Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 16, 2021

Daily Global Market Summary - 16 December 2021

All major European and most APAC equity indices closed higher, while all major US indices were lower on the day. US government bonds closed mixed with the curve steeper, while benchmark European bonds were lower on the day. European iTraxx closed tighter across IG and high yield, CDX-NAIG was flat, and CDX-NAHY was wider on the day. Oil, gold, silver, and copper closed higher, while the US dollar and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -0.1%, S&P 500 -0.9%, Russell 2000 -2.0%, and Nasdaq -2.5%.

- 10yr US govt bonds closed -3bps/1.43% yield and +1bp/1.87% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY +4bps/308bps.

- DXY US dollar index closed -0.5%/96.04.

- Gold closed +1.9%/$1,798 per troy oz, silver +4.4%/$22.49 per troy oz, and copper +2.9%/$4.31 per pound.

- Crude oil closed +2.1%/$72.38 per barrel and natural gas closed -0.9%/$3.77 per mmbtu.

- The march to electrify buildings continues, as the New York

City Council on 15 December voted to institute a limit on emissions

from building operations for new buildings that will act as a de

facto ban on the use of heating oil and natural gas, say

proponents. (IHS Markit PointLogic's Kevin Adler)

- The bill, known as Local Law 97, passed by a vote of 40 to 7 (out of a total of 51 council members).

- It would limit CO2 emissions from new buildings to less than 25 kilograms of CO2 per million Btu. It takes effect for buildings under seven stories tall in 2023 and for taller buildings in 2027. For affordable housing, the two deadlines are 2026 and 2028.

- According to the NYC Mayor's Office of Sustainability, over 70% of the city's GHG emissions come from buildings. The city already requires private buildings over 50,000 square feet and public sector buildings over 10,000 square feet to report their energy and water consumption each year for public disclosure.

- Assuming Mayor Bill de Blasio signs the bill -- and he has been vocal in support of the law -- New York City will join San Jose, San Francisco, and Seattle with gas bans or partial bans.

- Exceptions are made for commercial kitchens, hospitals, laundromats, crematoriums, and a catch-all category of gas used "for emergency or standby power".

- A research study from Hong Kong University has found that the Omicron variant of the COVID-19 virus replicated 70 times more rapidly in bronchial tissue than wild-type or Delta strains, but 10 times more slowly in lung tissue. This provides some plausible background to the observed rapid spread of the variant, but its apparently lower rate (so far) of producing severe disease. However, the researchers have warned that this should not be any grounds for complacency, since the rapid spread of the strain gives particular grounds for concern, and low viral replication does not take account of immune dysfunctions such as cytokine storm. (Life Sciences by GlobalData's Janet Beal)

- During yesterday's press briefing, Federal Reserve Chair Jerome Powell reviewed the outcome of the 14-15 December meeting of the Federal Open Market Committee (FOMC), in which there was a unanimous vote to maintain the target range for the federal funds rate at 0% to ¼% and to accelerate the reduction of bond purchases according to a revised plan that will see purchases fall to zero in the second half of March. Chair Powell noted that the Committee was prepared to adjust the pace of asset purchases should the economy fail to evolve as anticipated. The more rapid reduction in asset purchases positions the FOMC to raise rates multiple times next year, sooner and more rapidly than we had previously anticipated. (IHS Markit Economists Lawrence Nelson's and Ken Matheny)

- The US housing market is ending the year on a solid note.

Housing starts jumped 11.8% (plus or minus 15.2%, not statistically

significant) in November to a 1.679 million annual rate—the

second-highest reading since January 2006. Single-family starts

soared 11.3% (plus or minus 15.8%, not statistically significant)

to a 1.173 million rate, and multifamily starts grew 12.9% to a

506,000-unit yearly rate, only the sixth time in the past 30 years

this category has crossed the 500,000 threshold. Year-to-date

housing starts through November were 24% higher than in 2019. (IHS

Markit Economist Patrick

Newport)

- Weather played a role. November was the seventh warmest and eighth driest November in the past 127 years, according to the National Oceanic and Atmospheric Administration (NOAA).

- Single-family housing permits rose 2.7% in November after a 3.3% October increase. Multifamily permits climbed 5.2% to a rock-solid 608,000-unit annual rate, the fourth time in the past 30 years this category crossed the 600,000 threshold. Total permits increased 3.6% to a 1.712 million rate.

- Builders are working on new units at a furious pace. The number of homes under construction increased to a seasonally adjusted 1.486 million in October. That is the highest total since December 1973 and partly explains why builders are finding it hard to locate labor and materials.

- Authorized but not started units are at a series high of 273,000 (data start in 2000).

- Despite steady declines from January through September and stiff headwinds (from soaring lumber and materials prices, labor shortages, a lack of skilled labor, a lack of buildable lots, and supply chain issues), total housing starts and single-family housing starts are on track for their strongest year since 2006. Multifamily starts will post their highest totals since 1986.

- Electric vehicle (EV) startup Canoo has announced an acceleration of production plans, as well as shifting production from Europe to the US. According to a company statement, Canoo remains on target to bring up its Mega Micro factory in Pryor (Oklahoma, US) in 2023 as well as begin manufacturing at a facility planned for northwest Arkansas in 2022. In the statement, Tony Aquila, investor, chairman and CEO of Canoo said, "Canoo is now in a position to issue guidance at a time when many others in the industry are reducing targets and projections. The Company has now refined its manufacturing strategy and assembled a team to execute the production roadmap for 2022 - 2025." Canoo now expects to produce between 3,000 and 6,000 units in 2022, up from prior guidance for between 500 and 1,000 units. In 2023, the company now expects production between 14,000 and 17,000 units, compared with earlier projection for 15,000 units that year. In 2024, Canoo says it will produce between 40,000 and 50,000 units and in 2025 between 70,000 and 80,000 units. Canoo's shift also comes as the current US presidential administration is pushing for EV production to remain in the US and as US lawmakers are considering consumer tax incentives that will encourage US production. According to media reports, VDL Nedcar will return Canoo's USD30.4-million prepayment, but that VDL Nedcar parent VDL Groep will buy USD8.4-million-worth of Canoo stock. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric vehicle (EV) ride-hailing leasing company Hive Technologies has raised USD30 million in new funding, according to a company statement. The capital was received from investors including iSun, Galway Sustainable Capital, and Los Angeles Cleantech Incubator's Impact Fund, as well as strategic individuals from the renewables and real-estate sectors, aligned to Hive's Environmental, Social, and Governance (ESG) objectives. The company plans to use the proceeds to increase its fleet to 1,000 EVs and deploy 50 solar-powered direct-current fast chargers. Hive says this will enable it to eliminate 12,000 tons of carbon dioxide (CO2) and save 1.2 million gallons of fuel every year. Hive, which was founded in 2020, leases EVs to Uber Technologies and Lyft drivers on a per-mile cost basis, offering a potentially cheaper option than buying a new EV on loan. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Aurora Innovation has launched a pilot program with the freight unit of Uber Technologies to transport goods in Texas (US) as part of a multiphase commercial pilot. This partnership will integrate Aurora's trucking subscription service, called Aurora Horizon, into Uber Freight, helping carriers to increase utilization of the truck and haul goods more often between terminals. Aurora said it is using the Uber Freight shipping platform, which connects truck drivers with shippers that need cargo delivered, to haul freight for customers between Dallas and Houston. Aurora also said it will expand routes as it adds more terminals. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- All members of the Central Bank of Chile (Banco Central de

Chile: BCC)'s board agreed to aggressively raise the monetary

policy rate by 125 basis points (bps) during a board meeting on 14

December, totaling 350 bps raise in 2021. More central bank action

is expected in 2022. (IHS Markit Economist Claudia

Wehbe)

- Chile's consumer prices gained 0.5% in November, slowing from 1.34% month on month (m/m) in October - the fastest pace recorded since June 2008. The result was mainly driven by rising prices in the recreation and culture and the clothing and shoes categories.

- Annual inflation reached a 13-year high of 6.7% in November from 6.0% in October. Meanwhile, core consumer price inflation that excludes food and energy prices also spiked to 5.8% from 5.1%.

- Chile's unadjusted monthly economic activity indicator, a proxy for GDP, accelerated modestly from 14.8% year on year (y/y) in September to 15.0% y/y during October, posting another historical record. The result was mainly driven by contributions in services and commerce.

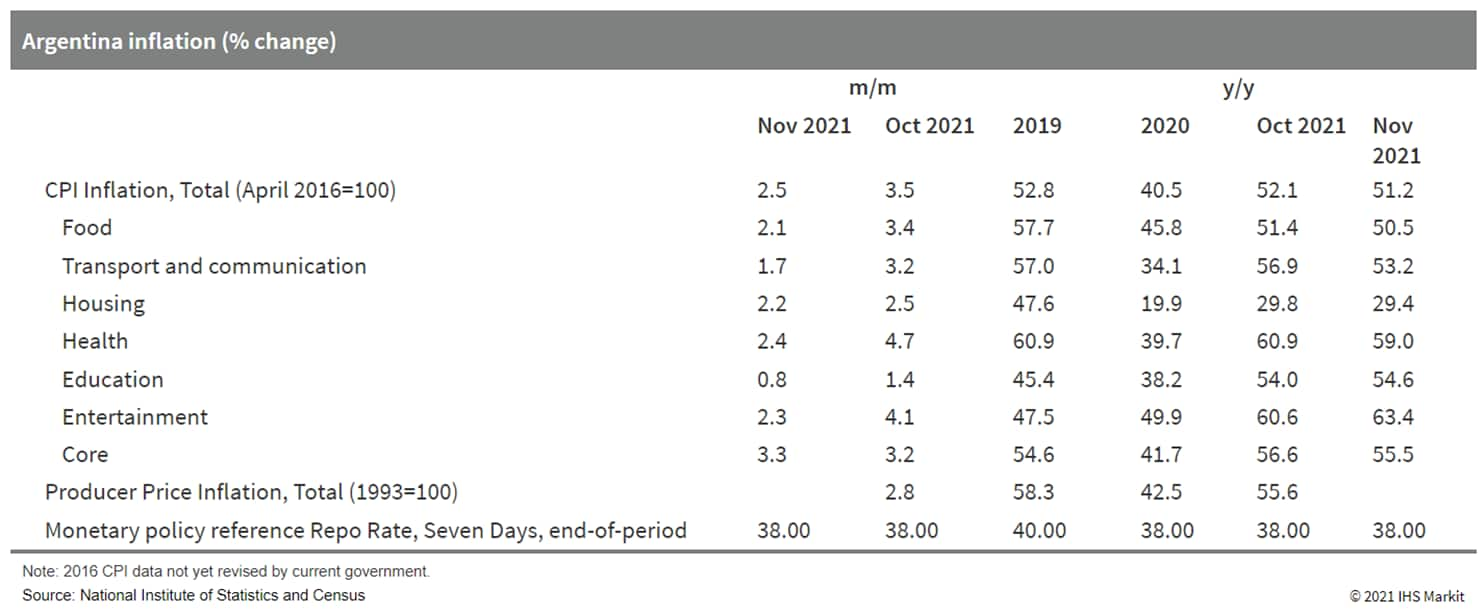

- Argentina's consumer price index (CPI) increased by 2.5% month

on month (m/m) during November, slowing from 3.5% in October. The

government's campaign over regulated-price compliance only modestly

helped slow consumer price growth. (IHS Markit Economist Claudia

Wehbe)

- Argentina's inflation was mainly driven by soaring prices in the restaurants and hotels, and clothing and apparel categories. Prices in the household maintenance category followed, mainly propelled by increases in salaries of household staff and personnel.

- The food and beverages category had the largest incidence across all regions, recording substantial price rises for meats, and bread and cereals, while drops in prices of fresh vegetables partially offset the overall increase.

- The prices of regulated items jumped by 1.0% m/m. The prices of

seasonal items increased by 0.5% m/m, slowing from the 8.1% m/m

surge in the prior month, helped by the decrease in costs of fresh

vegetables. The core inflation rate stood at 3.3% m/m.

Europe/Middle East/Africa

- All major European equity indices closed higher and none breached into negative territory at any point of the trading day; Spain/UK +1.3%, France +1.1%, Germany +1.0%, and Italy +0.4%.

- 10yr European govt bonds closed lower; Germany +1bp, France/UK +2bps, Spain +4bps, and Italy +5bps.

- iTraxx-Europe closed -2bps/50bps and iTraxx-Xover -7bps/250bps.

- Brent crude closed +1.5%/$75.02 per barrel.

- The UK economy is ending 2021 on a disappointing note, with the

pace of growth slowing sharply in December as COVID-19 worries once

again disrupt business activity. The IHS Markit/CIPS composite PMI

output index, covering both services and manufacturing, fell from

57.6 in November to 53.2 in December, according to the early

'flash' reading, indicating the slowest rate of expansion since the

lockdowns at the start of the year. (IHS Markit Economist Chris

Williamson)

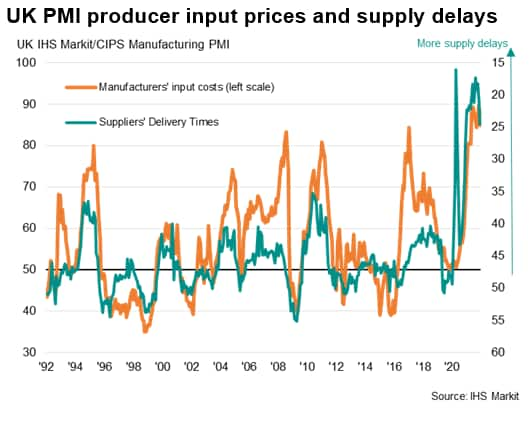

- Inflationary pressures meanwhile cooled during the month, albeit remaining elevated, attributable to the combination of the easing supply situation and weaker demand growth. Nevertheless, although down from November's record rate, the overall rate of input cost inflation measured in December was still the third highest in more than two-decades of survey history, with average prices charged for goods and services also rising at a rate unprecedented prior to September.

- The latest official data show consumer price inflation rising

to 5.1%, a breaching of the 5% level that the PMI data had signaled

ahead back in October. The latest PMI data are merely indicative of

the headline inflation rate falling to just under 5%.

- The headline IHS Markit Eurozone Composite PMI® dropped two

points from 55.4 in November to 53.4 in December, according to the

'flash' reading*, indicating an easing in the rate of output growth

to the lowest since March. The decline takes the average reading

for the fourth quarter to 54.3, substantially lower than the 58.4

average seen in the third quarter. As such the PMI data point to a

marked weakening of economic growth in the closing quarter of 2021,

albeit with the rate of growth remaining above the survey's

pre-pandemic long-run average of 53.0. (IHS Markit Economist Chris

Williamson)

- The December slowdown was led by the service sector, where business activity grew at the weakest rate since April. Slower service sector activity growth was in turn led by a steep fall in tourism and recreation activity of a similar magnitude to the declines seen at the start of the year amid rising COVID-19 infection rates and associated restrictions across the region. Inflows of new business into the service sector also slowed, dropping to the lowest since the recovery from early-2021 lockdowns began in May

- By country, growth stalled in Germany due to the first drop in new orders for goods and services since June 2020, ending a 17-month recovery. A renewed fall in service sector activity outweighed a pick-up in manufacturing production growth.

- France meanwhile continued to grow at a solid pace, albeit down on November, as a relatively resilient service sector helped offset a decline in manufacturing output for the second time in the past three months.

- Although supply chain delays continued to run far higher than anything seen prior to the pandemic, the lengthening of delivery times in December was the least marked since January. Input buying consequently rose at the fastest pace since August and pre-production inventories grew at a rate unprecedented in more than two decades of survey history, facilitating higher output in many firms.

- However, although input costs and average selling prices measured across both manufacturing and services both grew less steeply than in November, both series still showed the second fastest rates of increase recorded in the history of the survey. Companies reported that higher shipping costs, rising energy prices and increases in staff costs again added to the upward pressure on prices.

- The ECB has announced various changes following its December

policy meeting, including (IHS Markit Economist Ken

Wattret):

- In the first quarter of 2022, net asset purchases under the PEPP will be conducted at a slower pace than in the previous quarter.

- Net purchases under the PEPP will be discontinued at the end of March 2022.

- Net purchases under the PEPP could be resumed, if necessary, to counter negative shocks related to the pandemic.

- The reinvestment horizon for the PEPP will be extended until at least the end of 2024 (a year longer than previously).

- In the event of renewed pandemic-driven market fragmentation, PEPP reinvestments can be adjusted flexibly, including purchases of bonds issued by the Hellenic Republic "over and above rollovers of redemptions", to avoid impairment of monetary policy transmission.

- Monthly net purchases under the asset purchase programme (APP) will rise from EUR20 billion (USD22.7 billion) to EUR40 billion in the second quarter of 2022, and will then be EUR30 billion in the third quarter. From October 2022 onwards, net purchases will be maintained at a monthly pace of EUR20 billion for as long as necessary.

- The interest rates on the main refinancing operations and the marginal lending facility and the deposit facility are unchanged at 0.00%, 0.25%, and -0.50%, respectively.

- The headline and core HICP inflation projections have been revised up markedly for 2022, particularly the former, to 3.2% and 1.9%, respectively.

- Eurozone retail sales volumes expanded marginally in October,

by 0.2% m/m, matching the market consensus expectation. Following

the increase, sales volumes were 3.9% above their pre-pandemic

level in February 2020. (IHS Markit Economist Ken

Wattret)

- Looking beyond the headline data, however, the picture looks somewhat less positive. On a three-month-on-three-month basis, which smooths out the monthly volatility in the data series, retail sales volumes contracted by 0.2% in October, the first fall in eight months.

- Eurozone industrial production, meanwhile, rose by 1.1% m/m in October, again broadly matching the consensus expectation. However, October's increase followed back-to-back declines in August and September. On a three-month-on-three-month basis, industrial production actually fell by 0.6% in October, the weakest rate of change since June 2020.

- With supply chain disruption having recently hindered the industrial sector after an initially robust recovery from mid-2020, industrial production in the eurozone remained 0.7% below its pre-pandemic level despite October's rebound.

- The breakdown of production by type of good again highlights significant variations. Production of capital goods rebounded by 3.0% m/m in October, the highest increase for 11 months, although it remained over 2% below its pre-pandemic level. Production of both durable and non-durable consumer goods increased m/m in October and is now 3.5% and 4.3% above pre-pandemic levels, respectively.

- The EU's final agreement on the next Common Agricultural Policy

(CAP) has increased the allowed THC level in hemp production from

2% to 3%. The new CAP was approved by the European Parliament and

EU Council in November and December respectively and will come into

force on 1 January 2023. The farming policy's new regulations

include the possibility for farmers to receive direct payments for

hemp varieties registered in the EU Catalogue that have a maximum

THC level of 0,3 %. (IHS Markit Food and Agricultural Policy's

Pieter Devuyst and Jose Gutierrez)

- The European Industrial Hemp Association (EIHA) explained that this entails a potential enlargement of the number of hemp varieties accepted under the EU Catalogue, and pointed out that many EU members allow exceeding the 3% level.

- "I am proud of what has been achieved today. We worked hard to ensure that hemp had the recognition it deserves in the Common Agricultural Policy. I would say that this small step reflects that EU legislators are closer to fully acknowledging and recognizing the existence of a legitimate European hemp sector," the general manager of EIHA, Lorenza Romanese, said.

- France's business sentiment index stands at 110 in December,

down from 113 in November (revised from 114). The index has

declined for the first time in four months, but it remains well

above its long-term average of 100. (IHS Markit Economist Diego

Iscaro)

- The decline in sentiment has been particularly acute in the service sector, where the index has fallen from 114 to 108 (a seven-month low). Service-sector providers have reported significantly lower expected activity and demand, while the index measuring expected employment has also declined to its lowest level since April.

- Confidence is more subdued in all service sub-sectors, but it has fallen particularly sharply in accommodation/restaurants and administrative services (see second chart below).

- Meanwhile, confidence in the manufacturing sector has improved slightly as substantial increases in the indices measuring past production and production expectations have helped to offset weaker order books (particularly foreign). Confidence has improved in all manufacturing sub-sectors, with the exception of transport equipment.

- While confidence in the retail sector has edged downwards, the sentiment index in construction has improved to its highest level since 2007.

- Navya has launched the 6.X version of its Navya Drive autonomous vehicle (AV) software, according to a company statement. Navya says that this update, which has already been deployed across more than 20% of its vehicle fleet, will act as a core software for multi-platform deployments. The new 6.X version of Navya Drive is applicable to all current platforms, Autonom Shuttle, and Autonom Tract, as well as future third-party platforms such as the IT3 bluebus developed as part of the EFIBA project. Navya focuses on deploying Level 4 autonomous systems on a wide range of vehicle platforms. The company launched its Autonom Shuttle more than five years ago and claims to have sold more than 191 units across 23 countries as of June 2021. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- SEAT has announced that it has opened its new Test Centre Energy (TCE) facility, which will undertake research and development (R&D) on batteries for battery electric and plug-in hybrid vehicles. According to a company statement, the facility is located at SEAT's Technical Centre in Martorell (Spain). Thanks to EUR7 million (USD7.9 million) of investment, the 1,500-square-metre facility has a test capacity of up to 1.3 megawatts for testing the performance of cell modules, batteries, and electrified vehicles, employing 25 staff. (IHS Markit AutoIntelligence's Ian Fletcher)

- Vattenfall has awarded Jan De Nul the turbine installation contract for the Vesterhav Nord & Syd offshore wind project in the Danish North Sea. The contractor will use wind turbine installation vessel (WTIV) Vole au Vent to install 41 Siemens Gamesa 8.4 MW turbines. Construction is expected to start in 2022, with the project to be fully operational by the end of 2023. The wind farms are located between eight and nine km offshore. The project had originally been scheduled for commissioning in 2020, but was delayed after the Danish Energy Agency undertook supplementary environmental impact assessments (EIAs).

Asia-Pacific

- Most major APAC equity indices closed higher except for Australia -0.4%; Japan +2.1%, Mainland China +0.8%, South Korea +0.6%, Hong Kong +0.2%, and India +0.2%.

- China's Ministry of Agriculture and Rural Affairs has been opening public consultations on areas related to the cultivation of genetically modified, raising speculation about a gradual move towards the commercial cultivation of GM maize and soybeans. Earlier this month, the Ministry began consultations on amending seed industry regulations. Opinion was sought on the drafts of four ministerial regulations mainly focusing on: biosafety evaluation; naming and examination of crop varieties; seed production license of GM crops; and the amendment to national regulation on agricultural GMO safety control and the country's Seed Law. The expectation among research companies is that China could allow the commercial cultivation of GM soybeans or maize by late 2023. That would be in line with the goal of commercial cultivation of GM food crops envisaged in the country's 14th national five-year plan running from 2021-2025. The Ministry has also opened a public consultation on three supplements to existing registration measures, including data requirements for herbicides used on herbicide-tolerant maize and soybeans and two guidelines for efficacy trials on those GM crops. Compared with conventional herbicides, more detailed data would be required for herbicides, especially glyphosate and glufosinate, for use on GM crops. Product labels would have to indicate that the herbicide is only used for GM crops, as well as detailed application method and risk mitigation measures. (IHS Markit Crop Science's Sanjiv Rana)

- China's vehicle sales are expected to grow 5.4% year on year

(y/y) in 2022 to 27.5 million units, according to deputy

secretary-general of the China Association of Automobile

Manufacturers (CAAM), reports Gasgoo. The total vehicle sales will

include 23 million passenger vehicles (PVs), up 8% y/y, and 4.5

million commercial vehicles (CVs), down 6% y/y. In support of the

forecast, Chen cited predictions of China's GDP growth, efficient

prevention and control of the COVID-19 virus spread, and an

improvement in the semiconductor supply situation. (IHS Markit

AutoIntelligence's Nitin Budhiraja)

- The Chinese market's transition to electrification will further accelerate in 2022. According to CAAM data, new energy vehicle (NEV) sales accounted for 20.5% of total PV sales in November and 15.7% of total PV sales in the year to date (YTD). In addition, the market's shift towards EVs is driven by the increased availability of appealing EV models, rather than government subsidies.

- In the CV market, sales continued to deteriorate in November. High inventories of China V-compliant trucks remain the biggest drag on the CV market. OEMs' measures last year to clear China V-compliant trucks from inventories to prepare for the transition to the more-stringent China 6 emission standards have led to high volumes of unsold China V-compliant trucks in dealers' networks, which is dragging down sales of China 6-compliant models.

- Taiwan's Formosa Chemicals & Fibre Corporation (FCFC) has

started laying pipelines for its new purified terephthalic acid

(PTA) unit in China, according to a local media report. (IHS Markit

Chemical Market Advisory Service's Chuan Ong)

- This milestone keeps it on track to start up its 1.5 million mt/year PTA unit by April 30, 2023.

- FCFC has been constructing this new plant in Ningbo City, since ground-breaking on July 20 this year.

- Formosa runs another PTA plant in Zhejiang Province's Ningbo City, which has a capacity of 1.2 million mt/yr.

- OPIS data indicates that FCFC has started producing isophthalic acid (IPA) at its Ningbo site in 2021, with capacity reaching 200,000 mt/yr by 2022.

- Japan's trade balance recorded a deficit of JPY955 billion

(USD8.3 billion) on a non-seasonally adjusted basis in November.

The seasonally adjusted trade deficit also widened by 16.4% to

JPY487 billion. Export growth accelerated to 20.5% year on year

(y/y) in November following a 9.4% y/y rise in the previous month.

Import growth surged to 43.8% y/y in November after a 26.7% y/y

rise in October. In volume terms, exports and imports rose by 4.6%

y/y and 6.1% y/y, respectively. (IHS Markit Economist Harumi

Taguchi)

- The improvement in export growth was largely driven by exports to Asia (up 24.7% y/y) and to the US (up 10.0% y/y following a 0.3% y/y rise in October). Robust increases in exports of iron and steel (up 87.8% y/y), semiconductor machinery (up 44.7% y/y), and semiconductors (up 20.8% y/y) were major contributors to export growth. Export of autos also turned positive (up 4.1% y/y) following two consecutive months of declines.

- Higher prices for energy and other commodities continued to

underpin strong growth for imports. While imports of mineral fuels

remained the major driver of imports, contributing 19.7% percentage

points of total imports, imports of iron ore (up 110.8% y/y), iron

and steel products (up 126.5% y/y), and non-ferrous metals products

(up 62.8% y/y) remained major contributors to the overall growth of

imports. A surge in imports of aircraft (up 389.6% y/y) was also a

major factor behind the increase.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-december-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-december-2021.html&text=Daily+Global+Market+Summary+-+16+December+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-december-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 16 December 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-december-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+16+December+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-december-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}