Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 22, 2021

China drives considerable rise in global trade at start of the year

- Surge in Chinese exports drives noticeable rise in global exports over first two months of 2021

- Statistical noise makes annual comparisons challenging but data add to view that global economy continues to recover

- Pick-up in trade has exacerbated logistical difficulties, especially in sourcing goods from China

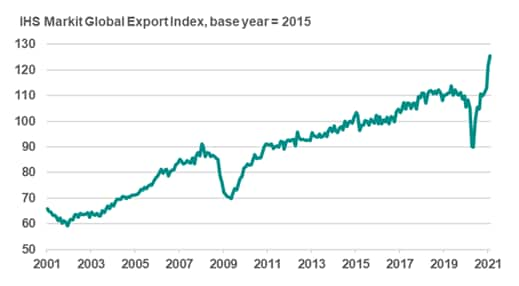

According to our latest Global Trade Index, global trade was estimated to be 14.9% higher than a year ago in January. That's the first time that growth has reached double digits since the early 2010s and adds to our view that the global economy is maintaining its recovery from the devastating effects on activity from the global coronavirus disease 2019 (COVID-19) pandemic.

However, growth was driven in the main by a surge in Chinese exports: recent official data indicated an average year-on-year increase in Chinese exports of around 60% over the first two months of 2020. Growth has been flattered by the sharp drop in trade seen in early 2020, when the pandemic led to the widespread closure of China's economy.

Regional divergences are also notably apparent in the early reports of official data, with growth seen in key Asian exporters (Japan, South Korea) but some weakness persisting amongst European nations. Intra-European trade was in part negatively impacted by challenges related to Brexit at the start of 2021.

Looking through the statistical noise owing to these temporary and pandemic base impacts - which are likely to make comparisons with year-on-year figures challenging throughout much of 2021 - global trade is nonetheless up around 10% on equivalent 2019 volumes.

Given the challenges with base comparisons - and adding Chinese New Year distortions on top of this - early estimates are exhibiting a naturally higher level of uncertainty than usual, but we expect year-on-year overall global trade growth to have pushed slightly higher again in February, probably reaching close to 16%. Whilst this outcome is again driven by strong growth in official Chinese statistics, positive trends in PMI data for the exporting behemoths of Germany and Japan reinforce the view of positive momentum in global trade heading into early spring.

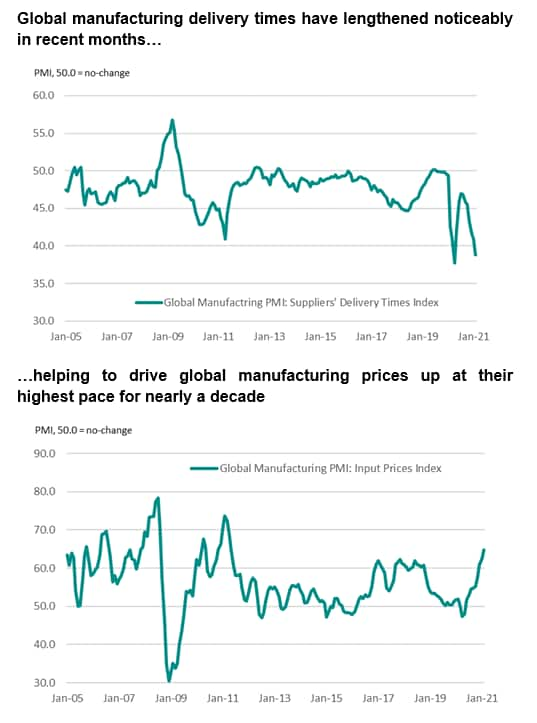

A consequence of the recovery in global trade has been a noticeable stretching of supply-chains, with our global manufacturing PMI suppliers' delivery times index recording levels in recent months unsurpassed in over 20 years of data availability - with the exception of the start of the pandemic last year.

Demand dynamics are noticeably different today than they were last spring of course: since the broad reopening of economies last summer, global industrial output has staged a noticeable recovery from the forced closures of 2020, with demand for inputs and goods in manufacturing processes surging higher in recent months.

However, the supply-side has struggled to readjust to the rise in industrial demand, with logistical difficulties widely reported by PMI panellists around the world. Combined with surging commodity prices, higher quoted costs for transportation, especially in shipping, explain why overall manufacturing input prices have risen to the greatest degree in nearly 10 years.

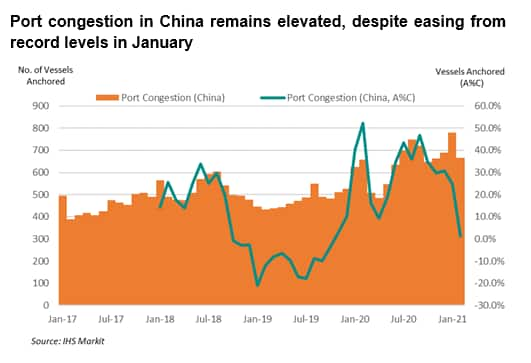

Delays have been especially noticeable from suppliers based in Asia, according to PMI panellists, and this is well highlighted by bulker fleet congestion metrics from our own Commodities at Sea, a service that provides near-real time insight into flows of major globally traded commodities and freight.

Looking specifically at port congestion statistics for China - which are based on the number of vessels currently anchored outside Chinese ports - at the start of the year levels of congestion have hit recent records, maintaining a trend that has been apparent in recent months.

February figures do however point to a stabilisation of the situation, with congestion statistics showing a drop compared to January and the annual rise the lowest recorded in nearly a year-and-a-half.

Moreover, weekly data for the first three weeks of March indicates that the downward trend is being sustained.

Whilst that will provide some hope that lead times will eventually start to improve - and give support to the views that recent price spikes will prove to be more transitory than permanent in nature - to highlight the scale of the challenge, the number of anchored vessels was still over 54% higher when compared to early 2019. Supply-side challenges are subsequently likely to persist for some time to come.

Paul Smith, Economics Director, IHS Markit

Tel: +44 (0) 1491 461038

paul.smith@ihsmarkit.com

Eliot Kerr, Economist, IHS Markit

Tel: +44 (0) 203 1593 381

eliot.kerr@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-drives-considerable-rise-in-global-trade-at-start-of-the-year-mar21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-drives-considerable-rise-in-global-trade-at-start-of-the-year-mar21.html&text=China+drives+considerable+rise+in+global+trade+at+start+of+the+year+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-drives-considerable-rise-in-global-trade-at-start-of-the-year-mar21.html","enabled":true},{"name":"email","url":"?subject=China drives considerable rise in global trade at start of the year | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-drives-considerable-rise-in-global-trade-at-start-of-the-year-mar21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+drives+considerable+rise+in+global+trade+at+start+of+the+year+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-drives-considerable-rise-in-global-trade-at-start-of-the-year-mar21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}