Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 16, 2020

Daily Global Market Summary - 16 November 2020

Today, most major equity markets closed higher across the globe, with multiple US indices closing at new record highs. Benchmark European and US government bonds closed mixed, while iTraxx and CDX closed tighter across IG and high yield. The US dollar was slightly lower on the day, with oil, gold, and silver all closing higher.

Americas

- US equity markets closed higher today; Russell 2000 +2.4%, DJIA +1.6%, S&P 500 +1.2%, and Nasdaq +0.8%, with all, but the Nasdaq, reaching new record high closes.

- Today's announcement that Tesla will enter the S&P 500 on Dec. 21 follows months of speculation, and one temporary setback, after the stock failed to make the cut during the index's quarterly rebalancing in early September. The anticipation has helped drive a nearly fivefold rally in the stock this year, making the Palo Alto, California-based electric vehicle pioneer the biggest company ever to be added to the gauge, at nearly $390 billion of market value. It will also be one of the index's most influential constituents with a weighting that falls around those of Berkshire Hathaway Inc., Johnson & Johnson and Procter & Gamble Co. (Bloomberg)

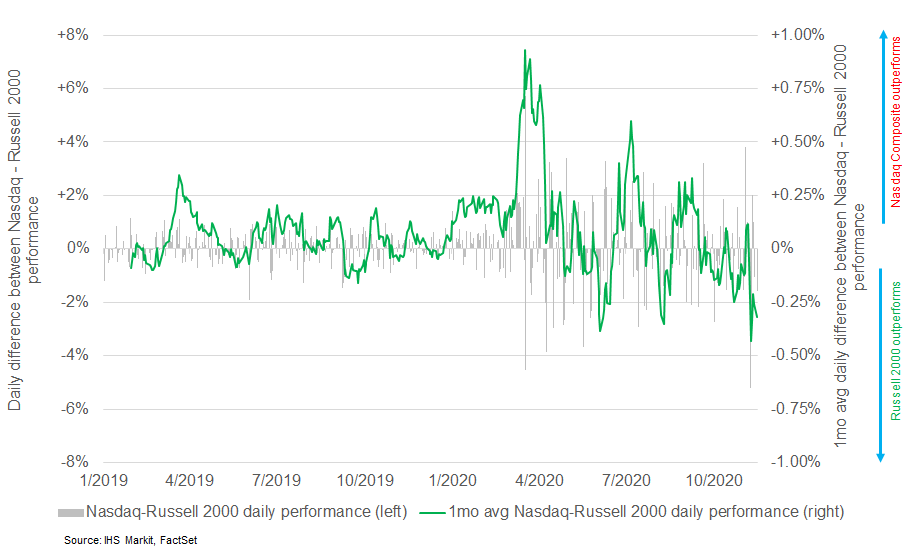

- The below chart gauges changes in COVID-19 sentiment across the

US equity markets by measuring the difference between Nasdaq

Composite and Russell 2000 daily performance. The grey bars

represent Nasdaq minus Russell 2000 daily performance and the green

line is the one-month average of the difference, with a value

greater than zero indicating more affinity to sectors that are

defensive to increases in COVID-19 concerns (ie. technology) and

values below zero indicate perception of improving conditions (ie.

positive vaccine trials) and increased government stimulus that

would particularly benefit smaller companies. The 1mo avg index

reached an almost two year low of -0.43% on 10 November and closed

at -0.32% today.

- 10yr US govt bonds closed flat/0.90% yield and 30yr bonds closed +2bps/1.67% yield.

- CDX-NAIG closed -2bps/52bps and CDX-NAHY -14bps/327bps.

- DXY US dollar index closed -0.2%/92.55.

- Gold closed +0.1%/$1,888 per ounce and silver +0.1%/$24.80 per ounce.

- Crude oil closed +3.0%/$41.34 per barrel.

- Moderna Inc. said its experimental coronavirus vaccine was 94.5% effective at protecting people from COVID-19 in an early look at pivotal study results, the second vaccine to hit a key milestone in U.S. testing. Ninety-five people in the study developed Covid-19 with symptoms; of those, 90 had received a placebo and only five Moderna's vaccine. The findings, from a 30,000-subject trial that is still under way, move the vaccine closer to wide use, because they indicate it is effective at preventing disease that causes symptoms, including severe cases. (WSJ)

- California will put more than 94% of its population in its most restrictive tier for coronavirus limits after a surge in cases that is "simply without precedent," Governor Gavin Newsom said Monday. Effective Tuesday, the state is moving 28 counties into the purple category in its four-tier system, indicating widespread transmission and requiring many indoor businesses to close. The regions affected include most of the San Francisco Bay area, San Diego and more rural counties. Los Angeles, the epicenter of the state's outbreak, has always been in the tightest category. (Bloomberg)

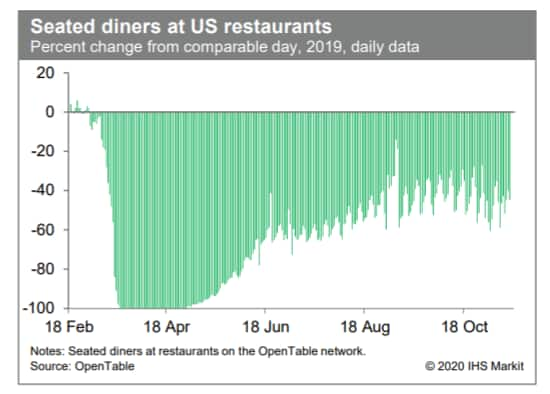

- The count of seated diners on the OpenTable platform averaged

over the last seven days was about 47% below the year-ago level.

This was a slight improvement over the prior week's average of 48%

down, but worse than readings around 40% down just one month ago.

(IHS Markit Economists Ben Herzon and Joel Prakken)

- The chair of the California Air Resources Board (CARB), Mary Nichols, has said that emissions targets agreed between the state and automakers could be a template for future US federal standards. Reuters quoted her as stating that this "is a good template and then we should be moving on to the next generation of regulation." On the question of future CAFE fuel efficiency stands, she said that they should be increased, but added that they are "not the most relevant tool for dealing with the future of transportation in this country or globally… Our future is not with the internal combustion engine." Nichols, who has been linked as a candidate for membership of US President-elect Joe Biden's Environmental Protection Agency (EPA), declined to say whether she was being vetted for a role, but added, "I have said that I am very interested but I think I also just need to make clear that I am interested in volunteering to do anything that is of service to the new administration." Nichols also suggested that there is "a huge volume of stuff that needs to be reversed and repudiated" by the new administration's EPA, but that some of the current policies could be undone "informally" through "negotiation and good will." (IHS Markit AutoIntelligence's Ian Fletcher)

- Uber Technologies has entered into negotiations to sell its autonomous vehicle (AV) unit, Uber Advanced Technologies Group (ATG), to AV startup Aurora Innovation, reports TechCrunch. According to the report, the companies have been in negotiations since October. If the deal goes ahead, it will enable Aurora to triple its headcount and Uber to unload its heavy-cash-burning division. Uber is now concentrating on profit over growth as it is under pressure from investors to be profitable. The company is refocusing on its core businesses, including ride-hailing and food delivery, since the coronavirus disease (COVID-19) virus pandemic. Uber's development of AV technology slowed because of a number of factors, including a fatal pedestrian accident in March 2018 in Arizona, United States, and a change of the company's leadership from founder Travis Kalaneck to Dara Khosrowshahi. In 2019, Uber ATG raised USD1.00 billion, at a valuation of USD7.25 billion, from Toyota, Denso, and SoftBank Vision Fund. Meanwhile, Aurora is seeking partnerships with automakers to integrate its AV technology into vehicle platforms. The company has recently attracted several clients, including Hyundai Group, Fiat Chrysler Automobiles, and Volkswagen. Aurora has AV operations in the US cities of Palo Alto, Pittsburgh, and San Francisco and recently expanded its testing to the US state of Texas. Aurora has received a three-year permit from the California Public Utilities Commission to conduct passenger rides in its fleet of driverless vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

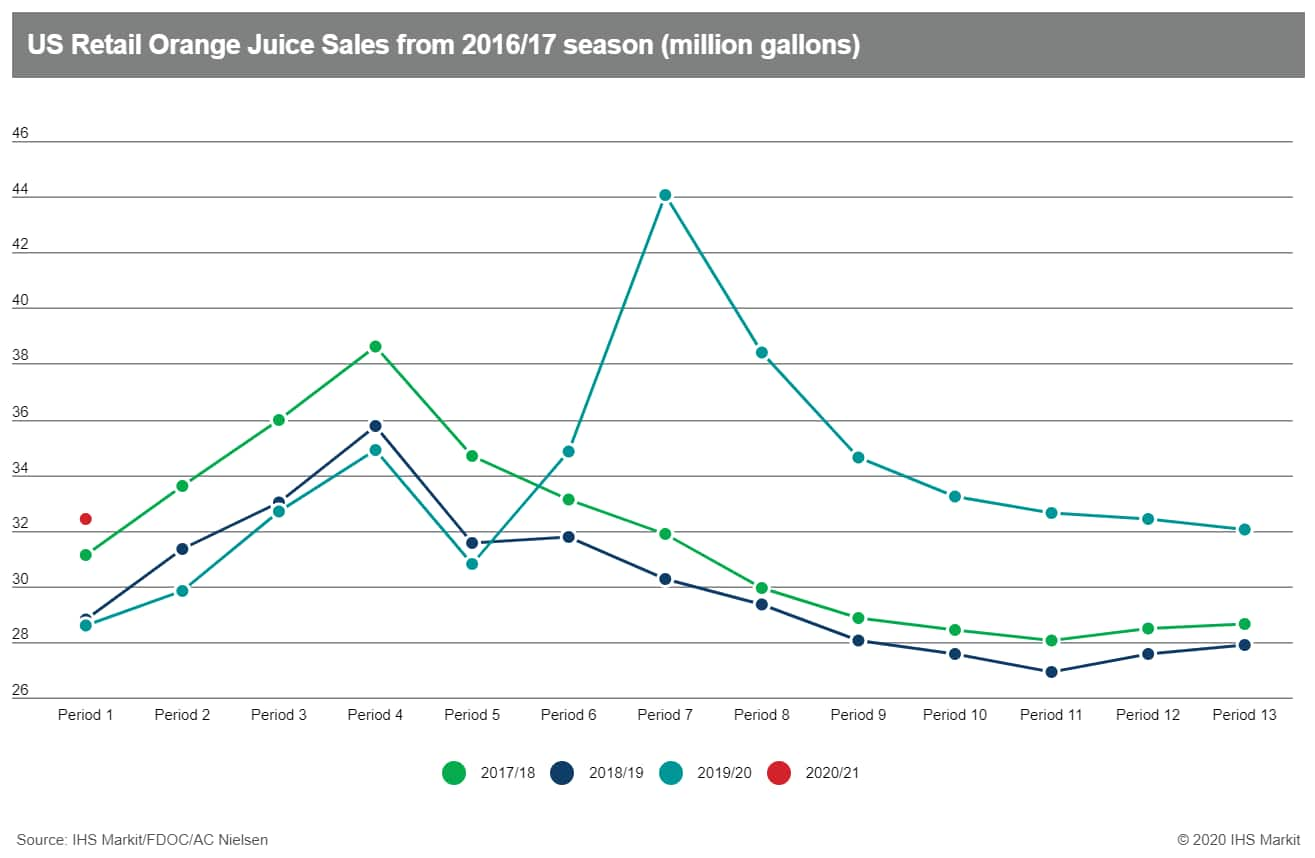

- US consumers bought 32.40 million gallons of orange juice in

the four weeks to 31 October, the first report of the new season.

By value, this represented an increase of 12% over 28.76 million

gallons in the same period last year. Value sales were USD234.47

million, compared with USD202.86 million. The key NFC sector was up

almost 20% by volume to 19.54 million gallons (16.42 million

gallons last season), worth USD168.80 million. Frozen orange juice

has continued its run with an increase in volumes of 11% to 930,000

gallons (840,000 gallons last season) and a value rise of nearly

14% to 5.10 million gallons (4.48 million gallons). Frozen orange

juice was almost extinct before the pandemic but has enjoyed a

renaissance since, even though volumes are small. It is the perfect

long-life juice product. (IHS Markit Food and Agricultural

Commodities' Neil Murray)

- Sasol has achieved beneficial operation of the final plant at its Lake Charles Chemicals Project (LCCP) in Louisiana, bringing the overall complex to full completion. The startup on 15 November of the 420,000-metric tons/year low-density polyethylene (LDPE) unit, which was damaged in a fire during commissioning in January, is the last of seven plants to be brought into operation. Total capital expenditure (capex) on the LCCP is forecast to be within the previously issued guidance of $12.8 billion, Sasol says. Beneficial operation signals that 100% of total nameplate capacity of the LCCP is operational, it says. All units at LCCP that were operating prior to Hurricane Laura have returned to operation, with no further operational impact from Hurricane Zeta, Sasol adds. Main power to the site was lost in late August after the arrival of Hurricane Laura. When Sasol made its original final investment decision for the LCCP in 2014, capex was estimated at $8.9 billion, but the figure was increased several times. Sasol entered into a $2.0-billion JV agreement for LyondellBasell to acquire a 50% stake in three of the LCCP base chemicals units. (IHS Markit Chemical Advisory)

- Ford is considering making its own battery cells, reports Reuters. The automaker's CEO, Jim Farley, said at the Reuters Automotive Summit teleconference that Ford is discussing battery manufacturing and he believes "that's natural as [electric vehicle, EV] volume grows". However, he shared no further details on the topic. Farley appears to have only given a general statement hinting that the automaker is weighing up whether to invest in its own battery manufacturing capability. As battery cells represent the most important and highest-cost components of EVs, automakers' investment in in-house battery know-how is considered critical in maintaining leadership in the EV sector. Compared to its US counterpart General Motors (GM), Ford's currently planned portfolio of pure EVs is much smaller. Therefore, investment in the field of battery manufacturing would need to be justified with a product plan involving scaling up production of EVs. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Ford will launch the E-Transit electric commercial van by the end of 2021 in the US and early 2022 in Europe. The E-Transit program leverages Ford's commercial vehicle leadership with innovative solutions enabled by the EV configuration and the company's work with telematics and connected vehicle fleet solutions. Since 2017, Ford has been explaining how it will build on its strengths in the commercial space and integrate new technology and propulsion system. The E-Transit reveal reflects Ford's deep understanding of commercial vehicle needs and provides tangible evidence that its efforts to create a more innovative environment is resulting in promising new vehicle solutions. (IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors (GM) has recalled 68,677 units of its Chevrolet Bolt electric vehicles (EVs) globally over a potential battery fire risk, reports Reuters. The recall affects model year (MY) 2017-19 Bolt EVs equipped with high-voltage batteries produced at LG Chem's Ochang (South Korea) facility. Of the total, the automaker has recalled 50,932 units in the US, and the rest are in other markets. GM said the vehicles pose a fire risk when charged to full, or nearly full capacity. It had developed software that will limit vehicle charging to 90% of full capacity to mitigate the risk, while it determines the appropriate final repair. Dealerships will update the vehicle's battery software beginning next week. Meanwhile, LG Chem said, "We will cooperate with GM and sincerely proceed with an investigation to identify the exact cause of fire". Vehicle recalls have become more frequent in recent years because of a more proactive approach from automakers following a series of industry-wide scandals, as well as greater official vigilance. The recall comes after five fires and two minor injuries have been reported. (IHS Markit AutoIntelligence's Jamal Amir)

- At its monthly monetary policy meeting in November, the Central

Reserve Bank of Peru (Banco Central de Reserva del Perú: BCRP)

opted to hold its benchmark policy rate at 0.25% for the seventh

consecutive month. (IHS Markit Economist Jeremy Smith)

- In view of below-target inflation and economic activity levels below pre-crisis levels, the central bank continues to provide aggressive monetary stimulus to help sustain the Peruvian economy through the ongoing crisis. The BCRP lowered the policy interest rate by a combined 200 basis points in March and April to arrive at the current level.

- Nonetheless, real interest rates have inched further into negative territory as the bank's continued commitment to expansionary policy begins to lift inflation expectations closer to the 2% target rate.

- In addition, as of 11 November, the BCRP has injected PEN61.7 billion worth of liquidity into the economy, PEN50.2 billion of which are government-backed repo operations. These measures boosted private-sector credit by 14.1% year on year in September, the largest such increase among major Latin American economies.

- The BCRP advises that a stance supportive of strong monetary expansion may be required for a "prolonged period" while the effects of the COVID-19 virus continue to exert downward pressure on inflation. IHS Markit currently forecasts a 1.72% increase in the consumer price index for 2020 and we expect the policy interest rate to remain at the current level until late 2021.

- At the same time, fiscal support remains strong as the government implements a USD25-billion stimulus package. In addition, the government is weighing new proposals to support households with early withdrawals from private and public pension funds. If implemented, these measures would add to a fiscal response that is already among the most ambitious in the region, although the effects would not directly benefit the large informal sector. However, the 10 November impeachment of now former-president Martín Vizcarra has added greater uncertainty to the policy direction.

- Argentina's Minister of Economy Martín Guzmán confirmed on 12 November that the government will not extend COVID-19-virus-related assistance programs into 2021. These include emergency handouts to families (Ingreso Familiar de Emergencia: IFE) and financial aid to help private companies, particularly small and medium-sized enterprises (SMEs), to pay salaries (Asistencia de Emergencia al Trabajo y la Producción: ATP). Instead, the government announced the strengthening of existing non-COVID-19-virus-related social programs, such as a job promotion scheme and child benefit. The announcement came while the government is renegotiating a USD44-billion loan with the International Monetary Fund (IMF). The umbrella labor union the General Confederation of Labour (Confederación General del Trabajo: CGT), traditionally an ally of the ruling Peronist party, criticized the cuts. Strikes and protests are likely to increase in the coming months while negotiations with the IMF are ongoing. President Alberto Fernández has ruled out accepting deep spending cuts or structural reform on pensions, labor or taxes as conditions of a new IMF deal. However, gradual spending cuts are likely, with the government proposing a primary fiscal deficit of 4.5% of GDP in 2021 (down from 6.6%) and it is likely to accept a slightly lower target. Changes to the way pensions are calculated are also being discussed and opposed by the CGT. This increases the likelihood of the CGT calling for a general strike in the next few months, causing major disruption to transport, commerce, and government services for 24 to 36 hours, particularly in Buenos Aires, but also other cities, such as Córdoba, Rosario, and Santa Fe. Delays at ports in Rosario and Buenos Aires are also likely. (IHS Markit Country Risk's Carla Selman)

Europe/Middle East/Africa

- European equity markets closed higher across the region; Spain +2.6%, Italy +2.0%, France/UK +1.7%, and Germany +0.5%.

- 10yr European govt bonds closed mixed; UK +1bp, Germany/France -1bp, and Italy/Spain -2bps.

- iTraxx-Europe closed -2bps/50bps and iTraxx-Xover -14bps/285bps.

- Brent crude closed +2.4%/$43.82 per barrel.

- The UK government is preparing to outline plans to end the sale of gasoline (petrol) and diesel ICE passenger cars in the country. According to a report by The Financial Times, the measures will be announced as part of a wider package of environmental initiatives in the United Kingdom. Sources told the newspaper that the UK government intends to pull forward an earlier stated deadline to 2030 as a way of accelerating the market growth of battery electric vehicles. However, the sources added that hybrids and plug-in hybrids are set to remain on sale until 2035, according to the report. An earlier government statement had announced the intention to end the sale of ICE light vehicles in the UK by 2040. However, Prime Minister Boris Johnson revealed earlier this year that the country was planning to pull forward this target to 2035, although comments and previous reports have suggested that this could take place even earlier. Having undertaken a consultation on the matter, the final announcement has been delayed by the COVID-19 virus pandemic. The report suggests that an announcement could come this week, although it remains to be seen whether this will be affected by the current self-isolation of Prime Minister Johnson following exposure to the COVID-19 virus last week. Although beneficial to the country's vehicle emissions targets, the banning of the sale of new passenger cars using ICEs within 15 years raises questions over what this will mean for the UK Treasury, which raised GBP27.9 billion through duty in the financial year 2017/18, according to the Office of Budget Responsibility. However, The Times reports that Chancellor of the Exchequer Rishi Sunak is said to be "very interested" in the idea of a national road-pricing scheme to make up for this shortfall. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Volkswagen (VW) Group has outlined enhanced spending plans for its electric and autonomous vehicle program as part of its latest corporate planning round, which will commit EUR73 billion in the next five years, according to a company statement. The plans will cover electrification, autonomy and digitization, with a renewed focus on the latter as VW steps up efforts to ensure its digital platforms and operating systems can be a match for the likes of Tesla and potential tech disruptors that are eyeing the automotive and mobility spaces. As a result, investment in digitization will be doubled over the next five years to EUR27 billion. The other big headline is that the share of investments in future technologies has been raised to about 50% of the total EUR150 billion, from 40% in the previous planning round. Out of the EUR73-billion investment in addition to the EUR27 billion on digitization, EUR11 billion will be spent on hybridization and EUR35 billion on electromobility. This planning round assumes that VW's production of full battery electric vehicles (BEVs) will stand at 26 million by 2030. Some 19 million of these vehicles will be based on the Modular Electric Drive Toolkit (MEB), with most of the remaining 7 million to use the high-performance PPE platform. The Group estimates production of around 7 million hybrid vehicles over the same period. (IHS Markit AutoIntelligence's Tim Urquhart)

- SGL Carbon SE, which manufactures carbon fibre reinforced plastic (CFRP) components for BMW Group, is looking to shed 500 jobs as response to diminishing interest in its products, according to a Bloomberg report. SGL has also been hit hard by the decline in the aerospace industry during the coronavirus disease 2019 (COVID-19) virus lockdown period, a sector to which it also supplies a lot of components. The company will book an impairment of as much as EUR100 million (USD118 million) in the fourth quarter, while lowering its headcount at the same time. BMW invested in SGL Carbon in 2011 as it wanted to secure a supply of CFRB to trim the weight of models such as the i3 electric vehicle (EV) hatchback and i8 plug-in hybrid (PHEV) sports car. But while the material is lighter and stronger than steel, it is cost- and labor-intensive to produce. In 2017, BMW announced that it was divesting its 49% stake in its joint venture (JV) with SGL Carbon SE, SGL Automotive Carbon Fibers GmbH & Co. KG (Germany) and SGL Automotive Carbon Fibers LLC. At the time, BMW was quick to state that it would remain a customer for SGL for CFRP components, as its forthcoming iNEXT flagship uses the technology on a comprehensive basis. However, it appears that the car that the iNEXT has become, the recently announced iX, will not feature an extensive use of CFRP in its structure. (IHS Markit AutoIntelligence's Tim Urquhart)

- UCB Pharma (Belgium) has acquired gene therapy development company Handl Therapeutics (Belgium) for an undisclosed sum. The purchase marks a major step forward for UCB's planned expansion of its research and development (R&D) pipeline and existing programs in the gene therapy field. Handl will bring expertise in adeno-associated virus (AAV) capsid technology in vivo gene therapies in neurodegenerative disease areas. In the same vein, UCB has also announced a new research and licensing collaboration pact with gene therapy start-up Lacerta Therapeutics (US), with a focus on AAV-based central nervous system (CNS) gene therapies. The collaboration deal gives Lacerta responsibility for conducting preclinical research, as well as early-stage manufacturing processes development. For its part, UCB will take responsibility for early-stage studies, a new investigational drug application, and manufacturing and clinical development. (IHS Markit Life Sciences' Eóin Ryan)

- The "flash" estimate by the Russian Federal State Statistical

Service includes only one figure, while the detailed breakdown of

the expenditure components will not be available until 30 December.

(IHS Markit Economist Lilit Gevorgyan)

- However, the available high-frequency data suggests that recovering consumer spending had a significant contribution to moderating annual losses in the real GDP.

- Specifically, retail sales turnover fell only by 2.5% y/y in the third quarter, compared to 16.7% y/y decline in the previous period when the sector felt the brunt of the lockdown to contain the COVID-19 virus.

- Paid services continued their double-digit fall during July-September, down by 18.8% y/y. However, the contraction was milder when compared to the fall of 37.3% y/y in the second quarter.

- Service-sector sentiment, captured by the IHS Markit PMI survey, shows a decisive improvement in the performance of the index. The index remained in growth territory in the third quarter, with its quarterly headline figure averaging at 56.8, contrasting sharp contraction in the previous quarter, when the index averaged at 31.9.

- Conversely, industrial output troubles persisted due to the implementation of the crude oil production cuts as part of the OPEC+ deal. The quarterly average fall of the sector in the third quarter stood at 5.0% y/y, compared to 6.5% y/y fall in the previous quarter.

- Recovering domestic demand helped the Russian manufacturing sector, which even posted a timid 0.4% y/y growth in August. IHS Markit Manufacturing PMI index recovery from a quarterly average of 38.9 in the second quarter of 2020 to 49.4 in the third quarter.

- The recovery in the third quarter was stronger than expected, but the available data suggest that the momentum had not been sustained at the start of the last quarter of the year.

- Despite lost exports of goods and services, Slovenia's

current-account surplus continued to grow sharply against

year-earlier levels throughout the first three quarters of 2020.

External debt rose sharply over the course of the first nine

months, however, even as the current account remained firmly in the

black. (IHS Markit Economist Andrew Birch)

- After posting another large surplus in September, the cumulative surplus through the first three quarters reached EUR2.480 billion, up by more than EUR400 million year on year (y/y). In particular, the merchandise-trade surplus has grown sharply over the course of 2020, up by nearly EUR900 million y/y as of September.

- The surge of the merchandise trade surplus has been a result of moderating export losses and severe import contraction (see Slovenia: 11 November 2020: Slovenia's industrial recovery falters in September, even as export losses continue to moderate). The current-account surplus has expanded even as the severe loss of service exports has slashed the services surplus.

- After a surge of portfolio investment inflows early in 2020, Slovenia saw a net outflow of portfolio investments every month since June. While the country may register a net inflow of portfolio investment for the year as a whole, these net outflows are likely to continue through the rest of the year.

- Import demand will remain extremely weak through the end of the year, exacerbated by the recent ramping up of lockdown measures against the background of a second wave of COVID-19. Even as the services surplus is severely undermined, IHS Markit anticipates that the current-account surplus will reach nearly 6% of GDP in 2020, up from the reported 5.6%-of-GDP surplus in 2019.

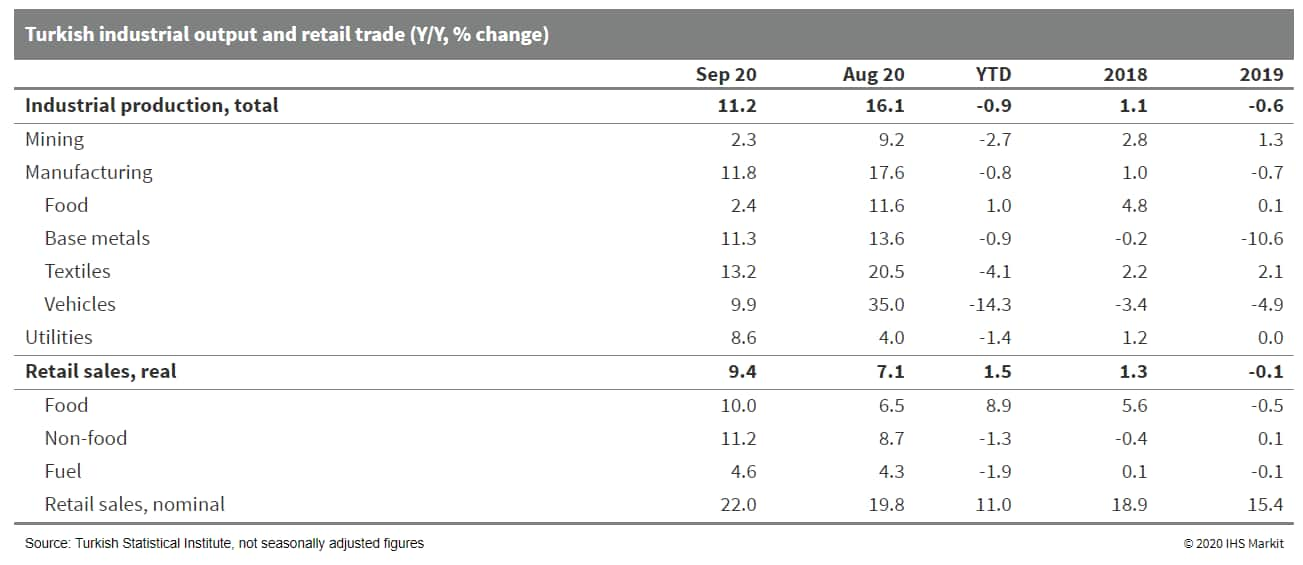

- The Turkish economic recovery continued throughout the third

quarter. Expansionary monetary policy and comparatively lax

anti-pandemic lock-downs contributed to both industrial production

and retail trade gains through September. A growing likelihood of a

sharp tightening of monetary policy in the fourth quarter will

bring these gains to a halt. (IHS Markit Economist Andrew Birch)

- In September 2020, Turkish industrial production grew by 1.7% month on month (m/m) in seasonally and calendar adjusted terms. After a plunge of output in March-April 2020, industrial production recovered strongly in May-June, returning total output to pre-pandemic levels as of July. Since mid-year, m/m industrial gains have slowed, but total output remains well up from year-earlier levels.

- In the third quarter, a moderation of export losses lowered the barrier to the recovery of industrial activity. After plunging by more than 26% year on year (y/y) in nominal dollar terms in the second quarter, total exports slipped by only 2.4% y/y in the third quarter.

- Without export losses dragging down demand for industrial activity as strongly, sustained strong domestic demand expansion provided a strong lift to industrial activity. Domestic credit was up by nearly 39% y/y as of end-September - rising from around 25% y/y as of end-June - providing impetus domestic demand for industrial activity.

- Strong credit expansion also fueled the strong retail trade activity in the third quarter. In seasonally and calendar adjusted terms, the total volume of retail trade was 25% higher in the third quarter than it had been in the second quarter. By September, the volume of total retail trade turnover had returned to pre-pandemic levels.

- Expansionary economic policies have been critical for both

fueling a sharp domestic demand recovery from the global

pandemic-induced downturn in the second quarter. These policies

have also, however, triggered a sharp widening of the

merchandise-trade and current-account deficits.

- Zambia became the first country in the sub-Saharan African

region to default on its external debt obligations due to

COVID-19-pandemic-related fiscal pressures. This follows the 30-day

grace period for a USD42.5-million coupon payment on a Zambian bond

that expired on 13 November. (IHS Economist Thea Fourie)

- On 20 October, the Zambian authorities approached bondholders to freeze debt obligations on three Eurobonds. Uncertainty over how Chinese private creditors will be treated, the release of a relatively scant 2021 national budget ahead of national elections scheduled for next year, and lack of a comprehensive International Monetary Fund (IMF) financially supported program that could result in debt sustainability over the medium term resulted in an underwhelming outcome at the bondholders' negotiations.

- The latest development will push IHS Markit's medium-term sovereign risk rating for Zambia to 70/100 (equivalent to CC+ on the generic scale) immediately, in the Default - Interest Arrears category. The outlook is likely to remain unchanged at Negative, increasing the risk of Zambia's debt rating being downgraded to 75/100 (CC), in the Default - Accumulating Interest Arrears category. An update of the IHS Markit medium-term sovereign assessment will be made within the next week.

- Zambia defaulted on its private creditor debt obligations shortly after the G20 countries (including China) approved a common framework for restructuring government debt for low-income countries on 13 November. Only countries with debt levels deemed unsustainable will qualify for possible debt reduction of rescheduling. This debt initiative will be in addition to the temporary external-debt freeze extension, which will end on 30 June 2021. The G20 will require full debt transparency to make this initiative successful.

Asia-Pacific

- APAC equity markets closed higher; Japan +2.1%, South Korea +2.0%, Australia +1.2%, Mainland China +1.1%, Hong Kong +0.9%, and India +0.5%.

- Mainland China's industrial value-added growth stayed at 6.9%

year on year (y/y) in October, unchanged from the year-high

recorded a month ago. However, the month-on-month (m/m) growth

moderated to 0.78%. (IHS Markit Economist Yating Xu)

- By sector, the headline stabilization was largely supported by acceleration in mining, likely owing to the rising prices of coal and steel amid the strong property investment. Manufacturing moderated marginally with slowdown in auto, computer, communication, and electronic equipment manufacturing, while textile, ferrous-metals and non-ferrous metals smelting rebounded.

- By ownership, October industrial production was driven by acceleration in private sector, while growth in state-owned sector and foreign firms slowed.

- Service production index rose by 2 percentage points to 7.4% in October, returning back to the three-year average level. The year-to-date index stayed in a 1.6% y/y contraction.

- By sector, real estate and transportation were the main drivers to services growth, while growth in renting remained weak and hotel and catering sector stayed in contraction.

- Fixed-asset investment (FAI) expanded 1.8% y/y through October, up 1 percentage point from a month ago and the growth in October rebounded to 12.2% y/y.

- By sector, the headline improvement was largely owing to strong property investment, with the year-to-date growth accelerated to 6.3% y/y and the estimated de-cumulative growth rose to 12.2% y/y. Manufacturing investment continued to recover with the estimated de-cumulative growth rose to 3.7, while the year-to-date figure remained in contraction. Investment in pharmaceuticals, IT, and electronic equipment maintained double-digits growth. Supported by gradual starts of major projects, infrastructure investment returned to expansion on year-to-date terms and the de-cumulative growth accelerated to 4.5% y/y.

- From the demand side, estimated de-cumulative floor space of housing sold bounced to 15.3% y/y in October, the fastest rate since July 2017 and the sales value growth recorded a 23.9% y/y expansion. From supply side, floor space of new starts and completion returned to expansion after two consecutive months of contraction in September and August. However, floor space of land purchase registered the fourth consecutive months of contraction, reflecting the rising base and tightened financing restriction.

- As the recovery in housing sales continued to outpace that in construction, housing inventory declined by 1.48 million in October, the eighth consecutive months of decline.

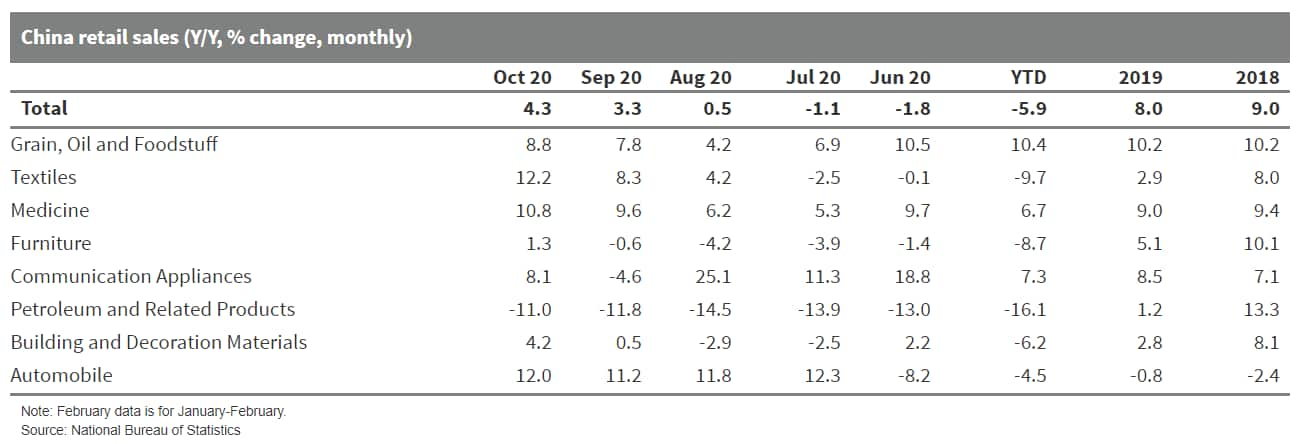

- Nominal and real retail sales growth increased to 4.4% y/y in October. Catering sales recorded its first expansion since the beginning of the year and commodity retail sales growth excluding auto accelerated to 3.6% y/y. However, retail sales of small firms deteriorated to contraction following a temporary expansion in September. Online sales of commodities rose 23.6% y/y supported by the 'double-11' shopping festival, while retail sales excluding online sales registered a 4.1% y/y contraction.

- Economic recovery is expected to moderate in the last two

months of the year as pent-up demand and production are gradually

digested and stimulus policy eases. M/m industrial production has

been moderating, property market control is tightening, and

regulators could be more cautious of risks amid the recent

corporate credit debt defaults.

- Brilliance Automotive Holdings, the Chinese joint venture (JV) partner of BMW, says its parent company, Huachen Automotive Group, may undergo restructuring after a creditor filed an application to a Chinese court, reports Reuters. According to a filing submitted by Brilliance Auto to the Hong Kong Stock Exchange on 15 November, Gezhi Automobile Technology Co filed an application to the Shenyang Intermediate People's Court for the restructuring of Huachen. It remains uncertain whether the restructuring application will be accepted by the court. Huachen, owned by the government of Liaoning province, has long been struggling with the poor performance of local brands introduced by Brilliance Auto. The automaker's passenger vehicle brand, Zhonghua, for instance, only recorded sales of 1,045 units in the first three quarters of 2020. However, owing to the strong sales performance of the BMW Brilliance JV, Brilliance Auto still reported a net profit of CNY6,763 million (USD1,027 million) in 2019. The JV's contribution to Brilliance Auto's profit is expected to decline significantly from 2022 as BMW is in the process of increasing its stake in the JV from 50% to 75%. The deal is set to be completed by 2022. (IHS Markit AutoIntelligence's Abby Chun Tu)

- According to a Chinese notice by Baoshang Bank published on the

National Interbank Funding Centre (NIFC)'s website on 13 November,

the bank has written down a CNY6.5-billion (USD980 million) tier-2

bond released in 2015 after the bank had been issued with a

"non-survival trigger event" by the People's Bank of China (PBoC)

and China Banking and Insurance Regulatory Commission (CBIRC) on 11

November, also listed on the NIFC website. The notice states that

interest will cease to be paid. (IHS Markit Banking Risk's Angus

Lam)

- Separately, Bloomberg reported on 13 November that banks are reducing their exposure to corporate bonds. China's big four banks are reported to be selling debts issued by China's state-owned enterprises and tightening the procedures and upgrading the approval requirement when purchasing corporate bonds.

- PBoC announced in its semi-annual monetary policy execution report in August that Baoshang Bank will file for bankruptcy after its one-year administrative takeover expires and some of its assets have been taken over by Mengshang Bank. Therefore, the subsequent announcement regarding the bank's "non-survival trigger event" and the writing down of its debt instrument is expected.

- Although the Shanghai Interbank Offered Rate (SHIBOR) has risen on both 12 and 13 November, it is unlikely to reflect on Baoshang Bank's bond situation because Baoshang Bank has long been expected to file for bankruptcy and SHIBOR takes the average of 18 commercial banks with strong credit risk ratings. The writing down of Baoshang Bank's bond is unlikely to trigger impact-and-cause contagion to the rest of the sector as this is part of the organized winding down of the bank.

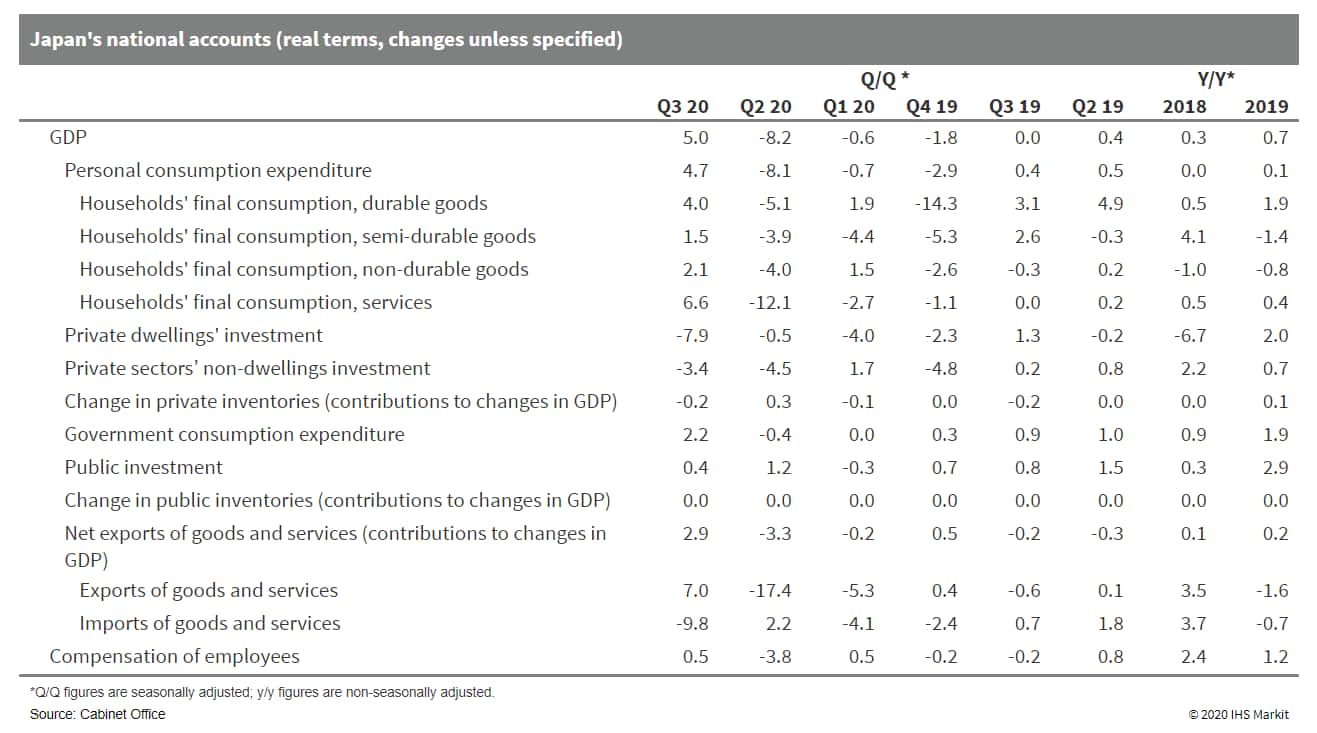

- Japan's real GDP growth rebounded by 5.0% quarter on quarter

(q/q, or 21.4% q/q annualized) in the third quarter of 2020

following a contraction of 8.2% q/q (or 28.8% q/q annualized,

revised down from a contraction of 7.8% q/q or 28.1% q/q

annualized) in the previous quarter. The greatest q/q growth in the

past 52 years, which followed three consecutive quarters of

declines, was thanks largely to rebounds in private consumption and

exports. (IHS Markit Economist Harumi Taguchi)

- Net exports contributed 2.9 percentage points to the q/q rise in real GDP growth.

- Exports of goods rose by 11.0% q/q largely because of improved exports of autos and other machinery.

- Imports of goods dropped by 9.2% q/q on the dropout of positive effects in the previous quarter from easing supply chain disruption (due to lockdowns in China) and weaker demand for machinery and production materials. Export and import services declined sharply because of border controls to contain the pandemic in Japan and abroad.

- Private consumption rose by 4.7% q/q, reflecting the resumption of economic activity after the lifting of the state of emergency in late May.

- In addition to the reopening of non-essential stores and longer business hours, the government's stimulus measures also contributed to the improvement in spending on all goods and services. In particular, easing social distancing guidelines and travel subsidies helped lift spending in services (up 6.6%q/q).

- Private consumption remained below the first-quarter level and the recovery following three consecutive quarters of declines was rather modest. This was partially due to the resurgence of COVID-19 infections from July to August and only a 0.5% q/q rise in compensation of employees because of the sluggish recovery in employment and hours worked.

- Public demand also rose by 1.9% in line with the introduction of various stimulus measures under the two sizeable economic packages. Government consumption surged by 2.2% q/q, while public investment continued to increase but softened to 0.4% q/q.

- Despite rebounds in private consumption and exports, private non-residential investment continued to decline, slipping 3.4% q/q.

- Double-digit decreases in corporate profits, low capacity utilization, and weak outlooks for a recovery suppressed machinery orders, weighing on capital investment.

- Private residential investment also continued to decline (by 7.9% q/q), reflecting pushbacks for housing starts during the state of emergency and a decline in household income.

- The third-quarter results were better than IHS Markit's projection. We forecast Japan's real GDP to shrink by 5.4% in 2020 and rise by 2.2% in 2021.

- While travel campaigns and other stimulus measures continued to boost personal-related services in October 2020, the upward momentum of economic activity is likely to soften in the fourth quarter and also in the first quarter of 2021. Although the government does not intend to halt its travel campaign, the recent rise in new confirmed infections could make consumers cautious.

- Weak outlooks for wages could suppress private consumption once

economic activity resumes, particularly when the upside from the

government's stimulus measures eases.

- Panasonic is planning to develop the new '4680' cylindrical battery cell for Tesla, reports Reuters. The cells will be based on the new tabless cell format unveiled by Tesla at its Battery Day in September. "We have considerable know-how for that battery. We started working on it immediately after Tesla's Battery Day and are also preparing to set up a prototype production line in parallel," said Panasonic CFO Hirokazu Umeda. At the Battery Day event, Elon Musk, cofounder and CEO of Tesla, unveiled a bigger and more powerful 'tabless' 4680 battery cell. The new cell has a bigger form factor than the current 2170 cell with a tab. The new cells replace tabs with a laser-patterned spirally-wound active material with dozens of connections. According to Tesla, this has reduced the electrical path length by five times from 250 mm to just 50 mm, and has resulted in a cell with better power-to-weight ratio compared to smaller cells. The end result is five times more energy, six times more power, enabling a 16% higher range, at a 14% USD/kWh cost reduction. By using innovative battery manufacturing technology, Tesla claims that it can reduce battery cell costs by 56%. Panasonic is also planning to increase battery production capacity at Tesla's gigafactory in Nevada (US). The Japanese company will invest about USD100 million in the new line, which is expected to increase production capacity by 10% to 39 GWh annually by 2022. The additional line will take the number of production lines at the Nevada gigafactory to 14. (IHS Markit AutoIntelligence's Jamal Amir)

- Asian styrene spot price surged to a two-year high last Friday

when it closed at $1,145/mt CFR China, IHS Markit chemical data

showed. Prices have rallied since the Chinese market reopened on 12

Oct after an extended National Day and Mid-Autumn festival spanning

1-9 Oct. The spot price jumped $442.50/mt or 63%, outpacing all

other aromatics. (IHS Markit Chemical Advisory's Sok Peng Chua)

- Stable downstream polymer operating rates in China were credited for styrene's price gain. Last Friday's IHS Markit Global Aromatics Weekly reported EPS run rate at 70-79%; polystyrene at 80-89% and acrylonitrile-butadiene styrene also at 80-89%.

- Low import volumes coupled with regional styrene units turnaround also contributed to a supply crunch. IHS Markit forecast that in Q4 China is expected to face a shortfall of 110,000 mt of styrene. "This situation could extend into Q1 next year as Middle Eastern styrene producers go into their turnaround season," said Liqiong Xi, IHS Markit senior research analyst. China imports more than 30% of its styrene from Saudi Arabia and Kuwait, trade data showed.

- On top of supply/demand fundamentals, speculative play by industry participants also contributed to Asian styrene's relentless rally.

- On Monday, discussion for prompt SM was between RMB9,950-10,000/mt or $1,297/mt on import parity basis, up RMB875 or 9.6% from last Friday. The market is sharply backwardated with January parcels priced between RMB8,240-8,330/mt ($1,075/mt on import parity basis). Benchmark January styrene futures on Dalian Commodity Exchange closed Monday at RMB8,299/lot, up RMB602 or 7.82%.

- A Shanghai-based trader felt that there is more room for styrene spot price to rise, based on historical highs achieved in 2015 and 2018. "China's domestic styrene price has yet to peak. The record high styrene spot price for prompt cargoes was at RMB14,700/mt in 2015 followed by RMB12,700/mt in 2018," he said. "Some of the spot transactions were done by short-sellers and cargoes were changing hands dozens of times without ever reaching the end-user," he added.

- South Korean OEMs Hyundai, Kia, General Motors (GM) Korea, Renault Samsung, and SsangYong have announced a 4.3% year-on-year (y/y) decline in their combined domestic output to 336,279 units during October, reports Yonhap News Agency, citing data released by the South Korean Ministry of Trade, Industry, and Energy. Vehicle exports by the South Korean OEMs also fell during the month, by around 3.2% y/y to 200,666 units, and the total value of their overseas shipments increased by 5.8% y/y to USD4 billion. The report highlights that South Korea's vehicle shipments to North America increased by 12.4% y/y in October, while vehicle exports to the European Union rose by 17.7% y/y, to Eastern European countries fell by 9.6% y/y, and to Asian countries declined by 21.2% y/y. Hyundai, South Korea's biggest automaker, posted a 12.2% y/y decrease in exports last month, due to rising COVID-19 virus cases in Europe. However, Hyundai affiliate Kia's overseas shipments jumped by 15.7% y/y in October, thanks to robust sales of alternative-powertrain models. Exports by Renault Samsung nosedived by 93.9% y/y last month, while exports by SsangYong increased 23.7% y/y. Outbound shipments by GM Korea grew by 2.2% y/y in October, on the back of the robust sales of sport utility vehicles (SUVs). The decline in South Korean vehicle production and exports during October was largely the result of sluggish demand in overseas markets caused by a contraction in consumer spending amid the COVID-19 virus pandemic, as well as a production suspension at Renault Samsung. (IHS Markit AutoIntelligence's Jamal Amir)

- South Korea's domestic sales of carbonated soft drinks (CSDs) and cider totaled KRW271.2 billion and KRW151billion, respectively, in the first half of 2020. This represents increases of 12% and 4%, year-on-year. Sales of energy drinks and carbonated water rose by 10% and 9%, y-o-y, to KRW118.4billion and KRW49.4billion, due to higher demand during lockdown. On the other hand, sales of juice (-7.4%), bottled water (-2.8%) and RTD coffee (-0.2%) declined. Lotte Chilsung Beverage, one of the country's major suppliers, reckons that there are few products that can replace carbonated drinks at specialty beverage stores, and their low price compared with functional drinks is the secret to their popularity. Recently, Lotte Chilsung has been strengthening the marketing of carbonated beverages and expanding its product range. Trevi, the number one carbonated water brand, has diversified its capacity from 300ml to 1.2L to satisfy various consumer needs, and Hot6ix, an energy drink, is expanding its lineup of The King products that differentiate capacity and calories. (IHS Markit Food and Agricultural Commodities' Mainbayar Badarch)

- Malaysia's real third-quarter GDP increased 18% over the second

quarter. This, however, follows a sharp drop in the second quarter

because of coronavirus disease 2019 (COVID-19) virus

pandemic-related lockdowns; therefore, third-quarter GDP was still

down 2.7% from a year earlier. (IHS Markit Economist Dan Ryan)

- The largest contributor to the rebound was private consumption. This makes sense, since household spending was hard-hit during the lockdowns, but the spending surge is nevertheless surprisingly strong given that social distancing and movement control continued in the third quarter.

- The other big growth component was exports, which fits the pattern of other successful emerging Asian economies. Capital expenditures also increased substantially, reflecting the optimistic outlook of exporting firms and their plans for expanding output.

- Imports increased, but not very much considering the rise in consumption, capex, and exports. This is explained by the drop in inventory investment, that is firms pulled raw materials and unsold final goods out of inventory, thereby reducing their need for imported goods.

- From the production side, services were the largest growth sector. This is unsurprising since this sector was feeding the surge in private consumption.

- Manufacturing was another big gainer, reflecting the rise in exports. Note that manufacturing is on a value-added basis; so, this plus a roughly equal amount of inputs yields the much larger expenditure-measured number for exports.

- Construction also rebounded strongly in the third quarter. This was a welcome sign, since construction was hit much harder than the overall economy in the second quarter, but the sector remains down more than 12% from a year ago.

- The strong recovery in the third quarter is a good sign. It shows not just Malaysia's growth potential, but also its flexibility in bouncing back from a negative demand shock.

- The current fourth quarter, however, remains problematic. A surge in COVID-19 cases has led to increased lockdowns and more rigid movement controls, making it more likely that GDP will decline in the fourth quarter.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-november-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-november-2020.html&text=Daily+Global+Market+Summary+-+16+November+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-november-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 16 November 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-november-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+16+November+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-16-november-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}