Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 10, 2021

Daily Global Market Summary - 10 June 2021

Most major US and APAC equity indices closed higher, while most European markets were lower. US government bonds closed sharply higher for the third day and benchmark European bonds were mixed. iTraxx-Europe (IG) closed flat, while iTraxx-Xover, CDX-NAIG, and CDX-NAHY closed modestly tighter. Copper closed lower, the US dollar and gold were flat, and natural gas, oil, and silver were higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except for Russell 2000 -0.7%, with the S&P 500 +0.5% closing at a new all-time high; Nasdaq +0.8% and DJIA +0.1%.

- 10yr US govt bonds closed -4bps/1.45% yield and 30yr bonds -4bps/2.13% yield, with both bonds being as low as +4bps at 9:00am ET before rallying 8bps by the close.

- CDX-NAIG closed -1bp/49bps and CDX-NAHY -4bps/278bps.

- DXY US dollar index closed flat/90.08, being as high as +0.2% (9:34am ET) and as low as -0.1% (10:23am ET) on the day.Gold closed flat/$1,896 per troy oz, silver +0.1%/$28.03 per troy oz, and copper -1.0%/$4.49 per pound.

- Crude oil closed +0.5%/$70.29 per barrel and natural gas closed +0.6%/$3.15 per mmbtu.

- The US consumer price index (CPI) rose 0.6% in May following a

0.8% increase in April. The core CPI rose 0.7% in May after a 0.9%

increase in April. The CPIs for food and energy rose 0.4% and were

unchanged (0.0%), respectively. Energy prices have been little

changed on net over the last two months following large increases

from the middle of 2020 through March 2021. (IHS Markit Economists

Ken

Matheny and Juan

Turcios)

- May's increases in consumer prices reflected a combination of increased demand with the reopening of the economy and supply-chain disruptions. Among the indices that posted substantial price increases were new vehicles (1.6%), airline fares (7.0%), and used cars and trucks (7.3%). The increase in the latter accounted for about one-third of the rise in the CPI. Strong demand for new vehicles has encountered tight inventories amid supply-chain disruptions, contributing to robust demand and large price increases for used motor vehicles. The CPI for used cars and trucks is up 29.7% from last May.

- The CPI rose 5.0% over the 12 months through May. The core CPI rose 3.8% over the same period, the largest 12-month increase since June 1992. Twelve-month inflation figures are boosted by comparison with low readings at the onset of the pandemic last spring.

- Seasonally adjusted (SA) US initial claims for unemployment

insurance fell by 9,000 to 376,000 in the week ended 5 June, its

lowest level since the week ended 14 March 2020. The number of

workers seeking unemployment benefits is falling as companies are

struggling to fill job openings and thus are hesitant to lay off

existing employees. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) decreased by 258,000 to 3,499,000 in the week ended 29 May, its lowest level since the week ended 21 March 2020. The insured unemployment rate fell 0.2 percentage point to 2.5%.

- In the week ended 22 May, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 69,869 to 5,231,952.

- There were 71,292 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 5 June. In the week ended 22 May, continuing claims for PUA dropped by 12,730 to 6,347,472.

- In the week ended 22 May, the unadjusted total of continuing claims for benefits in all programs fell by 95,099 to 15,349,465.

- Governors in many states—25 at last count—have announced an early end to pandemic-related federal unemployment programs. The federal pandemic-related unemployment programs, which include extra $300-a-week payments, the PUA and the PEUC, were set to expire on 6 September. They are now slated to expire between 12 June and 19 July in the 25 states that have opted out.

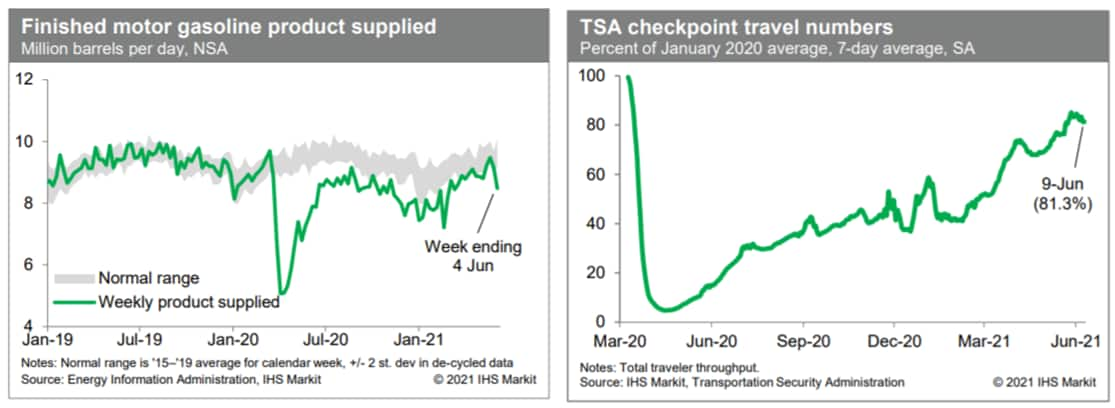

- US consumption of gasoline fell sharply last week and was below

the lower end of a normal range. There are various sources of

volatility for these data, though, and the broader trend, to date,

is solid. The next few weeks will reveal whether the trend in

gasoline consumption has remained within or has slipped below a

normal range. Meanwhile, averaged over the week ending yesterday,

passenger throughput at US airports (after seasonal adjustment) was

about 81% of the January 2020 level. This is down somewhat from

recent days but still up considerably from this past winter, when

airport passenger traffic was running at roughly one-half of the

January 2020 pace. These data still indicate ongoing broad recovery

in air travel. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- The Biden administration released a battleplan for

strengthening the US lithium-ion battery industry 8 June, taking

another step forward in support of its decarbonization and

electrification targets. The centerpiece of the administration's

response was the blueprint, helmed by five goals (IHS Markit

Climate and Sustainability News' Keiron Greenhalgh):

- Secure access to raw and refined materials and discover alternates for critical minerals for commercial and defense applications.

- Support the growth of a US materials-processing base able to meet domestic battery manufacturing demand.

- Stimulate the US electrode, cell, and pack manufacturing sectors.

- Enable US end-of-life reuse and critical materials recycling at scale and a full competitive value chain in the US.

- Maintain and advance US battery technology leadership by strongly supporting scientific R&D, STEM education, and workforce development.

- GM has issued a new statement on its recommendations and suggestions for vehicle emission and fuel-economy regulations, in support of the US federal government adopting the standards in the Californian vehicle emission framework agreed to by several other automakers in 2020. The GM statement represents a reversal of position from its decision in 2019 not to enter into the California agreement, although it is consistent with the company's support of the introduction of one set of national standards and with the automaker's electric vehicle (EVs) objectives. Under US President Joe Biden, the US has rejoined a global effort to reduce greenhouse gas emissions and achieve carbon neutrality under the Paris Climate Agreement, and is placing much more emphasis on EVs than the previous administration of President Donald Trump. The shift in presidential objectives has not fundamentally changed GM's strategy, but the company does sense an opportunity to move forward on the agenda, as well as a more open environment for the discussion. (IHS Markit AutoIntelligence's Stephanie Brinley)

- US autonomous vehicle (AV) technology company Argo AI CEO Bryan Salesky has said the company is considering launching an initial public offering (IPO) next year, according to a media report. During an appearance at an industry event recently, Salesky reportedly said, "So we're actively fundraising and are going out this summer to raise a private round initially. And then we're looking forward to an IPO within the next year… The raise this year will definitely provide capital that gives us plenty of runway and will help us continue to scale." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Karl Iagnemma, CEO of Motional, said the company is planning to explore potential involvement in autonomous trucking or logistics, reports TechCrunch. He also said that Motional still believes the biggest economic opportunity is solved by tackling the difficult technological issues of autonomy in the service of moving people, also known as the robotaxi model. Motional, a joint venture (JV) between Hyundai and Aptiv, has formed partnerships with ride-hailing firm Lyft and ride-sharing startup Via to offer robotaxi services (see United States: 17 December 2020: Motional partners with Lyft to launch driverless robotaxi services in major US cities by 2023 and United States: 28 October 2020: Hyundai-Aptiv JV partners with Via to launch robotaxi service in 2021). To date, it has delivered more than 100,000 autonomous rides with zero at-fault incidents. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- According to Argentina's National Institute of Statistics and

Censuses (Instituto Nacional de Estadística y Censos: INDEC), the

country's industrial production increased by 55.9% year on year

(y/y) in April. Seasonally adjusted data show a 0.3% month-on-month

(m/m) increase in April, compared with a 0.7% m/m increase in March

(revised figure). (IHS Markit Economist Paula

Diosquez-Rice)

- The largest annual increases in April were in vehicle assembly, clothing and apparel, general equipment, tobacco products, and other transport equipment, among others. A few sectors posted a slower y/y expansion in April: food and beverages, chemicals, and wood, paper, and printing.

- A qualitative industrial poll of companies conducted by the INDEC shows that 38.4% of respondents estimate that demand will expand in May-July, compared with the same period in 2020 (down from 43% in the previous month's survey). The percentage of respondents that expect demand to remain relatively the same increased to 38%, while 54% of respondents expect exports to remain at a similar level during the period.

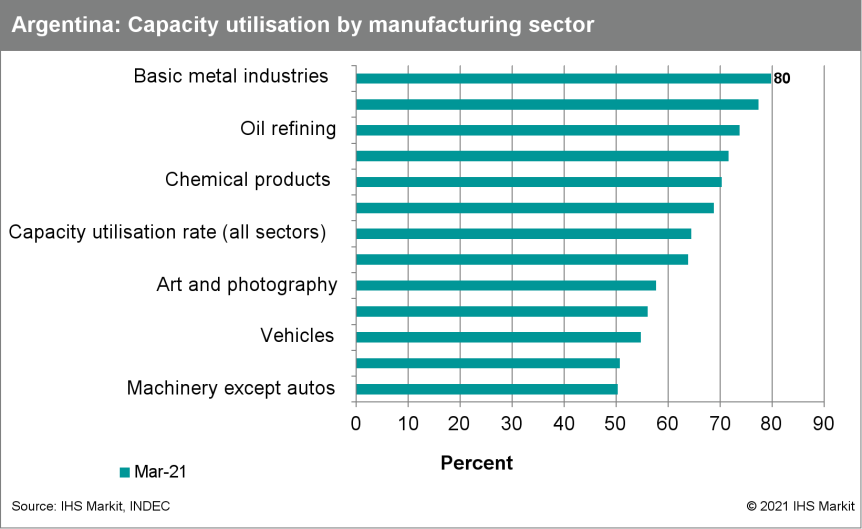

- The utilized capacity of Argentina's manufacturing sector rose

to 64.5% in March, the highest level since October 2018. The basic

metals industries had the highest utilized capacity at nearly 80%,

followed by the non-metallic minerals, oil refining, and chemicals

sectors. The sectors with the least utilized capacity were the

machinery except auto and textiles industries, at 50% and 51%,

respectively.

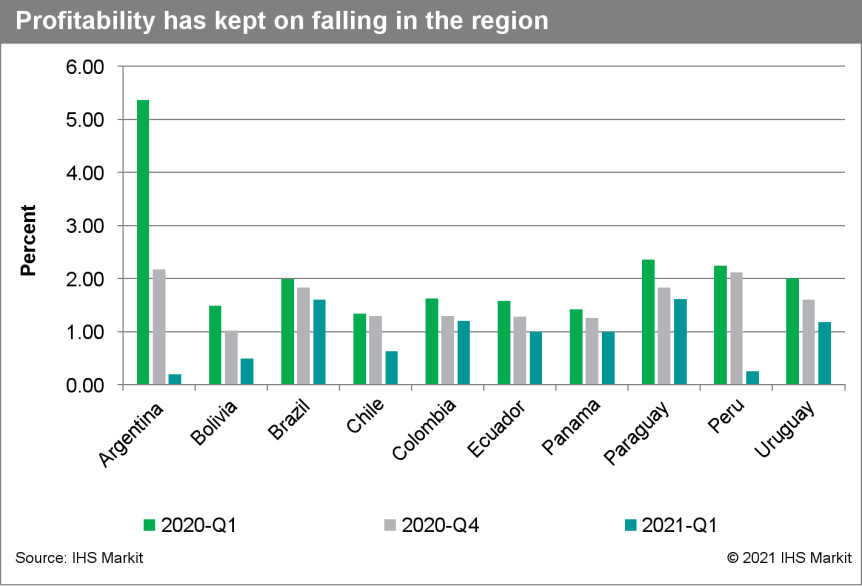

- IHS Markit has analyzed the main banking-sector indicators for

March in Argentina, Brazil, Bolivia, Chile, Colombia, Ecuador,

Panama, Peru, and Uruguay. Our key findings indicate that credit is

still growing in most countries, and that profitability has

continued to decline and impairment is increasing slowly. For the

rest of 2021, we expect a very moderate recovery in profitability,

although impairment will continue to rise. All averaged figures

presented here are calculated by simple (non-weighted) averages.

The data for Brazil were estimated through the average of the

largest five banks in the country. (IHS Markit Banking Risk's

Alejandro Duran-Carrete)

- Credit growth continued to grow in most of the region, although it has started to stall as credit-encouragement measures are being retracted. Credit grew at an average of 6.7% year on year (y/y) in March. Central bank liquidity support, aided by state-guaranteed credit measures, helped the region avoid the sharp decline that other countries, such as Mexico and those in Central America, have experienced over the last quarters

- Non-performing loans (NPLs) are still low but are slowly picking up. The average NPL ratio grew from an average of 2.7% at the end of 2020 to 2.9% in March 2021. The rise is mostly explained by those loans that received some type of forbearance and are starting to return to normal circumstances. Except for Argentina (whose corporate sector has been severely hit over the last three years of recession), most of the increase in impairment ratios stems from the household sector, which weakened progressively from the rise in unemployment in the region.

- Capital ratios remain adequate in most of the region except for Bolivia and Chile. With an average capital adequacy ratio at 17.5% in March, the sector displays substantial capitalization, growing by 1.4 percentage points since March 2020. This is a consequence of a large increase in lower risk-weighted assets (RWAs), such as cash and government securities where incoming deposits have been allocated.

- Profitability declined and is likely to remain low over the

rest of 2021. Profitability measured as return on assets (ROA)

averaged 0.9% in March, well below the 2.1% figure a year ago.

Europe/Middle East/Africa

- Most major European equity indices closed lower except for UK +0.1%; Germany -0.1%, Spain -0.2%, France -0.3%, and Italy -0.4%.

- 10yr European govt bonds closed mixed; Italy -3bps, Germany -1bp, Spain flat, and France/UK +1bp.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover -4bps/236bps.

- Brent crude closed +0.4%/$72.52 per barrel.

- Against a backdrop of ongoing financial market concerns over

rising inflationary pressures, and despite substantial upward

revisions to some of its macroeconomic projections, following its

June policy meeting the ECB opted to maintain the higher rate of

asset purchases under its pandemic emergency purchase programme

(PEPP), which was initially introduced in March 2020. (IHS Markit

Economist Ken

Wattret)

- Evidently, the ECB's revealed preference remains to look through what it considers to be transitory effects on inflation and to prioritize the prevention of what it would consider to be a premature tightening of financial conditions in the eurozone via a sustained rise in bond yields.

- The ECB's key policy announcements are below, with no

significant changes made compared with its prior meeting in April:

- Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council expects net purchases under the PEPP over the coming quarter to continue to be conducted at a significantly higher pace than during the first months of the year.

- The Governing Council will continue to conduct net asset purchases under the PEPP with a total envelope of EUR1.85 trillion (USD2.25 trillion) until at least the end of March 2022 and, in any case, until it judges that the coronavirus disease 2019 (COVID-19) crisis phase is over.

- There were numerous significant changes to the ECB's economic

assessment, including the following:

- The annual real GDP growth projections for 2021 and 2022 were both revised up by 0.6 percentage point, to 4.6% and 4.7%, respectively. The projection for 2023 was unchanged at 2.1%.

- The assessment of risks to growth was described as "broadly balanced", with the removal of the prior reference to downside risks in the near term.

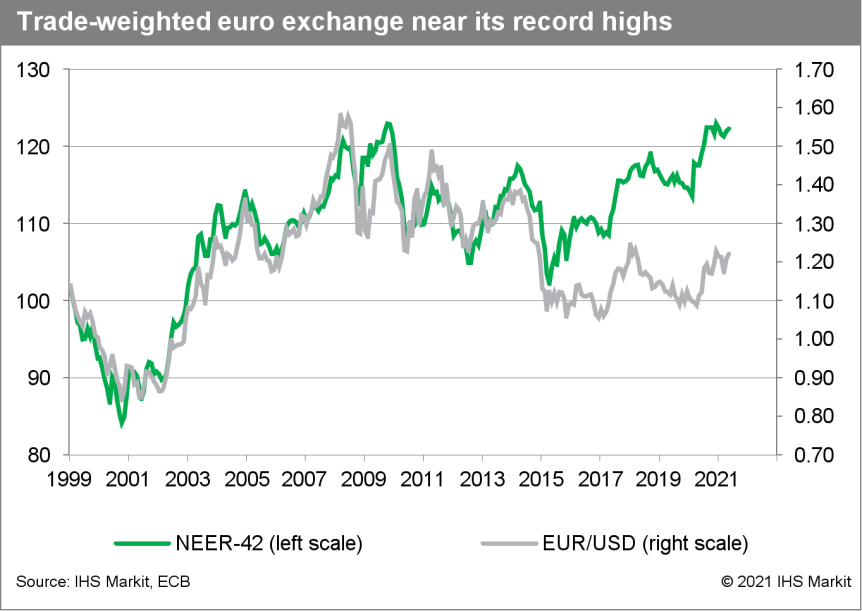

- The ECB's ongoing policy stimulus has helped to keep a lid on

bond yields, yield spreads and the EUR/USD exchange rate, although

the euro on a trade-weighted basis remains uncomfortably high

- Battery maker Northvolt, a Volkswagen (VW) Group supplier, has raised USD2.75 billion to expand its Swedish factory from a planned 40 GWh to 60 GWh, according to company statements. Northvolt says that the funding will finance more battery cell production capacity and R&D efforts "to meet the increasing demand of customers engaged in the transition to decarbonized, electric solutions." Northvolt says that it has, including this round, raised more than USD6.5 billion in equity and debt to support its expansion plan to 150 GWh of deployed production capacity in Europe by 2030. Northvolt also says it has more than USD27 billion in contracts from key customers, noting that those include BMW, Fluence, Scania and VW. Northvolt's plans include recycling capabilities to ensure 50% of all its raw materials requirements to be sourced from recycled batteries by 2030. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Eckes-Granini is now packing its one-liter Hohes C juice in bottles made entirely from recycled plastic (rPET). The company has worked with the KHS Group, which was responsible for ensuring that the new bottle could be produced on Eckes' existing InnoPET FreshSafe block. Eckes has been using 25% rPET in its Hohes C PET juice bottles since 2018. "Bearing the EU's plastic strategy in mind and the increase in recyclate quotas this prescribes, we've now decided to switch to using recycled PET only," commented Hermann Naumann, plant manager for Eckes-Granini in Bad Fallingbostel in Lower Saxony. The changeover to rPET will save over 4,000 tons of new PET annually and reduce carbon emissions by about 8,000 tons per year. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- As part of Italy's national recovery and resiliency plan, the civil procurement agency Consip has launched strategic tender competitions, valued at a combined total of up to EUR600 million (USD730 million), for telemedicine and digital healthcare services, including information technology related to electronic medical records. In December 2020, Prime Minister Giuseppe Conte's coalition government approved an ambitious COVID-19 recovery plan, including a EUR19.7-billion (USD24.0 billion) allocation of resources to improve healthcare services. (IHS Markit Life Sciences' Eóin Ryan)

- Despite above-target inflation and stronger-than-expected first-quarter domestic demand, Poland's Monetary Policy Council (MPC) maintained the base interest rate at a historic low of 0.1% during its session on 9 June. (IHS Markit Economist Sharon Fisher)

- Interest rates remain unchanged despite an acceleration of inflation to a preliminary 4.8% year on year (y/y) in May, well above the 1.5-3.5% target band set by the National Bank of Poland (NBP). In a statement published after the session, the MPC commented that the current inflationary pressures are temporary and beyond its control, driven by electricity price hikes at the start of 2021, rising global commodity prices, and supply-chain disruptions.

- The MPC added that retail sales growth remained below pre-pandemic levels in April, while construction activity was clearly negative, signaling that growth remains a top priority

Asia-Pacific

- Most major APAC equity markets closed higher except for Hong Kong closing flat; India +0.7%, Mainland China +0.5%, Australia +0.4%, Japan +0.3%, and South Korea +0.3%.

- China's Guangdong province has seen pockets of outbreaks with about 200 Covid-19 cases reported as of 9 June. Strict travel restrictions within and beyond the whole province, track and trace and mass vaccination are undergoing. Foodservice outlets are temporarily shut down, takeout only or running at restricted capacity. Some non-essential facilities such as entertainments are closed. Guangdong's major ports such as Shenzhen's Yantian and Shekou and Nansha are experiencing the shipping schedule delay and this situation could last 10-20 days, depending on how the situation unfolds, a local shipping agent told IHS Markit. Local governments and officials are on high alert about any rise in COVID-19 cases as the central government has seriously disciplined provincial or municipal officials where Covid-19 has re-emerged. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Citing its own sources and not publicly announced, Reuters

reported on 9 June that the People's Bank of China (PBoC) is

planning to change the deposit interest-rate ceiling for demand

deposits. The planned change will allow banks to offer a demand

deposit interest rate at 20 basis points (bps) higher than the

benchmark deposit rate. In terms of fixed deposits, smaller banks

and foreign banks are allowed to offer 75 bps on top of the

benchmark deposit rate. (IHS Markit Banking Risk's Angus

Lam)

- China last reformed its deposit rate rule in 2015, when the authorities removed the deposit ceiling. Instead, banks have to adhere to the rule of offering a maximum deposit interest rate at 1.5 times (originally 1.1 times in 2014) the benchmark deposit rate, and regulators have established the use of the reserve requirement ratio to ensure that competition for deposits among banks is not too fierce.

- From a cost perspective: The current one-year benchmark deposit interest rate is 1.5% (unchanged from 2015) and, theoretically, the maximum deposit interest rate banks can offer is 2.25% (1.5 times 1.5%) and is unchanged. However, for demand deposit, of which the benchmark rate is 0.35%, the 20-bps spread will result in a higher demand deposit interest-rate limit of 2.5 bps, a negligible amount that is unlikely to sway depositors and affect banks' costs.

- Shanghai is aiming to have 10,000 hydrogen-powered vehicles on its roads and 100 hydrogen refueling stations in the city by 2023, according to the South China Morning Post citing a statement from Chen Kele, a deputy division chief at the Shanghai Commission of Economy and Information Technology. The city will invest heavily in alternative energy sources and plans to create nine scenarios to push the use of hydrogen-powered vehicles. By the end of last year, Shanghai had 1,200 hydrogen-powered vehicles on its road and just nine hydrogen refueling stations. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- South Korea's Kakao Mobility has secured additional investment funding of KRW140 billion (USD125 million) from a consortium led by private equity giants TPG and Carlyle Group, reports Reuters. This brings the company's total funding to KRW920 billion (USD826 million). Kakao Mobility, a subsidiary of Kakao Corporation, provides transport services such as online taxi-hailing, parking, navigation, and electric bike sharing. The company offers these services through its app, KakaoT, which has 28 million registered users. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Singapore's Grab, which is going public through a merger deal with a special-purpose acquisition company (SPAC), has said that it expects to complete the merger during the fourth quarter of this year. When announcing the merger in April, Grab said it planned to complete the deal with Altimeter Growth Corporation in the third quarter. The delay comes as Grab is currently working on finalizing its financial audit of the past three years in accordance with US Securities and Exchange Commission (SEC) requirements. Grab is also working with the SEC to "obtain pre-clearance of certain accounting policies and related financial disclosures", reports Reuters. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-june-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-june-2021.html&text=Daily+Global+Market+Summary+-+10+June+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-june-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 10 June 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-june-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+10+June+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-june-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}