Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 13, 2022

Daily Global Market Summary - 13 January 2022

Most major European equity indices closed higher, APAC markets were mixed, and all major US indices closed lower. US and benchmark European government bonds closed sharply higher. European iTraxx and CDX-NA closed wider across IG and high yield. The US dollar, natural gas, oil, gold, silver, and copper all closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -0.5%, Russell 2000 -0.8%, S&P 500 -1.4%, and Nasdaq -2.5%.

- 10yr US govt bonds closed -5bps/1.70% yield and 30yr bonds -5bps/2.04% yield.

- CDX-NAIG closed +2bps/53bps and CDX-NAHY +8bps/307bps.

- DXY US dollar index closed -0.1%/94.79.

- Gold closed -0.3%/$1,821 per troy oz, silver -0.2%/$23.16 per troy oz, and copper -0.7%/$4.55 per pound.

- Crude oil closed -0.6%/$82.12 per barrel and natural gas closed -7.4%/$4.01 per mmbtu.

- Solar power will account for nearly half of US generation

capacity installations in 2022, more than natural gas and wind

power combined, according to the US Energy Information

Administration (EIA). Based on surveys of utilities and independent

power producers, EIA said it expects 46.1 GW of utility-scale

generating capacity to be added to the US power grid in 2022, of

which 21.5 GW (46%) will be solar. Natural gas will contribute 9.6

GW (21%), wind 7.6 GW (17%), and 5.1 GW (11%) will come from the

fast-emerging category of battery power. (IHS Markit Net-Zero

Business Daily's Kevin Adler)

- When 2.2 GW of nuclear power is included from two units coming onstream at Southern Company's Vogtle Electric Generating Plant in Georgia, carbon-free power will account for nearly 80% of US installations in 2022, marking a significant step towards the country's goal of transitioning to only clean energy production by 2035.

- Growth can be further accelerated by supportive federal policy, Hensley said. "This growth can be accelerated with the passage of the Build Back Better Act coupled with the infrastructure package—putting the country in a better position to meet climate targets and deliver clean energy to Americans," he said.

- "Wind, solar, and battery storage have been the top choice for new power capacity for six of the last seven years in the US," said John Hensley, vice president for research and analytics at The American Clean Power Association, a US trade group."Falling costs, improving efficiency, and customer demand support the strong growth this industry is experiencing, and we expect those drivers to continue shaping the energy transition underway," he added.

- Build Back Better is the Biden administration's $1.75-trillion spending plan that would include about $550 billion in incentives and loans for a wide range of renewable energy, from electric vehicle tax breaks to investments in transmission lines to extensions of tax credits for new wind and solar projects. The bill has been held up in the US Senate for several months due to objections raised about its overall price tag by US Senator Joe Manchin, Democrat-West Virginia, and is likely to be subject to significant modifications if it is passed at all.

- Federal Reserve governor Lael Brainard, the White House nominee to serve as the central bank's No. 2 official, told Congress that efforts to reduce inflation are the central bank's "most important task." The Fed's rate-setting committee "has projected several hikes over the course of the year. We will be in a position to do that as soon as asset purchases are terminated," said Ms. Brainard. "And we will simply have to see what the data requires over the course of the year." (WSJ)

- The Supreme Court on Thursday (January 13) blocked the Biden administration from imposing a COVID-19 vaccine-or-test mandate on large businesses, ruling the Occupational Health and Safety Administration (OSHA) lacked authority to impose the underlying rule. The 6-3 decision stays the rule and sends the legal dispute back to the US Court of Appeals for the Sixth Circuit. The ruling by the conservative majority of the court is likely a death knell for the mandate, which the White House has called critical to reining in the spread of COVID-19. "Imposing a vaccine mandate on 84 million Americans in response to a worldwide pandemic is simply not 'part of what the agency was built for,'" the majority wrote in an unsigned opinion. The court said that although COVID-19 is a risk that occurs in many workplaces, it is not a universal occupational hazard. (IHS Markit Food and Agricultural Policy's JR Pegg)

- US producer prices for final demand increased 0.2% in December

and rose 9.7% from a year earlier. The overall increase was the

smallest since November 2020, but it was an anomaly rather than a

fundamental shift. Energy goods, up over 31.4% in the past 12

months, sagged by 3.3% as Omicron variant fears hit the crude oil

market. Food prices cooled by 0.6% but that decline was less than

half of the November gain and monthly moves in food prices are as

reliable as a $2 watch. Core goods prices rose 0.5%. (IHS Markit

Economist Mike Montgomery)

- Final demand prices for services grew 0.5% in December but the November gain was revised 0.2 percentage point higher. Transportation and warehousing prices climbed 1.7% with airfares and air freight rates causing the outsized gain. The other services complex scored a 0.2% gain with car rental prices sagging.

- The decline in energy prices was purely temporary. As of 13 January, Brent crude spot prices were just under $85/barrel, above both the October and November prices and more than $10 higher than in December. The 3.3% December energy blip will end up a total quirk as the drop was founded almost exclusively on fears that the Omicron variant would crimp demand for oil. Those fears have proven exaggerated.

- Seasonally adjusted US initial claims for unemployment

insurance rose by 23,000 to 230,000 in the week ended 8 January.

Despite moving higher in the latest reading, the level of claims

remains low as employers are trying to retain existing employees

amid tight labor markets. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 194,000 to 1,559,000 in the week ended 1 January, hitting its lowest since 2 June 1973. The insured unemployment rate fell 0.2 percentage point to 1.1%.

- Ongoing claims for Pandemic Emergency Unemployment Compensation (PEUC) and Pandemic Unemployment Assistance (PUA) will no longer be published with this news release. There was a total of 255,142 claims under PEUC and PUA in the week ended 11 December—the last week data are available for. According to the Department of Labor, any ongoing claims under these programs represent claims for weeks of unemployment prior to the two programs' expiration on 6 September 2021.

- In the week ended 25 December, the unadjusted total of continuing claims for benefits in all programs rose by 226,264 to 1,948,624.

- Nuro has unveiled its third-generation electric autonomous delivery vehicle to scale its services to consumers across the United States. The new flagship model, called Nuro, is designed to carry more goods and enable more deliveries. The new model will be manufactured in partnership with BYD North America and it will be completed at Nuro's new USD40-million manufacturing facility in southern Nevada. Nuro has also reached an agreement with existing retail-chain partner Kroger to use its third-generation vehicle in grocery deliveries. Nuro has been testing its autonomous system on the R1 vehicle and its updated version of the R2 via partnerships with retail companies such as Walmart, Kroger, 7-Eleven, and CVS Pharmacy, as well as via partnerships for parcel deliveries with Federal Express and food deliveries with Domino's Pizza. Delivery services are an attractive option among many potential business use cases for autonomous vehicles. The expectation is that, eventually, elimination of the cost of a human driver could make delivery services far more affordable for both the merchant and the consumer. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Electric vehicle (EV) startup Lucid Motors is in talks on beginning production in Saudi Arabia by 2025 or 2026, following the company starting production of the Lucid Air sedan in the United States in 2021, according to media reports. During an interview on the Bloomberg television channel, Lucid chairman Andrew Liveris said, "Now that we are successfully producing and selling cars in the US, our attention is turning to this factory here [in Saudi Arabia]." According to a Bloomberg report, the executive was speaking at a Bloomberg mining conference in Riyadh, Saudi Arabia. Liveris said that the outstanding details to be resolved include ownership percentages for Lucid and the partners on the project. A site near the city of Jeddah is a potential location for the proposed plant, as is a site in the city of Neom, reports Bloomberg. Liveris also reportedly commented on the supply chain issues continuing to affect the auto industry, saying, "We'll have a lot more to say to the market about the sorts of things we're seeing in the supply chain. Yes, we're experiencing supply chain issues." Previous reports have indicated that Lucid has been in talks with Saudi Arabia's sovereign wealth fund, the Public Investment Fund. Lucid began production of the Air sedan in September 2021 and made the first deliveries in October. IHS Markit forecasts, prior to reports of the potential second production facility, showed Lucid's production reaching 94,000 units per year in 2028. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Plastic is key to present and future sustainability goals,

US-based trade group the Plastics Industry Association said in a

statement late last week. The trade group rejected findings in a

report by advocacy group Beyond Plastics, cited in The Atlantic,

claiming plastics production could have greater emissions than

coal-fired power plants by the end of this decade, which it said

ignores context. (IHS Markit Chemical Market Advisory Service's

Chuan Ong)

- The Plastics Industry said that an increasing prevalence of natural gas and other renewable energy sources cut US coal dependence by 50% from 2011 to 2021.

- It said plastics are widely used across the economy and hence account for higher emissions, and cannot be compared to coal, or to lesser utilized materials like glass. "Substituting all plastic bottlers with glass would create carbon dioxide emission equivalent to 22 large coal-fired power plants," the group said, quoting a research paper by the Imperial College London.

- The trade group also said that moving away from plastics calls for materials with more emissions-intensive production processes, adding that aluminum production has 30% more emissions than plastics, while iron, steel, and concrete's production emissions can exceed plastics' by up to 200%.

- Life-cycle assessment (LCA), a way of assessing environmental impacts associated with all life cycle stages of a product, also showed sustainability gains in plastics, the trade group said.

- Citing a study published on its own portal, the group said plastics are the most environmentally beneficial material compared to alternatives. It said plastic straws have over 60% less global warming potential, using 50% less energy during production than alternatives, and said similar figures apply for both plastic bags and plastic packaging.

Europe/Middle East/Africa

- Most major European equity markets closed higher except for France -0.5%; Spain +0.5%, Italy +0.5%, UK +0.2%, and Germany +0.1%.

- 10yr European govt bonds closed higher; Italy -4bps and France/Germany/Spain/UK -3bps.

- iTraxx-Europe closed +1bp/51bps and iTraxx-Xover +4bps/253bps.

- Brent crude closed -0.2%/$84.47 per barrel.

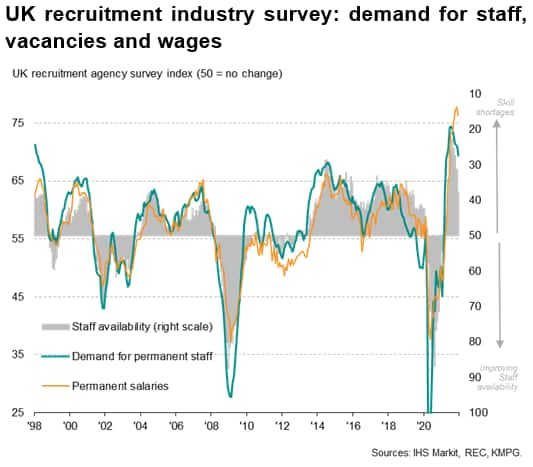

- UK recruitment agencies reported a further strong rise in the

number of people placed in permanent jobs in December, the rate of

hiring running close to the record highs seen in prior recent

months. The survey data, compiled by IHS Markit for the REC and

KPMG, suggest that companies continued to take on impressive

numbers of staff despite the rising spread of Covid-19 amid the

emergence of the Omicron variant. (IHS Markit Economist Chris

Williamson)

- Demand for staff from employers reportedly also continued to rise at a rate not seen over the two decades prior to the pandemic, albeit with the rate of growth of demand cooling further from July's recent peak to run at the lowest since April. This latest cooling will in part have reflected lower economic activity in December arising from the omicron spread. Note that business activity, as measured by the PMI, grew at the slowest rate since the lockdowns at the start of the year.

- At the same time, staff availability continued to deteriorate at a rate rarely exceeded in the recruitment survey's 24-year history, albeit below the rate of deterioration seen in mid-2021.

- Average starting salaries and average pay for temp/contract staff rose steeply again in December. For permanent salaries, only in October and November 2021 had the recruitment industry survey ever recorded a stronger rate of wage inflation than that seen in December.

- Such a lack of available staff is not surprising. The latest

available official data show that the number of unfilled vacancies

had risen to 1.2 million in the three months to October, while

unemployment was down to 1.4 million; an implied record low ratio

of job seekers to vacancies, pointing to a tight labour market

which is conducive of course to high wage growth.

- EDF Renewables and DP Energy have entered into a joint venture partnership to develop the Gwynt Glas project off England and Wales. The floating wind project is estimated to encompass 1,500 square kilometers in the Celtic Sea, 70 kilometers off the coast, and will generate up to 1 GW of electricity. Preliminary work has begun to engage key stakeholders, and remote aerial surveys are being carried out for wildlife activity. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- IHS Markit provides an overview of key agri-food sustainability

trends to watch out for in 2022. This year could see a big step

towards a more sustainable food system - if businesses and

policymakers turn their words into actions and show that their on

the right path forward. Pressure to deliver is growing after the

world's governments agreed at COP26 that limiting global warming to

1.5°C requires "rapid, deep, and sustained reductions in global

greenhouse gas (GHG) emissions" - with most legislators identifying

agriculture as a top focus area to achieve this goal. (IHS Markit

Food and Agricultural Policy's Steve Gillman)

- Methane momentum building: Pressure to act is likely to grow in 2022 after a recent UN report on methane showed reducing this greenhouse gas is "very likely the strategy with the greatest potential to decrease warming over the next 20 years". This already propelled over 100 countries to sign up to the Global Methane Pledge at COP26, where they committed to reducing their emissions by 30% by the end of the decade. Agriculture is responsible for roughly one-third of climate emissions, and as the world shifts toward eating more meat that proportion may go up. However, eliminating these emissions is scientifically impossible if methane from ruminants and nitrous oxide from manure decomposition continue at its current rate of growth.

- Carbon farming foundations: Environmental pressures will see hopes grow around carbon farming and its potential to generate new and green revenues for the agriculture sector - if they can eventually sell the amount of greenhouse gases stored in soils to green-minded organizations. According to Rabobank, about one ton of CO2-equivalent can be removed from the atmosphere per hectare of farmland each year, which also presents a lucrative economic opportunity if carbon farming practices are rolled out. However, Barbara Baarsma, CEO of Rabo Carbon Bank, said more farmers need to adopt more climate-friendly practices for any related profits to materialize.

- Steps to scale sustainability: Whether its government schemes or corporate programmes, sustainable farming pilots are found in most agriculture sectors, and in most markets, but the diversity of farm systems means wide-scale adoption of tried-and-tested solutions still struggle to materialize at the needed scale. Along with carbon farming, next year will see greater pressure to attract more farmers to join successful pilot projects, from boosting biodiversity to precision practices, and some industry leaders have already begun to see a clear path forward.

- Scope 3 collaboration: The push for more data is also coming from agri-food companies because they want to see greater progress towards reducing emissions in their supply chains, commonly referred to as scope three. Each year, more companies commit to net zero emissions through the UN science-based targets initiative (SBTi) and the approval process requires companies to commit to reducing supply chain emissions.

- Deforestation fight: The focus on supply chain emissions next year will also reinforce discussions around sustainable sourcing of raw materials, particularly to prevent contributing to deforestation. This will continue to affect many agri-food stakeholders and create stronger sustainability links between the likes of manufacturers and processors with brands and supermarkets.

- Plant-based foods: A lot of the sustainable food trends of 2022 can be concentrated in a single market segment - plant-based foods. And over the next twelve months, sustainability stakeholders will be carefully watching the growth of plant-based products to see if the sector can move from a niche position to a place where it can significantly push the food system back within planetary limits. US retail sales of plant-based foods have continued to grow in recent years, increasing by 27% in 2020 and bringing the total plant-based market value to $7 billion, according to the Good Food Institute.

- Sustainable pricing wars: With more environmental expectations falling on farmers, next year will see pressure also fall on brands and retailers to pay food producers more for sustainable food. Some brands have already committed to this, such as Pepsico, while Compass CFO Palmer Brown acknowledges that pricing levels may need to evolve, but he said this can be difficult as their industry operates on thin profit margins. In the meantime, he said food companies can take actions to help send more profitable signals to the farm.

- True cost of food: Answers on a fair price for food will need to be found sooner than later as the cost of increasing sustainability could create an economic blockade, one that slows down both green policies and corporate strategies.

- Sustainable labelling battlegrounds: Communicating to consumers through branding may be a more favored approach than changing food prices, but this is likely to evolve on its own over the next twelve months either way.

- European vehicle leasing firm Arval has partnered with software-as-a-service (SaaS) solution provider Ridecell to develop end-to-end mobility solutions. According to a company statement, this partnership will enable Arval to meet mobility needs of its customers across Europe by offering Ridecell's fleet automation and mobility platform. Arval customers using Ridecell's car-sharing platform will benefit from value-add services including a decentralized and convenient booking system and automated operations. The partnership will also support the recently launched Arval Mobility Hub concept, which combines shared mobility options, including car, bike, and micro-mobility solutions, in one location. Ridecell offers a platform for car sharing, ride sharing, and autonomous fleet management. The company says that its shared mobility platform helps companies make their fleets operational rapidly, as well as maximizes efficiencies. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Energinet expects that if biogas production continues to grow,

the fuel will be able to meet 75% of Denmark's gas consumption in

2030 and all of it by 2034. Biogas' share of total Danish gas

consumption reached 25% in 2021, up from just over 21% in 2020,

said state-owned Energinet, the country's system operator for

electricity and natural gas. (IHS Markit Net-Zero Business Daily's

Cristina Brooks)

- The network operator welcomed the role of increased biogas supplies in lowering its gas network's CO2 emissions, a result of more biogas-producing plants connecting to networks.

- Denmark has promoted the use of biogas through public subsidies, including as a fuel for transportation as well as for electricity and gas networks, aiming for targets obligated by the EU's Renewable Energy Directive. In 2020, it halted subsidies for new production plants, but kept subsidies intact for existing plants through 2032.

- More and more biogas plants are connecting to the gas transmission and distribution system, or 51 since 2016. For example, Sønderjysk Biogas Plant Bevtoft, an anaerobic digestion plant that uses manure and straw, was connected to the system that year.

- President Abdel Fattah El-Sisi has announced that Egypt will produce its first locally assembled electric vehicles (EVs) in 2023, reports MistNews. According to the source, this news comes after the negotiations with Dongfeng to locally assemble its E70 cars fell apart in November 2021. In December 2021, Egypt ordered El Nasr Automotive Manufacturing, a state-owned company, to work with a Chinese firm to build affordable EVs priced at EGP315,000. Egyptian authorities have approached three potential Chinese companies to partner with to build the affordable EV, with El Nasr aiming to invest EGP2 billion. The vehicle's production is planned to start in 2023 with annual output expected to rise to 20,000 units in three years. The government has also set an aggressive target of setting up least 3,000 charging stations in three years. (IHS Markit AutoIntelligence's Tarun Thakur)

- South Africa's real seasonally adjusted manufacturing

production grew by 3.7% month on month (m/m) during November 2021.

However, the m/m gain in November was not enough to leave real

seasonally adjusted manufacturing production up from a year

earlier, which fell by 2.5% y/y, following a 7.7% y/y contraction

in October. (IHS Markit Economist Thea

Fourie)

- Sectors showing the strongest m/m gains during November included basic iron and steel, non-ferrous metal products, metal products and machinery (up 17.2% m/m), followed by electrical machinery (up 14.1% m/m) and motor vehicles, parts and accessories and other transport equipment (up 12.1% m/m). Lower output in the food and beverages sector and the petroleum, chemical products, rubber, and plastic products sector were a drag on the manufacturing sector's overall performance during November.

- South Africa's seasonally adjusted manufacturing sales grew by 7.6% m/m in November 2021, with the biggest gains recorded in basic iron and steel, non-ferrous metal products, metal products and machinery, followed by motor vehicles, parts and accessories and other transport equipment.

Asia-Pacific

- Major APAC equity indices closed higher; Australia +0.5%, India +0.1%, Hong Kong +0.1%, South Korea -0.4%, Japan -1.0%, and Mainland China -1.2%.

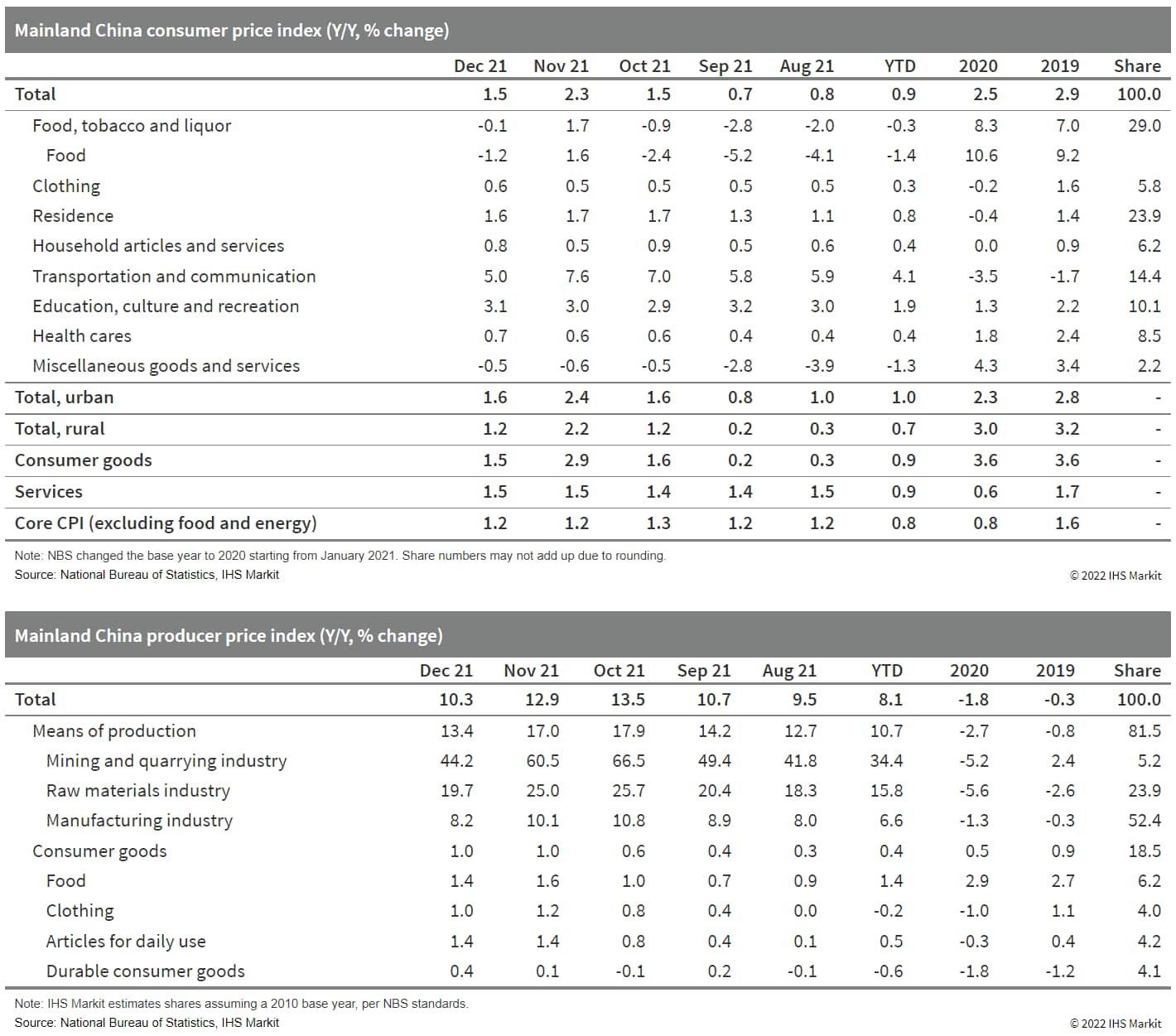

- Mainland China's consumer price index (CPI) increased by 1.5%

year on year (y/y) in December 2021, down by 0.8 percentage point

from the November reading, according to the National Bureau of

Statistics (NBS). Month-on-month (m/m) CPI declined by 0.3%,

falling into deflation territory from the 0.4% m/m inflation in

November. (IHS Markit Economist Lei Yi)

- The disinflation of headline CPI in December was largely driven by the weakened food and fuel prices. Compared with an increase of 1.6% y/y in November, food prices fell by 1.2% in December, as pork price deflation widened slightly by 4.0 percentage points to 36.7% y/y while fresh vegetable price inflation eased by 20 percentage points to 10.6% y/y thanks to ramped-up supply. Regarding the non-food components, vehicle fuel price inflation came in at 22.5% y/y, lower by 13.2 percentage points from the month before; while service price inflation held up at 1.5% y/y, unchanged from the November reading. Excluding the volatile food and energy components, core CPI stayed at 1.2% y/y in December.

- The producer price index (PPI) continued to report double-digit gains of 10.3% y/y in December; still, this represented a second month of moderation from the October high of 13.5% y/y thanks to authorities' interventions. Month-on-month PPI registered deflation of 1.2%, down by 1.2 percentage points from November.

- Retreating commodity prices—crude oil and coal in

particular—contributed to the month-on-month PPI deflation in

December. Prices of oil-related sectors including petroleum

extraction and fuel and chemical product manufacturing re-deflated

month on month; while the coal mining and dressing sector

registered a wider price deflation of 8.3% m/m in December compared

with 4.9% m/m in the prior month. Energy-intensive sectors like

non-ferrous and ferrous metal smelting and pressing continued to

log month-on-month price deflation in December. On the other hand,

owing to the government allowing for a wider coal-fired power

tariff fluctuation range, prices of the power and heat production

and supply sector continued to recover, with m/m inflation inching

up consecutively since September and reaching 3.0% m/m in

December.

- Chinese electric vehicle (EV) start-up Niutron revealed the images of its first model, the NV, on 12 January. The model, a larger sport utility vehicle, measures 4,915 mm long, 1,950 mm wide, and 1,750 mm tall with a wheelbase spanning 2,900 mm. Two variants, a battery electric model and an extended-range EV (EREV), will be made available in the Chinese market. The model will have a four-wheel drive as standard, enabling it to accelerate from still to 100km/h in 5.9 seconds. Reservations for the NV will begin in the first half of the year, with mass market deliveries slated to kick off in China in September. Niutron launched its auto brand Niutron on 15 December 2021. The company was founded by Li Yinan, the founder of electric scooter company, Niu Technology. According to local media reports, Niutron has secured an investment of USD500 million in the A round financing, which will help the company progress with its vehicle launch plan. Production of the NV will take place at Niutron's plant in Changzhou, Jiangsu province. (IHS Markit AutoIntelligence's Abby Chun Tu)

- South Korea's SK Geo Centric (SKGC) has signed an agreement

with US recycling company PureCycle to construct Asia's first

recycled polypropylene (PP) plant, according to a PureCycle press

statement late Monday. SKGC and PureCycle signed a non-binding head

of agreement (HOA), or term sheet, after agreeing to key terms to a

joint venture that will be further negotiated. (IHS Markit Chemical

Market Advisory Service's Chuan Ong)

- This recycled PP plant will be built in Ulsan, South Korea, with expected completion by end-2024. It is projected to have an annual PP capacity of 60,000 mt/year.

- PureCycle said that PP is commonly combined with other materials and additives, limiting traditional mechanical recycling from separating contaminants to produce "like-new" recycled plastic. Contaminated food storage containers, colored detergent bottles, and automotive interior plastic are mostly incinerated because they are difficult to recycle.

- Its technology can be used for commercial production to recycle these into ultra-pure recycled (UPR), it said.

- According to PureCycle, the cooperation with SKGC extends beyond a joint venture to recycle plastic waste and provide South Korea with UPR, but also to develop consumer products.

- PureCycle states that it is the world's only company with Procter & Gamble's solvent-based purification technology to separate contaminants, odors, and colors from PP plastic waste, to convert it to UPR, plastic suitable for any PP market.

- The company had also signed a memorandum of understanding on Sep. 13 last year with Japan's Mitsui & Co. to develop and run a similar facility in Japan. Project details remain unclear.

- SKGC, a petrochemical subsidiary of SK Innovation, had announced on Jul. 8 last year its plans to invest KRW 600 billion ($506 million) in South Korea's largest plastic waste recycling factory in Ulsan, which can process 184,000 mt of trash a year, about 60% of the country's total plastic waste.

- Vietnam's National Assembly has approved a supplemented and amended special consumption tax law, officially reducing this tax for electric vehicles (EVs) in the country, reports the Vietnam News Brief Service. Battery electric vehicles (BEVs) with nine seats or fewer carrying only people will be subject to a tax rate of 3% from 1 March 2022 to 28 February 2027 and 11% from 1 March 2027. BEVs with 10-15 seats will be taxed at a rate of 2% from 1 March 2022 through to 28 February 2027, increasing to 7% from 1 March 2027. BEVs with 16-23 seats will be subject to a 1% tax rate from 1 March 2022 to 28 February 2027, increasing to 4% from 1 March 2027. The tax rate for BEVs carrying people and goods will be 2% from 1 March 2022 to 28 February 2027 and 7% from 1 March 2027. For other types of alternative-powertrain vehicles, the tax rate will be 15% for passenger vehicles with nine seats or fewer, 10% for passenger vehicles with 10-15 seats or people and goods carriers, and 5% for passenger vehicles with 16-23 seats. (IHS Markit AutoIntelligence's Jamal Amir)

- New vehicle sales in the Philippines grew marginally by 0.9%

year on year (y/y) during December 2021 to 27,846 units, reports

Business World, citing data released by the Chamber of Automotive

Manufacturers of the Philippines Incorporated (CAMPI) and the Truck

Manufacturers Association (TMA). Sales of passenger vehicles stood

at 8,447 units during the month, down 3.8% y/y, while commercial

vehicle (CV) sales were up by 3.1% y/y to 19,399 units. Last

month's sales figure also represented a month-on-month (m/m)

increase of 5.3% from 26,456 units registered in November 2021.

During the full year 2021, total sales were up by 20.0% y/y to

268,488 units, comprising 85,260 passenger vehicles, up 22.4% y/y,

and 183,228 CVs, up 18.9% y/y. Toyota Motor Philippines continued

to dominate the vehicle market last year, taking a market share of

48.3% with sales of 129,667 units. It was followed by Mitsubishi

with a 14.0% market share and 37,548 units sold. Ford ranked third

in terms of market share with 7.5%, selling 20,005 units. The

strong growth in the Philippine new vehicle market during 2021 was

mainly due to a low base of comparison, a recovery in economic

growth, and the government's move to ease social and business

restrictions, which had been imposed to curb the growing number of

COVID-19 cases. However, the prolonged COVID-19 virus pandemic and

the provisional safeguard duty on imported passenger vehicles and

light commercial vehicles (LCVs) that was imposed earlier in 2021

did weigh down on the Philippine new vehicle market last year. (IHS

Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-january-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-january-2022.html&text=Daily+Global+Market+Summary+-+13+January+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-january-2022.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 13 January 2022 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-january-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+13+January+2022+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-13-january-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}