Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 24, 2018

China-US trade update

China's market liberalization is expected to continue and is likely to remain reliant on the United States as a key trading partner.

- The US regulatory arsenal has been strengthened and has effective tariff and non-tariff regulatory measures against China.

- US firms with a small, localized market presence and without strong political connections will probably be at higher risk of retaliatory actions if US tariffs are implemented.

- Despite the recent suspension of talks, it is likely that China will continue to seek de-escalation in the ongoing US-China trade conflict.

On 20 July, US President Donald Trump announced his readiness to impose tariffs on USD500-billion-worth of Chinese imports to the United States, after the previous week's threat of tariffs against more than 6,000 products representing USD200 billion of Chinese exports to the US. Furthermore, the recent US imposition of USD34 billion in new tariffs has not led to Chinese concessions to US demands on alleged intellectual property (IP) theft and forced technology transfer. In response, the Chinese government has shifted its focus to addressing its ongoing domestic economic priorities - such as moving towards financial deleveraging and diversifying trade away from the US - rather than the confrontational tit-for-tat approach that was pursued in previous months.

US businesses face stronger regulatory barriers in the

Chinese market

The US also has effective tariff and non-tariff regulatory measures

against China (for instance, Washington has previously imposed

quotas on steel from other countries such as South Korea). In

addition, the US regulatory arsenal was further strengthened in

July, when both houses agreed on broadening the powers of the

Committee on Foreign Investment in the United States (CFIUS) to

regulate investments by foreign firms in US companies (see United

States: 20 July 2018: CFIUS changes to increase refusals for

Chinese venture capital firms investing in US technology and

financial sectors). The US is likely to consider security-motivated

investment and "reciprocal" market access restrictions against

Chinese companies.

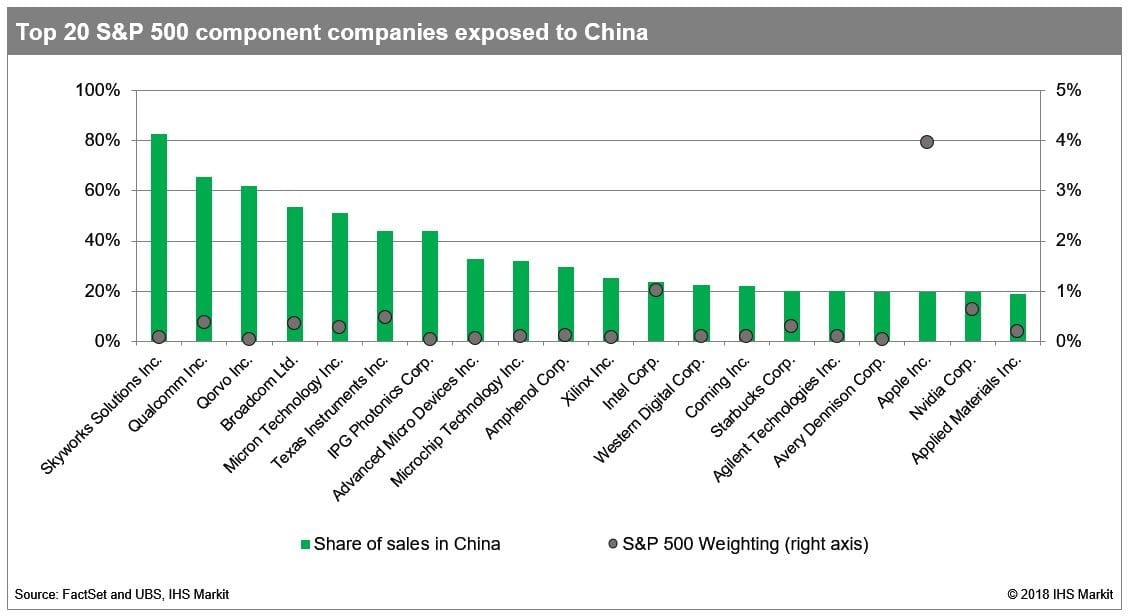

Export restrictions similar to those placed on Chinese telecoms firm ZTE are less likely due to an almost certain political escalation from China in response, likely in the form of regulatory measures targeting US businesses. In addition, such measures will potentially affect the US stock market: for instance, technology firm Apple's stock price fell by almost 4% when the tariffs on USD34 billion of Chinese imports were implemented. A number of major component companies of the Standard & Poor's 500 index are highly exposed to China; most of these are semiconductor chip manufacturers, which consider China a key export market. Retaliatory Chinese action would probably weigh on the performance of major US companies and increase the risk of political pushback against the Trump administration, which was emboldened by currently robust economic growth and financial markets to pursue trade action against China and other countries.

China's controlled market liberalization likely to

continue

If further US tariffs are imposed on Chinese exports, China will

almost certainly respond with both retaliatory tariffs and more

rigorous regulatory discrimination against US imports. China

imports approximately only USD130-billion-worth of goods from the

US (compared with USD505 billion in US imports from China), but US

firms generate about USD300 billion in Chinese sales. Possible

measures include delays in customs clearance or visa applications,

or using security-related measures to disrupt company

operations.

Furthermore, the Chinese renminbi has depreciated by more than 4% in July while the US dollar has strengthened, damaging the competitiveness of US exports; Trump has claimed on Twitter that China and the European Union were manipulating their currencies and interest rates. Sun Guofeng, director of the People's Bank of China's financial research institute, previously said that China would not weaponize its currency in its trade conflict with the US: this is in line with China's economic interests, as significant currency depreciation would increase the risk of capital flight by Chinese citizens and businesses.

Market liberalization and improved access will probably continue, especially after the 20th EU-China summit on 16 July, during which both sides pledged to promote trade liberalization. China's robust regulatory and national security apparatus enables Beijing to be selective in deciding which companies are favored by liberalization measures; key industries affected are likely to include sectors that are important for Trump's electoral base. In some industries, such as high-tech manufacturing, agriculture, and automobiles, it is probable that China will offer favorable treatment in exchange for continued lobbying in the US government. US firms with a small, localized market presence and without strong political connections will probably be at high risk of retaliatory actions if US tariffs are implemented. A Chinese government decision to approve US chipmaker Qualcomm's acquisition of NXP Semiconductors NV on 25 July would provide an indicator of Chinese attitudes towards US companies: this would represent a significant concession by Beijing, and would indicate a reduced risk of punitive measures against US businesses in technology industries.

Outlook and implications

China is unlikely to be willing to grant significant concessions

that would disrupt the country's plans for industrial

transformation, stable growth, and avoiding the middle-income trap.

Beijing will almost certainly continue to expand its trade and

investment relationships internationally to diversify away from the

US.

China remains highly reliant on the US market as a key export destination, and US exports of computing components - particularly semiconductors - remain a key input in China's high-tech manufacturing sectors such as smartphones, and industrial and military products. In 2016, China imported USD226-billion-worth of integrated circuits, more than that of crude oil, iron ore, and primary plastics combined. This is unlikely to change significantly in the period to 2020, a key date for China during which the government is expected to demonstrate progress in financial deleveraging, poverty reduction, and environmental protection, while maintaining an acceptable level of economic growth. Failure to reach this goal would also weaken Communist Party control and increase the likelihood of local governments diverging from central government policies.

As a result, it is probable that China will continue to seek de-escalation in its trade conflict with the US. This could include expanding US exports in services such as tourism, IP, and transport services, an area in which the US already enjoys a trade surplus; improved market access in specific sectors favorable to China's industrial policy, such as the recent approval of Tesla's recent wholly owned factory in Shanghai; improvements in IP protection, which is favored by US companies; and leveraging its influence in areas politically important to the Trump administration, such as North Korea's negotiations.

New Chinese measures are unlikely to be revealed before President Xi Jinping and party officials meet in August at the annual Beidaihe senior policymakers' strategy meeting to determine upcoming domestic and foreign policies. The US is expected to announce the tariff list of Chinese goods worth USD16 billion in late July; China will probably respond in kind with its own tariffs against US imports, targeting products from states in which the US Republican Party controls key positions, such as Wisconsin and Kentucky. Key indicators for an improved likelihood of China-US trade relations include a continuation of negotiations involving key trade figures such as US Treasury Secretary Steven Mnuchin, who recently indicated a willingness to continue trade talks with China and other trade partners (talks are currently suspended, with reports by US officials that China is unwilling to initiate formal discussions). Furthermore, US currency measures - either through attempts by Trump to further influence the US Federal Reserve Bank for looser monetary policy through Twitter statements, or if the US Treasury's upcoming semi-annual foreign-exchange policy report in October labels China as a "currency manipulator" - would indicate a continued deterioration in ties and a broadening of the trade conflict to monetary policy.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinaus-trade-update-72418.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinaus-trade-update-72418.html&text=China-US+trade+update+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinaus-trade-update-72418.html","enabled":true},{"name":"email","url":"?subject=China-US trade update | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinaus-trade-update-72418.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China-US+trade+update+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinaus-trade-update-72418.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}