Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 18, 2018

Copper end-use PMI data indicate prices set to stabilise over Q4 2018

- Forward-looking new order: inventory ratio indicator consistent with flat copper prices

- Tariffs impact Chinese economic conditions, weighing on base metal prices

- Supply shortages tick up, albeit marginally

Copper prices have slumped since the recent peak of $6,954 per tonne during June, down to $6,039 during August. Prices have cooled as markets have reacted to three key developments: news of slower global economic growth, subsiding fears of large-scale supply disruptions, and the detrimental impact of US tariffs on economic conditions in China.

Nevertheless, the latest survey data indicate that demand and supply fundamentals currently support a stabilisation in copper prices on a year-on-year basis in the final quarter of 2018.

Revisiting the new order: inventory ratio

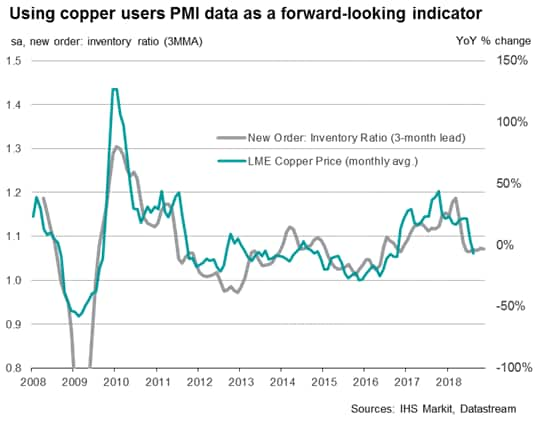

The global PMI index tracking business trends at copper-using manufacturers exhibits a strong positive correlation with copper prices, beating the widely-used broader global manufacturing PMI in terms of predictive ability. In particular, a ratio of new orders to stocks of finished goods at copper-intensive firms gives a powerful forward-looking indicator for copper demand and prices.

Previous analysis of the new order: inventory ratio indicator signalled headwinds to copper prices in mid-June, unveiling an aspect of speculation behind rising prices seen at the start of the month. In fact, the indicator was consistent with flat copper prices on a year-on-year basis, indicating that prices would likely fall back to levels seen in the summer of 2017, which has indeed been the case following the recent correction.

More recently, August PMI data saw a deterioration in the new order: inventory ratio to the second-lowest since February 2016, in part due to a deterioration in global export orders. The indicator nevertheless remained at a level supportive of flat copper prices on a year-on-year basis, thereby signalling steady and moderate growth in copper prices over the remainder of 2018.

Modest improvement in business conditions

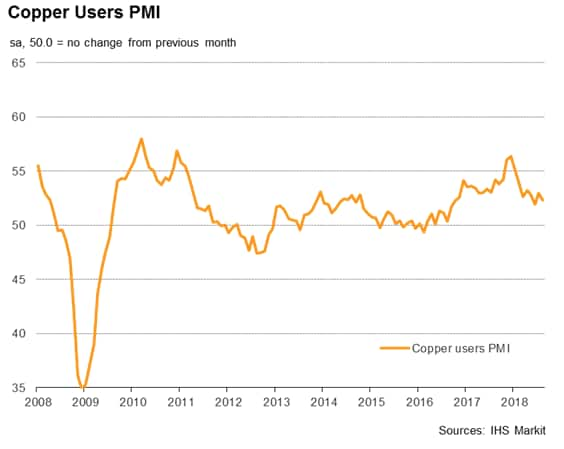

August PMI data presented a somewhat gloomier underlying environment for global copper demand. At 52.3, the Copper Users PMI remained in positive territory, scoring above the neutral 50.0 mark but nonetheless indicating the second-weakest improvement since October 2016. New orders expanded at a slower pace than in July and backlogs of work grew at the weakest rate in two years, in part reflecting a deterioration in export demand, notably in Asia.

Copper supplier conditions mixed

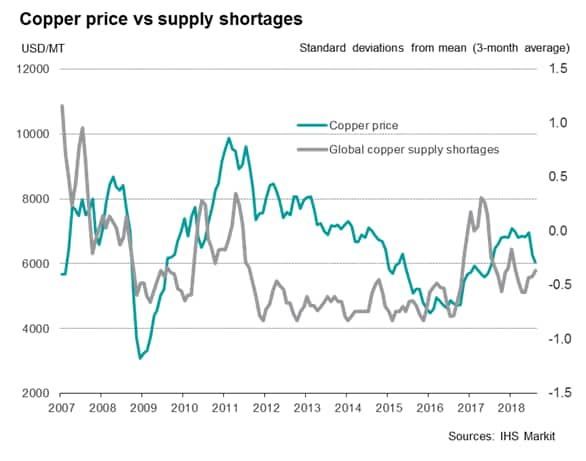

Looking specifically at copper supply, the latest IHS Markit Price & Supply Monitor data signalled that copper shortages were increasingly widely reported in August, with the supply shortage indicator hitting a six-month high.

However, prices have eased in part due to the aversion of strike action at Escondida in Chile, the world's largest producing mine. Furthermore, whilst deteriorating supply at copper-using factories may place upward pressure on prices, the overall level of supply shortages remained modest overall and well below the historical average.

Impact of US tariffs

Part of the recent correction in base metal prices has also been in reaction to US tariffs on China. Fears of slowing Chinese growth, alongside a devaluation in the renminbi, has shaken the largest market of metals and thus copper prices have dropped accordingly. In this environment it is interesting to note that August's PMI data picked up an improvement in business conditions at copper-using firms in the US, who outperformed their counterparts in Europe and Asia.

Future outlook

Whilst supply indicators signal slight upward price pressure, the extent of any uplift in copper prices will likely be limited by subdued global growth at copper-using companies and tariff implications.

PMI data provide insight to metals demand fundamentals

The copper PMI data are derived from IHS Markit's PMI surveys, and include monthly information provided by around 1,500 copper-using manufacturers across the world.

Using data from our established survey panels across Asia, Europe and the US, IHS Markit also produce data tracking trends at aluminium- and steel- intensive goods producers. Data cover indexes for output, new orders, new export orders, input purchasing, stock holdings, prices, vendor delivery times and employment.

The next Copper Users PMI is released on 5th October.

For further information on commodities PMI data, please contact economics@ihsmarkit.com

Sam Teague, Economist, IHS Markit

Tel: +44 1491 461 018

sam.teague@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcopper-end-use-pmi-data-indicate-prices-set-to-stabilise-over-q4-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcopper-end-use-pmi-data-indicate-prices-set-to-stabilise-over-q4-2018.html&text=Copper+end-use+PMI+data+indicate+prices+set+to+stabilise+over+Q4+2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcopper-end-use-pmi-data-indicate-prices-set-to-stabilise-over-q4-2018.html","enabled":true},{"name":"email","url":"?subject=Copper end-use PMI data indicate prices set to stabilise over Q4 2018 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcopper-end-use-pmi-data-indicate-prices-set-to-stabilise-over-q4-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Copper+end-use+PMI+data+indicate+prices+set+to+stabilise+over+Q4+2018+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcopper-end-use-pmi-data-indicate-prices-set-to-stabilise-over-q4-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}