Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 05, 2023

China PMI signals further slowdown in August, prices edge higher

PMI survey data from S&P Global and Caixin showed the mainland Chinese economy losing further growth momentum midway through the third quarter. A further cooling of the post-pandemic service sector expansion was accompanied by another sluggish performance of the manufacturing sector, albeit with the latter enjoying a modest return to growth after July's decline.

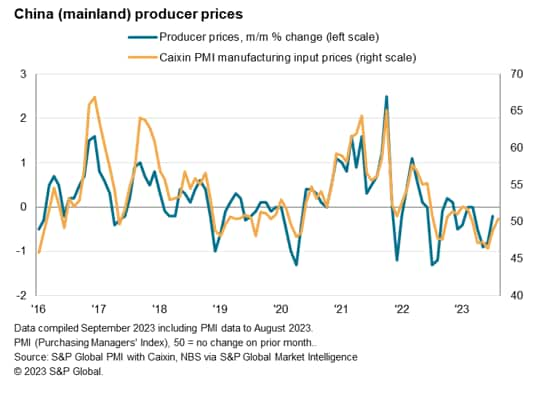

The fading of growth in the service sector was met by a further cooling of price pressures in the sector, though some encouragement for those concerned over deflation was gleaned from a slowing in the rate of decline of manufacturing prices after factory costs rose for the first time in six months.

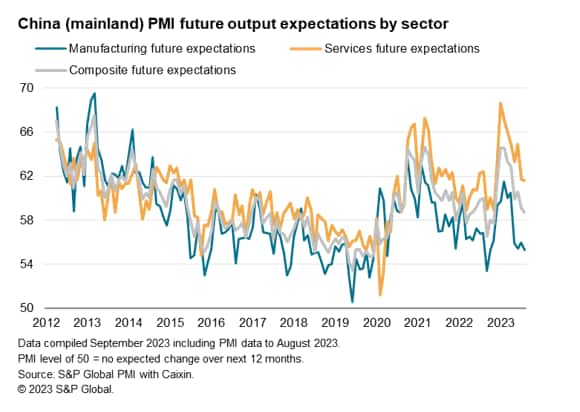

The overall growth and inflation picture nonetheless remains subdued, and a further downturn in business expectations for the year ahead adds to downside risks.

Rebound loses further momentum

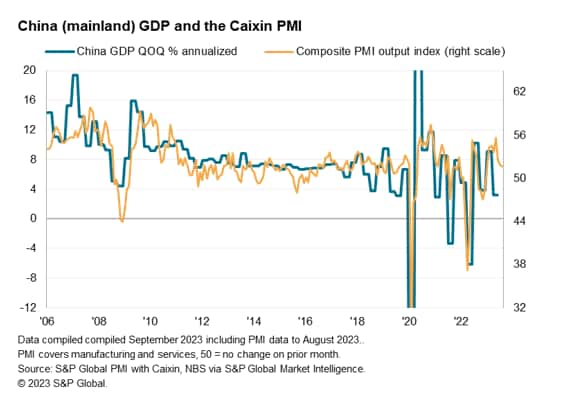

The post-pandemic recovery in mainland China continued to lose momentum in August. At 51.7, down from 51.9 in July, the headline Caixin PMI, compiled by S&P Global, fell for a third successive month to signal the weakest expansion since January. As such, the survey points to a further fading of the boost the economy received from the relaxation of COVID-19 containment measures at the start of the year, albeit hinting at a stronger underlying performance of the economy relative to the latest GDP data. Official GDP estimates signalled a modest 3.2% annual gain in the second quarter, down from 9.1% at the in the first three months of the year.

Service sector revival continues to fade

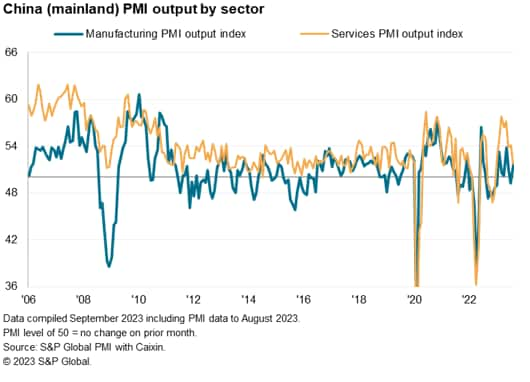

The deteriorating performance was fuelled by a further weakening of growth in the service sector, which suffered a further significant loss of pace in August to register the smallest monthly increase in activity since the recovery began in January. In contrast to the resultant modest expansion seen in August, the service sector's growth earlier in the year had been among the strongest recorded by the survey over the past decade. Although new orders for services continued to rise, the August gain was the second-smallest recorded over the past seven months to hint at weakening demand growth.

There was a somewhat more encouraging picture in manufacturing, where output returned to growth after a brief slide into contraction in July. The overall expansion of factory output nonetheless remained subdued. New orders received by factories likewise returned to modest growth, though export order continued to fall to act as an ongoing drag on the goods-producing sector, resulting in yet another disappointingly subdued overall order book performance.

Prices fall at reduced rate as costs rise

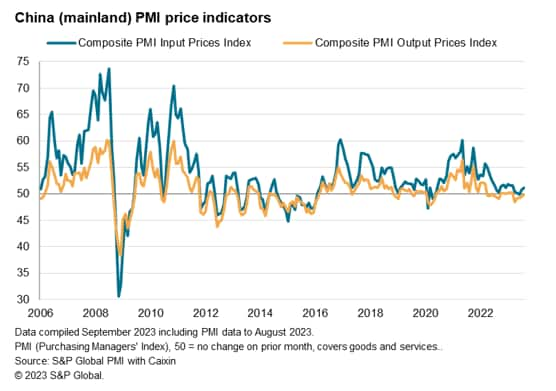

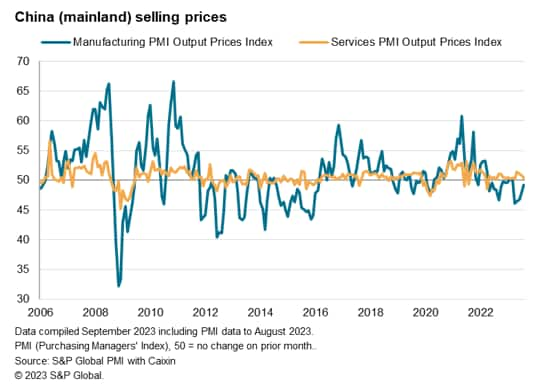

Inflation meanwhile showed some signs of stabilising. Average prices charged for goods and services fell for a fifth straight month, although the latest decline was only very marginal and the smallest recorded over the past five months.

The slower rate of price decline reflected some renewed upward pressure on companies' costs. Average input costs rose for a second month. Although only modest, the increase in costs was the largest recorded since March and in manufacturing a rise in costs was especially notable in being the first recorded for six months.

The price data are nevertheless far from encouraging from a deflation perspective. Average prices charged by manufacturers continued to fall in August, merely at a reduced rate. Rates charged by service providers meanwhile rose only marginally, the rate of increase having now slowed for three successive months from May's recent peak.

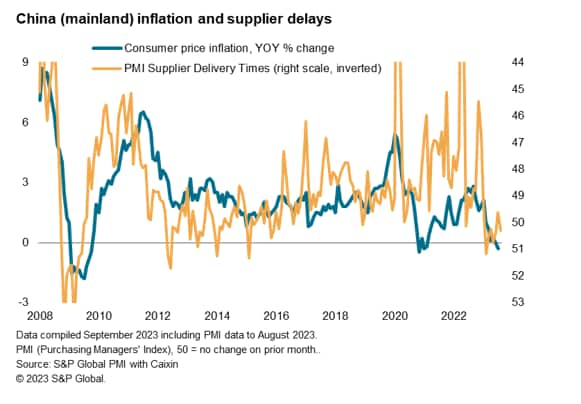

Supply chains help steady inflation

Similarly, broadly unchanged supplier delivery times in August are consistent with deflationary forces moderating only slightly. Supply chain delays are highly correlated with inflation, being indicative of capacity utilisation and hence the development of either buyers' or sellers' markets.

Growth expectations at nine-month low

Whether the current supply and demand balance can be sustained will be a key trend to watch in the months ahead. Any further waning of demand conditions from the subdued levels seen in August will likely result in excess capacity and increase pressure on companies to cut prices.

Worryingly, looking ahead, the subdued nature of the expansion is set to persist after August saw output expectations weaken further. Sentiment about the year ahead sank to the lowest since last November, hitting an 11-month low in manufacturing and a nine-month low in the service sector. However, whereas manufacturing sentiment has weakened further below the historical average, service sector expectations remain elevated relative to the long-run average to suggest services will provide the main impetus to any economic growth in the near-term, though clearly the post-pandemic tailwind has already faded.

Access the Manufacturing PMI and Services PMI press releases.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signals-further-slowdown-in-august-prices-edge-higher-Sep23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signals-further-slowdown-in-august-prices-edge-higher-Sep23.html&text=China+PMI+signals+further+slowdown+in+August%2c+prices+edge+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signals-further-slowdown-in-august-prices-edge-higher-Sep23.html","enabled":true},{"name":"email","url":"?subject=China PMI signals further slowdown in August, prices edge higher | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signals-further-slowdown-in-august-prices-edge-higher-Sep23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+PMI+signals+further+slowdown+in+August%2c+prices+edge+higher+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-signals-further-slowdown-in-august-prices-edge-higher-Sep23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}