Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 16, 2020

COVID-19: Sub-saharan Africa impact channel

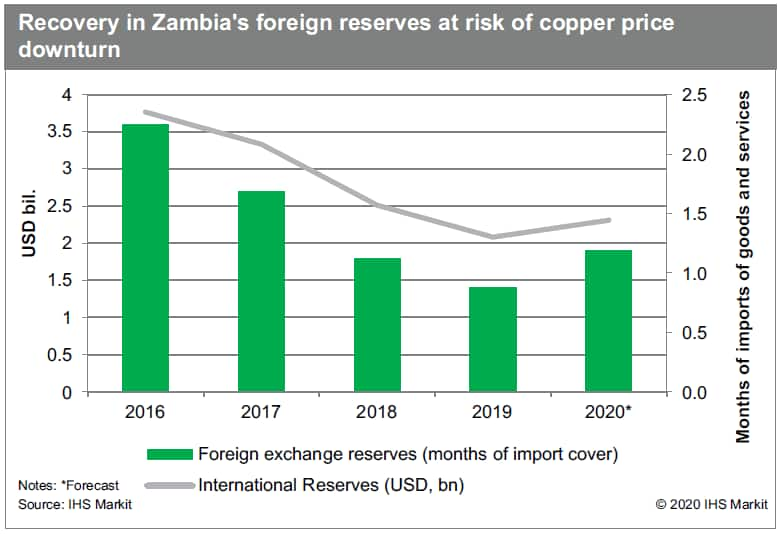

Although several cases of the coronavirus disease 2019 (COVID-19), largely related to European travel, have so far been recorded in sub-Saharan Africa (SSA) - the region is highly susceptible to ancillary effects from the COVID-19 virus outbreak, notably due to the economic slowdown in China. Channels of economic vulnerability include lower commodity prices - particularly for oil, copper, and iron ore - trade and supply-chain disruptions, and an accelerating decline in tourist arrivals.

Key findings: Intelligence cut-off date 5 March 2020

Declining Chinese demand for commodity imports, depressed commodity prices, and disruptions at ports during 2020 will slow economic growth in and worsen the balance of payments of sub-Saharan African countries with a relatively high dependency on trade with China.

- Liberia and Sierra Leone are especially dependent on iron-ore exports to generate fiscal revenues, increasing pressure on their public finances during 2020 as the slowdown in Chinese demand depresses global prices.

- Declining global oil prices and softer demand reflecting lower global growth prospects increase the risk of higher budget deficits in oil-dependent countries of sub-Saharan Africa.

- Nigeria and Cameroon are less dependent than other sub-Saharan African countries on the Chinese market for crude oil exports and are less affected by supply-chain disruptions associated with China's factory shutdowns due to the COVID-19 virus outbreak, but they are still vulnerable to the global price environment and increased risk aversion in foreign investment.

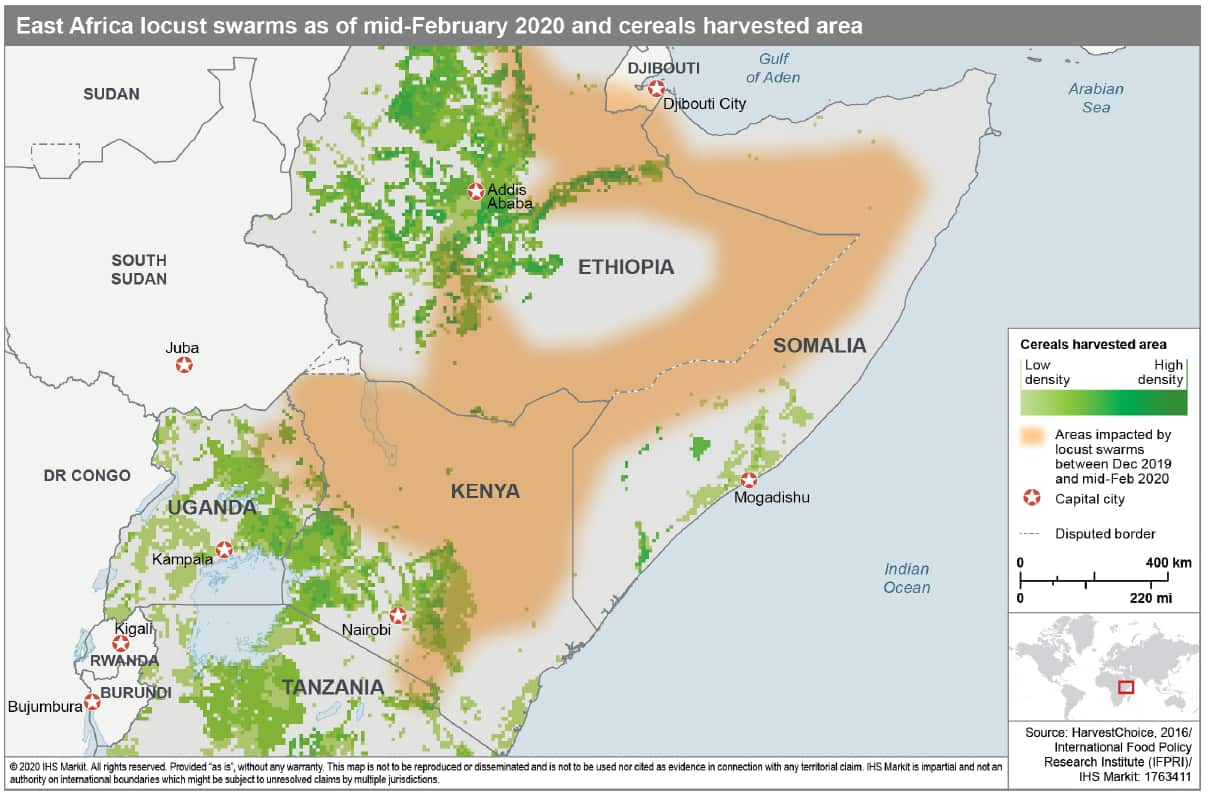

- In East Africa, the weakening of agricultural exports is likely to prove the most immediate drag on growth, especially given the ongoing destruction of crops caused by the locust swarm outbreak in that region.

- Disruption to manufacturing is likely to be concentrated in Côte d'Ivoire, Ethiopia, Rwanda, and South Africa, given their reliance on Chinese imports and end-markets, but this will probably have less impact on economic growth.

- South Africa's GDP growth rate is already below potential, as a result of production disruptions due to significant electricity deficits in the economy.

Indicators of changing risk environment

Increasing risk

- The results of IHS Markit's purchasing managers' indices, to be released on 2-4 April for Kenya, South Africa, and Zambia, show further declines, after having registered scores of less than 50, except for Mozambique, in the 3-4 March surveys, reflecting a further lengthening of delivery times for imports and exports, and increases in input prices.

- COVID-19 cases are reported in regional transport hubs, especially South Africa (which reported its first case on 5 March), Ethiopia, Ghana, and Kenya, increasing the risk of flight bans from affected countries, sharp decline in tourist arrivals, production shutdowns and supply-chain disruptions for export goods.

- Mainland Chinese counterparties begin triggering force-majeure clauses, resulting in financial losses that particularly affect sub-Saharan African copper exporters and those with unclear contractual terms.

Decreasing risk

- Chinese policy banks show flexibility towards Angola on receiving cargo deliveries to pay for oil-backed loans, reducing stress on Angola's foreign-currency reserves and potentially generating foreign exchange through sales of crude oil on the open market.

- The IMF provides affected sub-Saharan African countries with access to its USD50-billion emergency Rapid Financing Facility (RFF) announced on 4 March, or otherwise provides support through a new loan under its existing facilities, reducing liquidity risks. The poorest countries can access USD10 billion of the RFF at zero interest.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-subsaharan-africa-impact-channel.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-subsaharan-africa-impact-channel.html&text=COVID-19%3a+Sub-saharan+Africa+impact+channel+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-subsaharan-africa-impact-channel.html","enabled":true},{"name":"email","url":"?subject=COVID-19: Sub-saharan Africa impact channel | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-subsaharan-africa-impact-channel.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=COVID-19%3a+Sub-saharan+Africa+impact+channel+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcovid19-subsaharan-africa-impact-channel.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}