Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 14, 2021

Daily Global Market Summary - 14 June 2021

Most major European and APAC equity markets closed higher, while US indices were mixed. US and benchmark European government bonds closed lower. European iTraxx credit indices closed almost flat on the day and CDX-NA was slightly wider across IG and high yield. Natural gas and Brent closed higher, the US dollar and WTI closed flat, and copper, silver, and gold closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed, with the Nasdaq +0.7% and S&P 500 +0.2% reaching new all-time high closes; DJIA -0.3% and Russell 2000 -0.4%.

- 10yr US govt bonds closed +5bps/1.50% yield and +4bps/2.18% yield.

- CDX-NAIG closed +1bp/49bps and CDX-NAHY +2bps/277bps.

- DXY US dollar index closed flat/90.52.

- Gold closed -0.7%/$1,866 per troy oz, silver -0.4%/$28.04 per troy oz, and copper -0.2%/$4.53 per pound.

- Crude oil closed flat/$70.88 per barrel and natural gas closed +1.7%/$3.35 per mmbtu.

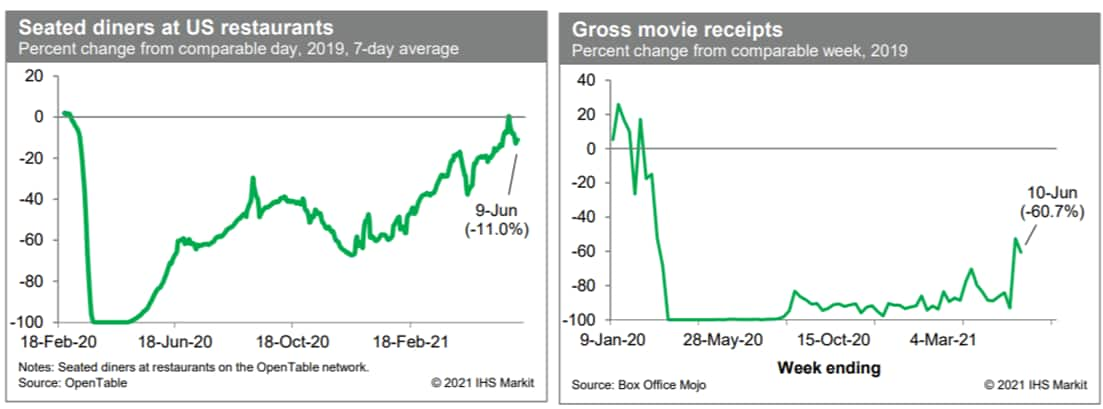

- As of last Wednesday, the count of seated diners on the

OpenTable platform (seven-day average) was 11% below the comparable

period in 2019, down somewhat from prior weeks but well up from

averages over the winter. Activity at restaurants has nearly fully

recovered. Meanwhile, over the week ending last Thursday,

box-office receipts were 60.7% below the comparable week in 2019.

This was down only slightly from the prior week and a vast

improvement over weeks before that. (IHS Markit Economist Ben

Herzon and Joel

Prakken)

- The US Department of the Interior (Interior) announced a

competitive offshore wind lease sale in waters off New York and New

Jersey 11 June, extending a sequence of landmark steps in recent

weeks for the nascent sector that now encompasses opportunities on

three coastlines for the first time. (IHS Markit Climate and

Sustainability News' Keiron Greenhalgh)

- Three days earlier, on 8 June, Interior said it intended to look into opportunities on the Gulf of Mexico Outer Continental Shelf, the first federal step for developments along the US southern coast. A day later, the state of North Carolina unveiled a 2030 offshore wind capacity goal of 2.8 GW.

- The acceleration of the prospects began at the end of May when the federal government designated two areas off the coast of California for development after overcoming long-standing Department of Defense objections. The designation sets the areas on the path to a lease auction by mid-2022.

- The Biden-Harris administration's first offshore wind lease sale will be in Atlantic Coast waters in an area known as the New York Bight as it seeks to fulfill a promise to reach 30 GW of capacity by 2030. The New York Bight is an area of shallow waters between Long Island and the New Jersey coast. The lease areas have the potential to unlock over 7 GW of offshore wind capacity, powering more than 2.6 million homes and supporting thousands of new jobs, Interior said in a statement announcing the sale.

- Lordstown Motors Corp. said its chief executive and top financial leader have resigned, decisions that come amid a new report from a board committee that says some aspects of disclosures it made about truck preorders were inaccurate. The company said Monday that a board committee had found some disclosures made about preorders for its forthcoming electric truck, the Endurance, to be inaccurate in certain respects, partially confirming claims outlined in a March report by short seller Hindenburg Research. The committee rejected other aspects of the short seller's report, such as the assertion that a September launch date for the Endurance was unrealistic, the company said. (WSJ)

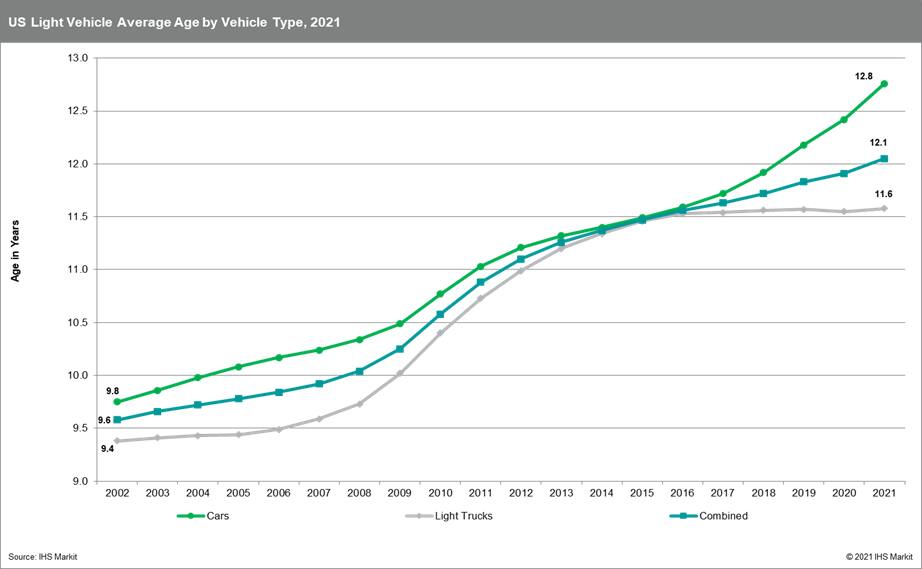

- New research by IHS Markit shows that the average age of light

vehicles in operation (VIO) in the US has risen to 12.1 years this

year, increasing by nearly 2 months during 2020 and elevated by the

COVID-19 pandemic. The COVID-19 pandemic and its impact across the

US caused a drastic reduction in new vehicle sales as well as a

sudden increase in vehicle scrappage, which was a catalyst for

increased velocity in the growth of the average age of light

vehicles. The pandemic-induced rate of increase in average age is

expected to be short-lived, as in 2021, increases in new vehicle

registrations and used-vehicle registrations are expected as the

country adapts to post-pandemic norms (IHS Markit

AutoIntelligence's Stephanie

Brinley).

- Chipmaker NVIDIA will acquire autonomous vehicle (AV) mapping company DeepMap for an undisclosed amount, according to a company statement. This will bolster NVIDIA's mapping and localization capabilities available on its DRIVE software. The deal is expected to finalize in the third quarter of 2021. The most difficult aspect of establishing full autonomy is obtaining accurate localization and updated mapping data that represents current road conditions. DeepMap, founded by former employees of Google, Apple and Baidu, has developed a high-definition mapping solution by using crowdsourced data from vehicle sensors. Meanwhile, NVIDIA is at the forefront of developing hardware for AVs and its line-up of NVIDIA DRIVE products are widely used. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Perrone Robotics has completed a series of demonstrations of autonomous vehicles (AVs) on public roads in the city of Westminster (Maryland, US). It is part of an event hosted by the Mid-Atlantic Gigabit Innovation Collaboratory (MAGIC) Autonomous Corridor Project, under which GreenPower Motor Company's AV Star zero-emission transit shuttle is deployed with Perrone's autonomous retrofit kit, TONY. These demonstrations have helped the company to develop an operational design domain (ODD) route that allows the AV shuttle to navigate a designated neighborhood. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- Most major European equity indices closed higher except for Germany -0.1%; Spain +0.8% and France/UK/Italy +0.2%.

- 10yr European govt bonds closed lower; UK/France/Italy/Spain +3bps and Germany +2bps.

- The European Union is testing investors' appetite to fund nearly $1 trillion of debt over five years as it seeks to finance its recovery from the coronavirus pandemic. The bloc opened books on debut 10-year bonds as part of its NextGenerationEU (NGEU) program, which will finance grants and loans to member states. European Central Bank President Christine Lagarde said in an interview published Monday the NGEU stimulus will "transform the future of Europe." The bonds, which are likely to price on Tuesday, are being offered with initial price thoughts around one basis point above mid swaps. That's wider than the EU's existing debt curve, according to data compiled by Bloomberg. (Bloomberg)

- iTraxx-Europe closed flat/47bps and iTraxx-Xover +1bp/232bps.

- Brent crude closed +0.2%/$72.86 per barrel.

- The United Kingdom's postal service, Royal Mail, has announced that it is to expand its battery electric vehicle (BEV) fleet tenfold as part of a push to reduce the carbon footprint of its parcel deliveries. According to a statement, it will add a further 3,000 BEVs across the UK but will initially focus on areas with ultra-low emission zones. These will have a load carrying capacity of between 3.7 cubic meters and 6.3 cubic meters. To support this, the company will also introduce charging points at all its Delivery Offices. (IHS Markit AutoIntelligence's Ian Fletcher)

- European cattle prices have risen to their highest level in more than two years, as constrained supplies of livestock continue to keep prices buoyant. Price movements are limited overall, but nevertheless prices have edged upwards for the fourth week in a row towards levels not seen since the start of 2019. The EU average all-cattle price is now just below the EUR378 (USD457) per 100kg mark - which constitutes 170% of the EU reference price level. Much of the impetus is coming from the supply side, with young bulls for slaughter described as scarce in some regions of Europe. There is also an imbalance between supply and demand in the manufacturing beef sector, and this has pulled up the price for cull cows to a level which is now 17.2% higher than at this time last year. Demand is said to be relatively quiet, as is generally the case in early summer, although the re-opening of the restaurant and foodservice sectors offers additional upside potential. The non-retail sectors typically favor beef supplies from outside the EU - but this year things may be different as a range of logistical factors, not least the continuing high price of refrigerated containers, has dampened imports from South America. (IHS Markit Food and Agricultural Commodities' Julian Gale)

- The BMW Group and Volkswagen (VW) Group are part of a new consortium comprising 10 German companies called Quantum Technology and Application Consortium (QUTAC), which will research practical cloud and quantum computing applications according to a company statement. BMW and VW are keen to extend their R&D capability in the area, with both companies having invested heavily in the field of digital architecture development in recent times. (IHS Markit AutoIntelligence's Tim Urquhart)

- Tesla's plan to build a battery cell production factory alongside the site of its car manufacturing facility that is currently under construction has received an objection from a German environmental group, according to a Reuters report. The objection was brought by the environmental groups Gruene Liga and NABU, which said that Tesla has not sufficiently clarified what precautions it will take to prevent poison gas escaping from the factory. The groups have said they will go to court to argue for a suspension of construction if the state authorities fail to file for a permit suspension by 16 June. (IHS Markit AutoIntelligence's Tim Urquhart)

- Clariant says it has reached definitive agreements for the previously announced divestment of its pigments business to a consortium of pigments manufacturer Heubach Group (Langelsheim, Germany) and private equity firm SK Capital Partners for an enterprise value of 805-855 million Swiss francs ($895-950 million) on a cash- and debt-free basis, depending on an earn-out payment of SFr50 million contingent on the 2021 financial performance of the Clariant pigments business. The value represents a multiple of 10.7-11.4 times (x) the standalone adjusted 12-month EBITDA of the business as of April 2021, Clariant says. The share of the participation in waste-management company Infraserv Höchst (Frankfurt, Germany), attributable to Clariant's pigments business, does not form part of the transaction, Clariant says. The deal is expected to close in the first half of 2022, subject to customary closing conditions and regulatory approvals, it says. Combining the Clariant business with Heubach will create a worldwide pigments player with approximately 3,000 employees generating more than €900 million ($1.1 billion) in annual sales and "strong service and production capabilities across the globe," Clariant says. Clariant's pigments business generated sales of about SFr850 million on a standalone basis in 2020 and had about 1,900 employees. (IHS Markit Chemical Advisory)

- Hungary's Central Statistical Office (KSH) has published

detailed data for economic activity in the first quarter of 2021.

Real GDP growth accelerated to 2.0% quarter on quarter (q/q), 0.1

percentage points higher than the flash estimate released in

mid-May suggested. On an annual basis, economic activity fell by

1.5% year on year (y/y). Although economic activity has fallen for

four consecutive quarters in annual terms, in quarterly terms

Hungary has maintained growth since the third quarter of 2020. (IHS

Markit Economist Dragana

Ignjatovic)

- Domestic demand has experienced a mixed first quarter. They key segment to drive growth in the first quarter was government consumption, up 2.6% q/q, reflecting ongoing pandemic-related spending amid the spike in infections and renewed lockdowns through much of January-March 2021. Private consumption has also proven to be robust in the first quarter, rising by 1.3% q/q. Labour market uncertainty amid tight restrictions weighed on confidence, was offset by the targeted government support to households. In contrast, fixed investment fell by 0.6% q/q reflecting the deferred spending decisions of companies and households amid the pandemic.

- Net exports made a positive contribution to headline growth. Exports grew by 1.6% q/q in the first quarter, while imports were up by 0.8% q/q. This reflected the decision in Hungary and wider Europe to exempt the manufacturing sector from the latest round of pandemic restrictions in effect through much of the first quarter. Pent-up consumer demand throughout Europe has helped boost demand for Hungarian goods in key European markets, however the global semiconductor crisis could depress automotive production in the coming quarters, weighing on Hungary's industry and exports.

- The imposition of severe lockdown measures to combat the spread

of the COVID-19 took a heavy toll on Turkish economic activity in

April 2021. For the first time since April 2020, industrial

production contracted on a month-on-month (m/m) basis in in April

2021 in seasonally and calendar adjusted data. (IHS Markit

Economist Andrew

Birch)

- Huge base effects ensured that total industrial output was well above year-earlier levels, but total output slipped by 0.9% m/m in the face of renewed lockdown measures that were even more severe than they had been a year earlier.

- The renewed lockdowns also undermined retail trade activity. Retail trade has not had as consistent of a rebound since the March-April 2020 initial lockdowns, but nonetheless, it plunged by 6.3% m/m in seasonally and calendar adjusted terms. As with industrial production, huge base effects ensured that total activity was still well up from a year earlier.

Asia-Pacific

- APAC equity markets closed higher, with multiple markets closed in the region; Japan +0.7%, India +0.2%, and South Korea +0.1%.

- China's Foreign Minister Wang Yi spoke with Burkina Faso's

Foreign Minister Alpha Barry on 10 June. The ministers highlighted

their intent to strengthen collaboration under the framework of the

Forum on China-Africa Cooperation (FOCAC), which is expected to be

held this year in Senegal's capital Dakar and will be attended by

senior members of the Chinese government as well as leaders of

African governments. (IHS Markit Country Risk's William Farmer,

David Li, Eva Renon, and Chris

Suckling)

- Debt deferral remains an urgent issue for sub-Saharan African governments, but Chinese policy announcements do not suggest any intent to make significant progress during the upcoming meetings. Debt relief has not been mentioned by Chinese policymakers as a primary topic for the upcoming FOCAC meetings. Chinese measures to support sub-Saharan Africa to date have included small-scale debt relief - particularly on interest-free loans and debt rescheduling - with only some Chinese state-owned creditors willing to undertake debt deferral, having shown reluctance towards large-scale debt forgiveness.

- The immediate focus of FOCAC is likely to be supporting access to Chinese-manufactured COVID-19 vaccines, which remains the most important current issue for African governments. During a Group of 20 (G20) Global Health Summit in May, Chinese President Xi Jinping announced a USD3-billion aid package to support the health and economic impact response to COVID-19 for developing countries.

- Chinese policymakers have also highlighted private-sector-led industries - including the digital economy and health - and have emphasized sustainability-related industries as key areas of future collaboration, in addition to regional commercial agreements, indicating increasing activity by non-state Chinese players. Promotion of private-sector participation as a key priority to future China-Africa engagements is likely. China is already seeking public-private partnerships (PPPs) with Kenya, Uganda, Mozambique, and Nigeria, either in developing toll roads or energy infrastructure.

- New vehicle sales in China declined year on year in May, after four consecutive months of increase, due to a higher base of comparison. Chinese new vehicle sales were impacted from January to March last year by the COVID-19 virus outbreak. However, new vehicle sales started to rebound in April 2020 and jumped sharply in May last year. According to IHS Markit's January light-vehicle market forecasts, light-vehicle production in mainland China is to increase 5.27% to 24.580 million units in 2021, after a decline of 4.3% in 2020. Light-vehicle sales in mainland China are expected to increase 5.0% to 24.853 million units in 2021. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Geely plans to continue working on the development of methanol-powered vehicles, according to the Hindustan Times. The automaker has invested in Carbon Recycling International, an Icelandic company, to work on technologies to produce methanol with carbon dioxide in a way to lower overall carbon emissions. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Senmiao Technology has collaborated with Didi Chuxing (DiDi) for aggregating riders on their platforms, according to a company statement. Senmiao will receive orders from riders using DiDi Open Platforms' online ride-hailing applications in certain cities, beginning with Chinese city Chengdu. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- South Korean OEMs - Hyundai, Kia, General Motors (GM) Korea, Renault Samsung, and SsangYong - have announced a 10.9% year-on-year (y/y) jump in their combined domestic output to 256,272 vehicles during May, reports the Yonhap News Agency, citing data released by the South Korean Ministry of Trade, Industry, and Energy. Vehicle exports by the South Korean OEMs also surged during the month, by around 58.0% y/y to 150,894 units, while the total value of their overseas shipments nearly doubled, reaching USD3.49 billion. The ministry attributed the growth to the strong performance of electric vehicles (EVs), along with Hyundai's premium Genesis brand. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-june-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-june-2021.html&text=Daily+Global+Market+Summary+-+14+June+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-june-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 14 June 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-june-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+14+June+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-june-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}