenario if FFA July contract breaches initial resistance level of about $40,000/day and triggers short-covering. Specifically, high-frequency indicators for regional Capesize demand and supply balance from IHS Markit's Commodities at Sea — Laden and ballast spread in Brazilian routes — started to rebound and indicated freight will increase in the coming weeks with the recovery of laden shipments against limited ballasters.

Also, it is worth noting that the current dry bulk freight market has been supported by several new factors mainly driven by COVID-19 environments, other than mere seasonal S&D balance. The most notable factor is the strong container trade demand and record high container freight rates along with inefficiency of supply chain including congestion. IHS Markit Supramax forecast models recently picked global container freight rates as one of the major drivers (8.2% contribution in the S10TC forecast, June 2021 update) and the container freight rates mostly affected Pacific and backhaul routes, which explained why there has been unusual difference between Pacific and Atlantic rates and also between Fronthaul and backhaul freight rates.

In this context, we maintain our medium and long-term cautiously bearish view as we believe the recent spike was a temporary cyclical recovery driven by the pandemic — with a strong short-term spike in the third quarter — instead of a long-term uptrend super cycle. With the assumption that the disruptions in the supply chains will be resolved once the pandemic recedes around the summer season, better balances are expected to develop in the markets with cost pressures dissipating.

Specifically, IHS Markit economists believe service-sector consumption likely regains its pre-pandemic level later this year or early next year as vaccination rollouts progress. Therefore, we assume container freight rates would face correction around that period and will affect geared bulkers market as well.

Finally, while it is important, it would be short-sighted to focus solely on the micro fundamentals of the dry bulk freight market. There clearly are some bullish/bearish fundamentals in dry bulk supply/demand balance, but the overall finance and commodity environment, and most importantly sentiments will be the major drivers for volatilities in the dry bulk freight rates.

For more insight subscribe to our complimentary commodity analytics newsletter

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcapesize-regional-sd-balance-signaled-a-strong-rebound-of-frei.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcapesize-regional-sd-balance-signaled-a-strong-rebound-of-frei.html&text=Capesize+regional+SD+balance+signaled+a+strong+rebound+of+freight+rates+in+the+coming+weeks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcapesize-regional-sd-balance-signaled-a-strong-rebound-of-frei.html","enabled":true},{"name":"email","url":"?subject=Capesize regional SD balance signaled a strong rebound of freight rates in the coming weeks | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcapesize-regional-sd-balance-signaled-a-strong-rebound-of-frei.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Capesize+regional+SD+balance+signaled+a+strong+rebound+of+freight+rates+in+the+coming+weeks+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcapesize-regional-sd-balance-signaled-a-strong-rebound-of-frei.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}