Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 14, 2020

Charting the COVID-19 Pandemic Effects on International Trade

US-Mexico Cross-Border Trade via Mexico Customs Bill of Lading (BOL) Data

Mexico customs BOL data allows us to track US-Mexico cross-border trade using all transport methods such as truck, rail, maritime, pipeline and air. Usually available earlier than official trade statistics, it also tracks the shipper and consignee companies at either end of the shipment, and shipment-specific values and quantities. Monthly publications expected approximately the 24th of each month for the previous month.

Source: IHS Markit PIERS

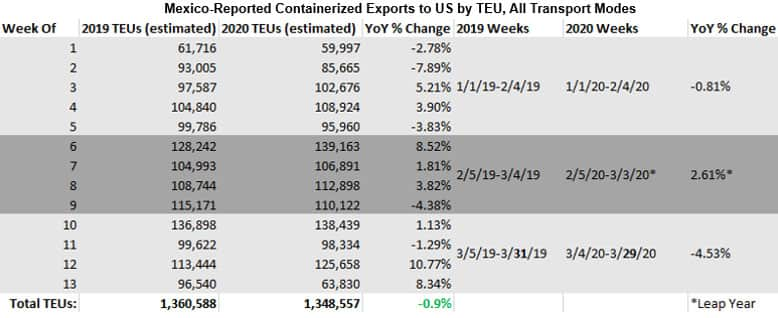

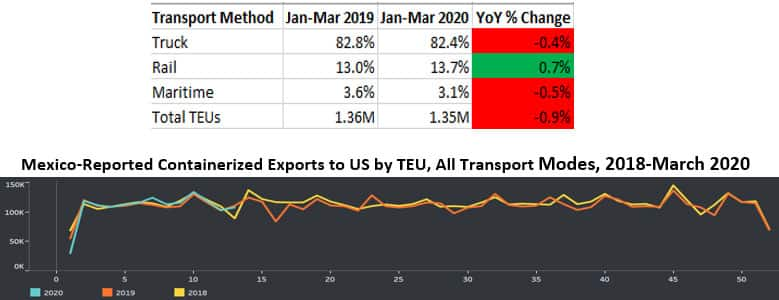

Looking at containerized trade by 20-foot equivalent units (TEUs), total Mexico exports to the US were relatively flat, declining just 0.9% the first 13 weeks of 2020 compared to the same period in 2019, closely tracking 2019 and 2018. Most cross-border containerized goods are moved by truck (~82%), followed by rail (~13%) then maritime (~3%), with little change year-on-year. Mexico didn't impose large-scale quarantines until the last week of March, so April 2020 TEU volumes will be watched closely when released approximately May 24, 2020. For comparison purposes, Mexico's April 2019 TEU exports to the US were 496,370.

Source: IHS Markit PIERS

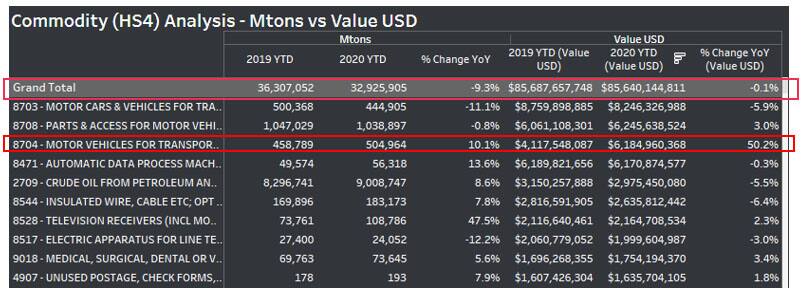

Analyzing the same period using metric tons (MTONS), which contains both containerized cargoes and non, a slightly different trend emerges. The first 13 weeks of the year showed a 9.3% decrease in total metric tons, with overall value remaining flat.

Source: IHS Markit PIERS

By USD value, the top five traded commodities are in the areas of Automotive, Digital Processing Machines and Crude Oil. Commercial vehicles for the transport of goods (HS 8704) actually gained over 50% year-on-year value, on an MTONS quantity growth of 10.1%.

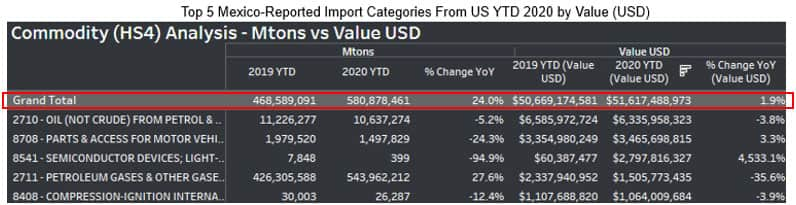

Mexico usually carries a trade surplus with the US. But for the first 13 weeks of the year, Mexico increased import MTONs from the US by 24% year-on-year and increased import value by 1.9% USD. Some of this increased trade may have been due to the US moving some sourcing from China to Mexico due to the ongoing trade dispute that ended in a Phase 1 agreement on January 15, 2020.

Source: IHS Markit PIERS

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-the-covid19-pandemic-effects-on-international-trade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-the-covid19-pandemic-effects-on-international-trade.html&text=Charting+the+COVID-19+Pandemic+Effects+on+International+Trade+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-the-covid19-pandemic-effects-on-international-trade.html","enabled":true},{"name":"email","url":"?subject=Charting the COVID-19 Pandemic Effects on International Trade | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-the-covid19-pandemic-effects-on-international-trade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Charting+the+COVID-19+Pandemic+Effects+on+International+Trade+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcharting-the-covid19-pandemic-effects-on-international-trade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}