Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 15, 2021

Daily Global Market Summary - 15 September 2021

All major US equity indices closed higher, APAC was mixed, and all major European markets were lower. US and benchmark European government bonds closed lower. CDX-NA closed slightly tighter across IG and high yield, while European iTraxx was close to flat on the day. Natural gas, oil, and copper closed higher, while the US dollar, silver, and gold were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +1.1%, S&P 500 +0.9%, Nasdaq +0.8%, and DJIA +0.7%.

- 10yr US govt bonds closed +1bp/1.30% yield and 30yr bonds +1bp/1.87% yield.

- CDX-NAIG closed -1bp/46bps and CDX-NAHY -3bps/273bps.

- DXY US dollar index closed -0.1%/92.55.

- Gold closed -0.7%/$1,795 per troy oz, silver -0.4%/$23.80 per troy oz, and copper +2.0%/$4.41 per pound.

- Crude oil closed +3.1%/$72.61 per barrel and natural gas closed +3.8%/$5.46 per mmbtu.

- Total US industrial production (IP) rose 0.4% in August,

reflecting increases in manufacturing (0.2%) and utilities (3.3%)

IP that were partially offset by a decrease in mining (down 0.6%).

Disruptions from Hurricane Ida in late August held back the gain in

industrial production by 0.3 percentage point. Still, total

industrial production surpassed its pre-pandemic level (February

2020) for the first time. (IHS Markit Economists Ben

Herzon and Akshat Goel)

- Manufacturing IP rose 0.2% in August despite plant closures due to Hurricane Ida, which shaved 0.2 percentage point from the gain. The hurricane forced plant closures for petrochemicals, plastic resins, and petroleum refining but most industries still recorded gains; among the laggards were electrical equipment (down 1.2%) and chemicals (down 0.5%).

- After recording a gain of 14.5% in July, the seasonally adjusted output of motor vehicles edged down 0.3% in August. Both of these readings were distorted by seasonal issues, as several automakers trimmed or canceled their typical July shutdowns. The trend in motor vehicle output remains weak, as the shortage of semiconductor chips continues to weigh on assemblies.

- The output of utilities rose 3.3% in August as demand for air conditioning was boosted by unseasonably warm temperatures.

- Mining activity decreased 0.6% in August as oil and gas production facilities in the Gulf of Mexico were forced to go offline because of Hurricane Ida.

- The index of US import prices fell 0.3% m/m in August. Among

imported fuel price categories, natural gas prices decreased 0.8%

m/m after jumping 16.6% m/m in July, while imported petroleum

prices dropped 2.4% m/m. Excluding petroleum, the monthly change in

import prices was a 0.1% decrease in August. (IHS Markit Economist

Gordon Greer)

- Excluding fuels, imported goods prices declined 0.1% in August, while the 12-month change was 5.6%. Industrial supplies and materials prices fell 1.7% m/m, while prices of automotive goods increased 0.3% m/m and capital goods edged up 0.1% m/m. The value of the US nominal trade-weighted dollar increased 0.3% m/m in August. A stronger dollar tends to put downward pressure on import prices. The import price index excludes tariffs.

- Fuel import prices dropped 2.3% in August after a 3.0% increase in July. The cost of imported fuel was up 56.5% versus August in the prior year.

- Export prices increased 0.4% m/m in August and the 12-month rate of increase was 16.8%. Agricultural export prices rose 1.1% m/m, while nonagricultural export prices pushed up 0.2% m/m.

- A new survey from IHS Markit, based on data from a panel of 100

institutional investors employed by firms which collectively

represent approximately $845bn assets under management, reveals

that US equity investors' risk appetite has deteriorated to the

worst level recorded over the past year as concerns mount over the

ongoing pandemic and investors perceive falling equity market

support from monetary and fiscal policy. (IHS Markit Economist Chris

Williamson)

- Risk appetite sinks to lowest in 12 months

- Expectations of market returns turn negative

- Pandemic impact seen stretching into 2022, curbing macro environment at same time as policy support perceived to be waning

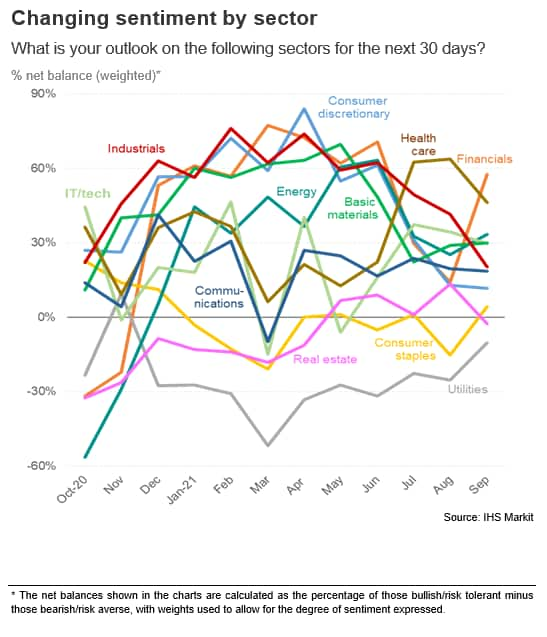

- September has seen a further shift in investor sentiment towards different sectors amid the Delta wave. Healthcare remains close to the top of favored sectors, beaten only by financials in terms of having the best outlook for the next 30 days.

- COVID-19 worries have kept consumer staples in favor but have

knocked sentiment towards consumer discretionary and industrials to

the lowest yet recorded by the survey, the latter likely hit by

additional concerns over supply chain disruptions.

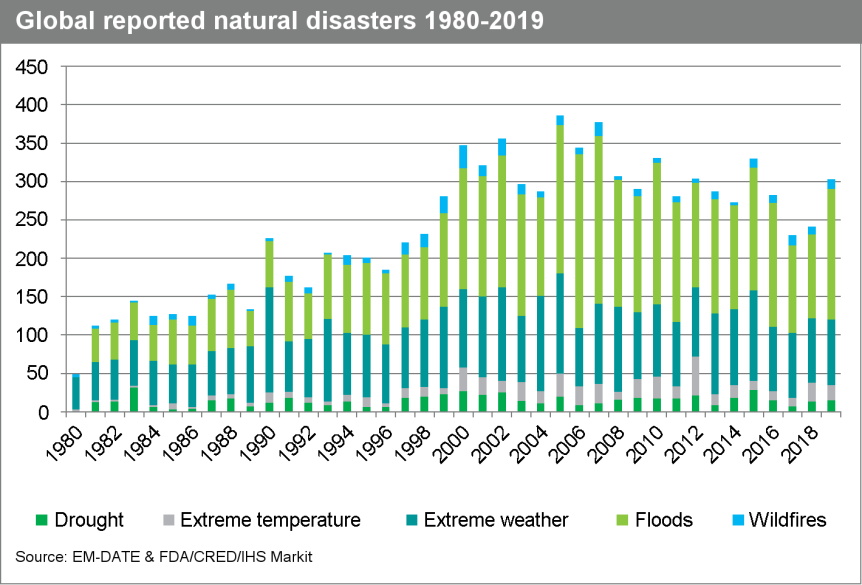

- The costs of this year's natural disasters are still being

counted, but the final bill is expected to be high - an earlier

record-breaking frost in France affected 80% of winegrowers and saw

the country's government put forward a €1 billion euro aid package.

In many regions, costs are also piling on top of previous years'

extreme weather. Back in 2015, the California drought cost the

agriculture sector around $2.7 billion - and just two years later a

similar dry spell hit the same area, all before 2021's heat wave.

(IHS Markit Food and Agricultural Policy's Steve Gillman)

- The world's food supply chains were hit by another summer of extreme weather in 2021.

- Similar events are expected to increase in the coming years, adding more pressure on businesses to align with climate policy.

- Supply chain emissions remain a weak spot in limiting the agri-food sector's carbon footprint, but collaboration can drive progress.

- Agri-food supply chains also need to adopt mitigation measures to become more resilient to the unavoidable impacts of climate change.

- Adaptation costs are expected, but agri-food companies can

maneuver through this by generating premiums through sustainable

branding.

- In testimony to the US Senate Committee on Banking for a 14 September hearing, Securities and Exchange Commission (SEC) Chair Gary Gensler highlighted that investors seek "consistent, comparable, and decision-useful disclosures around climate risk, human capital, and cybersecurity". In response, the SEC plans to develop proposals for corporate disclosure requirements in these areas, which will be subject to public consultation. Other focus areas highlighted include special purpose acquisition companies (SPACs), where the SEC claims to have identified "eight potential conflicts inherent within SPAC structures", with disclosure thereof again a priority. Additionally, he flagged compliance with the requirement for auditors of companies selling shares in the US to be subject to inspection by the Public Company Accounting Oversight Board, noting that while "more than 50 jurisdictions have complied", "two do not, [mainland] China and Hong Kong [SAR]". Another area for future SEC focus will be funds that claim ESG credentials, where SEC staff will "consider ways to determine what information stands behind these claims". Lastly, he highlighted conflicts of interest and fees related to private funds as an area where "we can enhance disclosures", better enabling investors to make informed decisions, while suggesting that recent disruptions to liquidity early in the pandemic have highlighted the need for greater review of money market funds and their true liquidity they offer. Gensler's testimony contains few surprises but does indicate that the US is moving towards an eventual mandatory framework for risk disclosure relating to climate risk, along with tighter scrutiny of funds claiming to have an ESG-based investment focus. (IHS Markit Country Risk's Brian Lawson)

- AbbVie and Regenxbio (both US) have jointly announced that they have entered into a collaboration to develop and commercialize RGX-314, which is a potential one-time gene therapy for the treatment of wet age-related macular degeneration (wet AMD), diabetic retinopathy (DR), and other chronic retinal diseases. Under the terms of the agreement, AbbVie will make a USD370-million upfront payment to Regenxbio, with the potential for up to USD1.38 billion in additional development, regulatory, and commercial milestones. Regenxbio and AbbVie will share equally in profits from net sales of RGX-314 in the United States. AbbVie will pay Regenxbio tiered royalties on net sales of RGX-314 outside the US. In addition, Regenxbio will lead the manufacturing of RGX-314 for clinical development and US commercial supply, and AbbVie will lead manufacturing of RGX-314 for commercial supply outside the US. (IHS Markit Life Sciences' Milena Izmirlieva)

- The US announced plans 14 September to join Canada, the EU, South Korea, Norway, Switzerland, and the UK in seeking an end to "official export financing support for unabated coal power." The US Department of Treasury will formally introduce the proposal at the 15 September meeting of the Organisation for Economic Co-operation and Development's (OECD) Participants to the Arrangement on Officially Supported Export Credit, a "gentleman's agreement" signed in 1976 to foster a level playing field in order to encourage competition among exporters. The US Treasury announced plans the same day as more investors join an international effort to phase out financing of fossil fuel projects as governments gather in New York City for the UN General Assembly meeting, and ahead of the COP26 global climate change meeting in Glasgow, Scotland, in November. At the OECD meeting, Treasury said the proposal will limit "official export credit support for coal power by expanding the scope of the commitments made in the "Sector Understanding on Export Credits for Coal Fired Electricity Generation Projects," a 2016 OECD guideline that direct export credit agencies (ECAs) on their backing of power generation projects. (IHS Markit Net-Zero Business Daily's Amena Saiyid)

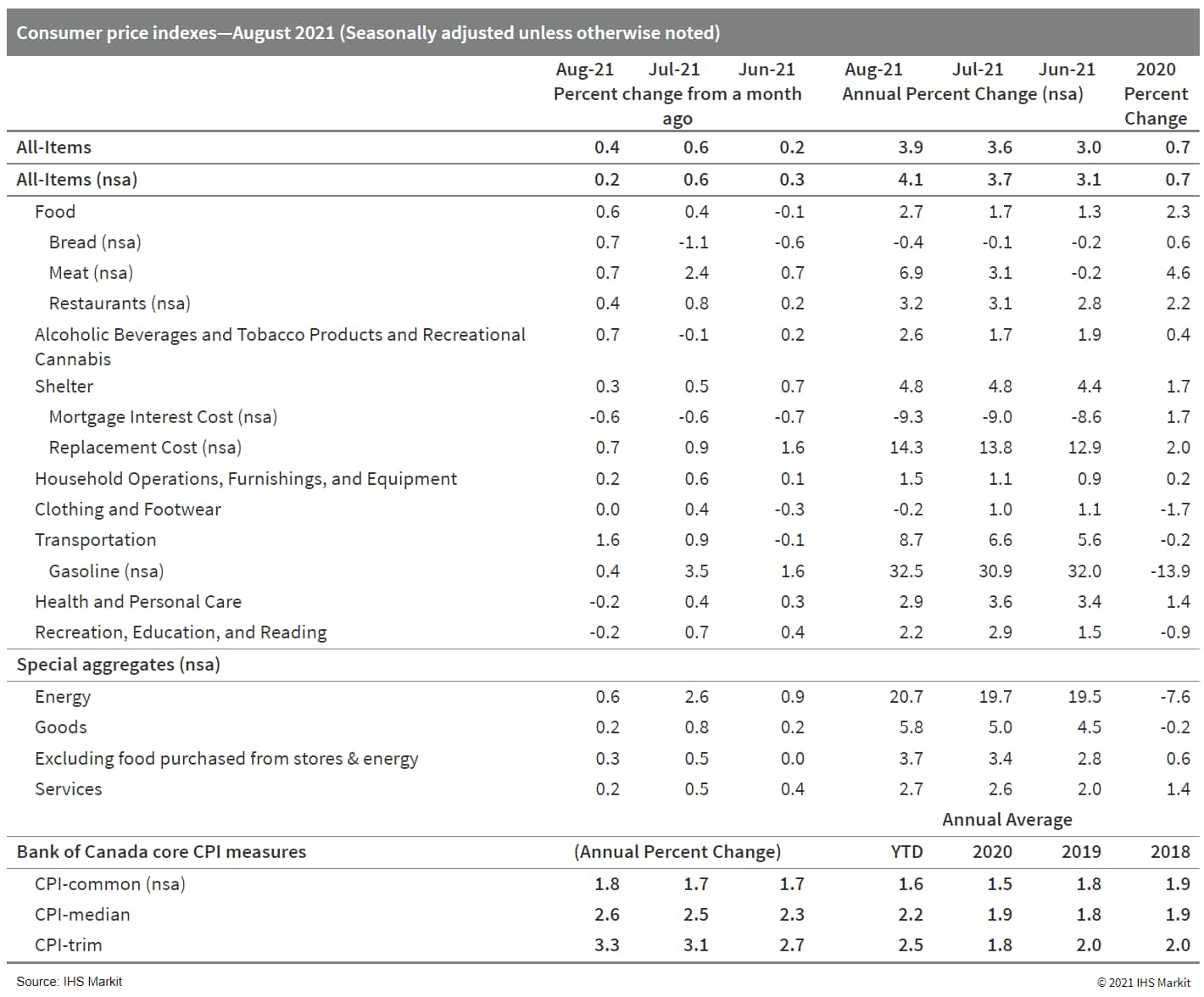

- Canada's consumer prices advanced at a decelerated monthly pace

in August, slowing to 0.4% month on month (m/m) on a seasonally

adjusted basis (SA) and 0.2% m/m on a non-seasonally adjusted basis

(NSA). (IHS Markit Economist Arlene

Kish)

- This accelerated annual inflation rates to 3.9% year on year (y/y) SA and 4.1% y/y NSA.

- The average core inflation rate was higher again at 2.6% y/y, with the consumer price index (CPI)-trim inflation rate advancing the fastest at 3.3% y/y.

- Goods price inflation quickened to 5.8% y/y and services price inflation edged up to 2.7% y/y on stronger demand from eased pandemic restrictions.

- The Bank of Canada is closely monitoring inflation to see what

can be deemed transitory and temporary. Gasoline always fits that

category. The inflation outlook is a bit stronger this year, but

unchanged at 2.2% in 2022.

- The second largest bank by assets in Brazil, state-owned Banco

do Brasil (BdB), has raised USD750 million of five-year debt at

3.25%, tightening pricing from the initial guidance of 3.625% after

gaining USD2.8 billion in demand, according to LatinFinance

sources. This is to finance the repurchase of existing liabilities

due in 2022, 2023, and 2024. (IHS Markit Banking Risk's

Alejandro Duran-Carrete and Brian

Lawson)

- The BdB is using the favorable environment in global financial markets to refinance itself at relatively attractive levels for a longer period, easing its debt service requirements over the following three years.

- Brazilian banks have very tight liquidity profiles, which leave them highly reliant on sources of funding other than deposits, such as bond issuance and repurchase operations. Wholesale funding had represented 31.1% of the BdB's total liabilities as of June 2021. The latest transaction will be risk-positive if the repurchase is completed successfully, lowering short-term liquidity and refinancing risks without increasing aggregate wholesale liabilities.

Europe/Middle East/Africa

- All major European equity indices closed lower; UK -0.3%, Germany -0.7%, Italy -1.0%, France -1.0%, and Spain -1.7%.

- 10yr European govt bonds closed sharply lower; Germany/Spain/UK +4bps, France +4bps, and Italy +5bps.

- iTraxx-Europe closed flat/45bps and iTraxx- Xover flat/226bps.

- Brent crude closed +2.5%/$75.46 per barrel.

- The Office for National Statistics (ONS) reports that the

United Kingdom's 12-month rate of consumer price index (CPI)

inflation increased from 2.0% in July to 3.2% in August, the

highest rate since March 2012. In addition, the increase of 1.2

percentage points in the 12-month rate was the largest rise in the

CPI National Statistic 12-month inflation rate since the series

began in January 1997. (IHS Markit Economist Raj

Badiani)

- The rate was above the Bank of England's (BoE) 2% target for inflation.

- During 2020, inflation averaged 0.9%.

- Energy-related prices rose rapidly on an annual basis, with transport fuel and lubricant prices growing by 17.7 year on year (y/y), the fifth successive double-digit increase (see chart below). This was in line with global crude oil prices rising by 58.3% y/y to average USD70.9 per barrel (pb) in August, the seventh successive y/y gain since February.

- The ONS reports that average gasoline (petrol) prices stood at 134.6 pence a litre in August, compared with 113.1 pence a litre a year earlier.

- The ONS reported another notable rise in second-hand car prices due to rising demand because the shortage of semiconductor chips has disrupted production of new vehicles.

- Restaurant and café prices increased by 8.0% y/y in August after the "Eat Out to Help Out Scheme" introduced in the same month a year earlier, which awarded diners a state-financed 50% discount on meals up to GBP10 (USD14) each from Mondays to Wednesdays.

- All-services price inflation nearly doubled to 3.0% in August; for goods, it stood at 3.3%, up from 2.5% in July.

- Core inflation, excluding energy, food, alcoholic beverages, and tobacco prices, moved up to 3.1% in August from 1.8% in July.

- The German government is looking to introduce new criteria for offering subsidies for plug-in hybrid (PHEV) passenger cars that would require then to have more electric-only range, according to a Deutsche Presse-Agentur report. The current rules relating to whether PHEVs qualify for the German government's Environmental Bonus subsidy needs them to either meet a maximum CO2 emissions rating or have a minimum range. From October 2022, the CO2 criterion is to be abolished and the requirement of a minimum purely electric range of 60 km will apply. From January 2024, eligibility for funding will require an increased range of 80 km, according to draft guidelines. (IHS Markit AutoIntelligence's Tim Urquhart)

- French President Emmanuel Macron said France will push for a rapid phase-out of pesticide use across the EU when it takes over the six-month presidency of the EU Council in 2022. On 10 September, Macron spoke at the World Conservation Congress in Marseille and promised to carry out a "strong initiative… for an accelerated phase-out of pesticides" to protect biodiversity. He said France will seek support from other member states during their EU Council Presidency because such a plan can only succeed "at the European level". These French ambitions could build on the European Commission's Farm to Fork strategy (F2F), which includes an aspirational target to reduce the use and risks of chemical pesticides by 50% by 2030. EU farming ministers in the Council already backed this level of ambition last year and members of the European Parliament (MEPs) did the same last week, arguing that the pesticide targets should be made binding. Macron also renewed his commitment to gradually phase-out pesticide use across France, but acknowledged that this transition has not been moving fast enough. However, he argued that it would be wrong to underestimate the efforts made by French farmers and said reducing pesticide dependence will require more research and support for farmers so that they have enough non-chemical alternatives to protect their crops. (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- Valmet Automotive has announced that it has started electric vehicle (EV) battery production at its Uusikaupunki (Finland) facility. According to a statement, it is investing EUR120 million into the site which is produce high voltage automotive battery modules and battery packs. The company added that the battery operations at the site will be extended, running with four battery production lines by 2024 which will have an annual capacity of 500,000 battery modules and battery packs at this point. Its headcount will also grow to around 500 staff by 2024, up from around 200 workers initially. (IHS Markit AutoIntelligence's Ian Fletcher)

- Africa Finance Corporation (AFC) plans to raise $2 billion over

the coming three years for direct investment in infrastructure

projects across the continent that the multilateral agency sees

slowing the impact of climate change, it said 14 September. (IHS

Markit Net-Zero Business Daily's Keiron Greenhalgh)

- As part of efforts to address Africa's vulnerability to climate risk, an initial $500 million will be raised over the next 12 months by a new AFC asset management arm, AFC Capital Partners, through a debut Infrastructure Climate Resilient Fund (ICRF).

- The ICRF will directly invest in ports, roads, bridges, rail, telecommunications, and logistics in Africa to tackle the impact of rising temperatures and sea levels due to climate change, the agency said.

- Climate adaptation projects counteract the current and future effects of climate change and is distinct from climate mitigation, in which the impacts of global warming are reduced by GHG emissions cuts.

Asia-Pacific

- Major APAC equity markets closed mixed; India +0.8%, South Korea +0.2%, Mainland China -0.2%, Australia -0.3%, Japan -0.5%, and Hong Kong -1.8%.

- Average new home prices in mainland China increased by 0.16%

month on month (m/m) in August, down by 0.14 percentage point from

July, according to the survey conducted by the National Bureau of

Statistics covering 70 major cities. This marked the third

consecutive month of decline in month-on-month new home price

inflation, and the August reading is also the lowest so far this

year. (IHS Markit Economist Lei Yi)

- All three city tiers recorded lowered month-on-month new home price inflation in August, with tier-2 cities posting the largest decline. Although the regional COVID-19 outbreaks that started at the end July to some extent disrupted home-buying activity in August, tightened mortgage lending rules, alongside other housing market regulations, remained the major driver of the reduction in home price inflation. Notably, new home prices in Guangzhou registered deflation of 0.1% m/m in August compared with a 0.2% m/m inflation the month before, and in capital city Beijing, new home price inflation fell by 0.6 percentage point to 0.2% m/m in August.

- Up to 46 out of the 70 surveyed cities reported month-on-month new home price gains in August, the lowest reading so far this year. A total of 20 cities registered month-on-month new home price declines, up by 4 cities from July.

- Chinese battery-maker Contemporary Amperex Technology Limited (CATL) has announced plans to invest CNY13.5 billion (USD2.1 billion) to set up a lithium-ion battery manufacturing base in the city of Yichun, Jiangxi province, China, reports Gasgoo. The production facility will cover an area of 1,300 mu (a Chinese unit of area), about 867,000 square meters. CATL has been expanding its production capacity in China and overseas to ensure a robust supply of batteries to its customers, including leading OEMs such as Tesla, Hyundai, Daimler Trucks, BMW, SAIC, and GAC Motor. Last month, the company announced plans to raise CNY58.2 billion through private share placements to fund six projects aimed at boosting its production capacity of lithium-ion (Li-ion) batteries in China and Germany. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Ouster has signed a strategic customer agreement with Juzhen Data Tech, according to a company statement. Under this agreement, Ouster will supply 1,190 digital LiDAR sensors through 2025 for Juzhen's next-generation delivery vehicles for the Chinese market. Juzhen plans to integrate up to three Ouster OS1 sensors per vehicle on its two next-generation electric vehicles (EVs). This will support autopilot functionality when these vehicles will be deployed on public roads. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Neolix has partnered with artificial intelligence (AI) chip company Horizon Robotics to develop integrated perceptual solutions for its autonomous delivery vehicles, reports Gasgoo. The solution will be based on the Horizon Journey chip to support the large-scale commercialization of Neolix's autonomous vehicles (AVs). Neolix, which was founded in 2014, offers Level 4 autonomous delivery vehicles and has its own production plant. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Foxconn Technology Group's electric vehicle (EV) project with Byton has been put on hold due to Byton's worsening financial position, reports Nikkei Asia. One of the people familiar with the matter has said, "The [Byton] project is not officially terminated yet, but it is very challenging to proceed at this moment". According to the report, there are still some Foxconn employees stationed at Byton's factory but they are wrapping things up and preparing for an exit when necessary. Byton and Foxconn had signed a strategic co-operation deal in January to accelerate the production launch of Byton's first mass-market model, the M-Byte. Under the partnership, the two companies aimed to begin volume production of the M-Byte in the first quarter of 2022, however, with this likely fallout, meeting the production timeline seems to be a challenging task. According to a Bloomberg report, Foxconn had planned to invest around USD200 million in the startup. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Japan's private machinery orders (excluding volatiles), a

leading indicator for capital expenditure (capex), rose by 0.9%

month on month (m/m) in July following a 1.5% m/m drop in June. The

increase stemmed from a 6.7% m/m rise in orders from manufacturing,

offsetting a 9.5% m/m decrease in orders from non-manufacturing.

(IHS Markit Economist Harumi

Taguchi)

- Orders from the public sector rose by 14.0% m/m in July, following a 2.8% m/m decrease in the previous month. Orders from overseas also rose solidly, rising 24.1% m/m in July after a 10.0% m/m drop in June.

- The fourth consecutive increase in orders from manufacturing was thanks largely to solid rebounds in orders from electrical machinery and shipbuilding, offsetting declines in orders from chemical and chemical products, other transport equipment, and some other groupings. The weakness in orders from non-manufacturing reflected declines in orders from transportation and postal activities, construction, wholesale and retail trade, and other industry groupings. External demand was largely driven by orders of electric devices, information and communication equipment, and industrial machinery (such as construction machinery).

- Japanese beverages production reached 21,579 thousand

kiloliters in 2020, down 5% y-o-y, according to the Japanese Soft

Drink Association. Only mineral waters increased by 6% while all

others declined. Tea-based drinks dominate the market with 24.3%

share followed by mineral waters (17.8%), carbonates (17.4%),

coffee drinks (14.1%), fruit juices (6.5%), and sports drink

(5.9%). (IHS Markit Food and Agricultural Commodities' Mainbayar

Badarch)

- Sales value fell by 7%, totaling JPY3,798 trillion ($33.6 billion) due to Covid-19. All types declined. Carbonates have a value market share of 18.8%, mineral waters 8.1%, sports drink 7.6%, and fruit drinks 7.5%.

- In terms of packaging, PET accounts for 76% of the total output, followed by can (11.2%), paper (8.6%), glass (0.9%) and other (3.4%). For PET, medium (400-699ml) accounts for 67%, while 700ml and 1-399ml make up 28% and 5%, respectively.

- For vegetable drinks, vegetable/fruit juice mixed juice dominates with 38% share, followed by vegetable juice (23%), tomato juice (16%), vegetable drink (14%) and tomato mixed juice (5%). For other soft drinks, drink soups leads the market followed by vinegar drink, cocoa drink, sweet sake, non-carbonated energy drink, and jelly drink.

- In-house manufacturing and contract manufacturing account for 68.6% and 31.4%, respectively.

- In terms of product varieties, fruit drinks lead by 1,996 types, followed by other beverages (1,132), soda (1,049), tea-based beverages (688), coffee drinks (653), and mineral waters (244).

- Hyundai Motor Group and LG Energy Solution have started construction of an electric vehicle (EV) battery cell plant in Karawang New Industry City, near the Indonesian capital Jakarta, according to a company press release. Construction of the plant is expected to be completed by the first half of 2023 and mass production of battery cells at the new facility is expected to commence in the first half of 2024. When fully operational, the facility is expected to produce a total of 10-GWh-worth of lithium-ion (Li-ion) battery cells every year, enough for more than 150,000 EVs. In addition, the facility will be ready to increase its production capacity to 30 GWh to meet the growth in future EV needs. Battery cells produced by the plant will be used in Hyundai and Kia's EV models built on the automotive group's dedicated battery electric vehicle (BEV) platform, the electric-global modular platform (E-GMP). The new plant will help Hyundai and Kia produce vehicles with high levels of efficiency, performance, and safety by supplying battery cells optimized for the two automakers' BEV models, according to Hyundai. In June, Hyundai Motor Group and LG Energy Solution signed a memorandum of understanding (MOU) with the Indonesian government to establish a USD1.1-billion joint venture (JV) in Indonesia to manufacture battery cells for EVs. The two companies will each have a 50% ownership stake in the JV, while the Indonesian government has agreed to offer various incentives and rewards to support the stable operation of the plant. (IHS Markit AutoIntelligence's Jamal Amir)

- General Motors (GM) is working with its long-time electric vehicle (EV) battery supplier LG Corp. in tracking down and fixing problems linked to battery fires in Chevrolet Bolt EVs, which threaten the strategic plans of both companies, reports Reuters. The report cites GM chief financial officer (CFO) Paul Jacobson, who said that LG was working with GM engineers to "clean up the manufacturing process" at LG battery plants and implement some "GM quality metrics". The report says that the EV battery plants in South Korea and Michigan (United States) operated by LG Energy Solution (LGES) have been identified by GM as the source of defects behind a rash of battery-related fires in the Chevrolet Bolt. The battery fire incidents have resulted in three recalls and USD1.8 billion in warranty set-asides by GM since last November, and GM has still not implemented a hardware fix for the recalled vehicles. (IHS Markit AutoIntelligence's Jamal Amir)

- DSME won an order of USD845 million (KRW990.0 billion) to build

four LNG carriers from an Asian company. The 174,000-cubic meter

vessels will be built at the Okpo shipyard and delivered by the

second half of 2024. With this order, DSME exceeded its 2021 new

orders target of USD7.7 billion, the first since 2014. Thus far,

DSME has secured a total of 46 vessels, including 16 container

ships, 11 crude oil tankers, nine LPG carriers, six LNG carriers, 1

WTIV, 1 submarine and two offshore plants, worth around USD8.0

billion. (IHS Markit Upstream Costs and Technology's Jessica Goh)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-september-2021.html&text=Daily+Global+Market+Summary+-+15+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-september-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 15 September 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+15+September+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-15-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}