Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 14, 2021

Daily Global Market Summary - 14 April 2021

Most major APAC equity indices closed higher, while the US and European markets were mixed. US and benchmark European government bonds closed lower. European iTraxx and CDX-NA closed almost unchanged across IG and high yield. Oil, silver, and copper closed higher, natural gas unchanged, and the US dollar and gold were lower on the day.

Americas

- US equity indices closed mixed; Russell 2000 +0.8%, DJIA +0.2%, S&P 500 -0.4%, and Nasdaq -1.0%.

- 10yr US govt bonds closed +1bp/1.63% yield and 30yr bonds +2bps/2.32% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY flat/293bps.

- DXY US dollar index closed -0.2%/91.69.

- Gold closed -0.6%/$1,736 per troy oz, silver +0.4%/$25.52 per troy oz, and copper +2.4%/$4.13 per pound.

- Crude oil closed +4.9%/$63.15 per barrel and natural gas closed flat/$2.62 per mmbtu.

- Coinbase Global Inc. fetched an $85 billion valuation in its stock market debut Wednesday, a watershed moment for an industry that began a decade ago as an experiment in digital money. Coinbase was last valued at about $8 billion in a 2018 fundraising round, but some analysts had projected its valuation could top $100 billion based on private market trading. It briefly topped that mark Wednesday before pulling back. (WSJ)

- Goldman Sachs Group posted records in quarterly revenue and profit. JPMorgan Chase notched its highest quarterly profit on record, driven by record revenue from trading stocks. Wells Fargo enjoyed its best-ever quarterly profit in corporate and investment banking. (WSJ)

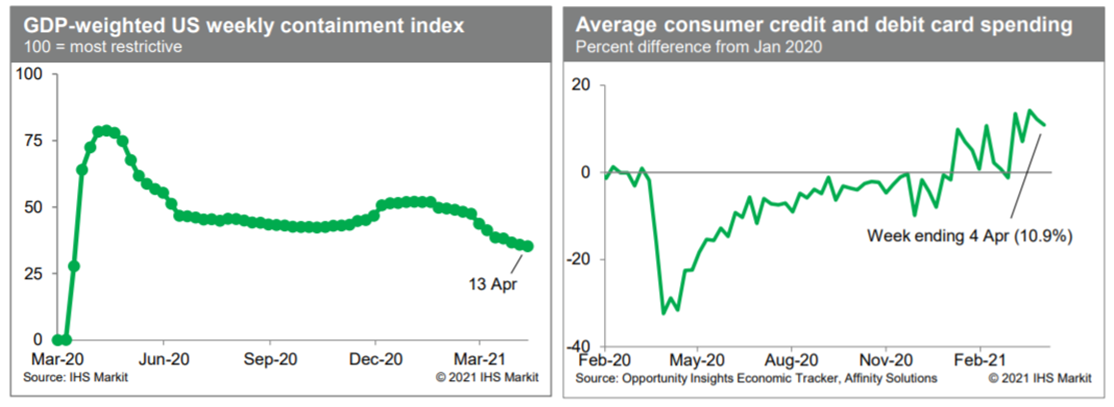

- The IHS Markit GDP-weighted US weekly containment index

declined (eased) 0.5 index point this week to 35.3. This continues

a run of declines that began in late January, as state and local

authorities continue to relax restrictions on social and economic

activity. Meanwhile, average consumer credit- and debit-card

spending during the week ending 4 April was 10.9% above the January

2020 level, according to the Opportunity Insights Economic Tracker.

This followed elevated readings over most of March that were

boosted by recovering consumer confidence and the distribution of

economic stimulus payments beginning 17 March. The weekly data,

when prorated to the monthly frequency, suggest roughly an 8%

increase in retail and food services sales in March, a bit more of

an increase than we assume. The advance estimate for sales in March

(from the Census Bureau) will be reported tomorrow morning (15

April). (IHS Markit Economists Ben Herzon and Joel Prakken)

- The index of US import prices rose 1.2% month on month (m/m) in

March following a 1.3% increase in February. The index's 12-month

rate of increase surged, registering at 6.9%. However, this number

is distorted by the 2.4% monthly drop in the index during March of

the prior year. (IHS Markit Economist Gordon Greer)

- The index of nonfuel import prices increased 0.8% m/m in March, while its 12-month rate of increase was 3.8%.

- Fuel import prices rose 6.3% in March after an upwardly revised 11.7% increase in February. The cost of imported fuel was up 54.3% versus March in the prior year.

- Export prices increased 2.1% m/m in March and the 12-month rate of increase was 9.1%. Monthly changes for both agricultural and nonagricultural export prices were positive.

- Magna has laid out several elements of its expectations for

increasing business from electrification in the coming years during

an Investor Day presentation, including electrified powertrain

business of more than USD2 billion by 2023. (IHS Markit

AutoIntelligence's Stephanie Brinley)

- Magna expects total business to grow to USD45.5 billion in 2023, compared with USD32.6 billion in 2020, although the company points out that its projection of 10-12% average growth per year through 2023 was developed prior to the semiconductor shortage.

- Magna also noted that more than 90% of its business in 2023 was to sales already booked. This includes the electric vehicle (EV) battery enclosures for the GMC Hummer and Ford F-150; the recently announced Clearview rearview camera and mirror technology, and a new seating surface trim that improves seat comfort called Freeform.

- As the transition to electrification continues, Magna expects its average content per vehicles (CPV) to increase from USD400 with to USD950 with a transition from 4WD/AWD systems to secondary eDrive systems, with a similar 20% take rate. As vehicles become electrified, Magna expects the average CPV to grow from USD900 to USD1,100 through the transition from DCT/manual transmissions the primary eDrive system.

- Canadian company Canopy Growth has acquired Toronto-based competitor Supreme Cannabis, both listed on the Toronto exchange, the latter being valued at CAD435 million (USD346.4 million). As a result, Canopy will own the brand 7Acres and will have a 23.3% market share in Ontario and 21.4% in British Columbia. The deal is expected to close by the end of June and Canopy expects to generate synergies of about CAD30 million within two years. Canopy is already the biggest hemp, cannabis and CBD Canadian company, having received a CAD4 billion investment from Constellation Brands, a Corona beer distributor. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

Europe/Middle East/Africa

- Major European equity indices closed mixed; Spain/UK +0.7%, France +0.4%, Italy -0.1%, and Germany -0.2%.

- 10yr European govt bonds closed lower; Germany/UK/France/Italy +3bps and Spain +2bps.

- iTraxx-Europe closed flat/51bps and iTraxx-Xover -2bps/247bps.

- Brent crude closed +4.6%/$66.58 per barrel.

- Daimler CEO Ola Källenius has said that the company's new flagship battery electric vehicle (BEV), the EQS, will be profitable from the start of production, according to a Bloomberg report. The car has already been shown in production-ready prototype form and will effectively shadow the S-Class as the range-topping luxury full BEV equivalent of the company's traditional range-topper. According to Källenius, the profits from the EQS will be "reasonable" from launch, although the car will still cost significantly more than the S-Class, as an equivalent BEV model still costs more to manufacture than even the most sophisticated conventional model. (IHS Markit AutoIntelligence's Tim Urquhart)

- Volkswagen (VW) must pay the interest on car loans taken out by customers who leased or purchased vehicles that were implicated in the diesel emissions scandal, according to a Reuters report. The German Federal Court of Justice in Karlsruhe yesterday (13 April) dismissed the German carmaker's appeal and said that it has to pay EUR3,300 to a customer who bought one of its diesel cars in 2013, including interest payments on the loan. The judge in the case Stephan Seiters said, "The buyer must be provided for as if the purchase had not happened." (IHS Markit AutoIntelligence's Tim Urquhart)

- French agri-food group Avril has decided to dispose of its animal processing businesses and focus instead on tapping demand for plant-based products. After announcing its financial results for 2020, the company said it is looking to sell some of its animal processing units over the coming months and is committed to finding buyers who can enable these units to keep growing. Avril's financial division Sofiprotéol invested a record EUR125 million in 2020, which enabled it to take minority stakes in Ceva, Sodiaal, Kersia and Soufflet Alimentaire along with Vegini, which makes meat-like products from pea protein. (IHS Markit Food and Agricultural Commodities' Max Green)

- French firm Ynsect has further underlined its leadership position in the insect protein market through the purchase of Protifarm. The deal sees Ynsect acquire the global leader in mealworm ingredients for human applications. Dutch firm Protifarm has customers in Germany, the Netherlands, England, Denmark and Belgium. While the transaction will help Ynsect bolster its production and offering for the human food market, it will also benefit the company's portfolio for companion animals. The firm plans to target new customers in wet pet food by utilizing Protifarm's production surplus of buffalo mealworms. The acquisition of Protifarm provides Ynsect with a third production site. Protifarm's facility is in Ermelo, which is one hour east of Amsterdam. The Ermelo site produces over 1,000 metric tons of food ingredients annually, with a goal of expanding to 20,000 metric tons of insect-derived ingredients to feed humans, pets and plants. The production site employs about 50 people in production, R&D and cross-functional areas. (IHS Markit Animal Health's Joseph Harvey)

- Portugal's consumer price index (based on the EU-harmonized

definition) rose by just 0.1% year on year (y/y) in March. Prices

had risen by 0.3% y/y in February (its highest reading in a year)

and had declined by an average of 0.1% in 2020. (IHS Markit

Economist Diego Iscaro)

- Inflation stood at 0.5% when measured by the national index. This was unchanged from February.

- In March, higher transport prices (+2.5% y/y, following a fall of 0.7% y/y in February) were more than offset by softer increases for food (+0.8% y/y following +0.9% y/y), miscellaneous goods and services (+0.9% after +1.2% y/y), and alcoholic beverages and tobacco (+0.1% y/y after +0.5% y/y).

- Prices of clothing and footwear also declined by 3.3% y/y, following a fall of 2.4% y/y in February.

- Fugro has been awarded a marine site characterization contract for the Danish Energy Island project in the North Sea from Energinet. Fugro will do geophysical survey in phase one and unexploded ordnance (UXO) magnetometry surveys in phase two. The geophysical survey includes seabed sampling and soil data down to at least 100 m below the seabed. The UXO magnetometry survey will include application of Fugro's dedicated Geowing solution. The surveys will be utilized to develop an integrated geological and geotechnical soil model which wind farm developers will use for future tenders. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- In the first two months of 2021, Slovenia's current-account surplus narrowed against its year-earlier level, but remained large. After rising year on year (y/y) in January, the current-account surplus narrowed by more than EUR160 million y/y in February. Earlier, customs-based data reflected an increase in merchandise exports in February. However, balance-of-payments data reported a modest, 2.4% y/y decline after making coverage adjustments. The resulting merchandise-trade surplus narrowed by EUR61 million y/y, pulling down the headline current-account balance. (IHS Markit Economist Andrew Birch)

- Larsen and Toubro (L&T) has received notice to proceed with construction of 300 MW Jeddah Solar PV Power Plant in Saudi Arabia from a consortium of Masdar, EDF Renewables and Nesma Company. The turnkey EPC contract to L&T plant was awarded by Saudi Arabia's Renewable Energy Project Development Office under a design, finance, build and operate contract. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

Asia-Pacific

- Most APAC equity markets closed higher except for Japan -0.4%; Hong Kong +1.4%, Australia +0.7%, Mainland China +0.6%, and South Korea +0.4%.

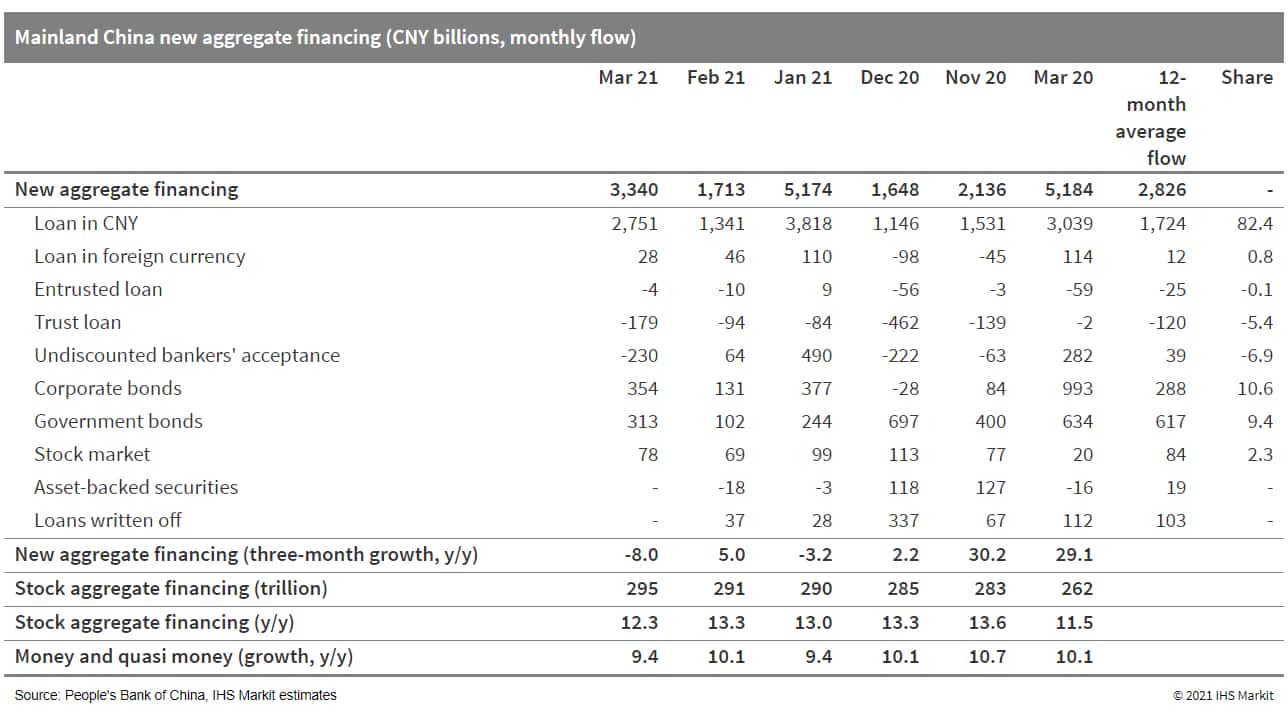

- Mainland China's new total social financing (TSF), the broadest

measure of net new financing to the real economy, totaled CNY3.34

trillion (USD515.58 billion) in March, down by CNY1.84 trillion

year on year (y/y), according to the People's Bank of China (PBOC).

Stock TSF expanded by 12.3% y/y by the end of March, 1.0 percentage

point lower than the month-ago growth rate. (IHS Markit Economist

Lei Yi)

- The year-on-year decline in new TSF in March is largely due to the high-base effect from 2020, when credit policy was loosened to support economic recovery. Components reporting the largest year-on-year declines include corporate and government bond issuance, and undiscounted bankers' acceptance. This can be explained by the absence of early quota allocation of local government special-purpose bonds, and the government's continued efforts to reduce off-balance sheet financing for financial de-risking.

- Cumulatively, new TSF reached CNY10.24 trillion in the first

quarter of 2021, down by CNY873 billion y/y. Bank loans increased

by CNY7.67 trillion, up by CNY574 billion y/y.

- Mainland China's merchandise exports rose 30.6% year on year

(y/y) in March in US dollar terms, down from the

low-base-effect-supported 60.6% y/y growth in the first two months

of 2021, according to the General Administration of Customs. (IHS

Markit Economist Yating Xu)

- Compared with the same period in 2019, 2020-21 average exports growth declined to 10.3% from 18% in January-February.

- Merchandise imports growth accelerated to 33.9% y/y in March on a rising base, and the 2020-21 average growth compared with the March 2019 level rose to 16.7% from the previous reading.

- The coal-fired power plants built in China in 2020 exceeded capacity taken offline in the rest of the world, a new report says. China added 38.4 GW of coal-fired power capacity, slightly more than the 37.8 GW of coal plants mothballed in all other countries. The increase marks the first net expansion of the global coal fleet since 2015—even as countries like the US get more aggressive about moving to lower-carbon energy. The data was released 5 April in the 2021 edition of "Boom and Bust," an annual report that tracks the state of the global coal industry, from environmental group Global Energy Monitor (GEM) and its partners. (IHS Markit Climate and Sustainability News' William Fleeson)

- China's foodservice sector sees ongoing recovery and increasing investments in supply chains, according to the April report from Rabobank (RBB). Foodservice sales surged to CNY709 billion (USD109 billion) in the first two months of 2021, up 69% year-on-year. However, the sales were still 2.3% lower than the same period in 2019. Overall food-only retail sales grew 11% y-o-y, driven by e-commerce. Online food sales rose over 40% y-o-y in January and February 2021. Most Chinese technology giants have ramped up their efforts to expand the community group buying model, following a temporary pullback during Chinese New Year. They are expected to continue their efforts to attract new users and increase the order frequency of existing users. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Li Auto has set up a new subsidiary to produce new energy vehicles (NEVs), according to Gasgoo. Called the Beijing Li Auto Co. Ltd., the new entity involves a registered capital of CNY1 billion (USD153 million) and will focus on manufacturing new smart NEVs, refitted smart NEVs, mobile charging vehicles, as well as NEV-related powertrains. (IHS Markit AutoIntelligence's Nitin Budhiraja)

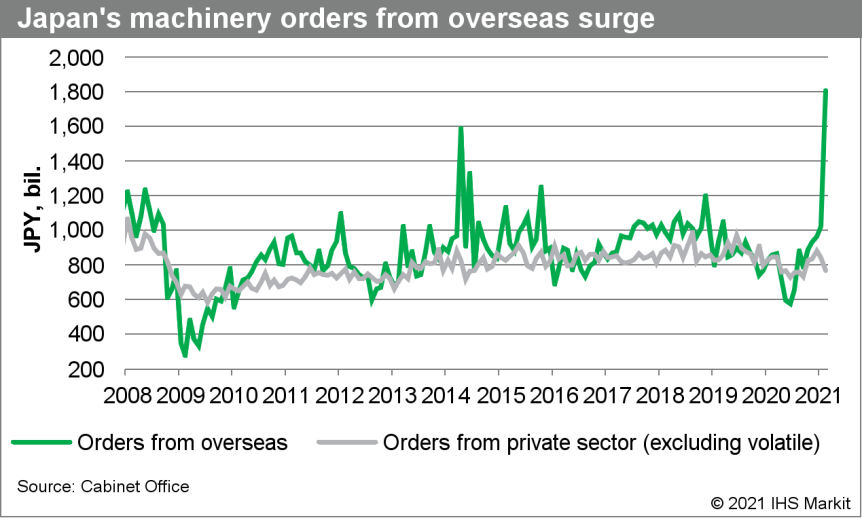

- Japan's private machinery orders (excluding volatiles), a

leading indicator for capital expenditure (capex), fell by 8.5%

month on month (m/m) in February following a 4.5% m/m drop in

January. (IHS Markit Economist Harumi Taguchi)

- The weakness reflected a 5.5% m/m decline in orders from manufacturing and a 10.9% decrease in orders from non-manufacturing (excluding volatiles) in February.

- While orders from governments rebounded by 17.0% m/m in

February following a 27.9% m/m fall in January, orders from

overseas rose for a fifth straight month with a 76.2% m/m increase

to a new all-time high of JPY1.8 trillion (USD16.6 billion) in

February.

- Japan's largest bank Mitsubishi UFJ Financial Group (MUFG) is said to be considering ending loan financing for new coal-fired power plants and reducing its outstanding loans for such projects after a climate resolution was filed by several environmental groups on 26 March. MUFG's latest move was reported by local newspapers Asahi Shimbun and Nihon Keizai Shimbun on 12 April, but no formal statement from MUFG was issued. MUFG did not respond to a request for comment from IHS Markit. (IHS Markit Climate and Sustainability News' Bernadette Lee)

- Vietnamese automaker VinFast has selected chip technology from Nvidia for its new generation of autonomous electric vehicles (EVs), according to a company press release. The automaker will first ship its autonomous EVs with the Nvidia Drive Xavier system-on-a-chip (SoC) starting in 2022. It will then upgrade to Nvidia Drive Orin chip technology across its entire range of upcoming premium EV models. Nvidia Drive Orin is the industry's highest-performing processor. The SoC is capable of processing more than 254 trillion operations per second, allowing it to handle a large number of applications and deep neural networks running simultaneously to support special vehicle features. (IHS Markit AutoIntelligence's Jamal Amir)

- New Zealand's government announced on 13 April the submission of the Financial Sector (Climate-related Disclosure and Other Matters) Amendment Bill, which would require financial-sector entities to disclose their climate risks, for its first parliamentary reading. The bill proposes mandatory disclosure of climate-related risks by large banks, insurers, and asset managers as well as most other listed issuers, according to the government statement, affecting approximately 200 firms altogether. Disclosure requirements would reflect climate standards to be issued by the country's External Reporting Board (XRB), which also would have powers to issue guidance on environmental, social, and corporate governance (ESG) reporting. The new requirement would first apply to the 2022 financial year, indicating that actual disclosures will be required in 2023. (IHS Markit Country Risk's Hannah Cotillon and Brian Lawson)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-april-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-april-2021.html&text=Daily+Global+Market+Summary+-+14+April+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-april-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 14 April 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-april-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+14+April+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-april-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}