Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 13, 2020

Daily Global Market Summary - 13 August 2020

European and most US equity markets closed modestly lower, while APAC markets closed mixed. The sell-off in European and US government bonds continued today, with European yields higher across the region and the tepid demand during the US Treasury auction drove US yields higher for the fifth consecutive day. European credit indices were close to flat on the day, while US indices were wider across IG and high yield. Oil and the US dollar were lower on the day, while gold and silver closed higher. US initial claims for unemployment insurance were lower versus last week and below 1 million for the first time since March, with the positive report actually creating some concerns that it and additional positive reports could decrease the perceived urgency of passing a new US stimulus bill. All eyes will now be on tomorrow's 8:30am EST US retail sales report to gauge if the recent re-closing of certain parts of the US impacted consumer purchases in July.

Americas

- US equity markets closed modestly lower except for the Nasdaq +0.3%; DJIA -0.3% and S&P 500/Russell 2000 -0.2%, after a late day sell-off across all US markets.

- 10yr US govt bonds closed +4bps/0.72% yield and 30yr bonds +6bps/1.43%, with 30s coming under pressure given today's $26 billion auction that was met with tepid demand. 30s are now +26bps from the lowest yield over past 5 trading days.

- CDX-NAIG closed +2bps/67bps and CDX-NAHY +12bps/401bps. Most of

the widening occurred after 2:00pm, with the CDX-NAHY widening 9bps

between 2:00-3:15pm EST.

- Crude oil closed -1.0%/$42.24 per barrel.

- Gold closed +1.1%/$1,970 per ounce and silver +6.7%/$27.72 per ounce.

- DXY US dollar index was down as much as 0.5% at 10:30am EST, but rallied during the remainder of the day to close -0.2%/93.25.

- Seasonally adjusted US initial claims for unemployment

insurance, at 963,000 in the week ended 8 August, remained at

historically high levels, although well below the all-time high of

6,867,000 in the week ended 28 March. It took 11 weeks for claims

to fall below 1 million. (IHS Markit Economist Akshat Goel)

- The seasonally adjusted number of continuing claims (in regular state programs), which lags initial claims by a week, fell by 604,000 to 15,486,000 in the week ended 1 August. The insured unemployment rate in the week ended 1 August fell 0.4 percentage point to 10.6%.

- There were 488,622 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 8 August. In the week ended 25 July, continuing claims for PUA fell by 2,233,082 to 10,723,396.

- In the week ended 25 July, 1,224,443 individuals were receiving Pandemic Emergency Unemployment Compensation (PEUC) benefits.

- The Department of Labor provides the total number of people claiming benefits under all its programs with a two-week lag. In the week ended 25 July, the unadjusted total fell by 3,065,616 to 28,257,995.

- The index of US import prices increased 0.7% month on month

(m/m) in July following a 1.4% surge in June. The index's 12-month

growth rate rose 0.6 percentage point to -3.3%. (IHS Markit

Economist Gordon Greer)

- The index of nonfuel import prices increased 0.2% m/m in July, while its 12-month growth was level.

- Fuel import price growth remained positive on the heels of strong showings during the previous two months. The index of prices for imported fuel increased 6.9% m/m in July after a 21.9% June advance. The cost of imported fuel was down 32.8% versus July in the prior year.

- Export prices advanced 0.8% m/m in July, with the 12-month growth rate rising 0.7 percentage point to -4.4%. An increase was seen in both agricultural and nonagricultural exports.

- IFR/Refinitiv data showed that US investment grade supply for 2020 had reached USD1.336 trillion on 11 August, surpassing the full-year record of USD1.33 trillion set in 2017. In addition, US high-yield issuance had reached USD274.8 billion on 12 August, exceeding the full-year issuance total for 2019. (IHS Markit Economist Brian Lawson)

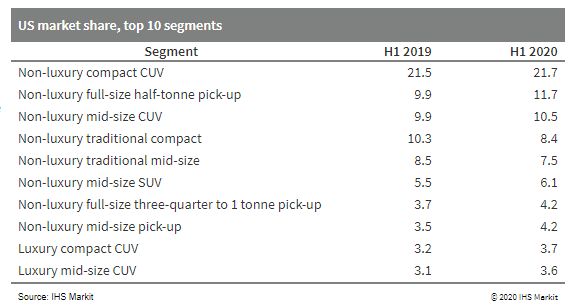

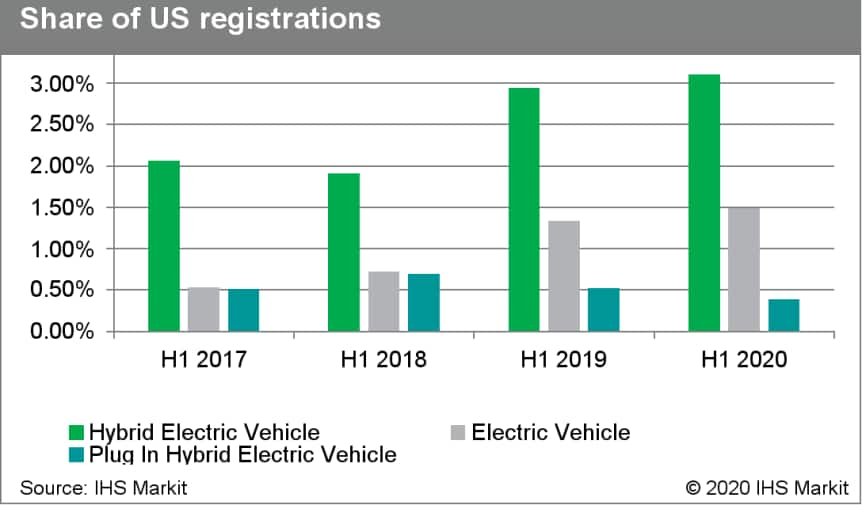

- Although 2020 began with expectations for a relatively normal

year of vehicle sales, although some contraction of the US market,

the COVID-19 pandemic began affecting the US light-vehicle market

in March and had a significant impact on registrations in the first

half of 2020. Over the first six months of the year, US

registrations declined 22.8% year on year (y/y). Barring the

introduction further shutdowns, either regional or national, the

registration figures for April are expected to represent the lowest

point of 2020, with the declines from May through July becoming

progressively smaller. IHS Markit has reviewed the first-half

registration data for early signals of changes in consumer

behavior, following our similar look at the results in April. US

registrations of pick-up trucks have continued to gain market share

in 2020. Electric vehicles (EVs) continued to gain market share in

the US, while the share of plug-in hybrid EVs (PHEVs) continued to

fall. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Volkswagen has announced that construction is to start soon of an engineering and planning center (EPC) at its plant in Chattanooga, Tennessee (United States), to support production of the ID.4 and other electric vehicles (EVs) at the facility. VW says the EPC will feature a unique, state-of-the-art high-voltage laboratory to develop and test battery cells and battery packs for upcoming EV models to be produced in the US. In a company statement, Wolfgang Maluch, vice-president of engineering at Volkswagen of America, said, "There are two ways that auto companies approach the development of electric vehicle batteries. A lot of them will farm out the development and testing of batteries to another company, and some will actually do the work of developing and testing in-house. We are doing the latter." VW says the lab will also have a multi-axis shaker table (MAST) designed specifically to test EV batteries and packs. VW notes that few MASTs are designed for an EV battery pack, which are the largest and heaviest component of an EV. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous vehicle (AV) startup May Mobility is planning to expand its operations in Ann Arbor (Michigan, US). The company is looking to expand all aspects of its services, including enhancements to its AV shuttle fleet, supported with a performance grant of USD700,000 by the Michigan Economic Development Corporation's (MEDC) Michigan Strategic Fund. The program is expected to generate total private investment of USD11.8 million and create 100 high-wage engineering and technology jobs in the city, reports MITechNews. Ann Arbor is attracting various tech players as it is one of the few cities that allows AVs to operate without a human behind the wheel. Recently, Yandex has begun testing a fleet of autonomous cars in Ann Arbor. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The US EPA has approved the plant extract, nootkatone, for use in insecticides and insect repellents against ticks, mosquitoes and other biting insects. The EPA proposed approval of the new active ingredient in July. This covers a manufacturing-use product only, but it can now be used to develop new products for protecting people and pets. Nootkatone was discovered by the US Centers for Disease Control and Swiss company Evolva (Rienach) has exclusive worldwide patent rights. Evolva is in advanced discussions with leading pest control companies for possible commercial partnerships, the EPA says. If interested companies submit a registration package, new products could be commercially available as early as 2022, it adds. Studies show that nootkatone-based insect repellents may protect from bites at similar rates as products based on existing ais and that they can provide protection for up to several hours, the EPA notes. A new ai will assist in addressing the growing levels of resistance to other insecticides, it says. (IHS Markit Crop Science's Jackie Bird)

Europe/Middle East/ Africa

- European equity markets closed lower across the region; UK -1.5%, Italy -0.9%, Spain/France -0.6%, and Germany -0.5%.

- 10yr European govt bonds closed sharply lower; Spain +7bps, Italy/France +5bps, Germany +4bps, and UK +1bp.

- iTraxx-Europe closed +1bp/53bps and iTraxx-Xover -1bp/335bps.

- Brent crude closed -1.0%/$44.96 per barrel.

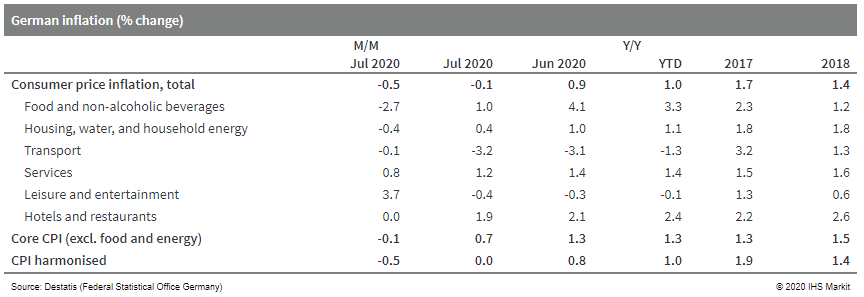

- Final July consumer price index (CPI) data based on national

methodology from the German Federal Statistical Office (FSO)

confirm the "flash" estimate released on 30 July, showing a

month-on-month (m/m) decline of 0.5% and a sharp drop in annual

inflation from June's 0.9% to 0.0%. (IHS Markit Economist Timo

Klein)

- The EU-harmonised CPI measure also declined by 0.5% m/m, dampening its annual rate from 0.8% to 0.0%. German harmonized inflation has thus fallen below the eurozone average (0.4%), with the gap between the two switching from +0.5 percentage point to -0.4 percentage point. This largely reflects the impact of the value-added tax (VAT) cut (from 19% to 16% for most goods and from 7% to 5% for the lower rate applied mainly to food).

- At 0.7% year on year (y/y), CPI inflation excluding food and energy, as a measure of core inflation, declined from 1.3% in June and an average of 1.5% during the 12 months leading up to June. The component breakdown reveals that energy (-0.7% m/m, annual rate down from -6.2% to -6.7%) played a role, but energy prices would have increased were it not for the VAT cut. By contrast, food prices would have even shown a declining annual rate in the absence of the VAT cut.

- The FSO also provided a measure of the theoretical maximum impact of the VAT cut on the m/m change for each category. This exceeds the actual impact, however, as firms will have passed on only part of the tax cut in order to bolster their margins and in view of ongoing capacity limitations for many services until a vaccine for the COVID-19 virus has become widely available (probably around mid-2021).

- For the total CPI, the maximum potential VAT cut impact is 1.6%, which reflects the fact that parts of the CPI - most notably rents - are not affected by VAT anyway.

- Generally speaking, the VAT cut dampened prices of goods much

more than it did those for services, the split showing that goods

price inflation fell from 0.2% to -1.4% y/y whereas service-sector

inflation only slipped from 1.4% to 1.2% (see Chart 2 below for

details about the relative influence of key CPI categories).

- The Volkswagen (VW) Group has boosted provisions for its financial services unit for credit and residual value risks by EUR500 million (USD590 million), according to a Bloomberg report. The provisions have specifically been increased in relation to risks to leasing contract defaults and the falling book value of vehicles under personal contract hire (PCH) or personal contract purchase (PCP) contracts. The increased provision for risk mainly relates to the company's operations in the United States as things stand at the moment. In other countries, especially in Europe, individual financial arms are making arrangements to recognize the enhanced risk to their operations that has resulted from the economic uncertainty stemming from the COVID-19 virus pandemic. (IHS Markit AutoIntelligence's Tim Urquhart)

- Lanxess says net profits in the second quarter of 2020 were

almost eight times higher than in the same period of the previous

year, at €798 million ($943 million). This is primarily due to the

sale of its 40% stake in chemical park curator Currenta to

Macquarie Infrastructure and Real Assets in April, which resulted

in a disposal gain of €740 million.

- Sales declined 16.7% year on year (YOY), to €1.44 billion, due to weak demand across many industries and lower raw material prices, the company says. EBITDA and EBIT shrank by 23.8% and 57.3%, to €198 million and €61 million, respectively.

- The company's consumer protection business posted a positive quarter with sales growing 21.9% YOY, to €301 million and EBITDA pre-exceptional items 41.7% higher YOY, to €68 million. The result was mainly due to strong business with agricultural chemicals in the Saltigo business unit and continued good demand for disinfectants in the material protection products division, the company says.

- Weak demand from the automotive industry squeezed earnings in the other three segments, especially engineering materials, which recorded a 33% YOY drop in sales, to €244 million, dragging EBITDA pre-exceptionals down 57%, to €28 million, Lanxess says.

- Sales of the advanced intermediates business fell by 20%, to €469 million, with EBITDA pre-exceptionals down 12%, to €100 million.

- Specialty additives' sales went down 20% YOY, to €403 million, and EBITDA pre-exceptional items declined 29%, to €63 million.

- The company says that its ongoing strong liquidity is helping it secure financial and operating liquidity in the uncertain environment caused by COVID-19.

- Operating cash flow decreased 39% YOY, to €52 million, and net debt at the end of June was down to €929 million from €1.74 billion at the end of June 2019.

- Meanwhile, in response to the impact of the pandemic the company reduced its capital expenditure by 19%, to €88 million, it says.

- A study of European domestic pig populations has identified an emerging reservoir of potentially zoonotic swine influenza A viruses. The research - coordinated by the Friedrich Loeffler Institut (FLI), Freiburg University Medical Center and other partners - carried out passive surveillance of nearly 2,500 European pig holdings. Over 18,000 individual samples identified a year-round presence of up to four major swine influenza A virus (swIAV) lineages on more than 50% of the farms monitored. Phylogenetic analyses showed "intensive" reassortment with human pandemic A (H1N1)/2009 (H1pdm) virus resulted in an "expanding and novel repertoire" of at least 31 distinct swIAV genotypes and 12 distinct hemagglutinin/neuraminidase combinations. Researchers stated these have largely unknown consequences relating to virulence and host tropism. Several viral isolates proved resistant to the human antiviral MxA protein - something the researchers said is a prerequisite of zoonotic transmission and stable introduction into human populations. Several lineages antigenically distinct from human vaccine strains were identified. The scientists concluded European swine populations represent reservoirs for emerging influenza A strains with zoonotic and possibly pre-pandemic potential. Dr Martin Schwemmle of the Freiburg University Medical Center said: "Some of the swine influenza viruses have already crossed an important immune defense barrier for transmission to humans. This considerably increases the risk." (IHS Markit Animal Health's Sian Lazell)

- South Africa's real seasonally adjusted annualized GDP is

expected to contract by 38.7% q/q during the second quarter,

initial indicators show. This will be the fourth consecutive

quarterly decline in South Africa's real GDP. (IHS Markit Economist

Thea Fourie)

- South Africa's nationwide COVID-19 lockdown measures commenced on 27 March and only started to be eased marginally from 1 May. This left overall economic activity severely under pressure during the second quarter due to the loss in local demand and export disruptions following business closures, the prohibiting of local and global travel, and the banning of the sale of alcohol and tobacco products.

- During the second quarter, real retail trade sales fell by 23.2% q/q, manufacturing production contracted by 38.3% q/q, and electricity production slowed by 13.9% q/q. Mining production fell by 38.2% q/q over the period.

- Real retail trade sales contracted by 49% month on month (m/m) in April, followed by a 68.7% m/m rebound in May. Sales in the textile, clothing, footwear, and leather products category showed the largest contraction (down 33.0 q/q) during the second quarter, followed by the household furniture, appliances and equipment segment (down 31.0% q/q).

- Manufacturing production fell by 44.4% m/m during April, followed by a 30.4% m/m rebound in May. During the second quarter, activity in the motor vehicles, parts and accessories and other transport equipment segment showed the biggest drop of 62.8% q/q, followed by the furniture and other manufacturing segment's decline of 58.7% q/q.

- South Africa's real GDP is expected to contract by an average of 6.4% year on year (y/y) during the first half of 2020. IHS Markit's overall GDP expectation for 2020 is unchanged at a contraction of 8.9%.

Asia-Pacific

- APAC equity markets closed mixed; Japan +1.8%, South Korea +0.2%, Mainland China flat, Hong Kong -0.1%, India -0.2%, and Australia -0.7%.

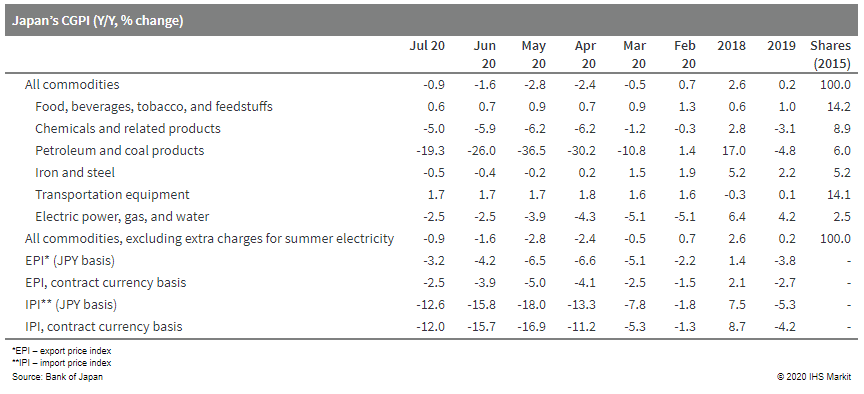

- Japan's Corporate Goods Price Index (CGPI) rose by 0.4% month

on month (m/m) in July on a seasonally adjusted basis (calculated

by IHS Markit), narrowing the year-on-year (y/y) contraction to a

0.9% drop. (IHS Markit Economist Harumi Taguchi)

- The improvement largely reflected softer declines in petroleum products, electric power, non-ferrous metals, and agriculture, forestry, and fishery products.

- The improvement in demand was due to the reopening of economic activities in many advanced economies, which lifted international commodity prices and pushed up the yen-based import price index by 1.7% m/m (calculated by IHS Markit), softening the y/y contraction to a 12.6% drop.

- Year-over-year increases softened in a broad range of machinery products, reflecting weak demand.

- The July results were slightly better than IHS Markit had

expected. The softening of the CGPI contraction is likely to

continue as containment measures ease.

- Japan's current-account surplus rose by 27.8% in June from the

previous month to JPY1.0 trillion (USD9.8 billion) on a seasonally

adjusted basis, according to finance ministry data released on 11

August. This was the second straight improvement for the seasonally

adjusted figure, but the surplus narrowed by 86.6% year on year

(y/y) to JPY167.5 billion on a non-seasonally adjusted basis. (IHS

Markit Economist Harumi Taguchi)

- A large y/y decline in the current-account surplus reflected the trade deficit, which fell from a surplus of JPY755.5 billion. The contraction of imports softened to 14.4% y/y from a 27.7% drop in May. Exports continued to decrease (by 25.7% y/y) because of weak demand caused by coronavirus disease 2019 (COVID-19) virus containment measures in Japan's trade partners.

- The service balance deficit softened slightly from a year earlier largely because of increases in intellectual property and computer services, which partially offset a decline in the travel balance deficit. Primary income remained a major source of the current-account surplus, but this softened because of weaker portfolio income.

- Nearly 70% of surveyed American companies expressed optimism

about China's market prospects and 87% reported that they have no

plans to shift production out of China, as reported by China Daily

citing the annual member survey of US-China Business Council

(USCBC). The survey was conducted in late May and June among more

than 100 of USCBC's member companies doing business in China, with

50% in manufacturing and 45% in services. (IHS Markit Economist

Yating Xu)

- Separately, 83% of surveyed companies counted China as either the top or among the top five priorities for their global strategy, and 91% indicate their China operations are profitable, though with a lower margin than in previous years. Moreover, 61% of the US companies reported China's IP protection had improved.

- Increased cost or uncertainties from US-China tensions and COVID-19 are reported as the main obstacles for investment decisions by American companies in China.

- The survey suggested that American companies remain committed to the Chinese market over the long term, despite trade frictions and rising calls for economic decoupling by political hawks weighing on investment decisions and near-term economic prospects.

- Chinese tech startup Human Horizons will debut its electric vehicle (EV), known initially by its prototype name HiPhi 1, at the 2020 Beijing Motor Show, which opens on 26 September. The model, which will officially be named the HiPhi X, will be offered in rear- and all-wheel-drive derivatives. Battery options will include a 96-kWh battery pack that provides a range of at least 610 kilometers. HiPhi is a premium brand introduced by Human Horizons. With the HiPhi X, the startup is looking to showcase its latest technologies on a production EV. Human Horizons itself is focused more on the development of mobility solutions, especially technologies that accelerate infrastructure upgrades for cities looking to build a more intelligent transportation system. According to the company, the HiPhi X is equipped with an advanced, highly personalized onboard artificial intelligence (AI) assistant, HiPhiGo, which has been developed in collaboration with Microsoft. The HiPhi X is able to analyze massive amounts of information and make decisions utilizing cloud computing with a powerful data analysis engine, which results in a highly intelligent and smart vehicle. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese battery-maker Contemporary Amperex Technology Company Limited (CATL) is working on a new technology that will allow battery cells to be integrated with an electric vehicle's (EV) chassis, shedding traditional casings that make battery systems bulky. According to Reuters, CATL chairman Zeng Yuqun hinted at the roll-out of the new technology before 2030 at an industry conference in Wuhan yesterday (12 August). By integrating cells directly into an EV's frame, the battery-maker can fit more cells into the vehicle, thus extending its range. With the new technology, EVs could have a driving range of more than 800 km, according to Zeng. CATL, as the industry's largest EV battery-maker, has been working with an array of OEMs, including premium automakers BMW and Daimler, to develop competitive solutions for their upcoming EVs. (IHS Markit AutoIntelligence's Abby Chun Tu)

- SHI reported a revenue of USD 1.4 billion (KRW 1.7 trillion)

for the second quarter of 2020, 9% lower than that of USD 1.5

billion (KRW 1.8 trillion) achieved a year ago because of revenue

recognition of project as a result of COVID-19 quarantine measures.

(IHS Markit Upstream Costs and Technology's Jessica Goh)

- Net loss for the same quarter more than doubled from USD 266 million (KRW 309.4 billion) in Q2 2019 to USD 578 million (KRW704.3 billion) owing to high operational loss.

- Second quarter 2020 operation loss plunged from USD 48 million (KRW 56.3 billion) in same quarter last year to USD 581 million (KRW 707.7 billion).

- Additional write-offs of the five drillships, decreased offshore workload due to COVID-19 quarantine measures and provision for guarantee for after-cost construction led to the deepened loss.

- Backlog as at end June 2020 stood at USD 19.9 billion, 13% lower compared with its 2019 full year backlog of USD23.0 billion.

- Three LNGCs, three containerships and one tanker were completed in the second quarter.

- No new orders were secured in second quarter 2020.

- SHI expects delays in its under-construction projects in the first half of 2020 due to COVID-19 evacuation measures from the yard to be recovered in the second half as most of the employees and service engineers returned to the yard in July.

- The company expects new LNGC orders from Russia and Mozambique, as dual fuel VLCCs and arctic shuttle tankers new orders to be placed this year. Additionally, replacement of old vessels will further boost newbuild demands for tankers.

- VE Commercial Vehicles (VECV), the truck and bus manufacturing arm of Eicher Motors, has signed an agreement to purchase Volvo India's bus division for INR1 billion (USD13.36 million), according to Moneycontrol. VECV is a joint venture between Volvo Truck Corporation and Eicher Motors. Following the transaction, there will be a new bus division that will include Eicher and Volvo's bus business. The transfer agreement with Volvo Group India is for the manufacture, assembly, distribution, and sale of Volvo buses in India. The commercial vehicle segment in India is currently facing headwinds in the form of subdued demand, tight liquidity, a lack of availability of finance, higher interest rates, the delayed impact of new axle-load norms announced in July 2018, and slowing industrial output. The integration of the bus divisions of Volvo and Eicher will help drive synergies and reduce costs. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- New Zealand's Monetary Policy Committee (MPC) has kept the OCR

on hold since it cut interest rates by 75 basis points to a record

low of 0.25% in an emergency meeting in March, as affirmed during

its 12 August meeting. However, it has again expanded the Large

Scale Asset Purchase (LSAP) program to soften the negative economic

effects of the COVID-19 virus pandemic. (IHS Markit Economist

Andrew Vogel)

- The LSAP program was almost doubled to a maximum of NZD100 billion from a previous maximum of NZD60 billion. However, the RBNZ did not modify the program's potential assets for purchase, maintaining the eligibility of New Zealand Government Bonds, New Zealand Government Inflation-Indexed Bonds, and Local Government Funding Agency Bonds.

- The MPC stated that "a package of additional monetary instruments must remain in active preparation," with the package including a negative OCR supported by funding retail banks directly at near-OCR (a "Funding for Lending Program"), as well as the option of purchasing foreign assets. However, the RBNZ's deployment of such tools will depend on the outlook for inflation and employment.

- New Zealand has successfully contained COVID-19 domestically, notwithstanding the recent Auckland-focused outbreak, and the resulting swifter relaxation of social restrictions and higher proportion of employees working from home has enabled output and employment to recover sooner than projected by the RBNZ in May. Nonetheless, the pandemic and the economic downturn are persisting globally and the RBNZ expects these factors to continue weighing on the country's economic activity, particularly tourism and migration as well as goods exports.

- The RBNZ expects very low inflation for 2021 at less than 1% for the year, with tradables prices in particular projected to be in deflation.

- The June-quarter inflation figures indicated the potential of tradables inflation dragging down headline inflation as it fell 1.2% quarter on quarter (q/q) and 0.6% year on year, led by a 12% q/q plunge in petrol prices. Food and housing prices were key sources of domestic price pressures, but both could ease in the coming quarters.

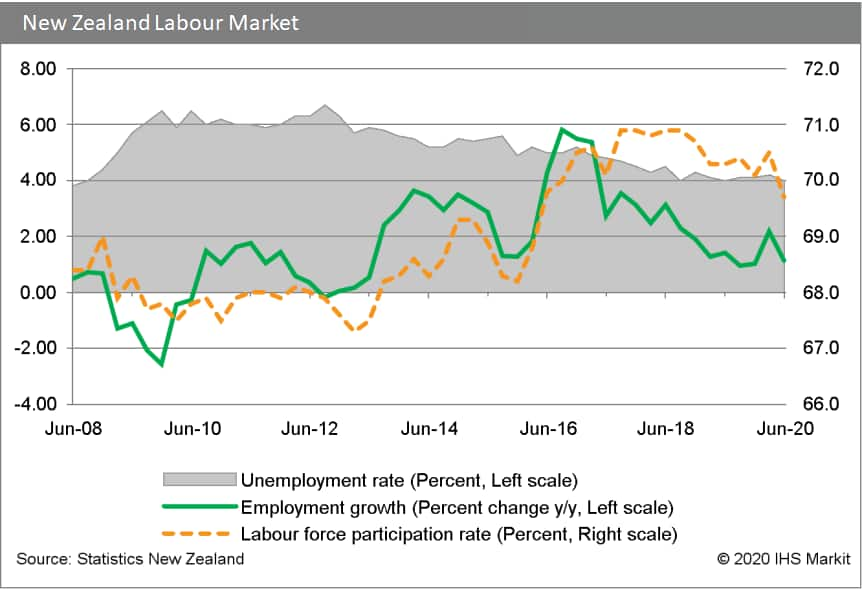

- The labor-force participation rate fell 0.8 percentage point

during the June quarter to 69.7%. Additionally, the

underutilization rate - a measure that captures individuals who are

unemployed and seeking work, those who are working part time but

wish to work full time, those who desire a job but are not actively

seeking work, and individuals who will be seeking a new job in the

next month - also rose sharply to 12.0%, up 1.6 percentage points

from the previous quarter.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-august-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-august-2020.html&text=Daily+Global+Market+Summary+-+13+August+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-august-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 13 August 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-august-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+13+August+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-august-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}