Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 25, 2023

CEE in focus: Shifting gears to monetary easing

Downward-trending core inflation in the first half of 2023 has enabled central banks in the four Central and Eastern European (CEE) economies to focus on reviving domestic demand.

Backdoor easing is already under way in Hungary and Romania. We forecast benchmark rate cuts across the region by early 2024, ahead of the European Central Bank pivot expected in June 2024.

Varying reluctance in appearing dovish

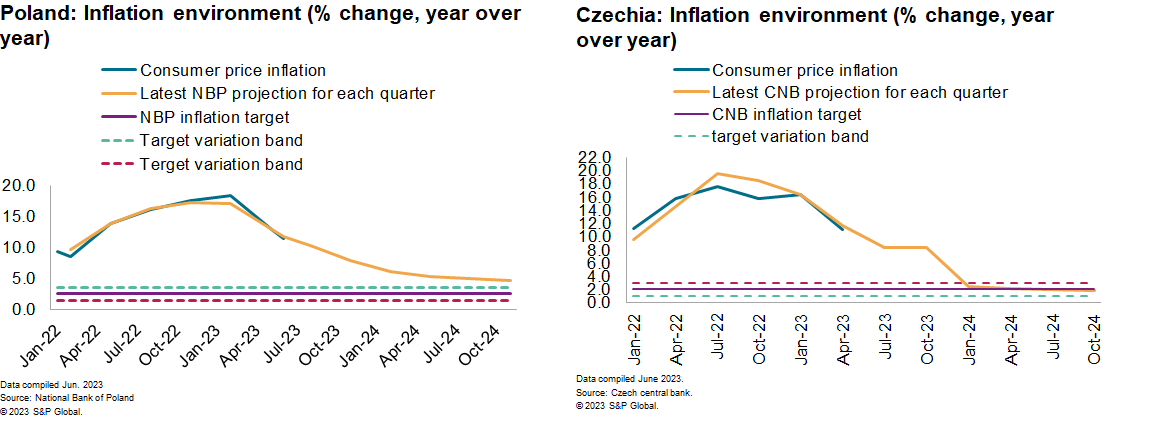

In the run-up to expected benchmark policy pivots, some central banks have been hesitant to appear dovish. The Polish central bank, which has not delivered a rate hike since September 2022, delayed officially ending its tightening cycle until July 2023. The focus has shifted to rate cuts, which we expect to start in October, as the governor has stated that monetary easing could be launched as soon as inflation drops into single digits, provided that the central bank is confident about continued declines ahead.

The Czech central bank's governor dismissed end-year rate cuts in his June press conference, which we see mainly as supporting the local currency. High-frequency inflation and wage data have been undershooting the central bank's projections, which we expect to be reflected in its August macroeconomic projections. This will act as a springboard for monetary easing to be launched in November.

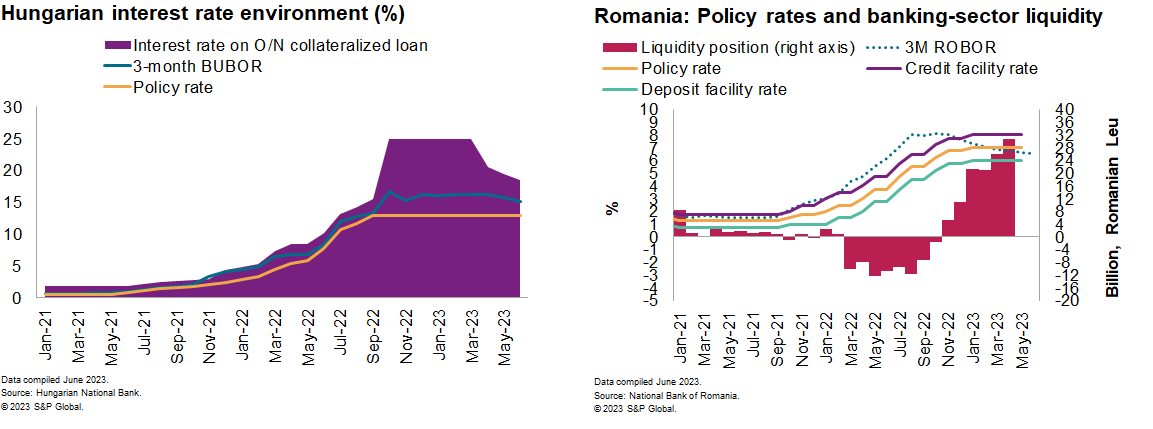

Other central banks have already turned more noticeably dovish. The Hungarian central bank has started cutting the O/N-collateralized lending rate (the top end of the rate corridor) since April while leaving other rates in the interest rate complex untouched. We expect the interest rate corridor to converge toward the 13.00% base rate by the end of the third quarter of 2023, with cuts to the main policy rate likely starting in December.

The Romanian central bank has quietly introduced backdoor monetary easing by generating record liquidity surplus in the banking system. Consequently, downward trending short-term rates have made the 6.00% deposit facility rate (100-bp lower floor of the interest rate corridor) the effective policy rate. We expect this situation to persist through the second half of this year and early 2024, with main policy rate cuts starting in April 2024.

Easing of borrowing costs will be more delayed

With monetary easing anticipated to commence later this year, borrowing conditions are expected to stabilize through the remainder of 2023 and to start falling in 2024. However, the past two years of hikes show that the transmission of policy rates to the real economy is incomplete and the speed of pass through varies across the CEE region, economic agents, and types of loans.

Higher domestic policy rates have been almost fully transmitted to lending rates for NFCs, meaning that any further increases will likely be modest. Furthermore, debt-servicing conditions remain broadly stable owing to rising profits and fiscal support, resulting in a higher nominal income that has prevented a deterioration in the debt-service-to-income ratio. Additionally, many corporations have locked in favorable euro-denominated financing, weakening the transmission of higher domestic loan rates.

Conversely, for households, transmission remains incomplete for new loans and even more so for outstanding loans, with changes in the latter reacting less to the change in the policy rate. This is due to the declining share of floating loan rates in CEE economies, except for Poland, offering protection from monetary policy cycles. The disproportion between new and outstanding loan rates is most visible in Czechia and Hungary, particularly regarding loans for house purchases. In both these countries, the share of variable mortgage rates is negligible, close to 4% in Czechia and 1% in Hungary. Hungary's government also has introduced an interest rate freeze on home loans, keeping them set at October 2021 levels.

The wider transmission lag to households presents greater further upside for borrowing costs, particularly on outstanding loans, over the second half of 2023. However, these should again be tempered by fixation periods that are longer than monetary cycles or by government-sponsored mitigation measures. For instance, in Czechia, for nearly 80% of total loan agreements, the rate-resetting window opens no earlier than in 24 months. A considerable amount of the increase in the monetary policy rate since mid-2021 should be erased by then as monetary easing will likely commence later this year and continue through 2024-25. With rate cuts under way, costs of new loans should stabilize toward the end of 2023 and start falling in 2024. This should give way for a rebound in borrowing activity, supporting growth.

Quicker growth rebound expected in 2024

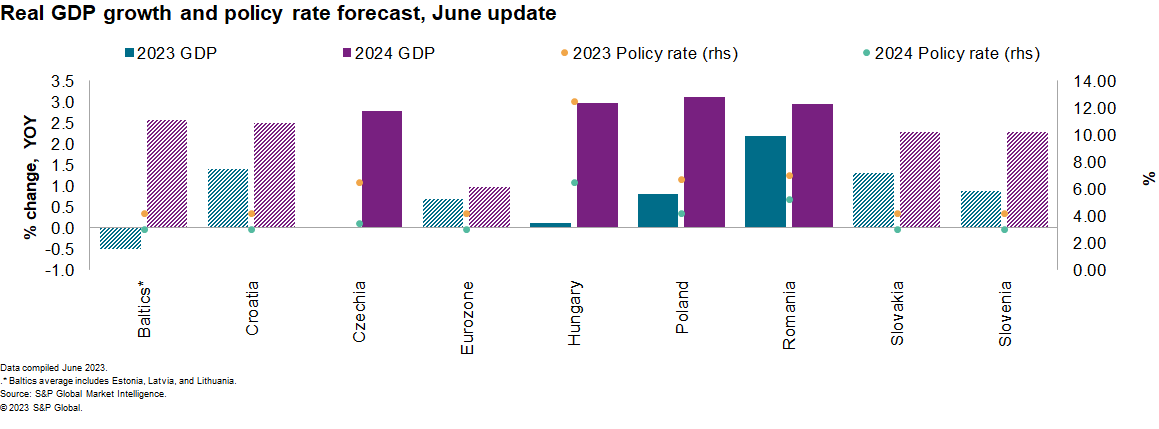

CEE's experience of post-communist transitions and accompanying inflation spirals in the 1990s prompted central banks throughout the region to tighten monetary policy more aggressively (earlier, faster, higher) than their Western European counterparts. Some CEE countries also used alternative monetary policy instruments to defend local currencies amid shifting investor confidence and fraught EU relations.

With monetary policy expected to start loosening across CEE ahead of the eurozone, the implications for growth are expected to be positive. Lower inflation and, in turn, easing interest rate conditions will support a modest acceleration in private consumption as well as improving credit conditions for households and businesses. With interest rates across the region currently higher than in the eurozone, CEE's easing cycles have further to cut, giving greater relief to households. The positive effect of the easing interest rate environment will result in stronger growth in 2024 compared with Central European economies tied to the eurozone.

The pro-inflationary impact of tighter labor markets and more aggressive tightening by major central banks are the key risks to our baseline monetary policy forecast.

Learn more about our economics data and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcentral-eastern-europe-shifting-gears-to-monetary-easing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcentral-eastern-europe-shifting-gears-to-monetary-easing.html&text=CEE+in+focus%3a+Shifting+gears+to+monetary+easing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcentral-eastern-europe-shifting-gears-to-monetary-easing.html","enabled":true},{"name":"email","url":"?subject=CEE in focus: Shifting gears to monetary easing | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcentral-eastern-europe-shifting-gears-to-monetary-easing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CEE+in+focus%3a+Shifting+gears+to+monetary+easing+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcentral-eastern-europe-shifting-gears-to-monetary-easing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}