Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 10, 2020

Daily Global Market Summary - 10 September 2020

European and APAC equity markets closed mixed, while US markets closed lower on the day. European benchmark government bonds were mixed, while US government bonds and the US dollar ended the day higher on the weakness in US equities. iTraxx and CDX indices ended the day modestly wider across IG/high yield and oil also closed lower. The US initial claims for unemployment insurance came in worse than expected, although it was relatively unchanged from last week.

Americas

- US equity markets opened modestly higher, but shifted course before noon and closed lower on the day; Nasdaq -2.0%, S&P 500 -1.8%, DJIA -1.5%, and Russell 2000 -1.2%.

- 10yr US govt bonds closed -3bps/0.68% yield and 30yr bonds closed -4bps/1.42% yield. 10yr bonds reached the lowest point (0.72% yield) of the day at approximately 11:30am EST and rallied 4bps from that time through 3:30pm EST.

- CDX-NAIG closed +3bps/69bps and CDX-NAHY +6bps/377bps.

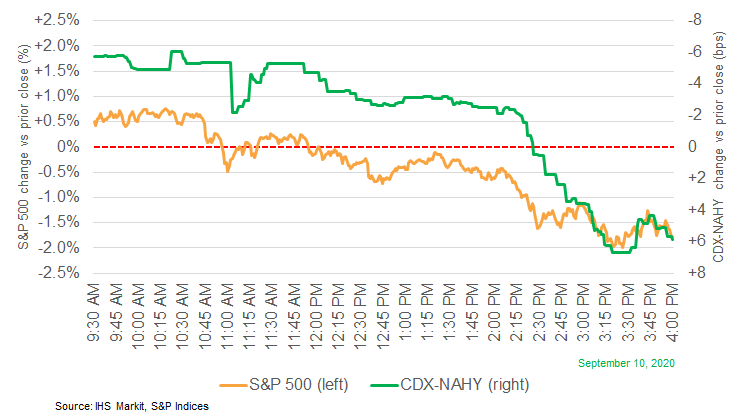

- The chart below compares today's S&P 500 and CDX-NAHY

intraday changes versus yesterday's close (note the change in

CDX-NAHY axis is in reverse order). The data shows CDX-NAHY was

tighter for most of the day until the S&P 500 fell below -0.5%,

which led to almost 10bps of widening between 2:15-3:15pm EST.

- DXY US dollar index closed near the highs of the day at +0.1%/93.35 on the late-day flight to quality.

- Gold closed +0.5%/$1,964 per ounce.

- Crude oil closed -2.0%/$37.30 per barrel.

- US seasonally adjusted initial claims for unemployment

insurance, at 884,000 in the week ended 5 September, remained at

historically high levels, although well below the all-time high of

6,867,000 in the week ended 28 March. (IHS Markit Economist Akshat

Goel)

- The seasonally adjusted number of continuing claims (in regular state programs), which lags initial claims by a week, rose by 93,000 to 13,385,000 in the week ended 29 August. The insured unemployment rate in the week ended 29 August ticked up 0.1 percentage point to 9.2%.

- There were 838,916 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 5 September. In the week ended 22 August, continuing claims for PUA rose by 1,021,294 to 14,591,621.

- In the week ended 22 August, 1,422,483 individuals were receiving Pandemic Emergency Unemployment Compensation (PEUC) benefits.

- The Department of Labor provides the total number of people claiming benefits under all its programs with a two-week lag. In the week ended 22 August, the unadjusted total rose by 380,379 to 29,605,064. Even as the number of continuing claims in regular state programs continues to decline, the number of people claiming benefits under all programs remains stubbornly high and has averaged 30.1 million since peaking at 32.4 million in mid-June.

- The US total producer price index (PPI) for final demand rose

0.3% in August, but remained 0.2% below a year earlier.

Pandemic-related price swings, mostly drops, are washing out of the

supply chain. (IHS Markit Economist Michael Montgomery)

- Total goods prices rose 0.1% with food down 0.4% and fuels off 0.1%. Core goods posted a moderate 0.3% firming, even though most prices were softer than this.

- Food prices in August were 0.2% above a year earlier (y/y). As food prices go, that is pretty close to normalized.

- Energy prices were down 12.4% y/y and core goods were up 0.8% y/y. The largest drops in energy were because of crude oil's plunge, with gasoline down by 29.7% y/y; both electricity prices as well as natural gas were comparatively stable.

- Total services prices posted a 0.5% increase for the month and rose 0.4% y/y, with trade margins up 1.2%, transportation and warehousing up 0.2%, and "other" services up 0.3%. Transportation and warehousing services were off 5.2% y/y thanks to drag from plunging airfares caused by massively reduced traffic and cheaper air fuel.

- Producer prices remain nearly unchanged over the past year with the total off 0.2% y/y; excluding food and energy the result is up 0.6% and also excluding trade margins it is up 0.3%. Those are milder y/y deviations than earlier in the year thanks to some recovery in recent months, but save for fuel and airfares more like "soggy" than "falling."

- The Office of Environmental Health Hazard Assessment (OEHHA) of the California Environmental Protection Agency has released a health assessment raising new questions about the neurological impact of children's exposure to food dyes. Conducted at the request of the California legislature, the 310-page report took an in-depth look at the latest science on the health effects related to children's exposure to synthetic food dyes, finding that exposure "may cause or exacerbate neurobehavioral problems in some children." The assessment also included a study of children's exposure to synthetic food dyes, which found that "none of the child intake estimates based on a daily serving of sampled foods exceeded US FDA Acceptable Daily Intakes (ADIs) for food dyes." However, the study cautioned that FDA had based its current ADIs on studies that were "many decades old" and could not detect a number of negative neurobehavioral outcomes in children highlighted in recent literature and data. Based on new information from high-throughput assays in cells, which OEHHA says, provides insight into the potential for synthetic food dyes to elicit neurobehavioral effects, the study cautioned that FDA's current ADIs for synthetic food dyes - the only regulatory threshold used in connection to food dyes - may be too high and are not "adequately protective of children." While the report stressed the need for more research to identify safe exposure levels for synthetic dyes in children, it also cautioned research is a long term endeavor and that action is needed now to curb children's exposure to synthetic dyes. "Research is generally a long-term proposition," authors said in the report. "At a minimum, in the short term, the neurobehavioral effects of synthetic food dyes in children should be acknowledged and steps taken to reduce exposure to these dyes in children." OEHHA's new assessment is focused on the seven synthetic food dyes most commonly consumed in the US: (1) FD&C Blue No. 1; (2) FD&C Blue No. 2; (3) FD&C Green No. 3; (4) FD&C Red No. 3; (5) FD&C Red No. 40; (6) FD&C Yellow No. 5; and (7) FD&C Yellow No. 6. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

- GM's electric vehicles (EVs) are to feature the automotive industry's first wireless battery management system, according to a company statement. The wireless battery management system has been developed by Analog Devices Inc. GM states that the system, called wBMS (wireless battery management system), has several advantages as a solution. GM states that the solution will enable the automaker to power different types of vehicles from a common set of battery components. The wBMS reduces wires within the battery pack by 90%, GM says, contributing to lighter vehicles overall and providing extra space for more batteries. GM says the solution enables cleaner designs, simpler and more-streamlined battery structuring, and more-robust manufacturing processes. The company states that the reason for this is that the wBMS eliminates the need to create specific communications systems or to design complex wiring schemes for each new vehicle. GM states that the wBMS will help GM to balance the chemistry within individual battery cell groups to enable optimal performance. The automaker also states that the system will enable it to conduct real-time battery-pack health checks as well as to refocus the network of modules and sensors as needed. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ride-hailing firm Lyft's trips rose 7.3% in August compared with July, as its operations recovered more quickly in Canada than in the United States. However, the COVID-19 virus pandemic is still battering demand for ride-hailing services and led to a drop in rides of 53% year on year (y/y) in August. Lyft's rides were down by as much as 75% in mid-April and gradually increased in the final weeks of the month, and in July, they were up 78% on April. The company's revenue declined to USD339.3 million in the second quarter of 2020, down 61% y/y. Lyft has laid off around 982 employees and furloughed hundreds more because of the COVID-19 virus pandemic. Recently, Lyft announced that it has partnered with car-rental company SIXT to expand its in-app rental business. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- At the request of the left-wing opposition, the Colombian Congress on 7 September agreed to remove a proviso (known as Article 210) from a recently passed royalties reform bill that would have granted tax benefits to future hydraulic fracturing (fracking) operations. Supporters of the change argued that approving Article 210 would have amounted to the legalization of fracking, which is still to be authorized by Colombia's Ministry of Mines and Energy. This constituted a setback for the government after the Lower House had passed the bill containing Article 210. However, on 3 September, the Senate rejected it by 44 votes against 39, forcing a conciliation of the bill that eventually resulted in the removal of Article 210. This compounds the situation for the sector, given that a legal case is being heard by Colombia's top administrative court known as the Council of State, which is expected to rule soon on several pilot fracking projects authorized by the government to assess environmental sustainability. The government said that the evaluation of the projects will settle the issue, but the Council of State has accepted a legal challenge against the mentioned pilots. Colombia's oil reserves are declining rapidly and the government of President Iván Duque is prioritizing fracking to replenish them; government sources claim that the sector could attract as much as USD5 billion in investment over the next five years. (IHS Markit Country Risk's Carlos Caicedo)

- Generics firm Mylan (US/Netherlands) has agreed to acquire the European thrombosis business of South African company Aspen for a sum of EUR642 million (USD756 million). The transaction will be used to ease Aspen's existing debt levels, although Mylan has said that it will only make an initial upfront payment of EUR263.2 million upon completion of the deal in late 2020, while the remainder will be deferred until mid-2021. The portfolio of products that Mylan is acquiring from Aspen in the European market includes well-established and lucrative injectable anti-coagulants such as the anti-thrombotic treatment Arixtra (fondaparinux sodium), the anti-thrombotic low-molecular-weight heparin Fraxiparine (calcium nadroparin), Mono-Embolex (certoparin sodium), and Orgaran (danaparoid), which had estimated combined sales amounting to EUR231 million in the 12 months before mid-2020. The acquisition of a revenue-strong thrombosis product line will help strategically reposition Mylan's European business by catapulting the firm into becoming the second-largest manufacturer of thrombosis products across the region. The Mylan-Aspen deal will have no effect on Mylan's planned tie-up with Pfizer. (IHS Markit Life Sciences' Eóin Ryan)

Europe/Middle East/Africa

- Most European equity markets closed lower except for Italy +0.3%; France -0.4%, Spain -0.3%, Germany -0.2%, and UK -0.2%.

- 10yr European govt bonds closed mixed; Italy/UK -1bp, Spain +1bp, and France/Germany +3bps.

- iTraxx-Europe closed +1bp/54bps and iTraxx-Xover +2bps/320bps.

- Brent crude closed -1.8%/$40.06 per barrel.

- The 27 countries in the European Union plus the U.K., Norway, Iceland and Liechtenstein recorded 27,233 new cases on Wednesday, compared with 26,015 for the U.S. That follows several weeks of resurgent infections in Spain, France and other countries across the continent. The comparison is based on data from the World Health Organization for the U.S. and Bloomberg calculations using numbers from the European Centre for Disease Prevention and Control. (Bloomberg)

- The tone of the European Central Bank's (ECB)'s statement

following its latest policy meeting echoed those of prior months,

with an explicit easing bias retained along with a reiteration that

the ECB continues "to stand ready to adjust all of its instruments,

as appropriate". (IHS Markit Economist Ken Wattret)

- The statement contained various tweaks to the assessment of growth and inflation prospects to reflect recent developments, along with one standout change: that is, the inclusion of two explicit references to the strength of the euro exchange rate.

- First, in the current environment of elevated uncertainty, the Governing Council "will carefully assess incoming information, including developments in the exchange rate", with regards to its implications for the medium-term inflation outlook.

- Second, in the short term, price pressures will remain subdued owing to weak demand, lower wage pressures, and "the appreciation of the euro exchange rate".

- Given the strength of the euro since July, the ECB's references were not a surprise. Indeed, in addition to euro strength against the US dollar, the ECB's own, broad nominal measure of the trade-weighted euro recently hit a record high.

- The fact that the references were included in the ECB's statement is significant, as this signals that the concern over euro strength is widespread across the members of the ECB's Governing Council. ECB President Christine Lagarde also acknowledged in the question and answer (Q&A) session that the euro was the subject of "extensive" discussion (accompanied by a reiteration that the ECB does not target a specific level).

- The staff projections for GDP and HICP inflation have also been adjusted (see table below). The GDP projection for 2020 was revised higher but remains indicative of a huge contraction (-8.0%), while projections for 2021 and 2022 were changed only marginally.

- The ECB's HICP inflation projections were also adjusted. Headline inflation was left unchanged in 2020 and 2022, and was revised up by 0.2 percentage point in 2021, largely owing to energy price swings (see table below).

- Surprisingly, the 2021 and 2022 projections for the core rate (excluding food and energy prices) were also revised upwards, by 0.2 percentage point in both years, to 0.9% and 1.1%, respectively.

- These upward revisions do not look very credible in our view given recent lower-than-expected core inflation rates, the softening of growth indicators, and the likelihood of large amounts of slack persisting in the economy for several years.

- Still, the bottom line remains that headline and core inflation rates are projected by the ECB to remain well below 2% throughout the forecast horizon, indicative of continued loose policy and a high likelihood of further easing.

- The ECB retains an explicit easing bias and we continue to expect additional stimulus to be announced in December, in tandem with the next set of macroeconomic projections. These will be extended in December to include 2023 for the first time and we expect the ECB to forecast another year of below-objective inflation, consistent with the need for additional policy accommodation.

- Our view is still that the Pandemic Emergency Purchase

Programme (PEPP) remains the ECB's favored policy instrument.

Therefore, our baseline policy forecast is for an additional EUR500

billion of asset purchases under the PEPP to be announced on 10

December.

- French industrial production rose by 3.8% month on month (m/m)

in July. This followed rises of 20.0% m/m in May and 13.0% m/m in

June. (IHS Markit Economist Diego Iscaro)

- Industrial output had contracted by 16.9% m/m in April and 20.5% m/m in May, and output in July was still 7.1% below its level in February.

- Manufacturing production rose at a slightly stronger rate of 4.5% m/m in July, following an increase of 14.8% m/m in June. Manufacturing output was still 7.8% below its pre-coronavirus disease 2019 (COVID-19) virus pandemic level in February.

- The breakdown by product shows production of transport equipment growing particularly strongly in July for the third consecutive month. It rose by 8.1% m/m, following increases of 53.1% m/m and 39.5% m/m in May and June, respectively.

- Nevertheless, production of transport equipment remained almost one-quarter below its pre-pandemic level, representing the most sluggish recovery among all the production sectors (see chart below). Only production in the pharmaceutical sector overtook its February level in July (+2.5%).

- Meanwhile, production of electrical and electronic goods also rose strongly in July (standing "just" 4.9% below its February level). Food/beverages production also continued to recover (+2.3% m/m), standing only marginally below its pre-pandemic level (-0.6%).

- The UK government has allocated further funding and is considering further measures to support the transition to battery electric vehicles (BEVs) in the country. According to a statement published yesterday (9 September) by the Department for Transport (DfT) to coincide with World Electric Vehicle Day, it is providing GBP12 million (USD15.6 million) to fund research and development (R&D) investment to support a series of competitions for promising BEV technologies, including one that could lead to a six-minute battery charge. In addition, a scheme to allow businesses to try BEVs for free for two months before buying has been launched by Highways England. Around GBP9.3 million has been allocated to encourage those with diesel van fleets to make the switch. The government is also reportedly considering recommendations in a government-commissioned report by the Office for Low Emission Vehicles (OLEV). These include installing charge points at popular destinations such as supermarkets and tourist sites, consistent and clear public signage for drivers on UK roads, and guidance for local authorities on painting electric vehicle (EV) parking spaces green. (IHS Markit AutoIntelligence's Ian Fletcher)

- The board of the Schaeffler Group has said that it plans to cut 4,400 jobs from its workforce in Germany and Europe by the end of 2022, according to a company statement. The headcount reductions will focus mainly on 12 locations in German as well as two in Europe. At the same time, Schaeffler has said that it will refocus on its German sites at Herzogenaurach, Bühl, Schweinfurt, Langen, and Höchstadt in order to cluster technology and production in these areas, with further research and development (R&D) investment being made at these locations. The company says that the cost of the job cuts and other elements of the efficiency drive will be in the region of EUR700 million (USD828.6 million) although as a result the company expects to save around EUR250-300 million annually, with 90% of these savings being realized by 2023. These new measures are an enhancement to an efficiency program that was first announced back in 2018. Schaeffler is the parent company of the world's fourth-largest tier-one component manufacturer, Continental AG, which recently announced its own comprehensive cost-cutting program in response to the post-COVID-19 virus business environment. (IHS Markit AutoIntelligence's Tim Urquhart)

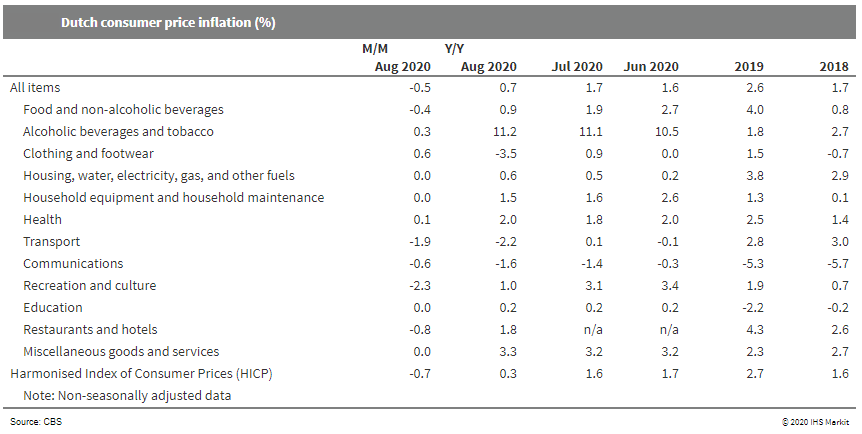

- Dutch consumer prices increased by 0.7% year on year (y/y) and

dropped by 0.5% month on month (m/m) in August, according to the

national consumer price index (CPI) measure, and grew by 0.3% y/y

and fell by 0.7% m/m according to the EU-harmonized measure. This

marks the sharpest fall in headline inflation in 11 years. (IHS

Markit Economist Daniel Kral)

- Among the biggest drivers of the decrease in August were airfares and package holidays. The former declined by 21.6% y/y, after rising 4.8% y/y in July, while prices of the latter declined by 11.5% y/y in August after a small rise of 0.5% y/y in July. Among the main sub-categories, clothing and footwear and transport were the biggest drags (see table below).

- Statistics Netherlands (Centraal Bureau voor de Statistiek: CBS) also notes that food price inflation slowed from 1.9% in July to 0.9% in August. This was driven by lower prices for vegetables and meat.

- Core inflation collapsed from 2.6% y/y in July to 0.8% y/y in August. This almost closes the differential versus the extremely low core inflation rate in the eurozone.

- August's inflation rate was heavily affected by seasonal

factors and heavy discounting for flights and holidays, given

consumers' reluctance to travel this year. It is likely that the

annual inflation numbers will be choppy in the coming months.

- According to all measures, Swedish headline consumer price

inflation edged up in August. The consumer price index (CPI), which

is the national definition, came in at 0.8% year on year (y/y), up

from 0.5% in July. According to the EU-harmonized measure (HICP),

inflation was 1.0% y/y, up from 0.7% in July. (IHS Markit Economist

Daniel Kral)

- CPI at fixed interest rates (CPIF), which is the most closely watched indicator by the central bank, also edged up to 0.7% y/y in August, which is 0.5 percentage point (pp) above the Riksbank's latest forecast from 1 July. CPIF excluding energy came in at 1.4% y/y, marginally lower than in July but still 0.1 pp above the Riksbank's July forecast (see chart 2).

- On an annual basis, food and non-alcoholic beverages (+0.3 pp), restaurants (+0.2 pp), and housing (+0.2 pp) were the main positive contributors to headline CPIF inflation. Conversely, fuel (-0.3 pp), electricity (-0.3 pp), and communication (-0.2 pp) subtracted most from headline inflation.

- On a monthly basis, CPIF fell by 0.1% month on month (m/m), compared with a drop of 0.4% m/m in August 2019. The main contribution to the monthly rate came from the price of electricity, which added 0.4 pp to the headline rate, and higher prices for miscellaneous goods and services, adding 0.1 pp. These were offset by lower prices for transport (-0.4 pp), car rental (-0.2 pp), and package holidays (-0.2 pp).

- Inflation continues to be significantly below the Riksbank's target, following a historic drop in GDP in the second quarter with clear signs of a partial rebound in the third quarter. Inflation in the coming months is likely to continue to be choppy and weighed down by the krona's strength against the euro and US dollar.

- Coca-Cola will eliminate virgin oil-based plastics in Norway and Netherlands. From October 2020, the soft drinks giant's Coca-Cola, Sprite and Fanta will be transitioning to 100% rPET in the Netherlands. Small plastic bottles first, then large formats follow in 2021. After the switch to 100% rPET in the Netherlands, the company would eliminate the use of over 10,000 tonnes of new virgin oil-based plastic. Meanwhile, Coca-Cola in Norway will be moving to 100% rPET for all plastic bottles that it produces locally during H1 2021, which will remove around 4,300 tons of new virgin oil-based plastic per year. Coca-Cola said that it is the first company to move its entire portfolio of locally produced plastic bottles to 100% rPET in both countries. The effective operation of local Deposit Return Schemes (DRS) enabled Coca-Cola's switch. Joe Franses, vice president sustainability at Coca-Cola European Partners, said:" Markets with well-designed DRS such as those in Sweden, the Netherlands and Norway not only have high collection rates but also have the capacity to collect a higher grade of material with less contamination." (IHS Markit Food and Agricultural Commodities' Hope Lee)

- The Dubai Supreme Council of Energy (DSCE) has issued a directive to government organizations to increase the number of electric and hybrid vehicles to at least 10% of their overall annual procurement of vehicles until the end of 2024, and to increase the number of purchased, as well as leased, electric and hybrid vehicles to 20% from 2025 to the end of 2029, and 30% from 2030, reports Zawya. Saeed Mohammed Al Tayer, vice-chairman of the Supreme Council of Energy in Dubai, said, "The Council's new directive to increase the percentage of electric and hybrid vehicles in government organizations will make them role models for other organizations in increasing the use of environmentally-friendly vehicles." (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- APAC equity markets closed mixed; India +1.7%, South Korea/Japan +0.9%, Australia +0.5%, Mainland China -0.6%, and Hong Kong -0.6%.

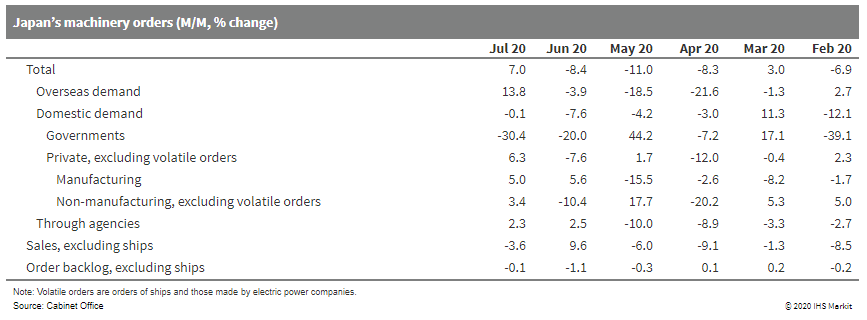

- Japan's private machinery orders (excluding volatiles) - a

leading indicator for capital expenditure (capex) - rose by 6.8%

month on month (m/m) in July following a 7.6% drop in the previous

month. (IHS Markit Economist Harumi Taguchi)

- The improvement reflected a continued rise in orders from manufacturing (up 5.0% m/m) and a rebound for orders from non-manufacturing (up 3.4% m/m).

- Machinery orders from overseas increased by 13.8% m/m for the first rise in four months.

- Orders from a broad range of manufacturing groupings continued to rise in line with the resumption of economic activity following the lifting of the state of emergency in late May. The improvement was partially offset by declines in orders from information and electronics equipment, electrical machinery, and some other groupings.

- The increase in orders from non-manufacturing (excluding volatiles) was thanks largely to rebounds in orders from finance and insurance, construction, and the miscellaneous non-manufacturing grouping.

- According to the Machine Tool Builders' Association, the

contraction of machinery tool orders from overseas continued to

narrow in August, which could drive recovery in exports and

industrial production. That said, it will take some time for

private machinery orders (excluding volatiles) to rise at a faster

pace.

- Honda has expanded its monthly flat-rate mobility service for used cars, 'Honda Monthly Owner', to four Honda-certified used-car dealerships in Japan's Aichi Prefecture. By the end of 2020, Honda expects to expand this service to Hokkaido, Miyagi, Gunma, Kanagawa, Osaka, Okayama, and Fukuoka prefectures in Japan. The service subscription is available for a minimum of one month up to a maximum of 11 months, a first for any Japanese automaker, claims Honda. The usage fee will include vehicle fee, automobile tax, auto liability insurance premium, voluntary insurance, registration, and maintenance. At present, Honda is offering used models of the N-Box, Fit Hybrid, Freed Hybrid, Vezel Hybrid, and N-Box wheelchair-specification car under this service. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Takeda (Japan) has agreed to divest a number of non-core prescription treatments in several therapeutic categories, marketed mainly in Europe and Canada, to Cheplapharm (Germany) for USD562 million, the Japan-based company said in a statement. Under the agreement, Takeda's divestment to Cheplapharm will include cardiovascular/metabolic and anti-inflammatory treatments, as well as calcium, which together earned sales of approximately USD260 million in fiscal year (FY) 2019. The deal is expected to close by end-FY 2020. Takeda plans to use the proceeds of the deal to reduce its debt, as well as to accelerate deleveraging towards its target of 2x net debt/adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) within FY 2021-2023. The deal marks further progress in Takeda's strong push to divest non-core assets and pay down debt acquired during its takeover of UK pharma major Shire in 2019. The divestment will also enable Takeda to further focus its Europe and Canada business units on core areas, building on its recent sale of approximately 110 non-core over-the-counter (OTC) and prescription pharmaceutical treatments marketed in Europe, as well as two manufacturing sites in Denmark and Poland, to Orifarm Group. (IHS Markit Life Sciences' Sophie Cairns)

- Changan Automobile has partnered with Chinese battery-maker Contemporary Amperex Technology Co Limited (CATL) to develop intelligent-connected electric vehicles (EVs), reports Gasgoo. This partnership is expected to help Changan implement its intelligent travel strategy, "Beidou Tianshu", and new energy vehicle (NEV) strategy, "Shangri-la". Changan has been working in the three areas of autonomous vehicles (AVs), intelligent interaction, and intelligent interconnection to provide a smart-driving experience. Earlier this year, Changan unveiled a Level 3 automated vehicle system, which will be rolled out on all of its recently released UNI-T models. In 2018, Changan announced that it would "no longer produce non-networked cars by 2020" (see China: 27 August 2018: Changan to have 100% connected cars in portfolio from 2020). Changan has partnered with Huawei to conduct research and development in the fields of intelligence, electrification, connectivity, and vehicle sharing at their joint innovation center. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese automaker Guangzhou Automobile Group Company (GAC)

recorded an 11.6% year-on-year (y/y) increase in sales during

August to 180,609 units, according to a company statement. (IHS

Markit AutoIntelligence's Nitin Budhiraja)

- Of this total, passenger car sales accounted for 180,308 units, up 11.6% y/y, while commercial vehicle sales reached 301 units, compared with 193 units in August 2019.

- On a year-to-date (YTD) basis, GAC's total sales are down 9.9% y/y at 1.189 million units. Of this total, YTD sales of passenger cars stand at 1.187 million units, down 9.9% y/y, while YTD sales of commercial vehicles are down at 1,621 units, compared with 1,798 units in the same period last year.

- Among the group's joint ventures (JVs), Guangqi Honda ranked first with sales of 72,587 units in August, up 26.18% y/y, and 462,779 units in the YTD, down 9.55% y/y.

- Sales of GAC Toyota increased 15.5% y/y to 67,000 units in August and are up 7.24 y/y at 462,449 units in the YTD.

- GAC Mitsubishi Motors' sales plunged 53.7% y/y to 5,002 vehicles in August, with its YTD sales down 53.3% y/y at 39,681 units.

- Sales of GAC Fiat Chrysler Automobiles (FCA) tumbled 40.0% y/y to 3,201 units last month and have decreased 48.6% y/y to 23,813 units in the YTD.

- Meanwhile, sales of GAC's wholly owned brands totaled 32,518 units in August, up 8.64% y/y, and now stand at 198,782 units in the YTD, down 18.4% y/y.

- According to news sources, HHI will team up with GIG and Total for the 1.5 gigawatts (GW) of floating offshore wind projects in Ulsan. GIG, a UK investment entity focused on green transition, and Total, French oil and gas company, will co-develop the offshore wind power farms near the city. While, HHI will construct the floating structures for the wind turbines. To move away from fossil fuel-powered energy generation, South Korea intends to build more wind farms off the southwestern coast of the country. The plan includes the construction of offshore wind farms with a combined capacity of 2.4 GW by 2028. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Vietnamese automaker VinFast signed an agreement on 9 September to purchase General Motors (GM) Holden's Lang Lang proving ground in the Australian state of Victoria, reports the Vietnam News Agency. The 877-hectare site has 44 km of sealed and unsealed test roads, skidpans, and 4.7 km of recently improved, high-speed banked oval track. It is surrounded by 18 km of fencing to ensure confidentiality. The Lang Lang proving ground is among the oldest, yet most modern in the world. VinFast did not reveal the value of the deal. VinFast, a new entrant in the car manufacturing industry, hopes to produce 500,000 cars per year by 2025, with a local content rate of 60%, and aims to be one of Southeast Asia's top car manufacturers by 2025. The automaker has partnered with world-leading automotive technology and manufacturing consulting firms such as BMW, Magna Steyr, and AVL. It has also signed agreements with companies such as Pininfarina, Siemens, Bosch, Torino Design, Italdesign, Zagato, and the German Chamber of Commerce and Industry to develop cars and buses. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-september-2020.html&text=Daily+Global+Market+Summary+-+10+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 10 September 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+10+September+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-10-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}