Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 10, 2022

Daily Global Market Summary - 10 February 2022

All major APAC and most European equity indices closed higher, while all US indices were lower on the day. US and European government bonds closed sharply lower on the day. European iTraxx and CDX-NA closed sharply wider across IG and high yield. The US dollar, copper, silver, and WTI closed higher, while Brent, natural gas, and gold were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -1.5%, Russell 2000 -1.6%, S&P 500 -1.8%, and Nasdaq -2.1%.

- 10yr US govt bonds closed +12bps/2.04% yield and 30yr bonds +7bps/2.32% yield.

- Federal Reserve Bank of St. Louis President James Bullard said he supports raising interest rates by a full percentage point by the start of July -- including the first half-point hike since 2000 -- in response to the hottest inflation in four decades. "I'd like to see 100 basis points in the bag by July 1," Bullard, a voter on monetary policy this year, said in an interview with Bloomberg News on Thursday. "I was already more hawkish but I have pulled up dramatically what I think the committee should do." (Bloomberg)

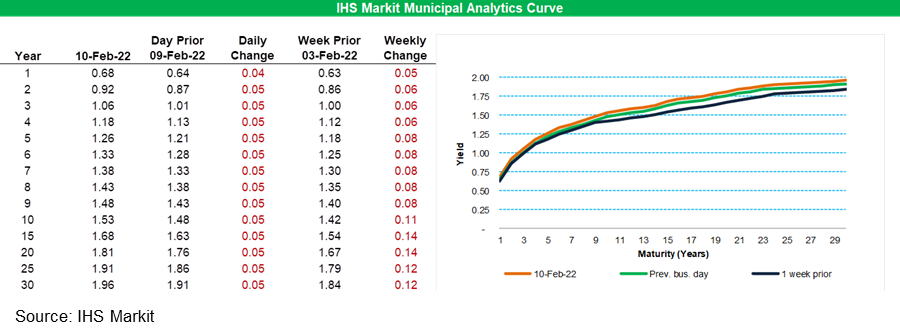

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

sold off 4-5bps across the curve, with the curve now 5-14bps worse

week-over-week.

- CDX-NAIG closed +4bps/65bps and CDX-NAHY +18bps/359bps.

- DXY US dollar index closed +0.1%/95.55.

- Gold closed flat/$1,837 per troy oz, silver +0.8%/$23.52 per troy oz, and copper +1.2%/$4.66 per pound.

- Crude oil closed +0.2%/$89.88 per barrel and natural gas closed -1.2%/$3.96 per mmbtu.

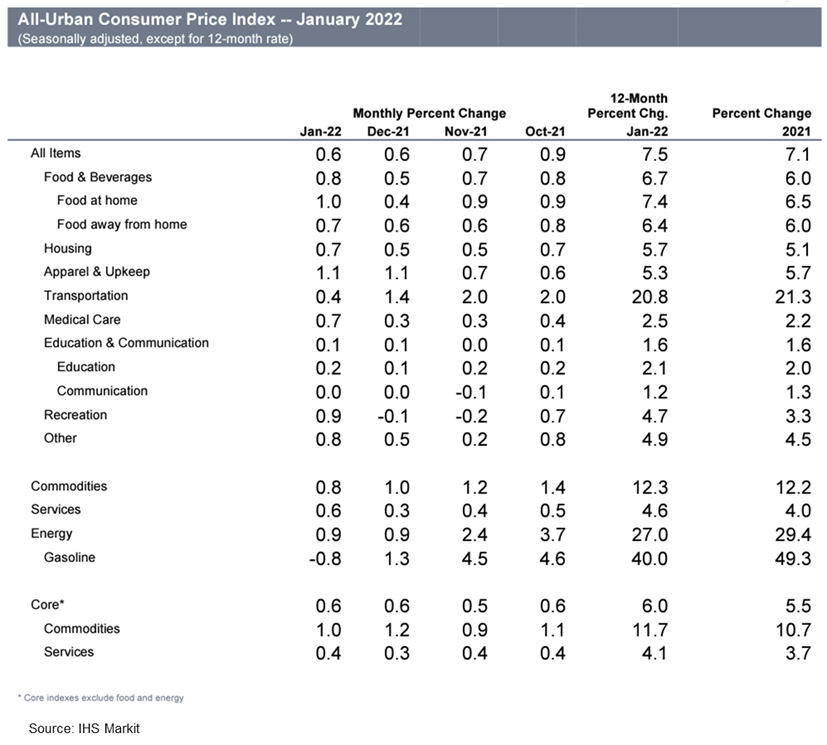

- Both the overall US Consumer Price Index (CPI) and the core

CPI, which excludes the direct effects of moves in food and energy

prices, rose 0.6% in January. CPIs for food and energy rose 0.9%

and 0.6%, respectively. (IHS Markit Economists Ken

Matheny and Juan

Turcios)

- The 12-month change in the overall CPI climbed 0.5 percentage point to 7.5%, the highest since February 1982. The 12-month change in the core CPI rose to 6.0%, the highest since August 1982.

- Upward pressure on prices has broadened beyond those most impacted during the early stages of the pandemic. Among notable increases in January were those for apparel (1.1%), airline fares (2.3%), used vehicles (1.5%), and medical care services (0.6%).

- Sharp price increases within goods have contributed to the rise in annual core inflation since 2020. The CPI for commodities less food and energy rose sharply beginning last spring, with an annualized increase of 14.2% since March 2021. Its 12-month change was 11.7% in January.

- Prices within nonenergy services have also risen but more gradually overall. Since March 2021, the CPI for services less energy services has risen at a 4.2% rate. Its 12-month change was 4.1% in January.

- A quick rebound in rent inflation has contributed to the rise of services inflation. The 12-month change in owners' equivalent rent (OER) and rent of primary residence (RPR) in January was 4.1% and 3.8%, respectively, up from 2.0% and 1.8%, respectively, in April 2021.

- Today's (10 February) report on consumer prices supports the

IHS Markit expectation that the Federal Reserve will tighten

monetary policy several times over the course of 2022, beginning

with consecutive rate hikes at each of the next three policy

meetings in March, May, and June.

- US seasonally adjusted initial claims for unemployment

insurance declined 16,000 to 223,000 in the week ended 5 February.

The impact of the Omicron-induced surge in cases on the labor

market is proving to be short-lived. Claims rose to a three-month

high of 290,000 in the week ended 15 January just as infections

peaked in the country, but claims are now trending down again as

employers are trying to retain existing employees amid tight labor

markets (the layoffs and discharges rate is at a record low). (IHS

Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) were unchanged at 1,621,000 in the week ended 29 January. The current level of continuing claims is below the 2019 average (1,700,000). The insured unemployment rate was unchanged at 1.2%.

- The Extended Benefits (EB) program provides up to 13 additional weeks of benefits to individuals who have exhausted regular benefits and work in a state that is experiencing high unemployment. Extended Benefits were available in New Jersey and New Mexico in the week ended 22 January, with a total of 36,539 continued claims under the EB program.

- In the week ended 22 January, the unadjusted total of continuing claims for benefits in all programs rose by 32,069 to 2,099,857.

- Total US household debt rose by $333 billion (2.2%) in the

fourth quarter from the third quarter, the largest percentage and

nominal gain since the second quarter of 2007. Household debt

balances totaled $15.58 trillion, $1.0 trillion higher than a year

earlier and $1.4 trillion higher than in the fourth quarter of

2019, the last pre-pandemic datapoint. (IHS Markit Economist Patrick

Newport)

- Mortgages, the largest debt category, increased by $258 billion to $10.93 trillion at the end of December.

- Home equity lines of credit (HELOCs), bucking a declining trend, edged up slightly to $318 billion, the first increase since the fourth quarter of 2016.

- Credit card balances grew by $52 billion, the largest increase on record (the data go back 22 years). Credit card balances remain $71 billion below their pre-pandemic level (fourth quarter 2019), despite the record fourth-quarter increase.

- Auto loans rose by $15 billion (1.0%).

- Student loans fell $8 billion (down 0.5%) from the third quarter of 2021 and increased by $21 billion from the fourth quarter of 2020—the smallest four-quarter over four-quarter increase since 2003.

- In total, non-housing balances grew by $74 billion.

- Mortgage originations were $1.0 trillion in the fourth quarter of 2021 and $4.5 trillion for the year, a historic high.

- Credit scores of newly originated mortgages have dropped in recent quarters but "remain very high," according to the report.

- Bankruptcy notations fell to about 94,000, a series low (data started in 1999.)

- The delinquency rate stood at 2.7% in late December, 2.0 percentage points lower than in the fourth quarter of 2019. Delinquencies, which had been declining in recent quarters, were flat in the fourth quarter of 2021 and remain low. Forbearances, provided by both the Coronavirus Aid, Relief, and Economic Security (CARES) Act and voluntarily offered by lenders, account for current low delinquency rates.

- US company Vontier Corporation has announced the acquisition of Israeli electric vehicle (EV) charging and energy management company Driivz, reports Trend News Agency. According to the source, the acquisition is part of Vontier's USD500-million commitment to lead the field of energy transition. Vontier president and CEO Mark Morelli said, "The energy landscape will change more in the next 10 years than in the previous hundred and today's announcement underscores our Net Zero goals and advances our plan to deliver solutions to help address the global emissions challenges." He added, "The acquisition of Driivz accelerates our portfolio diversification and e-mobility strategies toward long-term secular growth drivers and positions us well to capitalize on the global EVCI [electric vehicle charging infrastructure] market opportunities. Driivz provides us with market leading technologies within the highest growth, most profitable network management software market segment. We are excited to offer our customers with best-in-class software that is hardware agnostic and the ability to continue to own the consumer experience." Driivz was established in 2012 and offers a cloud-based end-to-end EV charging solution for operators, users, and utilities. This includes all aspects of EV deployment from charging, account management, and driver billing, through to onsite power management that allows businesses to optimize output to chargers in line with site energy demand and costs. (IHS Markit AutoIntelligence's Tarun Thakur)

- Shyft Group has announced plans to launch an electric delivery van in 2023. The van is to be revealed at the NTEA Work Truck Show in Indiana (United States) in March. The Shyft Group, formerly Spartan Motors, announced plans for its Class 3 electric vehicle (EV) chassis this week. In a statement, Shyft Group CEO Daryl Adams said, "Unable to find a viable EV chassis option in the market, we decided to build our own. We developed our proof of concept by leveraging nearly 50 years of experience in custom chassis production and last-mile delivery and will put prototypes in our customers' hands for testing and validation in the 2nd half of 2022. Leveraging the infrastructure that supports our coast-to-coast manufacturing and service footprint, we're poised to produce at scale to support the sharply rising demand for last-mile delivery vehicles as well as our customers' carbon-neutral goals." The EV is to be a purpose-built walk-in delivery van, and Shyft said it will provide a "new benchmark" on driver ergonomics and user experience. The chassis is to have a customizable length and wheelbase for a wide range of medium-duty needs. The driving range of the EV is estimated at between 150 and 175 miles, and Shyft says it will offer optional extended battery solutions. Shyft says the EV's chassis will be adaptable for last-mile solutions including delivery, work truck, mass transit, and recreational vehicle. The new van reportedly is the company's first turnkey vehicle since Spartan Group produced fire trucks. Shyft says the new van will be produced in a dedicated EV plant, and initially it will be more expensive than a gasoline (petrol)-powered counterpart. As with other companies entering the space, Shyft says fleet operators should achieve a lower cost of ownership through government incentives and lower maintenance costs. (IHS Markit AutoIntelligence's Stephanie Brinley)

- JBS, the world's largest meat processor, has launched a new

ground beef product that can be cooked from frozen without thawing.

The group's US division said its new Pound of Ground Crumbles would

fill a 'crucial gap' in offerings for ground beef. (IHS Markit Food

and Agricultural Commodities' Max Green)

- Created using a proprietary process, the product is made of quick-frozen ground beef that JBS USA claims will bring 'unmatched convenience and ease to meal planning'.

- "Ground beef is at the heart of dinnertime, and even though 62% of ground beef is stored frozen at home, it's easy to forget to thaw a brick of ground beef in time to start cooking," said product creator Heidi Meyer.

- "Crumbles can be pulled from the freezer and poured freely right into the pan, cooking in 10 minutes or less," she added.

- The new product is anticipated to add 83% of incremental category growth in the meat industry, according to an A.C. Nielsen Quantitative Test.

- Pound of Ground Crumbles is available at select stores across the US, including BJ's Wholesale Club, Festival Foods, GIANT, Meijer, Save A Lot, Weis Markets and WinCo Foods. It comes in three varieties - Original 80/20, Hearty-Sized Pieces 80/20 and Original with Onion.

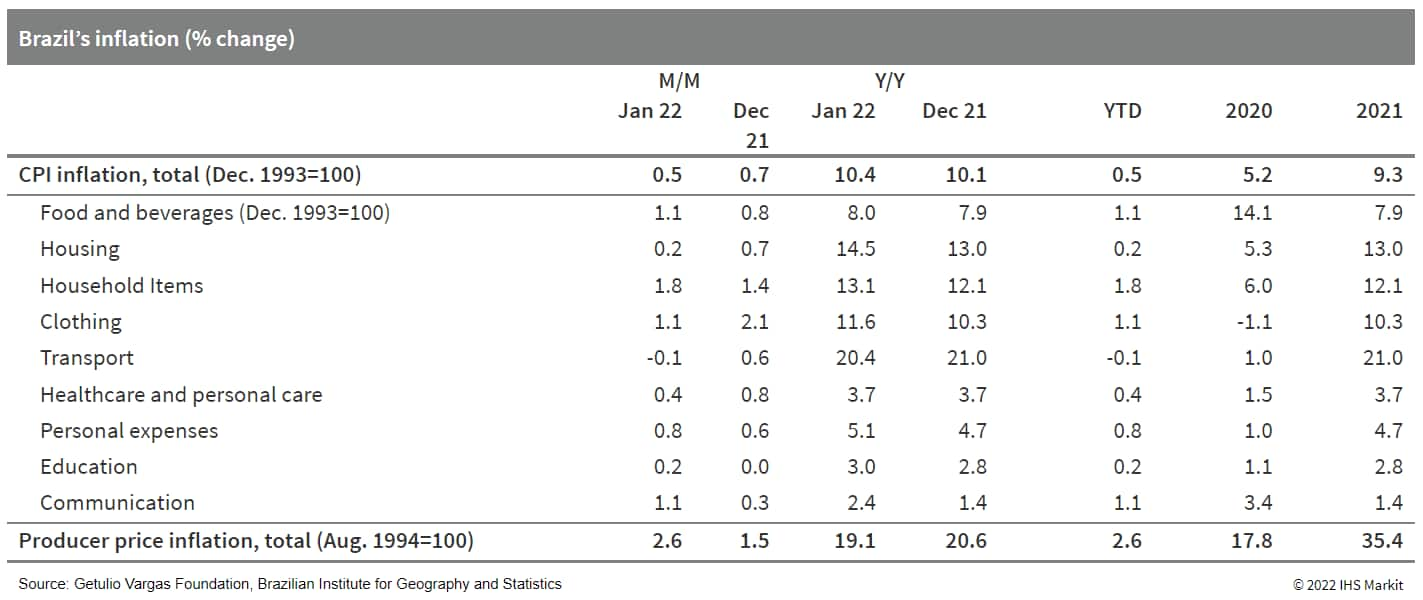

- The Brazilian Institute for Geography and Statistics IBGE

(Instituto Brasileiro de Geografia e Estatística) has reported that

inflation in January amounted to 0.54%, which marks the third

consecutive monthly decline (see graph below); however, annual

inflation remains in double digits (10.4%), well above the Central

Bank of Brazil (Banco Central do Brasil: BCB)'s target of 3.5% +/-

1.5 percentage points. (IHS Markit Economist Rafael

Amiel)

- Prices in the food category continue to increase rapidly and were partially offset in January by lower prices in the transport category, in turn driven by lower gasoline prices. Lower electricity costs helped to contain high inflation in housing items.

- In recent quarters, as in most regions in the world, the drivers of inflation in Brazil were high energy and food prices, supply chain disruption, and shortages. A severe drought, that led to increased electricity tariffs and the depreciation of the currency compounded inflationary pressures.

- From an annual perspective, half of Brazilian inflation was

driven by the energy components of the Consumer Price Index (CPI),

but there have been second-round effects or contagion into other

products. Core inflation, which excludes items in the food and

energy categories, i.e., those with high price volatility, amounted

to 8.0%, and inflation in the service category has gone above the

upper bound of the BCB's target.

Europe/Middle East/Africa

- Most major European equity markets closed higher except for France -0.4%; Spain +0.5%, UK +0.4%, Italy +0.2%, and Germany +0.1%.

- 10yr European govt bonds closed sharply lower; Germany +7bps, France/Spain +9bps, UK +10bps, and Italy +14bps.

- iTraxx-Europe closed +3bps/65bps and iTraxx-Xover +11bps/314bps.

- Brent crude closed -0.2%/$91.41 per barrel.

- A significant step-up in domestic energy prices from April

accentuates an already damaging cost-of-living crisis for many UK

households. Therefore, stretched household budgets will weigh down

on consumer spending developments and slow the pace of GDP growth

in the next few quarters. (IHS Markit Economist Raj

Badiani)

- UK energy regulator Ofgem has announced a rise in the energy tariff cap, or the prices that suppliers can charge for each unit of energy as well as the standing charge.

- The wholesale price of gas (system average price) was almost four times higher in January compared with early 2021. The United Kingdom imports around 50% of the natural gas consumed domestically, while natural gas accounts for 30% of the electricity generated in the UK.

- Elevated energy futures prices mean that Ofgem, which sets the tariff caps twice in the year in April and October 2021, has recently announced significant hikes.

- The tariff cap in April will increase by 54%. This implies that households on default tariffs paying by direct debit face an increase of GBP693, or from GBP1,277 to GBP1,971 per year. This is the largest increase since Ofgem introduced the cap in 2019.

- In addition, this was after a 13% or a GBP150 increase from 1 October 2021.

- Specifically, it will affect around 22 million households, primarily those on a standard variable tariff or with a fixed deal about to end.

- Finance Minister Rishi Sunak has announced that millions of UK households can obtain energy bill discounts totaling GBP350 to soften the impact of soaring domestic energy costs.

- Production at Tesla's new plant in Gruenheide, Germany, is not due to begin until mid-March, at the earliest, as the electric vehicle (EV) manufacturer waits for final regulatory approval, reports local broadcaster RBB. According to the report, the local regulatory authorities are still reviewing the plant's safety system and procedures. A spokesperson for the state of Brandenburg's environment ministry said, "We do not specify a concrete date, but we are in the final phase of the approval process." (IHS Markit AutoIntelligence's Tim Urquhart)

- The flash estimate for Saudi GDP in the final quarter 2021

revealed that the economy grew by 6.8% on the year, according to

the Saudi General Authority for Statistics (GASTAT). This is only

slightly below the rate for the third quarter (7.0%) and adds up to

GDP growth of 3.3% for the year 2021. (IHS Markit Economist Ralf

Wiegert)

- The breakdown in oil/non-oil/government activities showed that the oil sector continued to accelerate, while non-oil activities slowed down somewhat in Q4 (+5.0%) following strong growth in Q3 (6.2%). Non-oil activities had been impacted by rebound effects after the value-added tax (VAT) hike at the beginning of the third quarter of 2020; some slowdown of activity was therefore expected.

- In seasonally adjusted, quarter-on-quarter terms, GDP rose 1.6% in Q4, almost in line with non-oil growth (+1.5%) and oil sector growth (+1.8%). Government activities increased 1.2% from Q3. Oil production continued to increase and will be the key factor behind the strong growth outlook for the Saudi economy in 2022. It should be noted that the seasonally adjusted data should be taken with a pinch of salt, since the results are still subject to frequent and substantial changes for all indicators from release to the next, stretching back as far as the first quarter 2020.

- Separately, Saudi Statistics also published industry production data for the month of December. This showed continued acceleration of industry output (+11.2% in December, the highest rate for the year as a whole), which is still being driven by rising oil production.

- According to the latest data from the KNBS, Kenya's robust

annual GDP growth recorded in the second quarter of 2021 spilled

over to the third quarter, as the figures benefited from the low

base in the previous year. Nevertheless, the rebound was

underpinned by the gradual easing of COVID-19 pandemic-related

containment measures and government interventions in the latter

half of 2021. Kenya's real GDP grew by 9.9% year on year (y/y) (not

seasonally adjusted) in the third quarter of 2021, compared with

solid growth of 11.9% y/y in the second quarter. The figures for

the corresponding periods in the previous year were a contraction

of 2.1% y/y in the third quarter and a contraction of 4.7% y/y in

the second quarter. (IHS Markit Economist Ronel Oberholzer)

- The sectors that supported overall growth were mainly in the services sector, but manufacturing and construction also showed strong growth. In the third quarter of 2021, the sectors with particularly strong growth were mining and quarrying (25.1% y/y), manufacturing (9.5% y/y), accommodation and restaurants (24.8% y/y), and transport and storage (13% y/y). However, severe drought conditions in the northern part of Kenya impacted negatively on overall agricultural activity for most of 2021. The contraction in this sector accelerated from 0.1% in the first quarter to 0.7% in the second quarter and 1.8% in the third quarter. Since the October to December 2021 short rains largely failed, with a pessimistic outlook for the March to May 2022 long rains, the agricultural sector, contributing around 20% of GDP, is expected to continue to drag down growth through 2022.

- The tourism industry, although contributing only 0.8% of GDP, is vital to the external accounts. The latest statistics released by the KNBS show that 76,706 tourists visited Kenya in November 2021, a 146% y/y improvement. Nevertheless, Kenya's tourism industry remains susceptible to recurrent regional and global restrictions due to the slow rollout of the COVID-19 vaccination program. Around 13.3% of the population is fully vaccinated to date.

- Leading indicators for the second half of 2021 point to strong economic growth, although slightly lower than in the first half of the year. Cement production and cement consumption were up 22.12% y/y and 20.5% y/y, respectively, in October 2021. Likewise, the value of approved building plans jumped in September, after posting negative growth rates since January 2021. In November, electricity generation rose by 4.5 y/y, from 3.0% y/y in the previous month.

- A Renault Group-backed battery startup has chosen Dunkirk (France) as the location for its new manufacturing facility. Verkor said in a statement that it chose the site from 40 possible locations in France, Spain, and Italy. The site covers more than 150 hectares and "meets all the requirements for a Gigafactory in terms of land, logistics, energy capacity, proximity to customers, access to a qualified workforce, and scalability", the company said. Verkor says that construction of the facility is set to begin in 2023 and the first batteries are scheduled to be supplied to an electric vehicle (EV) that is due to enter into production in July 2025. It anticipates that manufacturing capacity will increase from 16 GWh in 2025 to 50 GWh by 2030. Verkor expects to create 1,200 direct jobs and 3,000 indirect jobs during the first phase. (IHS Markit AutoIntelligence's Ian Fletcher)

- Kenya-based electric vehicle (EV) startup BasiGo has announced the closure of USD4.3 million in seed funding, TechCrunch reports. The EV startup intends to sell mass transit vehicles in Kenya by setting up an assembly plant in Nairobi. The seed-funding round was led by Novastar Ventures, with participation from Moxxie Ventures, Nimble Partners, Spring Ventures, Climate Capital, and Third Derivative. The USD4.3 million includes USD930,000 raised during the pre-seed round in 2021. BasiGo set up a charging and bus servicing station in Nairobi after the import of two electric buses as part of a pilot program. BasiGo's buses will have a capacity of 25 to 36 seats, with a range of about 250 kilometers, and will use parts sourced from China's BYD Automotive. BasiGo co-founder and CEO Jit Bhattacharya said, "We are thrilled to be partnering with Novastar, Moxxie and this incredible group of investors, all of whom are deeply experienced in rapidly scaling businesses in this market. They understand this extraordinary moment of opportunity and urgency as time runs out for the world to make a meaningful impact on climate emissions." He added, "With East Africa's abundant renewable energy, this market can leapfrog to clean, modern electric transit at the exact moment that African cities emerge as the next center of economic growth. The support and knowledge of this investor group will catalyze BasiGo in its mission to make East Africa a leader in inclusive, sustainable bus transport." The startup aims to supply over 1,000 mass transit electric buses to transport operators in Nairobi in the next five years and will offer pay-as-you-drive credit options to drivers, maintenance, and charging services for early adoption. Kenya is in the early stages of moving to electric mobility. It plans for at least 5% of vehicles registered in the country to be EVs by 2025. The Kenyan government has also announced that its Bus Rapid Transit (BRT) network, due for completion this year, will only be operated by electric, hybrid, and biodiesel vehicles. This will provide more opportunities for Opibus and BasiGo. (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- All major APAC equity markets closed higher for a second consecutive day; India +0.8%, Japan +0.4%, Hong Kong +0.4%, Australia +0.3%, Mainland China +0.2%, and South Korea +0.1%.

- Battery electric vehicles (BEVs) are emitting more lifecycle

CO2 than internal combustion engine (ICE) cars in parts of northern

China, mainly due to the region's fossil fuel-dominated power

generation mix, according to a recent study from Chinese

researchers. (IHS Markit Net-Zero Business Daily's Max Lin)

- With strong policy support measures, including subsidies for vehicle purchases as well as government-sponsored technology and infrastructure rollouts in the past decade, China has emerged as the largest producer and buyer of BEVs globally.

- Chinese policymakers see higher penetration of low-emission cars as essential to meeting the country's targets of peak CO2 emissions by 2030 and carbon neutrality by 2060. But the study from Bowen Tang of Hubei University of Technology, Yi Xu of Wuhan University, and Mingyang Wang of State Grid Sichuan Electric Power Company suggests more BEVs do not always lead to lower emissions.

- Assessing 30 Chinese provinces and municipalities, the study found higher CO2 emissions from BEVs than ICE vehicles in Beijing, Heilongjiang, Jilin, Tianjin, Shandong, Shanxi, and Hebei. In Beijing, where the difference is widest, a BEV would emit 45.7 metric tons (mt) in its lifecycle while an ICE vehicle would emit 42.2 mt.

- In contrast, BEVs can help reduce CO2 emissions in other areas. In Yunnan, where the decarbonization impact is the strongest, a BEV's lifecycle emissions amount to nearly 12 mt while an ICE vehicle's emissions are 30.3 mt.

- "The promotion of BEVs helps to reduce carbon emissions in most regions in China," the researchers said. "However, the effectiveness of the emissions reduction dramatically varies … due to the difference in electricity generation mix, thermal power generation technology, and electricity transmission efficiency."

- The study highlighted the high proportions of coal, natural gas, and oil-fired power units in the electricity mix of the seven Chinese regions where BEVs have negative climate effects. Fossil fuels are responsible for 85%-90% of the power generation in three of them, and more than 90% in the other four.

- AutoX says its robotaxi fleet has expanded to more than 1,000 vehicles, which it claims to be the largest in China. The fleet is concentrated mainly in four Chinese cities: Beijing, Shanghai, Guangzhou, and Shenzhen. In addition, AutoX has opened a robotaxi operations center in San Francisco, California (United States), reports Gasgoo. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hong Kong SAR's consumers are struggling with fresh vegetable

price hikes, with a huge temporary supply shortage due to the Covid

disruption. Panic buying has been observed. (IHS Markit Food and

Agricultural Commodities' Hope Lee)

- Leafy vegetables from the mainland have seen prices rise significantly. On 5 February, the wholesale price for Choi Sum was HKD23.8 per kilo ($3.05/kg) compared with HKD12.6/kg on 24 January, 89% up; Pak Choi went up to HKD21.8/kg from HKD12.2/kg, Dou Miao was sold for HKD72.6/kg from HKD32.2/kg, according to the vegetable trade body. Meanwhile, retail prices soared 20-40%.

- The supply of meat, poultry and eggs remains stable.

- Vegetable vendors at the wet market said that wholesalers had raised their prices with some even doubling their usual rates. Vendors have had to pass on those increased costs to their consumers, local media reported.

- Hong Kong SAR's daily production (about 40 tons) of fresh vegetables accounts for only 1.6% of its total consumption. In 2021, Hong Kong SAR's fresh vegetable imports rose 14% y/y to $812 million. Imports of vegetables from the US lowered 12% y/y to $17 million, according to the USDA.

- Vegetables from the mainland make up about 91% by volume and 80% by value of the local market, according to the Hong Kong Imported Vegetable Wholesale Merchants Association.

- Taiwan's Foxconn will start a USD8-billion investment in Indonesia during the third quarter of 2022 to produce electric vehicles (EVs) and batteries, reports Reuters, citing Indonesian Investment Minister and head of the Investment Coordinating Board (BKPM) Bahlil Lahadalia. The company will build a plant, which will span over an area of 200 hectares, in an industrial zone in Batang in Central Java to make battery cells, cathode precursors, and telecommunications spare parts, in addition to the vehicles. The Reuters report highlights that Foxconn did not immediately respond to a request for comment on the investment. Last month, Foxconn signed a memorandum of understanding (MOU) with the Indonesian Ministry of Investment as well as Indonesia Battery Corporation, energy firm PT Indika Energy, and Taiwanese electric scooter vendor Gogoro to jointly develop a battery manufacturing and EV ecosystem in the country. (IHS Markit AutoIntelligence's Jamal Amir)

- South Korea's capital city Seoul will start the commercial operation of robotaxi service on 10 February, reports AJU Business Daily. A total of four autonomous vehicles (AVs; three electric sport utility vehicles [SUVs] and one mini-van) will be deployed to cover two different routes of 5.3 km and 4.0 km. A fare of KRW2,000 (USD1.7) will be charged each time a passenger hails the ride using the TAP! app. Seoul eventually plans to operate more than 50 AVs in Sangam's pilot zone by 2026. This is part of Seoul's recently announced five-year plan worth KRW148.7 billion to build city-wide AV infrastructure, with an aim to deploy more than 300 AVs and related services by 2026. South Korea has been launching numerous initiatives to become a leader in autonomous technology. It is also making efforts to revise existing traffic rules to accommodate AVs. Last year, Seoul passed a regulation that will allow the commercial operation of AVs. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Indonesia's state-owned energy company Pertamina plans to

jointly develop carbon capture, utilization and storage (CCUS)

technology with Japan's Chiyoda Corporation, Chiyoda said in

late-January. (IHS Markit Chemical Market Advisory Service's Chuan

Ong)

- Both parties signed a memorandum of understanding on the CCUS project in mid-January, which aimed to provide solutions to climate change issues and to work towards a low-carbon society.

- Pertamina and Chiyoda agreed to support emission reductions through the development of new and renewable energy.

- They also agreed to target net-zero emissions and to promote climate goals.

- Additionally, both parties will collaborate on CCUS technology application studies, and hydrogen production.

- Japanese engineering company Chiyoda said it has been working with Pertamina since the early 1980s, providing engineering, procurement and construction

- (EPC) service for LNG plants and utility facilities in Bontang,

Kalimantan Island, Arun, and Sumatra Island.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-february-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-february-2022.html&text=Daily+Global+Market+Summary+-+10+February+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-february-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 10 February 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-february-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+10+February+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-february-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}