Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 01, 2021

Daily Global Market Summary - 1 September 2021

Most major European equity markets closed higher, while major US and APAC indices closed mixed. US government bonds closed higher and benchmark European government bonds were mixed. European iTraxx was slightly tighter across IG and high yield, while CDX-NA was almost unchanged on the day. Natural gas, silver and WTI closed higher, while the US dollar, Brent, gold, and copper were lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; Russell 2000 +0.6%, Nasdaq +0.3%, S&P 500 0%, and DJIA -0.1%.

- 10yr US govt bonds closed -1bp/1.30% yield and -1bp/1.92% yield.

- CDX-NAIG closed flat/46bps and CDX-NAHY -1bp/274bps.

- DXY US dollar index closed -0.2%/92.45.

- Gold closed -0.1%/$1,816 per troy oz, silver +0.9%/$24.22 per troy oz, and copper -2.2%/$4.28 per pound.

- Crude oil closed +0.1%/$68.59 per barrel.

- Natural gas closed +5.4%/$4.62 per mmbtu, which is the highest closing price since June 2014.

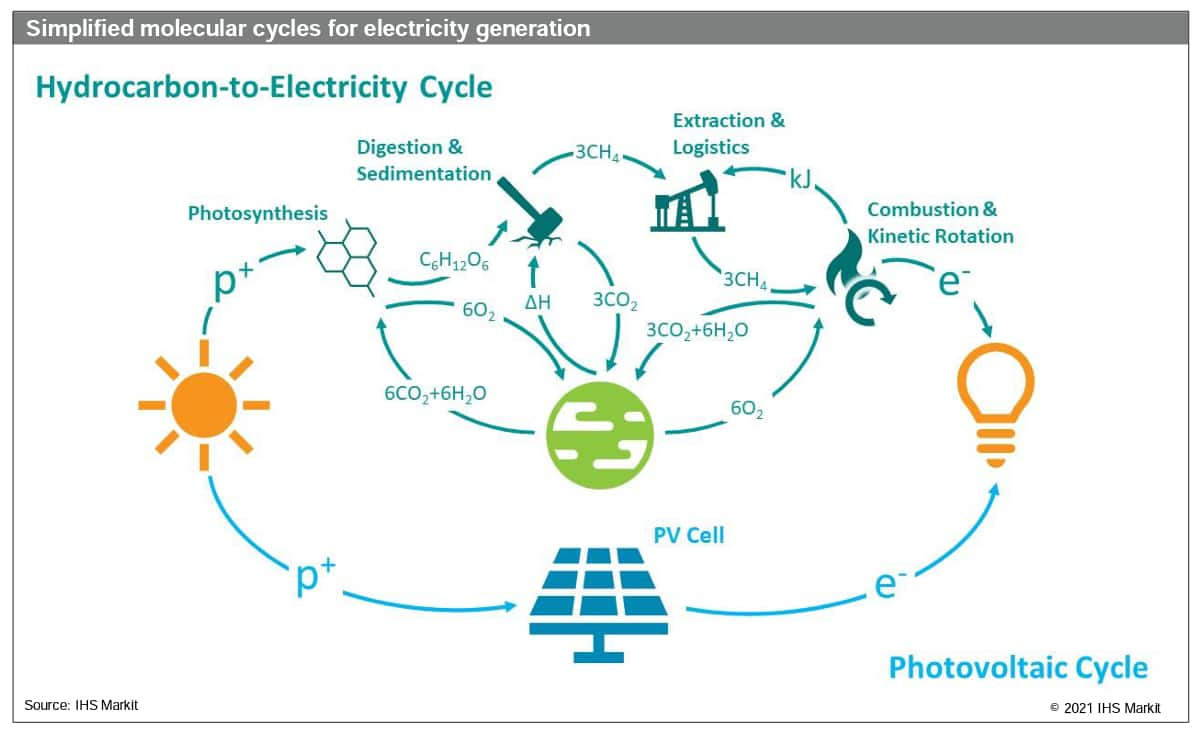

- The notion of a "free electron world" is a step beyond that of

a "carbon-neutral world" and entails that all short-run marginal

costs (SRMCs), not just environmental costs, have been reduced to

zero via perfect reliability, deep automation, and the elimination

of fuel scarcity, leaving only long-run fixed costs and capital

expenditure. (IHS Markit Power Market Edge's Chad Singleton)

- Running a thought experiment that processes the features and mechanics of a free electron world is a highly fruitful exercise in strategic planning, signpost anticipation, and dispelling common biases and logical fallacies, even if we never fully arrive in that world.

- The energy transition will not require environmental activism to sustain itself. While it's true that environmental concern was the primary catalyst for the transition and remains a major motivator to this day, the primary driver of the transition is far more fundamental and encapsulating: the prospect of machines that can reliably generate energy free of any variable operating expenses.

- It's highly unlikely that electric energy markets in today's form would persist in a free electron world as existing auction structures incentivize generators to minimize their offers to their respective SRMC in order to profitably clear - a mechanism that would simply lack utility in a post-SRMC world.

- Forward reliability markets (or some derivative) would take center-stage in power markets in a free electron world. Without revenues from energy markets, forward reliability markets would need to provide sufficient returns to cover generator fixed operating expenses and capital costs. But dated capacity auction constructs have already begun to buckle under the weight of their critical role in the transition, while markets devoid of any such auction are failing on a more routine basis. A conceptual reboot of forward capacity might be necessary sooner rather than later.

- The energy transition will evolve as one of many equally

transformative pillars of the 4th industrial revolution including

digitization, quantum sciences, genomics, brain-computer interface,

additive manufacturing, AI, and space exploration, all of which are

liable to intermingle with and alter the course of the energy

transition in ways that we can hardly imagine.

- Two days after Hurricane Ida plowed across southeastern

Louisiana on 29 August, petrochemical producers in Baton Rouge,

Plaquemine, Geismar, and other localities in the region are still

assessing the storm's impact on their operations, but damage seems

to be limited. Communications remain a problem, and some facilities

are still inaccessible owing to downed power lines or trees. Power

outages are likely to constrain recovery efforts for several weeks

to come. (IHS Markit Chemical Advisory)

- Six facilities producing ethylene were affected by the storm: ExxonMobil Baton Rouge; Shell Norco; Dow Plaquemine; Dow Taft; Shintech Plaquemine; and Nova Chemicals Geismar. Together, they represent about 16% of US ethylene capacity, according to data from IHS Markit.

- As for propylene, nearly 18% US refinery-grade propylene (RGP) and 17% of US chemical- and polymer-grade propylene (CGP/PGP) capacities are offline. Propylene inventories were already dangerously low before the storm, and spot prices had climbed to $1 per pound before the hurricane. Derivative units representing 12% of US propylene demand shut down in advance of Ida: Cornerstone's acrylonitrile unit at Fortier, Dow's oxo-alcohol facilities at Plaquemine and propylene oxide unit at Taft, Pinnacle Polymer's polypropylene (PP) units at Garyville, ExxonMobil's PP units at Baton Rouge, and Lion copolymer's ethylene-propylene elastomer unit at Geismar.

- About 9% of US polyethylene (PE) capacity and 6% of US PP capacity has been shut down by the storm. With power still out in the Plaquemine and New Orleans areas and access to ancillary services such as nitrogen uncertain, it may take several weeks for some of the plants to resume production, says IHS Markit.

- IHS Markit understands that the butadiene production units in Baton Rouge and Norco are down, and it is likely that the ExxonMobil extraction unit in Baton Rouge will move directly into a planned outage. Only a small volume of demand capacity was affected, however.

- Approximately 31% of US chlor-alkali capacity and 41% of US polyvinyl chloride (PVC) capacity are located in the region struck by Hurricane Ida, and all has been shut down.

- About 20% of US ethylene oxide (EO) capacity was shut in preparation for the storm—BASF's unit at Geismar, Dow's units at Hahnville and Plaquemine, and Shell's units at Geismar. These outages will worsen an already tight supply/demand balance, says IHS Markit. The same is true for derivative ethylene glycol, given high demand for downstream polyethylene terephthalate (PET) and the approaching winter season ramp-up in production of antifreeze.

- About 14% of US benzene-toluene-xylenes (BTX) capacity is offline owing to the shutdowns at Dow Plaquemine, ExxonMobil Baton Rouge, and the Phillips 66 Alliance refinery, the last of which may be particularly slow to restart owing to flooding.

- Downstream, Hurricane Ida shut down 44% of US styrene capacity. The market was long before the storm, but with planned turnarounds in North America starting in September, it was set to tighten.

- ADP's August employment report, which measures the change in employees on private companies' payrolls, said that 374,000 jobs were added last month, far short of the 600,000 expected by economists. The July report showed 330,000 new jobs, which was revised down by 4,000 to 326,000 in the latest release. (Barron's)

- The seasonally adjusted IHS Markit U.S. Manufacturing

Purchasing Managers' Index (PMI) posted 61.1 in August, down from

63.4 in July, and broadly in line with the earlier released 'flash'

estimate of 61.2. The latest improvement in operating conditions

was the softest for four months, but nonetheless among the

strongest seen in the over 14-year series history. (IHS Markit

Economist Chris

Williamson)

- Manufacturers commonly reported that material shortages hampered output growth, as supplier delivery times increased markedly and to one of the greatest extents on record. Longer lead times were attributed to greater global demand for inputs and capacity issues at suppliers.

- Subsequently, cost burdens rose substantially in August. The rate of input price inflation was the fastest seen in more than 14 years of data collection amid supplier price hikes. In an effort to partially pass on greater costs to their clients, goods producers raised their selling prices at the steepest pace on record. In line with greater new order inflows, manufacturers expanded their input buying during August. Firms also noted that efforts to build safety stocks drove the upturn in purchasing.

- Total US construction spending rose 0.3% in July, in line with

the consensus estimate, but below IHS Markit's. Spending in prior

months was revised higher. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

- Core construction spending rose 0.4% in July and was also revised higher for May and June. The increase in July was smaller than we had assumed. After rounding, though, the data on construction spending through July left our estimates of second- and third-quarter GDP growth unrevised at 6.6% and 4.7%, respectively.

- The trend in construction spending is slowing, mainly reflecting a fading boost from the private residential sector.

- Over the three months ending in July, total construction spending rose at a 4.0% annual rate and core construction spending rose at a 3.1% rate. Both are materially below their 12-month gains (9.0% and 10.4%, respectively), reflecting a sharp slowing in private residential construction.

- Permits for the construction of new single-family units have already peaked, and single-family housing starts are trending lower. Given the normal relationship between housing starts and value put-in-place, single-family construction spending will soon turn lower.

- Private nonresidential construction spending has been on a flat-to-declining trend so far this year, but there are a couple of bright spots. Spending on general commercial warehouses and on manufacturing structures has been firming, likely reflecting ongoing strength in the goods-producing sector.

- The US Department of Treasury's insurance arm is seeking

comment on its role in collecting data and taking action on risks

that the insurance sector faces as losses from climate-related

disasters reach into the billions. (IHS Markit Net-Zero Business

Daily's Amena

Saiyid)

- The move is based on Treasury's assessment that climate risks have the potential to disrupt national financial stability.

- Treasury's Federal Insurance Office (FIO) issued a 31 August notice, responding to President Joe Biden's 20 May order on climate-related financial risk, that seeks to better understand which data are needed to assess the climate risks faced by the insurance sector, what data remain unavailable, and how can it collect this data to make it available to stakeholders.

- The FIO also is seeking input on the specific types of data that would be needed to assess climate-related financial risks to the insurance sector, along with the challenges posed in the collection of such information.

- JD Power's 2021 Initial Quality Study (IQS) results continue previous themes, including the significance of infotainment system problems and that there are more problems per 100 vehicles (PP100) with models from luxury brands than from mainstream brands. JD Power's 2021 IQS shows an industry average score for PP100 of 162, lower than in 2020. The Ram brand has taken top position in the rankings, while the Chrysler brand has fallen to last place. The rankings in the IQS remain subjective, and vehicle owners' differentiation between "things broken" and "things gone wrong" is somewhat blurred. One of the benefits of the study is that, as an annual survey, it captures owners' responses over time and is useful in assessing trends in scores. JD Power says that the most problematic category remains infotainment systems and the top problem is smartphone connectivity. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Nuro, a maker of low-speed autonomous delivery vehicles, has announced investment plans in manufacturing facilities and a test track in the US state of Nevada. In a blog post, the company said the investment would create about 250 new jobs, saying it would fill these posts through partnerships with local colleges and career training programs. For these new jobs, Nuro said it would be "specifically targeting individuals traditionally underrepresented in current technology roles". For the test track, Nuro plans to take over 74 acres of the current Las Vegas Motor Speedway to create a closed-course testing facility, to perform development and validation activities. Nuro is to break ground on the projects in late 2021 and in 2022. Nuro intends to build a third-generation of its robot vehicle at the location, although it has not yet provided details on the updated vehicle. The new product is expected to have a similar use to the existing R1 and R2 vehicles; specifically, robotized delivery of goods, not people. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous truck startup Gatik has raised USD85 million in a Series B funding round, according to a company statement. This will bring the company's total raised capital to USD114.5 million. The round was led by new investor Koch Disruptive Technologies in participation with existing investors including Innovation Endeavours, Wittington Ventures, FM Capital, Dynamo Ventures, Trucks VC, and Intact Ventures, among others. Gatik plans to use the capital to advance its commercial-grade autonomous technology, add more vehicles to its fleet of Class 3-6 multi-temperature autonomous box trucks, and increase its team size. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- Most major European equity indices closed higher except for Germany -0.1%; Spain +1.6%, France +1.2%, Italy +0.7%, and UK +0.4%.

- 10yr European govt bonds closed mixed; UK -2bps, Italy -1bp, and Germany/France/Spain +1bp.

- iTraxx-Europe closed -1bp/44bps and iTraxx-Xover -2bp/226bps.

- Brent crude closed -0.1%/$71.59 per barrel.

- UK meat processors are calling for urgent measures to help them

recruit workers from overseas as a new report highlights how the

industry's capacity is being undermined by Covid-19 and post-Brexit

immigration policy. (IHS Markit Food and Agricultural Commodities'

Max Green)

- The report, produced by Grant Thornton on behalf of various organizations, was sent to government ministers last week. It estimates there are more than 500,000 vacancies across food and drink businesses, and sets out clear ways government can help the industry overcome current workforce challenges.

- These include the introduction of a 12-month Covid-19 Recovery Visa, which would enable all involved throughout the supply chain to recruit critical roles as a short-term response to labor shortages.

- The British Meat Processors' Association (BMPA) say this would provide a short-term fix while allowing time to explore and implement longer-term solutions. The BMPA says the second most important change the Government can make is to revisit the Shortage Occupation List and add to it skilled workers such as butchers and HGV drivers. The association points out that the food sector also has an aging workforce - with estimates suggesting that one in four workers are due to retire within the next 10 years, which amounts to over one million people leaving the industry.

- National Pig Association chief executive Zoe Davies says 70,000 pigs are already backed up on farms, with this number rising by 15,000 a week due to processors reducing throughput as a result of labor shortages. If Government fails to take action, she says perfectly healthy pigs will end up being destroyed and wasted.

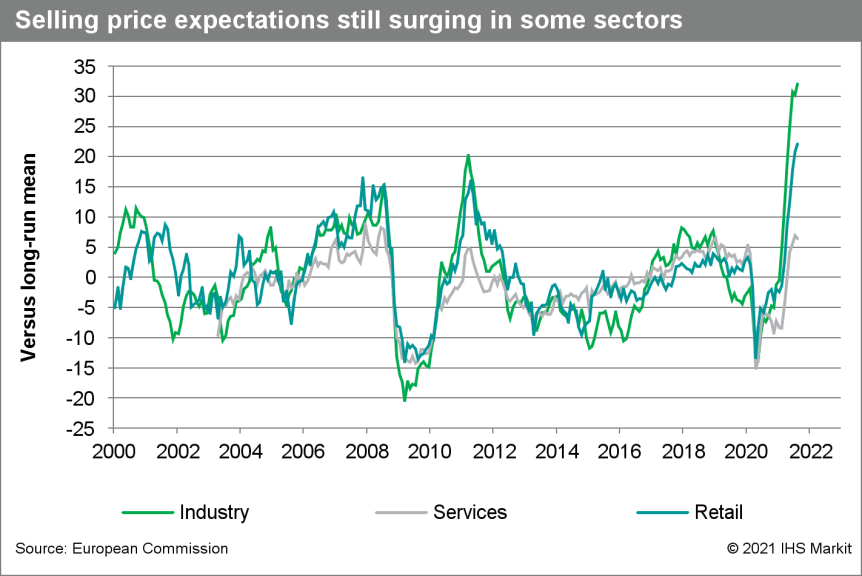

- August's economic sentiment indicator (ESI) for the eurozone

showed the first decline in seven months, slipping by 1.5 points to

117.5, below the market consensus expectation (of 117.9, according

to Reuters' survey). (IHS Markit Economist Ken

Wattret)

- Despite the decline, the ESI remains very elevated, with August's index still 13 points above its pre-pandemic level in February 2020, while the latest decline follows a record high in July.

- The breakdown of August's data by sub-sector was mixed, but the most important elements of the survey lost ground. The three highest weighted sub-indices, for industry, services, and consumer sentiment (worth a combined 90% of the ESI), all declined, albeit modestly. Retail and construction sentiment improved, again modestly, although they account for just 10% of the index.

- All the sub-indices remain well above their long-run averages, indicative of continued robust growth as economies have reopened from coronavirus disease 2019 (COVID-19) restrictions and activity has rebounded, although some of the forward-looking aspects of the survey are pointing to further weakness ahead.

- Switching to inflation-related developments, August's ESI data

again showed elevated price pressures. Industrial firms' pricing

intentions rose to a new record high, more than reversing July's

decline.

- According to German Federal Statistical Office (FSO) data, real

retail sales excluding cars declined sharply by 5.1% month on month

(m/m; seasonally and calendar-adjusted) in July, thus unwinding

about half of their major jump during May-June that had benefited

from the lifting of many COVID-19-related restrictions for shops

selling non-essential items. (IHS Markit Economist Timo

Klein)

- The real adjusted year-on-year (y/y) rate dropped from 4.9% to -0.3%. This overstates underlying developments, however, as June had an additional shopping day compared with a year earlier whereas July did not. The positive gap with February 2020 - the last month before the pandemic erupted - is still 3.8%.

- July's data have suffered from a combination of initial pent-up demand having been satisfied in May-June already and by the beginning summer holiday season, in which many people took advantage of finally being able to go on holiday in foreign countries again.

- July's breakdown by goods category, based on price-adjusted y/y data (total -0.3% y/y without shopping-day adjustment; see table below), did not reveal any major difference between food and non-food sales this time. This corroborates the impression that much pent-up demand has been satisfied especially in June, when non-food sales had outperformed by far.

- Among non-food sales, pharmaceutical/cosmetic goods did best in July (5.1% y/y), closely followed by the usual leader 'internet and mail orders' (4.4%). Elsewhere, only clothing/shoes posted another gain (1.5%), whereas specialized shops (-3.7%), 'furniture/household goods/DIY' (-5.4%), and general department stores (-7.3%) all saw their sales decline in part substantially.

- DS Automobiles has announced that all its new launches will be battery electric vehicles (BEVs) from 2024. In a statement, the brand said, "From 2024, every new DS Automobiles model will be available exclusively with a 100% electric powertrain." During that year, it will not only launch a BEV-only variant of the DS4 compact, but also unveil "a new design" that is underpinned by the new STLA Medium architecture. This will feature a 104kWh battery that will offer a range of over 400 miles, with DS Automobiles adding "this future model will offer remarkable technology and refinement with technical features that are a perfect fit for DS Automobiles customers." (IHS Markit AutoIntelligence's Ian Fletcher)

- In January-July 2021, Turkey posted a merchandise-trade deficit

of USD25.5 billion according to data from the Turkish Statistical

Institute. The gap was approximately USD1.2 billion smaller than it

had been in the same period of 2020. (IHS Markit Economist Andrew

Birch)

- In the first seven months of the year, merchandise exports grew vigorously, by nearly 35% y/y in nominal dollar terms. Shipments of iron and steel, refined energy, gold, and plastics have paced overall gains so far in 2021. The country's largest export commodity - automobiles - have been growing more modestly, a victim of the global supply chokepoints.

- Imports, meanwhile, also grew vigorously, up nearly 26% y/y. As with exports, purchases of iron and steel, refined energy and plastics all paced overall imports. Turkey did reduce gold imports by 58.1% y/y in January-July 2021, reflecting the easing of the downward pressures on the lira that drove imports in 2020.

- Chinese automaker Chery is looking at the prospect of establishing production of battery electric vehicles (BEVs) in Russia, according to an Itar-TASS news agency report. The company already has a relatively strong presence in Russia and is looking at adding BEVs to its line-up in the country by 2023. A company spokesperson told the news agency, "Yes, Chery sees the need for localization and is holding talks with Russian production sites." The news that Chery is considering introducing a BEV to its Russian line-up comes as the Russian government published a road map to expand local production of BEVs. (IHS Markit AutoIntelligence's Tim Urquhart)

- US alternative protein company Eat Just has announced plans to build the first-ever cultivated meat facility in the Middle East and Northern Africa (MENA) region. The project involves the creation of a regional hub in partnership with Doha Venture Capital (DVC) and Qatar Free Zones Authority (QFZA). The hub will be located in the Umm Alhoul Free Zone, one of two free zones overseen and regulated by QFZA, with direct access to Hamad Port. The hub will initially comprise a large-scale facility for Eat Just's GOOD Meat division, which created the world's first-to-market meat made from animal cells instead of slaughtered livestock. There are also plans to add a protein processing facility for JUST Egg, the company's plant-based egg division. This is DVC's first investment in the protein innovation space and the forthcoming meat facility will be a first for QFZA, which is focused on bringing together leading global companies using innovative technologies to build a more sustainable future. ABG, LLC and Alvarium Investments Ltd. advised on the transaction. (IHS Markit Food and Agricultural Commodities' Max Green)

Asia-Pacific

- Major APAC equity markets closed mixed; Japan +1.3%, Mainland China +0.7%, Hong Kong +0.6%, South Korea +0.2%, Australia -0.1%, and India -0.4%.

- Chinese tech giant Xiaomi has completed the official registration of its electric vehicle (EV) business. According to Reuters, the new unit, called Xiaomi EV Inc., has registered capital of CNY10 billion (USD1.55 billion) and already has a staff of around 300. The latest development is in line with the announcement in March, when Xiaomi first revealed plans to set up a smart EV business subsidiary. The company said that it plans to invest CNY10 billion in the initial phase of the development and plans a total investment of USD10 billion over the next 10 years to support its EV business. The company hopes to launch its first EV equipped with Level 3 autonomous technology in three years; its upcoming models are likely to be built by a partner engaged in contracting manufacturing and are likely to be positioned in the entry and standard price segment to appeal to first-time EV buyers. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- According to financial statements for the second quarter of

2021, sales for all of Japan's industrial sectors, excluding

finance and insurance, fell by 0.1% quarter on quarter (q/q),

marking the second consecutive quarter of decline. (IHS Markit

Economist Harumi

Taguchi)

- The year-on-year (y/y) figure turned positive, increasing by 10.4%. The continued q/q decrease was due to a 0.9% q/q drop in non-manufacturing sales following a 1.4% q/q decline in the first quarter, reflecting continued negative impacts from COVID-19-related containment measures.

- Sales in manufacturing continued to rise, moving up 2.2% q/q, or 20.1% y/y, thanks largely to solid external demand. While sales in a broad range of industry groupings turned positive y/y, the y/y improvement largely reflected increased sales in transport equipment, chemical and related products, information and communication electronics equipment, and wholesales.

- Ordinary profits rose by 1.8% q/q and 93.9% y/y, thanks largely to growth of 7.4% q/q and 159.4% y/y in manufacturing. The solid y/y rise in ordinary profits for manufacturing was driven by increases in transportation equipment, information and communication electronics equipment, chemical and related products, and electrical machinery/equipment/supplies, while all manufacturing groupings recorded substantial y/y growth.

- Ordinary profits in non-manufacturing dropped by 1.9% q/q, the first decline in four quarters, but a 64.2% y/y increase reflected improved profits for overall services, wholesales, and transport and postal services, offsetting continued declines in accommodation and eating/drinking places, as well as life-related services. Although sales remained weak, lower payroll costs and declines in the cost of sales helped lift ordinary profits.

- Fixed investment, including software, rose by 3.2% q/q and the y/y figure rose for the first time in six quarters with growth of 5.3%. Solid sales and profits encouraged manufacturers to increase fixed investment, which rose 3.9% q/q and 4.0% y/y. Non-manufacturing also increased fixed investment by 2.8% q/q and 5.9% y/y. The y/y rise in investment including software was thanks largely to increases in investment of information and communication electronics equipment, fabricated metal products, pulp/paper products, construction, information services, and production/transmission/distribution of electricity.

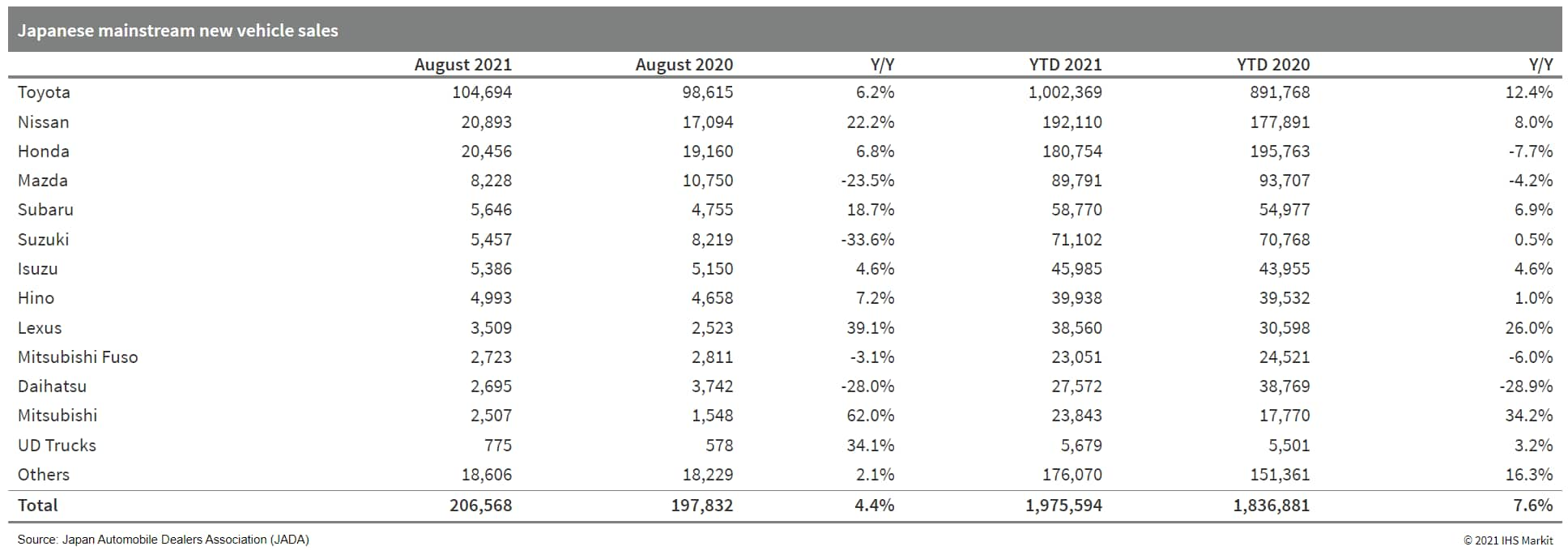

- Japanese sales of new vehicles, including mainstream registered

vehicles and mini-vehicles, stood at 319,697 units during August,

down by 2.1% y/y. During the first eight months of this year, sales

of new vehicles in Japan were up by 7.9% y/y to over 3.16 million

units. IHS Markit currently forecasts that Japanese light-vehicle

sales will recover in 2021 to nearly 4.88 million units, up by

8.2%. In 2021, passenger car sales, which account for nearly 85% of

the overall market, are expected to grow by 7.8% to 4.14 million

units, while sales of LCVs are forecast to increase by 10.2% y/y to

738,294 units. (IHS Markit AutoIntelligence's Isha Sharma)

- HHI, together with Korea Shipbuilding & Offshore Engineering Co. (KSOE) and Korea National Oil Corporation (KNOC), has developed an offshore platform to store CO2 under the ocean floor. The platform has been granted the AIP from DNV and is targeted to be launched by 2050 with the aim of storing 400,000 tons of CO2 annually for 30 years. HHI oversees the basic design of the platform, KSOE will develop a CO2 injection system while KNOC manages the gas injection and operations. On the other hand, HHI's affiliates, Hyundai Mipo will be joining hands with POSCO, steel making giant, to develop a 20,000 cubic meter liquid CO2 carrier by 2025. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- BW Offshore has completed the USD1.150 billion project financing for the company's Barossa FPSO under construction. The debt facility has been provided by nine banks and covers both the construction and operations period. The loan will become non-recourse once the FPSO has been completed . The loan has a tenor of 14 years with a balloon at maturity and carries a base interest rate plus 2.50% during construction and 2.25% during the operational phase. The interest rate for the Barossa FPSO loan is similar to the USD800 million BW Catcher FPSO loan secured in 2015. The interest rate for the BW Catcher loan was LIBOR plus 2.25% during construction and LIBOR plus 2.25% during the operational phase. Santos has contracted BW Offshore for the construction, connection and operation of the FPSO for deployment at Barossa field offshore Australia. The lease and operate contract is for a firm period of 15 years with a further 10 years of option. The FPSO will be turret moored with a new hull based on BW Offshore's RapidFramework® design. First gas is expected during the first half of 2025. (IHS Markit Upstream Costs and Technology's Kelvin Sam)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-september-2021.html&text=Daily+Global+Market+Summary+-+1+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-september-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 1 September 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+1+September+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-1-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}