Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 01, 2022

China manufacturing stabilises in February, but employment falls sharply again

February saw a welcome stabilisation of manufacturing production in mainland China, suggesting the health restrictions imposed to control the Omicron variant have caused far less economic disruptions to supply chains than prior COVID-19 waves. Price pressures also remained muted, providing leeway for policymakers to add more stimulus to address the overall weakness of the economy and a continued drop in employment.

Output steadies as demand rises

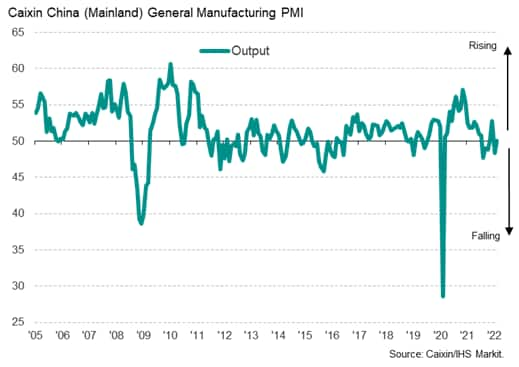

Manufacturing production in China stabilised in February, according to PMI survey data produced for Caixin by IHS Markit, in a welcome sign of the economic impact of the Omicron wave ebbing.

Manufacturing growth in mainland China

The survey data pointed to a marginal increase in production after output had fallen into decline at the start of the year due to health restrictions having been ramped up in prior months in the face of the Omicron and Delta waves. Having risen last November to the tightest since March 2020, China's pandemic-related restrictions were eased slightly in February, helping prevent a further decline in factory output.

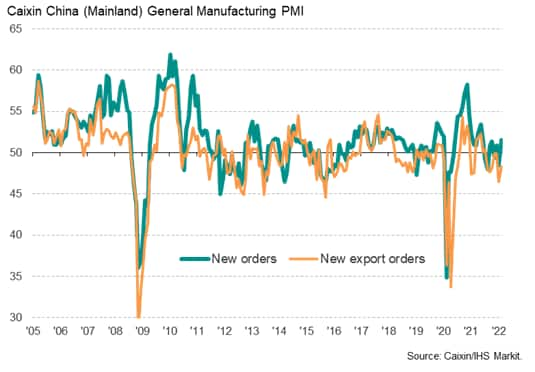

New orders rose, climbing at the fastest rate since last June, hinting at a more robust increase in production in March. However, new export orders continued to fall sharply, albeit less so than in January (which had seen the biggest drop in overseas demand for 20 months), suggesting the manufacturing sector remains heavily reliant on domestic demand as exports continue to act as a drag.

China's new order inflows

Subdued price pressures

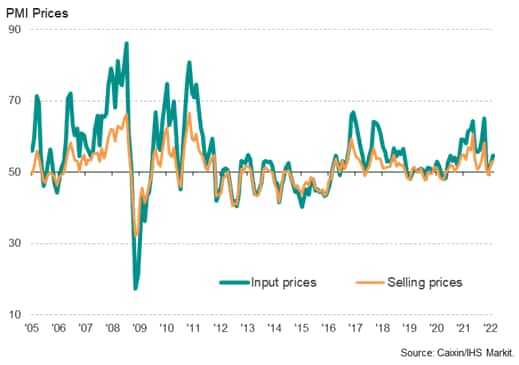

A further lengthening of supply chains was reported as a result of the ongoing pandemic, though the incidence of delays fell compared to January and delays remained far less prevalent than seen in the US, Japan and Europe in recent months. These fewer supply constraints, combined with government interventions in commodity markets, helped keep input price inflation lower than in the US and Europe, in turn feeding through to relatively muted selling price inflation.

China's raw material and factory gate prices

Job losses continue amid depleting backlogs of work

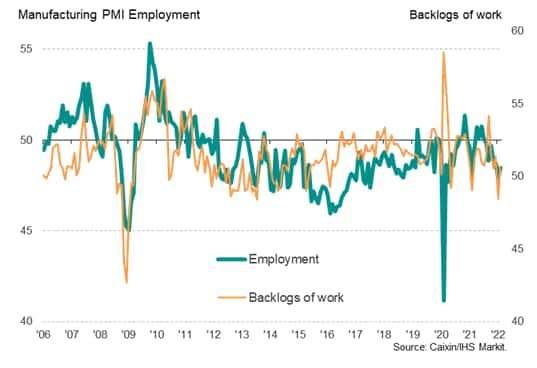

The renewed growth of new orders reported in February helped stabilise manufacturers' backlogs of orders - the amount of work in hand available to sustain production in coming months - which had fallen sharply in January. However, the modest rise in backlogs of work seen in February did little to deter companies from downsizing. Manufacturers reduced their workforce headcounts again at one of the sharpest rates seen during the pandemic, albeit slightly less so than in January (which had been the largest fall recorded since April 2020).

Manufacturing jobs and order book backlogs in mainland China

Outlook

The latest PMI survey data provide further reassuring news on inflation in China after consumer prices rose just 0.9% on an annual basis in January, down from 1.5% in December. However, the subdued output and export orders gauges support IHS Markit's recent lowering of China's real GDP growth forecast to 5.3% for 2022 and 5.2% for 2023, down respectively from 5.4% and 5.3% forecasts made in January.

Policy in China is meanwhile expected to be loosened further over the next few months to support economic growth and, perhaps more importantly, stem the decline in employment.

From a broader perspective, the steadying of production in China during February, and the avoidance of a drop in production due to the Omicron wave, will be welcome news for policymakers in other countries, boding well for global supply chains emanating out of mainland China. The prospect of further stimulus should likewise help allay worries of a further production or demand deterioration.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-manufacturing-stabilises-in-february-but-employment-falls-sharply-again-Mar22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-manufacturing-stabilises-in-february-but-employment-falls-sharply-again-Mar22.html&text=China+manufacturing+stabilises+in+February%2c+but+employment+falls+sharply+again+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-manufacturing-stabilises-in-february-but-employment-falls-sharply-again-Mar22.html","enabled":true},{"name":"email","url":"?subject=China manufacturing stabilises in February, but employment falls sharply again | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-manufacturing-stabilises-in-february-but-employment-falls-sharply-again-Mar22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+manufacturing+stabilises+in+February%2c+but+employment+falls+sharply+again+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-manufacturing-stabilises-in-february-but-employment-falls-sharply-again-Mar22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}