Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 15, 2021

Daily Global Market Summary - 15 June 2021

European and APAC equity markets closed mixed, while all major US indices were lower. US government bonds were close to flat on the day and benchmark European government bonds were modestly lower. CDX-NA closed flat and European iTraxx was slightly wider across IG and high yield. Oil closed higher, the US dollar flat, and gold, silver, copper, and natural gas were lower. Markets will be focused on tomorrow's FOMC meeting statement and press conference for any signs of a data driven shift in the Fed's view on inflation.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed lower; S&P 500 -0.2%, Russell 2000 -0.3%, DJIA -0.3%, and Nasdaq -0.7%.

- 10yr US govt bonds closed flat/1.50% yield and 30yr bonds +1bp/2.19% yield.

- CDX-NAIG closed flat/49bps and CDX-NAHY flat/277bps.

- DXY US dollar index closed flat/90.54.

- Gold closed -0.5%/$1,856 per troy oz, silver -1.2%/$27.69 per troy oz, and copper -4.3%/$4.33 per pound.

- Crude oil closed +1.7%/$72.12 per barrel and natural gas closed -3.3%/$3.24 per mmbtu.

- Total US retail trade and food services sales declined 1.3% in

May. Core sales remained elevated through May (including upward

revisions to March and April) but were below our prior assumption

for the month, implying less growth of PCE in the second quarter.

We revised down our estimate for second-quarter growth of real PCE

by 1.0 percentage point to 12.5%. (IHS Markit Economists James

Bohnaker and David

Deull)

- Sales at motor vehicle and parts dealers were down 3.7% in May, mostly reversing April's 4.3% surge. Still, the level of sales in May was an impressive 29% above the pre-pandemic benchmark of February 2020. Auto sales will likely continue to drift lower in the coming months due to high prices and supply chain bottlenecks.

- Outside of autos, retail sales were broadly lower, particularly in segments specializing in household durable goods. Sales at furniture and home furnishing stores declined 2.1%, electronics and appliance stores fell 3.4%, and building materials and garden supply stores decreased 5.9%. Further corrections are likely to occur as consumers pivot toward service-oriented consumption.

- Sales at food services and drinking places increased 1.8% as warmer weather, looser restrictions, and more vaccinations encouraged dining out. May's increase propelled sales in this category to 1.6% above its pre-pandemic level and is consistent with recent OpenTable data showing that the number of seated diners has nearly fully recovered.

- The total US producer price index (PPI) for final demand rose

0.8% in May after jumping 1.0% in March and 0.6% in April. The

12-month change was 6.6%, best described as atrocious. Base

effects, or weirdness in the prior year, are significantly notable,

and the energy metric is a clear example: energy prices were up

46.6% year over year (y/y), as oil prices were at bargain basement

prices last year. (IHS Markit Economist Michael Montgomery)

- Total goods prices also rose 1.5% on the heels of a 1.7% gain in March. The PPI for food jumped 2.6% while energy climbed 2.2%.

- Excluding foods and energy, or so-called core goods, the index jumped 1.1%. Among the many distortions, the "core" in the old stage of processing (SOP) data was "only" up 0.6%. Since the wedge between the old style and the new is government purchases and exports, the extra 0.5% was for exported items like carbon steel scrap and chemicals. Remember that the PPI is what our producers get, not what US customers pay, so that extra is almost a bonus for US exporters. What we paid is closer to the old-style metric. We pay it, too, but that is in the old-style core.

- Total services prices climbed 0.6% in May and April. Transportation and warehousing services grew 1.9% to lead the charge, mostly from air and ground transportation because of fuel prices. "Other" services include car rentals and hotel fees, which are in a post-pandemic spike.

- Total US industrial production rose 0.8% in May, reflecting

increases in manufacturing (0.9%), mining (1.2%), and utilities

industrial production (0.2%); revisions to prior months were mixed.

Total industrial production remains 1.4% below its pre-pandemic

(February 2020) level. (IHS Markit Economists Ben

Herzon and Akshat Goel)

- The details in this report that bear on our GDP tracking were consistent with our prior forecast of 11.0% GDP growth in the second quarter.

- Manufacturing industrial production rose 0.9% in May, recording gains across most market groups. The bulk of the gain in manufacturing output stemmed from a large gain in motor vehicle assemblies and was further supported by the continued recovery in chemicals (2.2%) as more petrochemical plants that were damaged by severe weather in the south-central region returned to operation.

- The strong gain in output of motor vehicles and parts (6.7%) was the highlight of today's report and helped pull the index for manufacturing output higher; manufacturing output increased 0.5% excluding motor vehicles and parts. Even as vehicle assemblies rose by 1.0 million units to 9.9 million in May, they remain more than 1.0 million units below the average level seen in the second half of 2020 as production continues to be restrained by a shortage of semiconductor chips.

- Output from utilities edged up 0.2% in May and mining activity increased 1.2%, following a small decline in April.

- The headline US housing market index slipped 2 points to at a

solid 81 in June. A reading above 50 indicates that more builders

view conditions as good rather than poor. All three sub-indexes

also lost 2 points. The current sales conditions index fell to 86;

the index measuring sales prospects over the next six months

dropped to 79; the traffic of prospective buyers' index decreased

to 71. (IHS Markit Economist Patrick

Newport)

- By region, the West and Northeast tumbled 5 points to at 86 and 73, while the South and Midwest lost 1 point to 85 and 70.

- Builders remain optimistic, just not as optimistic as in last November when the headline index hit a record-high 90. Demand for homes remains strong, but builders are being squeezed by rising costs and breakdowns in supply chains, according to the press release.

- The good news is that lumber's price bubble has burst. The Random Length Lumber Continuous Contract, which peaked at $1,670 on 7 June, has tumbled to $996 (note: prior to the pandemic, this contract traded at about $450.00, so lumber is still pricey.)

- On top of this, the average price of a new home soared to a record $435,400 in April, up 21% from a year earlier, suggesting the builders' profit margins are widening—the more they widen, the greater the incentive to ramp up on housing starts. The Census's construction cost index for homes under construction was up 8.8% from a year earlier in April.

- The bad news is that workers in the construction industry were quitting at record rates in March, when the quit rate climbed to 2.7% (it fell back to 2.4% in April). To counter this development, builders will have to increase wages.

- General Motors (GM) president Mark Reuss has indicated that the automaker plans to make another announcement about battery plant investment in the coming days, according to media reports. The Detroit Free Press reports that Reuss confirmed the planned announcement when speaking to the media at an IndyCar race in Detroit, Michigan, United States, on 13 June. Reuss reportedly said, "In the next week, we'll announce some more news, and it will be here in the US." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Cheniere Energy, the largest LNG producer and exporter in the US, will lead a research partnership to report and reduce GHG emissions from its natural gas production value chain. The system is meant to advance Cheniere's existing efforts at quantifying, monitoring, reporting, and verifying GHGs from LNG. That set of processes is also known by the shorthand QMRV, and it's indicative of the scaling-up of decarbonization efforts across the global LNG industry. The project enlists gas companies, technology firms, and universities in an effort to follow and eventually reduce the GHGs emitted in Cheniere's gas value chain. The work will "identify opportunities to reduce emissions," the company said. Cheniere's QMRV plan will rely on a system of measuring GHGs at the level of individual LNG-tanker shipment, delivering a certification, or cargo emissions "tag" (CE tag) to the company's customers. (IHS Markit Climate and Sustainability News' William Fleeson)

- Canadian housing starts jumped 3.2% month over month (m/m) to

275,916 units (annualized) in May. Urban multifamily starts soared

10.9% m/m, while urban single starts plummeted 18.0% m/m. Rural

starts sharply rebounded, increasing 22.3% m/m. (IHS Markit

Economist Chul-Woo

Hong)

- The substantial gains in multiple starts in most provinces offset the decreases in single starts except in Ontario and Quebec, where multiple starts also fell.

- Starts were revised slightly lower over the previous three months. Yet, the upswing in May's housing starts suggests that the decline in residential investment in the second quarter is not as large estimated in the June macroeconomic forecast.

- The strong jump in multiple starts was widespread, led by British Columbia, Nova Scotia, Alberta, and New Brunswick. Nova Scotia's multiple starts soared, reaching a record high in May after declining for five consecutive months, as housing starts in Halifax hit the highest level since October 2012.

- in Canada's two largest housing markets, Ontario and Quebec, multiple starts continued to ease back. After hitting a record-high of 75,861 units in January 2021, Quebec's multiple starts continued to moderate, reaching 49,172 units in May.

- Pembina Pipeline (Calgary, Alberta, Canada) says its proposed

merger with Inter Pipeline would make construction of a second

plant for the production of propylene by propane dehydrogenation

(PDH) in Alberta more likely. (IHS Markit Chemical Advisory)

- "[B]y combining Inter Pipeline's HPC [Heartland Petrochemical Complex] with Pembina's industry-leading 60,000 bpd of propane supply infrastructure in Fort Saskatchewan, long-term supply risk for HPC would be eliminated, while further improving the possibility of a second such facility," Pembina states in a business update posted on 14 June.

- Several years ago, Inter Pipeline and Pembina announced separate plans to build PDH/polypropylene facilities in Alberta, but only Inter Pipeline's project, the Heartland Petrochemical Complex (HPC), has gone forward.

- Noting that petrochemical facilities often cluster to take advantage of shared infrastructure and feedstock, Pembina now says a preliminary evaluation finds that synergies associated with the merger would result in about $200 million of capital cost savings and $100 million of annual operating, general, and administrative expense savings for the CKPC project, compared with the original, standalone conception.

- A Brazilian regulatory taskforce carried out operations leading to the closure last week of several plants producing counterfeit pesticides. The Ministry of Agriculture, the environmental agency, the Ibama, and the national health surveillance agency, the Anvisa, as well as environmental law enforcement agencies made up the force, which focused on businesses selling fraudulent pesticide brands to farmers in several Brazilian states. Operation Pirates Field monitored the businesses for six months, culminating in four arrests. The investigators found that expired and stolen pesticides were "bought in a parallel market" and used in the manufacturing process of counterfeit products. Seven companies were simultaneously inspected, and 128 violations reported, ranging from the manipulation of trade marks without the authorization of the producing company to the import of unregistered pesticides. As well as finding fraudulent products, some 12,715 kg of stolen pesticides were recovered. (IHS Markit Crop Science's Robert Birkett)

Europe/Middle East/Africa

- Major European equity indices closed mixed; UK +0.4%, Germany +0.4%, France +0.4%, Italy -0.1%, and Spain -0.5%.

- 10yr European govt bonds closed lower; Italy +1bp and Germany/France/Spain/UK +2bps.

- iTraxx-Europe closed +1bp/48bps and iTraxx-Xover +4bps/236bps.

- Brent crude closed +1.6%/$73.99 per barrel.

- The four-week delay to the final phase of the reopening of the

UK economy presents a further blow to the hospitality and leisure

sectors. However, we still anticipate the economy to enjoy a sharp

resumption of growth in the second quarter of 2021, expanding by

4.4% quarter on quarter (q/q), after a 1.5% q/q contraction in the

first quarter. (IHS Markit Economist Raj

Badiani)

- UK Prime Minister Boris Johnson has confirmed that the final stage of the easing of lockdown restrictions in England will now occur four weeks later, taking place on 19 July. However, the government has pledged to review the delay after two weeks if the data are substantially better than expected.

- The four-week delay will give the health services more time to administer two COVID-19 jabs to every adult to increase their resistance to the more infectious Delta variant (which is between 40% and 80% more transmissible than the Alpha variant, according to the Office for National Statistics).

- The number of new infections is currently around 8,000 cases a day, the highest since the end of February. In addition, hospitalizations are starting to rise, with the average number of people admitted to the hospital in England increasing by 50% per week.

- Jaguar Land Rover (JLR) has announced plans to test hydrogen fuel cell technology in a prototype vehicle. According to a statement, it will be part of Project Zeus, which is being backed by the UK's Advanced Propulsion Centre. Based around its Land Rover Defender, the company said that it is teaming up with several research and development (R&D) partners including Delta Motorsport, AVL, Marelli Automotive Systems and the UK Battery Industrialisation Centre (UKBIC). The vehicle will begin testing in the UK towards the end of 2021 to verify a range of attributes such as off-road capability and fuel consumption. (IHS Markit AutoIntelligence's Ian Fletcher)

- The UK city Birmingham will launch autonomous car trials this week as part of the government-backed Project Endeavour, reports Autocar. A fleet of Ford Mondeos, which are deployed with LiDAR, radar and stereo cameras, are integrated with Oxbotica's autonomy software platform. The vehicles will have Level 4 autonomous capability and will operate across a five-mile area in varied traffic and weather conditions. During the trials, a professionally trained safety driver will be present in the vehicle to take control in case of an emergency. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The EU review of existing biocides is no closer to meeting its December 2024 completion deadline, with only 77% of work finalized on non-crop pesticides and just 35% of work done on all biocide types. The figures come in the European Commission's latest report on the implementation of the EU biocidal products Regulation (528/2012). It acknowledges that slow procedures are acting as a "disincentive" for innovation in new active ingredients in the sector. The report is based on data submitted by all EU member states, except the Czech Republic, for the period up to the end of 2019. It also considered fact-finding missions carried out in five member states in 2017 and 2018, the results of which were reported in January 2020. The latest completion percentages are barely up on those reported by the European Chemical Agency (ECHA) in late 2019. The ECHA's Biocidal Products Committee warned last year that the review was too slow to be able to reach the 2024 deadline. (IHS Markit Crop Science's Jackie Bird)

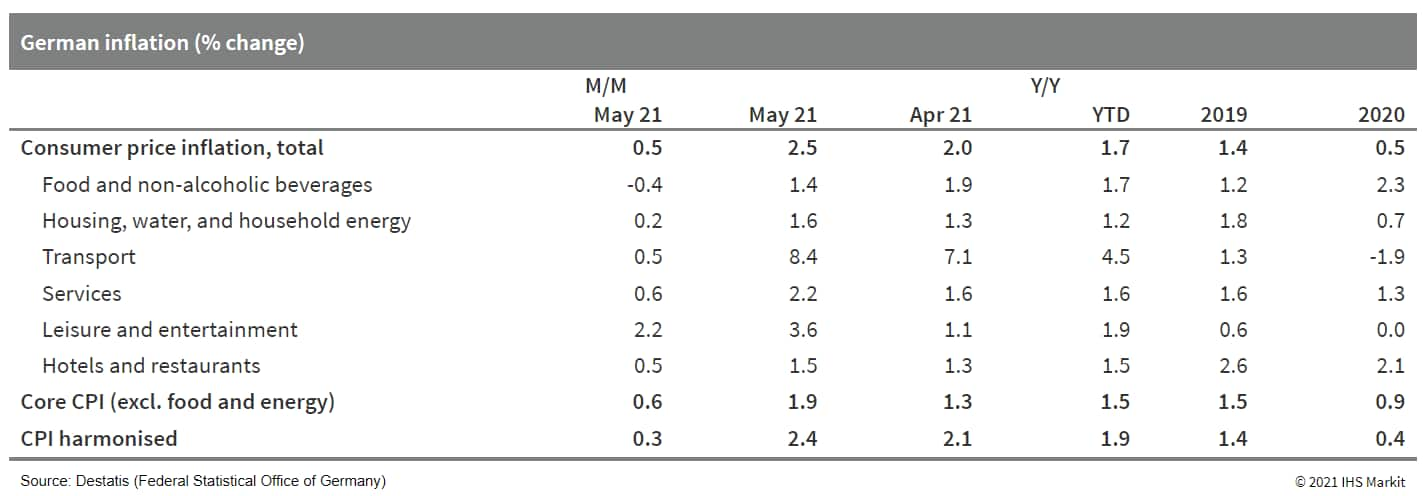

- Unlike in April, Germany's core inflation joined the headline

measure's further sharp increase in May. Higher energy prices

contributed anew, but the key factor at the data edge was the spike

in the prices of recreational and cultural activities as related

firms began to return to business with the gradual loosening of

COVID-19 virus restrictions. (IHS Markit Economist Timo

Klein)

- Final May data based on national methodology from the Federal Statistical Office (FSO) have confirmed the 31 May 'flash' data release, posting 0.5% month on month (m/m) and 2.5% year on year (y/y), with the latter increasing from 2.0% in April. This is now well above average inflation of 1.4% in 2019 and 0.5% in 2020.

- The European Union-harmonized CPI measure increased by only 0.3% m/m in May, raising its annual rate by a smaller margin from 2.1% y/y to 2.4% y/y. Nevertheless, this compares with -0.7% y/y as recently as in December 2020. Germany's harmonized inflation also exceeds the eurozone average (2.0%). January's re-weighting of (only) the harmonized rate to the changed consumer spending patterns in 2020 initially provided it with a 0.3-0.4-point add-on relative to the national rate, favoring those categories that showed the largest price increases in 2020, but the now emerging economic recovery is starting to reverse this effect.

- Importantly, May's national measure of core CPI (excluding food

and energy) rose sharply too, with its 1.9% y/y reading comparing

with roughly 1.4% during the first four months of 2021 and just

0.4% in December 2020 ahead of the jump linked to the return of the

VAT rate to its original (higher) level. May's leap is mostly

linked to the beginning of the loosening of pandemic-related

restrictions, which has allowed companies engaged in recreational

and cultural activities to return to business.

- Bayer (Germany) announced that it has entered into an agreement on the acquisition of Noria Therapeutics (US) and its subsidiary PSMA Therapeutics. It is set to gain exclusive rights to a differentiated alpha radionuclide therapy based on actinium-225 as well as a small molecule that targets prostate-specific membrane antigen (PSMA), both of which are at the pre-clinical development stage, intended primarily for the treatment of prostate cancer. As stated by Bayer, the acquisitions will expand its existing portfolio of targeted alpha therapies (TATs), which includes the only TAT to gain marketing authorization, Xofigo (radium (223ra) dichloride), indicated in the treatment of castration-resistant prostate cancer, as well as a platform of investigational TATs based on thorium-227. The financial terms of the agreement were not disclosed. (IHS Markit Life Sciences' Brendan Melck)

- A second estimate shows France's EU-harmonized price rising by

1.8% year on year (y/y) in May. This matches a provisional estimate

in late May. May's inflation rate was the highest since December

2018, when it stood at 1.9%. (IHS Markit Economist Diego

Iscaro)

- Core inflation, which is not released with the provisional estimate, eased from 1.0% in April (a three-month high) to 0.9%.

- Energy prices continued to be the main driver of inflation in May. They rose by 11.7% y/y, their highest increase since October 2018.

- Apart from energy, there is little evidence of higher inflationary pressures yet. Services price inflation decelerated from 1.2% y/y in April to 1.1% y/y in May, mainly because of a softer increase in the prices of recreational and cultural services (+1.1% y/y, following 1.3% y/y in April). The prices of package holidays accelerated from 1.2% y/y to 1.4% y/y, but they have a very small weight in the overall index (0.1%).

- The prices of manufactured goods declined by 0.1% y/y in May, following a 0.2% drop in April. The fall in the prices of clothing and footwear moderated sharply (-0.2% y/y, following a fall of 2.3% y/y), while the prices of furniture and furnishing decelerated from +3.6% y/y to 2.0% y/y.

- Balance-of-payment data confirmed previously reported

customs-based data showing a narrowing of Turkey's

merchandise-trade deficit over the first four months of 2021

compared to a year earlier. Although expansionary monetary economic

policies are fueling strong import demand, a resilient European

production cycle is contributing to even stronger gains in exports.

(IHS Markit Economist Andrew

Birch)

- With the merchandise-trade deficit narrowing sharply, the headline current-account deficit through April fell by more than USD4.5 billion year on year (y/y), to USD9.576 billion. The reduction of the current-account deficit occurred despite a worsening of the services surplus in that same time.

- Meanwhile, Turkey posted a second consecutive month of huge net portfolio investment outflows. Although the net outflow narrowed sharply from March's record-breaking losses, it remained substantial, reaching USD1.534 billion.

- The huge net portfolio outflows and a meagre net inflow of portfolio investment, contributed to the lira weakness over the bulk of April. After a brief rally on the first of the month, the Turkish currency depreciated by over 2.4% against the US dollar through the rest of April. Although its headline foreign currency reserves held steady that month, Turkey took on greater short-term swaps to boost those numbers.

- Revised data from GAStat showed Saudi Arabia's real GDP

declining by 0.5% quarter on quarter (q/q) in the first quarter of

2021, seasonally adjusted. The decline was slightly stronger than

previously announced in the flash estimate. On a year-on-year (y/y)

basis, real GDP growth fell by 3.0% in the first quarter. (IHS

Markit Economist Ralf

Wiegert)

- It has already been disclosed by the flash estimate that the oil sector was responsible for the decline of GDP in the first quarter. Oil GDP in the first quarter dropped by 8.7% q/q, and by 11.7% y/y, driven by Saudi Arabia's voluntary cuts to oil production levels in the first quarter in co-ordination with OPEC+. Saudi's non-oil economy posted a strong, seasonally adjusted 4.9% q/q in the first three months of the year, and an increase of 2.9% y/y.

- It should be noted that the updated estimate for the headline GDP data did not differ too much from the flash estimate published a month ago. However, there were significant changes for the details, including the contribution of the oil and the non-oil sector. For the first quarter, the estimate for non-oil GDP was increased from 4.0% to 4.9%, while the decline of the oil sector even rose from -5.1% to -8.7%. The estimates for 2020 have been revised too.

- The Bank of Ghana (BoG)'s May 2021 Summary of Economic and Financial Data shows a slowing in credit growth, a rise in the non-performing-loan (NPL) ratio, an increase in profitability, and sound capital buffers. Despite slowing from double-digit annual growth in 2020 to 4.8% year on year (y/y) in March 2021, private-sector credit growth picked up again in April to 6.9% y/y, underscoring IHS Markit's expectation of an improvement in credit growth in 2021 and 2022. However, NPLs continued to rise through April 2021. The NPL ratio rose to 15.5% in March 2021 and appears to be stabilising at this level in April 2021. Earnings (return on assets pre-tax) increased solidly to 4.7% in March 2021 from 4.4% in December 2020, dropping back slightly in April 2021 to 4.6%. The capital adequacy ratio improved to 21% in March 2021 from 19.8% in December 2020. (IHS Markit Banking Risk's Ronel Oberholzer)

- The International Monetary Fund (IMF) has approved a

USD650-million 18-month stand-by arrangement (SBA) and an

arrangement under the Standby Credit Facility (SCF) for Senegal,

according to press release on 7 June. In addition, the IMF has

completed the third review under Senegal's Policy Coordination

Instrument (PCI). (IHS Markit Economist Anton

Casteleijn)

- The IMF reports that Senegal's performance under the PCI remains positive but that the COVID-19 pandemic hit the country's economy hard, particularly the informal sector. The hospitality, tourism, and transport sectors contracted significantly, but a record harvest ensured that Senegal's real GDP grew 1.5% in 2020.

- The health sector was strengthened and households' and firms' income losses were countered through the government's forceful implementation of its Economic and Social Resilience Programme (PRES). However, a subdued recovery is expected in 2021, with the IMF forecasting GDP growth of about 3.7% given headwinds from the lingering impact of the pandemic and higher commodity prices.

- The 2021 budget envisages the withdrawal of COVID-19 stimulus measures, thereby ensuring consolidation to a fiscal deficit of about 5.4% of GDP, compared with 5% of GDP in the initial budget.

Asia-Pacific

- APAC equity markets closed mixed; Japan +1.0%, Australia +0.9%, India +0.4%, South Korea +0.2%, Hong Kong -0.7%, and Mainland China -0.9%.

- SAIC Motor has partnered with BOE Varitronix Limited, a supplier of automotive display products, to develop a new smart mobility ecosystem based on intelligent auto cockpit, according to Gasgoo. The two will jointly work on research and development (R&D) of centrally mounted curved displays, flexible organic light-emitting diode (OLED), and transparent window displays for automotive smart cockpit. SAIC intends to create a new ecosystem for the development of its R-branded electric vehicles (EVs), leveraging its partnerships with leading tech companies such as Alibaba Group, NVIDIA, Luminar, and Tencent. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- China's Evergrande Group has partnered with oil firm Sinopec Group for construction of electric vehicle (EV) charging and battery swapping facilities, reports Gasgoo. According to the agreement, the partners will use their expertise in the area of energy, technologies, referral traffic, and sales network to jointly work on the development of an EV charging network. They will also co-operate on automotive lightweight materials, and new high-performance building and chemical materials. Evergrande has been working aggressively for the past couple of years to make inroads into China's booming EV sector. In June 2019, it announced plans to build a CNY160-billion production complex for EVs and related components in the southern Chinese city of Guangzhou. The site will boast an EV plant with an annual production capacity of 1 million vehicles, a 50-GWh-capacity "super-factory" for EV battery production, and facilities supplying electric motors and control systems to 1 million EVs annually. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Japan has awarded its first floating offshore wind tender. The Ministry of Economy, Trade, and Industry (METI), and Ministry of Land, Infrastructure, Transport, and Tourism (MOLIT) have awarded a consortium of Japanese companies, led by Toda Corporation, 16.8 MW capacity in the Goto area, in Nagasaki prefecture. The consortium companies, Toda Corporation, Chubu Electric Power Co., Inc., NPEX Co., Ltd., Kansai Electric Power Co., Inc., and Osaka Gas Co., Ltd., will develop the Goto City Offshore Wind Power Generation project and will operate the wind farm after commissioning. There were no other bidders throughout the tender period from June to December 2020. The consortium, which submitted a joint bid, will build and operate Japan's first floating offshore wind farm. Toda Corporation had announced plans in 2016 for a 22 MW Goto City floating offshore wind farm to go online by 2022. It is highly likely that Toda Corporation's floating hybrid concrete/ steel spar structure, previously demonstrated at Kabashima with a 2MW turbine, will be used. Previous plans revealed by Toda Corporation was for the installation of eight Hitachi HWT2.1-80A wind turbines. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Mando has announced its intention to grow its auto parts business to KRW9.4 trillion (USD8.4 billion) by 2025, according to PR Newswire. It has decided to restructure its auto parts business into two segments: electric vehicle (EV) solutions (chassis electrification) and advanced driver-assistance systems (ADAS). The existing company (Mando) will grow as a highly focused EV solutions company through chassis (brake, steering, and suspension) electrification, and the new company (MMS) will split off from Mando and position itself as a specialized autonomous vehicle (AV) operation and mobility company. MMS will be primarily responsible for developing and manufacturing parts for AVs, autonomous robots, and mobility services. To create synergies in the autonomous business, Mando Hella Electronics (MHE) will become a wholly owned subsidiary of MMS. The two companies plan to make KRW2 trillion in sales by 2025, which is about KRW800 billion more than their sales projections for 2021. (IHS Markit AutoIntelligence's Jamal Amir)

- Automakers Hyundai Motor and General Motors (GM) are accelerating their efforts on developing air taxis, reports Reuters. A GM executive reportedly said that the company aims to commence commercial operations in 2030 by overcoming technical and regulatory hurdles. Meanwhile, Hyundai's global chief operating officer, Jose Munoz, reportedly said that the company is moving ahead of its previously stated timeline as it expects to launch air-mobility vehicles as soon as 2025. The company previously stated that its urban air taxis would be available at major US airports by 2028, if not sooner. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ashok Leyland has announced that its subsidiary Switch Mobility has acquired Switch Mobility Automotive Ltd. India, an electric vehicle (EV) manufacturer, reports the Press Trust of India. According to the source, citing Ashok Leyland's regulatory filing, "Switch Mobility Ltd, UK, a subsidiary of the company, acquired the entire shareholding in Switch Mobility Automotive Ltd, India on June 14, 2021." In November 2020, Ashok Leyland announced that it is renaming its Optare Group UK bus manufacturing arm to Switch Mobility. Formed in 2020, Switch Mobility is a technology-focused bus and light commercial vehicle company and brings together the EV capabilities of Ashok Leyland and Optare. (IHS Markit AutoIntelligence's Tarun Thakur)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-june-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-june-2021.html&text=Daily+Global+Market+Summary+-+15+June+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-june-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 15 June 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-june-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+15+June+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-june-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}