Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 14, 2020

Daily Global Market Summary - 14 September 2020

Most APAC and all major US equity markets closed higher on the day, while European markets were mixed. iTraxx and CDX indices closed modestly tighter across IG and high yield, while benchmark European government bonds were mixed and US bonds were close to unchanged. Gold ended the day higher, while Brent/WTI and the US dollar closed slightly lower. The main focus this week will be the FOMC meeting which begins tomorrow (Tuesday).

Americas

- US equity indexes closed higher; Russell 2000 +2.7%, Nasdaq +1.9%, S&P 500 +1.3%, and DJIA +1.2%.

- 10yr US govt bonds closed +1bp/0.68% yield and 30yr bonds flat/1.42% yield.

- CDX-NAIG closed -1bp/69bps and CDX-NAHY -6bps/352bps.

- DXY US dollar index closed -0.3%/93.09.

- Gold closed +0.8%/$1,964 per ounce.

- Crude oil closed -0.2%/$37.26 per barrel.

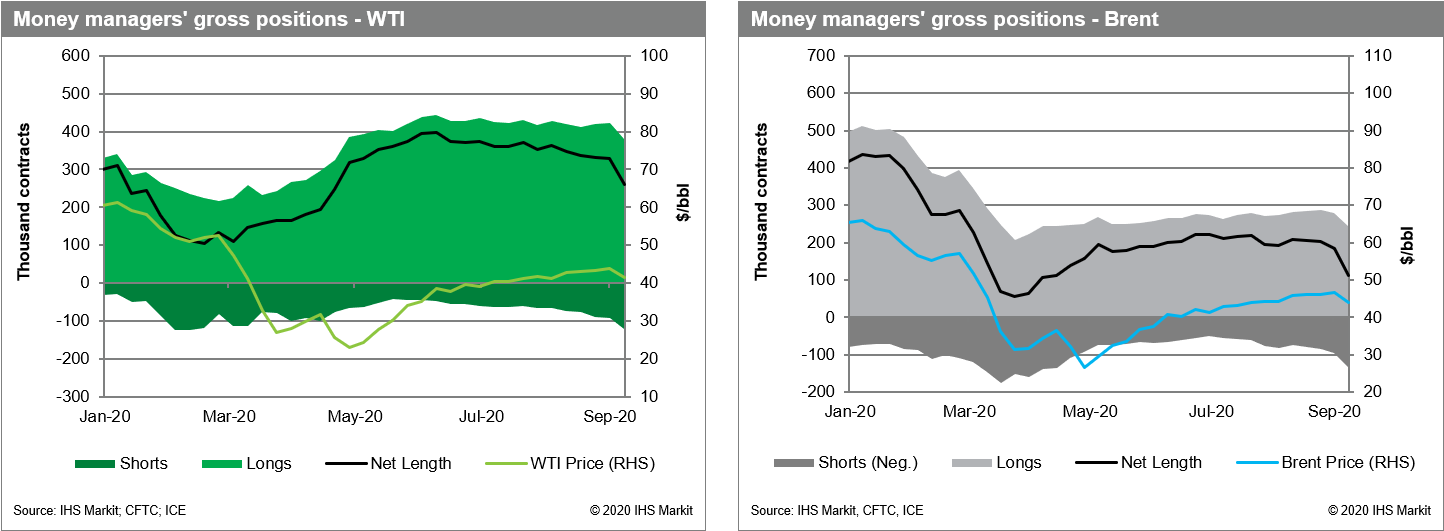

- Speculative positioning provides a clear illustration of the

forces driving crude prices over the past 10 days. Money Managers'

net length in NYMEX WTI and ICE Brent plummeted ~68,500 contracts

and ~72,800 contracts last week, respectively, with the combined

drop making it the largest weekly pullback in speculative bullish

positioning since 2017. Crashing speculative appetite was driven by

nearly equal parts fading long appetite, with combined long

positions declining ~75,900 contracts, and resurgent short

positions, with combined short positions increasing by ~65,400

contracts. The latter trend is especially worrisome. As markets

transitioned out of the crash correction phase of the recovery and

into this fraught transition phase, we warned that any renewed

concerns over the recovery were liable to bring a return of the

"short-cycles" that typically define such market conditions, as we

last saw in 2017. With prices once again at the low end of the

recent price band, rebounding shorts will test the resolve of the

OPEC+ group and its ability to manage physical markets. (IHS Markit

Energy Advisory's Roger Diwan, Karim Fawaz, Justin Jacobs, Edward

Moe, and Sean Karst)

- Gilead Sciences (US) has announced that it has entered into a definitive agreement to acquire Immunomedics for USD88.00 per share in cash - a 108% premium over the closing price on 11 September. The transaction values Immunomedics at nearly USD21 billion and will include first-in-class TROP-2 directed antibody-drug conjugate (ADC) Trodelvy (sacituzumab govitecan-hziy), which was approved earlier this year for breast cancer with clinical trials ongoing for other indications. Immunomedics also has other ADCs in its pipeline, including IMMU-130 in Phase II testing for colorectal cancer (CRC), and pre-clinical candidate IMMU-140 for hematological cancers. The acquisition was unanimously approved by both companies' boards of directors and is anticipated to close in the fourth quarter of 2020, subject to certain customary closing conditions. The strategic USD21-billion acquisition will add the promising ADC oncology therapy Trodelvy to Gilead's growing immuno-oncology portfolio, and follows the company's transformational acquisitions of Kite Pharma and Forty Seven. (IHS Markit Life Sciences' Margaret Labban)

- Delta Air Lines has turned its SkyMiles frequent flyer program into a separate subsidiary and is pitching it as collateral for $6.5 billion in new bonds and loans. The Atlanta airline said on Monday it plans a private offering for senior secured notes and a senior secured term loan, in the latest example of US carriers getting creative to raise capital to survive the coronavirus crisis. Delta is the third US airline to pledge its loyalty program as collateral for fundraising in the debt markets. United Airlines led the way in June, followed by low-cost carrier Spirit Airlines last month. (FT)

- Dow has agreed to sell three of its chemical storage terminals on the US Gulf Coast for $620 million to a joint venture (JV) between Vopak (Rotterdam, Netherlands) and investment firm BlackRock (New York, New York). The transaction includes marine and storage terminal operations and assets at Dow's sites at Plaquemine and St. Charles, Louisiana; and Freeport, Texas, Dow says. The cash proceeds will be used for "value-enhancing opportunities consistent with Dow's capital-allocation priorities," and demonstrates the company's "continued evaluation of non-revenue-generating assets across its global portfolio," it says. The sale to the newly established Vopak Industrial Infrastructure Americas (VIIA) JV, owned equally by Vopak and BlackRock's worldwide energy and power infrastructure fund, is expected to close before the end of this year, subject to regulatory approvals and other closing conditions in the US and EU. Dow and VIIA will enter into long-term service agreements for storage and infrastructure services at the terminals. "Dow expects Vopak's terminal expertise and capabilities will deliver additional operational efficiencies and opportunities for growth," says Vopak. The long-term agreements will ensure "reliable and cost-advantaged services for existing Dow businesses at the in-scope sites," according to Dow. Normal operations will continue throughout the divestment process, it says. All three terminals are situated alongside active Dow production complexes. VIIA and Dow "are working closely to ensure a seamless transition," Vopak states. The total storage capacity of the terminals is 852,000 cubic meters. Dow's terminal at St. Charles is the largest with 73 chemical storage tanks with a combined capacity of 409,000 cu meters, with its terminal at Plaquemine incorporating 30 tanks with 303,000 cu meters of storage capacity for chemicals and refined products in total, Vopak says. The terminal at Freeport has 53 tanks with a total chemicals storage capacity of 140,000 cu meters, it says. The three assets also include 16.4 hectares of expansion land, 36 vessel berths, multiple pipeline connections, and rail and truck racks, Vopak adds.

- Braskem has begun commercial production at its new $750-million, 450,000-metric tons/year "Delta" polypropylene (PP) plant in La Porte, Texas. The project, which began construction in October 2017, was planned with the assumption that about half of the plant's output would be exported to Europe, South America, and Asia, but it will initially focus on the domestic market, owing to current tight supply conditions. "While we have commitments to our affiliates in other regions, our focus is really supplying the domestic market over the near term and alleviating some of the short-term supply situation," Mark Nikolich, Braskem America CEO, told an online press conference Friday. "We were planning on having a more broad-based approach in the early days of the plant, supplying both domestic and export, but things are so tight right now that we have to allocate all of this new volume to our domestic clients to get the supply chain stabilized." Braskem's new Global Export Hub in Charleston, South Carolina, will facilitate exports as they ramp up. Announced in June and slated for completion during the third quarter, the facility will have capacity to support exports of up to 204,000 metric tons of product annually. Nikolich said PP demand was extremely depressed during the second quarter, with demand into automotive dropping as low as 15-20% of normal levels, but it has rebounded quickly.

- Financial research firm Hindenburg Research has issued a statement questioning developments at electric vehicle (EV) startup Nikola. Nikola has retained a lawyer and is taking the issue to the US Securities and Exchange Commission (SEC). In the statement on Nikola, Hindenburg Research questioned several developments at Nikola, accusing the company of dishonesty and fraud. The allegations are not based on an investigation led by any legal authority in the United States, and the allegations in Hindenburg Research's report may or may not be accurate. Hindenburg Research describes itself as specializing in forensic financial research. Nikola founder and CEO Trevor Milton initially posted to Twitter that he would respond to each of the allegations and insinuations in Hindenburg's report; however, later the company retained counsel and, on advice received, declined to issue further comment. Nikola issued a press release announcing its decision to retain a lawyer as well as to raise the issue with the SEC. In the statement, Nikola describes Hindenburg Research as "an activist short-seller" and alleges it is aiming to create and profit from a decline in the share price. It is unclear how this situation will affect Nikola or on Nikola's relationships with General Motors (GM) in the US or CNH in Europe. It is unknown if the allegations are accurate. The situation arose only days after Nikola and GM announced a new partnership in which GM will supply Nikola with fuel-cell electric vehicle technology and manufacture Nikola's upcoming Badger pick-up on a contract basis. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Panasonic is planning to add a 14th production line at the Tesla Gigafactory in Nevada, United States, which would come on line in 2021, increasing the plant's capacity by about 10%, according to a media report from the Reno-Gazette Journal. Along with the new production line, Panasonic is reportedly planning upgrades to the existing facilities to accommodate new battery technology. The report quotes Carl Walton, vice-president of production engineering and facilities for Panasonic Energy of North America, as saying, "There's some construction work that needs to take place over the next couple of months. Then early next year, we'll be installing new equipment with production starting shortly after that." The report states that the new line is expected to boost production capacity, although Panasonic did not confirm how many gigawatt hours the expansion would add; the plant's current capacity is 35 gigawatt hours per year. Walton also confirmed that Panasonic would increase its number of workers by about 100. The reason for the planned expansion, Walton said, was expectations of increased demand. Reportedly, he said, "The EV market throughout the world continues to explode and the demand is there. This is our way of helping our partner (Tesla) to continue supplying electric vehicles to the market." The news comes ahead of Tesla's planned Battery Day, scheduled for 22 September, when the electric vehicle manufacturer plans to reveal new battery technology. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Tesla is planning to export the Model 3 made in mainland China to other markets in Asia and Europe, reports Reuters, citing two sources familiar with the matter. The Model 3 produced at the Shanghai Gigafactory is likely to be shipped to Japan and Hong Kong SAR, markets in close proximity to mainland China. A Bloomberg report on the same matter indicates that the target markets also include Singapore, Australia, and New Zealand, as well as Europe. Tesla did not comment on the report as of this writing. Tesla only produces the Model 3 sedan in China at the Shanghai Gigafactory. The first phase of the facility has an installed production capacity of 200,000 units per annum (upa). With the second phase of the Shanghai Gigafactory to be completed in late 2020 or early 2021, Tesla will be able to produce the Model 3 and Model Y at the same facility and further reduce its production costs, as the two models share more than 75% of parts and components. The facility is likely to eventually have a production capacity approaching that of the Fremont plant in the United States, which is able to produce between 400,000 and 500,000 upa. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Brazil will extend a tariff-rate quota (TRQ) for duty-free imports of ethanol for 90 days as the as the US and Brazil embark on negotiations for a longer-term agreement on market access for US ethanol and Brazilian sugar, the Office of the US Trade Representative (USTR) announced Friday (September 11). "Brazil and the United States have held consultations regarding their bilateral trade on ethanol. As a result, they have decided to conduct results-oriented discussions on an arrangement to improve market access for ethanol and sugar in Brazil and the United States," the statement from USTR said. "They will also consider an increase in market access for corn in both countries." The aim of talks, according to USTR, is to find "ways to ensure there is fair market access along with any increase in the consumption of ethanol, as well as to coordinate and ensure that the ethanol industries in both countries will be treated fairly and benefit from future regulatory changes on biofuel products in Brazil and the United States." Achieving "reciprocal and proportional outcomes that generate trade and open markets to the benefit of both countries," is a top priority, it said. As talks take place, Brazil will extend the TRQ that was in place through August 30, which allowed 198 million gallons of US ethanol to be imported tariff free each year. Imports beyond the quota are subject to a 20% tariff. The expiration of the TRQ August 30 meant all imports to the 20% duty. The TRQ volume for the 90-day period will be "proportional" to the annual volume that was previously in place, USTR noted. That means that 16.5 million gallons of US ethanol could be shipped monthly to Brazil over the 90-day period duty free or a total of 49.5 million gallons. While the TRQ applies to all imports of ethanol by Brazil, the US has been the primary user. (IHS Markit Food and Agricultural Policy's Richard Morrison)

- The Central Reserve Bank of Peru (BCRP) kept its policy rate

unchanged at 0.25% for the fifth consecutive month, after cutting

the policy rate by 100 basis points in April. (IHS Markit Economist

Claudia Wehbe)

- To continue supporting liquidity injection operations, annual interest rates on BCRP's window facility operations in domestic currency with financial entities were left unchanged at 0.15% for overnight deposits and at 0.50% for direct security/currency repo and rediscount operations.

- Annual consumer price inflation decelerated to 1.7% in August, down from 1.9% in July. In a month-on-month comparison, the seasonally adjusted national production index advanced for the second consecutive month - at 14.56% in June - as multiple non-essential businesses started to reopen operations.

- IHS Markit's real GDP growth outlook stands at -14.2% for 2020, currently under revision during our September forecast round. We expect the BCRP to maintain its aggressive expansionary stance well into 2021 to provide liquidity and help boost economic growth amid signs of gradual economic recovery in July-August, although domestic demand remains weak.

Europe/Middle East/Africa

- European equity markets closed mixed; France +0.4%, Spain +0.1%, and Italy/UK/Germany -0.1%.

- 10yr European govt bonds closed mixed; UK +1bp, Germany flat, France -1bp, Italy -2bps, and Spain -3bps.

- iTraxx-Europe closed -1bp/55bps and iTraxx-Xover -8bps/318bps.

- Brent crude closed -0.6%/$39.61 per barrel.

- The eurozone's industrial production rose by 4.1% m/m in July,

matching the market consensus expectation (of 4.0% m/m according to

Reuters' survey) and the indications from member states' data

already released. (IHS Markit Economist Ken Wattret)

- July's increase follows m/m gains of 12.2% and 9.5%, respectively, in May and June, with the latter revised upwards versus the initial estimate of 9.1%.

- The exceptional nature of the coronavirus disease 2019 (COVID-19)-virus shock is illustrated by the evolution of the levels of industrial production, particularly when compared with prior recessions (see first chart below).

- Although eurozone industrial production rose by a cumulative 28.0% from April's trough up to July, it remains 7.2% below February's pre-pandemic level.

- From peak to trough, between February and April, the eurozone's industrial production plunged by 27.5%, an exceptionally large and rapid contraction. This compares with an equivalent peak-to-trough decline of 19.0% during the global financial crisis (GFC; see first chart below), although the latter was spread over 10 months.

- While this time it has taken three months for production to return to a level roughly 7% below its pre-recession level, following the GFC it took almost a year and a half.

- July's rebound was broad-based across the major categories of production but in all cases, m/m rates of increase have moderated markedly compared with the initial rebounds in May and June.

- Moreover, across all major categories of goods, levels of production remain well below where they were in February, albeit with some variations (see second chart below).

- Production of non-consumer durables outperformed, with July's level of production just 3.6% below February's pre-COVID-19-virus peak. Production of capital goods (-7.8% below February's level) and particularly intermediate goods (-9.7%) underperformed.

- MAN Truck & Bus is the latest OEM to announce a program of job cuts as a response to the new economic reality of the post-COVID-19-virus world, according to an Associated Press News report. The company is planning to improve its operating results by about EUR1.8 billion (USD2 billion) and this will involve a "fundamental restructuring" of all areas of its business. At the core of this plan is a move to cut 9,500 jobs, mostly in Germany and Austria, as a result. MAN said that the job reduction affects all areas of the company, and that it hopes to transfer development and production processes to other factories. The planned changes are extensive and could involve plant closures. According to the company, the prospects of its sites in Steyr, Austria, and in Plauen and Wittlich, Germany, "are up for discussion". The company plans to start negotiations soon with employee representatives at the plants in question and with the representatives' works council. MAN Truck & Bus CEO Andreas Tostmann said, "We are facing great challenges due to technological transformation, with digitization, automation and alternative propulsion." MAN is joining a number of OEMs and tier-1 suppliers in planning significant headcount reductions in order to adjust their operations for the current economic environment, although the company also appears keen to highlight the challenge of the technological changes the medium and heavy commercial vehicle market also faces. MAN has faced short-term challenges as a result of the impact of the COVID-19-virus pandemic. In the first half the company recorded a loss of EUR387 million. (IHS Markit AutoIntelligence's Tim Urquhart)

- The United Kingdom has signed its first major post-Brexit trade agreement with Japan. According to Livemint, the deal, which has so far only been agreed upon in principle and of which details are scarce, will increase trade with Japan by around GBP15 billion (USD19.2 billion). The deal is said to benefit the manufacturing, food and beverages, and technology industries, with businesses set to benefit from tariff-free trade on 99% of exports to Japan. The two countries have been undertaking trade negotiations for quite some time as the UK is now on course to the leave the European Union by the end of 2020. In June, Japan was reported to be calling for an early removal of tariffs on vehicles and auto parts during discussions on a post-Brexit trade agreement with Britain. The recently signed deal is likely to benefit Japanese firms in the UK, such as Nissan and Honda, from reduced tariffs on parts coming from Japan, and might result in further investments by Japanese automakers in the UK. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Chinese renewable energy group Envision is looking to build a battery factory in France to supply the growing electric vehicle (EV) market, reports Reuters, citing a report by French newspaper Journal du Dimanche (JDD). Several potential locations in France for the factory have been identified, according to the JDD report, and the new plant is expected to open in late 2023. Envision Group acquired Nissan subsidiary Automotive Energy Supply Corporation's (AESC) battery manufacturing operations in Tennessee (United States) and Sunderland (United Kingdom), along with Nissan's battery development and production engineering operations located in Oppama, Atsugi, and Zama (Japan). The new plant in France will enable the Chinese group to have a presence in Europe to serve the booming EV market. Chinese battery makers are eyeing the vast growth potential of the European market, as Europe is forecasted to remain the second-largest EV market in the world through 2025. Envision is not the only Chinese company making investments in the region. Chinese battery makers Farasis Energy and Contemporary Amperex Technology Co Ltd (CATL) are both building battery plants in Germany to service key OEM clients in the region. Daimler AG announced in July that Mercedes-Benz has acquired a 3% stake in Farasis. The latter will be able to supply Daimler in Germany when its plant in Bitterfeld-Wolfen, Germany, begins production. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese authorities have suspended poultry meat imports from an establishment in the US, while at the same time approving eight more suppliers in Russia. China's General Administration for Customs (GACC) said a US poultry facility was suspended from 13 September. The plant's registration number corresponds to an OK Foods plant in Fort Smith, Arkansas. OK Foods is a subsidiary of Mexico-owned Bachoco. Meanwhile, GACC said eight Russian plants had been cleared to start exporting frozen chicken meat from 11 September. The latest plant approvals will allow Russia to further strengthen its position as a supplier of chicken meat to China. The two countries held a videoconference on September 10, which dealt with a number of ongoing meat trade issues. Moscow reassured Beijing that it was taking all necessary steps to ensure meat products are not contaminated with Covid-19. The two sides also discussed ways to avoid trade disruptions via traceability, electronic certification and mutual arrangements for inspecting livestock products. China agreed to approve a list of bovine offal products that can be supplied by Russia without posing a risk of bovine spongiform encephalopathy (BSE). Rosselkhoznadzor said it was also seeking Chinese approval for a list of finished meat products that it deems to be of low biological risk. The agency said China had also agreed to consider lifting disease-related restrictions on the import of sheep and cattle, along with genetic material from these animals. Meanwhile, China's State Technical University is to inform Rosselkhoznadzor about the steps that are necessary for China to recognize Russia's regionalization for African Swine Fever (ASF). Rosselkhoznadzor said an agreement on this would ultimately allow Russia to start supplying pork from areas that are free of the disease. China currently bans imports from entire countries when they are hit by ASF. Germany is the latest country to feel the effects of this policy, as Beijing recently confirmed a ban on German pork following the country's first outbreak of the disease. (IHS Markit Food and Agricultural Commodities' Max Green)

- In July 2020, Turkey posted a current-account deficit of USD1.8

billion, pushing the cumulative shortfall through the first seven

months of the year to more than USD21.6 billion. Already in

January-July 2020, the current-account deficit had grown larger

than it has been since 2017 as a whole. (IHS Markit Economist

Andrew Birch)

- A 15.1% year-on-year (y/y) collapse of merchandise exports in the first seven months of the year triggered a USD10.9-billion y/y widening of the merchandise trade deficit. Also contributing to the deterioration of the trade gap, Turkey imported nearly USD6 billion more of gold than it did in the same period of 2019. Demand for gold imports has soared as consumers have lost faith in their lira holdings and banks scramble to build reserve levels.

- In the second quarter and the beginning of the third quarter, the loss of tourism export earnings has begun to more heavily affect the current account. In January-July 2020, Turkey earned just USD3.9 billion in travel service exports, a mere 26.7% of what it had earned in the same period of 2019. The resulting, January-July 2020 services surplus of USD4.0 billion was down by almost USD14.1 billion y/y.

- In a small positive development, Turkey attracted a net inflow of portfolio investment in July of a mere USD254 million. This was only the second month of 2020 in which the net flow of portfolio investment was inward. Nonetheless, for the year as a whole to date, Turkey had still lost nearly USD12.5 billion in portfolio capital, only minimally offset by a net inflow of USD2.2 billion in foreign direct investment.

- The rapid deterioration of Turkey's current-account deficit and lack of foreign capital inflows are two significant causes of ongoing lira instability. The turnaround in the flow of portfolio capitals in July did contribute to the stabilisation of the Turkish currency that month, but the meagre level and continued surge of gold demand reflects the ongoing fragility of the lira.

- We expect that net portfolio investment flows turned outward once again in August, as reflected by the sharp collapse of the lira once again that month. Similarly, demand for gold likely remained high, keeping import growth somewhat elevated.

Asia-Pacific

- Most APAC equity markets closed higher except for India -0.3%; South Korea +1.3%, Australia/Japan +0.7%, Mainland China +0.6%, and Hong Kong +0.6%.

- Yoshihide Suga won 377 out of 534 votes in the Liberal Democratic Party (LDP) leadership elections, indicating that he will become the next prime minister of Japan following a vote in the Lower House on 16 September, which the LDP is effectively certain to win. Suga will serve until September 2021 when another leadership election will take place, unless early elections are called. The other two candidates, LDP policy chief Fumio Kishida and former LDP secretary-general Shigeru Ishiba, secured 89 and 68 votes, respectively. Suga also won a majority among the LDP prefectural chapters despite earlier indications that Ishiba would be favored in the regional vote. Significance: Strong support for Suga within the LDP, including among LDP prefectural chapters, indicates a preference for policy continuity following the resignation of Prime Minister Shinzō Abe. Of the three candidates, Suga is likely to remain the most closely aligned with Abe on core economic policies, foreign relations, and Japan's security strategy. (IHS Markit Country Risk's Hannah Cotillon)

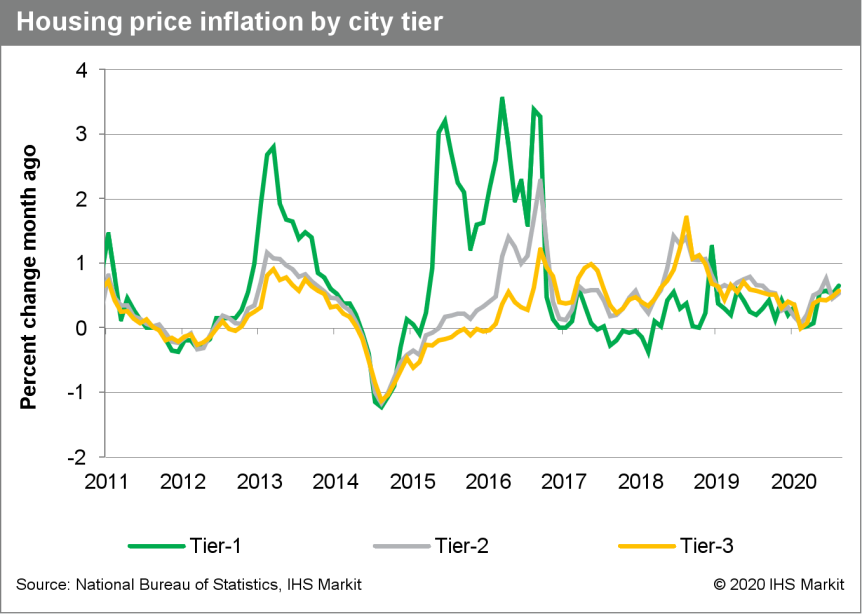

- New home price inflation of 70 major cities across mainland

China surveyed by the National Bureau of Statistics (NBS) averaged

at 0.6% month on month in August, up by 0.1 percentage points from

July. Entering the second half of this year, local governments have

stepped up purchase restrictions in response to the resurgence of

speculative buying in certain regions as the economy recovers. (IHS

Markit Economist Lei Yi)

- Up to 59 out of 70 surveyed cities reported higher new home prices than the previous month. By city tier, the pickup in month-on-month price inflation was led by tier-1 and tier-3 cities, while tier-2 cities reported the same month-on-month price gain as in July.

- Year-on-year new home price inflation in August edged down slightly to 4.7% on average, largely due to the weakness in tier-2 cities. As of August, year-on-year price inflation has been declining for 16 consecutive months in tier-2 cities.

- Recovery in the housing market will sustain in the remainder of

the year with declining inventory and relatively favorable credit

environment.

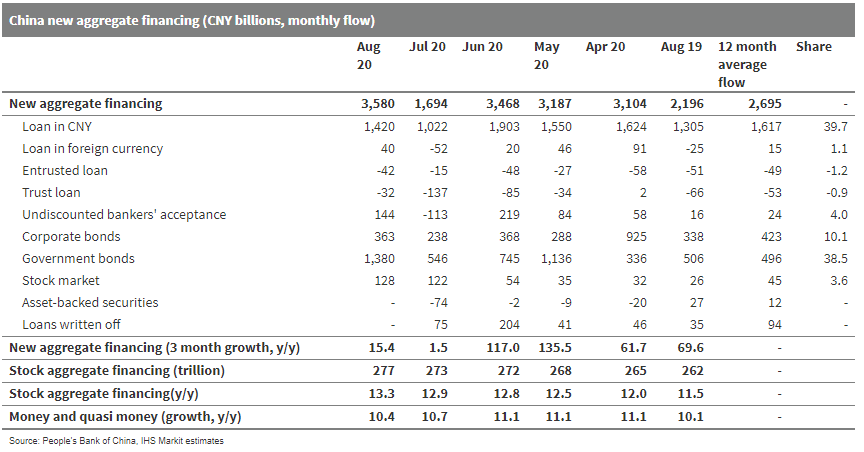

- China's new aggregate financing, the widest measure of net new

financing to the real economy, increased CNY3.58 trillion in August

2020, up CNY188.6 billion from the previous month and CNY138.4

billion higher than the amount a year ago, according to the release

of the People's Bank of China (PBOC). The stock total social

financing (TSF) increased 13.3% year on year (y/y), 0.4 percentage

points up from July. (IHS Markit Economist Yating Xu)

- Local government bond issuance reached CNMY1.38 trillion in August, up CNY800 billion from a year ago and contributing around 0.4 percentage points to headline TSF growth. Meanwhile, new bank loans continued to expand with CNY loans increased by CNY1.28 trillion and loan's structure further improved. Property market and infrastructure investment supported households and corporates' long and medium-term loans to increase further. Moreover, stock market financing was five times the level a year ago, thanks to the easing liquidity environment this year.

- Off balance sheet financing, including entrusted loans, trust loans and undiscounted bankers' acceptance, increased by CNY71 billion in August, compared with a CNY265 billion decline a month ago and a CNY101 billion decline last year.

- Broad money supply (M2) growth declined for the second consecutive month to 10.4% y/y, down 0.7 percentage point from June, while M1 growth rose by 1.1 percentage points to 8.0%. Narrowing gap between M1 and M2 suggested improving liquidity environment in corporate sector.

- TSF increased by CNY25.3 trillion in the first eight months of

the year, with new bank loans reaching CNY14.4 trillion compared to

an annual target of CNY20 trillion.

- CNOOC Ningbo Daxie Petrochemical Co. Ltd exported its first toluene cargo on 11 Sep, paving the way for more outflow of aromatics as China moves towards self-sufficiency, a company source told IHS Markit on Monday. A 3,000 mt parcel was shipped from its Ningbo, Daxie port to Vietnam, said the source. The price basis was FOB Korea, but internal discussions are on-going about using a FOB China moving forward. "This is a one-time spot deal but it does open up export opportunities for us especially since the domestic market is so weak," said the source. The 13% value-added tax on goods, one of the barriers to export, was fully refunded, he added. While exporting excess supply seems reasonable, the timing was rather interesting as China domestic toluene price was higher than the FOB Korea benchmark, said market observers. Also, the standard parcel size for toluene was 2,000 mt, rather than the 3,000 mt CNOOC exported, they added. On Friday, China domestic price closed at RMB3,385/mt ex-tank ($417/mt on import parity basis) and FOB Korea closed at $399.50/mt, according to the IHS Markit Daily Asia Aromatics Report. China is Asia's largest toluene consumer, responsible for 55% of regional demand in 2019, according to IHS Markit World Analysis report. Demand is mainly from paraxylene production and the recent start up of new large-scale PX plants have led to higher consumption. CNOOC Ningbo Daxie is a subsidiary of China National Offshore Oil Corp. It completed a $2 billion modernization and upgrading program in July 2016, lifting its overall crude processing capacity to 7 million mt/year. Its aromatics capacity is 75,000 mt/year of benzene, 280,000 mt/year of toluene and 340,000 mt/year of isomer-grade mixed xylenes. (IHS Markit Chemical Market Advisory Service's Sok Peng Chua)

- Chinese truck manufacturer FAW Jiefang has partnered with autonomous truck startup Plus.ai to introduce the Level 3 automated heavy-duty truck J7, reports China Internet Information Center. The truck is being manufactured as part of the companies' joint venture formed in 2019 to develop autonomous trucks for the Chinese market (see China: 9 September 2019: Plus.ai, FAW Jiefang form JV to develop self-driving trucks). The truck is deployed with seven cameras, five-millimeter wave radars, and one lidar, as well as an autopilot system. The J7 truck is built on Plus.ai's Level 4 autonomous technology stack and is capable of automatic overtaking, lane changing, lane centering, adaptive cruise control, blind spot monitoring, obstacle avoidance, and other maneuvers. The companies also announced plans to conduct commercial operations for Level 4 autonomous trucks in 2023. The trucking industry is growing rapidly in China. Driverless trucks can be very helpful in large warehouse facilities for moving goods from one storage unit to another, following fixed and dedicated paths. In 2018, FAW Group, Plus.ai, Full Truck Alliance, and NVIDIA announced plans to expedite the development and commercialization of autonomous trucks in China. In April 2017, FAW Jiefang - one of China's leading truck-makers - revealed an autonomous truck at FAW Tech Center in Changchun, which passed a navigation test and is able to recognize obstacles, slow down, speed up, and take detours. The truck also responded correctly to traffic lights, adaptive cruise control, and remote commands. Meanwhile, Plus.ai aims to make commercial freight transportation safer, more efficient, and less expensive for its customers. The company has raised USD200 million in funding over three rounds. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese automaker SAIC Motor plans to launch 10 fuel-cell vehicles (FCVs) by 2025, aiming to secure a 10% share of the segment in China. According to China Daily, the automaker announced the ambitious target at the debut event of the Maxus Euniq 7, the first fuel-cell multi-purpose vehicle (MPV) in China on 13 September. The Euniq 7 can provide a range of 605 km and be refilled with hydrogen in less than five minutes. By 2025, SAIC aims to achieve annual sales of 10,000 FCVs. The Euniq 7 is based on SAIC's G20 MPV. The model represents the second mass-market passenger vehicle powered by fuel-cell technologies in the Chinese market. SAIC is a pioneer among Chinese automakers to push for the commercialization of FCVs. Apart from the FCV80 and the Euniq 7 MPV, SAIC plans to roll out its first fuel-cell heavy truck in China by the end of 2020. To support its growing FCV fleet, SAIC opened a refueling station in Shanghai in September 2019. The station, which is the largest in China, can serve up to 400 vehicles per day. FCVs currently only account for a small fraction of new energy vehicle sales in China. From January to August, sales of FCVs fell by 49% year on year to 578 units. (IHS Markit AutoIntelligence's Abby Chun Tu)

- WeRide.ai has launched a robotaxi service in villages of Chinese city Guangzhou, according to a blog posted on the Medium website. This indicates the company's autonomous cars can now cruise in underdeveloped areas of cities characterized by high population density, narrow roads, and disorganized traffic. In June, the company opened a robotaxi service serving 144 square kilometers across the Huangpu and Guangzhou Development districts in Guangzhou. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Tata Motors Group is reportedly looking to cut over INR500 billion (USD6.7 billion) from its previously estimated capital expenditure (capex) over the next three years in a bid to achieve its zero-debt target, reports The Economic Times. The capex reduction includes over INR420 billion for the Jaguar Land Rover (JLR) unit and INR90 billion for its Indian operations. The automaker stated that the guiding principle for capex has been moved from "willingness to invest" to "ability to invest". Tata Motors plans to manage its capex tightly in the coming years by avoiding investments in non-core areas, and will prioritize capex for new platforms and electric vehicles (EVs). For the current fiscal year, capex for JLR is GBP2.5 billion and INR15 billion for the Indian business. At its 75th annual general meeting last month, Tata Motors Group revealed plans to significantly reduce its consolidated automotive net debt of INR480 billion, excluding the company's vehicle finance business, in the next three years. The latest measures to reduce debt and generate free cash flow come as Tata Motors' earnings have taken a severe hit with both its Indian business and JLR, its UK subsidiary, facing headwinds. The company implemented turnaround strategies for its domestic and JLR units but the COVID-19-virus outbreak derailed its plans. (IHS Markit AutoIntelligence's Isha Sharma)

- MAN Energy Solutions and Wasco have signed a memorandum of understanding to promote and commercialize power-to-x projects in south-east Asia. The power-to-x technology converts electricity into carbon-neutral synthetic fuels, gas or liquid, for use as a clean, carbon-neutral energy source. Due to travel restrictions triggered by the Covid-19 pandemic, the signing ceremony took place as a digital event with representatives from both companies participating via a live-video stream. MAN Energy Solutions has been developing power-to-gas technology for several years and commissioned a methanization plant to create green methane from hydrogen back in 2013. Today, the company offers industrially-scaled 50MW power-to-gas and power-to-x plants as part of its product portfolio. Wasco is an integrated energy group that provides among others pipe-coating, engineering and fabrication services, and manufacturing pipes. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- Southeast Asia's ride-hailing companies Grab and Gojek have resumed discussions about a possible merger, reports the Financial Times. These discussions come after the companies' shareholders, including Japan-based SoftBank 's CEO and founder Masayoshi Son, are reported to be backing the deal. The development is the result of a substantial fall in the companies' valuations in their secondary market due to the COVID-19-virus pandemic. The companies began their initial discussions about a merger in February; these were then opposed by SoftBank and its Vision Fund. The merger deal is expected to significantly accelerate both the companies' paths to profitability as ride-hailing business has been battered because of the COVID-19-virus pandemic. This year, Grab laid off 360 employees, representing 5% of its total workforce, owing to the pandemic. Gojek has laid off 430 employees, representing 9% of its total workforce, as part of cost-cutting measures in response to the impact of the pandemic on the company's business. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-september-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-september-2020.html&text=Daily+Global+Market+Summary+-+14+September+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-september-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 14 September 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-september-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+14+September+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-14-september-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}