Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 11, 2020

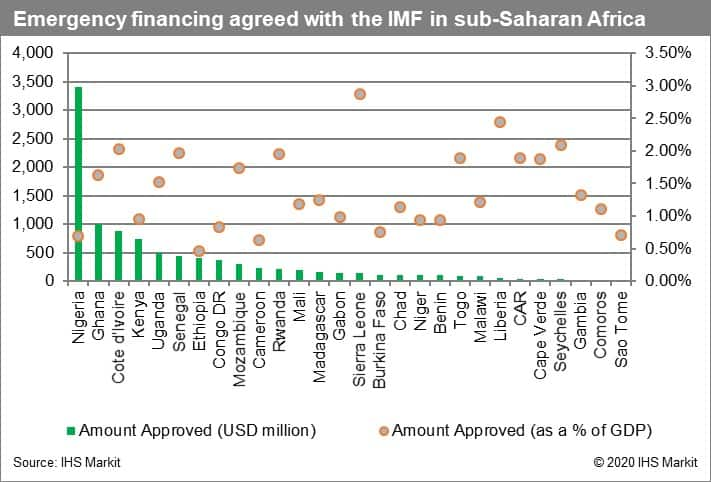

Creditor response in sub-Saharan Africa

Against the backdrop of the International Monetary Fund's (IMF) and the World Bank's annual meetings on 12-18 October, finance ministers from the G20 group of leading economies will meet on 14 October to discuss the progress on their decision in April to suspend debt service repayments for International Development Association borrowers and Angola from 1 May until the end of 2020. The G20 has so far failed to advance proposed reforms to the IMF's existing allocation of special drawing rights (SDRs) to better meet the needs of lower-income countries and is also yet to agree on extending debt standstills under the Debt Service Suspension Initiative beyond the end of 2020. Emergency financing from the IMF to cope with the direct and ancillary effects of the coronavirus disease 2019 (COVID-19) virus pandemic has already been agreed, with 28 countries in sub-Saharan Africa (including Djibouti) so far receiving USD10 billion in total, drawing on around USD100 billion in total available emergency disbursements through the Rapid Financing Instrument and the Rapid Credit Facility.

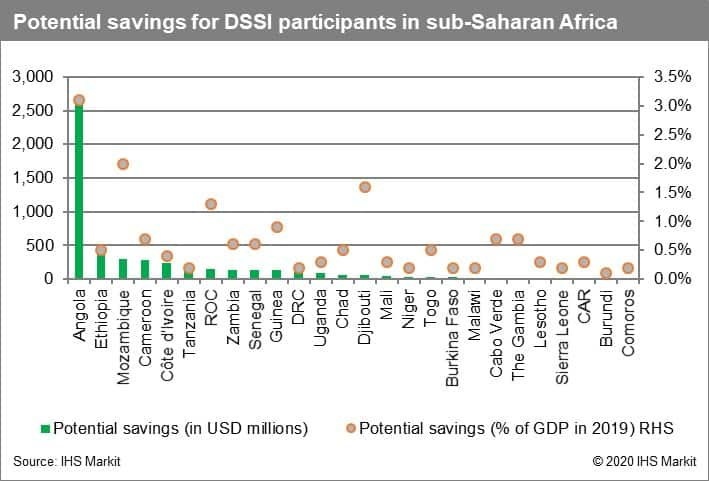

- The IMF has received requests from over 100 low- and middle-income countries for emergency financing, more than double the number during the 2008-09 global financial crisis. The IMF has taken several measures to support low-income countries. Financial resources available through its Catastrophe Containment and Disaster Relief Trust (CCRT) were expanded from USD50 billion to USD100 billion, to provide emergency assistance and debt relief to low-income countries. The CCRT provides grant-based disbursements to 29 of the lowest-income countries, 23 of which are from sub-Saharan Africa. The IMF also tripled concessional financing available under the Poverty Reduction and Growth Trust (PRGT) to USD17 billion. Complementing this, the G20 finance ministers agreed in April to a moratorium on official bilateral and multilateral debt repayments from 1 May until the end of 2020 for all International Development Association (IDA) borrowers and Angola, known as the G20 Debt Service Suspension Initiative (DSSI). According to the Paris Club of official creditors on 1 September, 39 out of 73 eligible low-income countries have applied, and debt relief has so far been agreed with 19 sub-Saharan African governments. These countries are Angola, Burkina Faso, Cape Verde, Cameroon, Chad, Comoros, Côte d'Ivoire, Democratic Republic of the Congo, Djibouti, Ethiopia, Guinea, Mali, Niger, Republic of the Congo, São Tomé and Príncipe, Senegal, Sierra Leone, Togo, and Zambia. Ghana and Kenya have stated that they will not apply to the DSSI. However, participation in the DSSI is likely to accelerate, with major credit rating agencies now deciding not to downgrade participants.

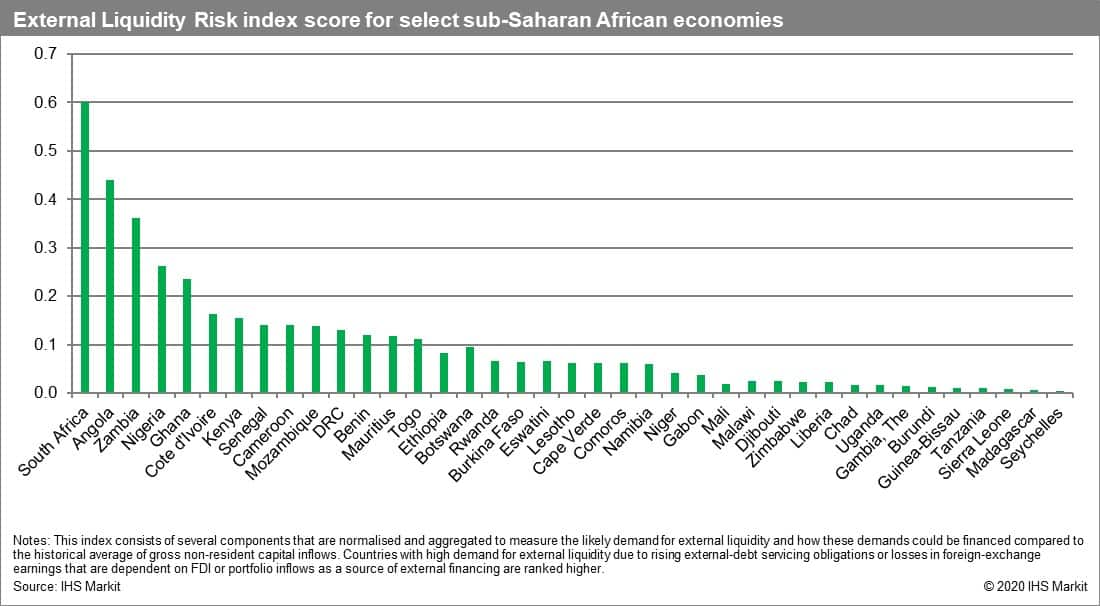

- The G20's debt relief agreement (DSSI) excludes an enforceable commitment from private creditors (bond-holders, commercial banks, and export/trade credit agencies), implying limited benefit for countries with a higher private credit exposure, where non-payment will have graver consequences. Angola, Ghana, and Nigeria are scheduled to make Eurobond repayments of more than USD500 million each this year. African finance ministers on 15 May established the Africa Private Creditor Working Group (APCWG) with around 25 private creditors to discuss suspending debt payments without causing defaults. The DSSI plans have been setback by limited input from the private sector and misinterpretation by borrowing countries, resulting in slower uptake. Private creditors' participation in the scheme is voluntary, and the wide range of market participants and their fiduciary duties to clients undermine a co-ordinated and willing response.

- Angola on 30 August reportedly agreed debt deferment terms with China, which is a key condition for finalising currently delayed emergency disbursements with the IMF. The terms of the negotiations are not public, but, according to IHS Markit sources, they include around USD17 billion in total debt held by the China Development Bank, the Export-Import Bank of China, and the Bank of China. Angola is offering increased equity stakes in oil fields under joint production agreements through Sonangol Sinopec International. China is permitting a reduction in crude oil cargoes for ongoing debt payments to free up foreign-exchange generation from sales on the open market, but these are restricted by Angola's compliance with OPEC+ production cuts agreed on 7 July. A moratorium period of up to three years is most likely to be agreed, with Portuguese media reporting that China initially lodged a one-year counter-offer. Given these ongoing negotiations, Angola missed a 30 July deadline with the IMF concerning whether to bring forward disbursements under the country's existing Extended Fund Facility (EFF) programme, which would amount to USD740 million. The EFF permits disbursements totalling a maximum of 216% of Angola's IMF quota, as opposed to 150% under an emergency Rapid Financing Instrument (RFI).

- Zambia's replacement of its central bank governor on 22 August is likely to increase political control over monetary policy and further delay discussions with the IMF over an emergency financing package. A week before his dismissal, former governor Denny Kalyalya had reportedly made concerted efforts to warn the government of the need for fiscal restraint over its plans to boost domestic spending substantially given COVID-19 and next year's upcoming presidential election. No reason was given for his dismissal, but IHS Markit sources in Lusaka suggest it stems from a disagreement between the president and the former governor on the latter's local media appearances over the state of the economy and policy preferences, especially the role of the central bank in financing the budget. The IMF on 24 August criticised the dismissal, and we assess that the resulting weakening of Zambia's policy credibility will further delay discussions with the Fund over an emergency financing package. Separately, Zambia announced on 1 April that it was seeking proposals from banks to help it reorganise an estimated USD11.2 billion of external debt, with media reports suggesting it was likely to postpone debt repayments to reflect its heavy debt burden and sharply reduced export earnings. Debt renegotiations, including with Chinese state-backed banks, will be unsurprising given multiple financial pressures on repayment.

Indicators of changing risk environment

Increasing risk

- Mainland Chinese counterparties begin triggering force majeure clauses, resulting in financial losses that particularly affect sub-Saharan African copper exporters and those with unclear contractual terms.

- Chinese authorities fail to classify state-backed banks as official lenders (particularly the China Development Bank), opting to classify them as privately operated, thereby exempting them from participation in the DSSI and reducing the prospects for debt relief to countries such as Angola that are highly exposed to Chinese lending. (Indicator partly not met - Angola reportedly agreed debt rescheduling with Chinese authorities on 30 August, with the Paris Club approving its DSSI request on 31 August).

Decreasing risk

- Finance ministers from the Group of Seven (G7) largest economies on 17 August agreed on the need to extend the DSSI into 2021, with explicit support from US Treasury Secretary Steve Mnuchin, signalling likely implementation at the G20 finance ministers meeting on 14 October 2020.

- At the G20 finance ministers meeting on 14 October and subsequent working dinner on 20 November, an agreement is reached to increase IMF SDR quotas for low-income countries, likely resulting in an increase to the cap for those that have already agreed RFI or RCF disbursements to over 125% of their existing quota.

- At the IMF's and the World Bank's annual meetings on 12-18 October, World Bank president David Malpass proposes eliminating some debts of low-income countries, rather than just deferring them under the DSSI, indicating likely discussion of the proposal by the G20 on 14 October. (Indicator partly met - Malpass said during an interview with international media on 19 August that he supported an "agreement to actually do haircuts or writedowns".)

- Sovereigns continue to make bond payments while waiting for a response on debt relief or otherwise refuse to seek a suspension of debt repayments. (Indicator partly met - Kenya's finance minister on 15 May ruled out an agreement on debt relief because of the perceived negative impact on the country's credit rating and limits on non-concessional borrowing during the six-month relief period. By contrast, Angola's finance ministry stated on 3 June that it was discussing debt relief under the DSSI initiative.)

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcreditor-response-in-subsaharan-africa.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcreditor-response-in-subsaharan-africa.html&text=Creditor+response+in+sub-Saharan+Africa+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcreditor-response-in-subsaharan-africa.html","enabled":true},{"name":"email","url":"?subject=Creditor response in sub-Saharan Africa | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcreditor-response-in-subsaharan-africa.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Creditor+response+in+sub-Saharan+Africa+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcreditor-response-in-subsaharan-africa.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}