Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 10, 2021

Daily Global Market Summary - 10 May 2021

Most major APAC equity markets closed higher, Europe was mixed, and all major US indices closed lower. US government bonds closed lower and benchmark European bonds were mixed. European iTraxx was flat across IG and high yield, while CDX-NA was wider on the day. Gold, Brent, and silver were higher, the US dollar and WTI were flat, and copper and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower, despite the DJIA -0.1% briefly hovering above 35,000 for the first time; S&P 500 -1.0% and Nasdaq/Russell 2000 -2.6%.

- 10yr US govt bonds closed +3bps/1.60% yield and 30yr bonds +4bps/2.32% yield.

- CDX-NAIG closed +2bps/52bps and CDX-NAHY +5bps/291bps.

- DXY US dollar index closed flat/90.21.

- Gold closed +0.3%/$1,838 per troy oz, silver +0.1%/$27.49 per troy oz, and copper -0.7%/$4.72 per pound.

- Crude oil closed flat/$64.92 per barrel and natural gas closed -0.9%/$2.93 per mmbtu.

- US technology stocks dropped on Monday as investors braced for further signs that inflationary pressures in the world's largest economy are building. Analysts expect data on Wednesday to show that headline US prices rose 3.6% in April from the same time last year. Chinese factory gate prices, an early indicator of price pressures for importers in the west, are forecast to have jumped more than 6% in a report to be released on Tuesday. (FT)

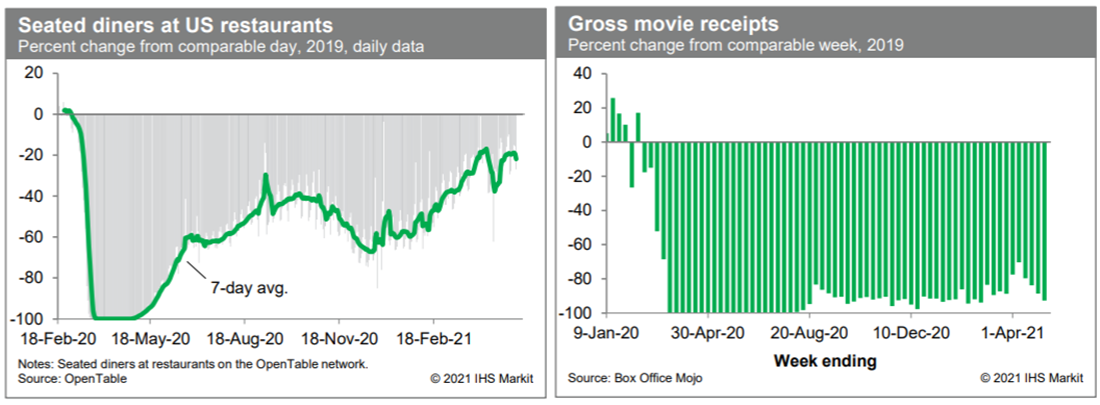

- The count of seated diners on the OpenTable platform, averaged

over the last week, was down roughly 20% from the comparable period

in 2019. Recovery in dining out has been robust since winter but

has progressed little over the last month or so. Meanwhile, after

showing signs of life a month or so ago, activity at movie theaters

has reversed and is now (as of last week) down about 90% from the

comparable period in 2019. Activity at small businesses (revenues

and the number open) remained weak through late April, according to

the Opportunity Insights Economic Tracker. The broad recovery

to-date has not benefited small businesses, at least by these

measures. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

- Impossible Foods, the maker of the meatless Impossible Burger, has secured labels to allow bringing its plant-based products to US school cafeterias - a milestone for entering the K-12 market by fall of 2021. Authorized by USDA, Child Nutrition labels are voluntary food crediting statements that make it easier for schools participating in the National School Lunch and National School Breakfast programs to determine how the content of a food contributes to federal meal pattern requirements for nutritionally balanced meals served to children each school day. The company announced the new label approval on May 6, after USDA's Food Nutrition Service (FNS) evaluated the formulation and quality of the Impossible Burger and determined it met the quality control program requirements for the school nutrition program's "Alternative Protein" category. The new label means the Impossible Foods' products are now eligible for funding under the national school meals programs, Impossible Foods said. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

- The world's banana trade was subdued in Q1 2021, with all reporters' combined volume at 4.5 million tons, 25% year-on-year down from the same time last year. The average cost, insurance, and freight (CIF) price was USD670 per ton, down marginally. The US bought 1.3 million tons of banana in Q1, a 4% y/o/y decrease from last year. The average cif price was USD560/ton, 1% up from last year. China increased its imports to 446,000 tons in Q1 2021, up 6% y/o/y, accounting for about 10% of world's total. The average cif price fell 1% y/o/y to USD550/ton, the lowest among the top 10 destinations. Many major European destinations saw a massive reduction in imports compared with last Q1, including Russia (-44% y/o/y), Germany (-44% y/o/y), the Netherlands (-43% y/o/y), Belgium (-44% y/o/y) and the UK (-41% y/o/y). The average cif price to Belgium exceeded USD1,000/ton, a 10% y/o/y increase. This is also the highest price paid in the top 10 destinations. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Air Products today reported first-quarter net income down 1%

year on year (YOY), to $473.1 million, on net sales up 13%, to

$2.50 billion. Adjusted earnings totaled $2.08/share, short of

analysts' consensus estimate of $2.12/share, as reported by

Refinitiv (New York, New York). Sales rose due to 7% higher

energy-cost pass-through and 2% higher selling prices, but volumes

fell due to the US Gulf Coast winter storms and lower merchant

demand due to COVID-19. (IHS Markit Chemical Advisory)

- Industrial gases Americas segment sales increased 13% YOY, to $1.06 billion, while segment adjusted EBITDA was up 6%, to $449 million. Volumes fell 6% YOY due to COVID-19 and winter storm impacts, but pricing was up 3%, and pass-through of higher energy costs rose 15%.

- Industrial gases Asia segment sales grew 6% YOY, to $698 million, while segment adjusted EBITDA was down 1%, to $324 million. Volumes fell by 2% YOY, while pricing was up 1%, as merchant volumes were up but contributions were lower from the company's Lu'An coal gasification facility in China.

- Industrial gases EMEA segment sales rose 19% YOY, to $585 million, while segment adjusted EBITDA increased 17%, to $218 million. Volumes grew 5% YOY, while energy-cost pass-through was up 3% and pricing rose 2%. On-site volumes were up, but COVID-19 hit demand for merchant volumes.

- Air Products expects full-year 2021 earnings to total $8.95-9.10/share, up 7-9% YOY.

- Electric vehicle (EV) startup Nikola has reported its financial results for the first quarter of 2021, although the company has not yet started delivering vehicles. The company continues to post an operating loss, although it has reported a lower net loss in the first quarter of 2021 (USD33 million) than in the first quarter of 2020 (USD120 million). With partner Iveco in Ulm, Germany, Nikola has built eight of the nine vehicles in the second batch of Tre battery electric vehicles (BEVs), and the startup stated that the ninth would be completed by 10 May 2021. Nikola said that three of those trucks are at Nikola's headquarters in Arizona, United States, one is in Indiana for crash testing, and four are in transit to the Arizona HQ. The first batch of five Tre vehicles have been commissioned and are undergoing validation, performance, and durability testing. Nikola said it is on track to begin its planned trial production of the Tre BEV at Ulm in June, and validation testing of the first two batches of trucks will continue. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Lion Electric, a Canadian manufacturer of electric school buses, has selected Joliet (Illinois) for a new US manufacturing location. Lion Electric says it will be the largest dedicated production site for zero-emission medium and heavy-duty vehicles in the US. Lion Electric is looking to meet demand for "Made in America" products, as the current US administration is moving quickly to support EV adoption. Lion has committed to investing USD70 million over three years, and plans to add 745 new jobs over the next three years. The company is planning annual capacity of 20,000 units per year, which Lion says will assist in scaling electric bus production in the US, as well as production of heavy-duty zero emissions trucks. Production at the new site is expected to begin in the second half of 2022. (IHS Markit AutoIntelligence's Stephanie Brinley)

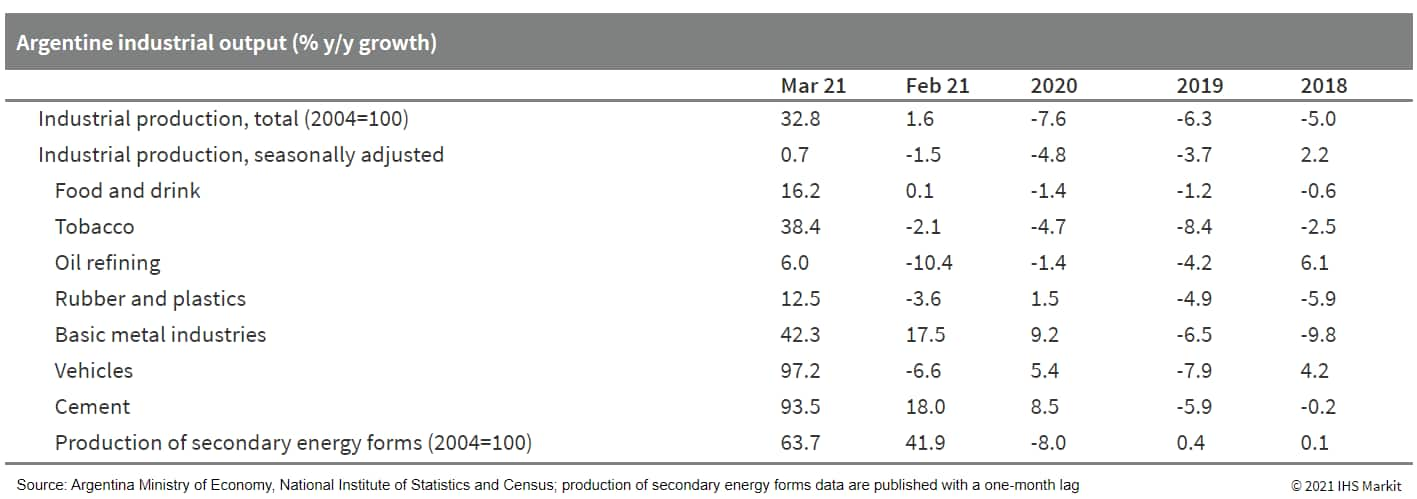

- According to Argentina's National Institute of Statistics and

Census (Instituto Nacional de Estadística y Censos: INDEC), the

country's industrial production increased by 32.8% year on year

(y/y) in March. Seasonally adjusted data show a 0.7% month-on-month

(m/m) increase in March, compared with a 1.5% m/m decrease in

February (revised figure). (IHS Markit Economist Paula

Diosquez-Rice)

- The largest annual increases in March were in vehicle assembly, non-metal minerals, general equipment and instruments, machinery and equipment, and clothing and apparel, among others. Very few sub-categories posted annual declines, such as aluminum and non-ferrous, fuel oil refining, and textile fiber processing.

- A qualitative industrial poll of companies conducted by INDEC

shows that 43% of respondents estimate that demand will expand in

April to June, compared with the same period in 2020 (up from 41%

in the previous month's survey); at the same time, 72% of

respondents do not expect any changes in their personnel numbers.

The percentage of respondents that expect demand to remain

relatively the same decreased to 35%, while 54% of respondents

expect exports to continue at a similar level during the

period.

Europe/Middle East/Africa

- European equity indices closed mixed; Spain +0.9%, Italy +0.8%, France +0.0%, Germany flat, and UK -0.1%.

- 10yr European govt bonds closed mixed; Italy -3bps, Spain -1bp, France/Germany flat, and UK +2bps.

- iTraxx-Europe closed flat/50bps and iTraxx-Xover flat/251bps.

- Brent crude closed +0.1%/$68.32 per barrel.

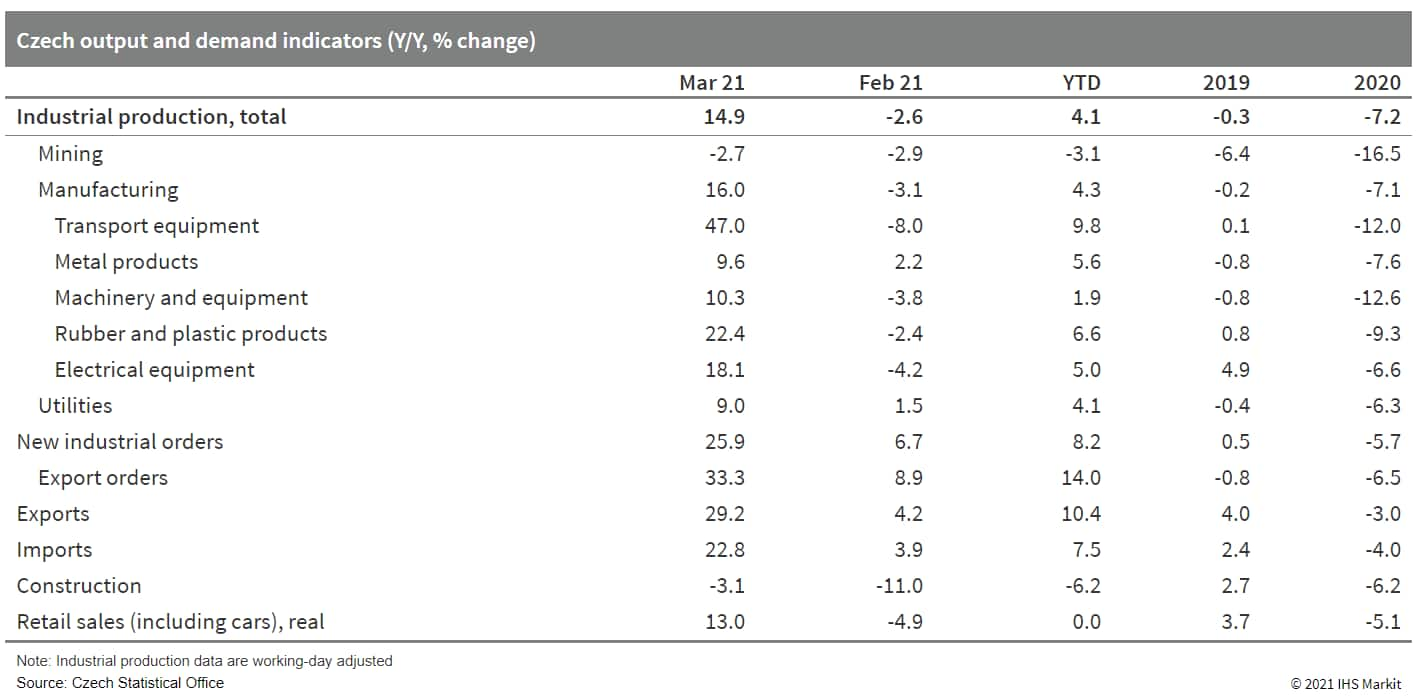

- Working-day-adjusted industrial production jumped by 14.9% year on year (y/y) in March, driven by robust growth in both manufacturing and utilities. In seasonally adjusted terms, output increased by 3.2% m/m.

- The UK government is exploring the possibility of stockpiling some materials used in the manufacture of batteries for electrified vehicles. The Daily Telegraph has been told by sources that officials at the Department for Business, Energy & Industrial Strategy are discussing it as an option intended to protect access to key materials for this component including lithium and cobalt. They added that as well as building a national stockpile, it could also support attempts to create domestic sources, as well as use its diplomatic network to secure supplies from overseas in partnership with private businesses. (IHS Markit AutoIntelligence's Ian Fletcher)

- Porsche is looking to acquire stakes in or full ownership of leading technology companies to improve and broaden its range of digital services and operating system development capability. According to a Bloomberg report, the company's chief financial officer, Lutz Meschke, said in a statement that the company would "pick up the pace on investments" in new technologies and would make "a few announcements this year". Porsche is accelerating its investment and interest in the area of digital platform development, battery technology, and e-fuels as it looks to future-proof one of the strongest and most-profitable automotive brands in the world. (IHS Markit AutoIntelligence's Tim Urquhart)

- Germany's largest industrial union IG Metall wants to set up union representation and a works council at Tesla's new plant in Brandenburg, according to a Bloomberg report. The Union's head Joerg Hofmann confirmed the plan. He said, "So far I have not been in contact with [Tesla CEO] Elon Musk. Why should I be, or he? Tesla is now hiring in Gruenheide, in the land of co-determination and collective bargaining agreements. Tesla's management knows this." He added, "If the team for Gruenheide is on board we will establish a works council with the employees and organize them." (IHS Markit AutoIntelligence's Tim Urquhart)

- Czechia's March manufacturing results benefited from strong

growth in nearly all branches. Despite supply-chain challenges,

output in the key transport equipment branch soared by 47.0% y/y,

more than compensating for the 29.0% decline seen in the same month

of 2020. (IHS Markit Economist Sharon

Fisher)

- The rise in industrial output translated to a surge in exports, which jumped by 29.2% y/y in local currency terms in March (versus import growth of 22.8% y/y). The rapid growth in March trade was partly due to low base effects; however, m/m gains were also strong, with seasonally adjusted exports and imports up by approximately 7.0% over February levels.

- Construction activity fell by 3.1% y/y in March, the best result in 11 months thanks to a rise in the civil engineering sector. Seasonally adjusted output was up by 3.1% m/m.

- While seasonally adjusted retail sales recorded m/m declines in March, the y/y results were more encouraging, given low base effects from the same month of 2020. Adjusted for calendar influences, real retail sales rose by 5.0%, while car sales surged by 25.7%.

- The March releases help complete the picture of first-quarter growth drivers, confirming the positive impact of net exports and government consumption. In the first quarter as a whole, goods exports and imports were up by a respective 10.4% and 7.5% y/y.

- Industrial output rose by 4.1% y/y in the first quarter, while

seasonally adjusted production fell by 1.1% quarter on quarter

(q/q). Construction activity showed the reverse pattern, falling by

6.1% y/y but increasing by 2.1% q/q.

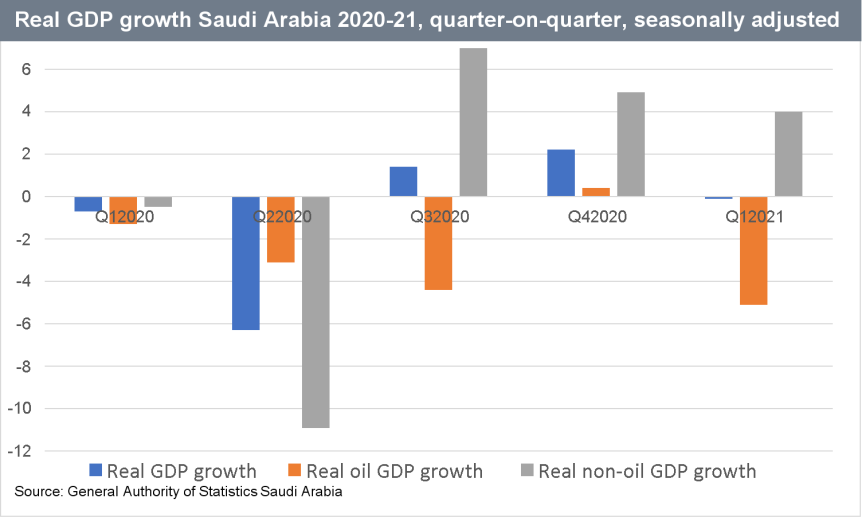

- Saudi GDP went down by 3.3% year on year (y/y) in comparison to

the first quarter and was all but flat with a small 0.1% drop

compared to the final quarter 2020, according to GAStat. The Saudi

economy had a relatively mild recession in 2020, with real GDP

falling by 4.1% as the non-oil sector of the economy outperformed

most expectations. (IHS Markit Economist Ralf

Wiegert)

- The decline has been solely due to the oil sector as Saudi oil production was cut from an average of 9.1 million barrel/day (mb/d) in January to 8.1 mb/d in February and March. This was based on a voluntary decision from the Saudi government that went beyond the decisions taken by the OPEC+ group of countries.

- The non-oil sector of the economy rebounded and posted growth

for the first time since the start of the COVID-19 pandemic in the

first quarter of 2020. Year-on-year non-oil growth was 3.3%

following -0.9% in the final quarter 2020. On the quarter, the

non-oil growth rate slowed from 4.9% in the final quarter of 2020.

However, the 4.0% growth rate published by GAStat for the first

quarter represents a solid increase nevertheless.

- The International Finance Corporation (IFC), a unit of the World Bank, recently inked its first certified green loan in Africa, which will boost funding for biomass and other renewable projects in South Africa. The $150-million loan to Absa Bank will support the country's hobbled power generation sector and economic recovery from the COVID-19 pandemic. The loan is the IFC's fourth green finance investment in South Africa, but the first that complies with the Loan Management Association's Green Loan Principles (GLP). As a result, lending by Absa for green projects will be disclosed, improving transparency, and encouraging other banks to follow the principles, the multilateral agency said. In addition to the $150 million, the IFC will provide technical advice and share knowledge with the bank to "develop a green, social, and sustainable bonds and loans framework." An IFC spokeswoman told IHS Markit the IFC has provided more than $1 billion globally in loans that meet the GLP guidelines. The IFC made climate-related investments totaling $3.3 billion in the 2020 financial year. (IHS Markit Climate and Sustainability News' Keiron Greenhalgh)

Asia-Pacific

- Most APAC equity markets closed higher except for Hong Kong -0.1%; South Korea +1.6%, Australia +1.3%, India +0.6%, Japan +0.6%, and Mainland China +0.3%.

- The World Health Organization (WHO) has granted emergency use listing to Sinopharm (China)'s inactivated whole-virion COVID-19 vaccine BBIBP-CorV to prevent COVID-19 in individuals aged 18 and older. The vaccine, which has already been granted emergency use approval in several countries and territories around the world, becomes the first non-Western COVID-19 shot to receive the WHO's backing. The WHO's endorsement of Sinopharm's BBIBP-CorV should boost global confidence in the safety and efficacy of the vaccine and enhance its export prospects, with several countries and territories around the world already using the vaccine under national emergency authorisations. More broadly, it can be seen as a victory for the Chinese COVID-19 research and development (R&D) drive, although questions remain around the transparency of clinical trial data reporting for Chinese vaccine candidates. (IHS Markit Life Sciences' Sophie Cairns and Ewa Oliveira da Silva)

- Mobility platform OnTime has launched its ride-hailing service in the Chinese city Zhuhai, in Guangdong province. The platform will deploy its first batch of 500 new energy cars in the city's downtown area, the Jinwan Airport and the Hengqin New Area, reports China Daily. OnTime is jointly invested by GAC Group, Tencent, Guangzhou Public Transport and other investors. It initially introduced the service in Guangzhou and later expanded it to Foshan. The OnTime platform uses cars that are majorly developed by the GAC Group, including its new energy vehicle model Aion S, which the company claims enhances high energy efficiency and safety. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese ride-hailing giant Didi Chuxing (DiDi) has shared details on the income it earned from ride-hailing services in 2020. The company said drivers receive on average 79% of what customers pay for a ride, reports Bloomberg. DiDi took a 30%-plus cut of 2.7% of the rides on its platform and said it would "try our best to prevent these extreme cases from happening". According to a report, DiDi's ride-railing business became profitable, with a net margin of 3.1% in 2020. The company has also pledged to improve its drivers' pay and users' fares following media criticism and increased government scrutiny of dominant tech companies. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Taiwan's merchandise exports soared 38.7 year on year (y/y) in

April, accelerating from an already-strong 27.1 % y/y surge March.

Expanding for the 10th straight month, exports' gain in April 2021

also marked the fastest since July 2010. (IHS Markit Economist Ling-Wei

Chung)

- Reflecting surging demand worldwide, exports to all major markets jumped by more than 20% y/y in April 2021. Exports to mainland China, which remained Taiwan's largest exporting destination, continued to climb in April, at 27.1% y/y, although decelerating from a 36.3% y/y surge in March. Demand from mainland China for technology and non-technology products picked up strongly during the month.

- Shipments to the US remained strong, surging 35.2% y/y in April 2021, after jumping 34.7% y/y in March, marking the sharpest expansion since April 2011. Surging demand for toys and sports equipment and transport equipment as well as exports of information and communication products remained the major drivers of shipments to the territory on the back of increasing demand from staying at home and its stimulus measures.

- By products, electronic exports - accounting for 39% of total exports - continued to provide the major support to overall export growth, surging 34% y/y in April 2021, despite an already-high comparison base. Within that, shipments of semiconductor products - accounting for 91% of electronic exports or 35% of total exports - jumped 34.9% y/y, while shipments of diodes surged 44.1% y/y and exports of electrical capacitors and resistors climbed 35.2% y/y.

- Technip Energies has been awarded an EPCC contract by Indian Oil Corporation Limited (IOCL) for its paraxylene (PX) and purified terephthalic acid (PTA) complex project at Paradip, Orissa, on the East Coast of India. The contract covers the delivery of a new 1.2 MMtpa PTA plant and associated facilities. PTA is a major raw material used to manufacture polyester fibers, PET bottles and polyester film used in packaging applications. This contract increases Technip Energies' already strong presence in India, while further strengthening its status as a global leader for downstream projects. This award follows IOCL awarding an EPCC contract to Technip Energies in April 2021 for its BR9 Expansion Project in Barauni, Bihar, in the Eastern part of India. Technip Energies did not release the exact value of the contract but stated that it was between EUR250 million (USD304 million) and EUR500 million (USD608 million). (IHS Markit Upstream Costs and Technology's William Cunningham)

- Maruti Suzuki India Limited has announced its plans to extend its plant shutdown to 16 May, reports ET Auto. According to a statement by the automaker, "The maintenance shutdown, which was till 9 May 2021, is being extended till 16 May 2021 keeping in view the current pandemic situation. Some activities will continue in the plants. The company has been informed that Suzuki Motor Gujarat has taken the same decision." It also partnered with Airox Nigen Equipments and SAM Gas Projects to boost their production of Pressure Swing Adsorption (PSA) oxygen generator plants. (IHS Markit AutoIntelligence's Tarun Thakur)

- Indonesian network service provider Telkomsel has invested an additional USD300 million in ride-hailing firm Gojek, according to a company statement. This follows a USD150-million investment by Telkomsel in Gojek in November 2020. The companies said their collaboration will open new synergies in scaling up digital services and creating innovative solutions in Indonesia. Gojek is reportedly close to finalizing a proposed merger with Indonesia's e-commerce giant Tokopedia, which would result in a new entity called GoTo. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-may-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-may-2021.html&text=Daily+Global+Market+Summary+-+10+May+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-may-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 10 May 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-may-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+10+May+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-may-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}