Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 01, 2020

Daily Global Market Summary - 1 December 2020

Major equity markets closed higher across the globe in a complete reversal of yesterday's synchronized sell-off. US and European benchmark government bonds sold off sharply on an increasing possibility of another major round of government stimulus to alleviate the financial strain of the second wave of COVID-19 restrictions. European iTraxx credit indices closed tighter across IG and high yield, while CDX-NA was close to unchanged on the day. The US dollar and oil were lower on the day, while gold, silver, and copper ended higher.

Americas

- US equity markets closed higher, with the S&P 500 and Nasdaq reaching new all-time highs; Nasdaq +1.3%, S&P 500 +1.1%, Russell 2000 +0.9%, and DJIA +0.6%.

- 10yr US govt bonds closed +8bps/0.93% yield and 30yr bonds +10bps/1.67% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY +1bp/304bps.

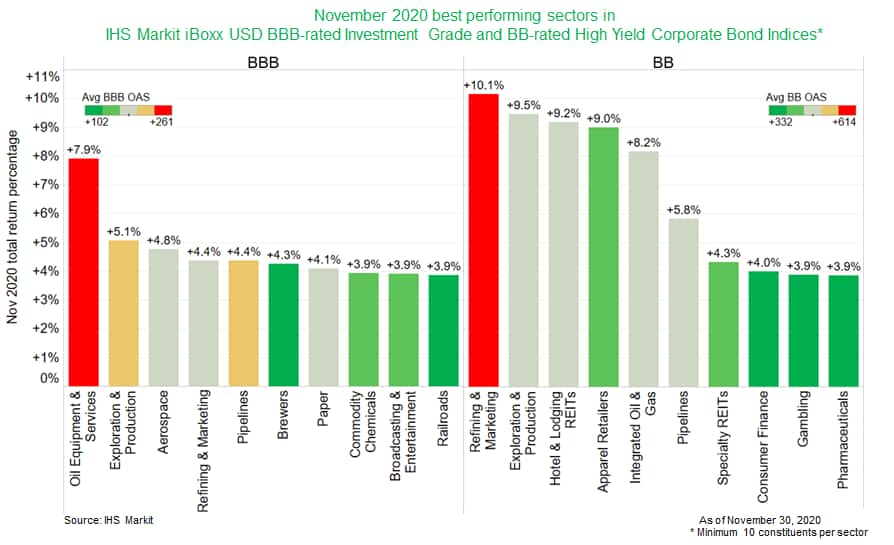

- The below chart shows that the energy debt sector outperformed

in November across USD BBB and BB rated corporate bond constituents

in the IHS Markit iBoxx Investment Grade and High Yield Corporate

Bond Indices.

- DXY US dollar index closed -0.8%/91.18 and is only 2.3% above the lowest level since January 2018.

- Copper closed +1.5%/$3.49 per pound, which is new 7+ year high close.

- Gold closed +2.1%/$1,819 per ounce and silver +6.6%/$24.09 per ounce.

- Crude oil closed -1.7%/$44.55 per barrel.

- TC Energy has announced that it has awarded USD1.6 billion in contracts to six US contractors to execute 1,300 km of pipeline construction in three states in 2021.The six contractors include Barnard Pipeline, Associated Pipeline, Michels, Precision Pipeline, Price Gregory International and U.S. Pipeline. When combined with additional 2021 contracts to be announced later, the total number of US union workers constructing the Keystone XL in 2021 will exceed 8,000 and earn more than USD900 million in gross wages. In total, the Keystone XL is expected to employ more than 11,000 Americans in 2021, creating more than USD1.6 million in gross wages. (IHS Markit Upstream Costs and Technology's Chris Alexander)

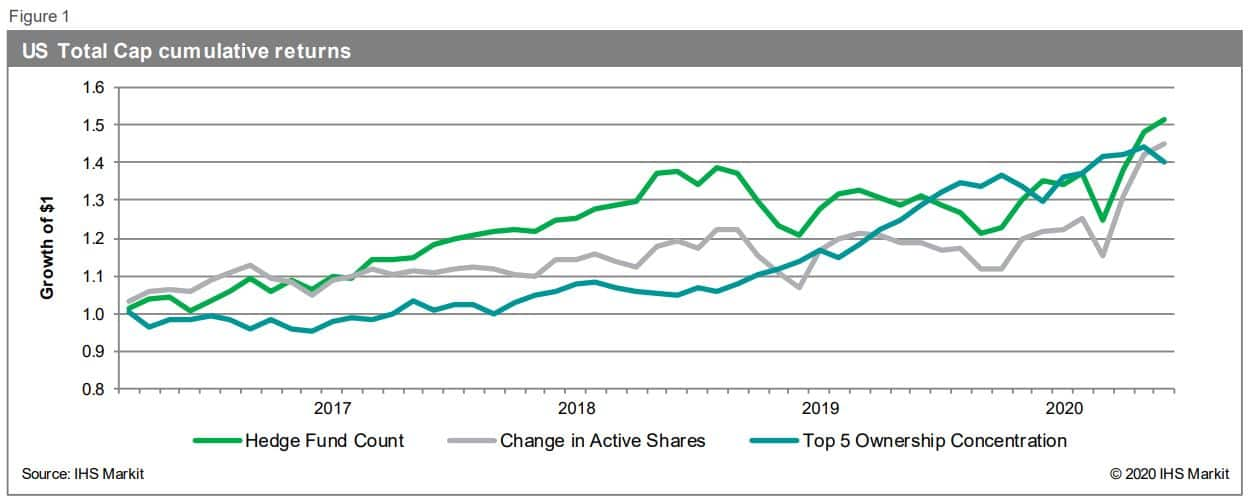

- In a 23 November research note, IHS Markit's internal

quantitative research group, Research Signals, reported their

initial research using the IHS Markit institutional ownership

point-in-time dataset. Using the company holdings data, they

constructed 17 factors built from holdings and trading activity.

Factors introduced evaluate ownership concentration, changes in

holdings, institutional and hedge fund holdings and liquidity flow

ratios globally across developed and emerging markets. For the US

Total Cap universe, the top performing factors include Change in

Active Shares, Hedge Fund Count and Top 5 Ownership Concentration,

with the latter two also capping performance in Developed Pacific,

along with Liquidity Flow (Count). The highest average monthly

spreads in Developed Europe were turned in by % Buyins out of

Bought (Count), Buyin-Selloff Imbalance (Count) and Average %

Change in Ownership. The following six figures show the best

performing factors in each market segment tracking the growth of $1

over the backtest time period.

- Salesforce.com Inc. agreed to buy workplace-collaboration software pioneer Slack Technologies Inc. for $27.7 billion in a deal that would turn the combined company into one of the biggest players in the competitive business-software market. (WSJ)

- US job postings during the week ending 20 November were 18.3% below the January average, according to the Opportunity Insights Economic Tracker. This continues a run of soft weekly readings, indicating a less-than-robust job market and raising concerns about the durability of the recovery. Meanwhile, the Weekly Economic Index, from researchers affiliated with the New York Fed, stood at -2.7 last week. Combined with prior readings during the fourth quarter, this points to roughly a 3% decline in real GDP over the four quarters of 2020. This imparts some downside risk to our latest GDP tracking, which implies a four-quarter decline of 2.1%. (IHS Markit Economists Ben Herzon and Joel Prakken)

- The Federal Open Market Committee (FOMC) met on 4 and 5 November amid an ongoing stalemate in Congress over additional fiscal support for the recovery, rising COVID-19 infections, and extraordinary uncertainty about the outlook. The committee kept the target for the federal funds rate at a range of 0.00% to 0.25% and repeated forward guidance for interest rates first announced at the conclusion of its previous policy meeting, on 16 September. That guidance included conditions that would have to be attained before raising the target federal funds rate from its effective lower bound. At the November meeting, the FOMC, in addition to its usual discussion of economic and financial developments and the economic outlook, considered whether it should issue guidance about its expectations for large-scale asset purchases beyond the vague intent to continue to purchases at least at current rates for coming months. No announcement was made with respect to updated guidance for asset purchases at the conclusion of the November FOMC meeting. The minutes suggest that the FOMC will soon provide qualitative, outcome-based guidance for asset purchases. We consider potential forms of that guidance and implications for our forecast. (IHS Markit Economists Ken Matheny and Joel Prakken)

- The seasonally adjusted IHS Markit final U.S. Manufacturing

Purchasing Managers' Index (PMI) posted 56.7 in November, up

notably from 53.4 in October and matching the earlier released

'flash' estimate. The improvement in operating conditions was the

sharpest since September 2014, as the headline PMI rose for the

seventh successive month. (IHS Markit Economist Chris Williamson)

- Contributing to the uptick in the headline index was a substantial increase in output at manufacturing firms in November. The rise in production was the steepest in over six years, amid stronger new order inflows.

- Supply chain disruptions led to a sharper and marked rise in input costs during November, as raw material shortages and COVID-19 restrictions pushed prices higher. The rate of cost inflation was the fastest since October 2018. Stronger demand conditions allowed firms to partially pass-through greater cost burdens on to clients, as selling prices rose at the steepest pace for over two years.

- Despite a faster upturn in new orders, manufacturers registered a softer increase in employment. The rate of job creation was only marginal overall, with some firms stating that short term uncertainty over demand and efforts to rein in spending weighed on workforce numbers.

- Nonetheless, supply delays led to the strongest rise in backlogs of work for over six years. In fact, vendor performance deteriorated to the greatest extent since May. As a result of longer wait times for inputs, stocks were depleted in November.

- Post-production inventories saw a renewed decrease, after a slight rise in October, while the rate of decline in stocks of purchases quickened despite a rise in purchasing activity.

- Expectations regarding output over the coming year improved to the strongest since February 2015.

- Total US construction spending rose 1.3% in October, matching

IHS Markit's expectation but topping the consensus expectation by

several tenths of a percentage point. Revisions to prior months

were mixed. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Core construction spending, which directly enters our GDP tracking, rose 1.3% in October (a shade less than we expected); revisions to prior months were mixed.

- Since reaching a trough in May, total construction spending has recovered to just 0.2% below the pre-pandemic peak reached in February.

- This recovery has been more than accounted for by private residential construction, a sector that has benefitted from historically low mortgage rates, pent-up demand, and a reprioritization toward homelife, as COVID-19 has damped activities outside of the home.

- Indeed, private residential construction has overshot by far its pre-pandemic peak and is approaching an all-time high that was reached at the height of the housing bubble in 2006.

- On the other hand, the private nonresidential category is languishing. Since February, private nonresidential construction has been trending lower. Nine of its eleven itemized categories were down more than 10% from a year earlier, including lodging (down 23.3%), educational (down 15%), religious (down 13%), amusement and recreation (down 23%) and manufacturing (down 12%). The office category was down 8%. With offices emptied and telework emerging, this category is in for hard times.

- Public construction spending rose 1.0% in October, but is still down 2.2% from February.

- Fears are growing for Florida's orange crop, as excessive fruit droppage in parts of Florida has been reported to IHS Markit. "In central and eastern Florida, the trees look good," said a source. "But in Florida's Ridge region around Polk County, which is the main citrus area in the state, and around Sebring: that's where you see the fruit on the ground." Mexico's orange crop is believed to be normal, with expectations of a harvest of some 50 million boxes, only slightly below the anticipated production from Florida. Mexico has finished harvesting its early/midseason fruit and will be running its Valencias from mid-December until March. The fruit is presently delivering ratios of 12-14, but the sweeter juice will develop in February. Despite the reasonable outlook for these harvests, it appears that orange juice buyers in the US are being cautious and not expecting any increase in overall demand (that is, retail plus foodservice sales). Buyers are pushing their contracts back and not taking up their immediate call-offs. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- General Motors (GM) and Nikola Corporation have announced a revised partnership agreement. The agreement consists of a non-binding memorandum of understanding (MoU), according to which the fuel-cell partnership plan between the two companies continues, reports Automotive News. However, the plans have been scrapped for GM to take an equity stake in Nikola and for GM to build Nikola's Badger electric pick-up truck. According to the MoU, which is subject to negotiation and a definitive deal between the two parties, GM will supply its fuel-cell system for Nikola's Class 7 and Class 8 commercial semi-trucks, and potentially, GM's Ultium electric battery system will be used in Nikola's commercial trailers. Following this announcement, Nikola's shares fell by 27%, closing at USD20.41 on NASDAQ, while GM's shares fell by 2.7%, closing at USD43.84 on the New York Stock Exchange. According to a statement by GM, Nikola will need to pay upfront to GM to produce the equipment. According to the news source, Nikola estimates production of the truck will start by 2022, depending on manufacturing partner, and it will refund all deposits taken for the truck. The revised agreement was announced before the 3 December deadline for conclusion of terms of the original deal. (IHS Markit AutoIntelligence's Tarun Thakur)

- PPG Industries says it has agreed to acquire Ennis-Flint (Greensboro, North Carolina), a maker of specialized transportation coatings, for $1.15 billion. Ennis-Flint sells and manufactures pavement markings, traffic paint, thermoplastics, and products for intelligent traffic systems. The company generates about $600 million/year in revenues and "mid-teens percentage EBITDA margins," PPG says."The addition of Ennis-Flint's products further enhances our existing mobility technologies in support of increased automotive occupant safety through driver-assisted and autonomous driving systems," says PPG chairman and CEO Michael McGarry. "We look forward to the Ennis-Flint team joining PPG and working together to further expand the company's product distribution on a global scale." Much of Ennis-Flint's revenue is derived from "non-discretionary, essential maintenance spending," PPG says. The company has manufacturing facilities in the US, Europe, South America, and Asia, and employs about 1,000 people. The deal is part of PPG's broader strategy to expand in transportation and mobility related business. The company formed a "mobility focus team" in 2017 to develop products and technologies for these markets. The transaction is expected to close in early 2021. (IHS Markit Chemical Advisory)

- Canada's real GDP surged 40.5% quarter on quarter annualized

(q/q a.r.) in the third quarter following upwardly revised

quarterly declines in the first half of the year. Household

spending contributed the most to the record upswing of 62.8% q/q

a.r., with record-setting leaps in durable and semi-durable goods

expenditures. (IHS Markit Economist Arlene Kish)

- Real residential investment was the star performer within total capital formation as all residential structure subsectors now exceed pre-COVID-19 levels.

- Real trade flows neared previous expectations, with imports advancing at a quicker pace than exports. Trade in services was the weak link in the trade chain.

- Economic advances going forward will be milder given ongoing modified confinements. However, expanded government stimulus will support consumers and businesses to expand spending capabilities. Low borrowing rates will also contribute to investment spending despite growing debt levels.

- Resilient domestic demand on the part of consumers helped revive and drive the economy's recovery in the third quarter. Spending on household items that already exceeded the pre-pandemic high remained above that threshold. However, big-ticket items like purchases of vehicles, furnishings and household equipment, and medical products jumped, joining the growing list of growing pre-pandemic spending. Household savings remain high, at 14.6% in the third quarter, leaving enough wiggle room to support expenditures in the near term.

- Given the sharp rising in homebuilding, sales, and renovation spending, the fast-paced jump in residential investment is not surprising. For non-residential investment, the big uptake in machinery and equipment is spurred by the large jump in trucks, buses, and other motor vehicles, followed by communications and audio and video equipment most likely associated with improving capabilities of businesses adapting to teleworking. There was also a healthy boost in industrial machinery and equipment. Against this backdrop, total real investment, including government spending, remains 1.7% below end-2019 spending levels. Greater certainty from geopolitical concerns can help boost non-residential investment spending.

- Canadian exports were slower to advance than imports in large part because of the second consecutive quarterly decline in energy products. On the upside, exports of transportation products advanced handily, supporting Canada's manufacturing industries. Exports of real services inched lower again as the fifth quarterly decline in travel and general government services reported large losses that offset gains in transportation and commercial services.

- Imports jumped on hefty gains across most categories, with motor vehicles and parts leading as the bounce came off extreme lows in the second quarter. Targeted restrictions will not likely negatively affect trade of goods going forward.

- The third-quarter rebound was a bit weaker than IHS Markit expectations, but data revisions indicate that real GDP levels are higher than previously estimated in the third quarter.

- As per IHS Markit's Commodities at Sea, coal and petcoke shipments from WC Canada during October 2020 stood at 3.9mt, down 7% y/y. Shipments from Westshore, Neptune, and Ridley stood at 2.5mt (down 11% y/y), 0.1mt (down 47%), and 1.2mt (up 14%), respectively. Amidst reports of China (Mainland) halting Australian metallurgical coal imports, there was an expectation of an increase in the sourcing of Canadian coal from the Chinese steel mills. Teck recently announced it could garner higher prices for its metallurgical coal sales to China (Mainland) versus other destinations. Canadian mining major mentioned its additional spot sales to China achieved an average premium of more than US$35/t above Australian FOB spot pricing at the time each sale was concluded. During 4Q20, Teck Resources to sell 5.8-6.2mt of coal, with 20% to China (Mainland). Teck reported having sold three metallurgical cargoes for US$160-165/ton. In 2021, Teck Resources plans to sell 7.5mt of coal to China (Mainland) with contracts priced on a CFR basis. For 2019 metallurgical coal shipments stood at 25mt and for 2021 anticipated at 21.6-22mt, respectively. Canadian coal and petcoke shipments forecast during 4Q20 calculated at 12.6mt (up 1% y/y). During the fourth quarter, exports anticipated strengthening due to increasing demand from Far East steel mills as well as supply from Vista coal mine. Canadian coal and petcoke exports during 2020 and 2021 forecasted at 46mt (down 2% y/y) and 49mt (up 6% y/y). Shipments to China (Mainland) during 2020 and 2021 forecasted at 7mt and 11mt, respectively. (IHS Markit Maritime and Trade's Rahul Kapoor and Pranay Shukla)

- Chile's Ministry of Public Works announced on 27 November that China Railway Construction Corporation has been allocated the concession of the Talca-Chillán tranche of Road 5. It will be the first Chinese investment in Chile's road infrastructure. This follows the announcement in November by China's State Grid International Development Limited (SGIDL) that it was in negotiations to acquire power distributor Compania General de Electricidad (CGE), owned by Spain's Naturgy. If Chile's regulator approves the transaction, State Grid will control approximately 57% of Chile's power distribution, as it already owns another power distribution firm in Chile, Chilquinta, acquired in 2019. Chile and China have close bilateral relations, with China being Chile's main commercial partner, the main buyer of Chile's copper, and the first source of foreign direct investment (FDI). Chile has also joined the China-led Belt and Road Initiative (BRI), by which China seeks to develop worldwide infrastructure projects to facilitate trade. Foreign involvement in strategic sectors is likely to become a topic of discussion in the upcoming process of writing a new constitution, which begins on 11 April 2021 with the election of 155 members of the Constituent Convention, as members of the political and business class have already raised concern about the market concentration by foreign capitals. (IHS Markit Country Risk's Carla Selman)

Europe/Middle East/Africa

- European equity markets closed higher across the region; UK +1.9%, France +1.1%, Spain +0.8%, Germany +0.7%, and Italy +0.2%.

- 10yr European govt bonds closed sharply lower; Italy +6bps, UK/Germany/France +5bps, and Spain +4bps.

- iTraxx-Europe closed -3bps/46bps and iTraxx-Xover -14bps/251bps.

- Brent crude closed -1.0%/$47.42 per barrel.

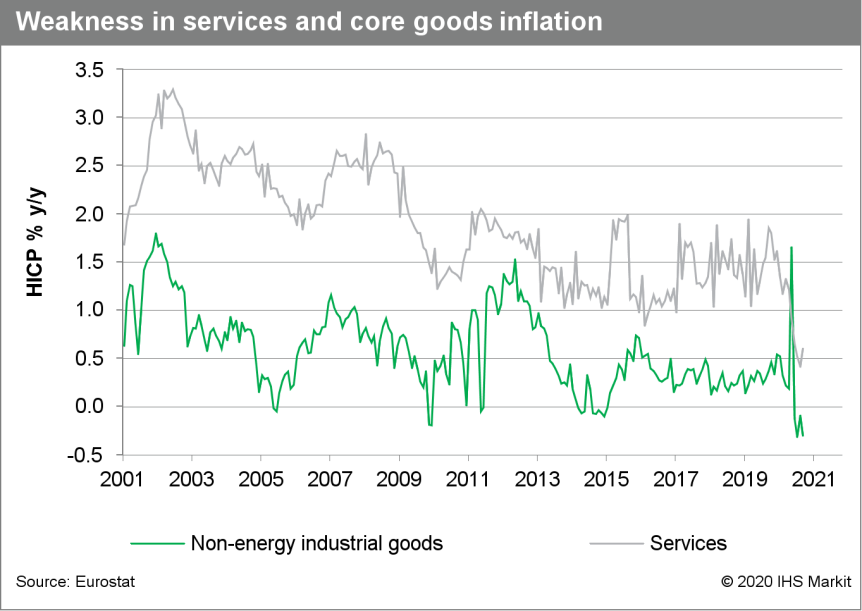

- November's "flash" HICP data for the eurozone showed the

headline inflation rate unchanged at -0.3% for the third successive

month, slightly weaker than expected, and negative for the fourth

month in a row. (IHS Markit Economist Ken Wattret)

- The core inflation rate excluding food, energy, alcohol and tobacco prices was unchanged for the third straight month at just 0.2%, matching its record low.

- Looking at the two key sub-components of the core rate, inflation for non-energy industrial goods slipped further into negative territory (to -0.3%), while inflation for services partly rebounded (to +0.6%).

- Both rates remain very low by historical standards. By way of comparison, just a year ago, the services inflation rate was 1.9%.

- A full breakdown of November's eurozone HICP by item will be released on 17 December and is likely to show continued weakness in the areas most affected by COVID-19. These include prices of clothing and footwear, package holidays, accommodation services and passenger transport.

- The inflation rate excluding these items in addition to food, energy, alcohol and tobacco prices, which we term the "extended" core rate, has fallen less markedly than the "traditional" core rate since the pandemic struck in early 2020 (see second chart below).

- Headline inflation should rise in December given the recent rebound in crude oil prices, ahead of a pick-up in headline and core rates during the early months of 2021.

- This expected pick-up will reflect the end of reduced VAT rates in Germany (in January) and upward base effects from energy prices (from February to May, given pronounced COVID-19-driven declines in oil prices in the equivalent period of 2020).

- Looking beyond these near-term upward pressures, with the

output gap having surged, unemployment to continue to rise, and

inflation expectations still rather low, disinflationary and

potentially deflationary forces will remain prevalent in the

eurozone.

- Seasonally adjusted German unemployment has declined by 39,000

in November, similar to October's -38,000. This is the fifth

monthly drop in succession following a cumulative surge by 671,000

during the second quarter. The cumulative decline during

July-November was 122,000, and the unemployment level at

end-November was 2.817 million, which compares to a cyclical low of

2.268 in March and an interim high of 2.939 in June. (IHS Markit

Economist Timo Klein)

- Separately, the Labour Agency has calculated that the COVID-19 virus pandemic's effect on unemployment was -37,000 in November, following -57,000 in October and -23,000 in September, around zero in July-August, and huge increases during the second quarter.

- The cumulative net rise in joblessness since April that can be linked directly to the pandemic is 520,000, down from 638,000 in June. The German unemployment rate, which had increased from 5.0% in March (close to 40-year lows) to 6.4% during June-July, has now slipped to 6.1% in November.

- Seasonally adjusted underemployment (as opposed to unemployment), which had deviated in both directions during 2019 due to fluctuations in the number of people receiving some form of (non-insurance-related) government support - which affects the underemployment data but not official unemployment - declined to a similar extent as unemployment in November, posting -42,000 month on month (m/m).

- The Labour Agency points out that statistical undercoverage of the number of people benefiting from public support measures - in turn related to COVID-19-influenced contact impediments and preoccupation with administering short-time work applications - is at least partly responsible. The official number for these measures (-12.9% y/y in November, down from -11.8% in October) indicates a sideways tendency of late.

- Employment is continuing to reverse its February-June plunge (cumulatively -752,000). In October (employment data lag behind unemployment numbers by one month), seasonally adjusted employment increased by 20,000, similar to the average of 18,000 per month during the third quarter. This equally almost matches the monthly average increase of 21,000 during 2019, but it is only half as strong as the average of 40,000 observed during the cyclical upward trend between March 2010 and end-2018.

- By comparison, the November level is still more than double that of the previous cyclical trough in July 2009 (281,000), then hurt by the global financial market crisis. Meanwhile, the seasonally adjusted vacancy index called BA-X introduced in 2005 - which measures employers' demand for labor, disregarding all seasonal and publicly subsidized job offers - recovered by another point to 99 in November, which is up from May's interim low of 91 but still 21 points lower than in November 2019 and 35 points below its all-time high of 134 in September 2018.

- The November report appears encouraging at first glance, but several qualifications are in order. Improvements since mid-2020 have owed to natural corrections from the second-quarter slump owing to the March-April lockdown, in line with the subsequent loosening of restrictions. Secondly, we expect another phase of deterioration in the coming months until roughly mid-2021 (likely timing of widespread vaccine availability) due to the renewed lockdown period since early November that will last until just before Christmas. The spike in short-time work announcements during November is a harbinger of that.

- RWE will install its patented collars on three of its monopile foundations at the Kaskasi offshore wind farm. The collars are designed by civil engineering company JBO, and manufactured by Bladt Industries. The latter is also manufacturing the foundations for the monopoles. The collared monopoles are expected to help increase the stability of the piles in difficult ground. Further to this, Kaskasi will also use the vibro-pile driving technique to reduce noise emissions and improve installation times. The Kaskasi offshore wind farm consists 38 units of 9 MW wind turbines, installed off the coast of Germany, 35 km north of the island of Heligoland. Foundation installation is expected to commence in the third quarter of 2021, and will be carried out by contractor DEME Offshore. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Mercedes-Benz has been testing prototypes of its EQE E-segment electric vehicle (EV) which is due to slot into the range just below the range-topping EQS, according to an Autocar report. According to the pictures accompanying the report, the EQE will have something of an unconventional 'cab forward' shape, which will be aimed at making the most of the cabin space and flexibility that is afforded by the model's electric powertrain. The effect is reminiscent in some respects of the shape and silhouette of the Jaguar I-Pace, but with less of an SUV influence than that car. The lack of a conventional internal combustion engine allows for a much shorter front end, and the new Mercedes bespoke EVA architecture with its flat floor should increase interior space. The EQE will effectively shadow the existing E-Class E-Car segment model in Mercedes-Benz 's new EQ electric car range. Mercedes have also confirmed that there will also be an EQE SUV which will be offered alongside the sedan. (IHS Markit AutoIntelligence's Tim Urquhart)

- Automotive OEMs are stockpiling components and vehicles ahead of the end of the Brexit transition phase at the end of the year, reports The Guardian. The newspaper has said that Volkswagen (VW) has imported more cars than normal recently, although a spokesperson for the company has said that it was not possible to attribute this directly to Brexit, as the company uses these stockpiles to cover factory shutdowns in December and the number plate change in March. Honda is also stocking additional components to ensure that production of the Civic can continue at its Swindon (UK) facility before it closes in 2021. Morgan Cars has also confirmed that it is rushing to finish orders for the European market before the end of the year, stating, "This is to protect against any potential delays and the initial shock of currently unknown tariffs on the vehicles." (IHS Markit AutoIntelligence's Ian Fletcher)

- The French passenger car market dropped by 27% year on year (y/y) during November as stricter measures were imposed to control a second wave of the COVID-19 virus pandemic. According to the latest data published by the French Automobile Manufacturers' Committee (Comité des Constructeurs Français d'Automobiles: CCFA), registrations during the month dropped from 172,731 units to 126,048 units. However, there was some impact from working-day factors as the month had 20 days versus 19 days in November 2019. When taking this into account, registrations would have fallen by 30.7% y/y on a like-for-like basis. The latest decline means that passenger car registrations have now fallen by 26.9% y/y to 1,463,795 units during the first 11 months of 2020, mainly because of the effect of earlier COVID-19 virus-related restrictions. (IHS Markit AutoIntelligence's Ian Fletcher)

- Italy's increase in GDP was stronger than anticipated in the

third quarter, but the balance of risks is now tilting to the

downside. Indeed, rising numbers of COVID-19 infections and tighter

containment measures point to renewed GDP losses in the fourth

quarter of 2020. (IHS Markit Economist Raj Badiani)

- The steady lifting of the COVID-19 virus pandemic-related lockdown spelled the end of Italy's technical recession during the third quarter.

- According to the second estimate, Italy's real GDP rose by 15.9% quarter on quarter (q/q) in the third quarter, revised down from the initially reported 16.1% q/q.

- This followed falls of 13.0% q/q in the second quarter and 5.5% q/q in the first.

- Nevertheless, Italian GDP in the third quarter was still 4.7% below its level at end-2019, the pre-COVID-19 level.

- A breakdown by expenditure reveals that domestic demand added 13 percentage points from the GDP change between the second and third quarters, with private consumption and fixed investment each representing boosts of 7.5 and 3.3 percentage points, respectively.

- Net exports also made a positive contribution of 4.4 percentage point, with exports revving more sharply than imports.

- A change in inventories was also a drag on the third-quarter GDP change, signifying a subtraction of 1.0 percentage point.

- Consumer spending grew by 12.4% q/q but was still 7.4% smaller than a year earlier in the third quarter. This was due to the release of pent-up demand in line with the reopening of non-essential shops and many consumer-facing services.

- Meanwhile, fixed investment revived surprisingly well, up by 31.3% q/q and 0.7% y/y in the third quarter. Spending on machinery and equipment, dwellings and residential structures all posting robust gains.

- The reopening of factories from 4 May triggered a robust rise in industrial production, which drove the third-quarter rebound. Specifically, industrial production rose 42.1% month on month (m/m) in May, followed by m/m gains of 8.2% in June, 7.0% in July, and 7.7% in August. Encouragingly, industrial output in August was only 1.8% below the level in February, the month prior to the pandemic-related lockdown.

- In addition, the IHS Markit Italy Manufacturing Purchasing Managers' Index (PMI) reveals that output rose for a fourth successive month in September, "with the headline figure the highest for 27 months and indicative of a moderate improvement in overall conditions."

- Italy's manufacturing sector reaped the benefits from the reopening of the global economy. Indeed, Italy has an open economy, with exports totalling 32% of GDP, make it highly sensitive to global downturns and upturns.

- Nevertheless, the scale of the overall GDP rebound in the third quarter was surprising, given that service providers appear to be lagging behind the recovery. Specifically, the IHS Markit Italy Services PMI signals a renewed and intensifying downturn in Italian service-sector activity during the August-October period.

- We anticipate a tighter squeeze on economic activity in the latter stages of this year. The more severe regional lockdowns targeting hospitality, transport and the retail sectors likely to spark a renewed and sharp contraction in the final quarter.

- Saipem has signed a collaboration agreement with Consiglio Nazionale delle Ricerche (CNR) to further develop its patented HEXAFLOAT pendulum-type floating foundation design for offshore wind turbines. The strategic research project will be financed by Italy's Electrical System Research fund and will cover numerical modelling, and model testing at Istituto di Ingegneria del Mare's (INM) indoor basin. The outcome of the laboratory tests will inform the deployment of a prototype in Naples, managed jointly by CNR and INM, which is expected to happen in the second quarter of 2021. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- PKN Orlen (Plock, Poland) will invest an average of 4.4 billion

zloty ($1.2 billion) per year between 2021 and 2030 for a major

expansion of its petrochemicals business and the creation of a

plastics recycling division, as part of an enhanced focus on

petchems and renewables over the next 10 years. (IHS Markit

Chemical Advisory)

- By 2030, the company it will have an annual petchems output of approximately 15 million metric tons and be "an active player" in plastics recycling with 300,000-400,000 metric tons/year of installed capacity, PKN Orlen says. The expansion is forecast to increase its petchems EBITDA from Zl2.3 billion in 2019 to approximately Zl7.0 billion by 2030, according to the company. "We are set to become one of Europe's largest integrated petrochemical producers and expand our recycling business," it says.

- The capital expenditure (capex) plans, outlined in PKN Orlen's latest strategy update, are being implemented to achieve targets including expanding the share of specialty products in its petchems portfolio from 16% in 2019 to 25% by 2030, and ramping up production capacities for olefins and other base chemicals to supply feedstock for the development of the specialty and other advanced petchem products. The increased focus on petchems will specifically include expanding the company's position in products such as phenol and other aromatic derivatives, it says.

- By 2030, about half the company's profits from crude-oil processing will be derived from PKN Orlen's petchems business, it says.

- In polymers the company is aiming to strengthen its position and extend its value chain to include compounding and concentrates, as well as "building [a] foothold in sustainable development" through mechanical and chemical recycling of plastics and the development of waste-to-energy solutions, while implementing advanced closed-loop technologies, it says. PKN Orlen had no plastics-recycling capacity in 2019. It also plans to build a lactic acid unit. Recycling and biomaterials will be new branches of the company's petchems segment.

- PKN Orlen has set an overall capex program of Zl140.0 billion for the period to 2030, with Zl85 billion to be spent in new areas such as petchems and renewables, including hydrogen and biofuels. A total of Zl55.0 billion will be spent on key existing assets, mostly in refining, to increase their efficiency and extend their life cycle to maximize performance.

- Approximately Zl3.0 billion will be spent over the period on innovation and R&D, with a focus on green technologies, it says.

- The Turkish economy bounced back strongly in the third quarter

following deep losses inflicted by the COVID-19 virus pandemic in

the second quarter. The government-backed credit boom provided a

strong lift to the recovery. A tightening of economic policies

under the new central bank governor is likely to limit further

gains in the fourth quarter. (IHS Markit Economist Andrew Birch)

- In the third quarter of 2020, Turkish GDP surged by 15.6% quarter on quarter (q/q) in seasonally and calendar adjusted data from the Turkish Statistical Institute (TurkStat). The credit-fueled recovery returned the economy to its pre-pandemic size after the implementation of lockdown measures sent GDP down by 10.8% q/q in the second quarter.

- In particular, the manufacturing and retail trade sectors posted vigorous recoveries in the third quarter. After contracting by 22.6% q/q in the second quarter, manufacturing value added surged by 37.0% q/q in the third quarter. Meanwhile, wholesale and retail trade activity skyrocketed by 33.4% q/q in the third quarter after having contracted by 24.7% y/y in April-June.

- In the second quarter, the Turkish government pushed the banking system into substantial new lending to try to keep domestic demand moving ahead. As a result, the value added of the financial and insurance sector in the second quarter soared by 42.9% q/q in seasonally and calendar adjusted data. In the third quarter, the government began to withdraw credit expansion pressures, resulting in the value added from the financial and insurance sector contracting by 13.6% q/q.

- That additional credit was instrumental in providing the impetus for both manufacturing and retail trade growth in the third quarter. The manufacturing sector was primarily geared towards fulfilling domestic demand, as exports of merchandise goods continued to contract in July-September.

- On the expenditure side of the GDP ledger, the credit fueled recovery led to a surge of both private consumption and gross fixed capital formation. In both seasonally and calendar adjusted terms, gross fixed capital formation was the largest it had been since the second quarter of 2018.

- Through the first three quarters, cumulative GDP was up slightly from a year earlier, by 0.5%. The third-quarter recovery was significantly stronger than we had anticipated. This surge in July-September will likely put full-year economic performance much better than our last forecast, which projected a full-year 6.0% GDP decline.

- The third-quarter recovery, however, is not expected to continue unabated in the fourth quarter. The pivot of economic policies under new Central Bank of the Republic of Turkey (TCMB) Governor Naci Agbal has already begun to dramatically raise interest rates and to restrict credit growth. This tightening of monetary policy will put an end to the surge of fixed capital investment and private consumption.

- The monetary policy committee (MPC) of the National Bank of

Angola (Banco Nacional de Angola: BNA) decided to keep the central

bank's key interest rates unchanged at its November meeting, having

last cut the rates in May 2019. At the meeting, the MPC raised the

coefficient of the mandatory foreign-currency reserves. (IHS Markit

Economist Alisa Strobel)

- The Angolan central bank's MPC met on 27 November to discuss the latest developments in the domestic economy and the implications of current global economic conditions for the country's macroeconomic growth performance, taking into account the consequences of a possible second wave of the coronavirus disease 2019 (COVID-19) pandemic in the main economies globally.

- At the meeting, the MPC decided to maintain the BNA's key policy rates, after last lowering its key policy rate by 25 basis points to 15.5% during its May 2019 meeting, which brought the cumulative reduction in the central bank's policy rate to 250 basis points since June 2018. Furthermore, in its official release, the MPC emphasised its commitment to the path of price stability, maintaining its forecast for annual headline inflation of 25% in 2020.

- The official statement by the MPC also highlighted that, since its last session, the reform of the operation of the foreign-exchange market on the foreign-exchange supply side has continued with the National Treasury joining the foreign-exchange governance platform. The MPC noted that about 61% of foreign-exchange purchases from commercial banks were purchased from their customers in October.

- Oil price softness continues to translate into a weaker exchange rate of the Angolan kwanza, so limiting room to ease monetary policy further in the near term. IHS Markit expects, therefore, the tight monetary-policy stance to continue. A rebound in oil exports and production growth could provide room for a moderate rate cut towards the second half of 2021.

- The BNA is maintaining its forecast for annual headline inflation of 25% for this year, and IHS Markit anticipates inflation of 22.5%. However, we could see some higher price developments during the holiday season in consumer prices, which could edge the annual rate upwards closer to the BNA's estimate. Headline inflation reached a monthly variation of 1.8% in October, substantially the same as in the previous month. The accumulated inflation rate in October reached 20.2%, while the annual rate reached 24.3%, 0.5 percentage point higher than September's reading.

Asia-Pacific

- APAC equity markets closed higher across the region; Mainland China +1.8%, South Korea +1.7%, Japan +1.3%, India +1.2%, Australia +1.1%, and Hong Kong +0.9%.

- Tesla has gained approval from the Ministry of Industry and Information Technology (MIIT) to begin sales of the Model Y in China. The electric vehicle (EV) manufacturer's Model Y appeared in a product catalogue published recently by the MIIT, China's industry regulator, indicating it has granted permission for sales of the new model to begin in China. Tesla's Chinese website shows no changes to the pre-sales pricing of the Model Y as of 1 December. The price range only provides an estimate for consumers willing to place an order for the Model Y, so the suggested pricing is likely to change when the vehicle hits the market. Tesla currently offers two versions of the Model Y in the market, a long-range version priced at CNY488,000 (USD74,240) and a performance version priced at CNY535,000. Earlier reports indicate that Tesla aims to begin Model Y production within the year at its Shanghai Gigafactory. The factory currently only produces the automaker's Model 3 sedan, but the facility is undergoing an expansion to accommodate production of the Model Y. The Model Y's appearance in MIIT's product catalogue indicates the vehicle will soon be entering the market to compete with premium electric sport utility vehicle (SUV) offerings from Chinese startup NIO. (IHS Markit AutoIntelligence's Abby Chun Tu)

- South Korean battery-maker LG Chem plans to boost its production capacity of battery cells in China next year to keep up with demand from Tesla, reports Reuters. With the increased capacity, LG Chem's China factory will also initially supply battery cells for Tesla vehicles in Berlin when production in Germany begins. LG Chem will invest USD500 million over 2021 to raise annual production capacity of its cylindrical battery cells at its Nanjing plant by 8 GWh. The plan involved increasing the number of production lines to at least 17 from eight. LG Chem has revised its production expansion target on the projection of rising electric vehicle (EV) sales in major global markets. The battery-maker said it aims to increase its production capacity to 260GWh by 2023, up from a projected production capacity of 120GWh by the end of 2020. The increased capacity will be able to meet demand for 3.72 million EVs equipped with 70kWh-battery packs. (IHS Markit AutoIntelligence's Abby Chun Tu)

- China State Shipbuilding Corporation (CSSC) will construct a new offshore wind manufacturing base in Qinzhou in Guangxi province, China. The new base will cover an area of 1.8 million square meters and include two 100,000 ton docks to support production for a total installed capacity of 1.5 GW yearly. Construction of the facility will come at an estimated cost of RMB12.9 million (USD2.0 billion) and will include a full suite of functions from research and development, equipment manufacturing, assembly and integration, installation, and maintenance. Although the facility will mainly support offshore wind construction, it is also expected to produce offshore oil and gas products such as platform modules and subsea equipment. The move to construct the base is part of the Guangxi region's push to promote and support the offshore wind industry in China, and especially its local Beibu Gulf Economic Zone. China has plan to add a further 52 GW of wind farms to its coastal regions by 2030. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Chinese consumers' strong demand for fresh sweet cherries

continues in the 2020/21 season with record-breaking wholesale

prices for early shipments. Prices are set to weaken when December

supplies arrive. (IHS Markit Food and Agricultural Commodities'

Hope Lee)

- Chilean cherries exports to China reached 164,800 tons in the January-October period, an increase of 28% by volume from last year. The price is about USD7,100 per ton cif, up 5%. Cherry is one of the most high-valued imported fruits in China.

- The first batch of Chilean cherries of the 2020/21 season has arrived at Shanghai and Guangzhou, wholesaling at CNY2,000 (USD294) per box (5.0 kilos) initially, up from CNY1,500/box of last year, according to FreshPlaza. The early picked fruits were sent by costly charter flights due to the pandemic.

- From mid-November to 23 November, prices have come down to CNY600-900/box as more shipments landed. The main varieties include Santina, Royal Down, Brooks and Glenred. Industry sources predicted that prices will stabilize in mid-December when cheaper fruits arrive by sea.

- The late start of the Chinese New Year (12 February 2021) will benefit suppliers and Chinese marketers.

- According to the Chilean Fruit Exports Association (ASOEX), global exports in the current season will increase by 36% to 310,350 tons.

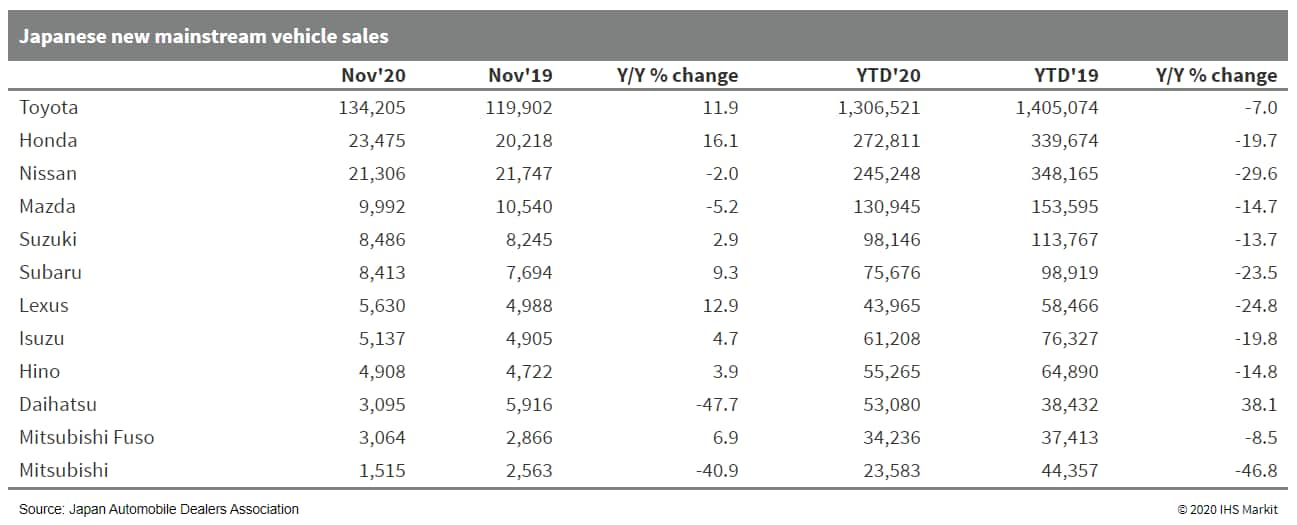

- Japanese sales of mainstream registered vehicles were 253,069

units, up by 6.0% year on year (y/y) during November, according to

data released by the Japan Automobile Dealers Association (JADA).

This figure excludes mini-vehicles, thus covering all vehicles with

engines bigger than 660cc, including both passenger vehicles and

commercial vehicles (CVs), sold in Japan. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- Sales of passenger and compact cars advanced by 6.4% y/y to 219,040 units in November, while truck sales were up by 4.0% y/y to 33,536 units and bus sales were down by 37.3% y/y to 493 units.

- In the year to date (YTD), sales of mainstream registered vehicles declined by 13.77% y/y to 2.636 million units.

- Sales of passenger cars were down by 13.7% y/y to 2.268 million units, while truck sales fell by 13.9% y/y to 359,919 units and bus sales by 30.8% y/y to 8,719 units. The decline in sales last month can be mainly attributed to last year's low base of comparison.

- New vehicle sales in Japan had declined by 14.6% y/y in November last year, as customers continued to cut back on spending following the 1 October consumption tax rise, the first since April 2014.

- Although consumers have gradually started to return to a new

normal during the COVID-19 virus pandemic, the market remains hurt

as customers have continued to cut back on spending following the

consumption tax rise.

- Indian GDP contracted 7.5% y/y in real terms during the

July-September quarter (the second quarter of the fiscal year

2020). This followed a contraction of 23.9% y/y in the previous

quarter, marking India's first technical recession on record.

Nevertheless, the contraction was smaller than most estimates,

including those of the Reserve Bank of India (RBI) and IHS Markit's

projection of 9.8% y/y. (IHS Markit Economist Hanna

Luchnikava-Schorsch)

- The contraction in private spending narrowed to 11.3% y/y in July-September, following a much steeper contraction of 26.7% y/y in the previous quarter. This was mostly a result of a progressive lifting of strict lockdown restrictions from June, with pent up demand for both durable and essential goods driving the partial recovery.

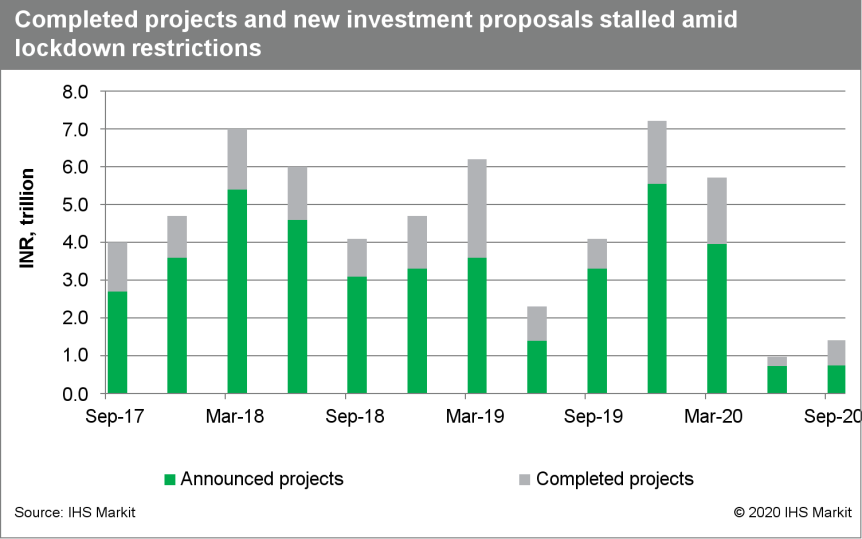

- Fixed investment spending fell by 7.3% y/y, rebounding strongly from a contraction of 47.1% y/y in the April-June quarter. The recovery in investment activity was significantly better than expected and is likely due to the resumption of projects already announced before the lockdown restrictions, with new project announcements remaining virtually unchanged from the previous quarter. The numerical base effect is also a factor, as real fixed investment contracted by 3.5% y/y during the same quarter of FY 2019.

- A fixed investment breakdown by ownership is not available, but the new investments likely originated from the private sector, with firms taking advantage of a temporary boost to liquidity following the central bank's injections and a lending moratorium imposed to assist borrowers affected by the COVID-19 virus pandemic. Another factor supporting private investment was substantial foreign direct investment (FDI) equity inflows of USD23.8 billion during the quarter (compared with USD10.1 billion during the equivalent quarter of 2019).

- Government consumption and investment activity, on the other hand, was modest despite the announced stimulus measures. Public consumption expenditure fell 22.2% y/y in real terms during July-September after rising 16.4% y/y in the previous quarter.

- The net exports position remained favorable: a 17.2% y/y contraction in imports was substantially steeper than a 1.5% y/y fall in exports, indicating persistent significant weakness in domestic demand.

- In terms of output, the economy contracted 7.0% y/y after recording a fall of 22.8% y/y in the June quarter. The most surprising development was a notable recovery in manufacturing output, which recorded modest growth of 0.6% y/y after contracting by 39.3% y/y in the June quarter. This was in contrast to industrial output data, which showed that manufacturing sector output declined by 6.7% y/y during the same period.

- The September-quarter result was better than IHS Markit's

expectations, with the most positive news being the private-sector

source of recovery. Given the incoming high-frequency

post-September data available so far, the economic recovery is

likely to expand into the December quarter, supported by further

removal of lockdown restrictions and a boost to domestic demand

from festival spending and the government's mini-stimulus announced

in October.

- Uber India plans to have 3,000 electric vehicles (EVs) in its fleet by the end of 2021. According to a report by Mint, Prabhjeet Singh, president of Uber India and South Asia, said, "As of now, we plan to have approximately 3,000 EVs and e-rickshaws (across two, three and four-wheelers) on our platform by the end of 2021." The company also plans to forge strategic partnerships with OEMs, EV infrastructure firms for charging and battery swapping, and fleets and financiers. The latest development is in line with Uber's goal to have zero-emission vehicles in 100% of its ride-hailing fleet globally by 2040. (IHS Markit Automotive Mobility's Isha Sharma)

- Dr Reddy's Laboratories (India) has entered into a definitive agreement to acquire a portfolio select of anti-allergy brands in Russia, Kazakhstan, and Uzbekistan, for an undisclosed sum, from Glenmark Pharmaceuticals (India). According to a press release published by Dr Reddy's, it plans to acquire rights to the Momat Rino brand (mometasone furoate, monohydrate nasal spray) in Russia, Kazakhstan, and Uzbekistan, the Momat Rino Advance brand (azelastine hydrochloride, mometasone furoate nasal spray) in Russia, the Momat A brand for Kazakhstan and Uzbekistan, and the Glenspray Active brands (mometasone furoate and azelastine hydrochloride) in Ukraine. The agreement includes all rights to the trademarks, dossiers, and patents in the territories specified. The acquired brands essentially represent two products, a mometasone mono product and a combination of mometasone with azelastine, and they are indicated for the treatment of seasonal and perennial allergic rhinitis. The divestment by Glenmark comes ahead of the planned launch of the company's new fixed dose seasonal allergic rhinitis (SAR) nasal spray Ryaltris (olopatadine hydrochloride and mometasone furoate). The company has reportedly decided to divest the Momat Rino brand and its extension as it awaits approval to launch Ryaltris in the Russian market, and as it moves to focus on this product for its respiratory franchise in Russia and the Commonwealth of Independent States (CIS) region. (IHS Markit Life Sciences' Sacha Baggili)

- Hyundai and South Korean IT company Naver have signed a memorandum of understanding (MOU) to collaborate on various aspects of future mobility, reports Korea JoongAng Daily. Under the MOU, the two companies will co-operate on creating content and services for connected cars. They will also work on finding business models in which they can work together with small and mid-size enterprises. The first service under this partnership will be enabling passengers to access various Naver services through Hyundai vehicles' infotainment systems, such as maps, search engines, shopping, and music streaming. The service will be introduced from next year. Advanced connectivity such as receiving alarms from Naver when the vehicle needs to be inspected or picked up after a service will also be available as early as next year. "By merging the automotive industry and ICT, [Hyundai Motor] will innovate customer service and improve mobility convenience," said Chi Young-cho, head of Hyundai Motor's strategy and technology division. The latest development is in line with Hyundai's future growth strategy to move away from being a traditional automaker to becoming a mobility service provider. Earlier this year, the automaker announced plans to invest KRW100 trillion (USD90 billion) over the next five years to develop future vehicle technologies. (IHS Markit AutoIntelligence's Jamal Amir)

- The Malaysian ringgit strengthened again in November. The

currency was originally expected to show a short-term weakening,

but it is now likely to continue directly to a medium-term

appreciation as well. (IHS Markit Economist Dan Ryan)

- The policy interest rate remains unchanged at 1.75%. Despite the resurgence of the COVID-19-related control measures, the policy rate should hold constant, reflecting the strength of the third-quarter rebound and the flat consumer and wholesale prices.

- Exports surged in September, resulting in a nearly 15% growth rate from a year earlier. Imports grew to a lesser extent, pushing the trade balance on again to high levels.

- In the industrial sector, the leading indicator continues on an uptrend, although its predictive power is limited. The industrial production index has been volatile but essentially flat for three months.

- The nominal wholesale sector has also been volatile - so much so that no short-term trend is clear. However, real wholesale sales appear to be rising, which bodes well for consumer and manufacturing sectors.

- The unemployment rate has been relatively stable in recent months, hovering around 4.7%. However, it is a big improvement from the 5.3% level recorded in the pandemic nadir in May.

- The consumer sector has been looking good, at least in September. Retail sales - both nominal and real - and auto registrations were on an uptrend, and all are higher than a year earlier.

- The monthly data show a healthy economy, at least through the end of the third quarter. These numbers are consistent with the national income accounts.

- However, the economy is likely to slow in the fourth quarter. The resurgence of COVID-19 and the resulting lockdowns and movement control should yield a small fourth-quarter contraction.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-december-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-december-2020.html&text=Daily+Global+Market+Summary+-+1+December+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-december-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 1 December 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-december-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+1+December+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-december-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}