Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 02, 2020

Daily Global Market Summary 01 May

Most European and APAC markets were closed for the Labor Day holiday, so market activity was limited. The US equity markets closed lower on Friday after digesting the last of the week's flurry of earnings reports, with many of the reporting companies hesitant to provide too much forward guidance in the midst of so much uncertainty around how the COVID-19 pandemic will impact their personnel, supply chains, and sales going into the remainder of the year.

Americas

- US equity markets closed lower today, retracing the last of the

week's gains to end almost flat week-over-week; Russell 2000 -3.8%,

Nasdaq -3.2%, S&P 500 -2.8%, and DJIA-2.6%.

- 10yr US govt bonds closed -3bps/0.62% yield.

- IHS Markit has released its latest light-vehicle sales and

production forecasts, including a top-line expectation of global

sales dropping 22.4% and production falling 22.0% in 2020. Global

light-vehicle sales are forecast to be down to 69.6 million units

this year in the wake of the COVID-19 pandemic, according to the

most recent analysis from IHS Markit. In addition, IHS Markit

forecasts a decline in global light-vehicle production to 69.3

million units. (IHS Markit AutoIntelligence's Stephanie

Brinley)

- IHS Markit CDX North America Investment Grade index closed

+4bps/90bps and CDX High Yield +25bps/650bps.

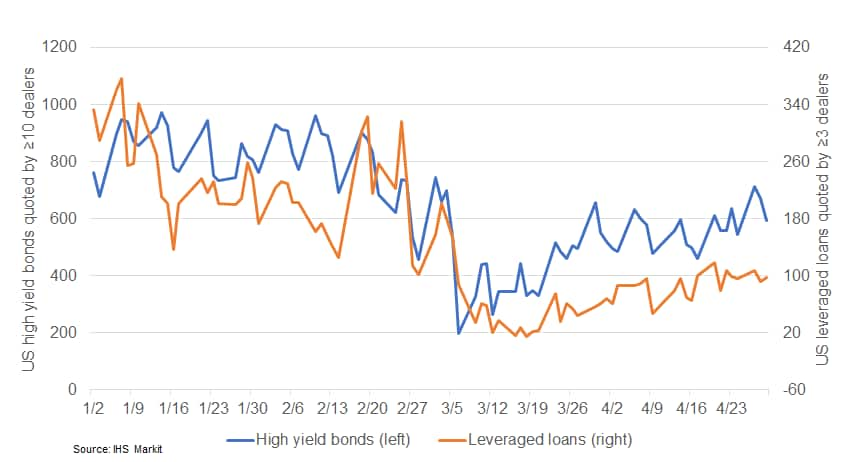

- US companies issued almost $32 billion in high yield bonds in

April, marking the biggest month of capital raising by low-rated

issuers in three years as optimism from the Federal Reserve's

programs spread through credit markets. It's worth noting that

close to half of the lower credit borrowers offered secured debt,

pledging assets as collateral in the event they are unable to repay

their obligations. (FT)

- The below chart shows the number of US high yield bonds quoted

by 10 or more dealers versus the number of leveraged loans quoted

by three or more dealers this year. The data shows the degradation

of liquidity in mid-March for both loans and bonds, but the chart

highlights how high yield bond dealer depth has since been

improving at a faster pace than for loans:

- Total US construction spending rose 0.9% in March, defying

expectations for a sharp decline. Construction spending for

February was revised lower. In response to the details in this

report that bear on our tracking, we raised our estimate of

first-quarter annualized GDP growth by 0.1 percentage point to a

4.7% rate of decline, and we raised our forecast of second-quarter

annualized GDP growth by 0.3 percentage point to a 36.0% annualized

rate of decline. Construction activity has been deemed an essential

activity throughout most of the country so does not face the same

constraints many activities face that have been deemed

nonessential. (IHS Markit Economists Ben Herzon and Lawrence

Nelson)

- Apple announced that it will not issue financial guidance for

the second quarter due to coronavirus based uncertainty; the last

time they did not release guidance was late-2003. (WSJ)

- Merck lowered its 2020 revenue guidance by about USD2.1 billion

due to the COVID-19 virus pandemic, including an unfavorable impact

of USD1.7 billion for pharmaceuticals and USD400 million for its

Animal Health business. Full-year revenues are forecast to range

around USD46.1-48.1 billion, down from the previously announced

USD48.8-50.3 billion. (IHS Markit Life Science's Margaret

Labban)

- Crude oil closed +5.0%/%19.78 per barrel.

- Chevron reported $3.6 billion in profits in the first quarter,

which is 36% higher than the same period last year. However, it

expects financial results to fall later in the year due to the

pandemic-led oil-price crash. The company announced additional

budget reductions, saying it would cut capital expenditures by $2

billion on top of the $4 billion it had announced just weeks

earlier. Chevron had planned to spend $20 billion in 2020 before

the virus took hold but now says it will likely spend $14 billion.

(WSJ)

- ExxonMobil reported a $610 million loss in the quarter, which

was its first quarterly loss since 1988, versus $2.4 billion in

profits during the same period last year. It had reported a

market-related charge of $2.4 billion, with the bulk of the

impairment related to its downstream business. (WSJ)

- In ExxonMobil's quarterly earnings report, the company

reiterated that spending this year will be approximately $23

billion. The company announced the budget cut in early April,

saying spending in 2020 will be down 30% from earlier guidance of

$33 billion. ExxonMobil joined BP in maintaining its quarterly

dividend. In its quarterly report, Shell opted to cut its dividend

by 66%. Other smaller operators have also moved to suspend or trim

dividend payments to shareholders. (IHS Markit's Plays and Basin's

Jeff Gosmano)

- LyondellBasell reports first-quarter net income of $144

million, down 82% year-over-year (YOY) from $817 million. A

non-cash, inventory valuation charge (LCM) accounted for $351

million of the decline, and integration costs for $13 million.

Sales into packaging and medical products were strong, but sales

related to transportation fuel and automotive production were

squeezed by the coronavirus disease 2019 (COVID-19) pandemic and

the oil crash, conditions that will persist during the second

quarter, says the company.

- Dana has reported its financial results for the first quarter,

showing a 10.6% year-on-year (y/y) decrease in sales to USD1.93

billion, compared with USD2.16 billion in first quarter 2019. Dana

reported an adjusted EBITDA of USD205 million and a sales margin of

10.6%. Dana's first-quarter sales results were attributed to weaker

demand in the heavy-vehicle markets in January and February, as

well as global production declines in March on the COVID-19

pandemic. At the close of the quarter, Dana stated it had liquidity

of more than USD1.8 billion and USD679 million available in its

committed revolving credit facility and USD500 million available

under a bridging facility to cope with the fallout from the

COVID-19 pandemic. (IHS Markit AutoIntelligence's Stephanie

Brinley)

- Automakers are looking for emergency financing for plants in

Brazil, after state and private lenders in the country demanded

collateral from parent companies, according to media reports.

According to Automotive News and Reuters reports, automakers in

Brazil are looking for financing to make up payrolls and keep the

crucial supply-chain operations going during the COVID-19 pandemic.

However, the report indicates that banks and the government want

carmakers to share loans with suppliers and dealerships. (IHS

Markit AutoIntelligence's Stephanie Brinley)

- According to the National Statistics Office (Instituto Nacional

de Estadística y Geografía: INEGI), Mexico's GDP contracted 1.6% in

Q1 compared with October-December 2019 (quarter on quarter, q/q),

based on seasonally adjusted data. Primary activities, mostly

agriculture, increased 0.5% q/q and were more than offset by sharp

declines in the industry and in the service sector. Mexico has been

in recession since the beginning of 2019, as GDP declined 0.1% q/q

in each of the quarters of the year and also in the full year 2019.

Sharp declines in investment were only partially offset by sluggish

growth in private consumption. The US, the destination of 80% of

Mexican exports, is entering a recession and this translates into

lower purchases of Mexican goods; in particular, the all-important

Mexican automotive sector will suffer a severe drop in production.

Fiscal accounts will not only deteriorate because lower economic

growth implies lower tax collection, but also because of lower oil

prices, as almost 20% of the government revenue comes from the

energy sector. (IHS Markit Economist Rafael Amiel)

Europe/Middle East/ Africa

- Ethiopia is set to conclude its key water infrastructure in the

21st century: the mega-dam called Grand Ethiopian Renaissance

(GERD) on the Blue Nile river. Although its name suggests a

'Pharaonic' work, it is much smaller than other projects such as

the Kariba, Aswan or Volta dams, all of them in Africa. East Africa

will become a key territory in the global water conflicts, once

Egypt is no longer the dominant country on the Nile basin and other

countries are demanding to increase their stakes in this natural

resource to secure irrigated orchards and energy supply. The

population all along the Nile basin totals around 300 million

people and may double in the next 30-40 years at the current birth

rate, increasing the energy and food demands of all its countries.

As a result, Egypt may moderate Ethiopian demands in the short

term. However, it will not be able to maintain a strong

agricultural industry if it does not plan strong investments to

update irrigation infrastructure, following the Israeli model in

the long-term. (IHS Markit Agribusiness' Jose Gutierrez)

- The Polish lower house of parliament (Sejm) approved on 30

April a review of the anti-crisis shield package, which aims to

mitigate the negative impact of the COVID-19 virus outbreak on the

economy. The bill contains a proposal to introduce a 1.5% levy on

streaming platforms' revenues, which would apply to both foreign

and Polish companies such as Netflix, Amazon Prime Video, Apple TV+

and Ipla. The government's decision to introduce the levy is

probably aimed at raising funds for its costly COVID-19 economic

relief package, which is worth 11.3% of GDP including the financial

shield. US-based streaming provider Netflix previously agreed in

2018 to pay a 2% levy on its revenues in France, indicating that it

would be unlikely to object to a similar levy in Poland. A

worsening economic downturn in the European Union would increase

the likelihood of other member states introducing similar levies to

fund national economic relief packages. Streaming service providers

will likely partially offset such levies by increasing subscription

fees. (IHS Markit Country Risk's Bibianna Norek)

- Ruter, Holo, Toyota Motor Europe, and Sensible 4 have teamed up

to launch autonomous mobility trials in Oslo (Norway). Sensible 4

will deploy its full stack autonomous vehicle (AV) software in

Toyota vehicles that will be integrated into Ruter's public

transport service this year. These AVs will be operated by mobility

service provider Holo, which has conducted AV pilot projects in

five different countries. (IHS Markit Automotive Mobility's Surabhi

Rajpal)

- German car dealers are finding the market environment extremely

difficult after reopening on 20 April, with a number of state

governments looking at introducing scrappage programs, according to

the website of Car Dealer magazine. German dealers are reporting

business to be around 40% of what it was prior to the COVID-19

virus-related lockdown. (IHS Markit AutoIntelligence's Tim

Urquhart)

- Renault Group is said to be planning to sell off one of the

buildings that makes up part of its headquarters in

Boulogne-Billancourt (France). Three sources have told Reuters that

the five-storey building is located in one of the historic parts of

this area and includes archives, sports facilities and is home to

its trade unions. Earlier reports have suggested that an

announcement related to cutting up to EUR2 billion of costs could

come as early as the middle of this month. (IHS Markit

AutoIntelligence's Ian Fletcher)

- Turkey's shipments in March to the European Union were down by

more than one-fifth of what they had been a year earlier.

Meanwhile, exports to the Middle East, hit by both the spread of

COVID-19 and by the precipitous collapse of energy prices, fell off

even more sharply, by nearly 29% year on year (y/y). The sharp drop

in exports contributed to a rapid escalation of the

merchandise-trade deficit, which jumped to over USD5.3 billion in

March, the largest single-month gap since July 2018. The drop-off

of merchandise exports will become even more severe in April, as

residual orders are fulfilled and new orders are not made. For the

year as a whole, IHS Markit anticipates that merchandise exports

will be down by 14%, with risks on the downside. (IHS Markit

Economist Andrew Birch)

- Continental has said that it will not spin off its Vitesco

Technologies powertrain unit this year as planned, as a result of

the prevailing economic conditions, according to a Reuters report.

Originally shareholders were to be asked to rubber-stamp the

proposal for Vitesco to become a separately listed entity at the

Continental annual general meeting (AGM) on 14 July, but this will

not now happen. Continental began the process of rebranding and

looking to spin off its powertrain division nearly two years ago

and Vitesco Technologies includes Continental's systems and

solutions for conventional and electrified drives for the global

automotive industry. (IHS Markit AutoIntelligence's Tim

Urquhart)

- The International Monetary Fund (IMF) has awarded Nigeria

USD3.4 billion in emergency assistance under the Rapid Credit

Facility (RCF) as the impact of the COVID-19 pandemic amplifies

existing economic vulnerabilities. Nigeria's RCF is the biggest

loan made yet under the IMF's RCF and will be repayable over three

to five years at a 1% interest rate with minimum policy

conditionality. The IMF financing will be used to meet urgent

current-account and fiscal funding gaps. (IHS Markit Economists

Thea Fourie and Martin Roberts)

- IHS Markit iTraxx Europe Investment Grade index closed

+4bps/84bps and iTraxx Xover +21bps/512bps.

- The UK equity markets closed -2.3%, while most European equity

and fixed income markets were closed for a holiday.

Asia-Pacific

- Japanese sales of mainstream registered vehicles declined by

25.5% year on year (y/y) during April to 172,138 units, according

to data released by the Japan Automobile Dealers' Association

(JADA) today (1 May). This figure excludes minivehicles, thus

covering all vehicles with engines greater than 660cc, including

both passenger vehicles and commercial vehicles (CVs), sold in

Japan. Of this total, sales of passenger and compact cars declined

27.5% y/y to 144,674 units in April, while truck sales were down

12.1% y/y to 26,691 units and bus sales fell 21.6% y/y to 773

units. All major automakers in Japan suffered double-digit

percentage sales declines last month. Nissan and Suzuki reported

the steepest falls, of 44.7% y/y and 47.0% y/y, respectively. (IHS

Markit AutoIntelligence's Tarik Arora)

- Ashok Leyland has received permission to restart production at

its facilities in Alwar, Bhandara, and Pantnagar, but has thus far

been unable to secure the necessary supply chain to resume

meaningful operations. India's commercial road transport has

effectively come to a halt since the COVID-19 virus-related

lockdown for all but essential goods. The mix of the commercial

vehicle transport sector is unusual in India and is largely devoid

of large commercial operators with huge fleets of vehicles, instead

relying on a high number of owner-drivers for much of its supply

routes, many using outdated vehicles. (IHS Markit

AutoIntelligence's Paul Newton)

- Toyota has decided to further extend the temporary production

shutdown at its two Gateway plants in Thailand until 23 May. OEMs

in the country - including BMW, Ford, General Motors, Honda, Isuzu,

Mazda, Mitsubishi, Nissan, Suzuki, and Toyota - initially announced

production suspensions from late March lasting several weeks into

April. However, most have now extended the temporary shutdowns for

several days into May as the number of confirmed infections in the

country continues to rise (it is currently above 2,900), while new

vehicle demand in the domestic and export markets will deteriorate

throughout 2020. As of 30 April, IHS Markit expects these

production suspensions to result in estimated lost volumes of about

130,514 units in Thailand. We have further downgraded our 2020

light-vehicle production forecast for Thailand by around 320,000

units to reflect the OEMs' production shutdowns during March and

April, and also now in May, owing to the pandemic, as well as the

deteriorating automotive industry throughout the year. (IHS Markit

AutoIntelligence's Jamal Amir)

- The Israeli co-founder of Chinese carmaker Qoros, Idan Ofer,

has sold 12% (half) his remaining stake in the company for USD237

million to the Chinese private conglomerate Baoneng Investment

Group, according to reports. Baoneng Investment Group already owns

51% of the struggling carmaker, having agreed the deal in 2019 with

Oder's investment company, Kenon holding group. Qoros was founded

in 2007 by Kenon Holdings and local carmaker, Chery, aimed at

creating a Chinese brand for export, with ambitions to break into

international markets globally. However, the business has struggled

to gain traction with the export model and has since turned its

focus internally to China's huge but highly competitive vehicle

market. (IHS Markit AutoIntelligence's Paul Newton)

- Most major APAC markets were closed for a holiday, except for

Australia -5.0% and New Zealand -0.8%.

Complimentary Access to Price Viewer

In light of current events, IHS Markit is offering complimentary access for qualified market participants to our historical cross asset coverage of global fixed income pricing and liquidity data, as well as OTC Derivatives data via the Price Viewer web-based data portal.

We use screenshots from the Price Viewer very frequently in this report and corporations use the credit default swap and bond price/yield data to identify potential risks to their supply chains. Request complimentary access here or contact sales@ihsmarkit.com.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-financial-market-summary-01-may.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-financial-market-summary-01-may.html&text=Daily+Global+Market+Summary+01+May+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-financial-market-summary-01-may.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary 01 May | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-financial-market-summary-01-may.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+01+May+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-financial-market-summary-01-may.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}