Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 14, 2021

Daily Global Market Summary - 14 July 2021

Major US, APAC, and European equity indices closed mixed across regions. US government bonds closed sharply higher and 10yr European government bonds closed mixed. European iTraxx and CDX-NA closed almost flat on the day across IG and high yield. Gold and silver closed higher, while the US dollar, copper, oil, and natural gas closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; DJIA +0.1%, S&P 500 +0.1%, Nasdaq -0.2%, and Russell 2000 -1.6%.

- 10yr US govt bonds closed -8bps/1.35% yield and 30yr bonds -7bps/1.97% yield.

- CDX-NAIG closed flat/48bps and CDX-NAHY -1bp/279bps.

- DXY US dollar index closed -0.4%/92.41.

- Gold closed +0.8%/$1,825 per troy oz, silver +0.5%/$26.27 per troy oz, and copper -0.9%/$4.27 per pound.

- Crude oil closed -2.8%/$73.13 per barrel and natural gas closed -1.0%/$3.66 per mmbtu.

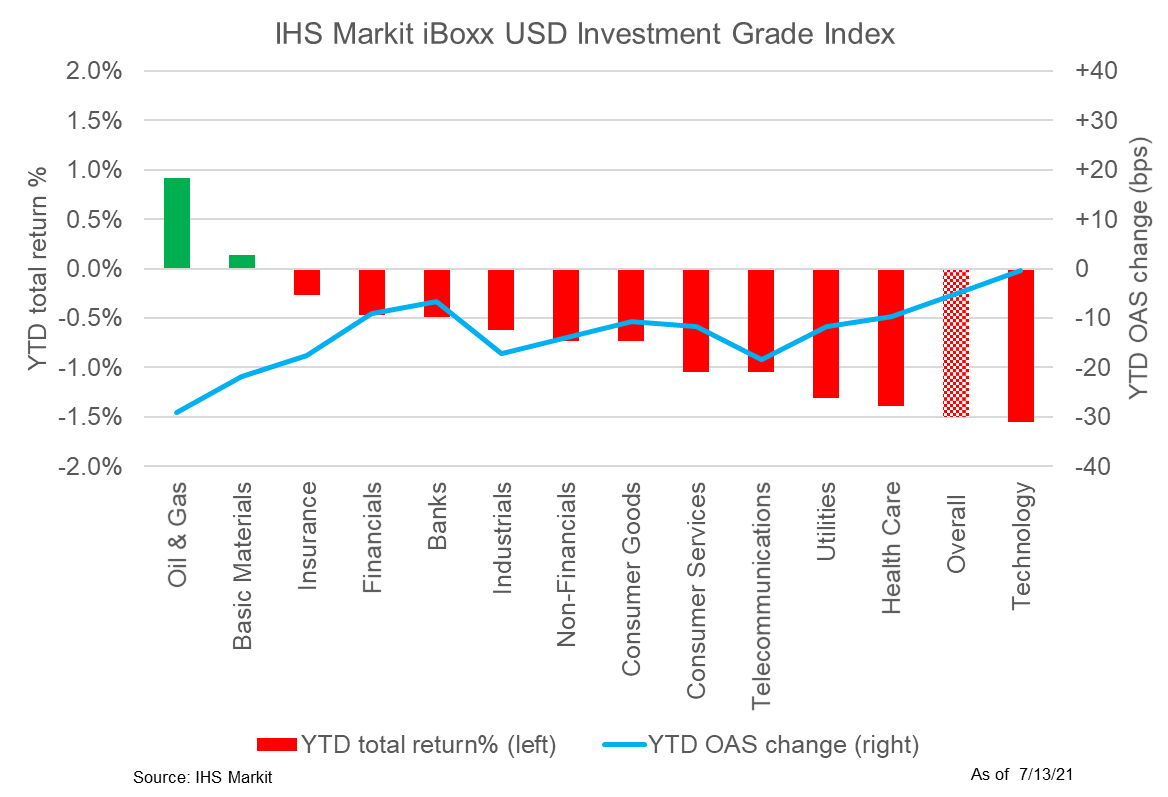

- The below chart shows IHS Markit iBoxx USD Investment Grade

Index year-to-date total returns versus changes in option adjusted

credit spreads by sector. Despite the sell-off in benchmark rates,

the oil & gas (+0.9%) and basic material (+0.1%) sectors are

the only sectors with positive returns YTD, tightening 29bps and

22bps YTD, respectively.

- US producer prices accelerated in June and in the second

quarter. The total producer price index (PPI) for final demand

climbed 1.0% in June, from 0.6% and 0.8% in April and May,

respectively. The 12-month change was 7.3% (note: year-on-year

comparisons are misleading because of base effects). (IHS Markit

Economists Michael Montgomery and Patrick

Newport)

- The index increased at a 9.4% annual rate in the second quarter—the fastest pace in its 11-year history.

- Final demand for services grew 0.8%, accounting for 60% of the June advance in final demand. About 70% of the advance in services was due to margins for final demand trade services. The press release noted that 20% of that increase "can be traced to margins for automobiles and automobile parts retailing, which rose 10.5%."

- Final demand goods prices rose 1.2%, down from 1.5% in May. The PPI for food slowed to 0.8% from 2.6% in May, while energy edged down to 2.1% from 2.2% in May.

- The core goods index, which excludes food and energy, increased 1.0% in June—the third straight month it has risen by 1% or more; the core index grew at an 11.2% annual rate in the second quarter—the fastest in its 11-year record.

- Red Bull and Rauch North America are joining forces to build a new USD740 million beverage manufacturing, filling and distribution center in Charlotte's Cabarrus County in North Carolina. The two million sq. ft. plant is being built on the site of an old Philip Morris facility. Rauch, headquartered in Austria, is the world's only bottler of beverages for Red Bull GmbH. This new development follows the recent establishment of a Red Bull bottling plant in Glendale, Arizona. Together, the companies will partner to develop a state-of-the-art campus for beverage manufacturing, can filling and distribution. Cumulatively, this high-tech beverage production hub will span 2,000,000-sq.ft. of vertical integration to include office space at The Grounds at Concord. The North Carolina Department of Commerce led the state's efforts to support Red Bull and Rauch's decision to locate to North Carolina, including the provision of two Job Development Investment Grants (JDIG) approved by the state's Economic Investment Committee. Based on new tax revenues for each company, the state has calculated that the project will provide a USD279 million boost to the state economy by Red Bull, and another USD1.5 billion by Rauch. (IHS Markit Food and Agricultural Commodities' Neil Murray)

- Electrify America and Electrify Canada have announced the Boost Plan to more than double the number of their electric vehicle (EV) charging stations in the United States and Canada by 2025. Electrify America, a subsidiary of Volkswagen (VW) Group of America, says the aim is to expand the networks to more than 1,800 charging stations and over 10,000 individual chargers. Electrify America, owner of Electrify Canada in partnership with VW Group Canada, says the deployment will increase the availability of 105-kW and 350-kW chargers and expand its initial USD2-billion, 10-year plan. Details of the amount of investment involved were not disclosed. Electrify America says the announcement is part of VW's EV strategy announced on 13 July, under which VW believes it can grow its US market share with the transition to EVs. (IHS Markit AutoIntelligence's Stephanie Brinley)

- There were no interest-rate changes by the Bank of Canada as

expected. The Bank lowered its weekly bond purchase program to $2

billion from $3 billion. (IHS Markit Economist Arlene

Kish)

- The July Monetary Policy Report (MPR) forecast is a bit lower than April's estimates as Canada's real GDP rebounds 6.0% this year. However, growth in the next two years is stronger at 4.6% and 3.3% in 2022 and 2023, respectively.

- The inflation outlook is expected to be much stronger as most other analysts have lifted expectations. For 2021, inflation will jump 3.0%, followed by an upwardly revised 2.4% in 2022 and a small downward revision to the 2023 pace of 2.2%.

- Supply and demand imbalances are pushing inflation above the target range, resulting in a bumpy economic recovery. "Achieving a full and inclusive economic recovery will, however, take time." The Bank judges that there is plenty of excess capacity within the economy and inflation will hit a sustained 2% rate in the second half of 2022, which is unchanged from previous outlooks.

Europe/Middle East/Africa

- Major European equity indices markets closed mixed; Italy +0.2%, France/Germany flat, Spain -0.4%, and UK -0.5%.

- 10yr European govt bonds closed mixed; Germany -3bps, France -2bps, Spain -1bp, and Italy/UK flat.

- iTraxx-Europe closed +1bp/47bps and iTraxx-Xover +1bp/233bps.

- Brent crude closed -2.3%/$74.76 per barrel.

- The Accenture/IHS Markit UK Business Outlook showed that the

impact of the COVID-19 pandemic on UK companies has lessened

considerably in recent months, as the latest data indicated that a

majority of businesses had seen activity return to levels seen

prior to the pandemic in June. (IHS Markit Economist David Owen)

- Approximately 51% of firms in our survey panel, comprising manufacturing and service sector companies, stated that output was either the same or higher than before the pandemic began last March. This represented a rise from 35% in February as the relaxation of COVID-19 measures supported a strong boost to economic activity.

- Roughly 31% of businesses reported an increase in output in June compared to pre-COVID levels, up from 17% in the February survey. This was the highest seen across all countries monitored by the Business Outlook Survey and compared with a global average of 20%.

- Manufacturing firms (62%) were more likely than their services counterparts (49%) to have seen output recover from the pandemic. Anecdotal evidence suggested that an increase in spending on goods and higher orders from construction firms had supported producers. Service providers often found that the easing of many restrictions had boosted consumer facing activity, although many firms noted business activity overall remained below pre-pandemic levels.

- Of those firms reporting that output had fallen since the start of the pandemic, most stated that they expect to recover within the next year. Around 17% projected a return to normal activity levels in the next six months, representing more than a third of those that had seen a decline.

- About 14% of businesses expect output to recover between seven- and 12-months' time in the latest survey, while a further 9% predicted it would take until June 2023.

- Only 4% of businesses expect a recovery time of more than two years, down from 5% in February. Approximately 2% of firms believe that they would never recover from the pandemic, about half that seen in the previous survey.

- May's monthly decline in eurozone industrial production despite

the ongoing loosening of COVID-19-related restrictions during the

period underlines the growing importance of the dampening impact

from supply-chain disruption. (IHS Markit Economist

Timo Klein)

- The hard evidence about industrial activity in the eurozone during May reveals that production (excluding construction) declined by 1.0% month on month (m/m), following a downwardly revised increase of 0.6% m/m in April. This leaves production 1.4% below its pre-pandemic level back in February 2020 and will cool some of the recent euphoria regarding near-term growth prospects. Still, persistently elevated leading indicator levels through to June, including IHS Markit's PMIs, and the concurrent marked recovery of the service sector owing to rescinded containment measures conversely argue against becoming unduly pessimistic about GDP in general.

- The setback in May was driven by production of consumer non-durable goods (-2.3% m/m), energy (-1.9%), and capital goods (-1.6%). In contrast, production of intermediate goods was fairly steady (-0.2% m/m) and output of consumer durables continued to gain (+1.6%) despite having surged by 3.4% m/m in April already. Indeed, consumer durables is the only category for which production is well above its pre-pandemic level now, with intermediate goods production only slightly higher.

- The Volkswagen (VW) Group has announced a new all-encompassing corporate strategy, NEW AUTO, which will marry many elements, some of which it has announced already, into a cohesive plan 'for transforming the Group into a software driven mobility company with a strong focus on its powerful brands and global technology platforms'. The strategic announcement was very investor-focused, showing how all these sometimes disparate elements would be pulled together with a focus on profitability and in order to future-proof the company. In the announcement, VW outlined how it is planning to gradually shift revenue and profit from traditional internal combustion engine (ICE) cars to battery electric vehicles (BEVs) and then to software and services, which will eventually culminate in fully autonomous vehicle technology, which will in turn open up numerous new commercial opportunities. According to VW, individual mobility, based on cars, is expected to still account for 85% of the market and the same amount of the company's business, with lower battery cost and synergies gradually driving margin parity between traditional ICE technology and BEVs in the next two to three years. VW has restated its medium-term financial goals to reflect the NEW AUTO plan, with return on sales now increased from the original range of 7-8% by 2025 to 8-9%. Investment, scale and synergies will be key to achieving this goal, with VW earmarking EUR73 billion for future technologies from 2021 through 2025, representing 50% of total investment. (IHS Markit AutoIntelligence's Surabhi Rajpal and Tim Urquhart)

- Vestas is in technical discussions with Poland's Port of Gdynia, in a collaboration intended to support the port's development into a major wind project hub. The two parties are collaborating on a range of topics, including the different requirements of an offshore wind pre-assembly site. Vestas has shared technical specifications required for the installation of turbines, including its flagship V236-15.0 MW turbine. This comes as Poland's parliament passed the Offshore Wind Act earlier this year, targeting up to 5.9 GW of capacity to be allocated by contract-for-difference (CfD) in 2021, and two 2.5 GW CfD auctions in 2025 and 2027. These projects will be given up to seven years from award to generation. In April, RWE secured a CfD for its 350 MW Baltic II wind farm, while Orsted and PGE secured CfDs for up to 2.5 GW for its Baltica 2 and 3 offshore wind farms. Just last month, Poland's Energy Regulatory Office approved the CfD for PKN ORLEN's and Northland Power's Baltic Power wind farm. Ocean Winds, a joint-venture between EDP Renewables and ENGIE, was also recently awarded a CfD for its 370 MW B&C offshore wind farm. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

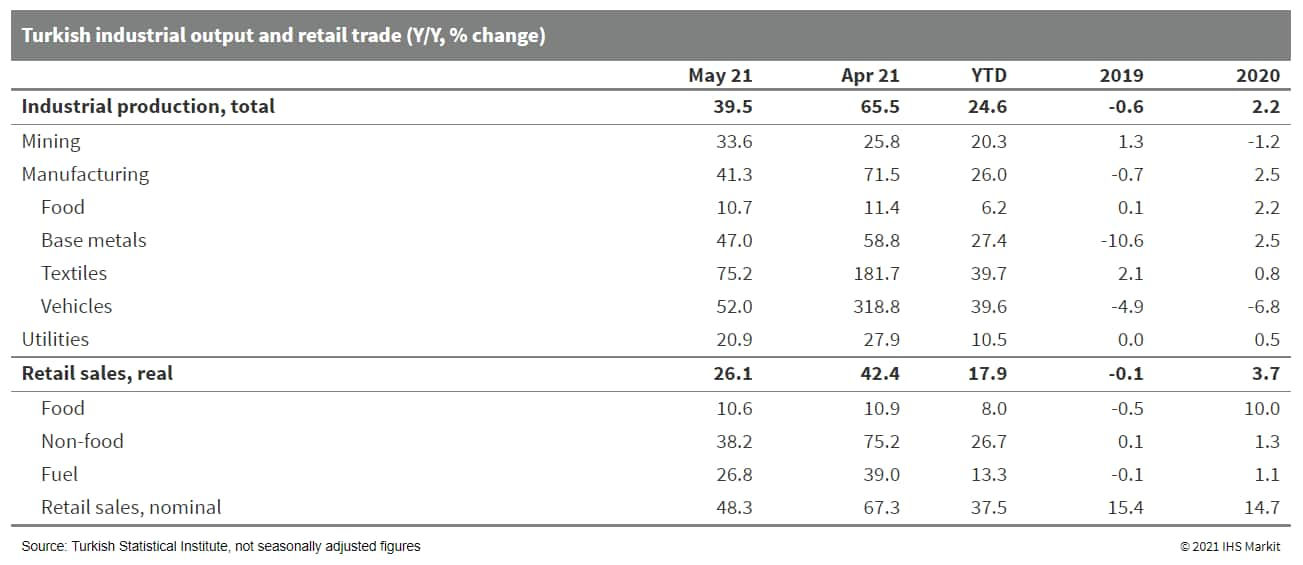

- Amid a tightening of lockdown measures to battle a worsening

coronavirus disease 2019 (COVID-19) virus outbreak at the time,

Turkish retail trade activity contracted month on month (m/m) in

May, extending the downturn that began in April. (IHS Markit

Economist Andrew

Birch)

- In May, retail trade activity - in constant, seasonally and calendar adjusted data - contracted for the second consecutive month, by 6.1% m/m. In April, activity shrank by 5.8% m/m.

- The dramatic escalation of lockdown measures from mid-April to mid-May enacted by the Turkish government to suppress a reintensification of COVID-19 infections severely undermined retail trade activity during those months. Shopping for non-food goods fell particularly sharply those months, down by 11.0% m/m and 7.6% m/m, respectively.

- Industrial production during those months was more resilient,

as lockdown measures excepted manufacturing in order to continue to

meet strong export demand. After initially dipping by 0.8% m/m in

seasonal and calendar adjusted data in April, total industrial

output increased once again by 1.3% m/m in May.

Asia-Pacific

- APAC equity markets closed mixed; Australia/India +0.3%, South Korea -0.2%, Japan -0.4%, Hong Kong -0.6%, and Mainland China -1.1%.

- Mainland China's merchandise exports rose 32.2% year on year

(y/y) in June in US dollar terms, up by 4.3 percentage points from

May, according to the General Administration of Customs.

Merchandise imports growth decelerated to 36.7% y/y in June from

51.1% in the prior month. (IHS Markit Economist Yating

Xu)

- The improvement in June headline exports was driven by demand pickup in Japan and the European Union, while growth of exports to the United States and Association of Southeast Asian Nations (ASEAN) member states moderated from a month ago.

- By product, labor-intensive goods continued to see deceleration in exports growth in Jue, yet high-tech and mechanical products saw a pickup in their year on year exports growth. With an increase of Delta-variant-related COVID-19 cases driving up demand for pandemic-prevention supplies, exports of textile products increased month on month and narrowed its year-on-year contraction.

- The deceleration in imports growth can be attributed to a higher baseline and a weakening recovery momentum of domestic demand, as volume declined month on month for major imports including copper, iron ores, and crude oil. That said, relatively high commodity prices were still supporting the overall import value.

- Trade surplus further expanded to USD51.5 billion in June, up by 15.0% y/y compared with a 26.5% y/y contraction in May. Cumulative trade surplus in the first half had been up by 53.1% y/y, narrowing from 70.2% y/y through May.

- China had around 1.947 million electric vehicle (EV) charging piles as of the end of June, according to the China Electric Vehicle Charging Infrastructure Promotion Alliance, reports Gasgoo. This figure represents an increase of 47.3% year on year (y/y). The report states that the total number of public charging piles in China had stood at 923,381 at the end of June, including around 374,000 DC piles, 550,000 AC piles, and 426 DC-AC integrated charging piles. The country witnessed an increase of around 30,400 public charging piles every month on an average between July 2020 and June 2021. Furthermore, there were about 66,000 charging stations in China including 10,514 in Guangdong, 5,981 in Jiangsu, 5,355 in Zhejiang, 5,337 in Shanghai, and 5,190 in Beijing. The country also had 716 battery swapping stations as of the end of June, including 221 in Beijing and 110 in Guangdong. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- China's first floating offshore wind turbine demonstration has set sail for its installation site off the coast of Yangjiang City in Guangdong Province. This project comprises of a single MySE5.5MW typhoon-resistant turbine developed by MingYang Smart Energy installed on a semi-submersible floating foundation built by Wison Offshore & Marine. The installation, commissioning, and testing of the wind turbine will be carried out over the next six months at the 400 MW Yangxi Shapa III offshore wind farm developed by China Three Gorges (CTG). The turbine is designed to withstand harsh environments encountered in the South China Sea, such as typhoons and extreme waves. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- SAIC Motor has announced plans to launch 40 to 60 robotaxis capable of Level 4 autonomous operations in the Chinese cities of Shanghai and Suzhou before the end of 2021. The statement was made by SAIC Motor vice-president and chief engineer Zu Sijie during the World Artificial Intelligence Conference (WAIC) 2021. The company plans to begin mass production of robotaxis in 2025. Sijie said, "We are embracing AI and you can call us a Shanghai AI Corp as SAIC," reports SHINE. SAIC has joined with technology partners including Alibaba Group, NVIDIA, Luminar, Tencent, and Intel in a bid to gain a foothold in the field of autonomous smart vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Volkswagen (VW) has signed a battery cell production agreement with Chinese battery maker Gotion High-tech, according to China Daily. As per the deal, Gotion High-tech Co., Ltd., will help Volkswagen AG produce battery cells at the carmaker's plant in Salzgitter (Germany) starting 2025. Gotion will serve as a technology partner for the cell factory layout, machinery, and production processes. The deal will, however, not affect ongoing contracts VW has with other battery suppliers. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Pony.ai has announced plans to mass-produce its Level 4 autonomous system by 2023 at the World Artificial Intelligence Conference (WAIC) 2021, reports Caixin Global. Pony.ai's Level 4 autonomous system will be powered by a new sensing platform equipped with Iris LiDAR sensors developed by Luminar Technologies. These sensors are 10 cm high and can detect objects up to 500 meters away. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Maruti Suzuki India Limited (MSIL) has announced an investment of INR180 billion (USD2.4 billion) to set up a plant in the state of Haryana with annual capacity for 1 million vehicles, reports Economic Times Now. According to the source, the automaker will need to consider the Haryana government's new policy, which mandates that 75% of private-sector jobs must be reserved for people from the state. RC Bhargava, Chairman of MSIL, said, "We have a plan to invest INR170-180 billion. The total capacity that we are planning is between 750,000 and 1 million cars per annum. (IHS Markit AutoIntelligence's Tarun Thakur)

- Australia continues to draw proposed major green energy

investments—even as projects run into roadblocks, the

government lags its neighbors' climate ambitions, and coal still

dominates the country's generation mix. (IHS Markit Climate and

Sustainability News' Keiron Greenhalgh)

- A consortium comprising InterContinental Energy, CWP Global, and Mirning Green Energy on 13 July unveiled plans for a wind and solar project in southeastern Western Australia that could be as large as 50 GW, with the output to be used to produce up to 3.5 million mt of green hydrogen or 20 million mt of ammonia annually.

- The Western Green Energy Hub, unlike many other energy mega-projects announced around the world, has the backing of both local aboriginals and politicians eyeing jobs and tax revenues. Mirning Green Energy is a wholly owned subsidiary of the Mirning Traditional Lands Aboriginal Corporation.

- The state already has backed a separate headline-grabbing mega-project proposed by InterContinental Energy and CWP Energy. The developers' proposed Asian Renewable Energy Hub (AREH)—a 15-GW to 26-GW wind and solar facility that would supply power to local industry and an up to 10 million mt ammonia export project—won support at the state level in late 2020. AREH is to be located in northwestern Western Australia's Pilbara region, an iron ore industry hub. AREH also won fast track approval status from the federal government.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-july-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-july-2021.html&text=Daily+Global+Market+Summary+-+14+July+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-july-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 14 July 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-july-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+14+July+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-july-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}