Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 06, 2023

Closing the book on the year of the bear

Research Signals - December 2022

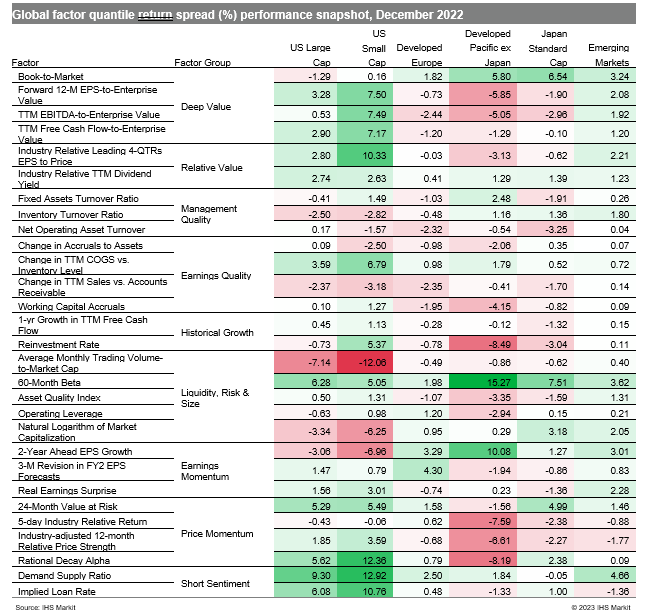

The bulls did not have much to celebrate at the close of the year and ultimately raised their glass to cheer conservative signals from the securities lending market and risk-off trades to round out the month of December (Table 1). In the end, stocks across major regional markets relinquished prior month gains as pressures from aggressive central bank rate hikes to fight inflation and recession fears wrapped up a rough year for global markets. Furthermore, markets will start the new year on negative economic data points such as the December J.P.Morgan Global Manufacturing PMI™ which signaled a continued downturn, with contractions in output and new work across the four largest industrial economies of mainland China, the US, the euro area and Japan.

- US: The top factor performance among both large and small caps was recorded by Short Sentiment factors including Demand Supply Ratio

- Developed Europe: 3-M Revision in FY2 EPS Forecasts turned in the highest performance last month

- Developed Pacific: The risk-off trade captured by 60-Month Beta was prevalent across the region in November

- Emerging markets: Deep Value measures including Forward 12-M EPS-to-Enterprise Value locked in a three-month string of outperformance

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fclosing-the-book-on-the-year-of-the-bear.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fclosing-the-book-on-the-year-of-the-bear.html&text=Closing+the+book+on+the+year+of+the+bear+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fclosing-the-book-on-the-year-of-the-bear.html","enabled":true},{"name":"email","url":"?subject=Closing the book on the year of the bear | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fclosing-the-book-on-the-year-of-the-bear.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Closing+the+book+on+the+year+of+the+bear+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fclosing-the-book-on-the-year-of-the-bear.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}