Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 07, 2018

China PMI surveys point to steady economic expansion but rising growth risks

- Caixin Composite PMI Output Index dips to 52.3 in July from 53.0 in June

- Export orders fall at quickest rate for over two years amid global trade tensions

- Business confidence remains historically weak

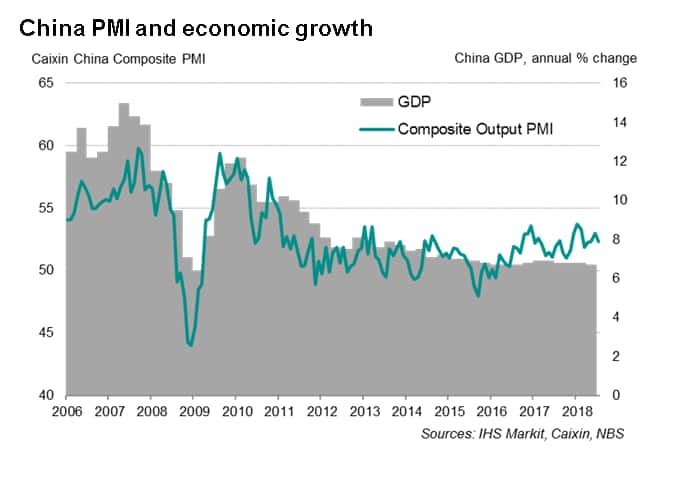

Chinese economic growth remained relatively stable at the start of the third quarter, with the latest Caixin PMI survey data pointing to a further modest rise in business activity. However, underlying PMI indices pointed to a potential slowdown in growth over the coming months amid rising trade tensions and growing internal challenges.

Economic growth remains solid

At 52.3 in July, the Caixin China Composite PMI™ Output Index (which covers both manufacturing and services) slipped slightly from 53.0 in June to signal a modest gain in Chinese business activity. Although the latest index reading came in below the average seen over the first six months of 2018 (52.7), the first half of the year had been the strongest since 2011.

Clouds gather over the outlook

Several survey indicators signal downside risks to the outlook. The amount of new orders placed with Chinese companies expanded at the slowest pace for just over a year at the start of the third quarter, which contributed to the weakest rise in backlogs of work since September 2017. The mild rise in the level of outstanding business indicates scant pressure on capacity. Consequently, services companies adopted a more cautious approach to hiring, adding to their payrolls at only a marginal rate, while manufacturers continued to shed staff. Overall, employment fell for the second month running in July, albeit only slightly.

Chinese firms were also less optimistic about the business outlook. Expectations regarding output in the year ahead slipped to the lowest in just over two-and-a-half years in July.

Intentions towards hiring and capital investment had already softened across China in June, according to the latest IHS Markit China Business Outlook. Companies highlighted several threats that may potentially limit growth over the next year, including stricter environmental policies, rising input costs and concerns over global trade wars and tariffs.

The weaker outlook validated a proactive response from Chinese authorities. The State Council recently said the government will pursue a more active fiscal policy to support the economy, as well as better-coordinated monetary measures. While a large stimulus package is not part of the agenda, Beijing plans to accelerate tax cuts and boost infrastructure spending amid the rising risks to growth.

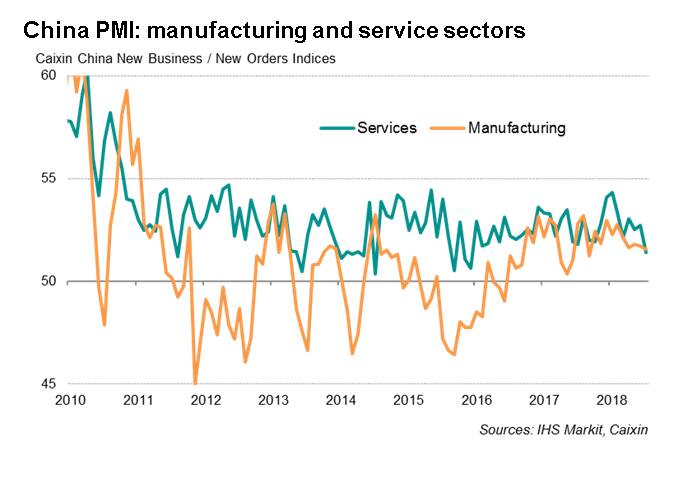

Declining exports

Sector data revealed further developments that are concerning. While manufacturing output and new orders increased at a largely steady pace, new export sales fell to the greatest extent for just over two years, suggesting that domestic demand is currently the primary driver of business activity in the sector. Some manufacturing exporters reported that escalating trade tensions had weighed on foreign demand for their products.

In services, incoming new business expanded at the weakest pace since December 2015, which was also well below the historical average. The development pointed to softening demand for services, which as a barometer for domestic demand, suggests a weakening consumption trend.

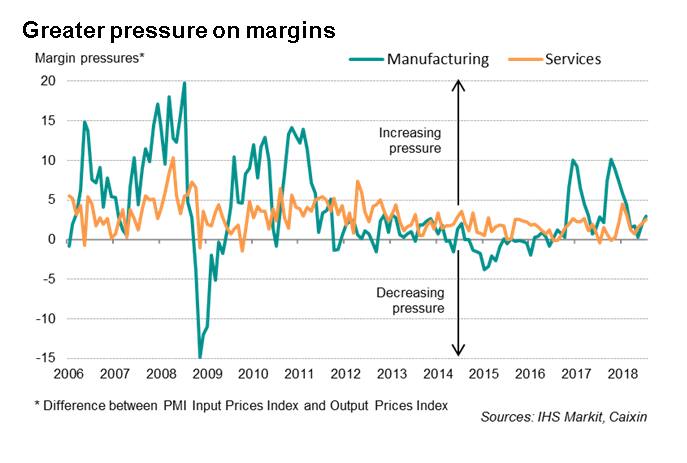

Rising margin pressures

Average cost burdens rose further across both the manufacturing and service sectors in July, with manufacturers reporting the stronger rate of increase. Higher commodity prices, especially steel and oil, remained a major driver of inflation.

While Chinese firms across both sectors were able to pass on some of the higher costs to customers, survey evidence suggested that relatively subdued demand had limited the extent to which firms could raise their selling prices. With input price inflation continuing to run above the rate of increase in charges during July, the survey data hint at a further squeeze on profit margins.

Bernard Aw, Principal Economist, IHS

Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-point-to-steady-economic-expansion-but-rising-growth-risks-18-08-07.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-point-to-steady-economic-expansion-but-rising-growth-risks-18-08-07.html&text=China+PMI+surveys+point+to+steady+economic+expansion+but+rising+growth+risks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-point-to-steady-economic-expansion-but-rising-growth-risks-18-08-07.html","enabled":true},{"name":"email","url":"?subject=China PMI surveys point to steady economic expansion but rising growth risks | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-point-to-steady-economic-expansion-but-rising-growth-risks-18-08-07.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+PMI+surveys+point+to+steady+economic+expansion+but+rising+growth+risks+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-pmi-surveys-point-to-steady-economic-expansion-but-rising-growth-risks-18-08-07.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}