Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 01, 2021

Daily Global Market Summary - 1 October 2021

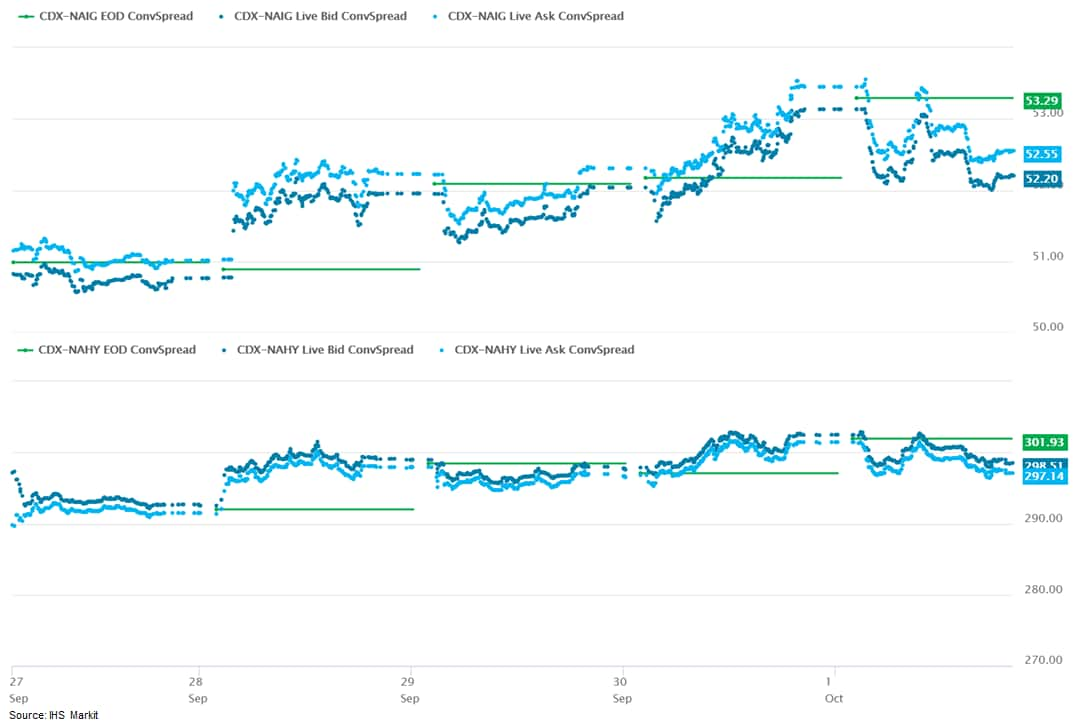

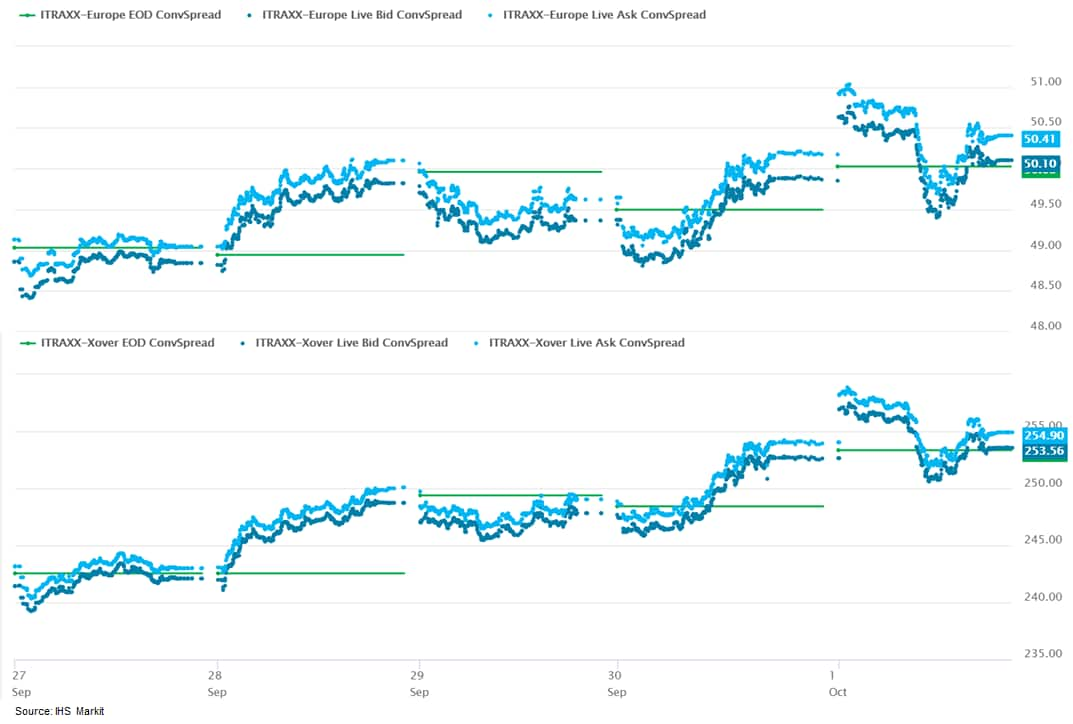

All major US equity indices closed higher, Europe was mixed, and APAC lower. US and most benchmark European government bonds closed higher. CDX-NA closed modestly tighter across IG and high yield, while European iTraxx was almost unchanged on the day. Copper, silver, gold, and oil closed higher, while the US dollar and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +1.7%, DJIA +1.4%, S&P 500 +1.2%, and Nasdaq +0.8%.

- 10yr US govt bonds closed -2bps/1.46% yield and 30yr bonds -1bp/2.03% yield.

- CDX-NAIG closed -1bp/52bps and CDX-NAHY -4bps/298bps, which is

+1bp week-over-week for the former (CDX-NAHY 37.1 rolled this week,

so there is no week-over-week comparison).

- DXY US dollar index closed -0.2%/94.04.

- Gold closed +0.1%/$1,758 per troy oz, silver +2.2%/$22.54 per troy oz, and copper +2.4%/$4.19 per pound.

- Crude oil closed +1.1%/$75.88 per barrel and natural gas closed -4.2%/$5.62 per mmbtu.

- US personal income increased 0.2% in August and wages and

salaries rose at the same rate. Real disposable personal income

(DPI) decreased 0.3%. Real personal consumption expenditures (PCE)

increased 0.4% in August as spending recovered from a downwardly

revised 0.5% decline in July. However, the increase was less than

IHS Markit analysts had assumed, resulting in a downward revision

to the forecast for third-quarter growth of real PCE, from 1.7% to

0.4%. (IHS Markit Economists James

Bohnaker and William Magee)

- Real PCE for durable goods fell 1.3% in August as spending on new motor vehicles plunged 11.1% amid severe supply chain issues. Real PCE for nondurable goods and services increased 1.7% and 0.3%, respectively.

- Advance payments of the Child Tax Credit authorized under the American Rescue Plan raised personal income by $226 billion (annual rate).

- Unemployment insurance (UI) transfer payments declined by $14 billion (annual rate) in August but remained a key support for personal income. Eligibility for pandemic-era UI benefits expired on Labor Day, so payments under these programs are expected to decline sharply in September.

- The core PCE price index increased 0.3% in August and its 12-month change was 3.6%. Outside of the core, the price index for energy goods and services rose 1.9% and was up 24.9% over 12 months.

- The spread of the Delta variant of COVID-19 likely had a peak impact on consumer spending in August, and continued improvement in labor income and elevated levels of household savings will support moderate growth over the next several months.

- GDP implications (third quarter: down 0.7 percentage point) Real PCE through August was lower than expected, implying less PCE and imports in the third quarter. As a result, we lowered our forecast for third-quarter GDP growth by 0.7 percentage point to 2.9%.

- The University of Michigan Consumer Sentiment Index rose 2.5

points from its August level to 72.8 in the final September

reading—slightly above its nadir in April 2020. The final

September reading was 1.8 points higher than the preliminary

estimate, suggesting that consumer sentiment improved over the

course of the month. This coincides with a gradual decline in the

number of COVID-19 cases in the last two weeks of September. (IHS

Markit Economists James

Bohnaker and William Magee)

- Consumer attitudes about both the present and future improved modestly. The index of the present situation rose 1.6 points to 80.1 and the expectations index increased 3.0 points to 68.1.

- The expected one-year inflation rate in the University of Michigan survey remained elevated at 4.6%, near its highest levels since 2008. Elevated inflation expectations over the near term are likely a reaction to higher observed prices for food, gasoline, and some large durable goods.

- Consumers do not appear overly concerned with inflation over the longer term; the expected 5-10-year inflation rate was 3.0% in September, which is well within the historical range over the past three decades.

- Views on buying conditions for big-ticket items remained depressed in September. The index of buying conditions for large household durable goods, automobiles, and houses all slumped further as limited inventories and high prices remain hurdles.

- Although consumer attitudes improved slightly in late September, they remain depressed relative to earlier in the year. The low level of sentiment, which is barely above its trough during the worst of the pandemic, is somewhat at odds with ongoing recovery in spending.

- US total construction spending was flat in August, below

expectations for a moderate increase. Core construction spending

declined 0.4% in August, in contrast to our assumption of a

moderate increase. The level of core construction spending was

revised higher for June and July. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- The trend in construction has stalled, mainly reflecting fading support from the private residential sector.

- While still elevated, construction of new residential housing turned down in August. This mainly reflected a recent downturn in the trend in single-family housing starts.

- The trend in multifamily housing starts has been firming this year, but they are lower in value (per unit) and slower to build than single-family units and so less important for the near-term trend in value put-in-place.

- Private nonresidential construction spending also declined in August following a roughly flat trend since February. More than half of the August decline was accounted for by manufacturing and electric power construction. Manufacturing structures had been a bright spot this year but has now declined in two of the last three months.

- State and local construction spending rose in August, with more than half of the increase accounted for by pavement construction. While up over the last two months, the level of state and local construction spending remains well below (seasonally adjusted) highs reached during the winter of 2020.

- For Merck, the main attraction of the acquisition is Acceleron's lead clinical candidate sotatercept, which has the potential to be a first-in-class therapy for the treatment of pulmonary arterial hypertension (PAH), and which - according to some analysts - could potentially earn annual sales of up to USD3 billion. Although some analysts have cautioned that the deal could potentially attract the scrutiny of the US Federal Trade Commission (FTC) owing to Merck's established presence in the PAH market, Merck's recently appointed chief executive Rob Davis has downplayed these concerns on the basis that sotatercept does not "overlap" with its existing portfolio. (IHS Markit Life Sciences' Milena Izmirlieva)

- Merck & Co. and its partner Ridgeback Biotherapeutics LP said their experimental Covid-19 pill helped prevent high-risk people early in the course of the disease in a pivotal study from becoming seriously ill and dying, a big step toward providing the pandemic's first easy-to-use, at-home treatment. The pill cut the risk of hospitalization or death in study subjects with mild to moderate Covid-19 by about 50%, the companies said Friday. (WSJ)

- New Jersey-based Global Concentrate has announced that it will purchase approximately 170 acres of industrial land in the Pretlow Industrial Park in Franklin to establish its largest processing operation in the US, said the city of Franklin in a statement. Global Concentrate will invest a minimum of $121 million in tangible business property, real estate and construction, and machinery and tools in Franklin, while the land in the Pretlow Industrial Park is expected to be sold for $2 million. Global Concentrate will close on the property in November, and construction is expected to begin in 2022. The job creation will occur over a 36-month period as build-out is completed at the Pretlow site. The new building space for Global Concentrate will be approximately 2,000,000 sq. ft. The company's final decision on a location was primarily motivated by the proximity to the Port of Virginia, a strong highway network in Virginia, a strong site in Franklin, and support from Franklin Southampton Economic Development. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- The California Department of Motor Vehicles (DMV) has issued permits for Cruise AV and Waymo to use autonomous vehicles for commercial services, in specific areas, according to a statement from the agency. The DMV says the permit means they are allowed to charge a fee and receive compensation for autonomous services offered to the public. The DMV is calling this a deployment permit, as opposed to the autonomous testing permit, which limits the compensation a manufacturer can receive from the public while validating on public roads. The DMV notes that the deployment permit granted to Cruise allows the company to use a fleet of light-duty autonomous vehicles for commercial services on surface streets within designated parts of San Francisco. (IHS Markit AutoIntelligence's Stephanie Brinley)

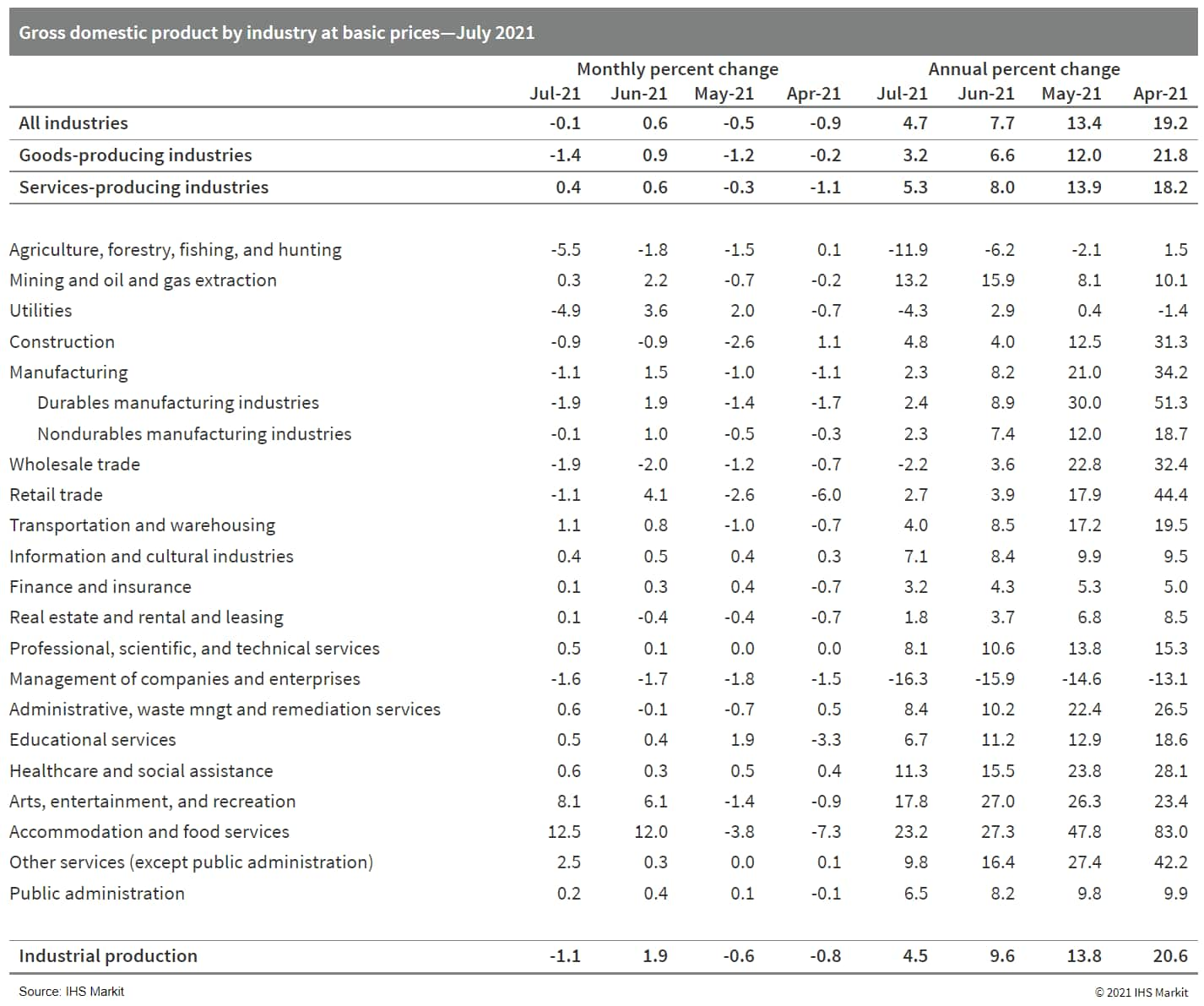

- The tiny 0.1% month-on-month (m/m) decline in Canada's GDP was

led by the 1.4% m/m plunge in goods-producing output that was

mostly offset by the 0.4% m/m jump in services-producing

industries. (IHS Markit Economist Arlene

Kish)

- The small rise in mining, quarrying, and oil and gas extraction output was the only upbeat industry within industrial production (down 1.1% m/m).

- The lifting of pandemic restrictions for the first time for certain tourism businesses helped accommodation and food services output advance rapidly for a second consecutive month.

- Statistics Canada estimates August's real GDP by industry

output will rebound 0.7% m/m, which is below our forecast estimate

last month. Third-quarter real GDP growth will be revised down,

below 7%. Annual 2021 growth will come down closer to 5.5%.

- Mexico's MIEA expanded by 0.5% in July compared with June

(month on month, m/m), driven by agriculture and industry. It was a

partial rebound after MIEA plunged by 1.1% m/m in June. (IHS Markit

Economist Rafael

Amiel)

- The Mexican industry expanded strongly, driven by manufacturing and utilities; the volatile agriculture sector also posted robust growth. Meanwhile, services expanded at a moderate rate as the reopening of some activities continued.

- Retail sales were down in July for a second consecutive month, while the index of sales of non-financial services was flat after a strong expansion in June. The beginning of the third COVID-19 wave caused this relatively poor performance of services in July.

- The Central Bank of Colombia (Banco de la República: Banrep) on

30 September increased its benchmark rate by 25 basis points to 2%,

becoming the fourth major central bank in South America (after

Brazil, Chile, and Peru) to start a tightening cycle to control

above-target inflation. (IHS Markit Economist Dariana Tani)

- The increase in the interest rates was supported by a majority of four of Banrep's seven board members and is in line with the expectations of change in policy by the Federal Reserve. It also marks the first time since July 2016 that policymakers have raised the rate and its first change to borrowing costs in 12 months.

- In addition, the bank has raised its forecasts for economic growth this year to 8.6% from 7.5% previously and now expects inflation to end 2021 at 4.5% in December. In August 2021, annual inflation rose to 4.4%, breaching Banrep's upper-limit target range. The bank targets inflation at 3.0% +/- 1 percentage point.

- In the accompanying statement, the bank highlighted higher-than-expected growth, external supply shocks, and the more-quickly-than-initially-anticipated closing of the output gap as the main drivers for the upward revisions. The bank also acknowledged that inflation expectations have started to rise. In the statement, it noted that the board of directors recognize the risks that the deviation of inflation expectations from the target will become a persistent phenomenon that will lead to higher inflation.

Europe/Middle East/Africa

- European equity indices closed mixed; France 0%, Spain 0%, Italy -0.3%, Germany -0.7%, and UK -0.8%.

- Most 10yr European govt bonds closed higher except for UK +7bps; Italy -4bps and Germany/France/Spain -3bps.

- iTraxx-Europe closed flat/50bps and iTraxx-Xover +1bp/254bps,

which is +1bp and +11bps week-over-week, respectively.

- Brent crude closed +1.2%/$79.28 per barrel.

- The Office for National Statistics (ONS) reports that UK real

GDP in volume terms grew by 5.5% quarter on quarter (q/q) in the

second quarter, revised from the first estimate of a 4.8% q/q

increase. (IHS Markit Economist Raj

Badiani)

- This compares with a 1.4% q/q drop in the first quarter and gains of 1.1% q/q and 17.4% q/q in the fourth and third quarters of 2020, respectively.

- In annual terms, the economy rose by 7.4% year on year (y/y) during the first half of this year after a 9.7% drop in the full year 2020.

- Consumer spending regained notable ground during the second quarter, rising by 7.2% q/q, revised down marginally from an initially reported 7.3% q/q increase, after a fall of 4.6% q/q in the previous quarter.

- Business investment increased by 4.5% q/q in the second quarter, revised up from an initially reported 2.4% q/q rise. Nevertheless, it remains 12.8% below the levels observed prior to the pandemic.

- Higher household and corporate tax burdens and lower health spending will apply a brake to growth in 2022 and 2023, projected at 5.1% and 1.8%, respectively.

- The UK's ambitious offshore wind target promises to reshape its energy landscape long-term, according to an executive panel at the Global Offshore Wind conference in London on 29 September. In 2020, the UK upped its offshore wind target to 40 GW in the next decade, building on its 2019 strategy for the sector, in a bid to reach net-zero emissions by 2050. Targeting this goal, the UK is gearing up to grant subsidies for 10 GW and 8 GW of capacity in the offshore energy sector, with July's auction bottom-fixed and floating offshore wind seabed leases and a competitive February auction for bottom-fixed offshore wind seabed leases. The Dutch and German governments have recently held auctions for offshore wind that is now set to be built subsidy-free, exposing developers with winning bids to more price volatility and potential price cannibalization. Speakers suggested that taking a Europe-style "zero-subsidy route" in the UK would threaten the viability of its 40 GW offshore wind target. Jim Smith is managing director of the renewables arm of Scottish utility SSE, which has 17 offshore wind assets in operation and another three under construction, and this week announced it would invest £100 million with Japanese major Marubeni into the Scottish offshore wind supply chain. (IHS Markit Net-Zero Business Daily's Cristina Brooks)

- According to German Federal Statistical Office (FSO) data, real

retail sales excluding cars increased by 1.1% month on month (m/m;

seasonally and calendar adjusted) in August, partially recovering

from July's plunge of -4.5% (revised up from -5.1% initially). (IHS

Markit Economist Timo

Klein)

- The real adjusted year-on-year (y/y) rate has broadly stabilized at 0.4%. This annual rate also applied to the non-calendar-adjusted series given the absence of any shopping-day effects. The positive gap with February 2020 - the last month before the pandemic erupted - was 6.0% in August.

- The stabilization in August suggests that the setback in July was a one-off event related to consumers temporarily concentrating their spending on holiday travel, having satisfied their most urgent retail needs in May-June already, following the lifting of many pandemic-related restrictions for shops selling non-essential items.

- The August breakdown by goods category, based on price-adjusted y/y data (total 0.4% without shopping-day adjustment; see table below), revealed a major divergence between food and non-food sales, unlike in July. An annual drop of food sales by 6.6% contrasts with an increase in non-food sales by 4.9% y/y. Among the latter, pharmaceutical/cosmetic goods again did best (10.5% y/y), as in July. Unusually so, clothing/shoes moved into second place at 8.3% y/y, followed by the traditional leader in recent times, 'internet and mail orders' (7.4%). Specialized shops also enjoyed higher revenues (4.1%), whereas 'furniture/household goods/DIY' (-2.5%) and general department stores (-3.1%) did worse than a year earlier.

- Continental has announced plans to restructure its automotive business. According to a statement, the unit will now become the Automotive Technologies group sector, and is being "comprehensively realigned according to strategic action fields." It is being split into five business areas that will come into effect from 1 January 2022. Safety and Motion will be led by Matthias Matic, while Autonomous Mobility will be managed by Frank Petznick. The company said that these two units will "combine the business for advanced driver assistance systems and for automated driving with the business activities related to safety electronics, sensors, as well as brake and chassis systems." SmartMobility will be led by Ismail Dagli and "will pool the business for mobility services, fleet operators and commercial vehicle manufacturers". User Experience will be taken over by Philipp von Hirschheydt and will combine the business for display and operating technologies, as well as sound solutions. Architecture and Networking will consolidate activities related to connectivity technologies, vehicle electronics and high-performance computers. Continental said that as part of the realignment of Automotive Technologies, the overarching advanced engineering organization, Holistic Engineering and Technologies (he(a)t) under the leadership of future chief technology officer (CTO) Gilles Mabire will be strengthened to include a sixth field known as Software and Systems Excellence. This will draw on the experience and expertise of Elektrobit (including Argus) and Continental Engineering Services. The changes are predominantly focused on the Automotive business, although its Tires and ContiTech units will be standalone group sectors. (IHS Markit AutoIntelligence's Ian Fletcher)

- Poland's Financial Stability Committee met on 28 September and warned of "a risk of significant disruption of the functioning of the financial system" if the European Commission fails to set a replacement for the Swiss-franc London Inter-Bank Offered Rate (LIBOR) rate. The Swiss-franc LIBOR is expiring at the end of 2021 and the European Commission has proposed replacing it with the Swiss Average Rate Overnight (SARON) rate. However, as reported by Bloomberg, it is not clear when the commission will announce the automatic change to SARON, in which case the Polish lenders will have to individually negotiate with borrowers. As the new rate is higher than the LIBOR rate of the past years, the non-mandatory switch is likely to encourage Swiss-franc-denominated mortgage borrowers to seek locking in old rates or file new lawsuits against the local banks. (IHS Markit Banking Risk's Greta Butaviciute)

- Bolt has partnered with a transport and accommodation solution provider CMAC Group to expand its ride-hailing service across Europe and Africa. CMAC Group will have access to Bolt's ride-hailing and scheduled rides services in more than 300 cities across 45 countries. Nick Powell, director of Bolt, said, "The nature of business travel still remains uncertain. In today's time, airlines and railways need to have a contingency plan in place. We are looking forward to taking advantage of our well-established presence in over 300 cities and providing CMAC Group with access to Bolt taxis for its passengers for both planned and on-demand commuting options", reports Business Travel News Europe. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- In January-August 2021, Turkey posted a merchandise-trade

deficit of USD29.780 billion, according to data from the Turkish

Statistical Institute. In the same period of 2020, the gap had been

USD33.020 billion. (IHS Markit Economist Andrew

Birch)

- Vigorous export gains are largely responsible for the narrowing of the merchandise-trade deficit over the first eight months of the year; rising by 36.9% year on year (y/y). A nearly 85% y/y surge of iron and steel exports had a substantial positive impact on headline shipments. High global prices contributed to a vigorous expansion of energy exports as well, up 65.8% y/y. Growth of the country's largest export commodity, automobiles, suffered as part of the global supply chain problems, growing only 27.9% y/y in the first eight months of the year.

- Several political opponents of President Recep Tayyip Erdoğan have suggested that his economic policies are purposefully weakening the lira, thus buoying the country's exports and, subsequently, reducing the merchandise-trade deficit.

- Undoubtedly, the now significantly weaker lira have sent merchandise import prices soaring. In July, the value of imports was up by 30.2% y/y while the volume of those purchases was actually down by 10.3% y/y.

- Higher import prices have depressed consumer good imports. In January-August 2021, that category of goods grew by only 16.4% y/y in nominal dollar terms, easily the slowest gaining category of imports. Both capital and intermediate good imports still grew by nearly 25% y/y in that same period.

- The monetary policy committee (MPC) of the National Bank of

Angola (Banco Nacional de Angola: BNA) decided to keep the central

bank's key interest rate unchanged at its September 2021 meeting,

having last raised the rate in July 2021. (IHS Markit Economist

Alisa Strobel)

- The MPC met on 30 September to discuss the latest developments in the domestic economy. It decided to maintain the BNA's key policy rate - with the basic rate at 20% - after last time raising its key policy rate by 0.5 percentage points during its July 202 meeting to assess the evolution and handling of higher inflation better.

- In addition, the MPC decided to keep the coefficients of required reserves at 22%. The Standing Liquidity Lending Facility interest rate and the seven-day Permanent Liquidity Absorption Facility Interest rate were also maintained at 25% and 15%, respectively.

- Angola's annual headline inflation spiked to 26.1% in August, its highest rate this year. Keeping its key interest rates unchanged is part of the central bank's effort to address the latest price elevation contained.

Asia-Pacific

- All major APAC equity markets closed lower; India -0.6%, South Korea -1.6%, Australia -2.0%, and Japan -2.3%.

- Japan's unemployment rate held at July's level (2.8%) in

August. A decline in the number of employees - down by 320,000

month on month (m/m) - was offset by a decline in the labour force

(down by 330,000 m/m). Although the number of regular employees

continued to rise, the number of non-regular employees declined,

reflecting containment measures to counter the surge of Delta

variant infections. (IHS Markit Economist Harumi

Taguchi)

- The year-on-year (y/y) increase in employees narrowed from 560,000 in July to 170,000, largely because of softer increases in wholesale and retail sales and declines in accommodation, eating/drinking services. Larger increases in the number of job applications led to a lower ratio of active job openings to active job applications as well as a lower ratio of new openings to new applications.

- However, the consumer confidence index rose by 1.1 point to 37.8 in September following a 0.8-point drop in the previous month. While all component indicators improved, index reached its highest level since February 2020 thanks largely to improvement in the index of employment, which rose by 2.9 points to 36.1. The ending of states of emergency made consumers more optimistic about employment.

- Japan's diffusion index (DI) of current business conditions for

large manufacturing groupings in the BoJ's September 2021 Tankan

survey moved up four points to 18, returning to the highest level

since the fourth quarter of 2018. The improvement was driven by

continued solid external demand and a softer decline in domestic

demand. The DI for autos fell by 10 points to -7 because of

shortages of semiconductors and other parts. Nevertheless, the DIs

improved for a broad range of manufacturing industry groupings,

particularly for lumber and wood, chemical products, iron and

steel, and general-purpose and production machinery. The DI for

small manufacturing enterprises also improved by four points to -3,

the highest level since the second quarter of 2019. (IHS Markit

Economist Harumi

Taguchi)

- The DI of current business conditions for large non-manufacturing groupings also moved up by one point to 2. COVID-19 containment measures continued to dampen personal services (down 14 points to -45) and accommodations and eating/drinking services (unchanged at -74), and the DIs for 7 out of 12 industries declined from the June survey. However, continued improvement for the DI for large non-manufacturing groupings was largely thanks to improvement in the DIs of services for businesses, wholesale, and transportation and postal services. However, the DIs for the small non-manufacturing grouping fell by one point to -10.

- Outlooks for the coming three months remain sluggish. The DI for future business conditions for large non-manufacturing rose by one point to 3, reflecting improved outlooks for personal services and accommodations and eating/drinking services thanks to the stabilization of Delta-variant infections and progress in vaccine rollouts. In contrast, the future business conditions DI for large manufacturing fell by four points to -14 largely because of declines in the DIs in basic materials in anticipation of weaker demand. The DI of future business conditions for small manufacturing and non-manufacturing groupings fell by one point to -4 and three points to -13, respectively.

- Fixed investment plans (including software, research, and development; excluding land) for all enterprises were unchanged at a 9.3% y/y rise in FY 2021/22. Investment plans for software and research and development were revised down slightly by 0.3 percentage point to 14.3% and by 0.9 percentage point to 5.7% y/y, respectively. These weaknesses were offset by an upward revision for investment plans for machinery and equipment. The large manufacturing industry plans to increase land purchasing expenses (up 25.9 percentage points to a 14.5% y/y increase) probably in order to counter supply-chain disruption.

- Honda said it plans to develop a rocket to launch low-earth orbit satellites to be used for its connected cars. To achieve this, Honda will make use of the control and guidance technologies it has created through the development of automated vehicles. The automaker, which has been working on small rockets, plans to reuse them by enabling some of the components to land back on Earth after launching, reports The Japan Times. Low-orbit satellites will help Honda with the high-speed internet connectivity, accurate navigation, and cloud-computing capabilities that are required to develop connected and autonomous vehicles (AVs). Chinese automaker Geely is also working on launching low-orbit satellites in an attempt to enable accurate navigation data for AV development. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- SK Innovation has officially launched its battery business as a standalone company, SK On, reports The Korea Herald. Around 1,400 staff and executives who belonged to SK Innovation's battery business will be relocated to SK On to continue electric vehicle (EV) battery, battery-as-a-service, and energy storage system businesses. Jee Dong-seob has been appointed as the CEO of SK On. Jee, a former executive of SK Telecom and the CEO of SK Lubricants, was appointed as the head of SK Innovation's battery business in 2019. Prior to that, he worked directly under SK Innovation CEO Kim Jun as leader of the e-mobility team. Globally, SK On plans to increase the battery production capacity from the current 40 GWh to 220 GWh by 2025 and over 500 GWh by 2030, highlights a separate report by the Yonhap News Agency. Furthermore, SK Innovation spun off its exploration and production business into SK Earthon, which will be led by Myeong Seong. He was appointed as the head of SK Innovation's oil business in 2019. (IHS Markit AutoIntelligence's Jamal Amir)

- Electric vehicle (EV) ride-hailing startup BluSmart has raised USD25 million in a Series A funding round led by BP Ventures. This is BP Ventures's first direct investment in India, infusing USD13 -million capital in the round. Mayfield India Fund, 9Unicorns, and Survam Partners along with existing investors also participated in the round. BluSmart will use the funds to expand its fleet of EVs and charging stations from its home city of Delhi to five additional Indian cities in the next two years. BluSmart offers a 100% electric mobility platform, which has completed more than 650,000 passenger trips. The service is currently available in Delhi-NCR with a fleet of more than 400 EVs, which includes the Tata Tigor EV, Mahindra eVerito, and Hyundai Kona EV. The company is also involved in installing a network of commercial large-scale EV charging stations in India. Meanwhile, BP's investment in the EV sector has intensified in the past five years. Global energy players are looking to diversify their businesses and react to lower demand for fossil fuels that greater EV demand will bring. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ola Electric, the electric vehicle (EV) arm of ride-hailing

startup Ola, has raised more than USD200 million in funding from

Falcon Edge, SoftBank Group, and others. Following this funding

round, Ola Electric's valuation has reached USD3 billion, reports

the Times of India. Ola Electric, which has launched its first

electric scooter, plans to use the infused capital to accelerate

the development of other vehicle platforms, including electric

motorcycles, mass-market scooters, and an electric car. Bhavish

Aggarwal, founder and CEO of Ola, said, "We're proud to lead the EV

revolution from India to the world. India has the talent and the

capability to build technologies of the future for the industries

of the future for the entire world. I thank our existing investors

and welcome new ones to Ola. Together we will bring mobility to a

billion and sustainability to the future." (IHS Markit Automotive

Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-october-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-october-2021.html&text=Daily+Global+Market+Summary+-+1+October+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-october-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 1 October 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-october-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+1+October+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-october-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}