Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 17, 2021

Daily Global Market Summary - 17 February 2021

All major European and most APAC equity indices closed lower, while the US was mixed. Benchmark European government bonds closed mixed and US government bonds were sharply higher but did not fully retrace all of yesterday's losses. European iTraxx and CDX-NA credit indices closed almost unchanged across IG and high yield. The US dollar and oil closed higher, silver flat, and gold/copper were lower on the day.

Americas

- US equity indices closed mixed; Russell 2000 -0.7%, Nasdaq -0.6%, S&P 500 flat, and DJIA +0.3%.

- 10yr US govt bonds closed -5bps/1.27% yield and 30yr bonds -6bps/2.04% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY +1bp/288bps.

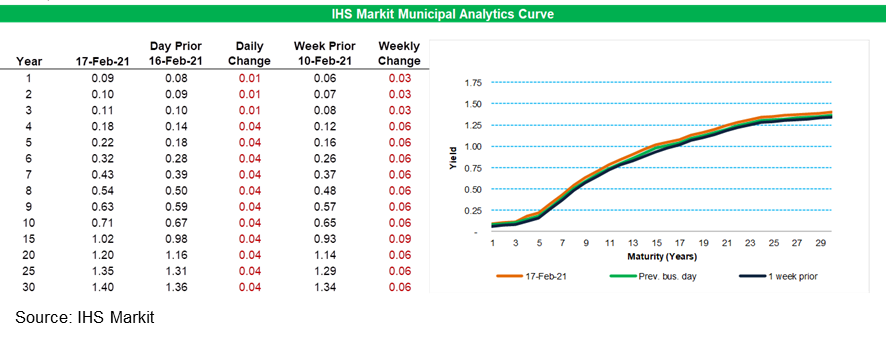

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

closed +4bps for 4yr and longer paper today and that same part of

the curve is +6bps week-over-week.

- DXY US dollar index closed +0.5%/90.95.

- Gold closed -1.5%/$1,773 per ounce, silver flat/$27.32 per ounce, and copper -0.3%/$3.82 per pound.

- Crude oil closed +1.8%/$61.14 per barrel.

- Total US retail trade and food services sales increased 5.3% in

January and core retail sales jumped 6.2%. Though solid, the

increase was less than we expected. As a result, we lowered our

first-quarter forecast of real personal consumption expenditures

(PCE) growth by 3.5 percentage points to 4.0%. (IHS Markit

Economists James Bohnaker and David Deull)

- All major retail categories posted positive sales growth, with electronics and appliance stores (14.7%) and furniture and home furnishing stores (12.0%) leading the way. Consumers are maintaining a strong propensity to spend on household durable goods while access to consumer services remains limited.

- Nonstore (mostly online) retail sales surged 11.0% in January as more online shopping was presumably delayed until after the holiday rush; this likely included large volumes of online gift card redemptions owing to social distancing.

- Food services and drinking places got back on track in January, with sales increasing 6.9% after sliding backwards during the previous three months. Still, the level of sales was 16.6% below the year-earlier level. The number of COVID-19 cases has dropped sharply in the last month, allowing authorities to gradually relax containment measures that have been especially hard on restaurants.

- Total US household debt rose in the fourth quarter by $206

billion (1.4%). The four-quarter change in total household debt was

unchanged at 2.9%. Outstanding household debt totaled $14.56

trillion. (IHS Markit Economist David Deull)

- Mortgages, the largest category of debt, were also the main source of increase in the fourth quarter, rising $182 billion for a four-quarter increase of 5.1%.

- Mortgage originations, which include refinances, rose by $125 billion to $1,174 billion, a record high that surpassed the levels seen during the prior boom in refinances in 2003.

- Nonhousing debt rose by $37 billion in the fourth quarter as credit card balances rose $12 billion, the first increase in four quarters, and a modest one given typical seasonal patterns. Credit card debt was 11.7% below its year-earlier level, the largest four-quarter decline on record.

- Auto loans rose by $14 billion (1.0%), while student loans added $9 billion (0.6%). Four-quarter growth for these categories was 3.2% and 3.1%, respectively.

- The overall delinquency rate (the share of balances delinquent by 30 days or more) saw a fifth consecutive decline, falling by a further 0.2 percentage point to 3.2%, from a recent peak of 4.8% in the third quarter of 2019. These declines reflect forbearances, which insulate credit records from notations of skipped or deferred payments.

- Bankruptcy notations were added to about 121,000 consumers' credit reports in the fourth quarter, a new record low.

- Total US industrial production (IP) rose 0.9% in January,

reflecting increases in manufacturing (1.0%) and mining (2.3%) that

were partially offset by a decline in utilities IP (down 1.2%). The

headline index was revised up for the past five months. (IHS Markit

Economists Ben Herzon, Lawrence Nelson, and Akshat Goel)

- The details in this report that bear directly on our GDP tracking along with a sharply cooler turn in temperatures so far this month—pointing to more consumption of electric and gas utilities—were on balance consistent with our prior forecast of 3.8% GDP growth in the first quarter.

- Manufacturing IP rose 1.0% in January. The industrial detail within manufacturing pointed to gains across the board with the notable exception of motor vehicles and parts (down 0.7%); excluding motor vehicles and parts, manufacturing output rose 1.1%.

- The output of motor vehicles was down 1.9% in January as car manufacturers were hit by a global shortage of semiconductors used in vehicle components. Major car manufacturers, including GM, Ford, and Honda, have cut production because of the shortage.

- Robust gains in manufacturing IP in recent months have raised its level to only 1.0% below that of last February. By this measure, the recovery in manufacturing is nearly complete.

- The total US producer price index (PPI) for final demand spiked

up 1.3% in January. The 12-month change was 1.7%, up from 0.8% in

December. (IHS Markit Economist Michael Montgomery)

- Total goods prices rose 1.4% with food up 0.2%, energy up 5.1% (oil products), and everything else in goods up 0.8%. The latter is an artifact of the final demand/intermediate demand (FDID) system including exports of raw materials as "final demands." The old-style SOP—or stage of processing—concept, which does not include exports, firmed 0.3%. The FDID tally includes the 20.6% spike upwards in carbon steel scrap prices as well as a large gain in chemicals.

- Oil-based products, especially gasoline and, to a lesser extent, heating oil, drove the monthly rise in energy prices in December. Gasoline climbed by 13.6%, which was reflected in the CPI earlier in the week. Electricity and natural gas prices, meanwhile, firmed only modestly.

- Total services prices were weak in both November and December but climbed by 1.3% in January. A part of the story was the soggy sales environment at the end of 2020 and stimulus checks hitting the consumer accounts in early January. There was little reason to have New Year's sales when consumers were about to start beating down the doors. This violation of normal patterns has price effects.

- BorgWarner has agreed to buy German commercial battery systems maker Akasol for USD880 million (EUR754 million, including EUR24 million of debt). As part of the agreement, a wholly owned subsidiary of BorgWarner will launch a voluntary public takeover offer at EUR120 per share in cash for all outstanding shares in the battery maker. Akasol designs and manufactures customizable battery packs for buses, commercial vehicles (CVs), rail vehicles, and industrial vehicles, and for ships and boats. According to a BorgWarner statement, Akasol's technology is cell-agnostic and a low-cost, flexible solution. Akasol has three facilities in Germany and one in the United States. (IHS Markit AutoIntelligence's Stephanie Brinley)

- A winter storm has brought unusually cold temperatures, snow,

and freezing rain to Texas and western Louisiana, forcing a large

share of US light olefins production offline. As of the evening of

Tuesday, 16 February, IHS Markit had confirmed the shutdown of at

least 61% of US ethylene capacity, 59% of US chemical- and

polymer-grade propylene (CGP, PGP) capacity, and 22% of US

fluidized catalytic cracking (FCC) capacity. Many plants that

remained online were running at reduced capacity. (IHS Markit

Chemical Advisory)

- The Texas Commission on Environmental Quality (TCEQ) has been inundated with air emission reports from producers whose operations have been affected by the weather. "Extreme cold and instability of electrical supply, nitrogen, and fuel gas systems caused operating unit monitoring and control systems failures," says a submission by Chevron Phillips Chemical (CPChem) relating to its Sweeny site in Old Ocean, Texas. CPChem shut down its Pasadena plastics complex because the cold has prevented delivery of nitrogen from a supplier. Many producers are also citing loss of steam because of the cold.

- The National Weather Service expects temperatures in the Houston area to begin warming up Friday, with a high of 66°F forecast for Sunday.

- IHS Markit believes the great majority of polyethylene (PE) and polypropylene (PP) lines in the area have been offline since Sunday, and they are not expected to restart until the end of the week. IHS Markit has also estimated that at least half of the region's chlor-alkali and vinyls capacity could be out of service.

- A debate over supplying power reliably reignited after subzero

temperatures and ice storms in the south central and Midwestern US

states downed transmission lines, froze wind turbine blades and

power plant equipment, resulting in rolling blackouts. (IHS Markit

Climate and Sustainability News' Amena Saiyid, Kevin Adler, and

Keiron Greenhalgh)

- The US Federal Energy Regulatory Commission (FERC) and the North American Electric Reliability Corporation (NERC) announced 16 February that they would open a joint inquiry into the operations of the bulk power system during the extreme weather conditions still testing Midwest and south central states. FERC's investigation is similar to the one it carried out a decade ago when Texas, New Mexico, and other south central states experienced subzero temperatures and massive power shutdowns.

- The outages, which spread from Texas across the Great Plains, hit hardest in Texas. The grid operator, Electric Reliability Council of Texas (ERCOT), reported the transmission network was overwhelmed late 14 February by sudden demand for power that is mostly supplied by natural gas-fired power plants, and to a lesser extent by coal, nuclear, and wind facilities. This led ERCOT to initiate rolling blackouts beginning on 14 February, which evolved into system failures throughout the state the following day.

- Princeton University Engineering Professor Jesse Jenkins said the outages were caused by a combination of factors. First, he cited record winter demand of more than 69 GW, some 3 GW more than the most extreme peak load scenario ERCOT envisioned, and second, the magnitude of the outages was more than double the grid operator's worst expectations, he said.

- ERCOT's 2020/2021 Winter Adequacy Resource Assessment estimated about 13 GW of planned outages as a worst-case scenario. As of 16 February, at least 31 GW of power remained offline in Texas.

- The American Gas Association (AGA) reported that 151.7 billion cubic feet (Bcf) of gas was delivered in the US on February 14, 2021 and 149.8 Bcf delivered on February 15, posting the second highest delivery day ever and a record for the largest demand for a two-day period. The AGA said the previous two-day record was set on January 30 and January 31, 2019 when 155 Bcf and 141 Bcf was delivered or exported.

- Retail potato sales in the US rose by 16% in value to USD14 million and 14% in volume to 8.0 billion pounds in January-December 2020, compared with the same period the year before, says a report from the organization Potato USA. This is a five-year record, considering that volumes were declining between 2016-18, while value sales have not grown above 2.2% per year since 2016. The largest increase for 2020 was recorded between April and June (+24% in volume and +23% in value), confirming that the pandemic has been the main factor behind shoppers' purchasing choices. However, the trend continued after the first lockdown with dollar sales up by 14% year-on-year in the July-September period and by 12% in October-December. Demand soared for all potato-based product with the only exception of deli-prepared sides which declined by 8% in dollar and 10% in volume sales. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

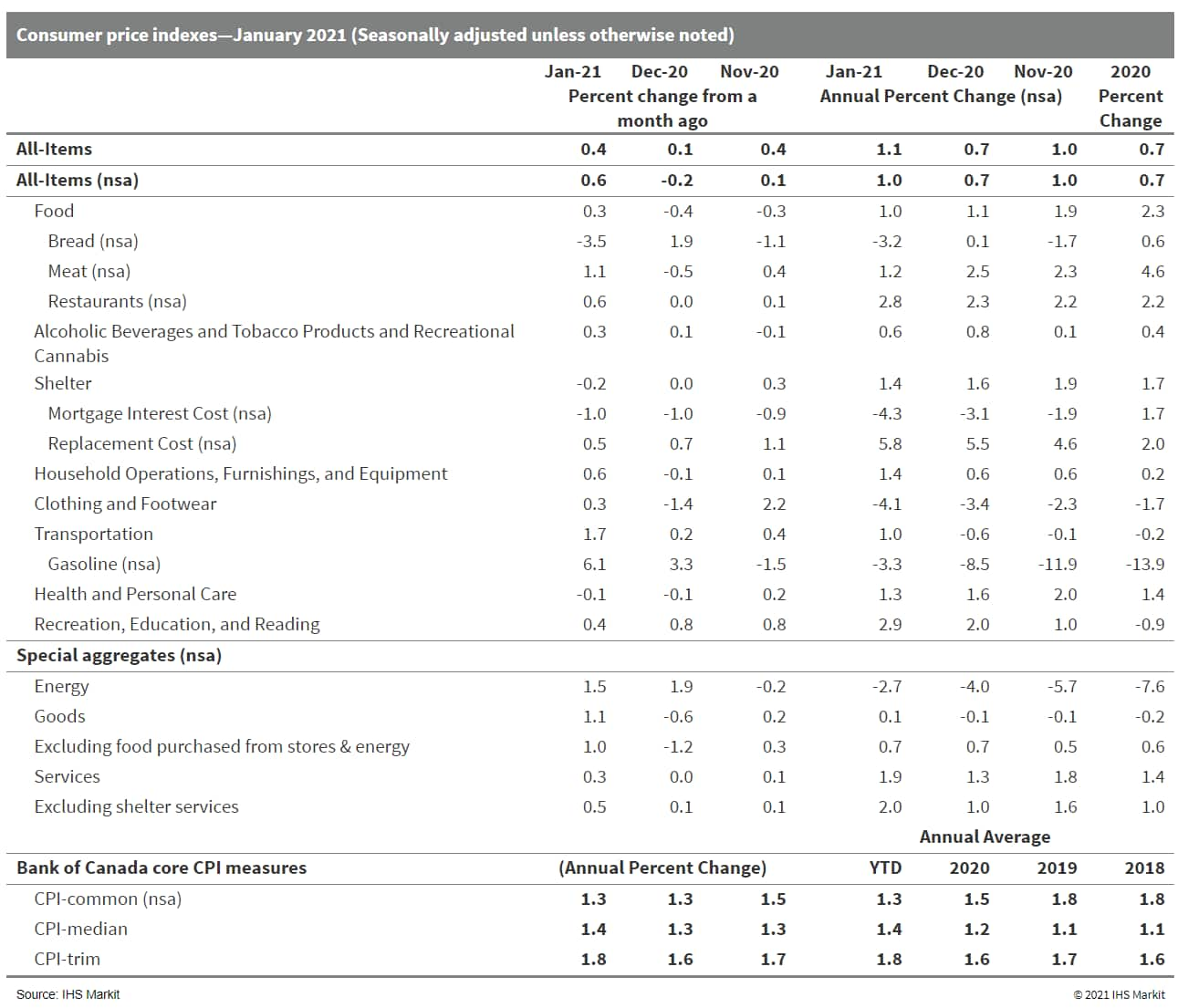

- Canadian consumer prices were higher from the previous month

with a 0.4% month-on-month (m/m) rise on a seasonally adjusted

basis (SA) and a stronger 0.6% m/m jump on a non-seasonally

adjusted basis (NSA). (IHS Markit Economist Arlene Kish)

- Annual inflation quickened to 1.1% year on year (y/y) SA and 1.0% y/y NSA.

- Two of the three Bank of Canada core consumer price inflation rates were higher, averaging 1.5% y/y.

- Food price inflation came in stronger than expectations and higher gasoline prices contributed to higher inflation pressures.

- The January blahs were made all the worse for consumers by stronger inflation pressures, albeit at a relatively modest rate. Looks for this trend to persist in the near term.

- Although food price inflation has decelerated for the past three months, the slowdown was weaker than expected. This was in part due to a boost in food prices purchased at restaurants, hitting a 22-month high of 2.8% y/y. The price increase in the food purchased from stores was significantly slower at 0.1% y/y.

- Inflation was driven higher by the 1.9% y/y lift in services.

The 31.1% y/y leap in travel tours contributed to the overall

annual price increase despite recommendations against non-essential

travel.

Europe/Middle East/Africa

- European equity markets closed lower; Germany/Italy -1.1%, UK -0.6%, and France/Spain -0.4%.

- 10yr European govt bonds closed mixed; Spain +7bps, Italy +2bps, France flat, Germany -3bps, and UK -5bps.

- iTraxx-Europe closed +1bp/48bps and iTraxx-Xover +3bps/247bps.

- Brent crude closed +1.6%/$64.34 per barrel.

- Frozen food sales rose by GBP872 million (USD1.2 billion) to GBP7.2 billion in 2020, a 14% year-on-year growth compared with the 11.3% recorded for the total grocery and 9.3% for the fresh sector, the Frozen Food Report released by the British Frozen Food Federation (BFFF) reveals. Ice cream sales rose by 19% or GBP207 million year-on-year, while the savory category went up by GBP214 million. A growing trend was recorded across the whole sector (confectionery, fish, meat, vegetables, pizza) with ready meals being the only category showing a declined both in value (-0.29%) and volume (-1.4%) as consumers revert to cooking from scratch. The report also found Generation Z (those born between 1997 and 2012) are 23% more likely to eat frozen food as they are attracted by the convenience and flavor of the growing range of vegetarian and vegan products on offer. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Italvolt has revealed plans for the large-scale manufacture of lithium-ion batteries for battery electric vehicles (BEVs) in Italy. According to the startup, the facility is intended to cover 300,000 square meters with an initial capacity to produce 45GWh annually, although this could expand to 70GWh in the future. It has also suggested that the site could employ around 4,000 staff, with a total of around 10,000 jobs expected to be created. Around EUR4 billion-worth of investment is expected to be required, with a first phase planned for completion in early 2024. However, the company added that the first step is to identify a location for the plant, with due diligence taking place on some sites at a national level. (IHS Markit AutoIntelligence's Ian Fletcher)

- Ørsted and Poland's state-owned Polska Grupa Energetyczna (PGE) have formed an equal joint-venture for the development and operation of the 1.5 GW Baltica 2 and 1.0 GW Baltica 3 offshore wind projects in the Baltic Sea. The projects are eligible to be included in the country's offshore wind allocation bids for 2021 and will make up about 40% of the total 5.9 GW capacity expected to be awarded. If the projects are to proceed, the earliest completion date will be for the Baltica 3 project which can come online as early as 2026. Ørsted will subscribe to newly issued shares for the projects, paying about USD176 million. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The second wave of the COVID-19 virus pandemic had a limited

economic impact on Slovakia in the fourth quarter of 2020, with

seasonally adjusted GDP rising by 0.2% quarter on quarter (q/q). In

a year-on-year (y/y) comparison, GDP fell by 2.7% in both

unadjusted and seasonally adjusted terms. (IHS Markit Economist

Sharon Fisher)

- In 2020 as a whole, GDP was down by 5.2%, better than our latest estimate (at -5.6%) and far below the January consensus figure (at -6.2%). The decline was much more modest than expected around mid-year, when some analysts were projecting a double-digit decline.

- Despite a continued contraction, construction also reported better-than-anticipated results in the fourth quarter, signaling a possible q/q improvement in investment.

- Employment fell by 2.0% y/y in the fourth quarter last year while rising by 0.2% q/q in seasonally adjusted terms.

- Israeli-based RadSee Technologies Limited has announced the availability of a 4D imaging radar for advanced driver assistance systems (ADAS) and autonomous vehicles, reports Green Car Congress. The company claims to offer scalability to OEMs and Tier 1 suppliers at one-third the cost of solutions that were previously offered. As RadSee uses its own algorithms, a patented antenna, and has a small form factor system architecture with 77GHz commercial off-the-shelf (COTS) components, it has reduced development risks. The RadSee platform can accommodate different levels of autonomy, comes with a 400-meter range, and has an angular resolution of 0.25 degree and the capability of static as well as dynamic object detection in a 120-degree field of view. (IHS Markit Automotive Mobility's Tarun Thakur)

- Nigeria's headline inflation rate accelerated to 16.5% year on

year (y/y) in January 2021 from 15.8% y/y in the previous month, as

food price inflation soars to levels last seen in 2008. (IHS Markit

Economist Thea Fourie)

- Food inflation accelerated to 20.6% y/y in January from 19.5% y/y in December 2020. Imported-food inflation remained broadly unchanged at 16.7% y/y during January, reports the Nigeria National Bureau of Statistics (NBS). However, the month-on-month (m/m) gains in overall food prices eased marginally to 1.8% during January from an average of 2.0% m/m recorded in the previous three months.

- Core inflation, excluding farm produce and energy, rose to 12.5% y/y in January from 11.8% y/y in December 2020. The highest annual price increase was recorded in the categories of passenger travel by air and road, medical and hospital services, and pharmaceutical products, reports the NBS. Other categories that recorded sharp increases in price levels include the repair of furniture, motor cars, and vehicle parts and maintenance.

Asia-Pacific

- Most APAC equity markets closed lower, except for Hong Kong +1.1%; South Korea -0.9%, India -0.8%, Japan -0.6%, and Australia -0.5%.

- Caixin Media and China Securities Times reported on 16 February

that the Beijing, Shanghai, and Guangdong province branches of the

China Banking and Insurance Regulatory Commission (CBIRC) have

asked banks to investigate whether personal business loans and

regular consumer loans granted after mid-2020 have been used for

buying property. To support the "home for living and not for

flipping" strategy, the regulator has asked banks to plug

operational loopholes and ensure that loans are going to the proper

destinations. (IHS Markit Banking Risk's Angus Lam)

- Personal business loans are normally uncollateralized and are similar to micro, small, and medium-sized enterprises (MSMEs) loans; the Chinese government has been encouraging banks to lend to these entities, especially since the onset of the COVID-19-virus pandemic.

- There is conflicting information about whether personal business loans are considered to be part of micro-enterprise loans. Lending to micro and small enterprises increased by 30.9% between the end of 2019 and the end of 2020. Growth is especially strong for large banks, whose growth increased by nearly 50%; this is because of the particular target set for them to lend to MSMEs.

- Overall, the failure to correctly identify the destination of the loan is not new and neither is the curbing of real-estate lending risk. Boosting MSME financing is a key Chinese strategy and the violation will be unlikely to change this; the authorities are likely to intensify their scrutiny of property-related loans to ensure compliance and that MSME loans are actually given to MSMEs.

- Northland Power has revealed plans for two new sites off the coast of Taichung county and Chunghwa that it will propose for the upcoming Round 3 offshore wind auctions in Taiwan. The two sites can yield up to 1,800 MW of power and are referred to as NorthWind and CanWind, respectively. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Japan's trade balance recorded a deficit of JPY323 billion

(USD3.1 billion) but declined by 75.4% from a year ago on a

non-seasonally adjusted basis in January. The seasonally adjusted

balance maintained a surplus of JPY392.8 billion, but down by 23.3%

from the previous month. Although the non-seasonal balance tends to

slip into deficit because of the new year's holidays, the softer

trade deficit reflected faster export growth (up 6.4% y/y) while

imports remained sluggish (down 9.5% y/y). (IHS Markit Economist

Harumi Taguchi)

- The improvement in exports was thanks to solid growth in exports to Asia, particularly to China, reflecting front-loaded demand ahead of the Lunar New Year holidays and low base effects, which offset continued declines in exports to the EU and the US. By product groupings, major factors contributing to the improvement were higher exports of semiconductor machinery, plastics, and non-ferrous metals.

- The continued weakness for imports was due largely to low energy prices, while import volumes declined by 4.3% y/y. Mineral fuels contributed 6.0 percentage points to the contraction for imports. Imports of clothes and accessories were also a major contributor to the decline, offsetting increases in imports of mobile phones, computers and autos.

- Japan's private machinery orders (excluding volatiles) - a

leading indicator for capital expenditure (capex) - rose by 5.2%

month on month (m/m) in December 2020 for the third consecutive

month of increase. The value of private machinery orders (excluding

volatiles) reached JPY899 billion (USD8.5 billion), the highest

level since November 2019, reflecting rebounds of orders from

manufacturing (up 12.2% m/m) and continued growth in orders from

non-manufacturing (excluding volatiles, up 4.3% m/m). (IHS Markit

Economist Harumi Taguchi)

- The solid increase in orders from manufacturing largely reflected continued increases in orders from electrical machinery and general-purpose and production machinery, as well as rebounds in orders from broad industry groupings, including shipbuilding.

- The continued rise in orders from non-manufacturing was thanks largely to increased orders from finance and insurance, transportation and postal services, information services, and miscellaneous non-manufacturing groupings.

- Private orders by machinery classification suggest increases was largely supported by solid demand for electronic and communication equipment, including computers and semiconductor production equipment.

- On 13 February 2021, a 7.3 magnitude earthquake with the epicenter located at the Fukushima prefecture hit North East Japan and is reported to have damaged Tohoku Electric Power's 2GW Haramachi coal-fired plant and one unit out of two units of Soma Kyodo's 2GW Shinchi coal-fired plant. As per IHS Coal, Metal, and Mining, due to the earthquake, there was some damage to the coal-fired plants, including tube leaks. As per the report, the tube leaks could take 1-2 months to repair. Until then Tohoku is expected to increase the utilization of its LNG and oil-fired fleet. The earthquake was reported to have also impacted some port infrastructure which could impact handling capacity. During the first 16-days of February 2021, thermal coal discharges at the Tohoku region stood at 2mt (down 19% y/y) on a 30-day basis. During Feb 2020 and March 2020, thermal coal arrivals at the Tohoku region were 2.4mt and 1.9mt, respectively. The recent quake could further slowdown thermal coal arrivals in this region from previous year levels. (IHS Markit Maritime and Trade's Pranay Shukla)

- Toyota plans to adjust production operations at its Japanese plants as a result of an earthquake in the country last week, according to a company press statement. Of the total 28 assembly lines at its 15 plants in Japan, Toyota will suspend operations on 14 production lines at nine plants over different shifts from 17 to 20 February inclusive. The plants affected by this production suspension include its Takaoka plant, Tahara plant, Miyata plant, Iwate plant, Fujimatsu plant, Yoshiwara plant, Gifu plant, and Hamura plant. Among the vehicles whose production will be affected are the Toyota Harrier, Prius, RAV4, Prado, and C-HR and the Lexus NX, UX, and CT. The automaker has not revealed how much production will be lost as a result of this suspension. IHS Markit currently forecasts a production loss of around 19,000 units for Toyota during February as a result of this suspension of operations. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Vehicle sales in Pakistan jumped by 44.8% year on year (y/y) in January. According to data released by the Pakistan Automotive Manufacturers' Association (PAMA), 17,878 vehicles were sold in the country last month, compared with 12,345 units in January 2020. Passenger cars led this growth with a 44% y/y sales increase to 14,543 units. By nameplate, the Suzuki Alto led the passenger car market with sales of 3,827 units last month, followed by the Toyota Yaris with sales of 2,992 units. According to IHS Markit data, total new vehicle sales in Pakistan, including light vehicles and medium and heavy commercial vehicles, will improve by 27.5% y/y to 159,471 units in 2021. (IHS Markit AutoIntelligence's Isha Sharma)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-february-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-february-2021.html&text=Daily+Global+Market+Summary+-+17+February+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-february-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 17 February 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-february-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+17+February+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-17-february-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}