Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 10, 2021

Daily Global Market Summary - 10 March 2021

All major European and most US equity indices closed higher, while APAC was mixed. US government bonds closed almost unchanged on the day, while most benchmark European bonds were slightly higher. iTraxx Europe was close to flat on the day, while CDX-NA was tighter across IG and high yield. The US dollar and silver closed lower today, while oil, natural gas, gold, and copper were higher.

Americas

- Most US equity markets closed higher, except for Nasdaq ending the session flat; Russell 2000 +1.8%, S&P 500 +0.6%, and DJIA +0.1%. The DJIA closed at a new all-time high and above 32,000 for the first time.

- CDX-NAIG closed -2bps/53bps and CDX-NAHY -10bps/300bps.

- 10yr US govt bonds closed -1bp/1.52% yield and 30yr bonds closed flat/2.24% yield.

- Hedge funds and other institutional investors are paying an annual rate of as much as 4% to borrow the most recent issue of the 10-year U.S. Treasury note in the market for repurchase agreements, or repos. These hedge funds and others want to borrow and sell the bonds now in a wager that they can buy them back later for less, as rising U.S. rates push bond prices lower. The inversion—which last reached these levels a decade ago—has caught traders and investors off guard. (WSJ)

- DXY US dollar index closed -0.2%/91.82.

- Gold closed +0.3%/$1,722 per troy oz, silver -0.2%/$26.13 per troy oz, and copper +0.5%/$4.03 per pound.

- Crude oil closed +0.7%/$64.44 per barrel and natural gas closed +1.1%/$2.73 per mmbtu.

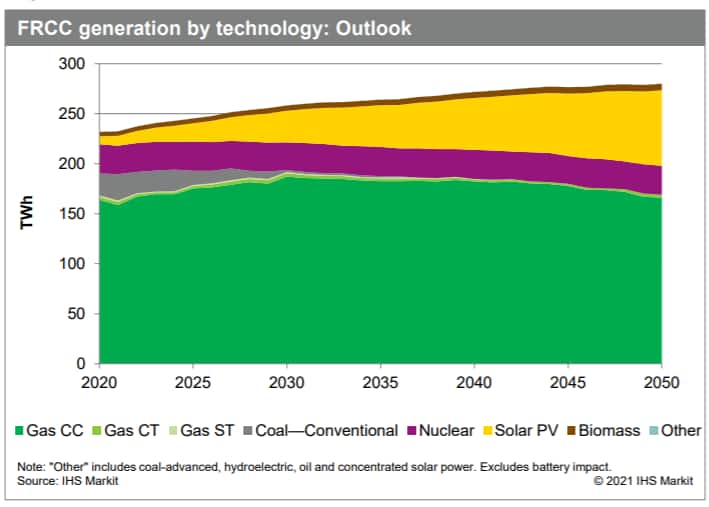

- Florida's importance as one of the largest energy consumers and

a key downstream outlet for natural gas cannot be overstated. The

state accounts for nearly 12% of the total US lower-48 gas demand

from the power sector and sites some of the largest gas-fired power

plants. Transformational developments in power markets and

strengthened focus on clean energy generation are, nonetheless,

reshaping the future of gas in the state (IHS Markit Global Gas

Markets Insight's Suzanne Edwards and Nikolay Filchev):

- Renewables' cost competitiveness and aggressive decarbonization goals have spurred Florida's investor-owned power utilities to embark on a massive solar photovoltaic (PV) build-out. Despite a fast-changing generation mix, however, natural gas will remain a dominant fuel in Florida because of continuous electricity demand growth and the need for firm generation capacity.

- Florida finally has sufficient inbound interstate gas pipeline capacity to meet current and future market needs, preserving basis stability for gas-fired generators and end users. Prior to 2017, supply access was often constrained, but major expansion efforts have helped to mitigate market concerns.

- Lower Mid-Continent supplies will be critical to Florida's gas supply portfolio as Gulf of Mexico production continues to decline and rising Gulf Coast demand competes for the cheapest available molecules.

- Even with the Investment Tax Credits (ITC) declining to 10% for

solar projects completed after 2023 based on the current

legislation, IHS Markit projects that the solar build-out in the

Florida Reliability Coordinating Council (FRCC) will continue at a

brisk pace, resulting in over 45.6 GW in gross additions by

2050.

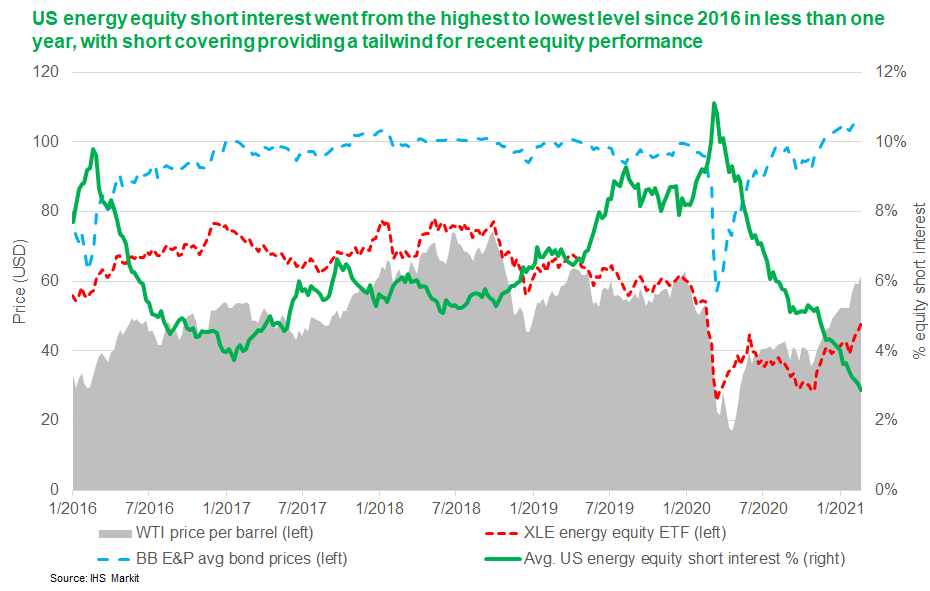

- The below graph shows the weekly average equity short interest

(green line/right axis) from January 2016 to February 2021 for a

static group of 36 US energy companies with a 2021 market cap of

>$500 million. In addition, the graph also shows the price of

WTI, average prices of BB rated US E&P debt, and the XLE energy

ETF closing price. The data indicates that average short interest

for the cohort reached both its highest and lowest level since 2016

within this past year, with the short covering being a substantial

tailwind behind the recent rally in US energy equities.

- President Joe Biden's $1.9 trillion Covid-19 relief bill cleared its final congressional hurdle Wednesday, with the House passing the bill on a 220-to-211 vote, sending it to the president for his signature. (Bloomberg)

- The US CPI rose 0.4% in February following a 0.3% increase in

January. The price index for gasoline rose 6.4%, contributing to a

3.9% increase in the consumer price index (CPI) for energy and

accounting for over half of the rise in the overall CPI. The food

index rose 0.2% while the core CPI, which excludes the direct

effects of movements in food and energy prices, rose 0.1%. (IHS

Markit Economists Ken Matheny and Juan Turcios)

- Outside of the ongoing surge in gasoline prices, inflation remained subdued through February. The CPI rose 1.7% over the 12 months through February, up 0.3 percentage point from January.

- The modest increase in the core CPI in February (0.1%) continued a pattern of low readings in most months since the beginning of the pandemic. Over the last five months, the core CPI has risen at an average annualized rate of just 1.0%.

- Rent inflation firmed in February but remained low. Rent of primary residence rose 0.2% and owner-equivalent rent of residences rose 0.3% in February after both posted 0.1% increases over the prior three months. The 12-month changes for both were 2.0%, down 1.8 and 1.3 percentage points, respectively, from 12-month readings as of February 2020. The CPIs for rent represent about 32% of the overall CPI and 40% of the core CPI.

- The price index for gasoline rose 6.4% in February. Since May, the price of gasoline has risen 46.2%, largely reversing a sharp decline over the first five months of 2020.

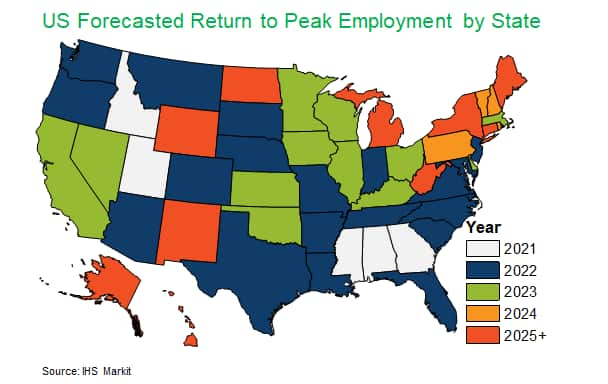

- The below US heat map chart shows the IHS Markit US Regional

Economics teams' current forecast of the year when each US state

will return to peak employment. (IHS Markit Economist Michael

Bugay)

- The recent award of a contract for new-generation US mail delivery vehicles and President Joe Biden's call for increased zero-emission vehicles (ZEVs) in the federal fleet have prompted calls to action from US lawmakers. Reuters reports that a group of 17 Democrats in the US House of Representatives have proposed a bill for providing USD6 billion in funding to support purchase of more ZEVs for the United States Postal Service (USPS). The funding proposal was apparently in part sparked by the USPS saying in February 2021 that it aimed for 10% of its next-generation fleet to be electric vehicles (EVs), although it could do more with more funding, Reuters reports. Reuters quotes the US Postmaster General Louis DeJoy as saying to lawmakers that the USPS does not "have the 3 or 4 billion extra in our plan right now that it would take" to buy 90% EVs. In a separate report, a USPS statement is quoted as saying, "With the right level of support, the majority of the Postal Service's fleet can be electric by the end of the decade." The proposed bill would reportedly require that no less than 50% of the medium and heavy duty vehicle purchases from the USPS be EVs or ZEVs through 2029 and that all new USPS vehicles be ZEVs after January 2040. In addition, three lawmakers are requesting that the USPS award of a contract for 50,000-165,000 new mail delivery trucks awarded to Oshkosh, specifically the USD465 million portion for finalizing production of the vehicle, be frozen until the deal can be reviewed. (IHS Markit AutoIntelligence's Stephanie Brinley)

- For the most part, there were no surprises in the Bank of Canada's March policy announcement. The Bank noted a stronger-than-expected economic outlook, albeit through inventory accumulation and the resiliency in many industries that allow for virtual person-to-person interactions. Like IHS Markit, the Bank anticipates a solid upswing in first-quarter 2021 growth, without providing an actual forecast. IHS Markit is forecasting a 4% quarter-on-quarter annualized rate boost. Stronger global conditions from stimulus spending measures are supporting economies, especially in the US. The solid economic performance is pushing US Treasury yields higher along the curve, resulting in a similar shift for Canadian yields. The pickup in commodity prices is always a boost to Canada's terms of trade and an overall boon to economic wealth. Against this backdrop, the Bank has kept the status quo. Although economic growth is stronger than anticipated, the Bank does not yet believe this is the time to pull back on the quantitative easing program. If the economy advances at a smooth pace compared with the potential choppy pace, then the bond purchase program will likely be reduced. (IHS Markit Economist Arlene Kish)

- Bravo Motor Company (BMC) has announced an investment of USD4 billion to build an electric-vehicle (EV) factory in the Minas Gerais state in Brazil, according to an Autoblog report. According to the source, the plant will be constructed in the city of Belo Horizonte and aims to manufacture 22,790 EVs (as of 2024) and 43,750 lithium-ion battery packs per year, while creating 14,000 direct and indirect jobs. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity markets closed higher; France +1.1%, UK +0.9%, Germany +0.7%, Italy +0.5%, and Spain +0.3%.

- Most 10yr European govt bonds closed higher, except for France flat; Spain, Italy, Germany, and UK -1bp.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover -4bps/250bps.

- Brent crude closed +0.6%/$67.90 per barrel.

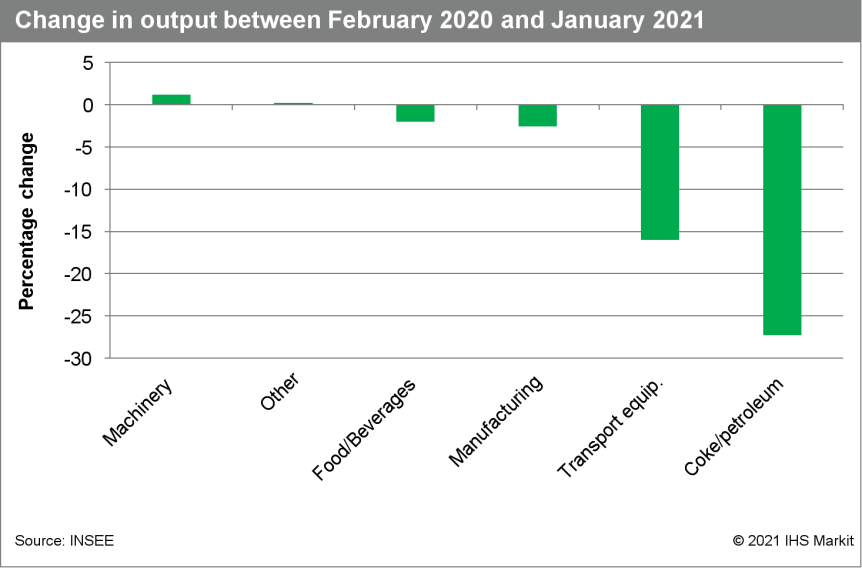

- French industrial production rose by 3.3% month on month (m/m)

in January, according to seasonally adjusted figures released by

the National Institute of Statistics and Economic Studies (Institut

national de la statistique et des études économiques: INSEE).

Production fell by 0.3% in November and 0.7% m/m in December 2020.

(IHS Markit Economist Diego Iscaro)

- Prior to November 2020, industrial production had grown for six successive months. On a year-on-year (y/y) basis, industrial production waned by 0.2% in January, the weakest annual decline since November 2019.

- Manufacturing output also rose by 3.3% m/m in January, following a rise of 1.4% m/m during the previous month. Manufacturing production in December 2020 was still 2.6% below its pre-COVID-19 virus level in February 2020.

- However, there is a large discrepancy among sectors since the start of the pandemic. While output of machinery goods was 1.2% above its pre-pandemic level in January, production of transport equipment was around 16% below its level in February 2020.

- January's m/m increase in output was also driven by an 8.4% m/m increase in production of machinery, and electrical equipment in particular (+11.0% m/m). Production of coke/refined products and food also increased by 7.2% m/m and 1.6% m/m, respectively.

- Production of 'other' manufacturing also rose by a strong 3.9% m/m, boosted by a 30.7% m/m jump in the manufacture of pharmaceutical goods.

- On the other hand, production of transport equipment, which had

risen by 1.2% m/m in December 2020, declined by 2.9% m/m at the

start of 2021.

- Sales of medicines to treat the common cold and influenza (flu) in Germany have declined significantly as a result of the hygiene and social-distancing measures in place during the COVID-19 pandemic. According to Werner Baumann, the CEO of German pharma major Bayer (which has a number of top-selling products in this market segment), quoted by German newspaper Die Welt, sales of cold medications have dropped by 20% year on year (y/y). Die Welt also quoted data from the Federal Union of German Associations of Pharmacists (ABDA) showing that there was a 13% reduction in the number of cold medication packages sold in pharmacies in the first three quarters of the year, and a 20% decrease in the volume of diarrhea medications sold. Conversely, there has been an increase in the sales of dietary supplements; Bayer's Werner Baumann stated that this segment has profited considerably from the pandemic. (IHS Markit Life Sciences' Brendan Melck)

- The German flavor and essential oil processor Symrise has

reported that its 2020 sales increased by 3.3% year-on-year to

EUR3.5 billion (USD4.16 billion). The company has exceeded its

initial 1% growth forecast. (IHS Markit Food and Agricultural

Commodities' Jose Gutierrez)

- EBITDA rose by 5.8% to EUR742 million.

- The chief officer, Heinz Jurgen Bertram, estimated that the 2021 organic sales may rise between 5-7%.

- The company suffered a cyberattack last December, hitting sales although a strong performance between October-November offset these poor results.

- Nutrition segment revenues increased by 8.2% to EUR926 million thanks to pet food sales during lockdowns.

- Meanwhile, the flavor and scent and care segments increased by 1.5% and 0.5%, respectively, to EUR1.37 billion and EUR1.22 billion

- The company has ambitious investments to secure expansion in the long-term, such as new factories in China and Columbia and the acquisition of the fragrance and aroma chemicals business of Sensient Technologies Corporation.

- Continental has announced that it has been hit by a loss during 2020 as a result of the impact of the COVID-19 virus pandemic. During the 12 months ending 31 December 2020, sales fell by 15.2% year on year (y/y) to EUR37.7 million, with organic sales dropping 12.7% y/y. Furthermore, the company said that its EBIT loss had risen compared to 2019, growing from EUR268.3 million to EUR718.1 million. Adjusted EBIT fell by 58.7% y/y to EUR1,333 million, as its adjusted operating margin reached 3.5% compared to 7.3% a year ago. Net income for the year stood at a loss of EUR961.9 million, albeit an improvement on the EUR1,225 million recorded a year ago. However, the company added that its free cash flow before acquisitions and carve-out effects were EUR1.1 billion, against EUR1.3 billion in 2019. (IHS Markit AutoIntelligence's Ian Fletcher)

- German automotive supplier Bosch has partnered with chipmaker GlobalFoundries to develop next-generation automotive radar technology that will power ADAS (advanced driver assistance systems) applications. Under this partnership, GlobalFoundries will develop mmWave automotive radar system-on-chip (SoC) using its 22FDX RF solution. The chips will be manufactured at GlobalFoundries's Dresden (Germany) factory and are delivery is targeted for the second half of 2021. Oliver Wolst, senior vice-president heading Bosch's Integrated Circuit division, said, "Dependable radar and ADAS systems are of paramount importance to drivers and automakers around the world. We chose to partner with GlobalFoundries for their proven leadership in RF and mmWave technology, which is reinforced by their deep expertise in the automotive market. We carefully scrutinized the universe of available semiconductor solutions, and GF's 22FDX RF solution proved to be today's most attractive and most appropriate platform for our next generation of highly efficient and safe automotive radars." (IHS Markit Automotive Mobility's Surabhi Rajpal)

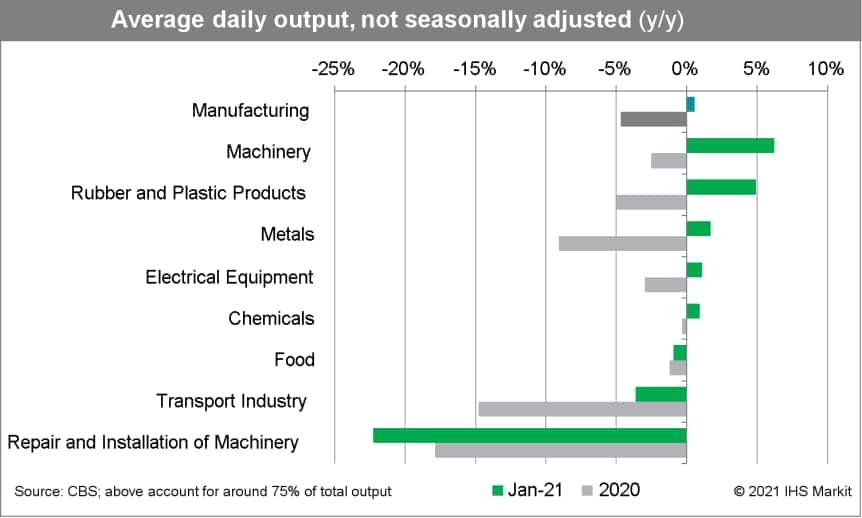

- In January 2021, on a seasonally and working-day adjusted

basis, Dutch manufacturing output was up by 2.3% month on month

(m/m), while the data for December 2020 were revised up from growth

of 0.5% to growth of 1.0%. Output was down by just 0.8% year on

year (y/y) and up by 1.0% compared with February 2020, prior to the

impact of the COVID-19 virus pandemic. (IHS Markit Economist Daniel

Kral)

- In late February, the Netherlands enacted amendments to the Mining Act that introduce a higher Marginal Field Tax Allowance (MFTA) for investment in hydrocarbon projects as well as legal provisions for the repurposing and decommissioning of oil and gas infrastructure. The changes could slow the decline of hydrocarbon production from remaining reserves and are likely to streamline regulatory procedures for the use of upstream infrastructure in clean-energy projects, such as carbon capture and storage (CCS). The amendments to the Mining Act are expected to encourage new investment in Dutch oil and gas projects and prevent the early decommissioning of existing fields. Under the recently enacted legislation, the investment allowance for State Profit Share (SPS), an additional income tax, was increased from 25% to 40% for all investment in offshore and onshore assets. (IHS Markit E&P Terms and Above-Ground Risk's Aliaksandr Chyzh)

- According to Stuart Rowley, president of Ford of Europe in a media interview with Automotive News Europe, the company is considering repurposing some facilities and exiting passenger car lines as it shifts its European range to electric vehicles (EVs). Automotive News Europe quotes Rowley as saying, "The [earlier] restructuring program was very significant. But the next phase of the transformation, however, is going to require further action that could mean rescaling or repurposing facilities or other changes… We will choose segments where there is consumer demand, growth and where we can be profitable. We will not necessarily try to be all things to all men or women in the future." Rowley indicated that Ford may repurpose some plants to produce e-components, including e-axles. "As we transition, there are going to be fewer powertrain plants, equally, we may invest in electric components." Rowley, however, called the Craiova (Romania) plant an asset, as it has begun building the Puma, which has begun outselling the Focus in Europe. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Valmet Automotive has announced that it has started to recruit 1,000 additional permanent staff. In a statement, the company said that the new roles are both production and salaried positions for its vehicle manufacturing and EV Systems business lines. It added that 700 staff will be taken on at Uusikaupunki and 300 at Salo (both Finland). Valmet Automotive is expanding its headcount at both its manufacturing facilities. Salo undertakes battery assembly, and Uusikaupunki is starting to build battery packs alongside its core vehicle manufacturing operations. Both sites require battery builders, logistics workers and quality operators for these operations, in addition to employees for product development, testing and business support tasks. (IHS Markit AutoIntelligence's Ian Fletcher)

Asia-Pacific

- APAC equity markets closed mixed; India/Hong Kong +0.5%, Japan flat, Mainland China -0.1%, South Korea -0.6%, and Australia -0.8%.

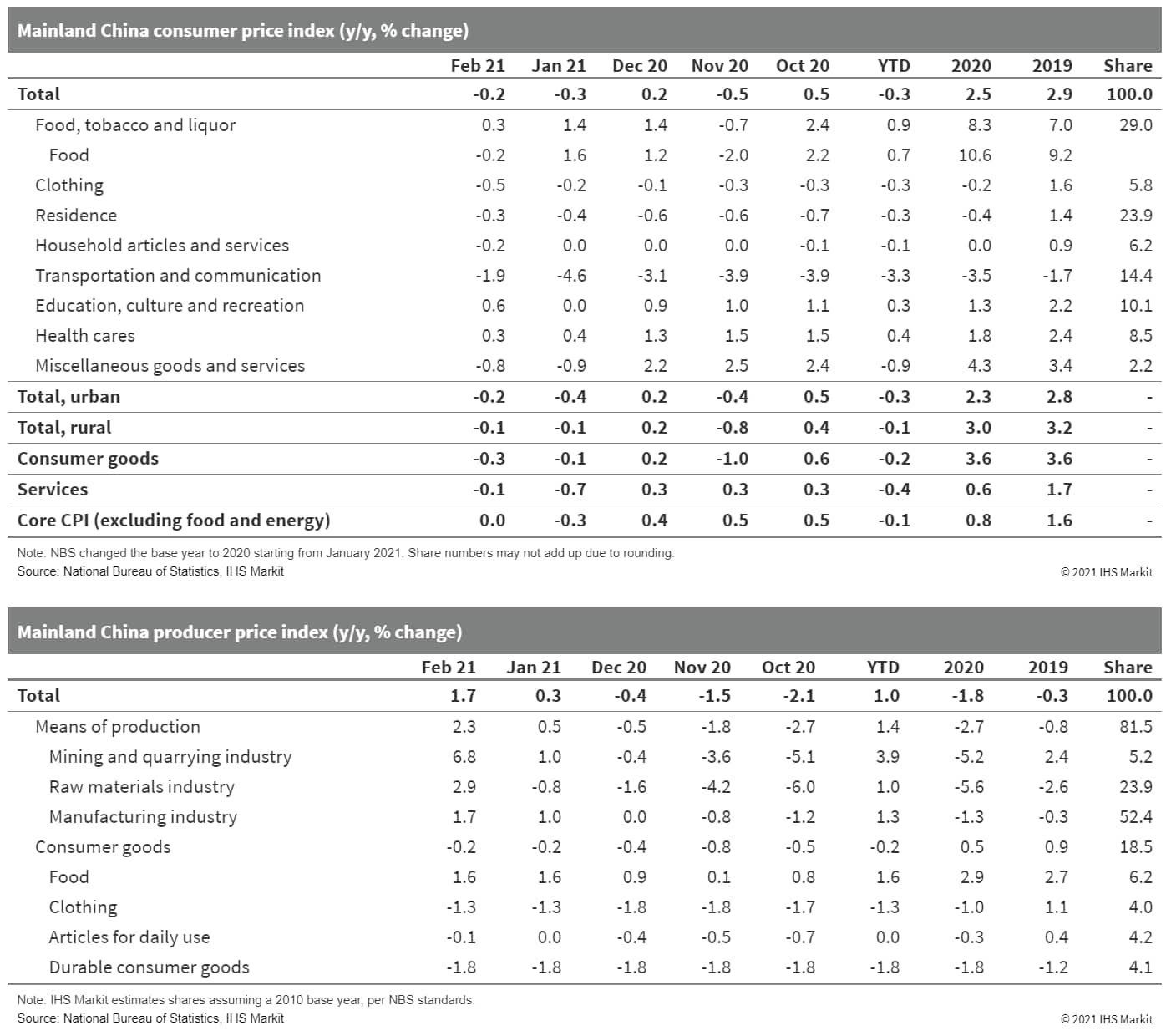

- Mainland China's consumer price index (CPI) registered a

decline of 0.2% year on year (y/y) in February, narrowing from the

0.3% y/y deflation in January, according to the data release by the

National Bureau of Statistics (NBS). Month-on-month (m/m) CPI

inflation edged down to 0.6%, down by 0.4 percentage points from

January's reading. (IHS Markit Economist Lei Yi)

- By component, services prices posted notable improvement in February as deflation narrowed to 0.1% y/y from 0.7% y/y a month ago, thanks to the successful containment of recent regional outbreaks, as well as the low-base effect given February 2020 being the height of national outbreak.

- Producer price index (PPI) increased by 1.7% y/y in February, up by 1.4 percentage points and was the highest since end-2018.

- The divergence between industrial and consumer goods PPI

persisted in February, as the former posted inflation of 2.3% y/y

while the latter remained in deflation of 0.2% y/y. Upstream

sectors seemed to have benefited more from the sustained recovery

in global commodity prices, with largest price gains falling into

mining and quarrying, and raw materials industries.

- Chinese electric vehicle (EV) makers Li Auto, NIO, and Xpeng plan to list in Hong Kong as soon as this year, reports Reuters. The report indicates each plans to sell at least 5% of enlarged share capital in Hong Kong. The initiative will help raise around USD5 billion, based on their market capitalization in the United States on Monday. Xpeng is also reportedly planning to list its share on the STAR Market of mainland China. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Nissan Motor and Mitsubishi Motors plan to launch an electric mini-vehicle in Japan next year with a price under JPY2 million (USD18,400) after subsidies, according to Nikkei Asia. The vehicle is intended for short-range and day-to-day driving as it comes with a battery with a range of around 200 km, thereby reducing the build cost of the vehicle. The price is expected to fall even further to around JPY1.5 million in cities such as Tokyo after accounting for local subsidies. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Japanese city Tokyo's Chiyoda Ward has begun public trials of an autonomous bus. The trials will run until 14 March around a 350-metre section between the Marunouchi Building and the Marunouchi Park Building. The bus, which is manufactured by French company Navya, deploys Boldly Inc.'s autonomous technology. It makes five to eight round trips a day and runs at a speed of about 6 km/hour. Up to six passengers can ride the bus, which will have two attendants on board to take over in case of an emergency. These trials are conducted by the Council for Area Development and Management of Otemachi, Marunouchi, and Yurakucho, reports The Mainichi. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The South Korean government plans to invest more than KRW200 billion (USD175.6 million) in developing automotive chip-making technology by 2022 in an effort to nurture the next-generation vehicle sector, reports the Yonhap News Agency. It plans to co-operate with local automakers to find ways to ease a current supply shortage of automotive chips that may last until the third quarter of 2021, according to South Korean Finance Minister Hong Nam-ki. "As automotive chips are key parts of the car industry and demand for future-generation cars is high, it is urgent to ease a short-term supply shortage of such chips, enhance supply channels and preempt the market," said Nam-ki. (IHS Markit AutoIntelligence's Jamal Amir)

- An executive panel session focused on Asia Tuesday at the IHS

Markit World Petrochemical Conference (WPC) 2021 explored finding a

new normal in a post-pandemic world and the implications for the

chemical industry in APAC. Speaking at the session, Vipul Shah,

COO/petrochemicals at Reliance, said that the company conceived the

idea of its new oil-to-chemicals (O2C) business, ahead of the rest

of the industry. (IHS Markit Chemical Advisory)

- Shah said that waste generation is growing fast in APAC, with rapid growth in plastic consumption. He noted the need to utilize resources productively and move from a linear- to a circular model. He said that Reliance had adopted an integrated approach to a circular economy. The company aims to create an enabling eco-system for widespread adoption of circularity and make India a global leader in plastics recycling, and intends to promote circularity across its value chains and trading partners.

- Shah said that the company is addressing the issue—ranging from the segregation, collection, and processing of waste, to communication—across the digital platform that the company is creating. "Whatever we can recycle, we will recycle, what we cannot recycle, we will use to make roads, put it into energy, conservation of waste-to-oil, bring the oil back to our cracker, and make green polymers." Shah said Reliance's goal is to produce 1 million metric tons/year of recycled material by 2025. The company started polyester recycling 20 years ago in India, he added.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-march-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-march-2021.html&text=Daily+Global+Market+Summary+-+10+March+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-march-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 10 March 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-march-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+10+March+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-march-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}