Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 25, 2024

Cash Reinvestment Gains: Returns Increase Amid Rate Uncertainty.

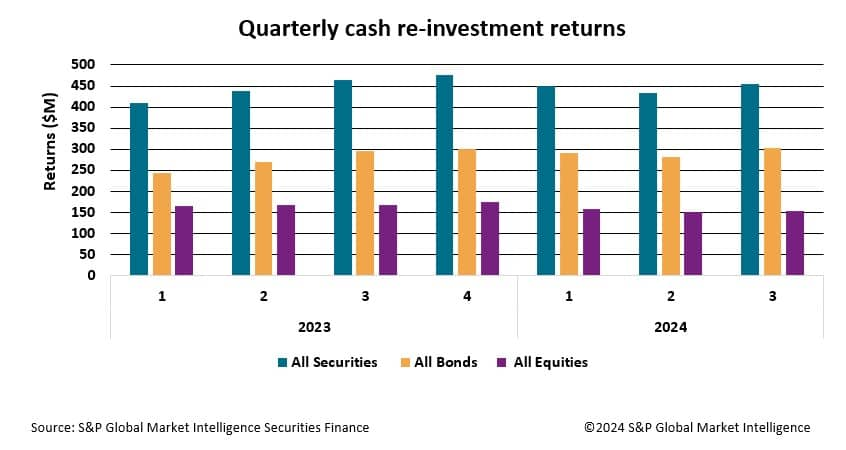

Cash reinvestment returns rose in Q3 amid ongoing uncertainty regarding the Fed's path to a neutral rate.

Uncertainty regarding the timing and size of Federal Reserve interest rate cuts benefitted cash reinvestment pools within securities lending programs during the third quarter. These programs, which loan securities in exchange for cash collateral, rely on cash reinvestment strategies to generate additional income. But with shifting economic indicators and ambiguity around Fed policy, particularly in light of the upcoming U.S. presidential election and a recently disinverted yield curve, reinvestment pools face added complexities in pricing short-term instruments like commercial paper, certificates of deposit (CDs), reverse repos, and to an extent overnight deposits.

The broader economic context, marked by ongoing inflation concerns alongside robust economic data, has kept short-term rates higher than typical in anticipation of a future rate cut. Instruments like commercial paper and CDs, often priced based on rate expectations, remain elevated as issuers delay rate adjustments while awaiting clear Fed signals. With an election looming, the Fed may also tread more cautiously than markets expect, to avoid any perception of policy interference, prolonging uncertainty in yield structures.

Instruments like reverse repos and overnight deposits respond acutely to Federal Reserve policy shifts, and in times of uncertainty, they remain attractive for reinvestment pools looking for flexibility. Reverse repo rates, influenced by the Fed's overnight reverse repurchase (ON RRP) operations and short-term funding needs, remain high in a market hedging against potential rate swings. Overnight deposits, while offering flexibility, expose reinvestment pools to reinvestment risk if the Fed enacts rate cuts, which could reduce their yield opportunities.

The recent yield curve disinversion adds another layer of complexity. Following a period where short-term rates exceeded longer-term rates—a classic recession signal—the yield curve's reversion hints at market confidence in economic resilience. However, this shift introduces reinvestment risks, as managers must now consider whether the rate normalization will continue or if another inversion might signal new economic weaknesses. Reinvestment pools, in response, are balancing between maintaining liquidity in short-term instruments and locking in yields in medium-term investments that will be beneficial as rates continue to fall.

In this environment, reinvestment pools have an opportunity to capture attractive yields by strategically positioning along the yield curve. Locking in medium-dated investments, such as CDs or term repos, allows pools to secure higher rates before any cuts, potentially protecting yield margins when rate reductions eventually come into play. With short term rates relatively high and expected to remain so in the short term due to pre-election caution, reinvestment pools can capitalize on the current yield curve structure, taking advantage of elevated yields without extending duration risk excessively.

Money market funds have recently reached a record high of $6.5 trillion in assets, reflecting investors' appetite for safe, liquid assets amid ongoing interest rate and geopolitical uncertainty. This surge in money market investments has increased competition in short-term markets for instruments such as commercial paper, certificates of deposit, and Treasury bills. As demand for these assets drives up prices yields fundamentally remain attractive as they are closely linked to elevated central bank policy rates. This trend underscores the cautious sentiment among investors, who prioritize stability over risk, particularly as they anticipate future Federal Reserve policy shifts.

As seen last quarter, larger Fed rate cuts can positively impact reinvestment returns within securities lending programs by enabling managers to lock in the higher yields currently available across the yield curve. When rates are cut significantly, the yields on newly issued short-term instruments tend to fall, while previously secured investments with higher yields maintain their value. This widening spread between old and new reinvestment rates boosts overall returns, as cash reinvestment pools benefit from these locked-in, elevated rates for a longer duration. By capturing these yields ahead of further cuts, securities lending programs often enhance income and hedge against the impact of future rate declines.

In summary, securities lending reinvestment pools find themselves well-positioned in the current environment, bolstering returns by capitalizing on both the yield curve's recent disinversion and the current policy ambiguity. As the Fed's direction unfolds, pools that have locked in elevated yields along the curve will stand to benefit even if cuts materialize, ensuring strategic positioning amidst both economic and political uncertainties.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcash-reinvestment-gains-returns-increase-amid-rate-uncertainty.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcash-reinvestment-gains-returns-increase-amid-rate-uncertainty.html&text=Cash+Reinvestment+Gains%3a+Returns+Increase+Amid+Rate+Uncertainty.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcash-reinvestment-gains-returns-increase-amid-rate-uncertainty.html","enabled":true},{"name":"email","url":"?subject=Cash Reinvestment Gains: Returns Increase Amid Rate Uncertainty. | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcash-reinvestment-gains-returns-increase-amid-rate-uncertainty.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Cash+Reinvestment+Gains%3a+Returns+Increase+Amid+Rate+Uncertainty.+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcash-reinvestment-gains-returns-increase-amid-rate-uncertainty.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}