Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 11, 2021

Daily Global Market Summary - 11 January 2021

All major European and most US equity indices closed lower, while APAC was mixed. US and European government bonds were lower on the day, continuing the sell-off in rates that began early last week. European iTraxx and CDX-NA closed wider across IG and high yield. Gold and silver were higher, Brent and copper lower, while WTI closed flat on the day.

Americas

- US equity markets closed mixed; Nasdaq -1.3%, S&P 500 -0.7%, DJIA -0.3%, and Russell 2000 flat.

- 10yr US govt bonds closed +3bps/1.15% yield and 30yr bonds +1bp/1.89% yield.

- CDX-NAIG closed +2bps/51bps and CDX-NAHY +8bps/300bps.

- DXY US dollar index closed +0.4%/90.46.

- Gold closed +0.8%/$1,851 per ounce, silver +2.6%/$25.28 per ounce, and copper -3.0%/$3.56 per pound.

- Crude oil closed flat/$52.25 per barrel.

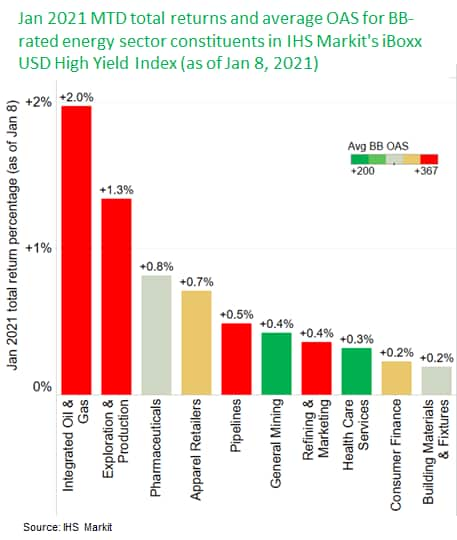

- The below graph shows the top 10 BB rated sectors by

month-to-date (as of Jan 8) total returns from IHS Markit's iBoxx

USD High Yield Index. The data indicates that energy sectors

continued to outperform most other BB rated debt sectors again.

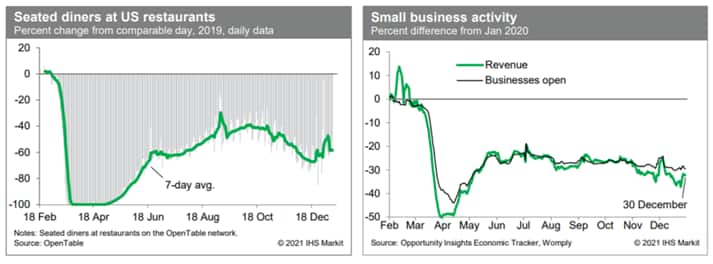

- In recent days, the count of seated diners on the OpenTable

platform has averaged roughly 60% below year-ago levels. These data

have been volatile in recent weeks, but they generally indicate

continued weakness in the restaurant sector. Relatedly, small

business activity continued to weaken through December, according

to the Opportunity Insights Economic Tracker. While the data have

been volatile, the trends in both the number of small businesses

open and revenues earned at small business have been declining

since early November. This most certainly reflects the effects of

surging COVID-19 cases and tightening containment measures. (IHS

Markit Economists Ben Herzon and Joel Prakken)

- General Motors (GM) has fully revised its corporate logo for

the first time since 1964, in conjunction with the launch of a new

marketing campaign aimed at raising awareness and excitement about

GM's Ultium electric vehicle (EV) platform and its future EVs. The

announcement comes days before the CES 2021 virtual expo, a forum

that GM intends to leverage to continue to set out its EV and

technology plans. Although GM is advertising the group on a

corporate level for the first time in many years, the new GM logo

and "everybody in" message will not be incorporated directly into

specific vehicle brand messaging. According to GM chief marketing

officer Deborah Wahl, speaking to journalists and industry analysts

during a briefing ahead of the announcement, GM is "still a house

of brands". GM wants to lead the EV future by "inviting everybody

in" and inspiring inclusion, Wahl said. Prior to this latest move,

GM's most recent corporate-level advertising and branding effort

occurred just before the 2008 recession and included putting a

small GM badge on the front quarter panel of all vehicles,

regardless of brand. The effort in 2021 is not to be manifested in

this way. Although the new GM logo and messaging will be included

on all corporate communications and websites, brands will continue

to carry their own identities and will not necessarily include the

new GM logo in their messages. GM believes that the EV market is at

a tipping point where mass-market adoption is set to occur. GM is

also planning to launch 25 new EVs globally through 2025, including

three models due to go on sale in 2021 (the GMC Hummer pick-up,

refreshed Bolt EV, and new sibling Bolt EUV) and several more set

for 2022. The new marketing campaign and new logo are part of the

company's broader effort to transition to become an EV company, and

eventually drop ICE models. (IHS Markit AutoIntelligence's

Stephanie Brinley)

- Fruit giant Dole Packaged Foods will open a new state-of-art frozen fruit facility in McDonough, Georgia. This will be Dole's third frozen fruit facility, after Atwater (California) and Decatur (Michigan). "We are excited to have this facility open later this month" stated Sunil Phabiani, vice president of manufacturing, Dole Packaged Foods. "Dole has a strong commitment to bringing our healthy products to as many people as possible and this operation will help us achieve this goal." The new facility is 63,000-sq.ft., fully automated and will have four manufacturing lines with an annual processing capacity of 60 million pounds of fruit. It will process frozen fruit retail, foodservice and private label customers on the east coast. Production will start at the end of January with a phased approach and it should become fully operational by September 2021. United States Cold Storage will handle the warehousing and distribution in an adjacent building with a state-of-art automated storage/retrieval system. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- The story of Mexico's light-vehicle sales, production, and exports in December was similar to that in previous months recently. In December, light-vehicle sales in Mexico continued to decline on the impact of the COVID-19 virus outbreak, as the number of infections increased. However, as firms in major export market the US looked to replenish inventories, light-vehicle production was up 18.4% y/y and exports were up 16.1% y/y in Mexico in December. In the full year 2020, however, Mexico's light-vehicle sales, exports, and production were all are down. Production of passenger cars continues to decline as LCV production improves. Mexico's overall light-vehicle sales declined in 2018 and 2019, and at the start of 2020 were soft prior to the COVID-19 pandemic. In December, COVID-19 cases were on the rise again, and although light-vehicle sales did not decline as sharply as in November 2020, demand did continue to decline at a double-digit rate. In full-year 2020, Mexico's light-vehicle sales dropped 28.0%. IHS Markit forecasts Mexican light-vehicle sales growth of 12.9% in 2021, as COVID-19 vaccines become more widely available in the second half of the year. IHS Markit also sees light-vehicle production increasing in Mexico in 2021, although not to the pre-pandemic level. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Seasonally adjusted data show that Brazil's industrial

production (IP) grew by 1.2% in November 2020 compared with

October. This marks the seventh consecutive monthly expansion and

puts the IP index 40.8% above its April value, according to the

National Statistics Office of Brazil (Instituto Brasileiro de

Geografia e Estatística: IBGE). Monthly growth will slow down in

the months ahead. (IHS Markit Economist Rafael Amiel)

- All four economic categories expanded, with production of capital goods posting the fastest growth, followed by production of durable goods. The two categories are catching up as they were the most affected during the March and April 2020 lockdowns.

- On the annual comparison and using unadjusted data, IP grew by 2.8% with respect to November 2019, and in the first 11 months of 2020, IP declined by 5.5% compared with January-November 2019.

- In December, the IHS Markit Brazil Manufacturing Purchasing Managers' Index (PMI) was at 61.5, suggesting further improvement in the health of the sector. PMI is a diffusion index and values above 50 indicate expansion, while below 50 contraction.

- We estimate IP to have contracted by 4.7% in the full year of 2020; fiscal and monetary stimuli have avoided a deeper decline. However, most of the fiscal stimulus will be withdrawn during the first half of 2021 and will restrain growth.

- On a positive note, we assume that by mid-2021, a large majority of the population will be vaccinated against the coronavirus disease 2019 (COVID-19) virus and that activities that require face-to-face contact will start to return to normality.

- Given the IP level reached in November 2020 and the very low levels recorded in earlier months, particularly in the second quarter of 2020, even if the IP index remains similar to its November 2020 level throughout 2021, the annual average for 2021 would still be 9.2% higher than the annual average of 2020.

- There is still ample room for catch up in the production of capital goods as well as durable goods, especially in the automotive sector, and we expect these to be the drivers of growth during 2021.

- Our latest forecast calls for industrial output to increase by 8.2% in 2021.

Europe/Middle East/Africa

- European equity markets closed lower; UK -1.1%, Germany/France -0.8%, Spain -0.6%, and Italy -0.3%.

- 10yr European govt bonds closes lower; Italy +5bps, Spain/France +2bps, and UK/Germany +2bps.

- iTraxx-Europe closed +1bps/49bps and iTraxx-Xover +8bps/253bps.

- Brent crude closed -0.6%/$55.66 per barrel.

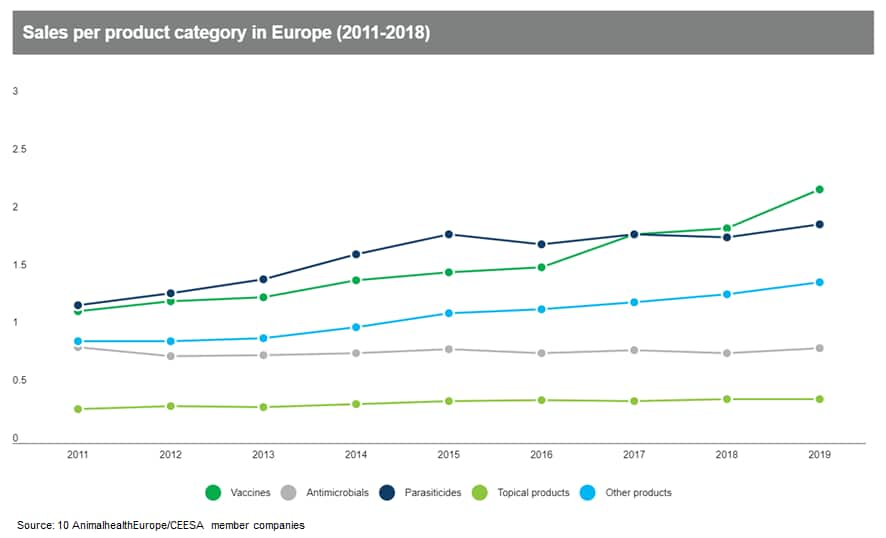

- According to the latest year of combined data from

AnimalhealthEurope and Executive Animal Health Study Centre (CEESA)

member companies, the European animal health industry amassed

revenues of €6.6 billion ($8.1 billion) in 2019. This was up by

9.5% year-on-year, which is the largest annual leap since 2014. It

is the third year in a row the European animal health sector has

grown. (IHS Markit Animal Health's Joseph Harvey)

- Vaccines were the only product category to display sales growth in Europe's animal health sector during 2019. Veterinary vaccines accounted for 33% of revenues at around $2.2bn - the largest product category. Vaccines became the strongest-selling animal health product category in Europe, overtaking revenues from parasiticides in the prior year. In 2019, sales of vaccines climbed 18%.

- The most recent figures also indicated a slight increase in revenues from antimicrobials (+5%). However, the latest total for antimicrobial sales is less than the figure for 2011 - revenues from this category have witnessed small deviations over the past eight years but remained largely flat, according to AnimalhealthEurope/CEESA statistics.

- After a dip in the sales of antiparasitics during 2018, this category rebounded to growth in the latest year (+6%).

- Europe makes up around 29% of the global animal health market and is the second-largest segment behind North America (43%). There are about 260 animal health companies in Europe that employ approximately 50,000 people. Of these businesses, over 110 are small-to-medium-sized enterprises.

- Animal health companies in Europe dedicate more than €500m each year to R&D - 7.6% of 2019's total revenues. It also represents an 11% improvement on the previous year's R&D spend of €450m. This increase is notably more than the overall increase in the European animal health sector's sales for 2019.

- According to AnimalhealthEurope, firms spent about 10% of revenues on R&D in the late 1990s and early 2000s. Over the last decade, animal health R&D expenditure dropped to around 7-8% of yearly turnover.

- AnimalhealthEurope's membership base represents around 90% of

the total European veterinary medicines market.

- France's consumption of goods (which account for around

one-third of total consumption) declined by 18.9% month on month

(m/m) in November 2020, according to seasonally adjusted figures

released by the National Institute of Statistics and Economic

Studies (Institut national de la statistique et des études

économiques: INSEE). (IHS Markit Economist Diego Iscaro)

- The November 2020 figures were largely driven by the substantial tightening of COVID-19 virus containment measures introduced in late October 2020. Non-essential retail businesses were closed between 30 October and 28 November 2020.

- The November 2020 m/m fall compares with declines of 16.7% m/m in March and 18.7% m/m in April 2020 (a cumulative fall of 32.3% compared with February 2020). While consumption of goods is likely to have rebounded strongly in December 2020 as shops reopened, it is likely to have recorded a quarter-on-quarter (q/q) decline of between 6.5% and 7.0% during the fourth quarter of 2020.

- As a reference, consumption of goods fell by 6.7% q/q and 7.0% q/q during the first and second quarters of 2020, respectively.

- In November last year, sales of manufactured products plummeted by 30.1% m/m, as sales of textile/clothing (-53% m/m), household durables (-25% m/m), and transport equipment (-20.8%) declined sharply.

- Energy consumption also went down by a strong 19.2% m/m in November 2020, following a 6.4% m/m increase in October 2020.

- IHS Markit projects French GDP to have declined by between 4.0%

q/q and 4.5% q/q during the last quarter of 2020. Although most

short-term indicators available so far suggest that the decline in

activity is likely to have been close to the lower bound of our

estimate, the decline in consumption in November 2020 was larger

than expected and represents a key downward-revision risk to our

fourth-quarter estimate.

- Sanofi (France) has announced the acquisition of clinical stage pharmaceutical company Kymab (UK) for up to USD1.45 billion. The deal will help the French firm bolster its late-stage pipeline with the addition of Kymab human monoclonal antibody targeting key immune system regulator OX40-Ligand, KY1005, which is a potential best-in-class treatment in a variety of immune-mediated disease therapeutic areas. The financial terms of the deal will mean that Sanofi provides Kymab with a proportionally large upfront payment of USD1.1 billion, as well as having a commitment to provide a further USD350 million contingent upon reaching certain milestone targets for KY1005. KY1005 is a potential first-in-class and best-in-class therapeutic, involving a new mechanism of action, across a wide range of immune and inflammatory disorders, according to Sanofi. The innovative candidate completed a Phase IIa study in August, having cleared both primary endpoints in moderate to severe atopic dermatitis in patients whose disease is inadequately controlled with topical corticosteroids. (IHS Markit Life Sciences' Eóin Ryan)

- Lanxess says it has entered exclusive negotiations to acquire

Theseo (Laval, France), a manufacturer of disinfection and hygiene

products used in livestock farming to prevent and control diseases.

Lanxess says it plans to finance the envisaged acquisition with an

enterprise value of approximately €70.0 million ($85.2 million) out

of cash. Completion of the planned transaction is expected in

mid-2021, subject to French employee information and consultation

process, and antitrust clearance, the company says. (IHS Markit

Chemical Advisory)

- Lanxess intends to integrate the business into its material protection products unit. "A successful acquisition of Theseo will allow us to strengthen our position in the field of animal hygiene and to expand our portfolio with further renowned premium products," says Michael Schäfer, head of material protection products at Lanxess. Acquiring Theseo will also enable Lanxess to offer products for the animal nutrition industry in the future, the company says.

- Theseo has about 100 employees and sites at Laval, France; Wietmarschen, Germany; Hull, UK; and Campinas, Brazil, and is projected to generate sales of about €33 million and an EBITDA in the mid-single-digit-million-euro range in 2020. Lanxess expects an additional annual EBITDA contribution in the same amount from synergy effects, within three years of completion of the planned transaction.

- Lanxess sees strong growth prospects due to rising biosecurity requirements, with the continuous drive toward antibiotic-free meat, with these products playing an ever-growing role in livestock production. Theseo also has a well-positioned portfolio in water hygiene as well as animal nutrition, Lanxess says.

- Mercedes-Benz's passenger car brand experienced a 7.5%

year-on-year (y/y) decline in its global sales volumes in 2020 to

2,164,187 units owing to the impact of the COVID-19 virus pandemic,

according to a company statement. The brand enjoyed a strong end to

the year with a 0.2% y/y increase in sales to 615,328 units. (IHS

Markit AutoIntelligence's Tim Urquhart)

- The Smart brand, however, had a very difficult year, with the pandemic significantly hitting demand for the city carmaker. For the full year 2020, the Smart brand's sales fell by 67.1% y/y to 38,391 units and by 43.5% y/y to 16,385 units in the last quarter of 2020.

- This left combined Mercedes-Benz and Smart passenger car sales at 2,202,578 units in 2020, which was a decline of 10.3% y/y.

- In the final quarter of 2020, the brands posted a combined 1.8% y/y decline to 631,713 units. In 2020, Mercedes-Benz Vans posted an 8.9% y/y fall to 325,771 units, although in the final quarter of the year the unit managed to post growth of 1.7% y/y to 103,892 units.

- Daimler's board member for sales and marketing Britta Seeger said, "2020 placed great demands on us as a society. For Mercedes-Benz, the safety and health of our customers is our top priority. Dealerships and sales partners were able to meet the diverse customer requirements with creative, digital and contactless customer advice. We are delighted that our models continue to be so popular in these challenging times. The new S-Class in particular is inspiring and fascinating, as can already be seen from the high number of more than 40,000 orders worldwide."

- In terms of the regional market development, the Mercedes-Benz brand managed to maintain positive growth in Asia Pacific, with an increase of 4.7% y/y to 1,024,315 units.

- The majority of these sales occurred in China, which was the first country to experience a major economic impact due to the pandemic while also being the first to recover, with sales up by 11.7% y/y during the year to 774,382 units.

- In Europe, the brand delivered 784,183 passenger cars last year (-16.4%), while in Germany Mercedes-Benz sold 286,108 cars (10.1%).

- Sales in the North American region totaled 317,592 units (-14.7%), and Mercedes-Benz delivered 274,916 cars in the United States last year (-13.0%).

- The Mercedes-Benz brand in particular looks to have weathered the storm of the pandemic relatively well, while in the Chinese market it was a standout performer.

- PPG Industries announced today it will acquire Worwag

(Stuttgart, Germany), a producer of liquid, powder and film

coatings for industrial and automotive applications. Terms of the

transaction, including purchase price, have not been disclosed. The

deal is expected to close in the first half of this year. (IHS

Markit Chemical Advisory)

- Worwag, a family-owned business, has operations in several countries in Europe, the Americas and Africa, and generates about €220 million/year ($269 million) in revenue. It has about 1,100 employees.

- "The addition of Worwag will also enhance PPG's waterborne, direct-to-metal, liquid and powder coatings offerings, and allow us to further expand current customer distribution in key geographies," says Rebecca Liebert, executive vice president at PPG.

- The deal is the second substantial acquisition announced by PPG this year, and the fourth since mid-November, including the $1.52-billion acquisition of Finnish decorative coatings producer Tikkurila.

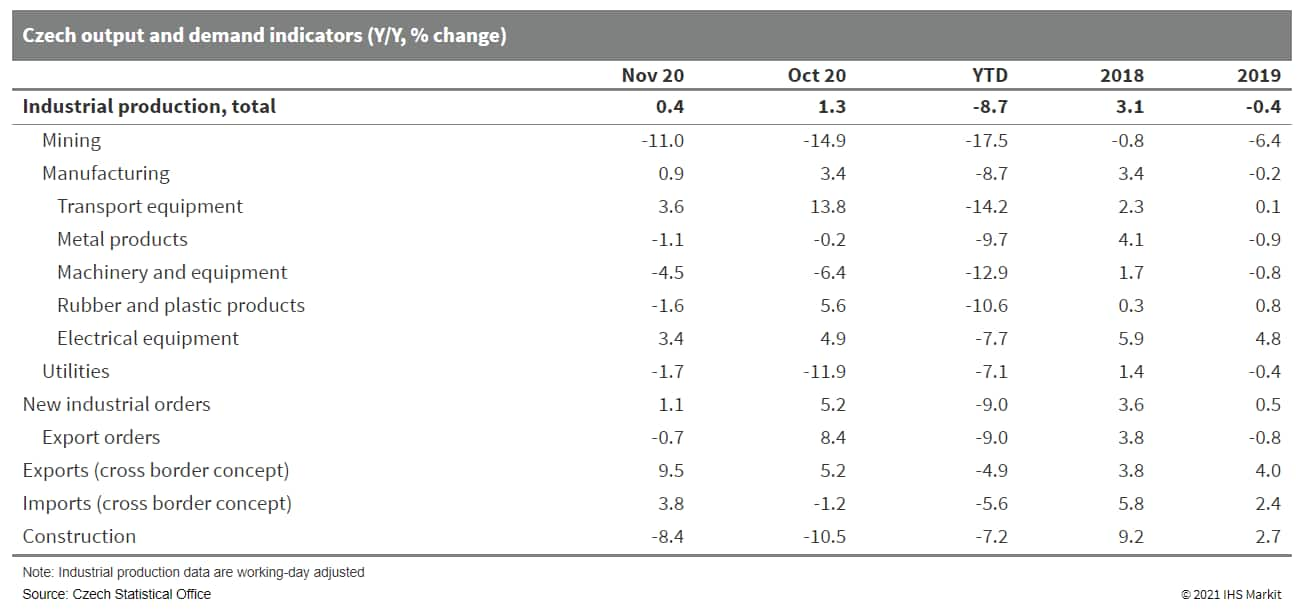

- Czech seasonally adjusted industrial output fell by 1.7% month

on month (m/m) in November 2020, the steepest decline since April

2020, according to a release by the Czech Statistical Office.

Nevertheless, year-on-year (y/y) production growth remained in

positive territory when adjusted for the number of working days, at

0.4%. (IHS Markit Economist Sharon Fisher)

- The motor vehicles branch was the main driver of November 2020 growth, rising by 3.6% y/y, while chemicals and construction materials also contributed positively. Growth was hindered by declining output of machinery and equipment and beverages.

- Nominal industrial receipts increased by 1.1% y/y in November 2020, negatively affected by a decline in domestic orders (down by 3.7% y/y). Average industrial employment fell by 3.8% y/y, while nominal monthly wages increased by 3.4%.

- In a separate release, seasonally adjusted construction output rose by 0.9% m/m in November 2020, the strongest rate since January 2020. Despite those gains, activity fell by 8.4% y/y in November 2020, affected by a steep drop in building output.

- The construction sector continued to struggle with labor shortages in 2020, further hampered by reduced inflows of foreign workers due to COVID-19 virus restrictions. Although Czechia's registered unemployment rate edged upwards to 4.0% in December 2020, bringing the full-year average to 3.6% from 2.8% in 2019, the number of job vacancies remained higher than the number of registered unemployed throughout the year.

- On the fiscal front, the state budget gap jumped to a record high of CZK367.4 billion (USD15.8 billion) in 2020, but still below the revised target of CZK500 billion. With CZK216.5 billion going to the fight against the COVID-19 virus pandemic, state budget expenditures surged by 18.8%, while revenues fell by 3.1%.

- Industrial production plunged by 8.7% y/y in the first 11 months of 2020, and full-year growth was likely close to our December 2020 forecast at -7.9%. The IHS Markit purchasing managers' index for manufacturing improved markedly in December 2020, reaching the highest level since April 2018.

- Czech confidence indicators also improved significantly in December 2020, with m/m increases in all sectors, particularly services and industry, as well as among consumers. Nevertheless, new COVID-19 virus restrictions will hurt services activity in early 2021 while also putting a damper on household demand.

- Czech households are also likely to be hit by higher unemployment rates during the coming months, although the government will aim to keep employment support going as long as possible, especially with parliamentary elections approaching in October 2021. Some analysts have warned that pre-election spending, combined with COVID-19 virus measures and the recently approved tax package, will result in a state budget gap that is even bigger than last year's figure.

- Currently targeted at CZK320 billion, the 2021 state budget gap

does not take into account the tax package, which is expected to

result in a loss of revenue worth CZK87.5 billion owing to the

abolishment of the super-gross wage, the reduction of the excise

duty on diesel fuel, and the increase in the tax-free threshold to

CZK3,000. Although President Miloš Zeman had threatened to veto the

tax package, he sent it unsigned to the lower house, allowing the

legislation to take effect at the start of the year.

- In early January, French major Total evacuated all non-essential staff - around 500 contractors and sub-contractors - from its operated Mozambique LNG project site at the Afungi LNG Park in northern Cabo Delgado Province. The LNG project of 12.88 million tons per annum (MMtpa) was sanctioned in mid-2019 and is due for start-up in 2024. Attacks by Islamist insurgents near the site prompted the evacuation via the project's dedicated airstrip as Total deemed land and sea routes too hazardous. Total has referred to the evacuation as precautionary and temporary, and a skeleton staff remains. Insurgent attacks close to the Afungi LNG Park, which will also host the proposed ExxonMobil-operated Rovuma LNG plant, have been intensifying. A 1 January 2021 attack on the resettlement village of Quitunda and a nearby riot police station marked a new level of threat as both occurred within the Afungi LNG Park, less than 1 km from the airstrip but outside the fenced project construction area. Previously, the militants had secured several notable victories, including temporarily seizing and occupying the strategic Port of Mocímboa Da Praia. In June 2020, militants kidnapped and killed workers sub-contracted by Total, around 50 km from the project site. The proximity of the violence was a clear driver of Total's decision to evacuate the site. Although mooted as a temporary measure, it remains unclear what security parameters will have to be met for the workers to return. The scale of the evacuation is surprising in the context of Total's August 2020 formation of a joint task force (JTF) with Mozambique's government to improve security around the Afungi LNG Park, allowing Total to house several hundred government troops on-site to supplement the French company's private security personnel. (IHS Markit E&P Terms and Above-Ground Risk's Roderick Bruce)

Asia-Pacific

- APAC equity markets closed mixed; India +1.0%, Hong Kong +0.1%, South Korea -0.1%, Australia -0.9%, and Mainland China -1.1%.

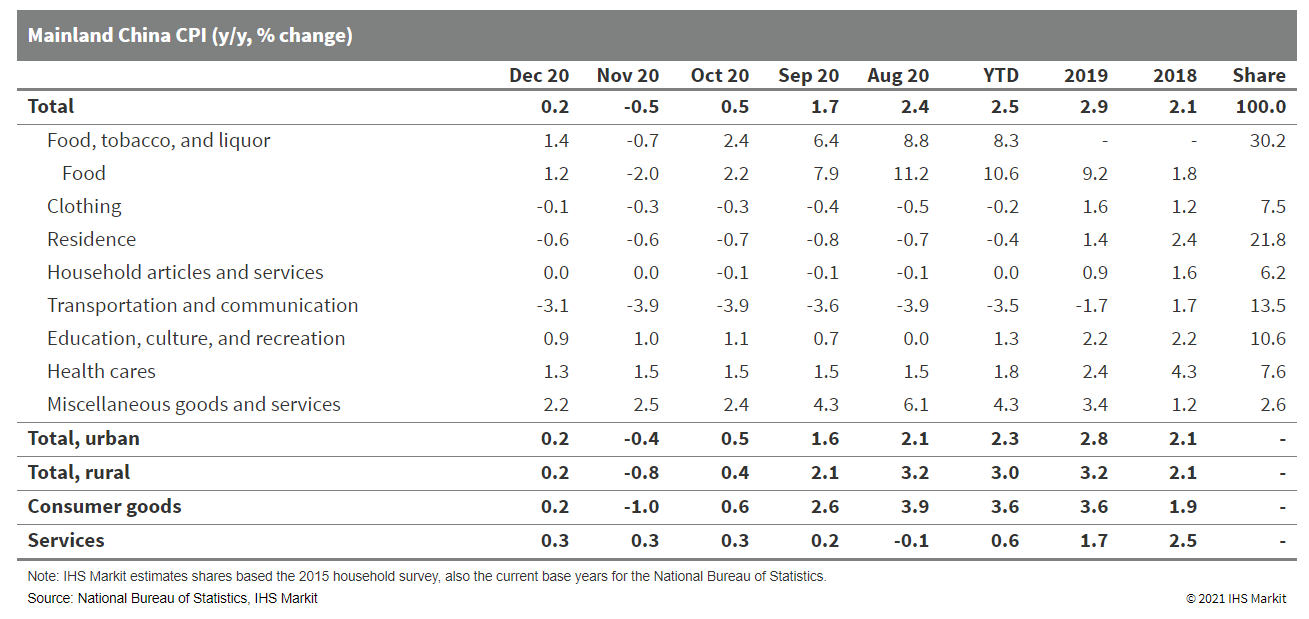

- Despite the recent regional COVID-19 outbreaks in northern

mainland China, targeted pandemic control measures and stable

monetary policy could facilitate sustained nationwide economic

recovery. Further improvement in the core Consumer Price Index

(CPI) and Producer Price Index (PPI) is therefore expected in 2021.

(IHS Markit Economist Lei Yi)

- Mainland China's CPI increased 0.2% year on year (y/y) in December 2020, returning to inflation territory from the 0.5% y/y deflation registered in November, according to the latest data release from the National Bureau of Statistics. Month-on-month (m/m) consumer price gains, at 0.7%, was the highest recorded since February 2020, compared with the November reading of -0.6% m/m.

- By component, the reinflation of food prices was behind the pickup in the headline CPI reading in December. In addition to persistently cold weather increasing the costs of storage and transportation of fresh food, the new year celebrations and upcoming Spring Festival also drove up food demand, especially for meat products. Pork price deflation, notably, narrowed to 1.3% y/y in December from 12.5% y/y in November. December's services price inflation remained unchanged from the preceding two months at 0.3% y/y. However, the core CPI, excluding food and crude oil, rose by 0.4% y/y, down from 0.5% y/y in July-November 2020.

- Producer price index (PPI) deflation further narrowed to 0.4% y/y in December 2020, up 1.1 percentage points from the November reading. Month-on-month PPI inflation stood at 1.1%, the highest rate recorded since end-2016. The continued recovery of global commodity prices supported the improvement in the headline PPI in December. This led to expanded month-on-month price inflation in oil-related sectors including petroleum and natural gas extraction and fuel processing, as well as smelting and pressing of ferrous and non-ferrous metals.

- Cumulatively, the CPI registered an increase of 2.5% y/y through the end of 2020, with core CPI excluding food and crude oil rising by 0.8% y/y; full-year PPI deflation reached 1.8% y/y.

- The latest CPI data is in line with our full-year CPI forecast

for 2020, which stands at 2.5%. In 2021, while food prices will

most likely continue to decline in year-on-year terms owing to the

high base effect, the risk of a persistent overall deflation

remains low given the stabilized core CPI and services prices. With

mainland China's central bank prioritizing stability in its

monetary policy, IHS Markit now forecasts full-year CPI to reach

1.2% y/y in 2021.

- Tesla is reportedly planning to begin production of a new compact model at its Shanghai Gigafactory to make its models more accessible to mass-market consumers. According to electrive.com, the new model will be positioned bellowed the Model 3 and will begin production as early as 2022. News regarding the new Tesla model has also been reported by several Chinese media recently. According to Tencent, the vehicle will start at CNY160,000 (USD247,000), a price point much lower than Tesla's standard-range Model 3 which is sold for CNY249,900 in China. Tesla announced its plan to introduce a new compact car for USD25,000 at the Battery Day event held in the US in September. Reports regarding the new model planned to begin production in China seem to match Tesla's hints at the Battery Day event, although the reported details, including the production timeline, have not been confirmed by Tesla at this point. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese electric vehicle (EV) startup AIWAYS has partnered with auto service provider Jinjiang Auto to jointly explore mobility service business, reports Gasgoo. AIWAYS' mass-market model, the U5 electric sport utility vehicle (SUV), which has received operational licences, will be supplied to Jinjiang Auto to be deployed for mobility services. Mobility services are witnessing impressive annual growth rates. Having identified opportunities in the segment, automakers are announcing collaborations to strengthen their offerings in the mobility sector. AIWAYS has already launched its own mobility service platform, Fengchi Chuxing, which operates in Shangrao (Jiangxi province). The EV startup has collaborated with the leading Chinese car service provider, eHi Car Services, to jointly deploy mobility services in 18 cities in China. In addition, AIWAYS has launched sales of the U5 in Europe and has delivered several hundred units of the U5 to car rental company Filippi Auto in Corsica. (IHS Markit Automotive Mobility's Automotive Mobility)

- Coca-Cola's upmarket soft drink has been well received by Japanese consumers. Fanta Premier Grape, a new drink aimed at adults released last March, sold 31 million bottles by the end of November 2020. This made it the top-selling Fanta drink in the country, taking into account all variants launched in the last decade. Premier Peach, another new Fanta beverage with 13% fruit juice, was released in mid-October and shipped 11.55 mln bottles in slightly more than a month. In Japan, a drink product is typically considered a success when its shipment volume has exceeded 10 million bottles. Customers in their 30s and 40s were consuming less and less fruit-flavored carbonated soft drinks, with an annual decrease rate of more than 10%, so four years ago Coca-Cola (Japan) started a project for new Fanta products targeting such customers and created about 60 trial products for the purpose, fine-tuning the volumes of fruit juice and fruit purée. The resulting beverage, Fanta Premier Grape, contains 13% fruit juice and is made using grapes processed within 24 hours of harvesting, that are partly pressed into juice and partly ground into purée. Fanta Grape and Fanta Orange each contain only 1% fruit juice. Fanta Premier Grape is packed in 380ml bottles and sells for JPY150 (USD1.45), excluding tax, while told older variants come in 500ml bottles priced at JPY140. "More than 90% of adults (in Japan) have drunk Fanta," said Masaki Kawano, 33, in charge of marketing Fanta products at Coca-Cola (Japan). "We hoped they would recall their formative experiences of childhood and have a reunion (with Fanta products)." (IHS Markit Food and Agricultural Commodities' Neil Murray)

- The main creditor bank of SsangYong Motor, Korea Development Bank (KDB), proposes to infuse additional funds into SsangYong on condition that its Indian parent, Mahindra & Mahindra (M&M), holds off from a stake sale until the company has been turned around, reports the Business Korea. SsangYong's domestic creditors also put forward another condition that M&M should extend the period of its guarantees of loans that SsangYong received from foreign banks. A Seoul court has given SsangYong until 28 February to undertake autonomous restructuring support (ARS) to solve its default crises before it is placed under a court rehabilitation program. So far, the chances of reaching a settlement appear poor, as M&M remains firm in its stance on offloading its majority stake in SsangYong. The company is currently in talks with potential investors and could undertake a 25% capital reduction and hold a minority stake of 30% or less in the beleaguered South Korean arm if the deal goes through. US-based automotive distribution company HAAH Automotive Holdings has shown an interest in taking over M&M's stake. SsangYong recorded a net loss for the 15th consecutive quarter in the third quarter of 2020. (IHS Markit AutoIntelligence's Isha Sharma)

- The State Bank of Vietnam (SBV) has announced its 2021 credit

growth target, which has been set at 12%. This figure is similar to

2020's 12.1% year-on-year credit growth. However, the SBV has

stated that the target is flexible. (IHS Markit Banking Risk's

Angus Lam)

- The SBV did not specify whether individual banks will be given different credit growth targets as previous years; the 12% credit growth target is similar to the 2020 target. Different credit growth targets in the previous years were based on their progress on meeting the Basel II accord.

- The main concern regarding the credit growth target is that it is unlikely to reflect on actual demand on the economy and in order to meet the target, banks have the potential to lower credit standards, such as the state-directed lending of VND293 trillion (USD12.7 billion) to businesses affected by the COVID-19-virus outbreak.

- It is likely that banks will be given a different credit growth target based on their performance; in 2020, several banks were given higher credit growth targets

- Toyota Australia has partnered with leading miner BHP to conduct trial operations of a converted electric Land Cruiser. These trials will be conducted at a BHP Nickel West mine in Western Australia. The companies will test a Land Cruiser 70, converted to a battery electric vehicle (BEV), which will be deployed for underground mine use and will operate under full battery power. Edgar Basto, president of Minerals Australia, BHP, said, "This partnership is another step in our ongoing studies into how we can reduce the emissions intensity of our light-vehicle fleet. Reducing our reliance on diesel at our operations will help achieve our medium-term target of reducing operational emissions by 30% by 2030". The Toyota Land Cruiser is an E-segment SUV based on the F1 platform and has been selling well in the Australian market with annual sales of around 13,000 units in the last couple of years, according to IHS Markit's light-vehicle sales forecast. The automaker plans to launch a 2021 Horizon special edition of its Land Cruiser 200 Series Sahara in March this year. BHP has recently been focusing on using cleaner forms of power supply, and aims to reach net zero operational emissions by 2050. (IHS Markit AutoIntelligence's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-january-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-january-2021.html&text=Daily+Global+Market+Summary+-+11+January+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-january-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 11 January 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-january-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+11+January+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-11-january-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}