Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 14, 2021

Daily Global Market Summary - 14 May 2021

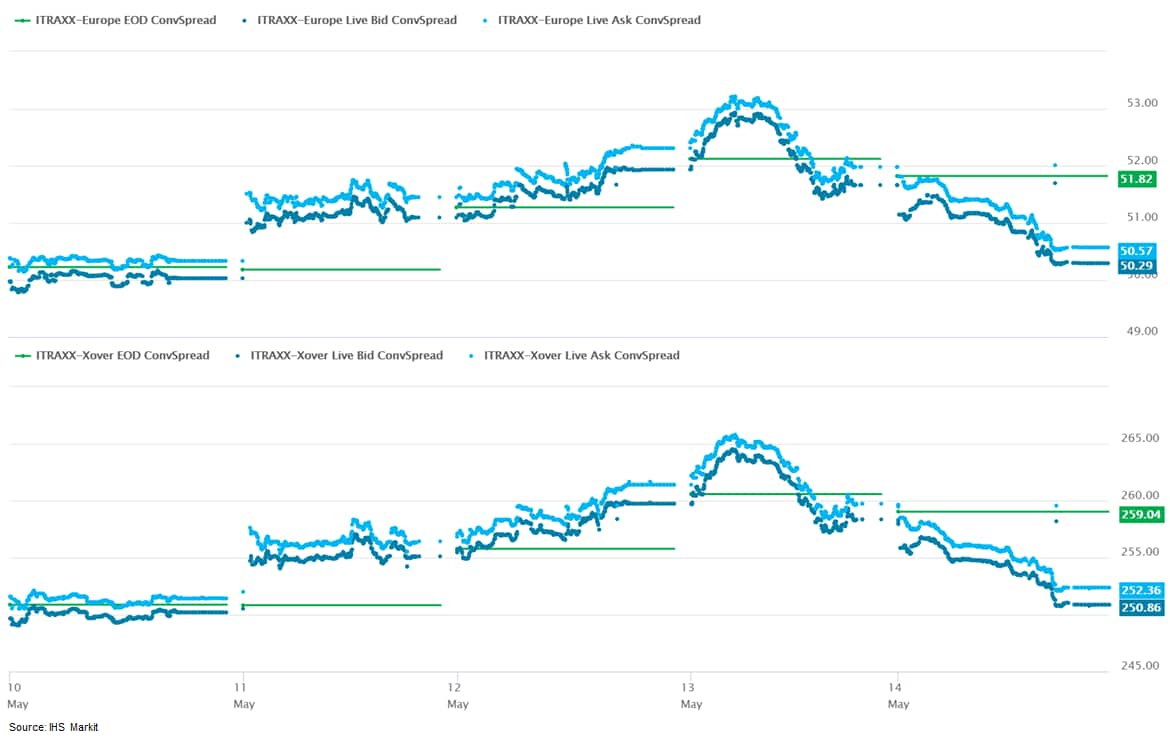

All major APAC, European, and APAC equity indices closed higher today. US government bonds closed higher for a second consecutive day and benchmark European bonds closed mixed. European iTraxx and CDX-NA closed modestly tighter across IG and high yield. Oil, silver, and gold closed higher, while the US dollar, natural gas, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +2.5%, Nasdaq +2.3%, S&P 500 +1.5%, and DJIA +1.1%.

- 10yr US govt bonds closed -3bps/1.63% yield and 30yr bonds -3bps/2.35% yield.

- CDX-NAIG closed -1bps/51bps and CDX-NAHY -7bps/288bps, which is

flat and +2bps week-over-week, respectively.

- DXY US dollar index closed -0.5%/90.32.

- Gold closed +0.8%/$1,838 per troy oz, silver +1.1%/$27.37 per troy oz, and copper -0.8%/$4.66 per pound.

- Crude oil closed +2.4%/$65.37 per barrel and natural gas closed -0.4%/$2.96 per mmbtu.

- The level of total US retail trade and food services sales was

virtually unchanged in April at $620 billion. (IHS Markit

Economists James

Bohnaker and David

Deull)

- Sales at motor vehicle and parts dealers increased 2.9% after a 17.1% surge a month earlier. Sales in April rose to a level that was 32% above the pre-pandemic benchmark of February 2020. While this pace is unsustainable, it reflects consumers' willingness to make large purchases with stimulus money received in March and April.

- Outside of autos, retail sales moved 0.8% lower in April with clothing and clothing accessory stores (-5.0%), general merchandise (-4.9%), and sporting goods (-3.6%) showing the most significant declines. We anticipate a more broad-based decline in retail sales over the next few months as consumers pivot toward more service-oriented consumption.

- Home improvement remains a preferred retail outlet for homeowners. Although sales at building materials and garden supply stores edged down 0.4% for the month, the level remained significantly higher than the pre-pandemic mark at 31.0% above February 2020.

- Sales at food services and drinking places increased 3% as warmer weather, looser restrictions, and more vaccinations encouraged dining out. Restaurant activity should continue to improve over the next few months and surpass the pre-pandemic level this summer.

- The US University of Michigan Consumer Sentiment Index fell 5.5

points (6.2%) to 82.8 in the preliminary May reading. The decline

followed two sturdy increases and left the index above its level in

February 2021. (IHS Markit Economists James

Bohnaker and David

Deull)

- Signals of inflation perceptions in the survey came alongside improved expectations for the labor market. The net percent of respondents expecting further declines in the unemployment rate was the highest in the 43-year record, consistent with our expectation for robust growth of consumer spending in the second quarter amid a transitory rise in prices.

- The May decline in consumer sentiment was broad-based. The index measuring views on the present situation fell 6.4 points to 90.8, while the one-year expectations index fell 5.1 points to 77.6.

- Similarly, consumer sentiment fell across the income distribution. The index of sentiment for households earning more than $75,000 a year fell 6.0 points to 88.3, while sentiment for households earning less than $75,000 a year fell 5.2 points to 77.0.

- Views on buying conditions plunged in May as rising prices left their mark. The index of buying conditions for large household durable goods fell 12 points to 114, while that for vehicles fell 16 points to 102. The index for homes dove by 19 points to 95. For vehicles, May's level was the lowest since 2008, and for homes, the lowest since 1983. According to the University of Michigan, the measure of net negative references to prices across these three categories was the most pronounced since 1980.

- Putting this together, the expected one-year inflation rate vaulted 1.2 percentage points in May to 4.6%, the highest since August 2008. The expected 5- to 10-year inflation rate rose 0.4 percentage point to 3.1%.

- Total US industrial production rose 0.7% in April, reflecting

increases in manufacturing (0.4%), mining (0.7%), and utilities

industrial production (2.6%). Total industrial production remains

2.7% below its pre-pandemic (February 2020) level. (IHS Markit

Economists Ben

Herzon and Akshat

Goel)

- The drop in industrial production in February due to the severe weather and the subsequent rebound in March are now estimated to have been larger than reported last month; the change in industrial production for February was revised down from -2.6% to -3.5%, and the change in March was revised up from 1.4% to 2.4%.

- Manufacturing industrial production rose 0.4% in April, recording gains across most market groups with the notable exception of groups related to motor vehicles and parts. April's manufacturing output was helped by the continued recovery in petroleum and coal products (1.6%) and chemicals (3.2%), as plants that were damaged by severe weather in the south-central region returned to operation.

- Output of motor vehicles and parts (-4.3%) was the main drag on factory output in April, as it continues to be restrained by a shortage of semiconductor chips used in vehicle components, one of many supply-chain bottlenecks affecting output more broadly. Manufacturing output excluding motor vehicles and parts was up 0.7% in April.

- Output from utilities rose 2.6% in April after dropping substantially in March due to unseasonably warm weather. Mining activity increased 0.7% in April.

- Hyundai Motor Group is planning investment of USD7.4 billion into its US operations, with a focus on electric vehicles (EVs) and mobility. Hyundai's statement says it plans to invest the funds in the US to "produce future EVs, enhance production facilities and further its investments in smart mobility solutions… HMG's investment will enhance overall product competitiveness by prioritizing future mobility technologies, including electrification and hydrogen energy." The announcement does not specify details of what areas get what portion of the funding, but the company did confirm that both Hyundai and Kia will build EVs in the US. The investments and directions are consistent with Hyundai's broader global strategy to invest in these areas and signal the importance of the US market to Hyundai's global strategy and ambitions. The US EV investment also comes as US President Joe Biden is encouraging a faster transition to EVs as well as for US manufacturing. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Fisker and Foxconn have signed framework agreements on development and production of a Fisker-branded electric vehicle (EV) in the United States in 2023. According to a joint statement by the companies on 13 May, Fisker and Foxconn have signed agreements related to joint development and manufacturing of what they are calling Project PEAR (Personal Electric Automotive Revolution). No specific figures involved were disclosed, but the agreements will see Fisker and Foxconn jointly investing in the project, with each company taking proceeds from successful delivery under the programme. The vehicle is to be on a new lightweight platform called FP28, developed together by the companies "leveraging technological expertise from each company", according to the statement. As well as Project PEAR, other vehicles could be developed under the deal. The vehicle is envisioned to have a price point of less than USD30,000, and production is planned in the fourth quarter of 2023. However, the two companies have not yet selected the manufacturing site. (IHS Markit AutoIntelligence's Stephanie Brinley)

- A US House of Representatives committee has reportedly approved draft legislation authorising the US Postal Service (USPS) to spend USD8 billion to buy more electric vehicles (EVs). According to a Bloomberg report, the House Oversight and Reform Committee approved revisions to a bill aimed at improving tracking of voters' mailed ballots during elections. The measure must still be voted on by the House and the Senate, but it is moving in the direction of approval. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- All major European equity markets closed higher; Spain +2.0%, France +1.5%, Germany +1.4%, UK +1.2%, and Italy +1.1%.

- 10yr European govt bonds closed mixed; UK -4bps, Germany -1bp, France flat, and Italy/Spain +1bp.

- iTraxx-Europe closed -2bps/50bps and iTraxx-Xover -7bps/252bps,

with both indices flat week-over-week.

- Brent crude closed +2.5%/$68.71 per barrel.

- Mobility firm Ola has launched a new electric vehicle (EV) category on its ride-hailing platform in London (UK), reports Livemint. The category, called Ola EV, will allow users to specifically book rides in an EV at no extra cost. To incentivise drivers to switch to EVs, Ola will offer 0% commission rate for the first three months. After the launch, Ola plans on "extending offers through key partnerships by providing easy and affordable options for drivers and riders to shift to fully EVs". Ola plans to roll out the EV category over time to other cities around the world where it is operational. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Audi's CEO Markus Duesmann has said that while electrification offers new opportunities in terms of vehicle design and segmentation, it expects to retain its involvement in traditional segments. Duesmann was asked about the new Q4 e-tron, which is smaller in footprint than the conventional ICE-powered Q5 while having a bigger interior, and whether BEV architectures would change the company's traditional model line-up as a result. (IHS Markit AutoIntelligence's Tim Urquhart)

- Daimler's CEO Ola Källenius has said that the industry needs an open and honest conversation about the impact of electrification on jobs. Speaking at the Financial Times (FT) annual conference on the future of the car, Källenius said that the fact that a move to electrification means fewer jobs in the industry has long been the elephant in the room that the industry has been slow to engage with. Battery electric vehicles (BEVs) do not have a conventional powertrain or drivetrain, so there are no mechanical components, and they also do away with conventional transmissions. Källenius said Daimler was ready if the European Union (EU) wanted to accelerate the pace, but there would be an obvious impact on headcount. He said, "It's an ambition that we say yes to." But he added, "We have to have an honest conversation about jobs. Everyone knows it takes more labor hours to assemble and build a combustion based powertrain compared to an electric powertrain." (IHS Markit AutoIntelligence's Tim Urquhart)

Asia-Pacific

- All major APAC equity indices closed higher; Japan +2.3%, Mainland China +1.8%, Hong Kong +1.1%, South Korea +1.0%, Australia +0.5%, and India +0.1%.

- Great Wall Holdings Group has teamed up with oil firm Sinopec Group to co-operate on hydrogen energy business, reports Gasgoo. Under the agreement, the two companies are to jointly develop technologies related to production, storage, transport, refuelling, application of gaseous and liquid hydrogen, and jointly develop pilot projects of hydrogen cities, the report states. Their efforts will include setting up hydrogen fuelling stations, and application of hydrogen energy in heavy-duty trucks for transporting construction materials in Xiong'an New Area and in city buses in Baoding, Hebei province. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Chinese electric vehicle (EV) startup Xpeng has reported a net loss of CNY786.6 million (USD122 million) during the first quarter of 2021, compared with a net loss of CNY649.8 million for the same period of 2020. According to a company statement, Xpeng's gross margin was 11.2% for the first quarter of 2021, compared with negative 4.8% for the same period of 2020 and 7.4% for the fourth quarter of 2020 while total revenues stood at CNY2.950 billion during the first quarter of 2021, up 616.1% year on year (y/y). The company increased its research and development (R&D) expenses by 72.2% y/y to CNY535.1 million on account of an increase in employee compensation in line with hiring more engineering staff, and higher expenses relating to the development of the P5. For the second quarter of 2021, Xpeng expects deliveries of vehicles to be between 15,500 and 16,000 vehicles, up by around 380-395% y/y, while total revenues are expected to be between CNY3.4 billion and CNY3.5 billion, an increase of approximately 475.5-492.4% y/y. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Japanese Prime Minister Yoshihide Suga added three more prefectures to a coronavirus state of emergency, as his government tackles a surge in infections just over two months before Tokyo hosts the Olympics. The emergency status, which currently includes Tokyo and other major metro areas, will be expanded to the northern island of Hokkaido as well as Hiroshima and Okayama prefectures. It will be effective May 16 through the end of the month. (Bloomberg)

- Hyundai and Samsung have signed a co-operation agreement with the South Korean Industry Ministry, the Korea Automotive Technology Institute, and the Korea Electronics Technology Institute to bolster their ties with regard to the automotive chip industry, reports the Yonhap News Agency. The move comes as the country aims to establish a supply chain amid the global semiconductor shortage. The South Korean government plans to offer tax incentives and state subsidies for semiconductor companies to spend a combined KRW510 trillion (USD452 billion) by 2030. Details of the co-operation agreement have not yet been made available. (IHS Markit AutoIntelligence's Jamal Amir)

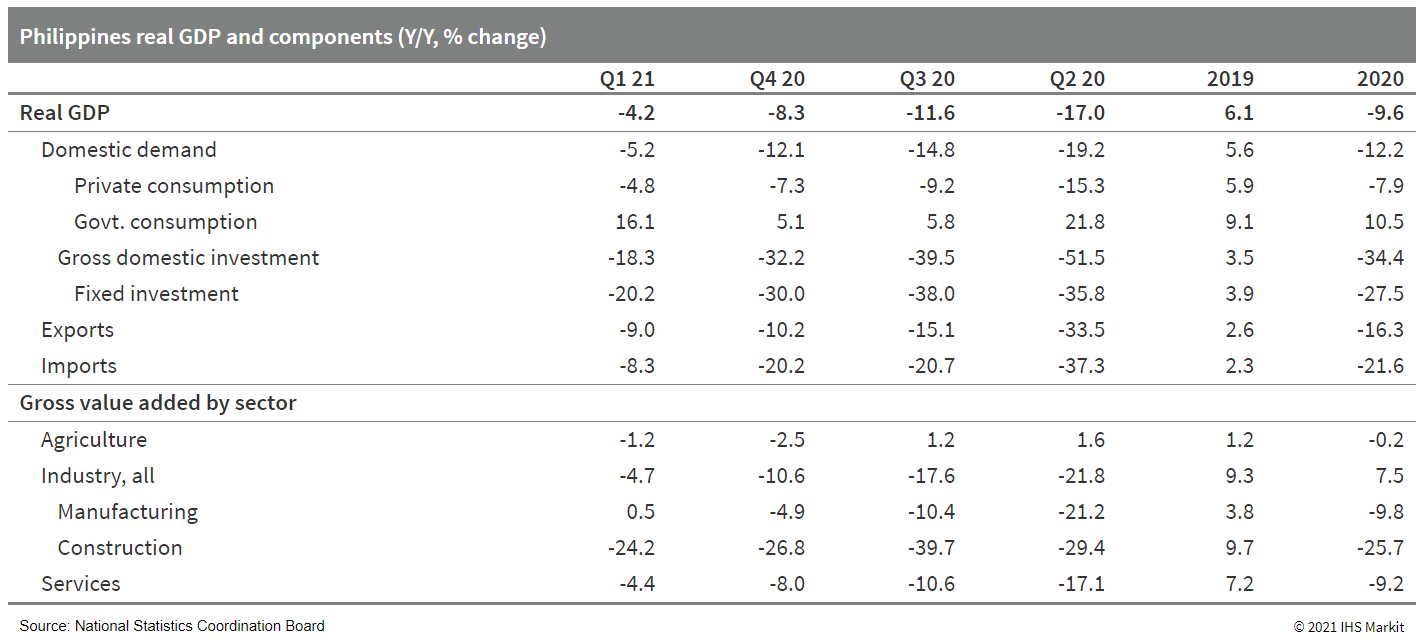

- The Philippine's economy suffered another year-on-year

contraction in the first quarter of 2021, marking the longest

recession since 1984-85. In seasonally adjusted terms, the economic

momentum also decelerated to near a standstill as economic pains

caused by the resurgence in local infections took another heavy

toll on domestic sentiment and spending as a surge in government

spending failed to offset the pandemic impact. The result indicates

that containing local outbreak conditions will remain the key to

the economy's recovery, along with a faster rollout of the

vaccination campaign, reopening business activities, and carrying

out fiscal spending plans. (IHS Markit Economist Ling-Wei

Chung)

- Real GDP contracted 4.2% year on year (y/y) in the first quarter, although the rate of decline moderated from the 8.3% y/y in the fourth quarter of last year. Being the fifth quarter of contraction, it also marked the slowest fall since the economy started to shrink in the second quarter of 2020.

- Construction spending by financial and non-financial

corporations plunged further by 45% y/y and household related

construction investment slumped 30.1% y/y. As a result, total

construction investment dropped 27.2% y/y, despite the surge in

public investment. Coupled with a 13.8% y/y drop in investment on

durable equipment, fixed investment registered a 20.2% y/y

contraction in the first quarter.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-may-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-may-2021.html&text=Daily+Global+Market+Summary+-+14+May+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-may-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 14 May 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-may-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+14+May+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-may-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}