Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 10, 2021

Daily Global Market Summary - 10 December 2021

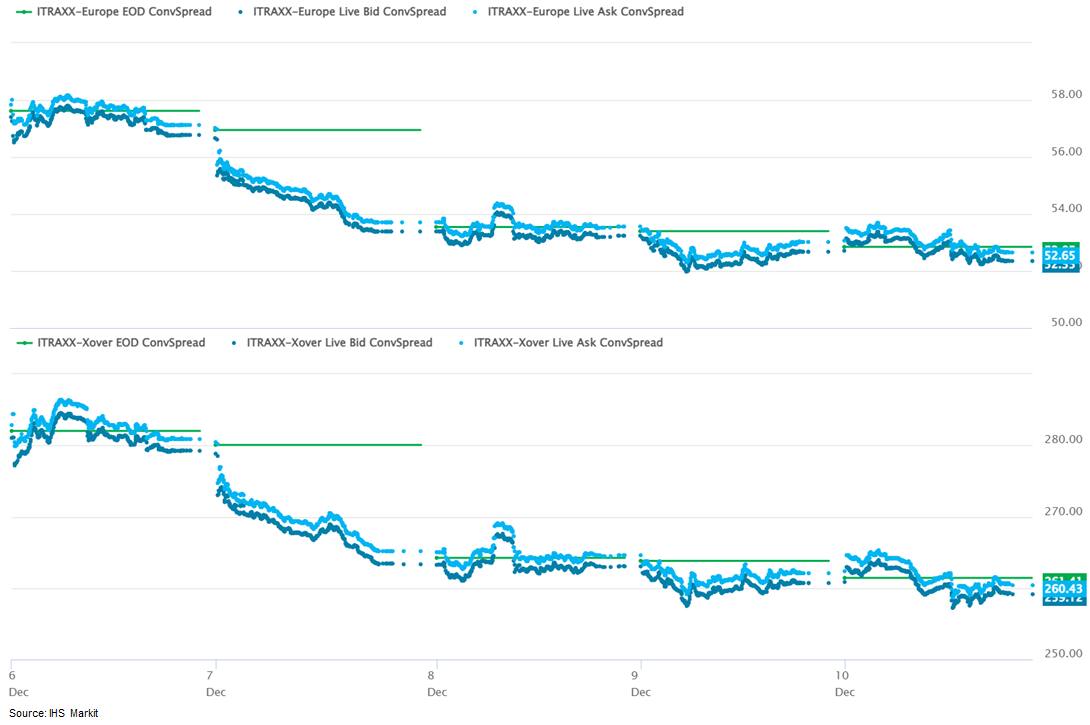

Most major US equity indices closed higher, while all European and most APAC Markets were lower on the day. US government bonds closed mixed with the curve steeper on the day, while most benchmark European bonds closed higher on the day. CDX-NA closed tighter across IG and high yield, while European iTraxx was close to flat on the day. Natural gas, oil, silver, and gold closed higher, while the US dollar and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except for Russell 2000 -0.4%; S&P 500 +1.0%, Nasdaq +0.7%, and DJIA +0.6%.

- 10yr US govt bonds closed -2bps/1.49% yield and 30yr bonds +1bp/1.89% yield.

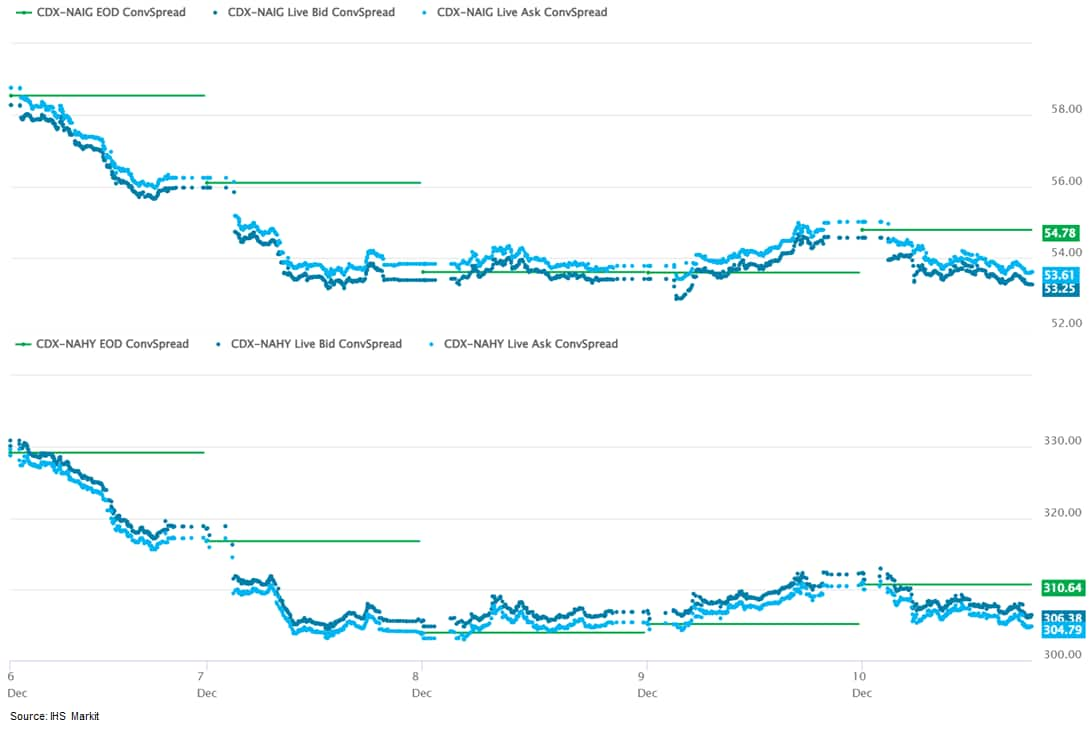

- CDX-NAIG closed -2bps/53bps and CDX-NAHY -5bps/306bps, which is

-5bps and -23bps week-over-week, respectively.

- DXY US dollar index closed -0.2%/96.1.

- Gold closed +0.5%/$1,785 per troy oz, silver +0.8%/$22.20 per troy oz, and copper -1.1%/$4.29 per pound.

- Crude oil closed +1.0%/$71.67 per barrel and natural gas closed +2.9%/$3.93 per mmbtu.

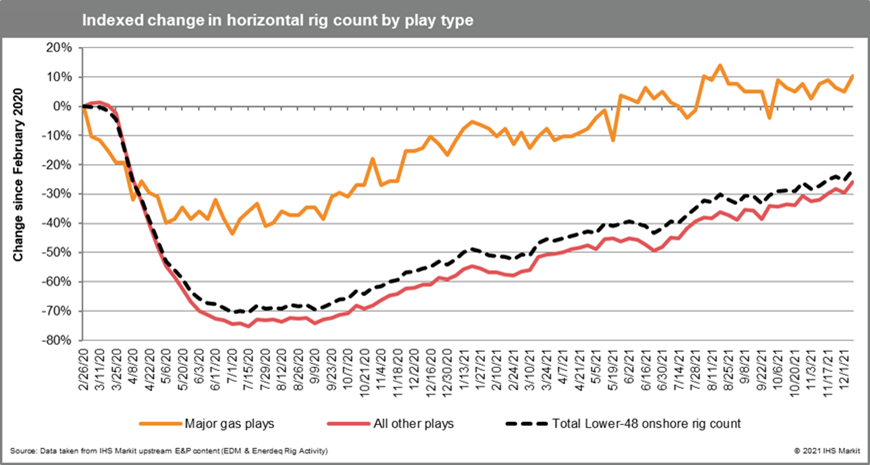

- Operators continued to add rigs back to the field following the

Thanksgiving holiday, with the Lower-48 onshore horizontal rig

count reaching 507 on 8 December; this represents the highest

horizontal-directed activity level since February 2020. The

SCOOP/STACK and Wolfcamp Midland led in terms of net rig additions

over the past two weeks, while the greatest declines were observed

in the Delaware Basin and the Eagle Ford. (IHS Markit Energy

Advisory's Raoul

LeBlanc, Plays and Basins' Imre

Kugler and Prescott Roach)

- Gas-directed drilling activity stagnated in recent weeks, with virtually all incremental gains in Lower-48 onshore rig counts being driven by activity in liquids plays. Although drilling in Appalachia and the Haynesville initially drove a substantial share of the recovery in rig activity during late 2020, the gas-directed rig count in these major gas plays has plateaued since late summer of 2021.

- This marks a particularly notable departure for the

Haynesville, where rig counts rose by more than 50% between

mid-2020 and mid-2021. Despite this stagnation, gas-directed

activity remains slightly above pre-pandemic levels, while

oil-directed rig counts remain a full quarter below February 2020

levels despite their continued (and ongoing) recovery.

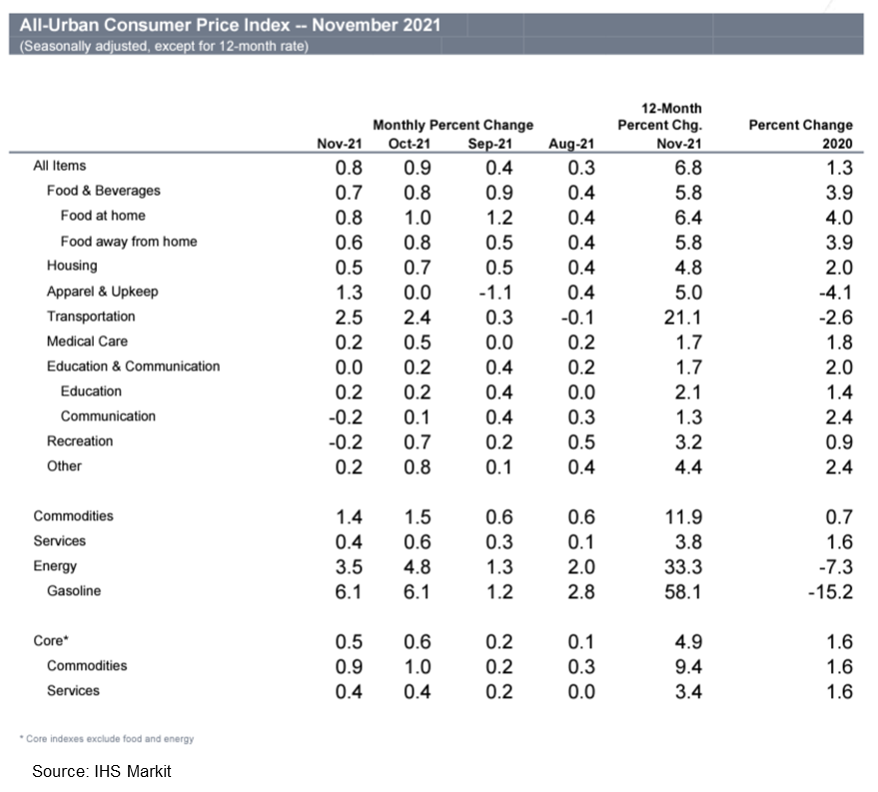

- The US consumer price index (CPI) rose 0.8% in November

following a 0.9% increase in October. The core CPI, which excludes

the direct effects of moves in food and energy prices, rose 0.5% in

November after a 0.6% increase in October. The CPI for food rose

0.7% and the energy CPI rose 3.5%. (IHS Markit Economist Ken

Matheny and Juan

Turcios)

- As in October, the rise in consumer prices in November was broadly based. Notable increases occurred for apparel (1.3%), airline fares (4.7%), used vehicles (2.5%), new vehicles (1.1%), and shelter (0.5%). The price of new vehicles rose for the eighth consecutive month and is up 11.3% since March. Severe supply chain bottlenecks have hampered new vehicle production, resulting in extraordinarily lean inventories and firming prices. Used-car prices rose in November and are up 34.3% since March. The ongoing supply issues in new vehicles continue to shift demand to used vehicles, resulting in ongoing upward pressure on used-car prices.

- Rent inflation rose robustly for a third consecutive month. The surge in house prices following the onset of the pandemic is translating into higher rents. Owners' equivalent rent (OER) and rent of primary residence (RPR) both rose 0.4% in November. Monthly increases in OER and RPR have averaged 0.4% over the last three months. At 3.5% for OER and 3.0% for RPR, annual (12-month) rent inflation readings in November were close to or below average readings in a broad historical context but have moved up briskly from 2.4% and 1.9% since July, respectively.

- The 12-month change in the overall CPI increased to 6.8%, the highest reading since June 1982, while the 12-month change in the core CPI increased to 4.9%, the highest reading since June 1991. We anticipate that 12-month inflation readings will moderate over the course of 2022 as supply chain issues are addressed.

- We estimate that the core price index for personal consumption

expenditures (PCE) rose 0.4% in November, revised up from our

previous estimate of 0.2%. We estimate that the 12-month change in

the core PCE price index rose from 4.1% in October to 4.5% in

November.

- The US University of Michigan Consumer Sentiment Index rose 3.0

points to 70.4 in the preliminary December reading, recovering from

the decade low in November. The increase was driven by an

improvement in views on both the present situation and the future.

The present situation index rose 1.0 point to 74.6, and the

expectations index jumped 4.3 points to 67.8. (IHS Markit

Economists Akshat Goel and William Magee)

- Elevated inflation remains the foremost drag on sentiment. At 6.8%, the 12-month increase in the consumer price index (CPI) in November was the fastest since 1982, with energy prices up a stunning 33.3%. The median expected one-year inflation rate in the University of Michigan survey remained at 4.9%, its highest level since 2008.

- There was a large disparity in the monthly change in sentiment between households in the bottom and the top halves of income distribution. The index of sentiment for households earning over $100,000 per year declined 4.9 points, while that for households earning below $100,000 per year jumped 7.8 points. According to the report, the uptick in sentiment among the bottom half was the result of an expectation of a substantial increase in income in the year ahead.

- The indexes of buying conditions for large household durable goods, automobiles, and homes improved in December but continue to be held back by high prices and limited inventories.

- Despite an improvement this month, consumer sentiment remains low and underscores the downside risks related to a prolonged period of above-trend inflation. Nevertheless, inflation risks are balanced by our expectation for strong job and wage growth in the coming months, which should continue to support solid consumer spending growth. Sentiment will track spending more closely as inflation subsides, although these might not align until next year.

- General Motors (GM) has announced two new partnerships to secure supplies of rare earth metals and rare earth magnets. The partnerships are part of GM's efforts to ensure it is in control of necessary materials for EVs across the value chain, a critical element of the company's EV strategy. This strategy has resulted in several joint ventures and new products. With a company called MP Materials, GM has announced a long-term supply agreement to scale up rare earth magnet sourcing and production in the United States. The agreement with supplier MP Materials will create a fully integrated US supply chain for rare earth magnets, a necessary component in motors for battery EVs, according to a GM statement and a GM phone call with analysts and media that IHS Markit participated in. MP Materials will source the rare earth metals from a mine and processing facility that it owns at Mountain Pass, California. The metals are to be made into magnets by MP Materials at a facility in Fort Worth, Texas. Specifically, the supply deal relates to neodymium-iron-boron (NdFeB) magnets critical for permanent magnet motors. GM states that currently there is virtually no US supply of these. Speaking during the call, Shilpan Amin, GM vice-president of global purchasing and supply chain, said that the agreement would secure GM supplies to meet its plans for Ultium platform vehicle production in North America. In addition, GM announced plans with Germany's Vacuumschmelze (VAC) to build a magnet factory in the US. Under the partnership, VAC is to build a new plant in the US to supply GM with permanent magnets for electric motors in more than a dozen planned models on the Ultium platform, in addition to the GMC Hummer EV, Cadillac Lyriq, and Chevrolet Silverado. VAC is a leading global producer of advanced magnetic materials and the largest producer of permanent magnets in the Western Hemisphere, GM said. The location of the plant is to be announced later; however, the plant is expected to begin production in 2024. The two companies have signed a non-binding memorandum of understanding (MOU), with a definitive agreement due in early 2022. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Embark Trucks is expanding into Texas (US) by launching a new autonomous trucking lane between Houston and San Antonio, reports FreightWaves. The company plans to begin hauling freight for Embark's customers in Texas next year. To support the expansion into Texas, Embark has collaborated with the Texas A&M University Engineering Experiment Station. Embark will use Texas A&M's test track and its Center for Autonomous Vehicles and Sensor Systems. In addition, Embark announced it has opened autonomous trucking facility in Houston. Stephen Houghton, Embark's chief operations and fleet officer, said, "Our new footprint in Texas will support our growing network of partners and fuel our rapid growth across the Sunbelt. As we scale our operations, we will continue to work closely with local and state governments and other organizations so that we improve the safety, sustainability and efficiency of trucking with autonomous technology." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- House Agriculture Committee Chairman David Scott (D-Ga.) and a

dozen other lawmakers are pressing the Biden administration to hold

off on any new restrictions on agricultural uses of glyphosate,

dicamba and other herbicides. (IHS Markit Food and Agricultural

Policy's JR Pegg)

- Imposing new limits or requirements prior to the 2022 growing season would cause economic—and potentially environmental—harm to US farmers, the lawmakers said in a December 9 letter to EPA Administrator Michael Regan.

- "Now is not the time to add additional costs to U.S. farmers that will not only harm agricultural communities but could drive up the cost of food at a time when families are already facing significant increases in the price of essential goods," according to the letter.

- Led by Rep. Abigail Spanberger (D-Va.), the letter warns that new restrictions could exacerbate existing herbicide shortages, provide needless uncertainty for farmers and negatively impact the ag economy in the 2022 growing season.

- "We strongly urge the EPA to reconsider any new herbicide registration restrictions at this time," the lawmakers say. "In addition, we urge the EPA to provide sufficiently advanced notification of any expected future registration revisions so that farmers, suppliers, herbicide manufacturers, and seed producers have adequate time to plan for new use conditions."

- Planting decisions The letter says farmers and producers began placing orders for seeds, herbicides and other inputs beginning in late summer, adding that many have already made purchases.

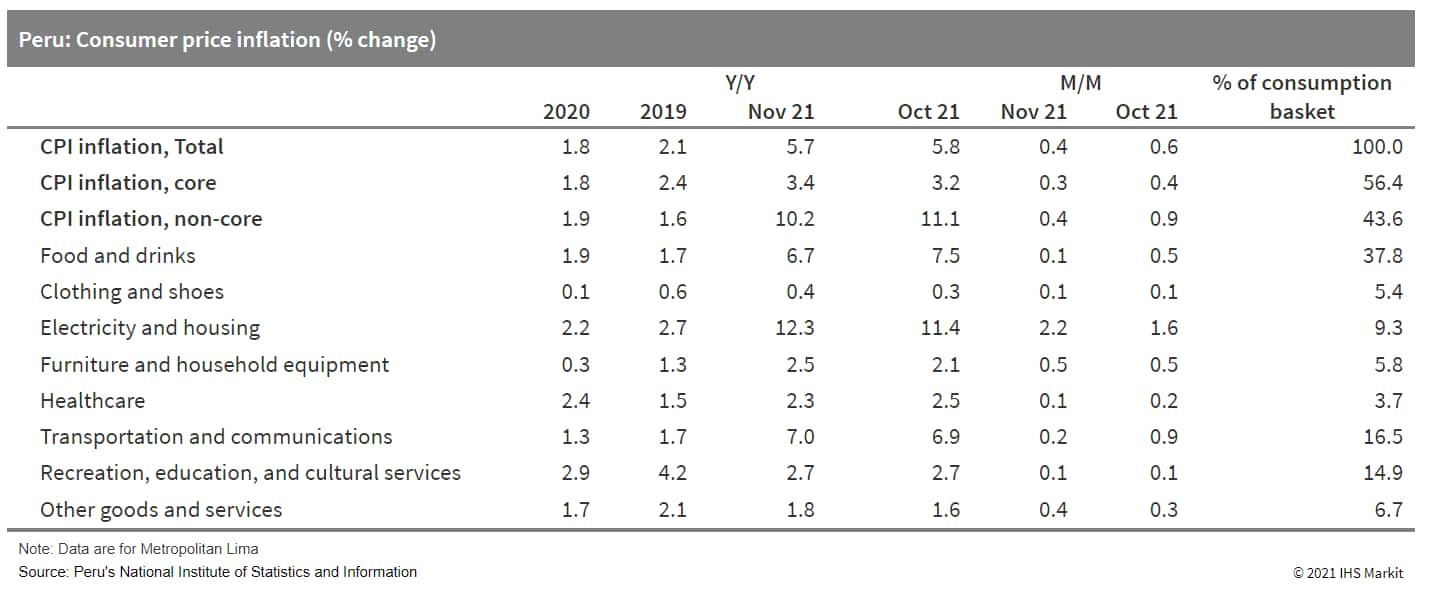

- The Central Reserve Bank of Peru (Banco Central de Reserva del

Perú: BCRP) at its December meeting has increased its policy

interest rate by 50 basis points to 2.5%. Forward guidance remains

unchanged and points to continued gradual rate increases. (IHS

Markit Economist Jeremy Smith)

- Five successive months of policy rate increases have lifted Peru's benchmark interbank loan rate from a historical low of 0.25% in July to 2.5% in December.

- Consumer price inflation slowed to 0.4% month on month (m/m) in November compared with an average of 0.7% m/m from July-October. Year-on-year (y/y) inflation eased marginally from 5.7% in October to 5.6% in November, still well outside the central bank's 1%-3% target range.

- Unlike many central banks, the BCRP continues to refer to above-target inflation as 'transitory', reflecting its view that international commodity price escalation and currency depreciation will reverse, allowing inflation to return to the target range by the second half of 2022.

- Meanwhile, the BCRP continues to intervene in the

foreign-exchange market amid unabating policy uncertainty. In

November, the Peruvian sol depreciated by 2.2% against the US

dollar as the government threatened to close several mines (before

quickly backtracking) and survived a motion of impeachment against

President Pedro Castillo.

- Banco de Chile, the fourth largest bank by assets in Chile, on

6 December launched a USD500-million 10-year deal. The deal gained

USD1.6 billion in peak demand, being priced at 3.276%, 185 basis

points over comparable US Treasuries and 15 tighter than initial

guidance. (IHS Markit Banking Risk's

Alejandro Duran-Carrete)

- Over the second half of 2021, Chilean banks have been aiming to attract diverse sources of funding, exemplified by Scotiabank Chile and Santander Chile, which sold perpetual AT1 bonds back in October, and by BCI, which sold Swiss franc bonds in October as well. The issuance reflects the still-receptive market for Emerging Market debt, given that despite Federal Reserve tightening, bond yields remain historically low, even after a general correction in November. With further Fed tightening likely, it is tactically logical for borrowers to seek to capture longer-term international funding before conditions deteriorate.

- The decision to use international markets is also explained by reduced domestic funding availability reflecting three consecutive pension fund withdrawals. These have curtailed local demand for investment in securities, including domestic bonds. The Chilean banking sector has historically enjoyed a diversified and mature funding system that has made it less reliant on deposits and more dependent on bond issuance primarily sold to domestic pension funds. Given the reduction of new demand caused by the pension fund withdrawals, Chilean banks are now likely to diversify their sources of funding into international markets for both domestic demand and tactical reasons.

- For Banco de Chile, the new bond issuance is overall risk-neutral. This reflects the deal's modest size versus the overall balance sheet of the bank, with the new issue representing less than 1% of its total liabilities. While the new issue may involve more direct foreign-exchange risks, its interest rate is relatively close to Chilean funding levels. According to the Central Bank of Chile, the average foreign-exchange deposit rate for a term of three years or more was at 2.68%, as of end-October 2021, when last reported and the inflation-adjusted rate at 3.15% at end-November 2021.

Europe/Middle East/Africa

- All major European equity indices closed modestly lower; Germany -0.1%, France -0.2%, Italy -0.4%, UK -0.4%, and Spain -0.5%.

- Most 10yr European govt bonds closed lower except for Germany +1bp; Italy -5bps, Spain -2bps, and France/UK -1bp.

- iTraxx-Europe closed flat/53bps and iTraxx-Xover -2bps/260bps,

which is -5bps and -22bps week-over-week, respectively.

- Brent crude closed +1.0%/$75.15 per barrel.

- The Office for National Statistics (ONS) reports that the UK

economy grew by 0.1% month on month (m/m) in October, after a gain

of 0.6% m/m in September. The figure for October was below the

market consensus, which had predicted a 0.4% m/m gain during the

month. (IHS Markit Economist Raj

Badiani)

- Moreover, this was after real GDP rose by 1.3% quarter on quarter (q/q) in the third quarter of 2021. Therefore, the level of real GDP in October was 0.5% below that before the first COVID-19-related lockdown in February 2020.

- The ONS reports that real GDP grew by 0.9% in the three months to October, when compared with the previous three months (May to July). This growth primarily reflected the steady easing of COVID-19-related restrictions across the United Kingdom, including the full reopening of accommodation and food service activities and arts, entertainment, and recreation services.

- Consumer-facing services improved again in October, albeit at a slower pace.

- Services output grew by 0.4% m/m in October to reach its pre-COVID-19 level (February 2020).

- The largest contributor was human health activities, which grew by 3.5% m/m in October, primarily as GPs in England worked through their backlog of face-to-face appointments.

- Output in consumer-facing services grew by 0.3% m/m in October but remained 5.2% below its pre-pandemic level.

- Wholesale and retail trade and repair of motor vehicles and motorcycles services performed robustly, rising by 8.1% m/m during the same month, alongside a 30.4% m/m gain in travel agency, tour operator, and other reservation services and related activities. These increases were partially offset by a fall in food and beverages service activities (down by 7.5%).

- Production output decreased by 0.6% m/m in October, dragged down by falling electricity and natural gas output and mining and quarrying extraction.

- Manufacturing activity remained flat in October, flagging an uneven performance across the sector. The manufacture of machinery and equipment not classified elsewhere shrank by 9.5% m/m, which was partially offset by rising manufacture of basic pharmaceutical products and pharmaceutical preparations.

- EU governments have given the greenlight to the European

Commission to authorize another two insect products as novel foods

in the 27-nation bloc before the end of the year, clearing

applications for dried, ground and frozen house cricket (Acheta

domesticus) and frozen, dried and powdered yellow mealworm

(Tenebrio molitor). (IHS Markit Food and Agricultural Policy's Sara

Lewis)

- They will be authorised for use in a multitude of food and drink products ranging from bread and cereal bars, through pasta, processed potato products, chocolate and confectionary, to meat analogues and beer.

- National government approval for the two followed a week-long written procedure that closed on 8 December in the Standing Committee on Plants, Animals, Food and Feed (PAFF) novel foods and toxicological safety of the food chain section.

- The Commission now has to adopt implementing legislation to the 2015 novel foods regulation (2283/2015) formally authorizing the two insect product ranges. They will take effect 20 days after publication in the EU's Official Journal, so early in 2022.

- Both ranges are from the Dutch company Fair Insects, the edible insect arm of Protix. The frozen house cricket is already on the market in some member states, but this authorization will allow Fair Insects to sell the range EU-wide.

- The two authorizations will bring the number of approved edible novel insect foods up to four after the first approval, a dried yellow mealworm range for French producer Agronutris and the second, the migratory locust (Locusta migratoria), which is also a Fair Insects range.

- This will be the second novel food authorization of a yellow mealworm range because the first granted to Agronutris in June gave the French producer five year's proprietary market protection for the safety data used to support the application. However, data protection does not mean that another company cannot generate its own studies to back up another application for the same species, which is what Fair Insects has done.

- Final November data based on national methodology from the

Federal Statistical Office (FSO) confirm the 'flash' data release

of 29 November, showing rates of -0.2% month on month (m/m) and

5.2% y/y. The latter is up from October's 4.5% y/y and at a level

last seen this high in mid-1992, then related to reunification. It

contrasts starkly with average inflation of 1.5% in 2019 and 0.5%

in 2020. (IHS Markit Economist Timo

Klein)

- The EU-harmonised consumer price index (CPI) measure even increased by 0.3% m/m, raising its annual rate from 4.6% to 6.0%. This markedly exceeds the eurozone average of 4.1%. The renewed divergence between the harmonized and the national measure, owing to very different weights for package tours and this component's extreme seasonality, will narrow sharply in December already.

- The national core CPI (excluding food and energy) rate increased from October's 2.9% to 3.3% y/y in November, more than twice as high as the 1.4% average during January-April, not to mention the December 2020 level of 0.4%. Although this partly owes to the temporarily lower value-added tax (VAT) rate during July-December 2020, an effect that will unwind in January 2022, recent upward pressures have come not only from energy (including not just oil but also natural gas and electricity) but also from rising prices for other commodities and intermediate goods owing to global supply chain bottlenecks.

- In November, more expensive durable goods and a smaller seasonal decline than usual for package tours also contributed. This was enabled by consumers having both the funds and the urge to satisfy their pent-up demand accumulated during previous lockdown periods. Thus, companies were able to pass on their higher costs fairly easily.

- Specifically, energy prices increased by 1.8% m/m in November, boosting their annual rate from 18.6% to 22.1%. Along with higher inflation for food, clothing/shoes, and household goods, this raised the y/y rate for goods in general from 7.0% to 7.9%. Its service-sector counterpart increased from 2.4% to 2.9%, which largely owes to the influence of package-tour prices.

- Daimler's Mercedes-Benz won regulatory approval to deploy a hands-free Level 3 automated operation system in Germany, according to a company statement. The German Federal Motor Transport Authority (KBA) has approved this system based on the technical regulation UN-R157. The technology will allow the driver to hand control to the car. Customers in Germany can buy an S-Class with Drive Pilot in the first half of 2022, enabling them to drive in conditionally automated mode at speeds of up to 60km/h. The system approval also applies to the EQS. Mercedes-Benz is initially offering Drive Pilot on 13,191 kilometers of motorway in Germany. Markus Schaefer, Mercedes CTO, said, "For many years, we have been working to realize our vision of automated driving. With this LiDAR based system, we have developed an innovative technology for our vehicles that offers customers a unique, luxurious driving experience and gives them what matters most: time. With the approval of the authorities, we have now achieved a breakthrough: We are the first manufacturer to put conditionally automated driving into series production in Germany". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Stellantis plans to integrate hands-free Level 3 automated technology in its cars, starting in 2024. The technology is being developed in collaboration with BMW and will allow the driver to hand control to the car. Joachim Langenwalter, head of artificial intelligence, software, and hardware at Stellantis, said, "The first Level 3 solution will come in 2024 before rolling out across the full portfolio in the years to come," reports Automotive News. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- South Korean battery materials company EcoPro BM is to establish a new factory in Hungary to manufacturer cathodes for electric vehicle (EV) batteries, reports Reuters. According to the report, the company is to invest HUF264 billion (USD810 million) in the first phase of the construction, which is planned to be completed by the second half of 2024, with the second-phase finishing a year later. Hungary's foreign minister, Peter Szijjarto, confirmed the investment plan for the factory, which is to be located in the eastern town of Debrecen. (IHS Markit AutoIntelligence's Tim Urquhart)

- Volvo Cars and battery-maker Northvolt have signed a binding joint venture (JV) agreement to develop and manufacture batteries together for the automaker's next-generation vehicles. Volvo confirmed in a statement that the pair will invest in a new research and development (R&D) site in Gothenburg (Sweden) from 2022, which will create "a few hundred jobs." This will be followed by the construction of a new manufacturing plant in Europe that will produce "next generation state-of-the-art battery cells, specifically developed for use in next generation pure electric Volvo and Polestar cars". The location of this facility, which will have the potential capacity to make up to 50 gigawatt hours (GWh) of batteries per annum, is expected to be confirmed early next year. Construction is then envisaged to begin in 2023, and large-scale production at the site, which is expected to employ up to 3,000 people, is seen as beginning in 2026. (IHS Markit AutoIntelligence's Ian Fletcher)

- South Africa's real seasonally adjusted manufacturing

production decreased 5.9% m/m during October, pulling the

year-on-year (y/y) rate down to an 8.2% contraction. During

January-October, manufacturing output increased 13.5% y/y, from a

contraction of 14.4% during the same period last year. (IHS Markit

Economist Thea

Fourie)

- The monthly fall in real seasonally adjusted manufacturing production was broad based, with the biggest declines recorded in the categories of basic iron and steel, non-ferrous metal products, metal products and machinery (down 14.1% m/m), furniture and other manufacturing (down 11.3% m/m), and motor vehicles, parts and accessories and other transport equipment (down 6.9% m/m). The only manufacturing sub-sector in which production increased in October was the radios, television and communication apparatus and professional equipment category, which recorded growth averaging 25.4% m/m.

- Seasonally adjusted manufacturing sales decreased by 5.8% m/m during October, with the biggest fall recorded in the motor vehicles, parts and accessories and other transport equipment category, at 30.1% m/m.

- The weak start to South African real seasonally adjusted manufacturing production during the fourth quarter is very disappointing, especially since output in the sector contracted by 4.2% quarter on quarter (q/q) during the third quarter, latest GDP numbers show. Rising electricity disruptions, increasing and uncompetitive logistical costs, and industrial action and strikes in the steel industry over salary disputes, combined with global supply chain disruptions and rising input costs, contributed to the dismal performance of the sector during October.

Asia-Pacific

- Most major APAC equity indices closed lower except for India flat; Mainland China -0.2%, Australia -0.4%, South Korea -0.6%, Japan -1.0%, and Hong Kong -1.1%.

- The People's Bank of China (PBoC) announced on 9 December that

it will lower the reserve requirement ratio (RRR) for foreign

currencies from 7% to 9%. The announcement noted that the move is

to improve and strengthen foreign currency liquidity management.

The higher RRR will be in effect from 15 December, the same day as

the cut for banks' RRR, as announced on 6 December. (IHS Markit

Banking Risk's Angus

Lam)

- According to annual statistics from PBoC, as of 2020, foreign-exchange loans account for 3.2% of total loans by banks. PBoC did not mention the liquidity reduction due to the RRR increase, however, given the small proportion, the impact on overall loan growth is expected to be minimal.

- Together with the general RRR cut for banks, this latest move is expected to slightly improve the amount of lending granted to local companies. In recent days, the authorities have eased liquidity pressure by also reducing the relending rates to boost lending to MSMEs.

- IHS Markit expects that while the general RRR cuts will boost longer-term lending by 0.6%, the foreign exchange RRR increase will have limited impact. Overall, credit growth is expected to be 11.7% in 2021 and 11.4% in 2022, somewhat dragged down by the recent issues faced by the real-estate sector, despite easing of the three red lines for real estate companies and also the relaxation in property loans by local authorities.

- China's Ningbo Zhongjin Petrochemical has slashed its

paraxylene (PX) production ahead of an urgent shutdown due to an

emergency COVID-19 lockdown, three sources told OPIS late-Thursday.

A local trader in Ningbo said that Zhongjin Petrochemical was

cutting production due to COVID-19 issues. (IHS Markit Chemical

Market Advisory Service)

- Zhongjin's current production rate remains unclear but it was expected to shut its 1.6 million mt/yr PX plant Thursday night or Friday morning, said an industry source in Shandong.

- "Zhongjin is facing a conundrum, its logistics are bottlenecked by transportation vehicles that will no longer have entry and exit permits from the Zhenhai district," according to a Zhejiang polyester producer. The producer said that the access permits to Zhenhai will expire "Friday or Saturday". "There will be no further processing of these permits," he said.

- Zhongjin is hence neither able to receive its procurements, nor deliver its finished goods to customers, meaning its supply chain has been completely severed, the polyester source said.

- OPIS previously reported that Zhenhai commenced lockdown at 0200 hrs on Dec. 7, while the wider Ningbo city declared a "Level 1" emergency at the same time. Zhenhai District then set up multiple testing points by 0500 hrs Dec. 7, including one at Zhongjin Petrochemical.

- The only unit affected initially was Yisheng Petrochemical's 3.6 million mt/yr purified terephthalic acid (PTA) unit, which lowered its production rates to an undisclosed level.

- Talks had been underway to clear logistical bottlenecks at factories and docks since the lockdown began.

- Besides Zhongjin Petrochemical, Zhenhai district is also home to Sinopec Zhenhai with its 750,000 mt/yr PX capacity.

- Port sources had estimated Zhenhai's lockdown to last 14 days, meaning that Zhongjin's logistics might be equally gridlocked.

- The consortium led by South Korean electric bus manufacturer Edison Motors, the preferred bidder to acquire SsangYong, is demanding a cut of about KRW15.5 billion (USD13.2 million) in the sale price, citing increased losses, reports the Maeil Business Newspaper. "We have asked for an adjustment in the acquisition price after finding additional bad assets during due diligence," said Edison Motors CEO Kang Young-kwon. He nevertheless reiterated the consortium is intent on seeing through the deal by injecting a maximum of KRW800 billion to turn SsangYong around and invest in vehicle electrification. Meanwhile, the sale advisor EY Hanyoung accounting firm maintains deduction cannot be more than KRW5 billion. "Once the acquisition price is cut as much as the amount of the new loss, we'll make an investment that matches the discount amount," said Young-kwon. (IHS Markit AutoIntelligence's Jamal Amir)

- South Korean steelmakers are forming partnerships with

international miners in their initial decarbonization phase,

focusing on potential value-chain emissions cuts before the

government can secure domestic supplies of what's required to

produce low-emissions steel: renewable power. (IHS Markit Net-Zero

Business Daily's Max Lin)

- POSCO and Hyundai Steel, which together account for over 90% of the South Korean steelmaking sector's GHG emissions and crude steel output, both signed memorandums of understanding (MOUs) with Vale to develop low-carbon iron in November.

- Earlier this year, POSCO-the No. 1 player at home and No. 6 globally-also teamed up with BHP and Rio Tinto to explore technologies to reduce emissions across the steelmaking value chain, some of which could be used to optimize coke quality.

- Those initiatives came after POSCO and Hyundai Steel committed to carbon neutrality by 2050 last December and February, respectively. The two companies also have interim targets of a 20% cut in CO2 emissions by 2030.

- Joojin Kim, managing director of Seoul-based non-profit Solutions for Our Climate (SFOC), said international cooperation is an important way to exchange experiences and knowledge in cutting emissions.

- But he expressed concern that the partnerships focus on indirect reduction activities rather than decarbonizing the steelmaking process. "POSCO may opt out of investing in proper infrastructure and technologies to meet their net-zero goal by signing these MOUs," Kim told Net-Zero Business Daily.

- When establishing national decarbonization roadmaps earlier this year, the government said South Korean steelmakers will achieve emission cuts mainly via replacing blast furnaces with electric arc furnaces (EAFs) and swapping out coking coal for clean hydrogen as a reducing agent.

- Raasta Autotech Private Limited, a car and bike service aggregator, has announced a partnership with BookmyHSRP for doorstep deliveries of high-security registration plates for vehicles, reports the Financial Express. This alliance will be beneficial for vehicle owners booking registered number plates from Indian states including Delhi, Uttar Pradesh, and Himachal Pradesh, as well as union territories Daman and Diu and Andaman and Nicobar Islands. The service can be accessed through a mobile app available on both Apple's App Store and Google Play Store. Karn Nagpal, founder and managing director of Raasta Autotech, said, "This [alliance] would enable Raasta to further bridge the gap in the industry by providing hassle-free services to the customers at their doorsteps. The customers will be able to choose various services from a wide range of vehicle aid provided by Raasta." Raasta will allow the seamless booking of new registration plates, replacement of existing registration plates, tracking of shipments in real time, as well as options for cancellations or refunds. (IHS Markit AutoIntelligence's Tarun Thakur)

- Pattaya City Municipality plans to buy electric vehicles (EVs)

for its public transport system, to improve the environment under

its Neo Pattaya project, reports the Bangkok Post. On the resort

island of Koh Lan, electric public transport vehicles such as

songthaew minibuses and taxis will be tested and promoted as part

of ecotourism efforts under the Neo Pattaya policy, according to

city mayor Sonthaya Khunpluem. The policy aims to develop the city

as an economic hub in eastern Thailand, with natural and

environmental conservation. The city has signed a memorandum of

understanding with the private sector for a trial to replace

gasoline (petrol)-fueled vehicles. The city council aims to

purchase around 20 EVs for pilot services in the city by next year.

The results of the trial will be compared with gasoline-engine

operations in order to determine whether or not to continue

investing in EVs, according to Khunpluem. (IHS Markit

AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-december-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-december-2021.html&text=Daily+Global+Market+Summary+-+10+December+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-december-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 10 December 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-december-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+10+December+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-december-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}